The Indian rupee closed weak against the US dollar on Tuesday, with analysts seeing banks turning cautious over their dealings with the domestic unit.

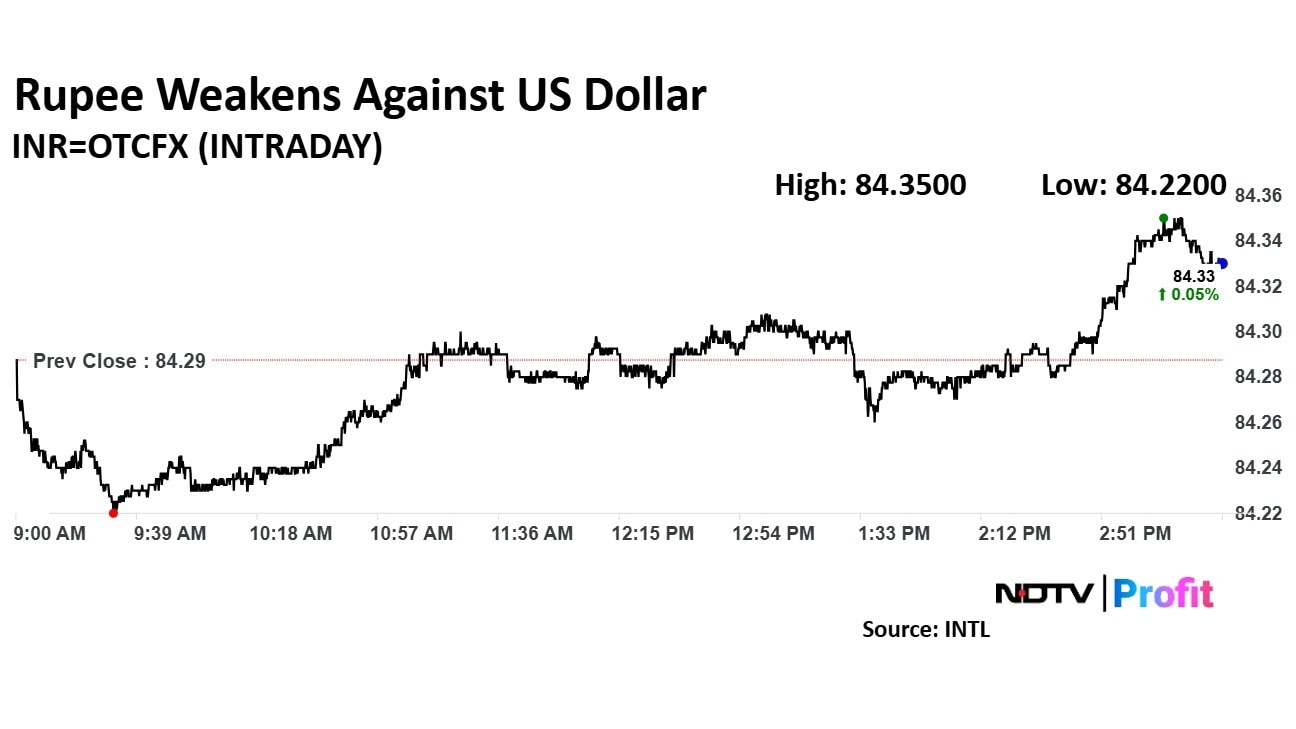

The local currency slipped by six paise to close at 84.34, after opening flat against the greenback earlier in the day. The slip in rupee's value comes a day after the currency appreciated by 17 paise to close at 84.28 on Monday.

The rupee was expected to be on weaker grounds on Tuesday, following a brief period of inflows that had helped the domestic unit close higher on the preceding day.

Banks are becoming more cautious in their dealings with the rupee after the Reserve Bank of India issued warnings against speculative long positions, said Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors. This caution could result in the rupee taking longer to reach the 84.5-mark, as banks proceed with more care.

On Friday, the rupee had faced pressure but managed to recover slightly by the close, appreciating by 5 paise to end at 84.45, after opening at 84.49. Earlier in the last week, it had hit a record low of 84.50, weighed down by foreign investor outflows and rising geopolitical tensions.

Global funds offloaded Rs 5,321 crore worth of Indian equities on Thursday, pushing the net outflow tally to Rs 1.65 lakh crore over the past 37 sessions. In addition, the ongoing Russia-Ukraine conflict had further strained market sentiment and impacted global currencies, putting additional pressure on the rupee.

Despite these challenges, the Reserve Bank of India has actively intervened to stabilise the rupee, including measures in the non-deliverable forward market, to sell dollars and support the domestic currency, analysts point out.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.