The shares of Thyrocare Technologies Ltd. are surging in trade on Wednesday, after the company posted strong September quarter earnings for the financial year ending March 2026.

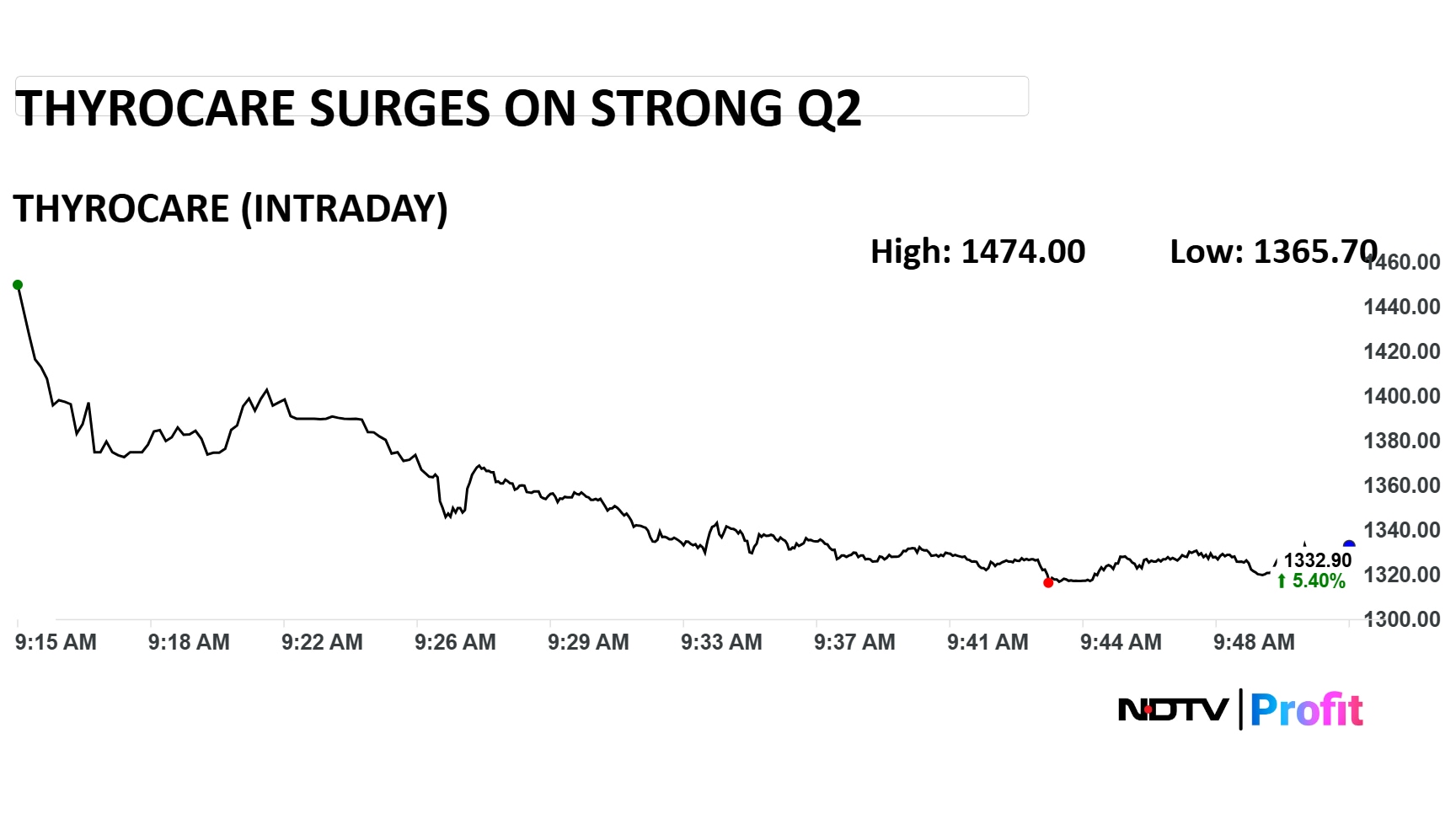

The stock is currently trading at Rs 1,324, which accounts for a gain of almost 5% compared to Tuesday's closing price of Rs 1,264. However, in early trade, the stock reached an intraday high of Rs 1,474.

This rally in Thyrocare comes on the back of a strong September quarter, where the company recorded its highest-ever revenue, PAT and Ebitda.

Photo: NDTV Profit

While consolidated net profit rose 80% year-on-year to Rs 48 crore, Thyrocare's revenue during the second quarter rose 22.1% to Rs 217 crore in the July-September period, as against Rs 177 crore over the last quarter.

Operating income, or earnings before interest and taxes, rose 47.8% year-on-year to Rs 71.4 crore. The margin expanded to 33% versus 27.2%.

Thyrocare's revenue was largely driven by a 24% growth in the pathology segment, while the company also recorded over 20% growth in completed tests, which reached 53 million.

Several other key factors, including PharmEasy integration with access to bundled healthcare offerings and strong presence in thyroid and wellness testing, have also aided growth for Thyrocare.

The company also announced a second interim dividend of Rs 7 per equity share for the fiscal year 2025. They announced the distribution of nearly Rs 37.1 crore to shareholders.

Thyrocare is currently trading at a relative strength index of 52, which suggests neutral market sentiment.

Only four analysts cover Thyrocare, all of whom have issued a buy call on the counter. The 12-month analysts' consensus target price on the stock is Rs 1,557, implying an upside of 17%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.