The NSE Nifty 50 finds immediate support near 23,600, with key resistance positioned at the 23,840-24,070 levels. Analysts highlight further resistance in the 24,320 zone while maintaining a cautious outlook given current market conditions. A strong move above the 23,850-24,000 range could signal a trend reversal.

"Technically, Nifty encountered resistance around its 200-day simple moving average, or 200-DSMA, at 23,840 and formed an inside bar candlestick pattern. Immediate hurdles for the index are positioned at 23,840 and 24,070, while the 100-Day Exponential Moving Average, or 100-DEMA, at 24,320 remains a critical barrier," according to Hrishikesh Yedve, AVP technical and derivatives research at Asit C. Mehta Investment Interrmediates Ltd.

"After a significant dip last week, the index might bounce back slightly, but any recovery should be used to book profits as long as the index remains below the 100-DEMA threshold of 24,320," Yedve advised.

"Indian markets are expected to remain range-bound due to a lack of triggers amidst Christmas holidays, relentless FII selling, and a weak Indian rupee," said Siddhartha Khemka, Head of Research, Wealth Management, Motilal Oswal Financial Services Ltd.

"A strong and sustainable move above the zone of 23,850-24,000 will confirm a trend reversal, whereas on the downside, the level of 23,600 will continue to act as a support," noted Aditya Gaggar, Director of Progressive Shares.

Bank Nifty closed positively at 51,318. Yedve noted that on the daily chart, the index formed a bullish harami candlestick pattern. On the downside, the 200-day simple moving average, or 200-DSMA, is placed near 50,500, which will act as a strong support for the index in the short term.

"On the higher side, the 100-DEMA hurdle is placed near 51,650 levels. Sustaining above 51,650 could extend the short-term pullback towards 52,000–52,200 levels," said Yedve.

FII/DII Activity

Overseas investors stayed net sellers for the sixth consecutive day and offloaded stocks worth approximately Rs 168.71 crore on Monday, according to provisional data from the National Stock Exchange.

Foreign investors collectively offloaded stocks worth Rs 15,996.82 crore in the past six sessions. Domestic institutional investors stayed net buyers for the fifth straight day and bought stocks worth Rs 2,227.68 crore on Monday.

F&O Cues

Nifty December futures up by 0.6%, settling at 23,768 at a premium of 15 points.

The open interest for Nifty December futures fell by 12.2%.

As for Nifty options expiring on Dec. 26, the maximum call open interest is at 25,000, while the maximum put open interest stands at 23,500.

Major Stocks In News

HG Infra Engineering: The company's arm entered into a battery energy storage purchase agreement with NTPC Vidyut Vyapar Nigam for procurement of 185 MW/370 MWH on long term basis.

Zaggle Prepaid: The company raised Rs 595 crore via QIP. The company to allot 1.14 crore shares at issue price of Rs 523.2 per share, which indicates a 5% discount to floor price.

TVS Motor: The company completed acquisition of 39.11% stake in DriveX. Post acquisition, the company's holding in DriveX has increased to 87.38%.

PG Electroplast: The company signed an agreement with Whirlpool to contract manufacture select Whirlpool branded semi-automatic washing machines.

Market Recap

Indian benchmark equity indices tracked the gains in US and Asian markets to close higher on the first session of Christmas week. Before today, both the indices had lost nearly 5% last week.

Nifty ended 0.7% or 165.95 points up at 23,753.45, and Sensex closed 0.64% or 498.58 points higher at 78,540.17. Intraday, both the indices had gained more than 1%.

Globally, sentiment was bolstered as November US PCE data cooled more than expected and eased fears of future rate hikes in the country.

Global Cues

Stocks in the Asia Pacific region traded mixed on Tuesday after a rally on Wall Street led by technology stocks as markets worldwide will take a break in the following session on account of Christmas

Japan's Nikkei was 30 points, or 0.07%, lower at 39,127, while Australia's S&P ASX 200 was up 4 points, or 4.2%, at 8,205, as of 6:56 a.m. Futures contracts pointed to gains in Hong Kong and mainland China.

Shares of Nissan Motor Co. slumped 7.3% while Honda Motor Co. rallied 14% as the former company confirmed it's in talks with Honda Motor over a possible business integration.

Meanwhile, consumer confidence in South Korea dropped this month by the most since the outbreak of Covid-19, triggered by the political turmoil as a result of the recent martial law.

Stock markets worldwide will remain closed because of Christmas on Wednesday. Japan's industrial production data for November is expected. on Friday along with their CPI data. Tokyo's core inflation, excluding fresh food, is expected to climb to 2.5% year on year in December.

The dollar index — which tracks the greenback's performance against a basket of 10 leading global currencies — was trading 0.09% higher at 108.13. Bitcoin was trading at $94,228.75 mark.

Stocks on Wall Street saw a renewed rally led by technology stocks after weaker-than-expected data on US consumer confidence. The S&P 500 and the tech-heavy Nasdaq Composite rose 0.73% and 0.98%, respectively, on Monday. The Dow Jones Industrial Average climbed 0.16%.

