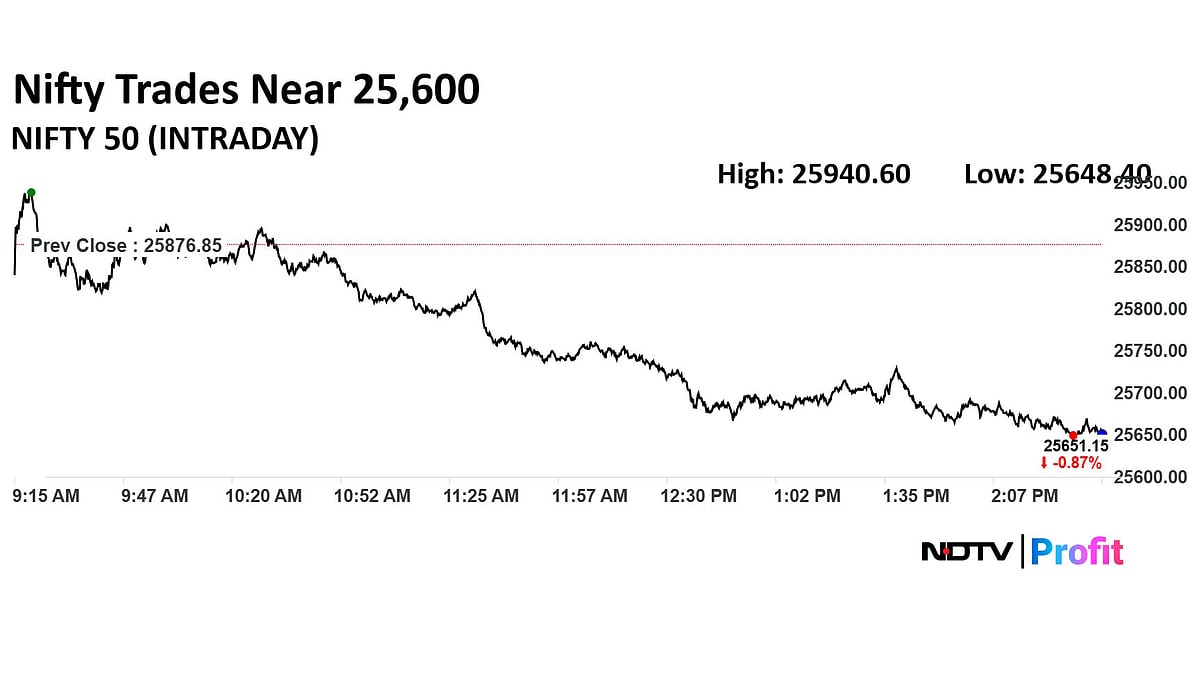

Trade Setup For Jan 12: Nifty's Weakness To Persist, Immediate Support At 25,600

On the upside, Nifty's immediate resistance is seen at 25,750 level.

