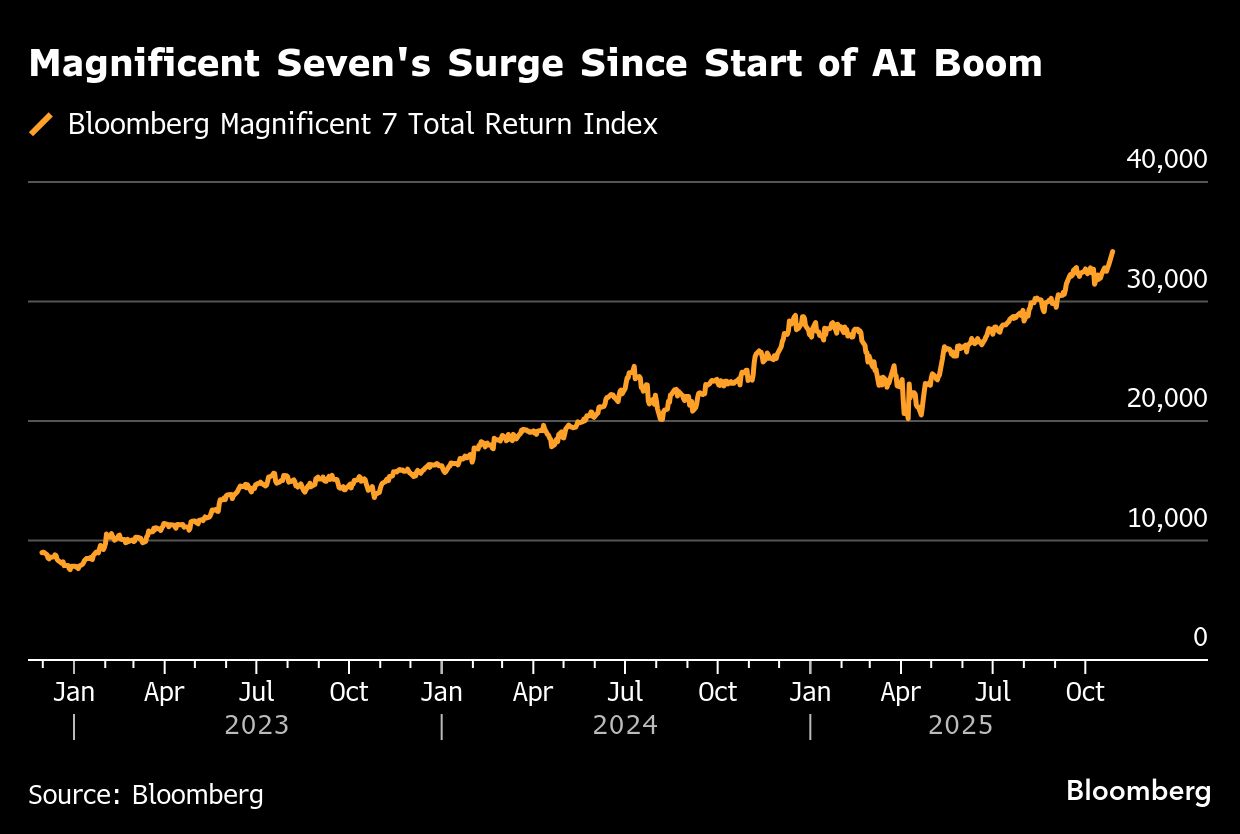

A rally in the world's largest technology companies left stocks at all-time highs amid speculation that artificial intelligence will keep driving earnings for the group that has powered the bull market.

While most sectors in the S&P 500 took a breather after a three-day run, the cohort of tech megacaps kept powering ahead. Microsoft Corp. climbed 2% after finalizing a new pact with OpenAI that will give the software giant a 27% ownership stake worth about $135 billion. Apple Inc. briefly topped $4 trillion. Nvidia Corp. plans to make a $1 billion equity investment in Nokia Oyj.

(Photo: Bloomberg)

On Wednesday and Thursday, five big techs that account for about a quarter of the US benchmark will report earnings. Investors will be looking for assurances that the flow of tens of billions of dollars for computing infrastructure will continue — and ultimately pay off down the road.

“This group has repeatedly reassured investors that the AI theme is alive and well, and given the number of deals that have been announced over the past few months, it seems likely that this narrative will continue so long as Wall Street rewards them for this approach,” said Bret Kenwell at eToro.

Aside from earnings, policymakers in Washington will take the spotlight, with a widely anticipated quarter-point reduction from the Fed on Wednesday. Trade headlines also remain in focus, with President Donald Trump's Thursday sit-down with Chinese President Xi Jinping watched most closely.

The S&P 500 hovered near 6,880. The yield on 10-year Treasuries was little changed at 3.98%. The dollar edged lower.

(Source: Bloomberg)

The Magnificent Seven is projected to deliver profit growth of 14% in the third quarter, down from 27% in the second quarter, according to data compiled by Bloomberg Intelligence. That's nearly twice the 8% expected profit growth for the broader S&P 500, but it also would be the slowest pace since the first quarter of 2023.

However, Big Tech firms have a history of reporting earnings that far exceed Wall Street estimates. And that's what many investors are counting on.

“We expect another strong round of mega cap tech earnings reports, given the relentless demand for AI technology and infrastructure,” said Clark Bellin at Bellwether Wealth. “While profitability in AI remains an unknown, investors for right now are willing to overlook this as the AI arms race heats up”.

The stock market's record highs leave little room for disappointment when it comes to big tech earnings, according to Paul Stanley at Granite Bay Wealth Management.

