- NSE Nifty 50 key support lies between 24,400 and 24,600 levels

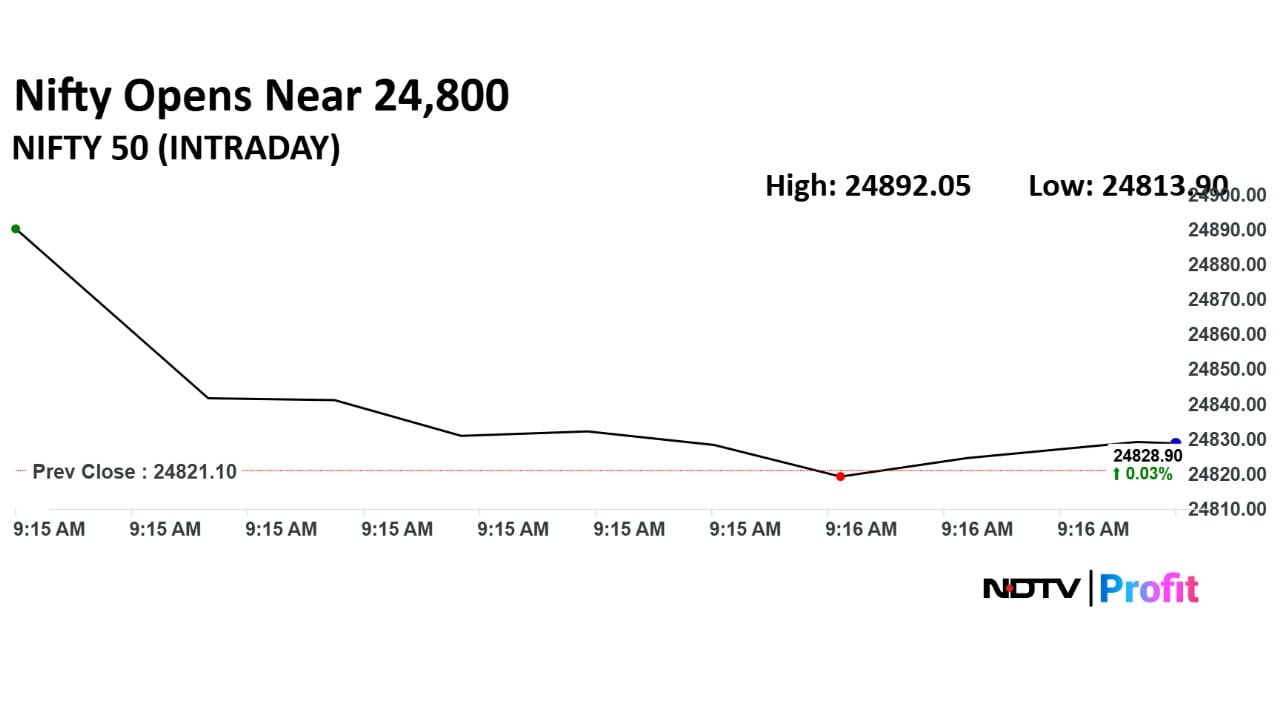

- Nifty 50 closed 140 points higher at 24,855, holding above 24,750 support

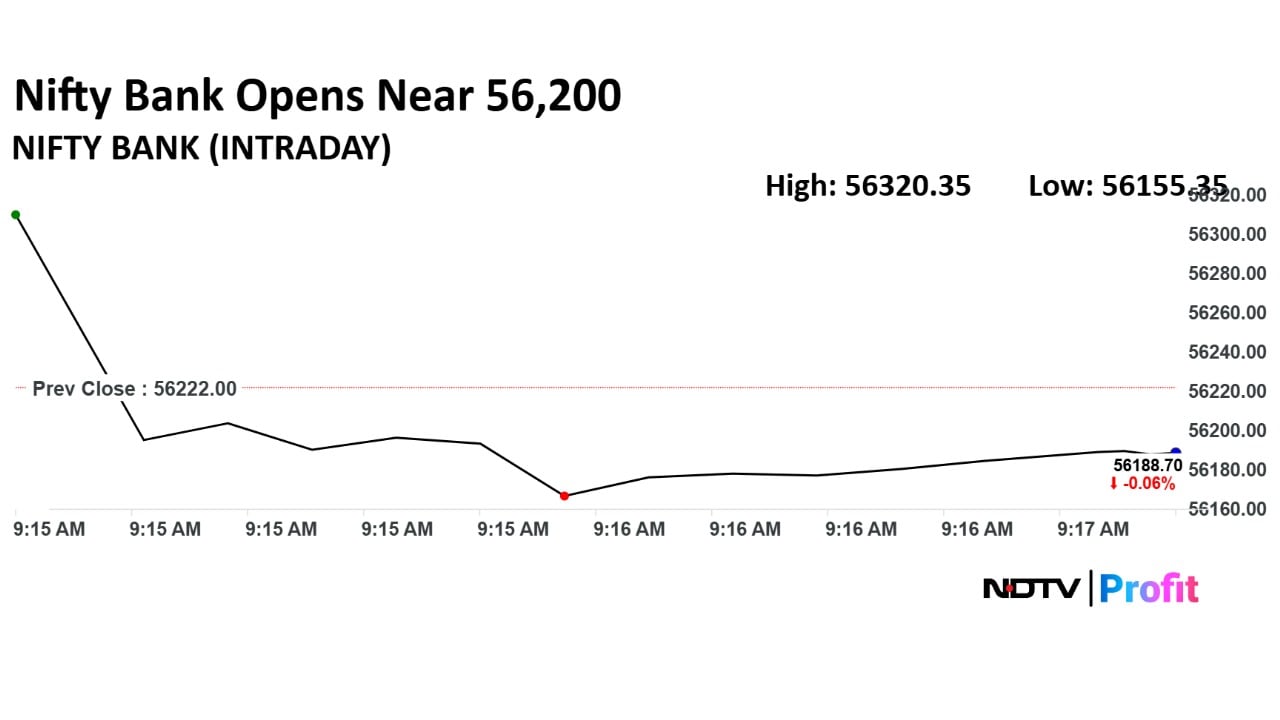

- BankNifty support range is 55,500 to 55,000, near 100-day EMA and Fibonacci levels

The NSE Nifty 50's crucial support is seen in the range of 24,400-24,600 levels, according to analysts. The market is feared to open lower, as Gift Nifty slid by 150 points following US President Donald Trump's announcement of 25% tariffs against India on Wednesday.

