Trade Setup For Jan 5: Nifty To Maintain Short Term Positive Trend, Resistance Seen At 26,500

As long as Nifty sustains above the 26,000 mark, the near to short term outlook for the index is bullish with a buy on dips approach favoring the bulls.

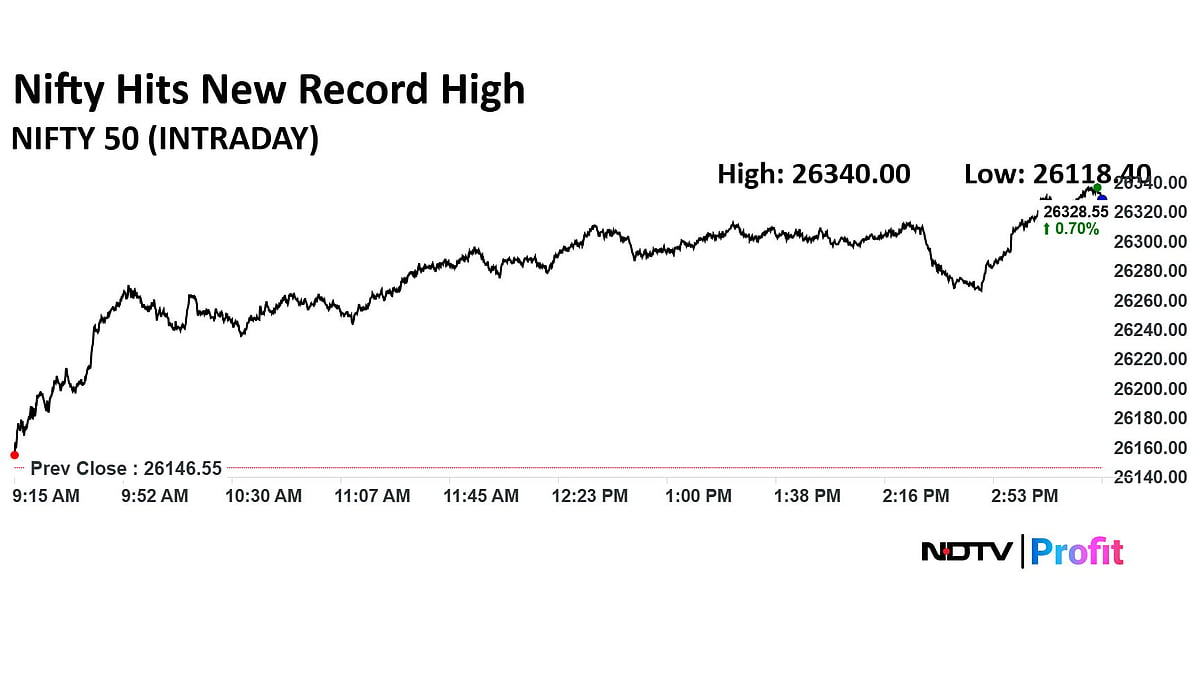

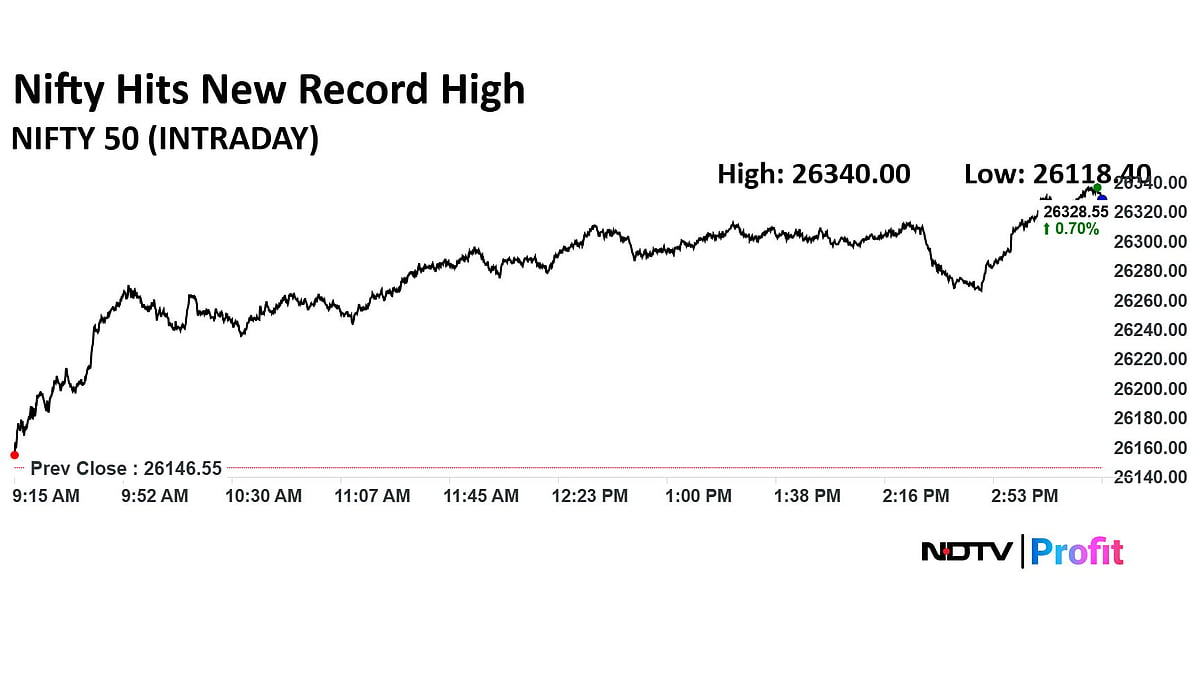

The Indian equity markets extended their bullish momentum on Friday and ended the session on a strong note, with the Nifty touching the year's first record high.

According to analysts, optimism around upcoming corporate earnings and strong domestic participation lifted overall investor sentiment.

"A strong bullish candle on the daily chart has pushed the index to a fresh high of 26,340, signalling scope for further upside into uncharted territory", said Bajaj Broking Research.

The brokerage added that the benchmark's consistent trading above its key moving averages is a confirmation of the strength of its ongoing uptrend.

As long as Nifty sustains above the 26,000 mark, the near to short term outlook for the index is bullish with a buy on dips approach favoring the bulls, the brokerage highlighted.

Resistance levels are seen between 26,500 and 26,700, whereas the index will find support between 26,250 and 26,100.

"Expectations around upcoming Q3 results and supportive policy measures in the Union Budget have helped lift overall sentiment. A key factor has been improved participation in the broader market, particularly selective buying in mid-cap stocks", said Siddhartha Khemka, Head of Research, Wealth Management, Motilal Oswal Financial Services.

Khemka added that he expects this positivity to continue into next week, supported by several companies announcing their pre-quarterly business updates.

