The NSE Nifty 50 signals uncertainty but holds key support at 22,780, suggesting potential for a short-term pullback, according to analysts.

Immediate resistance at 23,200 will be crucial. A breakout can drive further gains, while a breach below support may trigger additional downside, they said.

From a technical perspective, the Nifty formed a doji candle on the daily chart, indicating uncertainty. However, the index managed to hold support of 22,780 level, indicating buying interest at lower levels, according to Hrishikesh Yedve, research analyst at Asit C Mehta Investment Interrmediates Ltd.

"As long as the index sustains above 22,780, a short-term pullback rally toward 23,200 and 23,500 remains possible. Conversely, a breakdown and sustained trading below this level could push the index further down toward 22,500," Yedve said.

From a technical standpoint, there have been no significant developments in the Nifty, but the support near the sloping trendline of falling wedge seems to have its significance, according to Osho Krishnan, senior technical and derivatives analyst at Angel One.

"On the levels front, 22,800 remains the critical support zone on an immediate basis. On the flip side, 23,100–23,150 seems to be the intermediate hurdle, while formidable resilience is seen around 23,350–23.400, breaching which could only provide some thrust to the bullish sentiment in the markets," Krishnan highlighted.

"At present, the heightened volatility remains a significant concern, with small and mid-cap stocks being the primary victims," he said, adding that it is essential for traders to remain vigilant and assess potential strategies to navigate this landscape effectively.

The Bank Nifty settled the day on a positive note at 48,867. Yedve noted that on the technical front, the Bank Nifty has confirmed a bullish inverted hammer candle, which was formed near previous swing support.

"As per this pattern, as long as the index holds 47,840, bullish momentum is likely to continue. On the upside, 49,200 and 49,500 will act as resistance points. Thus, traders are advised to adopt a buy on dips strategy in Bank Nifty," he said.

FII/DII Activity

Foreign portfolio investors stayed net sellers of Indian equities for the 18th straight session on Tuesday and domestic institutional investors were net buyers for the 29th consecutive session.

FPIs sold stocks worth Rs 4,920.7 crore, while domestic institutional investors mopped up equities worth Rs 6,814.3 crore, according to provisional data from the National Stock Exchange.

F&O Action

The Nifty January futures were down 0.63% to 22,990 at a premium of 32.75 points, with the open interest down by 24.01%.

The open interest distribution for the Nifty 50 Jan. 30 expiry series indicated most activity at 25,300 call strikes, with the 25,300 put strikes having maximum open interest.

Market Recap

The Indian equity benchmark indices closed higher, ending a two-session decline, as bank stocks led gains.

The NSE Nifty 50 ended 128.10 points or 0.56% up at 22,957.25, while the 30-stock BSE Sensex closed 535.23 points or 0.71% higher at 75,901.41.

Major Stocks In News

360 One WAM: The NSE levies penalty of Rs 11.7 lakh on the contention that the impugned transactions done by the clients of 360 One DSL, wholly owned subsidiary of the company. The Income Tax Department initiated a search at the registered office of the company in Mumbai.

One Mobikwik Systems: Launch CBDC E-rupee in partnership with RBI and Yes Bank. The new CBDC product is available to all Android users, and allows users to send and receive funds to other e-rupee wallets as well as regular bank accounts via UPI.

JSW Steel: The company extended the long stop date for the transaction regarding an acquisition of Minas de Revuboe Limitada from Jan. 31 to June 30 due to ongoing arbitration between Minas de Revuboe and the Republic of Mozambique.

Home First Finance Co: The board approves raising up to Rs 1,250 crore via QIP, and elevation of Ajay Khetan to the position of Deputy CEO.

Grasim Industries: State tax conducts inspection at marketing office and depot of Tamil Nadu unit, and seized certain documents after inspection.

Global Cues

Stocks in the Asia-Pacific region edged higher on Wednesday after a rebound on technology stocks — following a DeepSeek scare — on Wall Street lifted the benchmarks.

Australia's S&P/ASX 200 opened higher with the benchmark index advancing by 0.83%, or 70 points, to 8,469 as of 6:54 a.m. Japan's Nikkei was up 170 points, or 0.44% at 39,193. Future contracts in China hinted at a positive start while those in Hong Kong will open higher.

Nvidia Corp. rallied 8.9% after suffering the biggest market-cap loss for a single stock in market history. The S&P 500 and the tech-heavy Nasdaq Composite rose 0.92% and 2.03%, respectively. The Dow Jones Industrial Average advanced 0.31%.

