Nifty 50 remains poised for a short-term pullback if it sustains above 22,780, with upside targets at 23,360 and 23,500. Analysts suggest a breakout above these levels could signal further bullish momentum.

The positive divergence in the RSI worked well and at present, the index stands on the brink of a falling wedge formation breakout, which could drive the index further up to 23,550 if the breakout occurs between 23,200-23,250. The immediate resistance and support are positioned at 23,270 and 23,000, respectively, said Aditya Gaggar, director, Progressive Shares.

"We believe that if the market stays above 23,000, the pullback formation is likely to continue, and on the upside, the market could bounce back to the 20-day SMA at 23,350 and 23,400," highlighted Shrikant Chouhan, head of equity research at Kotak Securities.

"However, if it falls below 23,000, the sentiment could change. In that case, traders may prefer to exit their long positions," Chouhan said.

Bank Nifty settled the day on a positive note at 49,166. Yedve noted that on a daily chart, Bank Nifty has formed a green candle, indicating strength. As long as the index holds 47,840, bullish momentum is likely to continue.

"On the upside, 49,500 and 50,000 will act as resistance points. Thus, traders are advised to adopt a buy-on-dips strategy in Bank Nifty," he further said.

FII/DII Activity

Foreign portfolio investors stayed net sellers of Indian equities for the 19th straight session on Wednesday, while domestic institutional investors were net buyers for the 30th consecutive session.

FPIs sold stocks worth Rs 2,586.4 crore and domestic institutional investors mopped up equities worth Rs 1,792.7 crore, according to provisional data from the National Stock Exchange.

F&O Action

The Nifty January futures were up 0.87% to 23,176.90 at a premium of 13.8 points, with the open interest down by 24.01%.

The open interest distribution for the Nifty 50 Jan. 30 expiry series indicated most activity at 26,300 call strikes, with the 26,300 put strikes having maximum open interest.

Market Recap

Indian equity benchmark indices closed higher for the second day in a row, as Shriram Finance Ltd., Bharat Electronics Ltd. and Tata Motors Ltd. among others, led gains.

The NSE Nifty 50 ended 205.85 points, or 0.90% up, at 23,163.10, and the 30-stock BSE Sensex ended 653.95 points, or 0.86% higher, at 76,555.36.

The NSE Nifty Bank also closed higher at 49,165.95. The index ended 0.61% up at 49,165.95.

Major Stocks In News

Union Bank of India: The board has approved to raise long term bonds up to Rs 20,000 crore, and issue of green or sustainable bonds up to Rs 5,000 crore.

Afcons Infrastructure: The company received a letter of award worth Rs 1,283 crore from Hindustan Gateway Container Terminal Kandla Pvt. Ltd. with a completion period of 29 months.

Allied Blenders and Distillers: The board approves acquisition of all brands & other intellectual property rights from Fullarton Distilleries.

Authum Investment & Infrastructure: The company has acquired 34,802 equity shares of Welspun Michigan Engineers Ltd. representing 2.01% of equity share capital.

Blue Dart: The board has approved renewal of aircraft, crew, maintenance & insurance pact with arm Blue Dart Aviation for 5 years.

JK Cement: The company won tender floated by Gujarat Mineral Development Corporation Ltd. for long term supply of 250 million tonne of limestone.

Global Cues

Stocks in the Asia-Pacific region wavered on Thursday after the US Federal Reserve kept the key rates unchanged while hinting it was not in a hurry to lower rates.

Australia's S&P/ASX 200 opened higher with the benchmark index advancing by 0.37%, or 31 points, to 8,477 as of 6:35 a.m. Japan's Nikkei was down 69 points, or 0.18% at 39,350. Stock markets in China, South Korea and Taiwan remained closed for the Lunar New Year holiday.

Jerome Powell said that interest rates are now significantly higher than the neutral rate adding that the central bank is pausing to see further progress on inflation following a string of rate reductions last year.