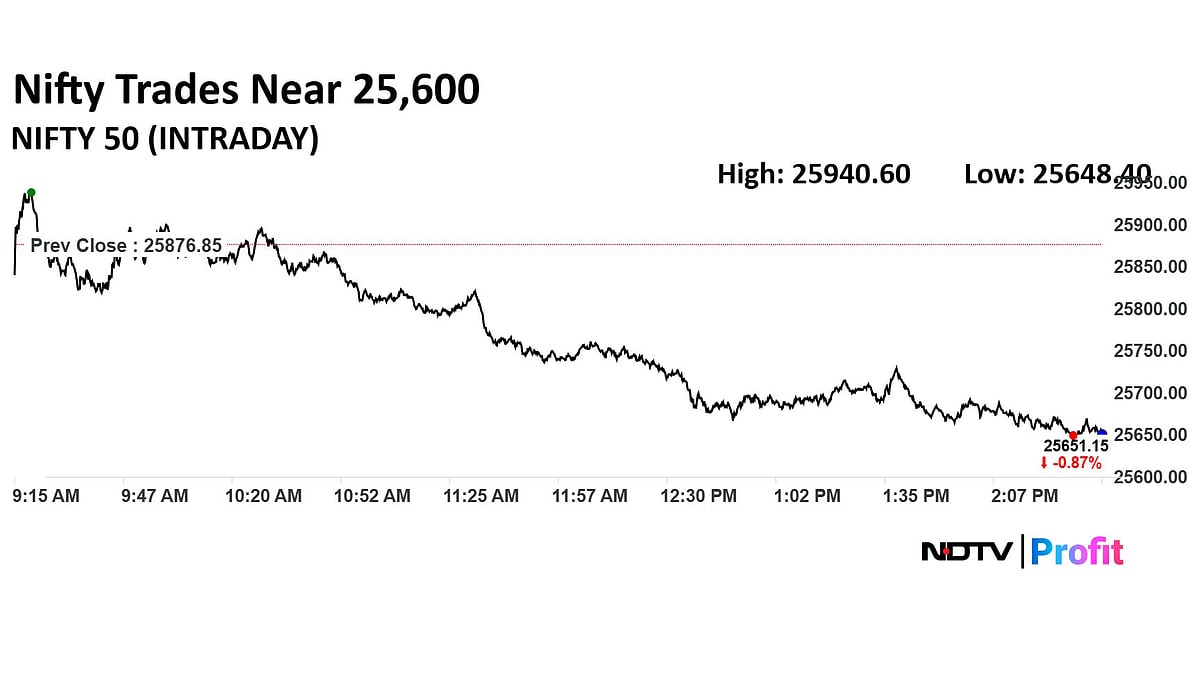

The Indian equity markets extended their decline into the fifth consecutive session on Friday, with Nifty 50 erasing its previous week's gains. Analysts project the weakness to continue at least in the short term.

"Nifty on the weekly chart formed a bearish engulfing candlestick pattern signaling profit booking at higher levels as the index gave up its entire previous week's gains and closed below the last-month low, highlighting downward bias," stated Bajaj Broking Research.

The research firm added that in the near-term, momentum indicators suggest the market is in an oversold territory.

The index is moving below its 50-day Simple Moving Average or SMA. "We are of the view that as long as the market trades below the 50-day SMA or 26,000, the weak formation is likely to continue," said Amol Athawale, VP -Technical Research, Kotak Securities.

The immediate support zone for Nifty lies at 25,600, while on the upside, immediate resistance is seen at 25,750 level, he added.

