Foreign institutional investors indicate a cautious outlook for Wednesday's session with their long:short position further dropping to 42:58, according to Soni Patnaik, assistant vice president of JM Financial Services Ltd. The Nifty futures witnessed long unwinding a day ago to the tune of 4%, with a drop in overall put-call ratio open interest to 0.78 indicating an indecisive outlook, Patnaik said.

Immediate support for the Nifty can be seen around 22,170 and resistance now drops to the 22,400-22,450 range, he said.

The Nifty Bank Futures witnessed OI additions of 7% whilst breaking crucial support of 48,600, Patnaik said. "It has an immediate support of 48,000, below which it can test a lower support area of 47,600-47,500 levels."

The Nifty has finally slipped below the short-term moving average (20 EMA) and is likely to witness further decline to the next major support around the 22,150 level, according to Ajit Mishra, senior vice president of research at Religare Broking Ltd.

While the majority of sectors are seeing pressure, FMCG, IT and pharma are showing resilience, he said.

The GIFT Nifty was trading 0.3% lower at 22,590.00 as of 06:30 a.m.

F&O Action

The Nifty May futures were down 0.78% to 22,381.8 at a premium of 79.3 points, while its open interest was down 3.8%. The Nifty Bank May futures were down 1.46% to 48,349.05 at a premium of 63.7 points with its open interest up 6.93%.

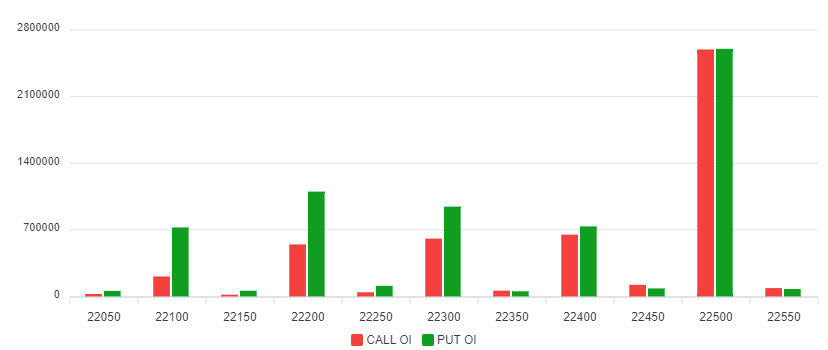

Open interest distribution for the Nifty May series indicates that 22,500 levels are seeing the most put strikes and call strikes.

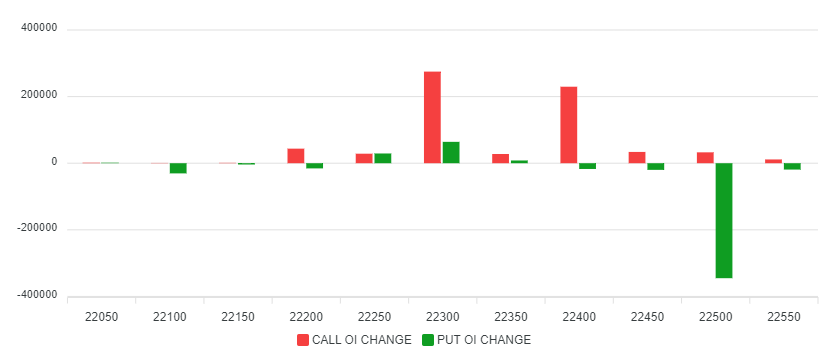

During the previous session, open interest at 22,500 saw the most decline in put strikes, and call strikes at 22,300 saw the maximum open interest change.

For the Bank Nifty options May expiry, the maximum call open interest was at 49,500 and maximum put open interest was at 47,000.

Open Interest Distribution

Open Interest Change

FII/DII Activity

Overseas investors in Indian equities remained net sellers on Tuesday for the fourth consecutive session. Foreign portfolio investors offloaded stocks worth Rs 3,668.8 crore.

Domestic institutional investors remained net buyers for the eighth session and mopped up equities worth Rs 2,304.5 crore, the NSE data showed.

