A breakout in the Nifty Metal index after four months could place major companies in an attractive buying space.

"Nifty Metal has been in a consolidation space for nearly four months and now there is a breakout. Positionally, Tata Steel Ltd., Jindal Steel and Power Ltd., and Hindustan Copper Ltd. look good for buying," said Hemen Kapadia, senior VP-institutional equity at KR Choksey Stocks and Securities Pvt.

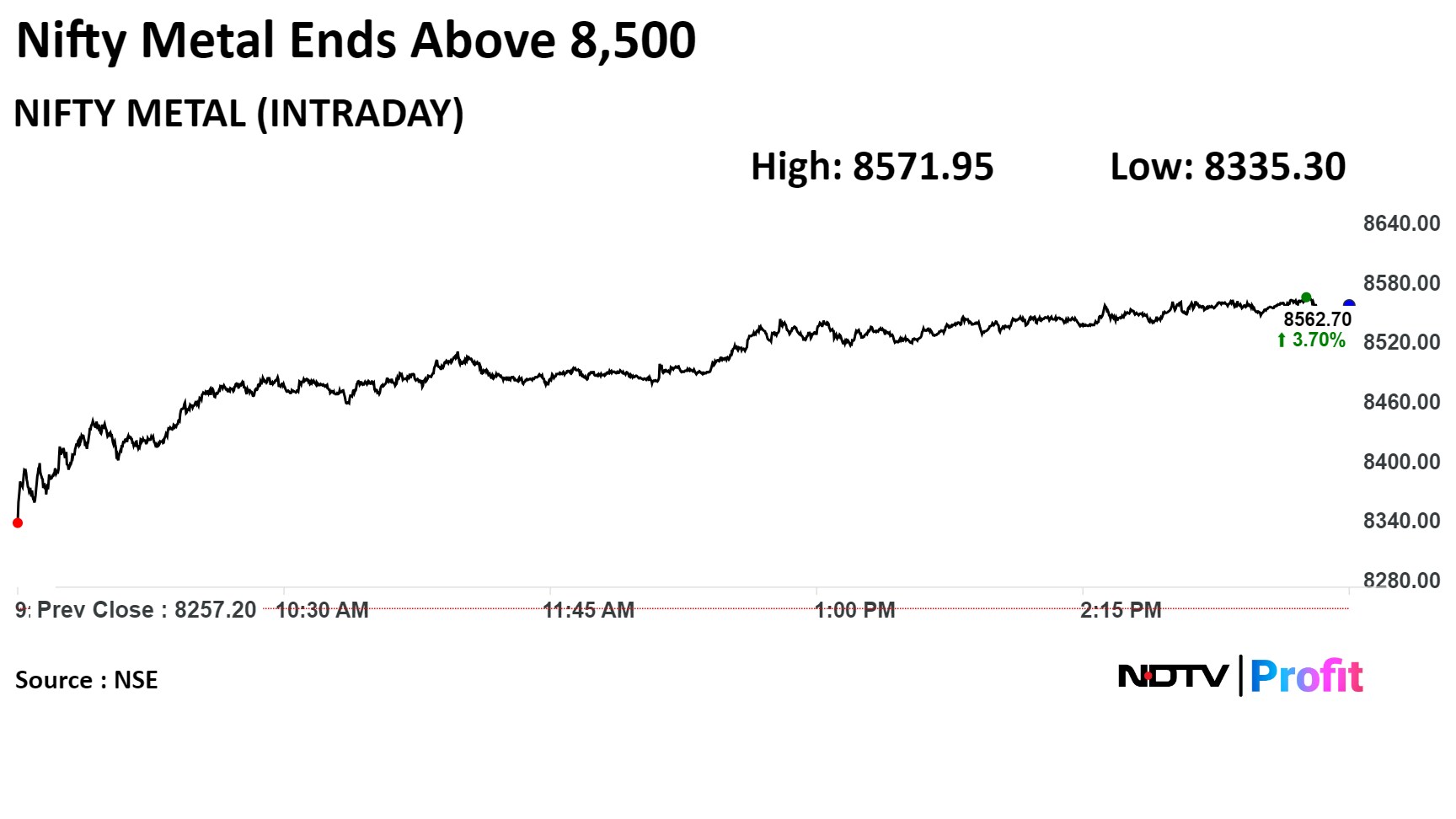

The index closed 3.7% higher, just behind the Nifty Realty, to become the second-best performer among sectors on Monday.

According to Kapadia, once the benchmark Nifty 50 breaks out of the 22,526 mark, the upside momentum will be towards 22,800. But he did not rule out a "minor correction" momentarily.

Any breakout in the Bank Nifty will take the index to the 50,000 level, he told NDTV Profit.

India's benchmark indices extended gains for the third day to start FY25 on a positive note as shares of HDFC Bank Ltd., Larsen and Toubro Ltd., and Tata Steel rose.

Intraday, the NSE Nifty 50 rose 0.91% to a life high of 22,529.95, and the S&P BSE Sensex rose 0.82% to a record 74,254.62.

In his sectorwise commentary, Kapadia said cement stocks are oversold while railway, PSUs, and Adani Group stocks look attractive.

Bajaj Auto Ltd. and Hero MotoCorp Ltd. are better placed in terms of quarterly results, according to market expert Hemang Jani. "If we see a small correction because of monthly sale numbers not being good, I would see them as an entry point for buying."

Auto stocks declined on Wednesday, with Bajaj Auto and Hero MotoCorp being among the key losers after disappointing monthly sales figures.

Jani said real estate stocks are also likely to benefit in an election year on expectations that a new government will roll out initiatives to support affordable housing, like interest rate subvention.

Watch the full conversation here:

The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Ltd, an Adani Group company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.