India's benchmark index, NSE Nifty 50, is poised for further upside, with immediate resistance at 24,250–24,300 and a key support zone near 23,890. Analysts suggest a break above 24,300 could trigger fresh momentum, while dips toward the support levels offer potential buying opportunities.

"On the technical front, the 24,000 zone, coinciding with 20 DEMA, is likely to cushion any upcoming blips, with 200 DSMA as a crucial support for Nifty. On the other hand, continued buying above 24,250-24,300 is likely to trigger fresh momentum in the benchmark index in the near period. It is advisable to utilise any dips toward the mentioned support zone as a buying opportunity," according to Osho Krishnan, senior analyst, technical and derivatives of Angel One.

"Technically, on the daily chart, Nifty has held its trend line support, crossed the 200-day simple moving average, or 200-DSMA, and formed a strong bullish candle, indicating strength. Additionally, the index has broken out of a short-term consolidation range of 23,500–23,900. Following this breakout, the index is poised to test levels of 24,300–24,400 in the short term," according to Hrishikesh Yedve, AVP technical and derivatives research at Asit C. Mehta Investment Interrmediates Ltd.

"On the downside, 200-DSMA is placed near 23,890, which will act as a short-term support for the index. As long as the index holds above 23,890, a buy-on-dips strategy is advisable for Nifty," he further said.

"Investors will closely track the pre-quarterly business updates to be released over the next few days for insights into the upcoming result season. We expect the gradual uptick to continue in the market over the next few days, alongside a close watch on Q3 earnings and the global cues as foreign markets reopen after year-end holidays," said Siddhartha Khemka, head of research, wealth management, Motilal Oswal Financial Services Ltd.

Bank Nifty closed positively at 51,606. Yedve noted that technically, the index has maintained support at the 200-DEMA, which is near 50,490, and formed a strong bullish candle on the daily chart, indicating strength. On the upside, 50-DEMA is placed near 51,870, which will act as resistance.

"Moreover, the index is still consolidating in the range of 50,500–52,000. Sustaining above 52,000 could spark a fresh rally toward 52,500-53,000 levels," Yedve further said.

FII/ DII Activity

Foreign portfolio investors snapped a 12-session selling streak on Thursday and bought stocks worth approximately Rs 1,506.8 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors have been buyers for 12 consecutive sessions and bought stocks worth Rs 22.1 crore.

F&O Action

Nifty January futures up by 1.56% to 24,270 at a premium of 82 points.

Nifty January futures open interest down by 6.4%.

Nifty Options Jan. 9 Expiry: Maximum call open interest at 26,500 and maximum put open interest at 21,850.

Market Recap

The Indian benchmarks closed higher for the second consecutive day on Thursday and recorded their best sessions since Nov. 22. Both the equity indices saw their highest closing since Dec. 18.

The NSE Nifty 50 closed 445.75 points, or 1.88%, up at 24,188.65, and the BSE Sensex ended 1,436.30 points, or 1.83%, higher at 79,943.71. Intraday, the Nifty had risen 2% and the Sensex 1.9%.

Major Stocks In News

Hindustan Zinc: The company in its business update reported Q3 mined metal output at 2.65 lakh tonnes, down 2% year-on-year, saleable metal production at 2.59 lakh tonnes year-on-year, Refined zinc production at 2.04 lakh tonnes year-on-year, Refined lead production down 2% year-on-year at 55,000 tonnes.

Capital Small Finance Bank: The bank in its Q3 business update reported total deposits up 12% year-on-year at Rs 8,384 crore versus Rs 7,482 crore, gross advances up 19.2% at Rs 6,816 crore versus Rs 5,718 crore and Gross NPA rose to 2.67% versus 2.61% previous quarter.

Bank of Maharashtra: The bank in its Q3 business update reported total deposits up 13.54% year-on-year at Rs 2.79 lakh crore versus Rs 2.45 lakh crore, gross advances up 21.19% at Rs 2.28 lakh crore versus Rs 1.88 lakh crore and CASA ratio remained flat at 49.3%.

Global Cues

Stocks in the Asia-Pacific region advanced despite a fifth consecutive fall on the Wall Street. The dollar index shot to a two-year high.

Australia's S&P ASX 200 was up 40 points, or 0.48%, at 8,240, as of 6:50 a.m., while South Korea's Kospi was trading 45 points, or 1.9% higher at 2,445. Stocks in Japan will be closed through Jan. 6.