The Federal Open Market Committee voted unanimously to keep the federal funds rate in a range of 4.25%-4.5%, after lowering rates by a full percentage point in the final months of 2024.

“The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid,” the statement.

Treasuries were steady while the dollar inched lower on Thursday. The dollar index — which tracks the greenback's performance against a basket of 10 leading global currencies — was 0.14% down at 107.85.

Meanwhile, Tesla Inc. rose after it expects vehicle sales to climb this year while Microsoft Corp. shares tumbled as growth in its cloud-computing business slowed. The S&P 500 and the tech-heavy Nasdaq Composite fell 0.47% and 0.51%, respectively. The Dow Jones Industrial Average declined 0.31%.

In Asia, Australia's quarterly inflation will be the key data to watch out along with the speech by Bank of Japan Deputy Governor Ryozo Himino on Thursday.

Crude oil prices rose during the day as traders await clarity on Trump's tariff plans. The Brent crude was up 0.20% at $76.73 a barrel as of 6:45 a.m. IST, and the West Texas Intermediate was up 0.29% at $72.83.

Money Market

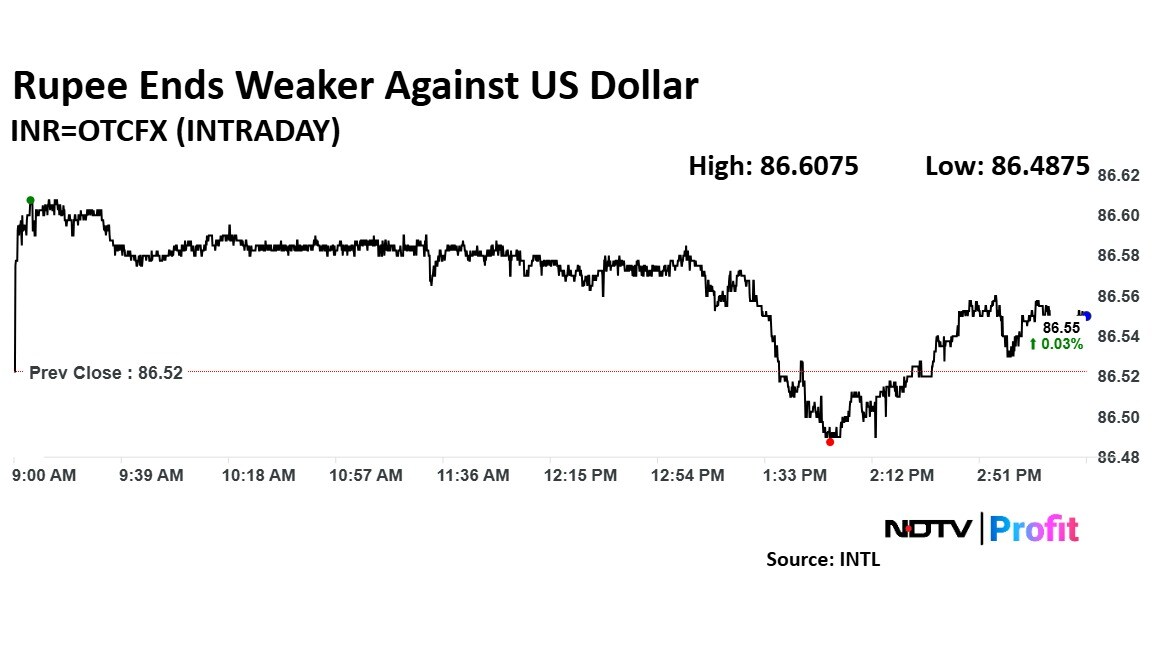

The rupee ended weaker against the US dollar on Wednesday. It weakened by 2 paise to close at 86.55.

The domestic currency had opened weaker against the US dollar on Wednesday, falling by 5 paise to trade at 86.58. This marks the continuation of its downward trajectory, following a 19 paise drop on Tuesday that brought the currency to 86.53.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.