“Given how so much of the S&P 500's market cap consists of Magnificent Seven names, if any of these earnings reports disappoint, that could cause a stock market selloff or keep the market range-bound for the foreseeable future until we see the next catalyst,” he said.

(Source: Bloomberg)

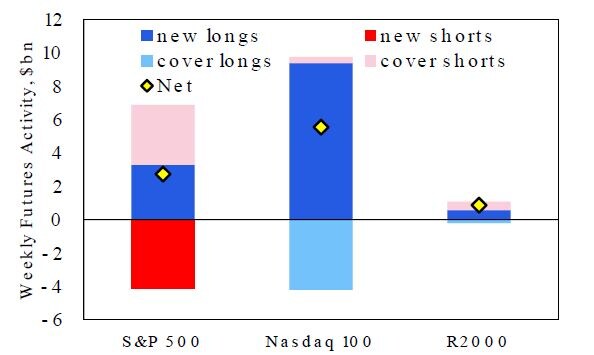

Nasdaq 100 positioning has increased significantly as investors add new long risk, reversing the fading momentum seen in recent weeks, according to Citigroup Inc. strategists. That ensures that tech remains among the most-crowded sectors, they say.

As for the S&P 500, a Citi team led by Chris Montagu wrote that $2.7 billion of risk was added to the benchmark, through a mix of short covering and new longs. Meanwhile, US small caps face a heightened chance of profit taking as positioning has become extended, the strategists noted.

The tech-heavy Nasdaq 100 is also now almost 18% above its 200-day moving average, noted Peter Boockvar, author of The Boock Report. That's the most since July 2024 when it got to 20% right before a 13% correction, he said.

“The markets are once again pressed into overbought/extended territory across multiple time frames,” said Dan Wantrobski at Janney Montgomery Scott. “We remain on high alert for a correction in the magnitude of 5% to 10% before 2025 closes out.”

Yet he also noted that November overall has historically been one of the best months for US equities, per the Stock Trader's Almanac.

(Source: Bloomberg)

“An increasing number of investors are growing concerned that the strong stock gains seen over recent months may have outpaced fundamentals, at least in the very near term,” said Anthony Saglimbene at Ameriprise. “This week's Mag Seven earnings reports provide a chance for companies to either confirm or challenge that view.”

Speaking of size, he noted that at no other time over the last 35 years have the top 10 companies by market-cap in the S&P 500 held so much influence on one of the broadest measures of the US stock market.

“Overall, we believe the Mag Seven is well-positioned to meet profit expectations for the prior quarter,” Saglimbene noted. “However, given current valuations and the size and influence these companies currently hold over the broader market, it's their outlooks and views on profitability moving forward that will likely carry the most sway with investors this week, and probably beyond.”

(Source: Bloomberg)

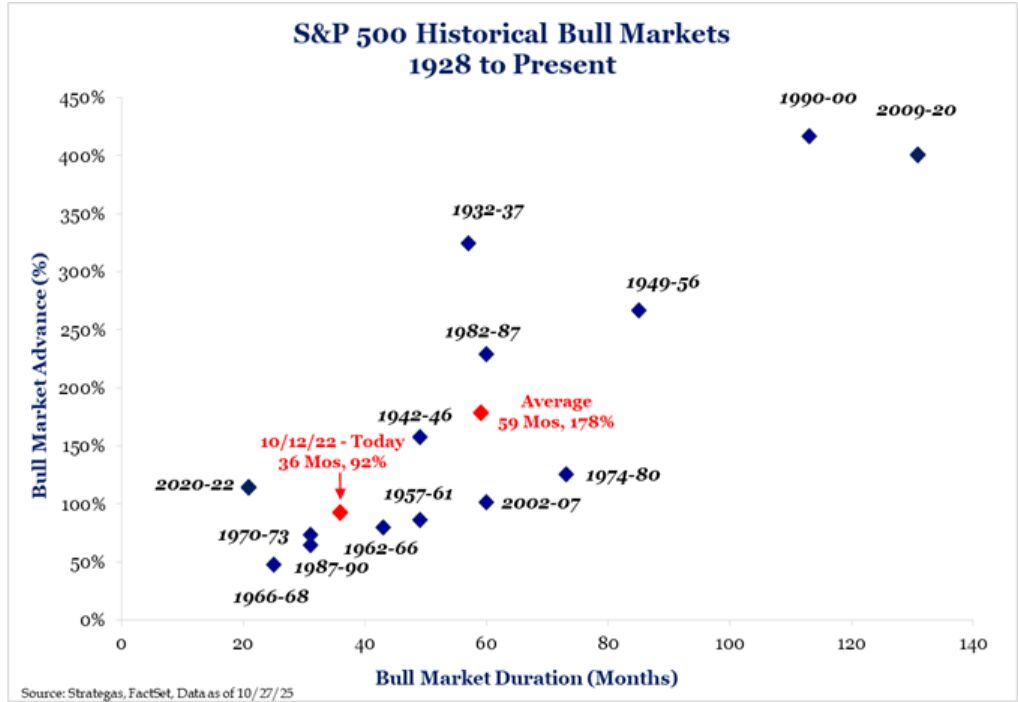

With the bull market now entering its fourth year, Ryan Grabinski at Strategas says he's started to receive more questions about how the current run from the lows compares historically.

The market is up 92% from its October 2022 low, but it still trails the average S&P 500 bull market by roughly two years and about 85%, he said.

“Looking at the median figures paints a slightly different picture, though it also suggests there may be further room to run,” he said. “The bottom line, however, is that the AI-driven capital expenditure trade remains the most critical factor to watch. Any disruption in that area could unwind an index that has become increasingly dependent on sustained spending.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.