The dollar rose on Wednesday as US President Donald Trump threatened tariffs across industries. The dollar index — which tracks the greenback's performance against a basket of 10 leading global currencies — was 0.14% up at 107.91.

Australia's quarterly inflation will be the key data to watch out for on Wednesday, along with the US Federal Reserve's rate decision. The Fed is expected to hold rates steady on healthy demand and stubborn inflation, according to Bloomberg.

Crude oil prices steadied after the biggest gain in almost two weeks on Trump's tariff plans. The Brent crude was flat at $77.49 a barrel as of 7:05 a.m. IST, and the West Texas Intermediate was up 0.05% at $73.81.

Money Market

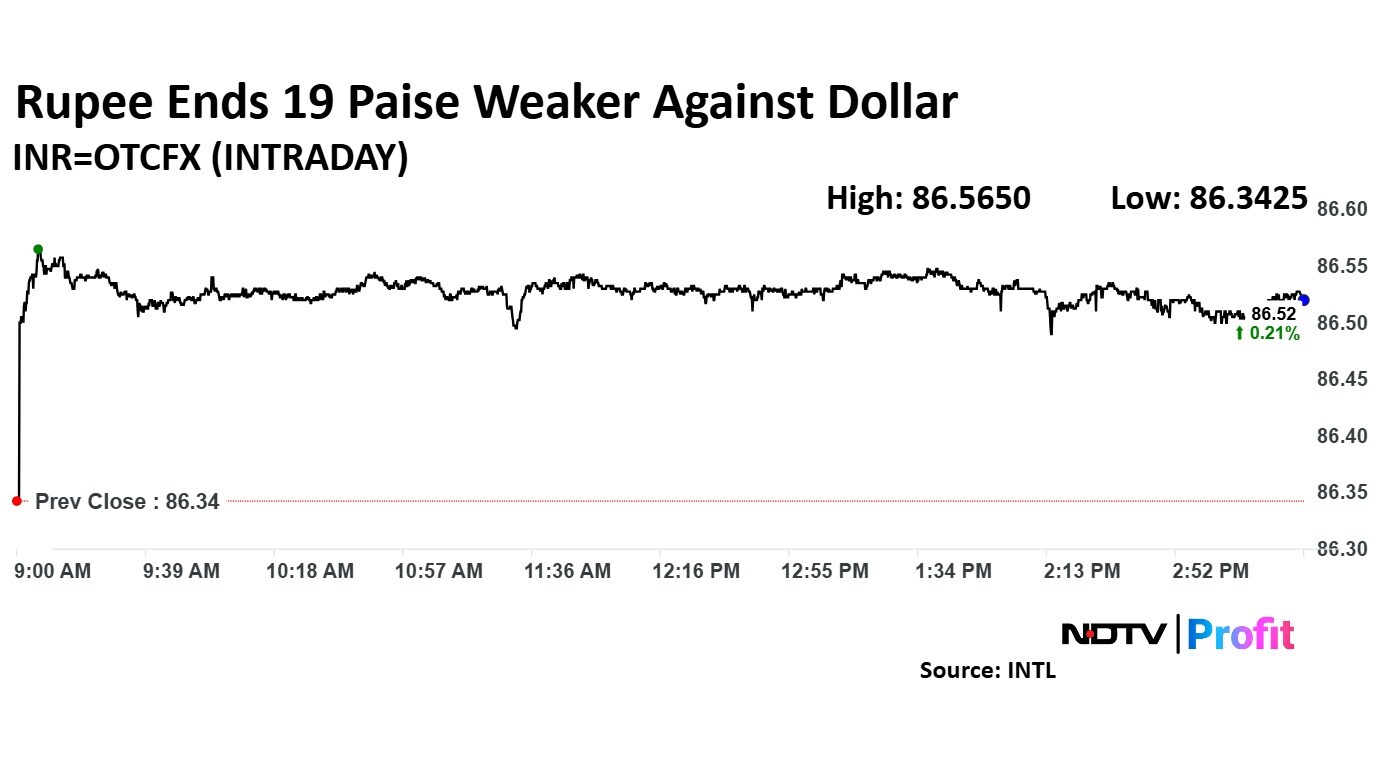

The rupee continued to weaken against the US dollar, as it slipped for a second day in a row on Tuesday. The domestic currency weakened by 19 paise to settle at 86.53 against the greenback.

Earlier on Tuesday, the rupee had opened on a weak note against the American counterpart, sliding by 16 paise against the previous close of 86.50. Notably, the rupee had weakened by 13 paise on Monday to settle at 86.34.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.