The current Nifty technical analysis suggested that the market is likely to experience buying opportunities at lower support levels.

"The daily and weekly momentum is positive and hence, we do not expect any significant price correction," said Ruchit Jain, lead research at 5paisa.com. "On the lower side, the immediate supports are placed around 23050 and 22930."

"Traders are advised to focus on sector/stock specific momentum as better trading opportunities are seen while any dips in the index towards the supports would be buying opportunity there too," Jain added.

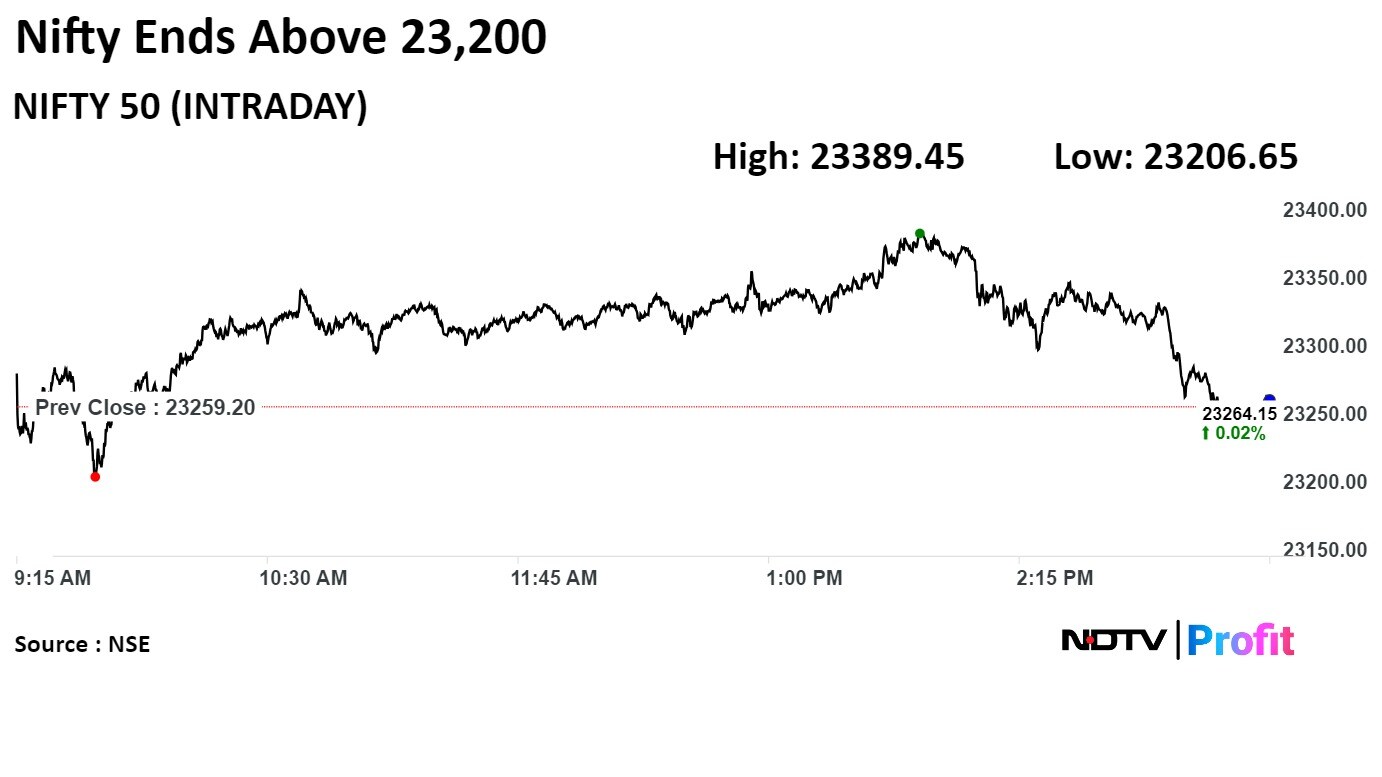

The short-term texture suggesting 23400 would be the key resistance zone for the short-term traders, while 23200 would act as a crucial support zone, Kotak Securities' Shrikant Chouhan said.

