The NSE Nifty 50 sees immediate support at 24,300, with key resistance located near 24,500. Further resistance appears between 24,700 and 24,800, according to analysts.

The daily chart shows that Nifty has broken out of an inverted head and shoulders pattern, according to Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C Mehta Investment Intermediates Ltd. "The index has crossed the 100-day exponential moving average at 24,310 and the 50-day DEMA at 24,370, closing above these levels."

"On the upside, 24,550 will act as immediate resistance for the index. If index sustains above 24,550, then upmove could extend towards 24,700-24,800 levels. As long as the Nifty remains above 24,300, traders should adopt buy on dips strategy," said Yedve.

"As the Nifty index gradually inched higher, it is now headed for a critical blockade placed at 24,500, which is likely to be seen as the make-or-break zone for market sentiments," according to Osho Krishnan analyst at technical and derivatives at Angel One.

A decisive breakthrough at this point may indicate a trend reversal, potentially leading to a continuation of the primary bullish trend and movement toward 24,800. Conversely, the support zone has slightly shifted upwards to 24,350-24,300, followed by 24.200-24,150, said Krishnan.

Bank Nifty settled the day on a positive note at 52,696 levels. "Technically, on a daily chart, Bank Nifty has formed a bullish candle. Furthermore, the index crossed the resistance of 52,500-52,600 and closed above it, suggesting strength. If the index maintains above 52,500 levels, then it may approach towards 53000-53,500 levels. Thus, a buy-on-dips strategy needs to be adopted in Bank Nifty," Yedve said.

FII/DII Activity

Overseas investors turned net buyers of Indian equities after three consecutive sessions of selling on Tuesday, while the domestic institutional investors turned net sellers after four straight sessions of buying.

Foreign portfolio investors mopped up stocks worth Rs 3,664.67 crore, and the domestic institutional investors bought shares worth Rs 250.99 crore, according to provisional data shared by

F&O Action

Nifty November futures were up by 0.43% to 24,547.00 at a premium of 89.85 points, with open interest down by 1.32%.

The open interest distribution for the Nifty 50 December 5 expiry series indicated most activity at 25,000 call strikes, with the 23,000 put strikes having maximum open interest.

Market Recap

Benchmark equity indices gained for a third consecutive session to close at their highest in around a month as global sentiment was uplifted ahead of monthly jobs data from the US and on the back of gains in heavyweights.

Intraday, Sensex hit a high of 80,949.10, its highest level since Oct. 22, and Nifty hit a high of 24,481.35 points, its highest since Nov. 7.

Nifty ended 0.75% or 181.10 points up at 24,457.15, its highest close since Nov. 6, and Sensex ended 0.74% or 597.67 points higher at 80,845.75, its best close since Oct. 21.

Major Stocks In News

Reliance Power: SECI withdraws order banning company with immediate effect. This means Co & Arms, except Reliance Nu Bess, are now eligible to participate in all SECI tenders.

TCS: The tech company has received an order from the authority for disallowance of input VAT, levying a penalty of Rs 11,04,895 for the fiscal 2015-16.

Aditya Birla Capital: The company invests Rs 300 crore in the arm Aditya Birla Housing Finance on a rights basis.

Kaynes Technology: The company to acquire a 54% stake in Sensonic Austria via its arm, Kaynes Holding.

Global Cues

Stocks in South Korea plunged on Wednesday after President Yoon Suk Yeol imposed martial law, which was later lifted but left the nation in chaos. The country's currency gained after weakening nearly 3%.

Equities in Japan rose while Australian stocks were trading lower during the session's opening. The Nikkei was 87 points, or 0.24%, higher at 39,313, while the S&P ASX 200 was up 39 points, or 0.46%, at 8,454 as of 5:40 a.m. Kospi was down 0.95% in early trade.

All eyes will be on US factory orders, durable goods and the S&P Global Composite PMI data that are due later today. Multiple Federal Reserve officials expect the rate-cutting cycle to continue over the next year, but stopped short of saying if it will happen later this month.