Markets On Tuesday

India's benchmark stock indices ended lower on Tuesday as heavyweights HDFC Bank Ltd., ICICI Bank Ltd. and Reliance Industries Ltd. declined. The Nifty extended its loss to a third session, while the S&P BSE Sensex reversed gains from Monday.

The NSE Nifty 50 settled 140.20 points, or 0.62%, lower at 22,302.50, and the S&P BSE Sensex ended down 383.69 points, or 0.52%, at 73,511.85. Intraday, Nifty declined 0.94% to 22,232.05, and Sensex fell 0.86% to 73,259.26.

On NSE, 10 sectors ended lower and two settled higher. The NSE Nifty Realty was the worst performer among sectoral indices, and the NSE Nifty FMCG was the top gainer.

Broader markets underperformed their larger peers. The S&P BSE Midcap closed 1.9% lower and the S&P BSE Smallcap settled down 1.65%.

Seventeen out of 20 sectors on the BSE closed lower. S&P BSE Fast Moving Consumer Goods, S&P BSE Information Technology, and S&P BSE Teck were the only indices that rose.

Market breadth was skewed in favour of the sellers. Around 2,727 stocks declined, 1,096 rose and 109 remained unchanged on the BSE.

Major Stocks In News

Patel Engineering: The company and its joint venture partner emerged as the lowest bidders for an irrigation project worth Rs 343 crore. The company's share in the irrigation project stands at Rs 120 crore.

Mahindra & Mahindra: NCLT approved the merger of Mahindra Heavy Engines, Mahindra Two Wheelers and Trringo.com with the company.

Dr Reddy's Laboratories (Consolidated, YoY)

Revenue up 12.6% at Rs 7,114 crore vs Rs 6,315.2 crore (Bloomberg estimate Rs 7,026 crore).

Ebitda up 19.4% at Rs 1,831 crore vs Rs 1,534 crore (Bloomberg estimate Rs 1809 crore).

Margin at 25.7% vs 24.3% (Bloomberg estimate 25.8%).

Net profit up 36.4% at Rs 1,310 crore vs Rs 960 crore (Bloomberg estimate Rs 1,214 crore).

Board recommended final dividend of Rs 40 per share.

Pidilite Industries (Consolidated, YoY)

Revenue up 7.9% at Rs 2,902 crore vs Rs 2,689 crore (Bloomberg estimate Rs 2,831 crore).

Ebitda up 25.64% at Rs 576.9 crore vs Rs 459.2 crore (Bloomberg estimate Rs 621 crore).

Margin at 19.88% vs 17.07% (Bloomberg estimate 21.9%).

Net profit up 6.45% at Rs 304 crore vs Rs 286 crore (Bloomberg estimate Rs 425 crore).

Board recommended dividend of Rs 16 per share.

Global Cues

Stocks in the Asia Pacific region were weak in early trade on Wednesday, taking overnight cues from a sluggish trade in Wall Street. The Nikkei 225 was 0.93% or 362 points lower at 38,459, and the Kospi was trading 0.67 points or 0.02% down at 2733.69 as of 06:23 a.m.

The focus for the Asian markets will be on Chinese President Xi Jinping's trip to Europe and how trade relations will develop from here. In another sign of growing tension, the US has revoked licences allowing Huawei Technologies Co. to buy semiconductors from Qualcomm Inc. and Intel Corp., Bloomberg reported.

The rally in US stocks in May struggled to gain much traction on Tuesday, with investors split on whether the market can sustain the advance given all the economic crosscurrents.

The S&P 500 rose 0.13%, while Nasdaq Composite fell 0.10% respectively, as of Tuesday. The Dow Jones Industrial Average rose 0.08%.

