- Titan's consumer business grew 20% in Q2 ending September

- The company added 55 new stores, total retail network is 3,377 stores

- Jewellery division grew 19% domestically, adding 34 stores

Titan Co. shares surged over 4% in trade so far after the company announced its business update for the second quarter. The consumer business saw a growth of 20% in the second quarter ended September.

The Tata Group-managed jewellery and watchmaker added 55 stores during the July-September quarter, taking its combined retail network presence to 3,377 stores, according to an exchange filing on Tuesday.

Its jewellery division, which contributes over three-fourths of its revenue, reported an 19% growth in the domestic market and added 34 stores. The growth in the quarter was on the back of large ticket size amid the surge in gold prices. This also helped offset marginal year-on-year decline in buyer counts.

"The impact of Q2FY25's high base (due to custom duty reduction) was offset by early onset of festive season in September this year, compared to October in FY25," the company said in its exchange filing.

"As long as gold prices rise, we will see short-term fluctuations in Titan share price. However, I believe Titan is a clear compounder story for anyone looking to invest over the next few years," said Avinash Gorakshakar, director at Research Profitmart Securities. Any dip in its price presents a good entry point, although valuations are currently on the expensive side, he added.

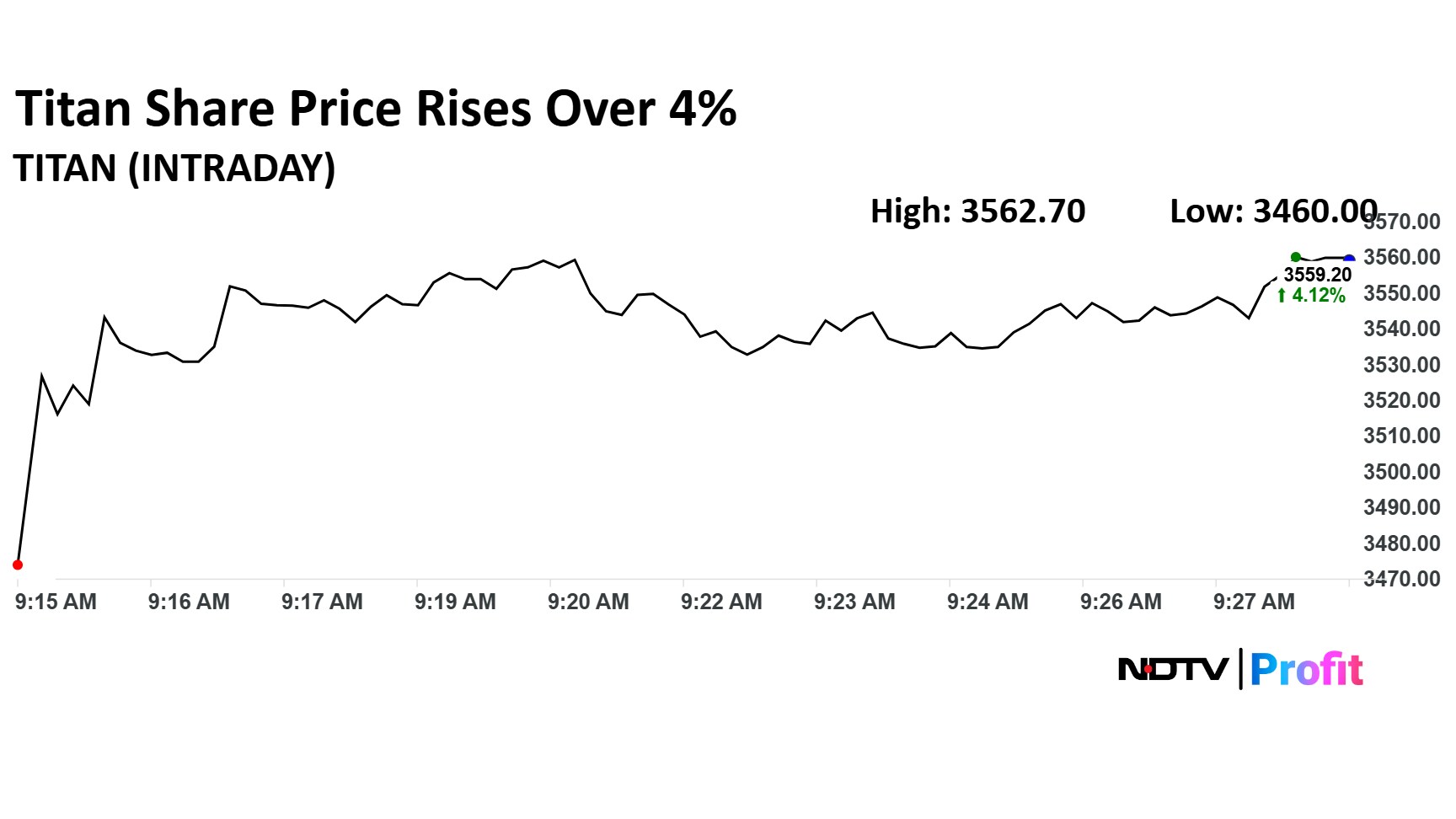

Titan Share Price

Titan stock rose as much as 4.23% during the day to Rs 3,562 apiece on the NSE. It was trading 4.12% higher at Rs 3,558.7 apiece, compared to an 0.28% advance in the benchmark Nifty 50 as of 9:32 a.m.

It has risen 1.91% in the last 12 months and 9.42% on a year-to-date basis. The total traded volume so far in the day stood at xx times its 30-day average. The relative strength index was at 66.2.

Twenty nine out of the 38 analysts tracking the company have a 'buy' rating on the stock, six recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 3,958.8, implying a upside of 11.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.