With broader markets showing mixed trends, heavyweights aided the index to end higher on Wednesday with strong put writing, call unwinding at the 22,000 level.

Private banks will have some tailwinds, with the recently issued reversal clarification for the alternative investment funds provision from the Reserve Bank of India. Metals stocks are unlikely to eke out strong gains in the wake of Chinese rallies faltering.

The NSE Nifty 50 can experience a breakdown if it snaps the support level of 21,830, according to Jai Bala, chief market technician at CashTheChaos.

The market texture is bullish, but the 20-day simple moving average or 22,170, and 73,100 marks for Nifty and Sexsex, respectively, would act as a key resistance for the bulls, Shrikant Chouhan, head of equity research at Kotak Securities Ltd., said.

The much-anticipated T+0 settlement in the Indian capital market will come live on the exchanges on an optional basis from March 28. Bajaj Auto Ltd., Ashok Leyland Ltd. and Vedanta Ltd. will be among the 25 companies that will see a switch to trading in the T+0 rolling settlement cycle.

The GIFT Nifty, an early indicator of the Nifty 50 index's performance in India, was trading 42.5 points, or 0.19%, lower at 22,348 as of 7:18 a.m.

"It just might come one day out of the blue. This has happened in the past; we've had flash crashes. One big fund starts de-levering some positions, a second fund hears that and tries to re-position, the third fund basically gets caught off guard, and the next thing you know, we start having a bigger and bigger momentum unwind."Lakos-Bujos, JPMorgan

FII And DII Activity

Overseas investors remained net buyers of Indian equities for the second consecutive day on Wednesday. Foreign portfolio investors bought stocks worth Rs 2,170 crore, while domestic institutional investors remained net buyers and mopped up equities worth Rs 1,198 crore, the NSE data showed.

Market On Tuesday

India's benchmark stock indices recouped from loss to gain on Wednesday, tracking recovery in heavyweights Reliance Industries Ltd., HDFC Bank Ltd., and Axis Bank Ltd.

The NSE Nifty 50 closed 143.25 points, or 0.65%, higher at 22,147.95, and the S&P BSE Sensex ended 526.02 points, or 0.73%, up at 72,996.31. Intraday, the Nifty scaled a high of 22,193.60, and the Sensex rose to 73,138.73.

Shares of Bajaj Finance Ltd., HDFC Bank Ltd., Maruti Suzuki India Ltd., Larsen & Toubro Ltd. and Reliance Industries Ltd. were positively contributing to changes in the Nifty. HCL Technologies Ltd., Infosys Ltd., Tata Motors Ltd., Tata Consultancy Services Ltd. and State Bank of India capped gains.

On the NSE, six sectors advanced and six declined. The NSE Nifty Realty was the top-performing sectoral index, while the NSE Nifty PSU Bank fell the most.

Broader markets ended on a mixed note. The S&P BSE Midcap ended flat, and the S&P BSE Smallcap ended 0.70% higher.

Major Stocks In News

Bajaj Finance: Bajaj Housing Finance Ltd., a wholly owned subsidiary of the company, is preparing for an initial public offering, people aware of the matter told NDTV Profit.

Bharat Heavy Electricals: The company has received an order worth Rs 4,000 crore from Adani Power for setting up a thermal power plant in Chhattisgarh.

NHPC: The board approved plans to borrow Rs 6,100 crore from the market in tranches for FY25. It also gave in-principle approval for the closure of Loktak Downstream Hydroelectric in Manipur, subject to government approval.

IDFC First Bank: Cloverdell Investment has offered up to 15.9 crore shares via large trade. The floor price at Rs 75 per share, a discount of 3.6% to last close, according to the term sheet viewed by Bloomberg.

Top Brokerage Calls

Motilal Oswal On Titan

The brokerage maintains 'buy' rating with a target price of Rs 4,300 per share.

It said that the reduction in gold premium is compensated with other initiatives to protect the operating margin.

Management said that a jewellery EBIT margin of 12-13% is sustainable.

Jewellery and other businesses still have strong long-term growth potential.

Gradual recovery in the studded ratio should support margin improvement.

Continues to prefer the company for its best-in-class execution track record.

Consumer preference for branded jewellers will keep the robust growth rate intact.

Citi on Kalyan Jewellers

Target price is set at Rs 480 per share, a 24% discount to its rival Titan.

Differences in business models affect growth rates, cash flows and return profiles.

The brokerage said there is ample room for the stock to re-rating, provided there is steady execution.

PE stake overhang or stock liquidity issues also affect headline multiples.

Upside risks include stronger consumer traction, company's expansion plans, and better-than-expected margins.

Global Cues

Most equity markets in Asia fell in early trade after the U.S. stocks ended higher in the final hours to snap three days of losses.

The Nikkei 225 was trading 0.90% lower at 40,400, and the S&P ASX 200 was trading 1.04% higher at 7900, as of 06:37 a.m.