Stocks on Wall Street felt pressure from South Korea's political chaos after the benchmark S&P 500 index briefly hit another life high, taking the tally to 55 this year. The S&P 500 index and the tech-heavy Nasdaq Composite rose 0.05% and 0.40%, respectively, on Tuesday. The Dow Jones Industrial Average slipped 0.17%.

Treasury 10-year yields advanced four basis points to 4.23%. The dollar index—which tracks the greenback's performance against a basket of 10 leading global currencies—was trading 0.08% lower at 106.36.

The Brent crude was trading 2.49% higher at $73.62 a barrel as of 6:00 a.m. IST, and the West Texas Intermediate was up 0.13% at $70.03.

Key Levels

US Dollar Index at 106.3650

US 10-year bond yield at 4.23%.

Brent crude up 2.49% at $73.62 per barrel.

Bitcoin was down 0.39% at $95,710.19

Gold spot was down 0.08% at $2,641.3

Money Market

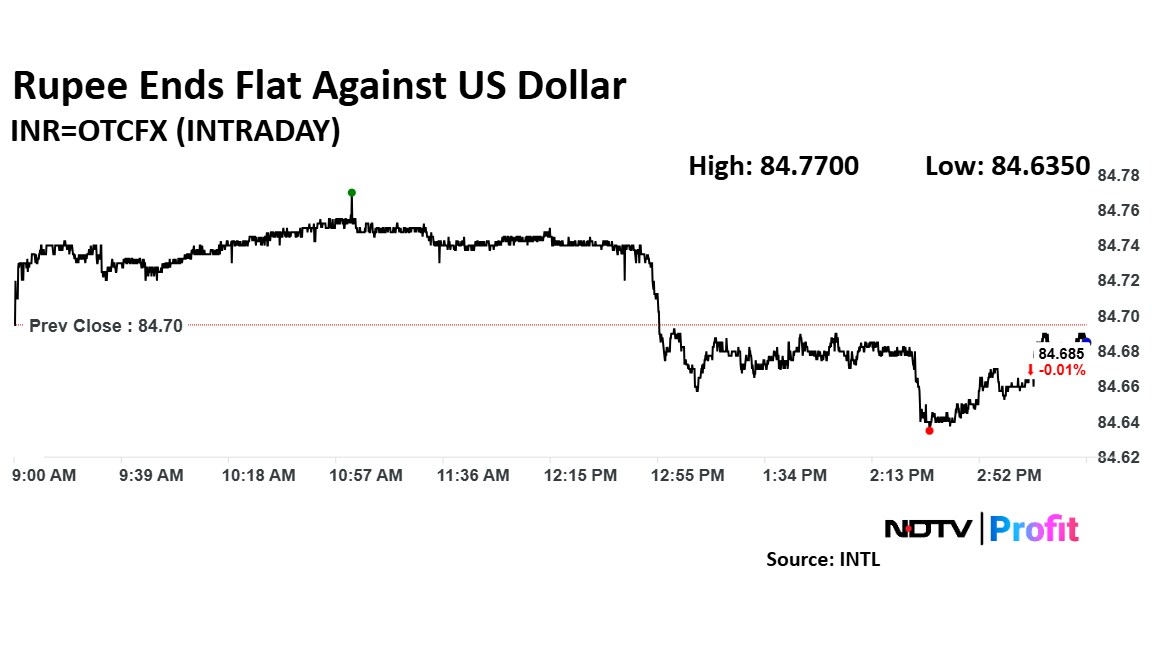

The Indian rupee extended its record fall but ended flat on Tuesday as foreign outflows and domestic growth concerns, coupled with Donald Trump's threat on the BRICS countries, weighed on the currency.

The rupee closed flat at 84.69 after hitting a record low of 84.75, according to Bloomberg data. The local unit closed at 84.7 against the greenback on Monday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.