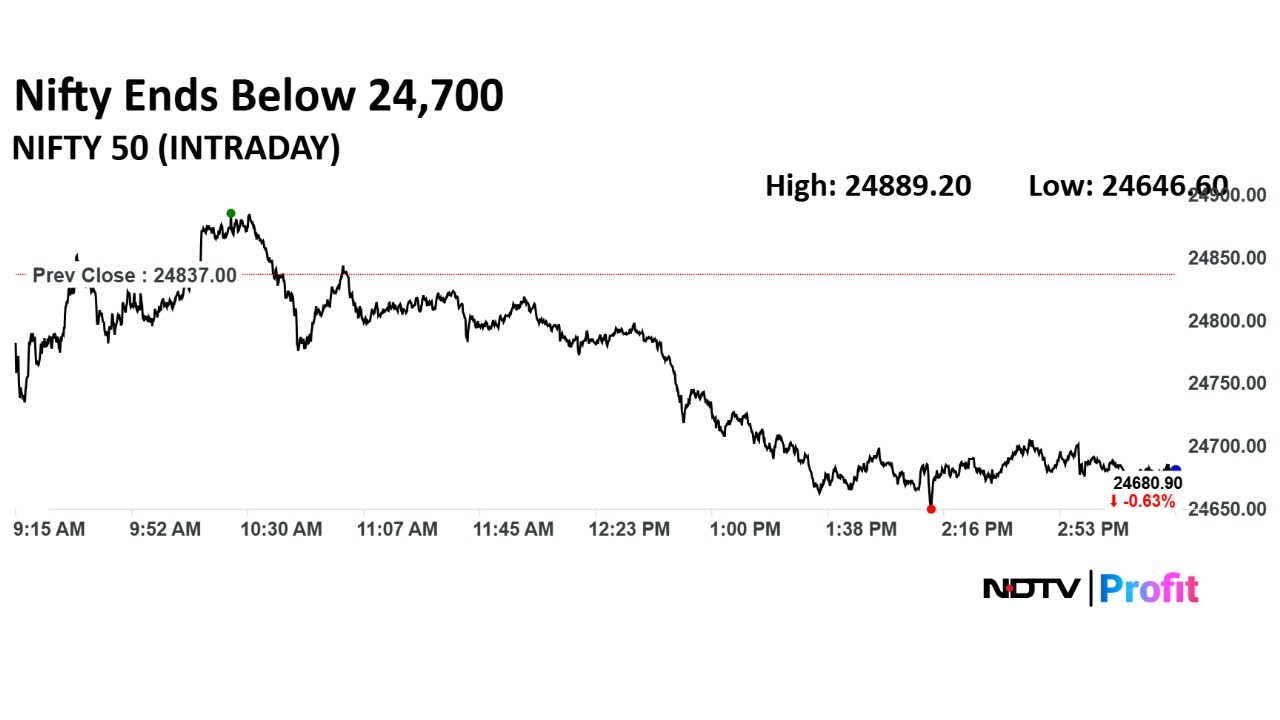

The NSE Nifty 50 sees major support at 24,400-24,500 levels after extending its decline for a third consecutive day, according to analysts at Bajaj Broking Research.

"Major support is seen in the 24,500–24,400 zone, which coincides with last month's low, the 100 days EMA, and a key Fibonacci retracement of the recent up move from 23,935 to 25,669," it said.

The Nifty formed a third consecutive bear candle with a lower high and lower low, signalling extended decline, according to Bajaj Broking.

The Nifty's weak sentiment is likely to continue as long as the market is trading below 24,800, as per Shrikant Chouhan, head - equity research, Kotak Securities. On the downside, the market may correct until 24,550–24,500, he said.

"On the upside, a break above 24,800 could lead to a pullback rally extending up to 24,900. Further upside may also continue, potentially pushing the market up to 25,000," Chouhan said.