"Post 23400 breakout the market could rally up to 23500-23525. On the other side, below 23200 the index could retest the level of 23050-23000," Chouhan said.

F&O Action

Nifty June futures increased by 0.28% to 23,309, trading at a premium of 45 points. Open interest for Nifty June futures rose by 0.17%.

Nifty Bank June futures saw a marginal rise of 0.01%, reaching 49,768, with a premium of 63 points. The open interest for Nifty Bank June futures increased by 0.7%.

For Nifty Options expiring on June 13, the highest call open interest is at 24,000, while the highest put open interest stood at 22,500.

For Bank Nifty Options expiring on June 12, the highest call open interest stands at 51,000, and the highest put open interest was at 48,000.

FII/DII Activity

Overseas investors in Indian equities turned net sellers on Tuesday, after two days, and offloaded stocks worth Rs 111 crore, according to provisional data from the National Stock Exchange.

On the other hand, domestic investors stayed net buyers for two straight sessions and mopped up equities worth Rs 3,193.3 crore.

Markets Recap

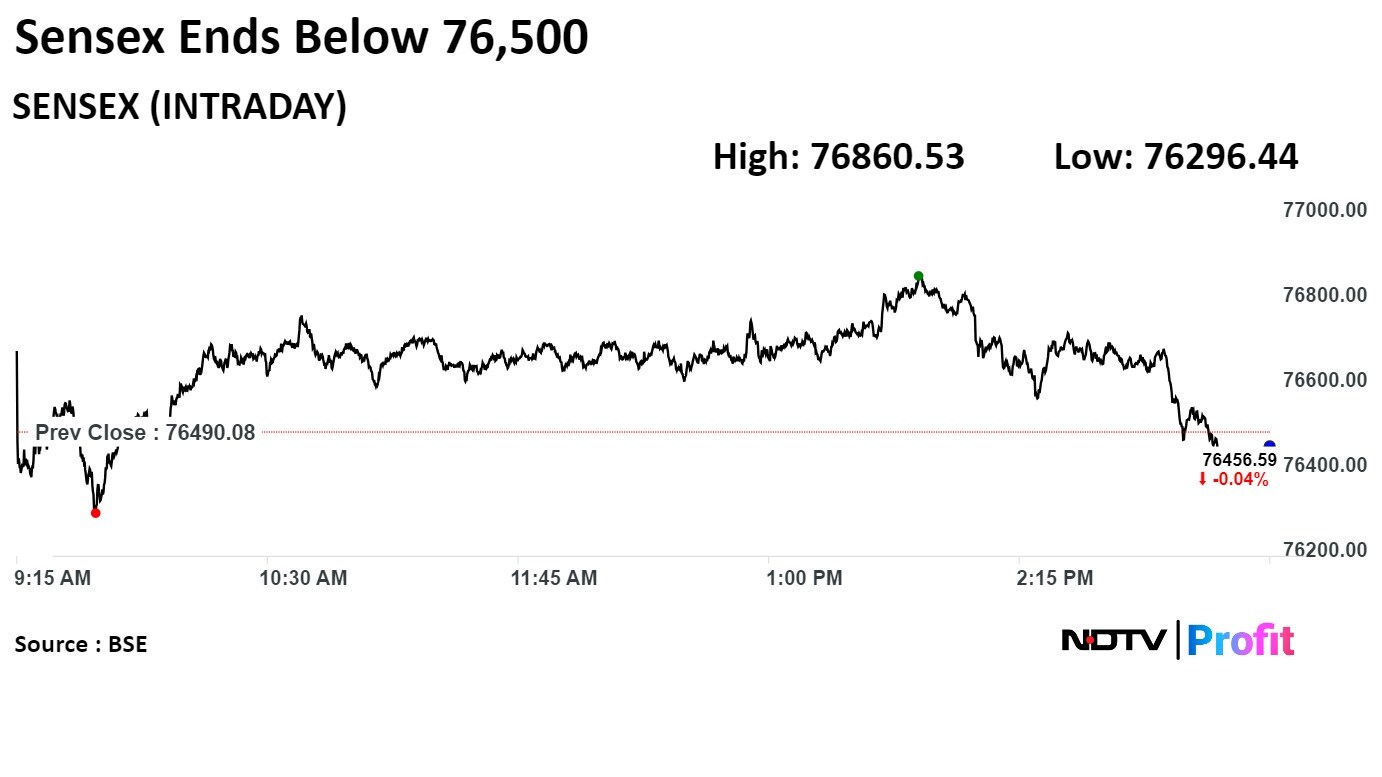

India's benchmark equity gauges erased all their gains in the last hour of the session on Tuesday and ended little changed as losses in the shares of Reliance Industries Ltd. and ICICI Bank Ltd. weighed. The NSE Nifty 50 ended 5.65 points or 0.02%, up at 23,264.85, while the S&P BSE Sensex closed 33.49 points or 0.04%, lower at 76,456.59.

Major Stocks In News

HCL Technologies: The company signed a $278 million deal with Germany's largest cooperative primary bank, apoBank for 7.5 years.

TCS: The company launched a new IoT engineering lab in Ohio for manufacturing, energy, and consumer solutions.

B.L. Kashyap and Sons: The company secured two new orders aggregating to Rs 1,021 crore, approx. These include a construction order worth Rs 924 crore from DLF City and a civil construction order worth Rs 97 crore from Sattva Homes. The total order book as of date stands at Rs 3,545 crore.

Cipla: Patna Tax Office rules against the company on input tax credit. The company is to appeal to a higher authority on the input tax credit ruling.

