.jpg?downsize=773:435)

Citi has reduced its target price for Tata Consultancy Services Ltd. to Rs 3,205 from Rs 3,900, reflecting adjustments to its estimates for financial years 2025-2027. This is mainly due to changes in exchange rates and operational factors. The target price reflects a discount to TCS' five-year historical average, due to broader sector challenges.

The brokerage maintained its 'sell' rating for the IT giant. It has lowered its valuation multiple to 22 times for September 2026 earnings from the earlier 28 times for March 2026, due to macroeconomic uncertainty, which is expected to impact near-term growth.

TCS' earnings are projected to grow at a 5% annual rate over financial year 2024-26. According to the brokerage note, key risks to the downside include stronger-than-expected demand or currency fluctuations.

The revision comes as Nifty IT continues to trade in bear market territory. The index that was trading in the green on Tuesday has corrected 20.51% since Dec. 13, 2024, when it hit a high of 46,088.90, against an 8.08% correction in the Nifty 50 in the same period.

The correction comes amid fear of tariffs, concerns about a US slowdown, expectations of rising inflation, uncertainty around Fed rate cuts, delays in IT spending decisions by US customers, a stalled IT order pipeline, and increased competition for large deals.

Earlier this month, Morgan Stanley in its report had said there will be a downside for both the revenue growth of Indian IT services and its valuation.

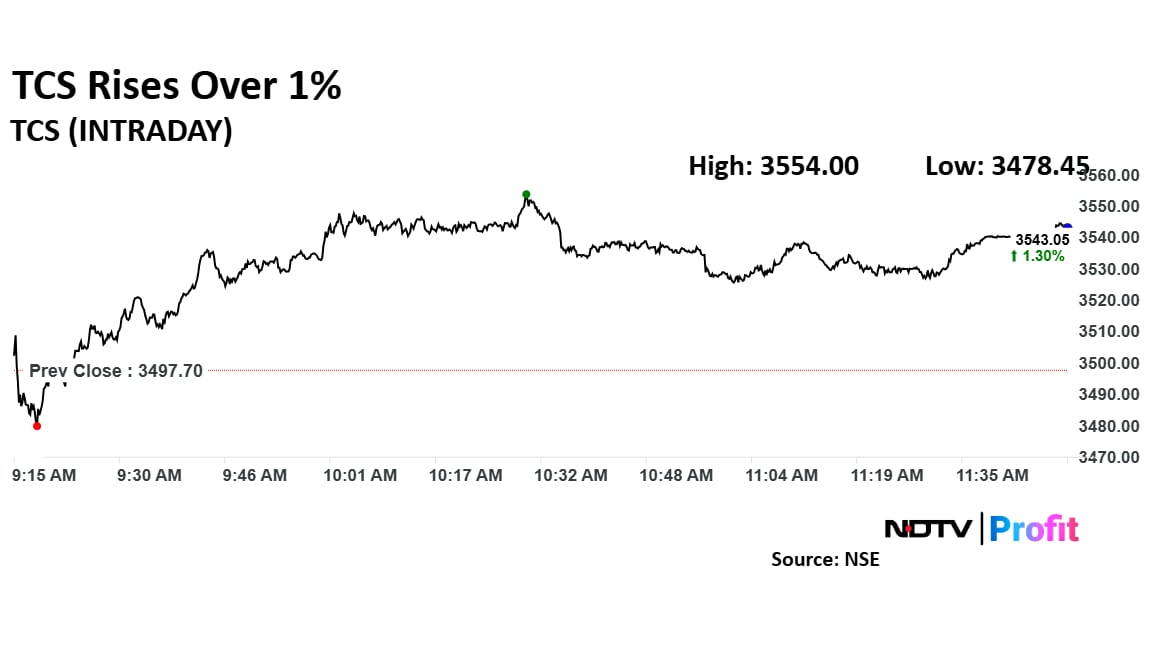

TCS Share Price Rise

The scrip rose as much as 1.61% to 3,554 apiece, the highest level since March 12. It pared gains to trade 1.24% higher at Rs 3,541.15 apiece, as of 11:45 a.m. This compares to a 1.12% advance in the NSE Nifty 50.

It has fallen 14.72% in the last 12 months and 13.89% year-to-date. Total traded volume so far in the day stood at 1.8 times its 30-day average. Relative strength index was at 33.

Out of 48 analysts tracking the company, 33 maintain a 'buy' rating, 10 recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 23.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.