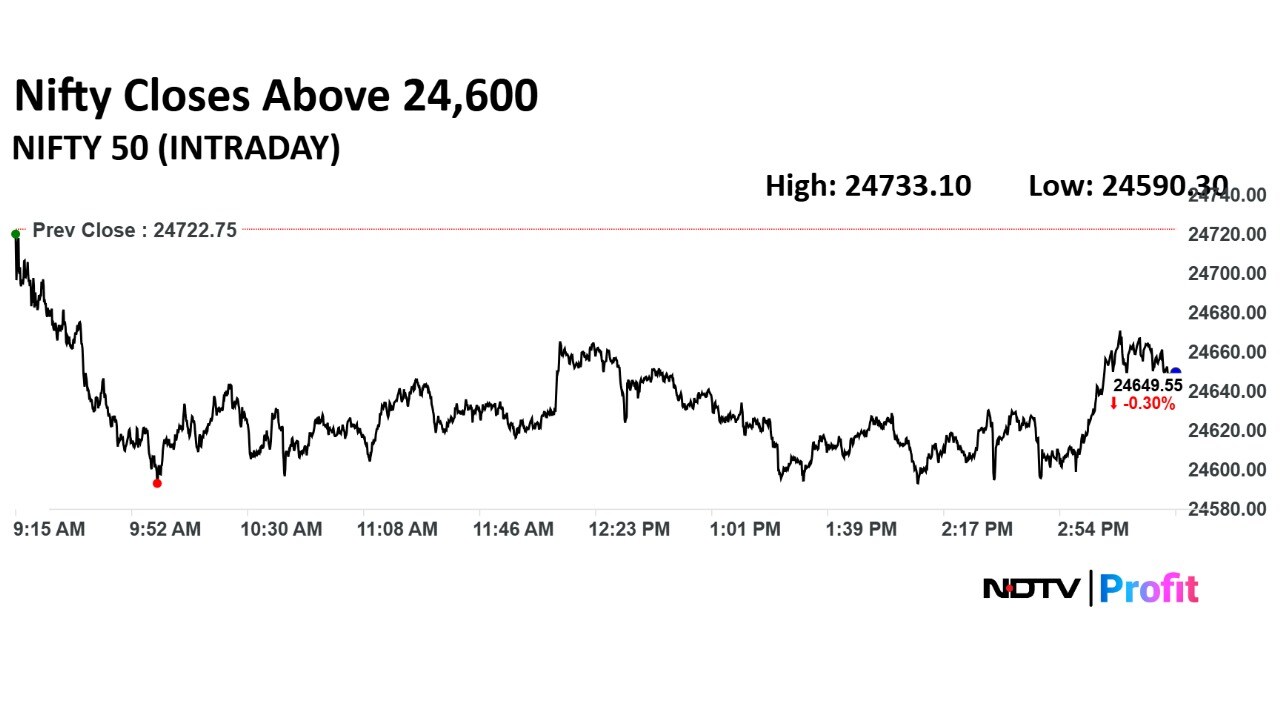

- NSE Nifty 50 support zone shifted to 24,400-24,500 levels after recent decline

- Nifty expected to consolidate between 24,400 and 25,000, says Bajaj Broking Research

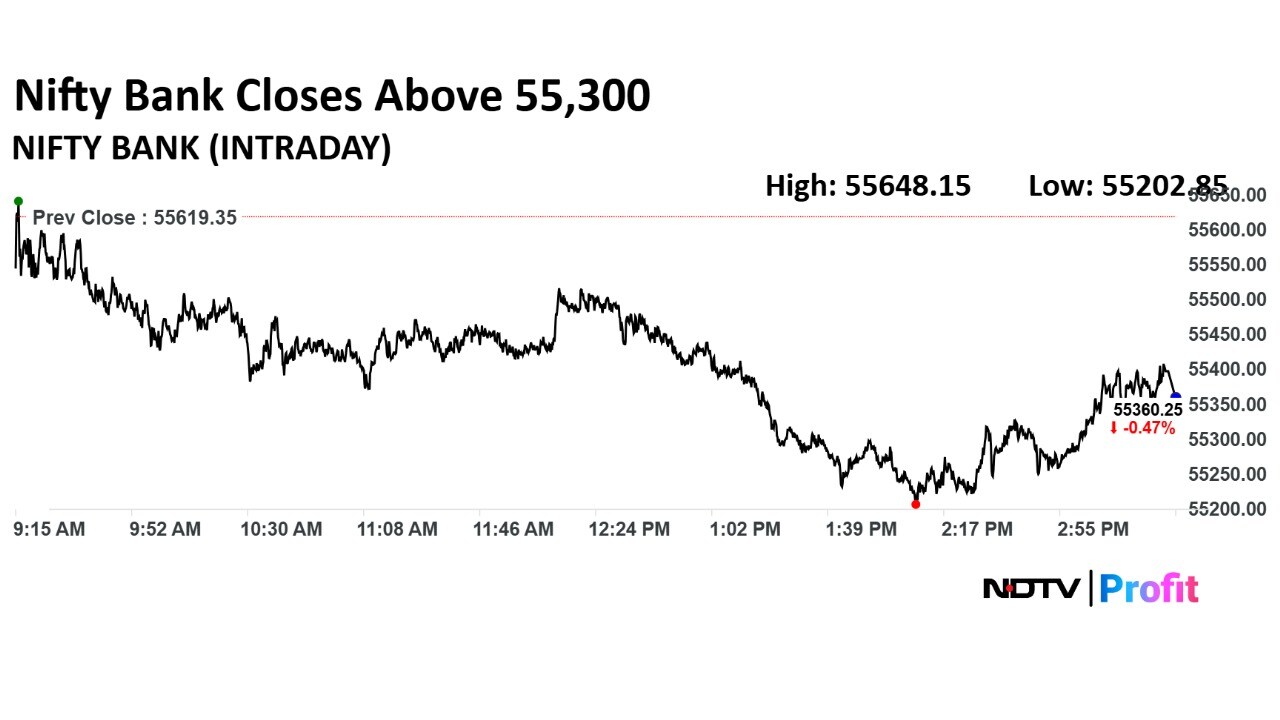

- BankNifty shows short-term downtrend with support at 55,200-54,900 and resistance at 56,300-56,500

The NSE Nifty 50's support zone moved to 24,400-24,500 levels, analysts said on Tuesday, after the benchmark index declined again.