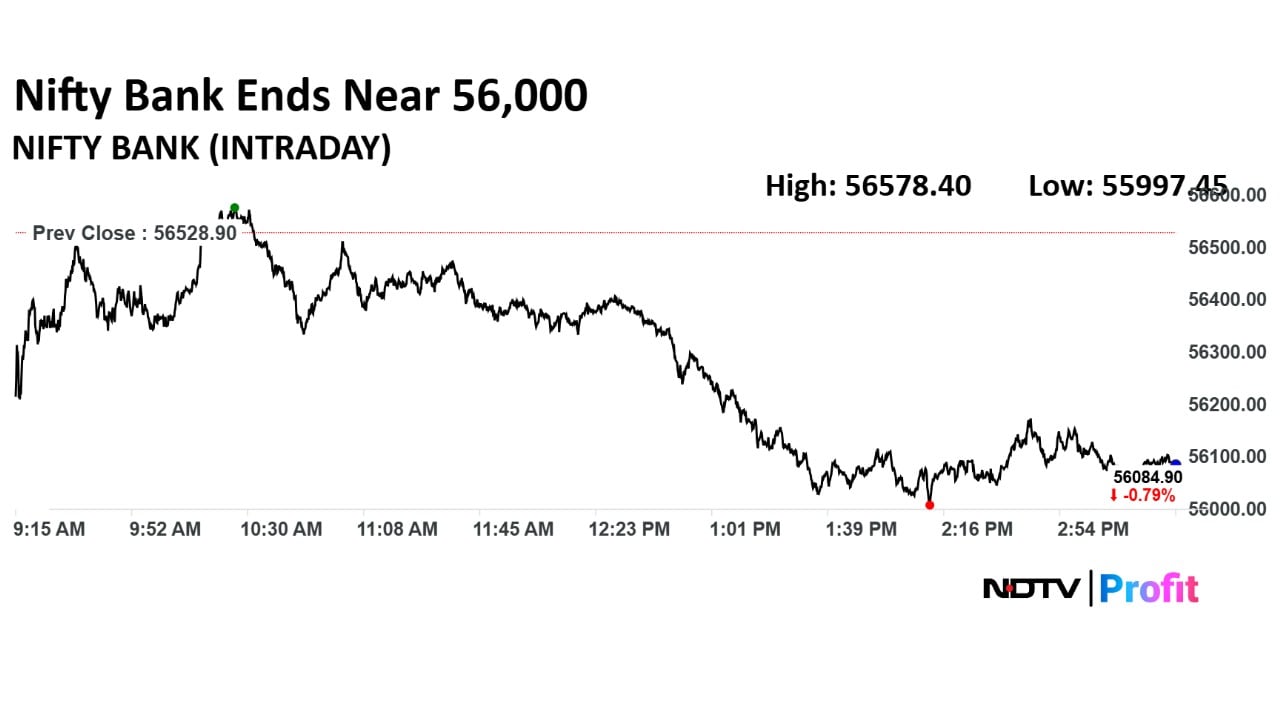

Bank Nifty formed a bear candle with a long upper shadow which maintained lower high and lower low, highlighting continuation of the corrective decline for the third session in a row, according to Bajaj Broking Research. The 55,500–55,000 area would remain as a key support zone for the index, it said.

Market Recap

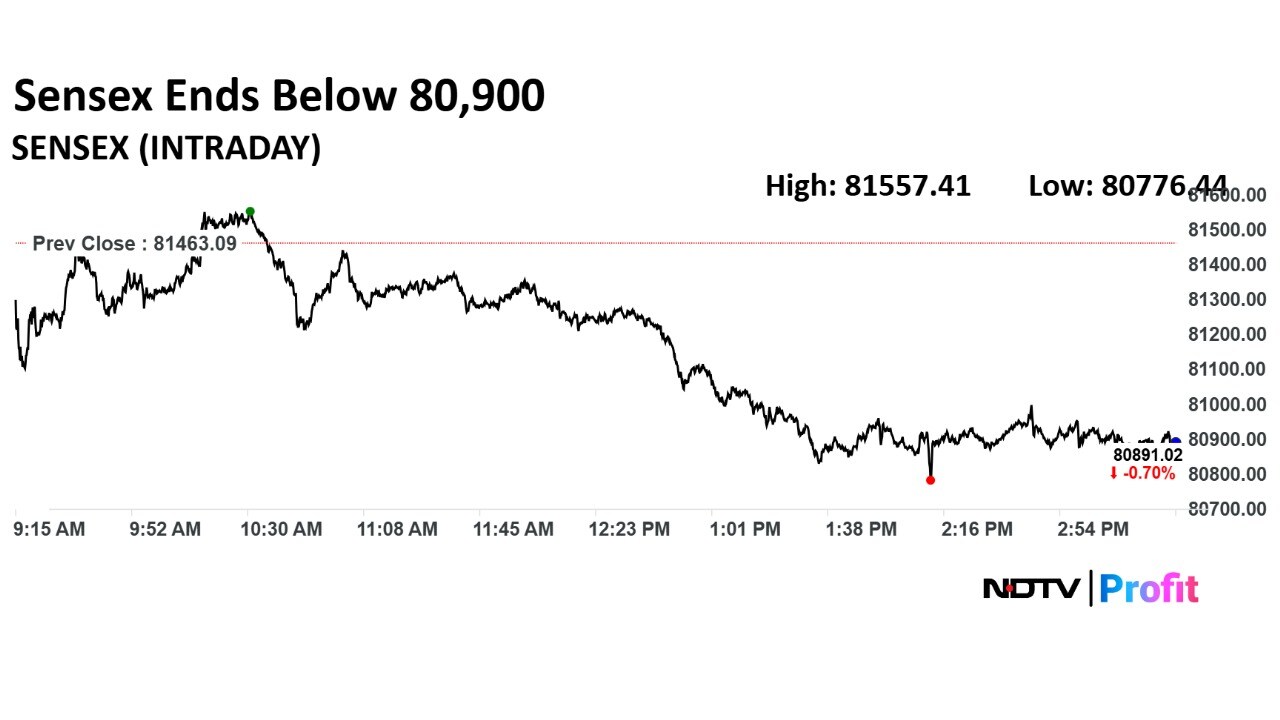

India's benchmark equity indices extended their decline to the third day as weak first-quarter results from Kotak Mahindra Bank Ltd. weighed the most.

The NSE Nifty 50 settled 156.1 points or 0.63% lower at 24,680.9, while the BSE Sensex shed 572.07 points or 0.7% to close at 80,891.02.

Currency Recap

The Indian rupee closed weaker against the US dollar on Monday, reversing early gains amid cautious global sentiment and persistent foreign portfolio outflows. The currency settled at 86.67 per dollar, down 16 paise from Friday's close of 86.51.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.