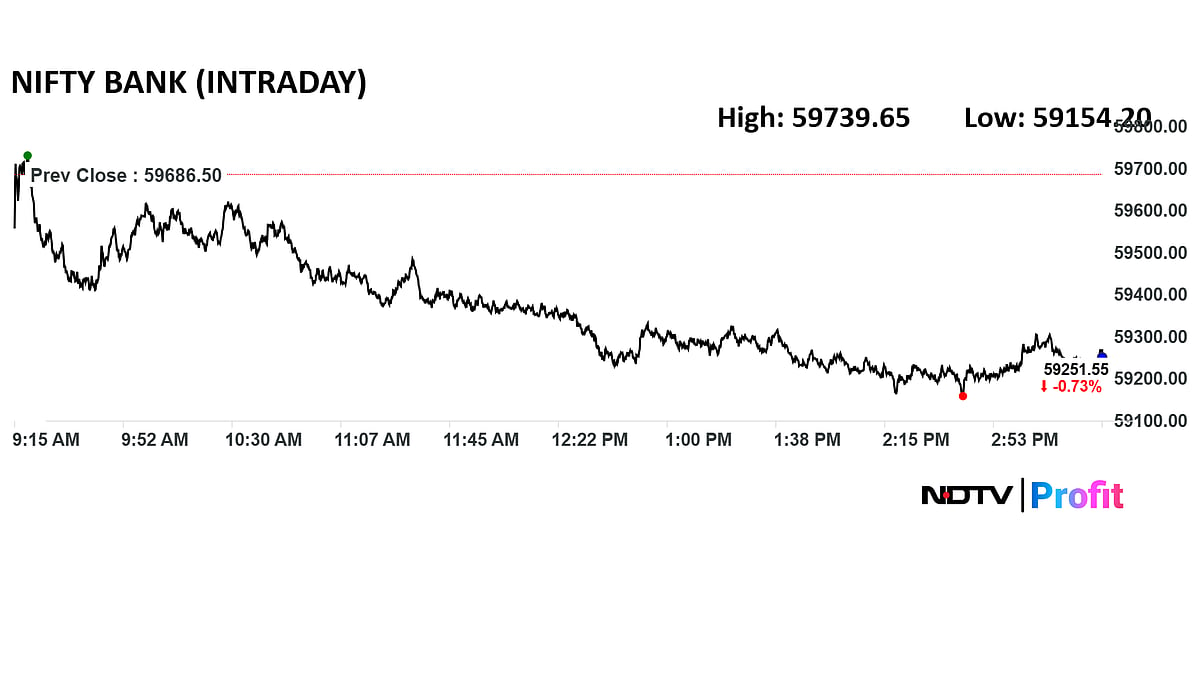

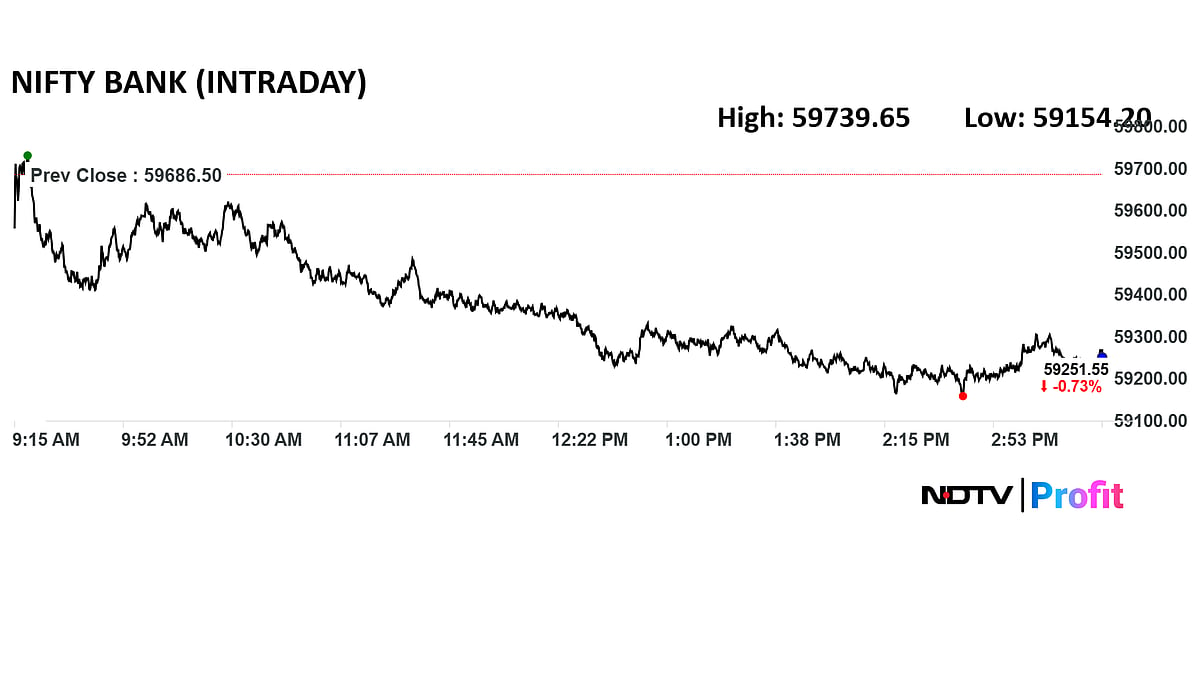

Bank Nifty Outlook

The Bank Nifty index is expected to remain in the consolidation phase, according to Bajaj Broking Research.