"Structurally, Nifty is expected to oscillate within a defined consolidation band of 24,400–25,000," Bajaj Broking Research said in a note.

Only a decisive breach below the 24,400-support threshold could trigger a corrective move towards the 24,200 handle in the upcoming sessions, according to the brokerage.

The Nifty formed a bearish candlestick on the daily chart, entirely contained within the previous session's trading range, indicative of a continuation of the prevailing consolidation phase amidst a stock-specific rotational theme, according to Bajaj Broking Research.

Mandar Bhojane, senior technical and derivative analyst at Choice Broking, identified immediate resistance at 25,000 and 25,200 levels. He said that these were zones where traders may consider for partial profit booking.

"On the downside, 24,400–24,186 remains a critical support area, coinciding with the 200 exponential moving average, providing a strong base for any dips," Bhojane said.

The Bank Nifty extended its corrective trajectory, printing a bearish candlestick characterised by a lower high–lower low formation, reinforcing the continuation of the short-term downtrend amid a stock-specific churn, as per Bajaj Broking. The index's key support was identified at 55,200–54,900 levels. On the higher side, key resistance is placed at 56,300–56,500 levels, it said.

Market Recap

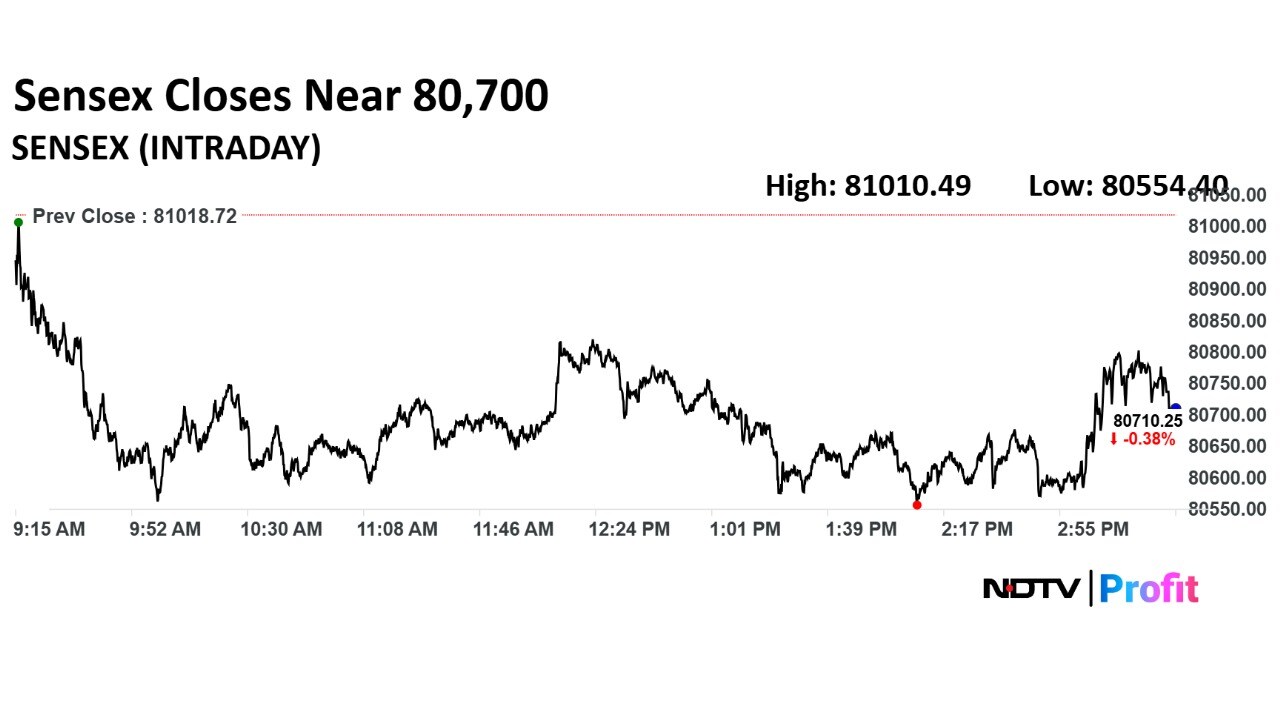

The Indian equity benchmark indices closed lower after a day of closing in the green.

The Nifty 50 ended 73 points, or 0.30% down at 24,649, and the 30-stock BSE Sensex ended 308 points, or 0.38% lower at 80,710. The NSE Nifty Bank closed 0.48% lower at 55,360.

Currency Recap

The Indian rupee closed weaker against the US dollar on Tuesday, after Trump threatened to raise tariffs on India "substantially" for continuing to buy Russian crude.

The local currency closed 14 paise weaker at 87.8 against the greenback compared to previous close of 87.66 on Monday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.