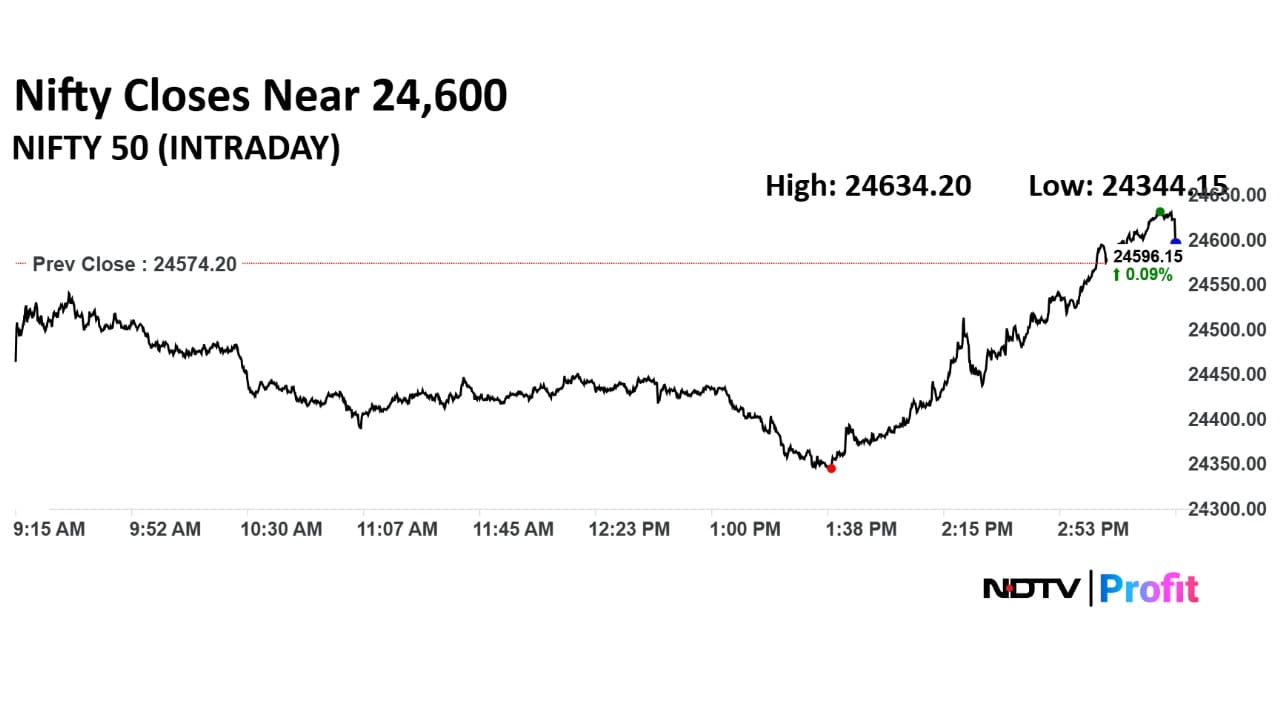

The NSE Nifty 50's support zone was seen to be at 24,400-24,500 levels, analysts from Bajaj Broking Research said on Thursday.

The benchmark index ended in the green after a two-day slump, remaining steady despite the announcement of 50% tariffs on India from US President Donald Trump.

"Strong support for the index is seen in the 24,500–24,400 zone, which coincides with multiple technical indicators — including the previous swing low, the 100-day exponential moving average, and a key retracement level from the recent uptrend," Bajaj Broking said in a note.

A pullback is likely to continue above 24,700 up to 24,850–24,900. Conversely, a decline below 24,500 could push the market down to 24,350–24,300, according to the brokerage.

The index formed a bull candle with a long lower shadow, highlighting buying demand around the key support area of 24,400-24,500. The indices need to start forming higher high and higher low on a sustained basis to signal a pause in the corrective trend, Bajaj Broking Research added.

The Nifty's key support at 24,500. As long as the market stays above this level, the pullback formation is likely to continue, according to Shrikant Chouhan, head of equity research at Kotak Securities.

"On the higher side, the market could move up to 24,800. Further upside may also continue, potentially lifting the index up to 24,875. On the flip side, a decline below 24,500 could change the sentiment. Below this level, the market could retest the levels of 24,350-24,300," Chouhan said.

