Tega Industries Ltd., a leading manufacturer of specialised mining and mineral processing equipment, has announced a preferential share issue to raise up to Rs 2,001 crore. In an exchange filing, the company stated that its Board of Directors has approved the issuance of 1,00,33,090 equity shares at Rs 1,994 per share, including a premium of Rs 1,984, on a private placement basis. The face value of each share is Rs 10.

The preferential allotment will be made to identified investors, subject to regulatory and shareholder approvals. The company has received Expressions of Interest from the proposed allottees and will seek shareholder approval at an Extraordinary General Meeting scheduled for October 10, 2025.

Founded in 1976 and headquartered in Kolkata, Tega Industry is involved in designing and manufacturing of critical consumables for the mineral processing, mining and material handling industries. It is a multi-national company with presence in over 92 countries.

The company's manufacturing hubs are located across India, Australia, Chile and South Africa. The company has over 700 customers.

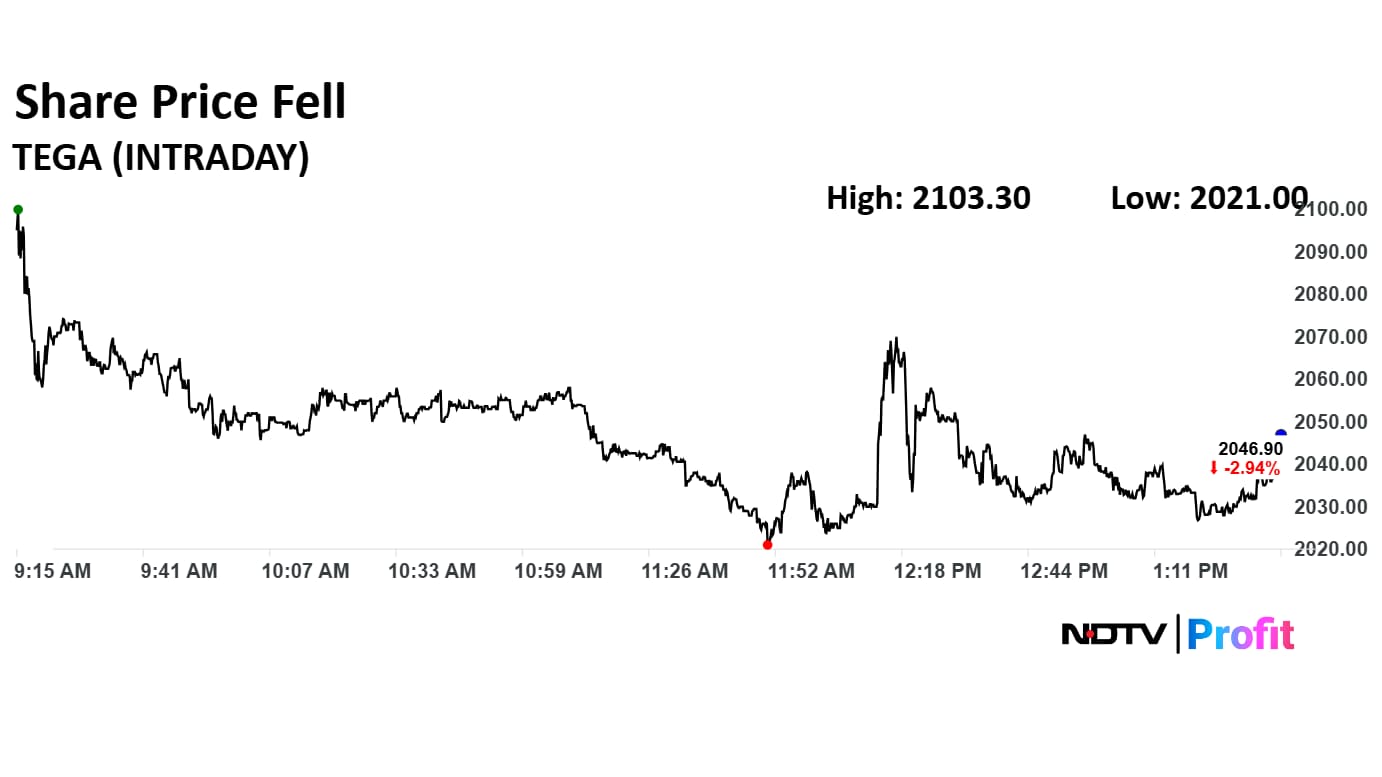

The scrip fell as much as 4.17% to Rs 2,021 apiece. It pared losses to trade 3.61% lower at Rs 2,032.80 apiece, as of 01:32 p.m. This compares to a 0.18% advance in the NSE Nifty 50 Index.

It has risen 9.80% in the last 12 months. Total traded volume so far in the day stood at 4.7 times its 30-day average. The relative strength index was at 56.

Out of four analysts tracking the company, three maintain a 'buy' rating, one recommend a 'hold,' and none suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 2.2%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.