The Nifty formed a a small, bodied candle with a lower shadow signaling consolidation with key support placed at 24,600–24,400 levels, Bajaj Broking Research said in a note issued before the tariff announcement.

Mandar Bhojane, senior technical and derivative analyst at Choice Broking, saw support at at 24,590–24,400 levels and said it was a zone for a potential 'buy-on-dips' strategy.

The resistance area was identified at the 25,250 level, conditional on a move above 25,000, opening pullback to this resistance area, according to analysts at Bajaj Broking Research.

"While a move above 25,000 will open further pullback towards the key resistance area of 25,250 being the almost identical high of the last 2 weeks," it said.

The Bank Nifty formed a small bear candle signaling consolidation amid stock specific action ahead of the monthly F&O expiry, according to Bajaj Broking.

"The 55,500–55,000 region emerges as a critical support cluster, coinciding with the 100-day exponential moving average and key Fibonacci retracement levels of the prior up move—underscoring it as a high-probability demand zone where buyers may look to re-enter, potentially arresting the ongoing decline," the analyst said.

Bhojane identified support for the index at 55,500–55,150 levels.

Market Recap

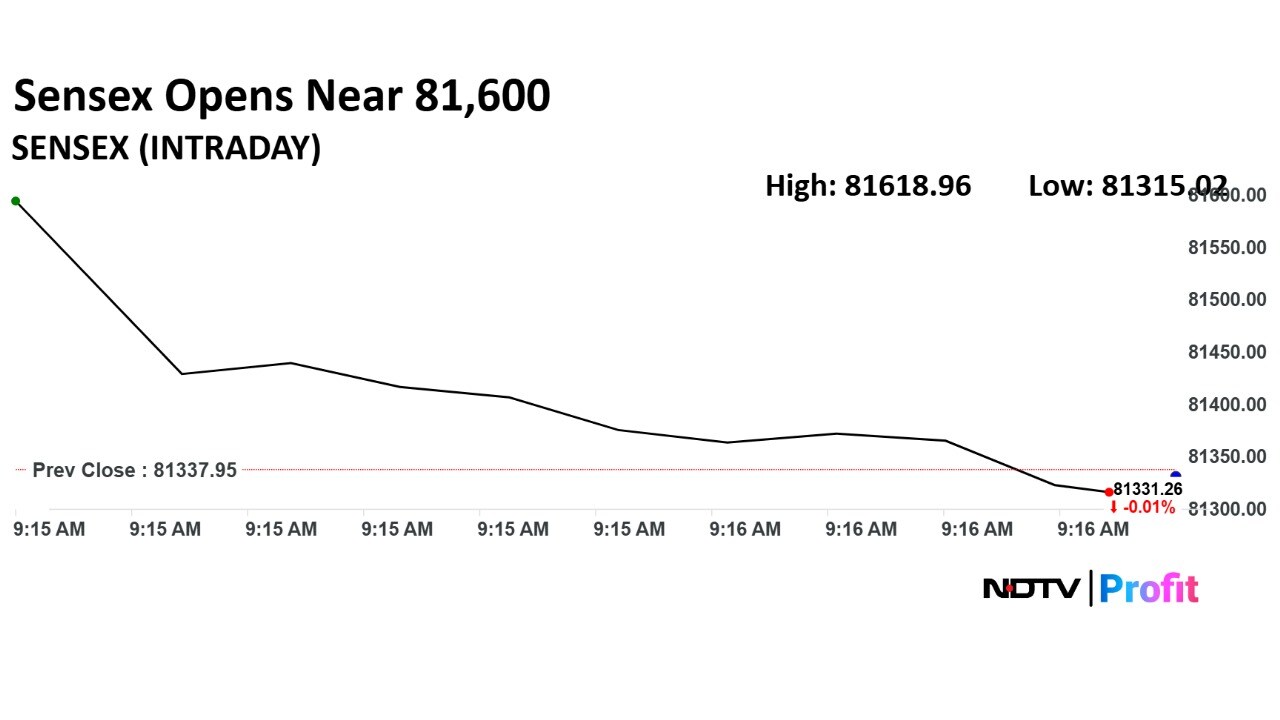

India's benchmark equity indices ended higher for a second consecutive session on Wednesday as better-than-expected earnings pulled up heavyweight Larsen & Toubro Ltd. to help offset decline in Tata Motors Ltd. and Reliance Industries Ltd.

The NSE Nifty 50 settled 140 points or 0.14% higher at 24,855, managing to hold above the support level of 24,750. The BSE Sensex added 144 points or 0.18% to close at 81,481.86.

Currency Recap

The Indian rupee closed at its lowest level in over five months on Wednesday, ending the session at 87.43 against the US dollar, down 61 paise from 86.82 a day ago.

This marks the weakest closing level for the currency since Feb. 28, reflecting persistent pressure from global risk-off sentiment and foreign fund outflows.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.