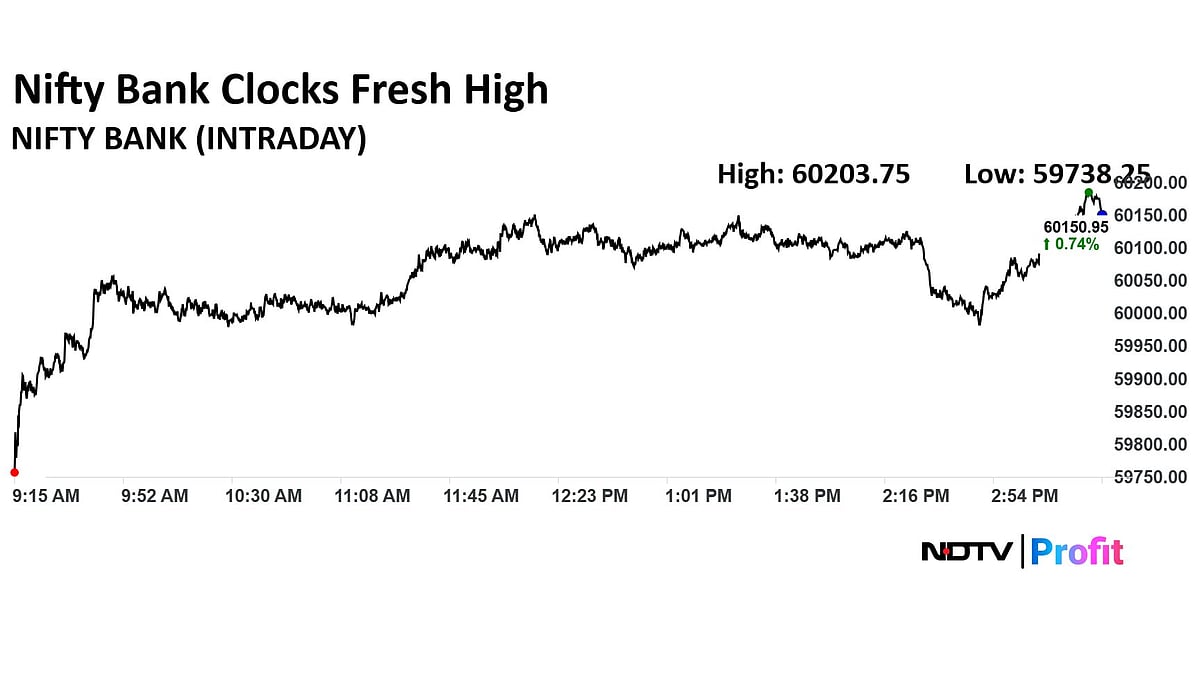

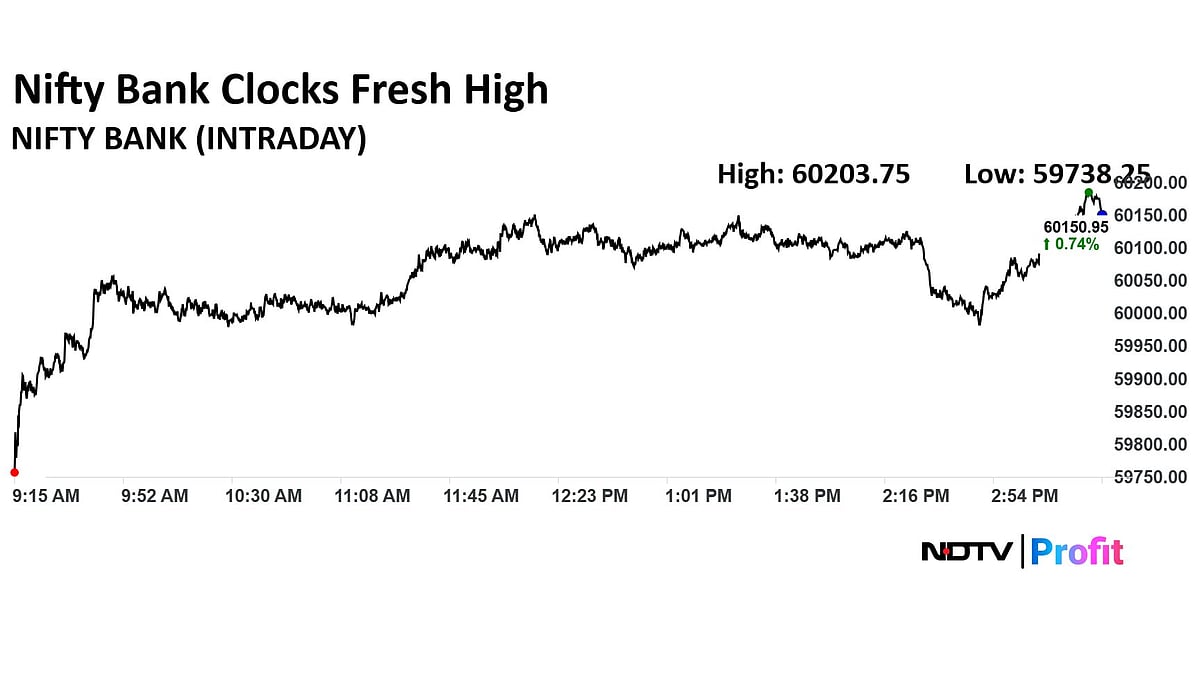

Nifty Bank Outlook

The bank nifty has also maintained a bullish momentum, clocking a fresh at 60,203.75 over the last few sessions, driven by sustained strength in PSU banks, according to Bajaj Broking Research.

"For Bank Nifty, the short-term trend is positive, with 59,800 and 59,500 acting as key support zones, while 60,500-60,700 could act as crucial resistance areas for the bulls", stated Amol Athawale, VP Technical Research at Kotak Securities.