In a volatile session, Wall Street traders closed higher with a 10% surge in final hours, with many institutional investors potentially rebalancing their portfolios, according to Bloomberg. Later, Fed Governor Christopher Waller emphasised that recent U.S. economic data could delay the number of cuts seen this year.

The S&P 500 index and Nasdaq Composite rose 0.86% and 0.51%, respectively, as of Wednesday. The Dow Jones Industrial Average ended 1.22% higher.

Brent crude was trading 0.49% higher at $86.51 a barrel. Gold was lower by 0.31% at $2,188.07 an ounce.

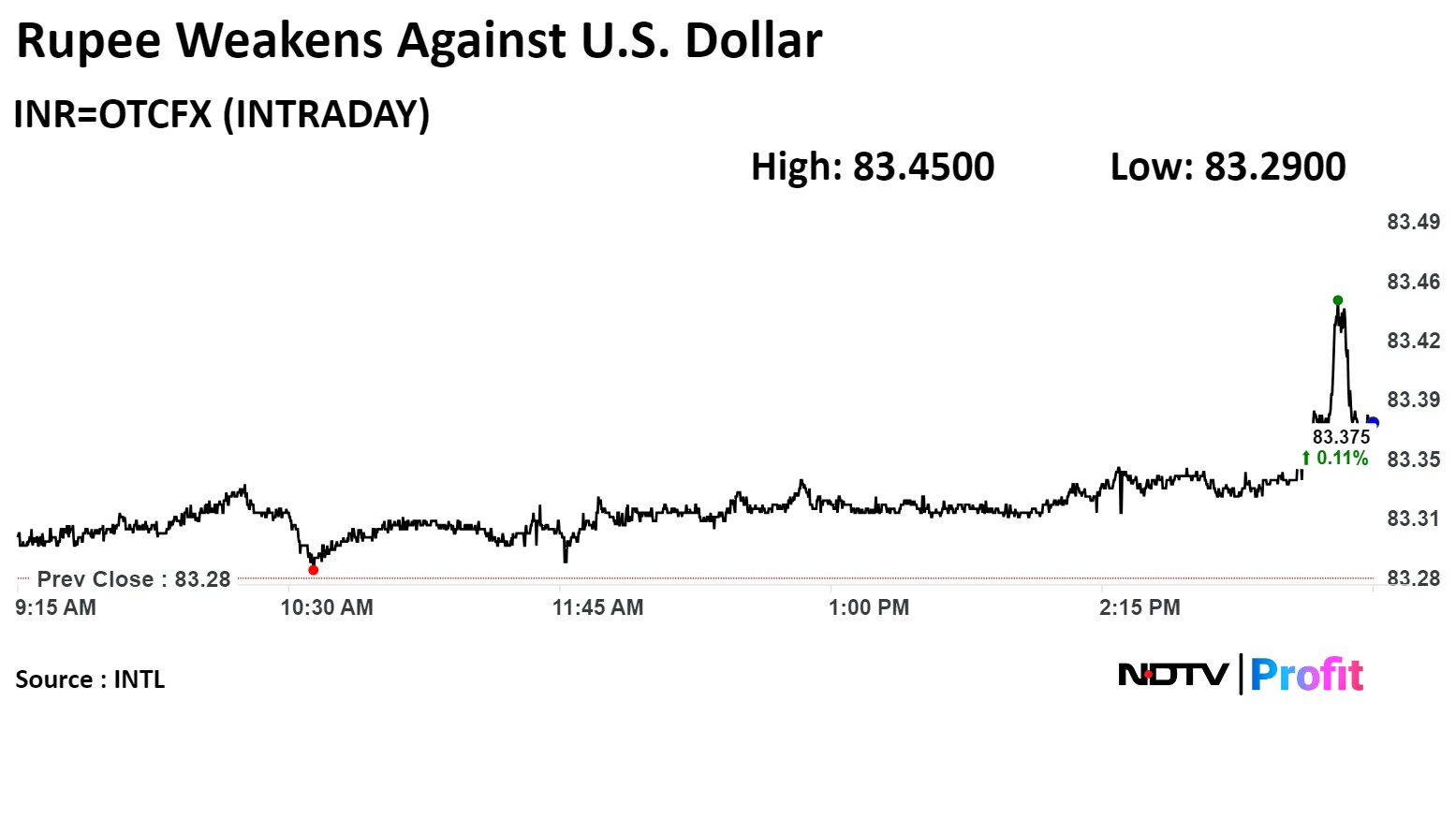

Rupee Update

The Indian rupee closed weaker against the U.S. dollar on Wednesday as the yuan and yen weighed on the Asian currency.

The local currency weakened by 9 paise to close at Rs 83.38 against the U.S. dollar, after opening at Rs 83.33. It closed at Rs 83.29 per dollar on Tuesday, according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.