The key short-term support for the index lies at 59,000–58,700, while immediate resistance is seen at 59,500 level. "It could bounce back up to 59,800," stated Amol Athawale of Kotak Securities.

Market Recap

Indian benchmark indices continued their decline for a fifth consecutive session, amid persistent risk-off mode due to uncertainty over US–India tariff talks and escalating geopolitical tensions, especially concerns over potential US trade measures linked to Russia-related sanctions.

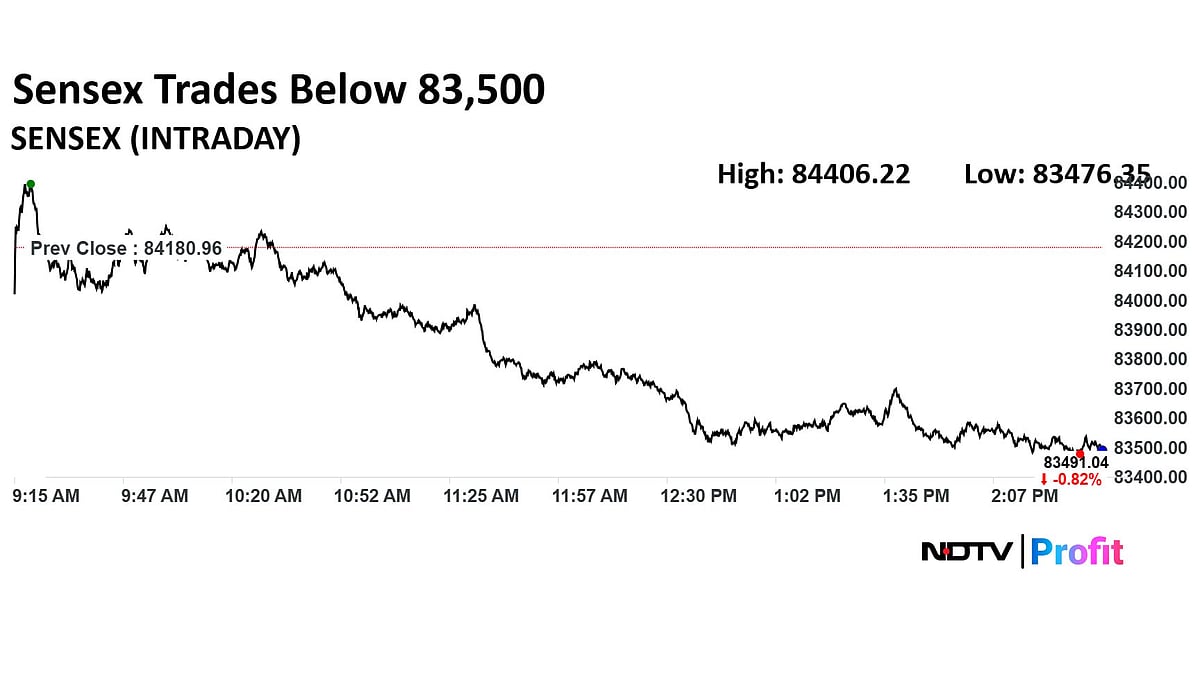

At the close, the BSE Sensex declined 604.72 points, or 0.72%, to 83,576.24, while the Nifty 50 fell 193.55 points, or 0.75%, to 25,683.30.

The broader market underperformed the benchmarks, with Nifty Midcap100 and Smallcap100 falling 0.8% and 1.8%, respectively.

The Nifty 50 saw a sharp correction of 2.5% during the week, marking one of its weakest performances in the past three months.