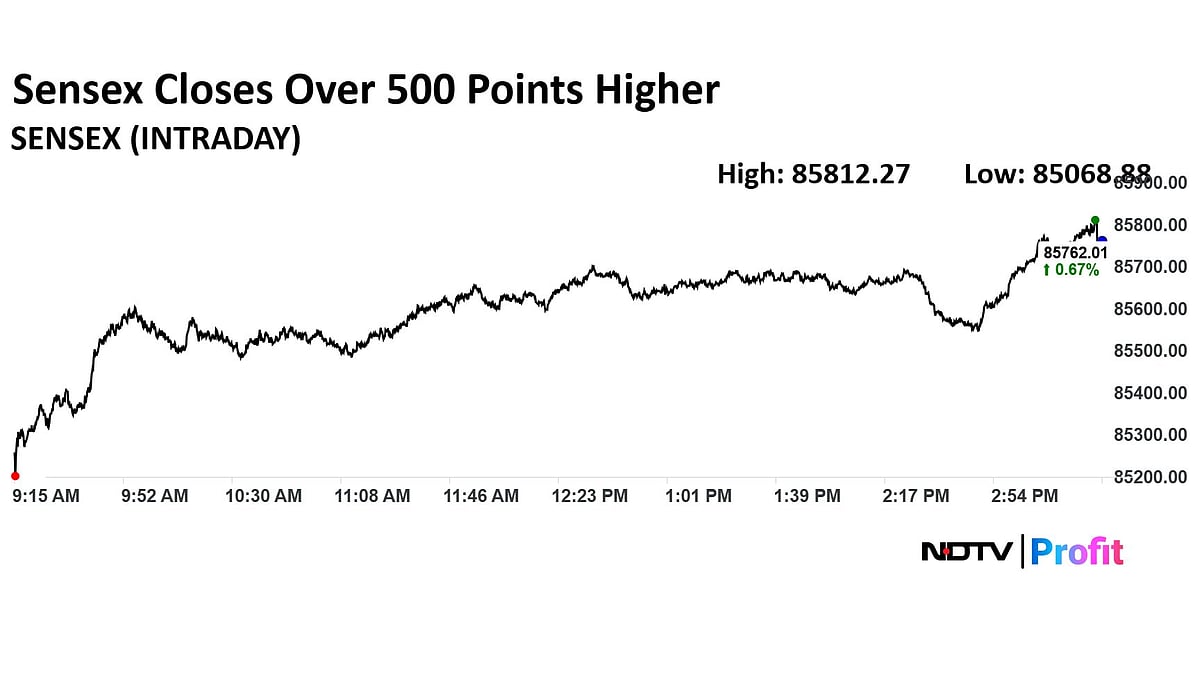

Market Recap

India's benchmark Nifty 50 index soared to a record high on Friday, led by gains in financial and energy stocks.

The 50-stock blue-chip index gained 0.7% or 182 points to close at 26,328.55 points, logging a third consecutive session of advance. Intraday, it hit 26,340. The market capitalisation of the index jumped by Rs 1.64 lakh crore.

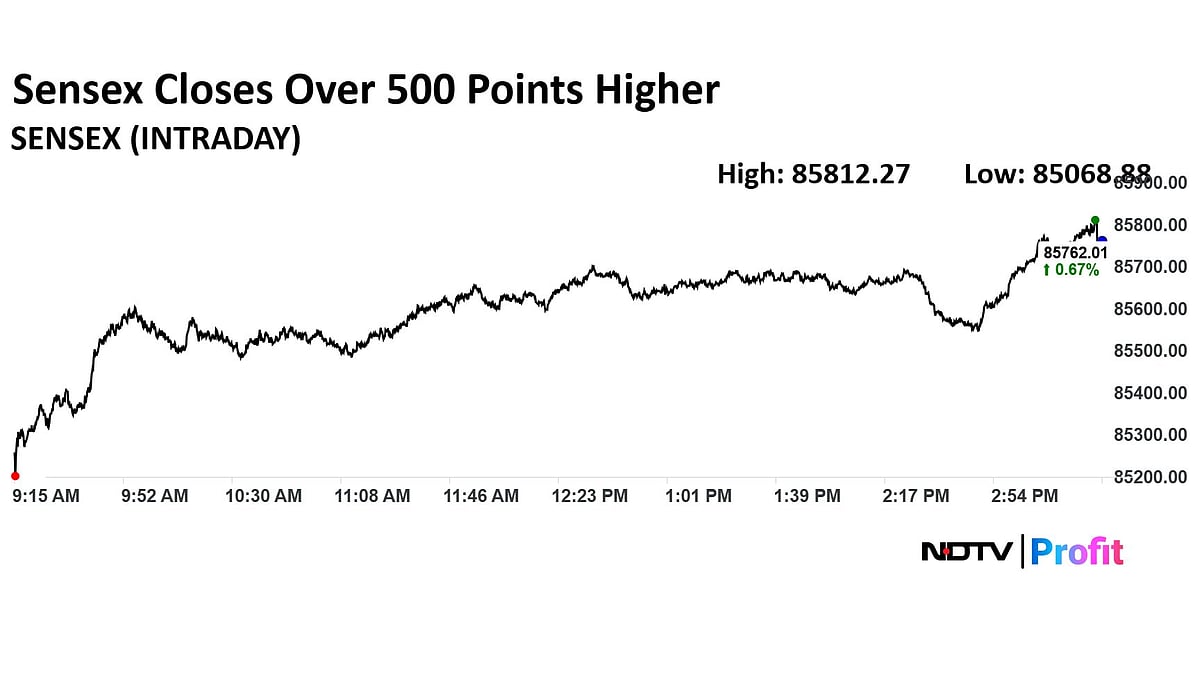

The BSE Sensex comprised of 30 blue-chip stocks ended 573.41 points or 0.67% higher at 85,762.