Tilaknagar Industries Ltd. allotted nearly 34 lakh shares to Madhudsudan-Kela-backed Singularity Equity Fund. Following the news, the stock price declined in Friday's session.

On Thursday, Tilaknagar Industries' Finance Committee of the Board of Directors approved to allot 3.7 crore equity shares with a face value of Rs 10 to warrant holders. The decision followed warrant holders exercising their right for conversion of warrants into equity shares.

The company made the allotment for cash upon the receipt of the remaining exercise price of Rs 286.50 per warrant, aggregating to Rs 1,080.53 crores, Tilaknagar Industries said in an exchange filing.

Post the allotment, Tilaknagar Industries has 24.59 crore shares outstanding compared to 20.82 crore shares earlier.

The allotted equity shares allotted above will rank equally with respect to existing equity shares of the Tilaknagar Industries, the exchange filing said. The company will apply to seek approval of listing and trading to the stock exchanges for the equity shares allotted in due course.

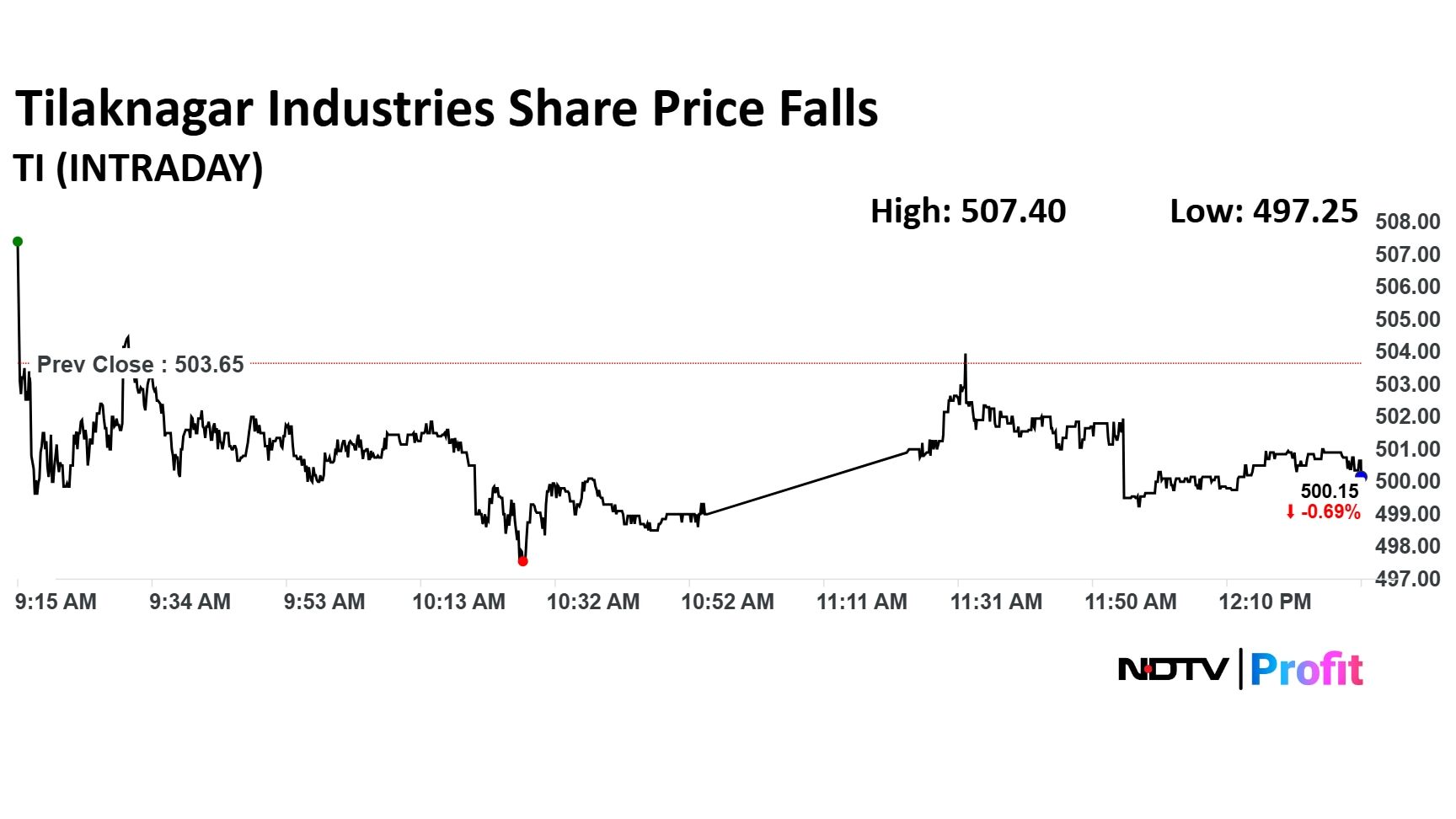

Tilaknagar Industries share price declined 1.27% to Rs 497.25 apiece. It was trading 0.55% down at Rs 500.90 apiece as of 12:25 p.m., as compared to 0.13% decline in the NSE Nifty 50 index.

Tilaknagar Industries share price advanced 5.54% to Rs 515 apiece in Thursday's session. It settled 3.22% higher at Rs 503.65 apiece.

The stock advanced 45.40% in 12 months, and 18.33% on year-to-date basis. Total traded volume on National Stock Exchange so far in the day stood at 0.23 times its 30-day average. The relative strength index was at 53.74.

Two analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 21.0%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.