Futures contracts pointed to losses in mainland China and Hong Kong. Stocks in China were the worst performers in the previous session among its Asian peers.

A global gauge of emerging-market stocks dropped to the lowest level since September and neared a 10% decline from a high in early October, according to Bloomberg.

Stocks in Wall Street extended their losing spree for day five, led by lacklustre results from Tesla Inc. The Elon Musk-owned company's annual vehicle sales dropped for the first time in more than a decade despite a year-end push that sent deliveries to a record in the fourth quarter.

The S&P 500 and the tech-heavy Nasdaq Composite fell 0.22% and 0.16%, respectively, on Thursday. The Dow Jones Industrial Average slumped 0.36%.

Meanwhile, the initial applications for US unemployment fell to an eight-month low, giving little support for the Federal Reserve to cut rates in the next meet. The US ISM manufacturing, light vehicle sales data will be the key monitorable on Friday's session.

The dollar index — which tracks the greenback's performance against a basket of 10 leading global currencies — fell 0.20% but traded at a two-year high of 109.17.

Crude oil prices were steady after Thursday's increase on an industry report that showed US crude stockpiles continued to shrink. The Brent crude was trading 0.25% higher at $76.12 a barrel as of 7:05 a.m. IST, and the West Texas Intermediate was up 0.29% at $73.34.

Money Market

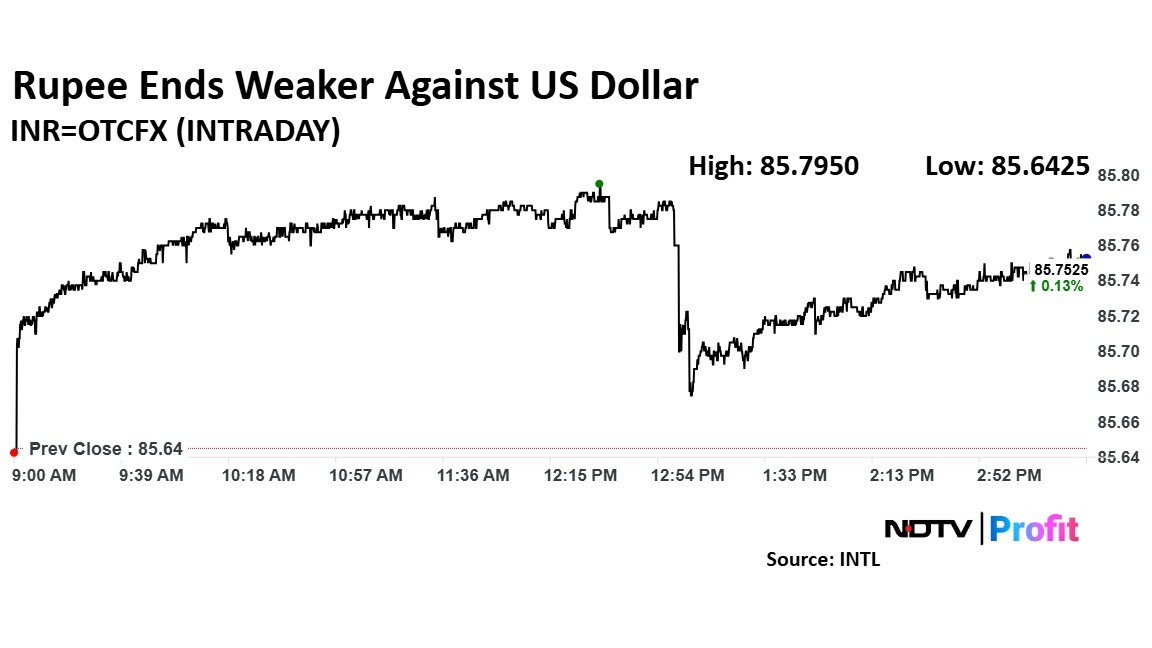

The rupee ended weaker against the US dollar on Thursday, declining by 10 paise to close at 85.75. This marks a continued weakening trend for the rupee, which has been grappling with global dollar strength and domestic demand pressures.

The domestic rupee opened weaker by 6 paise at 85.71 against the US dollar on Thursday, continuing its decline from the previous session. In the first trading session of 2025, the rupee had already weakened by 4 paise, closing at 85.65 after opening at 85.62.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.