The S&P 500 is on its way to record a stellar annual return and back-to-back years of more than 20% gains, according to Bloomberg.

Treasury 10-year yields advanced six basis points to 4.59%. The Bloomberg Dollar Spot Index rose 0.3%.

Crude oil prices continued to gain on Tuesday. The Brent crude was trading 0.40% higher at $72.92 a barrel as of 7:09 a.m. IST, and the West Texas Intermediate was up 0.39% at $69.51.

Money Market

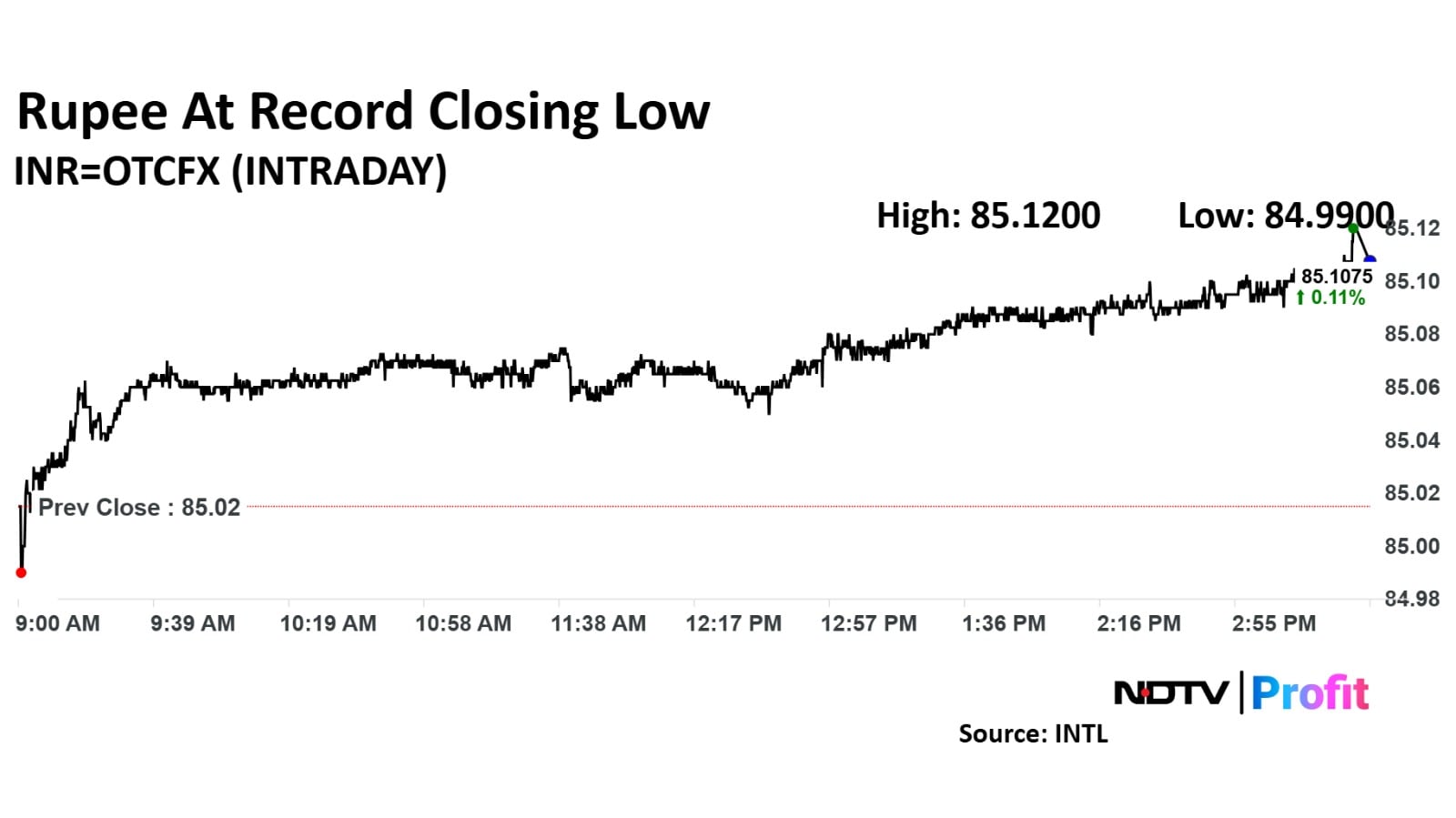

The Indian rupee weakened by 10 paise to close at a record low of 85.12 against the US dollar on Monday.

The domestic currency had opened at 84.85, according to Bloomberg data. It had closed at 85.02 on Friday.

Meanwhile, the dollar index gained 0.12% to 85.1187, maintaining its upward momentum.

Brent crude rose 0.41% to $73.24 per barrel, supported by easing concerns over a potential US government shutdown and a softer US Personal Consumption Expenditures price index, which boosted hopes for further policy easing by the US Federal Reserve, said Anil Bhansali, executive director at Finrex Treasury Advisors LLP.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.