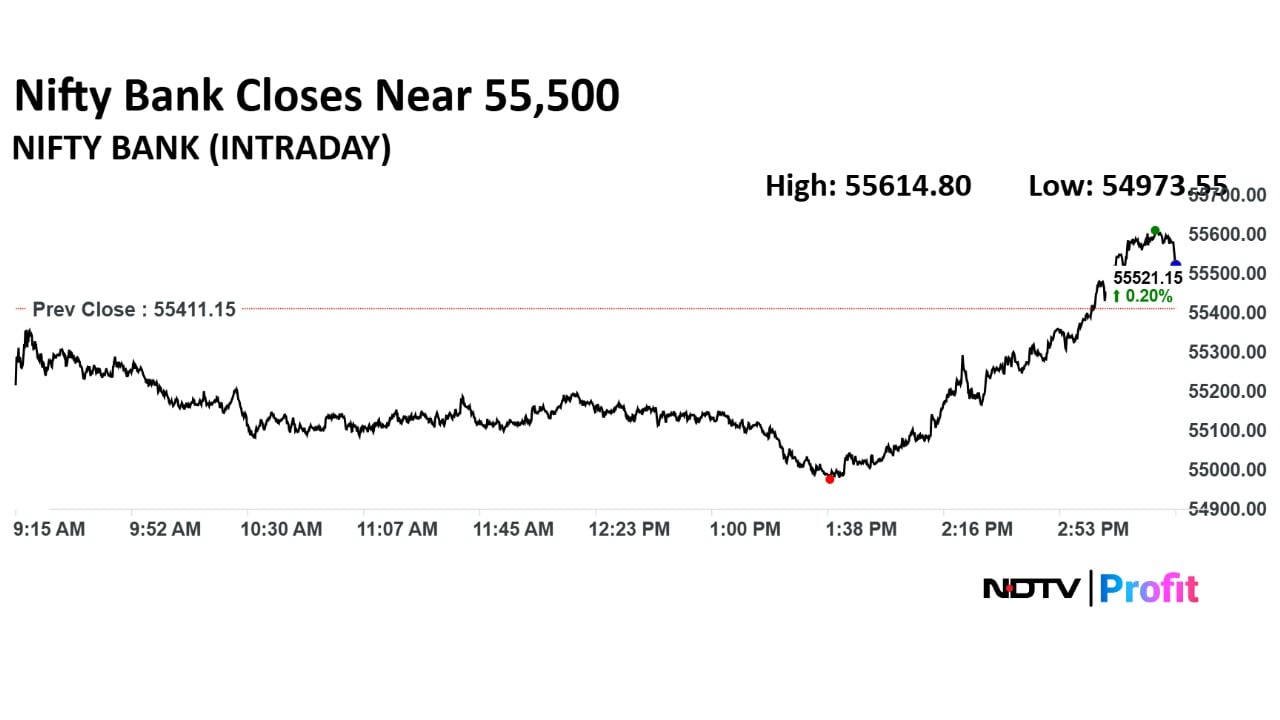

The Bank Nifty's key support is between 55,200 and 54,900. On the upside, resistance is seen at 56,300–56,500 levels, according to Bajaj Broking.

Market Recap

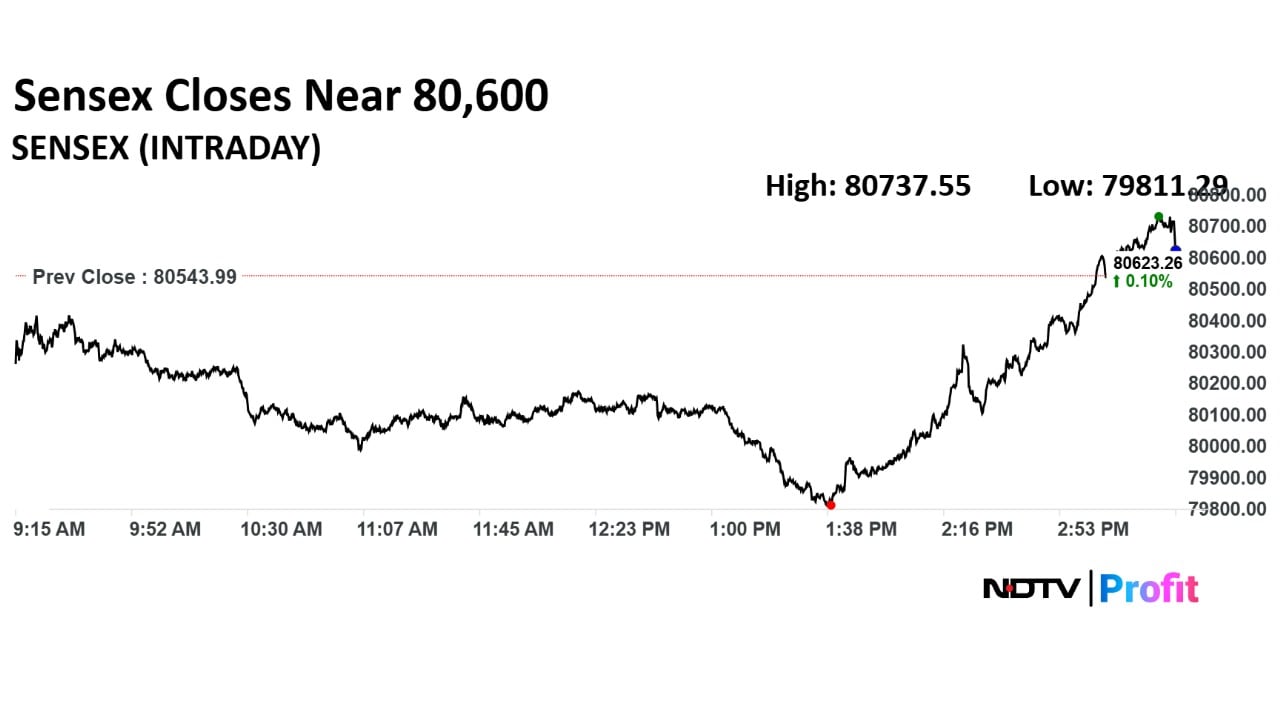

The Indian equity benchmarks closed in the green, recovering sharply during the last hour of trade.

The NSE Nifty 50 benchmark ended 21 points, or 0.09% higher at 24,596 and the 30-stock BSE Sensex ended 79 points, or 0.10% lower at 80,623.

Currency Recap

The Indian rupee closed stronger against the US Dollar on Thursday, even after United States President Donald Trump slapped an additional 25% tariff on India.

The local currency closed 3 paise stronger at 87.70 against the greenback compared to the previous close at 87.73.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.