Key Levels

U.S. Dollar Index at 105.4

U.S. 10-year bond yield at 4.46%

Brent crude down 0.24% at $82.96 per barrel

Nymex crude down 0.19% at $78.23 per barrel

Bitcoin was down 1.12% at $62,269.84

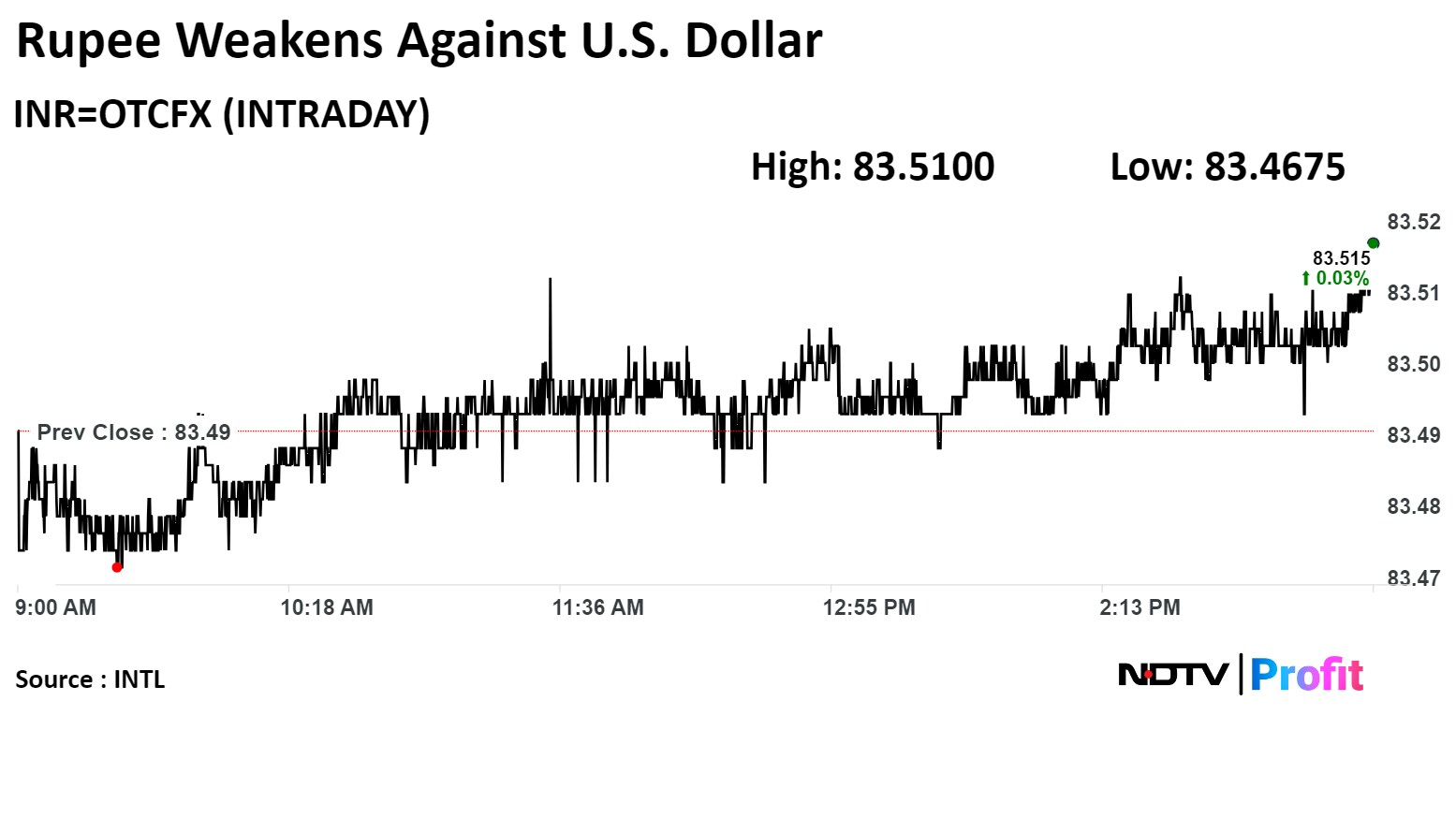

Rupee Update

The Indian rupee closed weaker against the US dollar on Tuesday after crude oil prices surged.

The local currency closed 2 paise weaker against the US dollar at Rs 83.51.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.