Dollar Industries: The company recorded the highest-ever revenue in 2023–24. To open 50 exclusive brand outlets across South India by 2027. Aim for 50% sales growth in South India in 2024–25.

NHPC: The National High Power Test Laboratory approved the transfer of 1 crore shares from the company to Power Grid Corp. The company's stake in NHPTL now stands at 12.5%, up from 20% earlier. NHPTL ceased to be an associate company of the company.

TVS Supply Chain Solutions: The company received a five-year contract with Daimler Truck AG for integrated supply chain solutions services in Singapore.

Castrol India: The board appointed Kedar Lele as MD for 5 years, effective Nov 1.

LTIMindtree: The company announced the inauguration of its regional headquarters in Saudi Arabia's capital, Riyadh, as part of the expansion in KSA and the Middle East.

Patanjali Foods: The company has clarified that the Board has evaluated the initial proposal by Patanjali Ayurved for the sale of non-food businesses on April 26. A committee comprising an independent director, CEO and CFO is in the process of evaluating the proposal.

Wipro: The company introduced the Lab45 AI Platform, designed to increase efficiencies and transform business functions.

Global Cues

Most benchmarks in Asia-Pacific declined on Wednesday, not tracking overnight gains on Wall Street as traders await for the US Federal Reserve's policy decision and inflation print.

The Nikkei 225 was 253.22 points 0.65% down at 38,881.57, and the S&P ASX 200 was 46.80 points or 0.60% down at 7,708.60 as of 06:45 a.m. The KOSPI index was 11.20 points or 0.41% higher at 2,716.52.

After climbing to fresh highs, the S&P 500 Index settled 0.27% higher at 5,375.32. The Nasdaq Composite index rose 0.88%, while the Dow Jones Industrial Average index declined 0.31%.

Brent crude was trading 0.22% higher at $82.10 a barrel. Gold fell 0.22% to $2,311.92 an ounce.

Money Market Update

The Indian currency weakened by 7 paise to 83.57 against the US dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.