TCS Shares Rise After Q3 Results, Higher-Than Anticipated Dividend

TCS reported December-quarter results, which are broadly in line with expectations, prompting mixed reactions from analysts with bullish call from Macquarie while bearish from Citi.

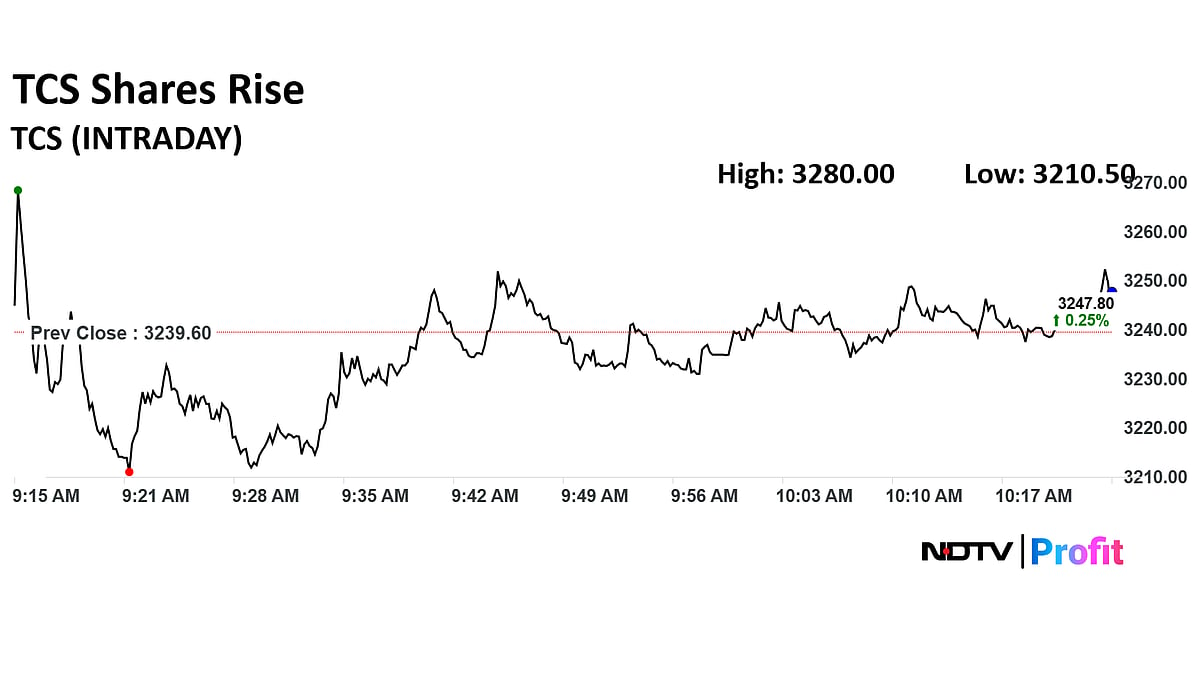

Shares of Tata Consultancy Services Ltd. rose on Tuesday, with the stock currently trading at Rs 3,262 with an uptick of 0.77%.

While India’s largest IT services company, Tata Consultancy Services Ltd. (TCS), has mixed reactions from analysts, over two-thirds of analysts maintain a "buy" rating on the stock. This is despite a 25% correction over the past 12 months.

TCS reported December-quarter results, which are broadly in line with expectations, prompting mixed reactions from analysts with bullish call from Macquarie while bearish from Citi.

Macquarie remains the most bullish, setting a price target of Rs 4,810 implying an upside of 48.2% from Monday’s closing price, as per Bloomberg. The brokerage firm expects growth acceleration and margin improvement to drive a price-to-earnings (PE) re-rating by FY27, and the Bloomberg recommendation says "outperform'

Kotak Institutional Equities also reiterated its "buy" call with a target of Rs 3,675, citing TCS’s strong positioning as a core partner for clients in cloud, data, and AI. However, Kotak noted that sustained execution, particularly in AI, will be critical for any re-rating.

On the other hand, Citi stuck to its "sell" rating with a target of Rs 3,020. The brokerage firm warned that the muted growth in TCS’s international business could disappoint investors. Citi added that equipment and software businesses accounted for nearly half of TCS’s Q3 growth.

Nomura remains “neutral” with a target of Rs 3,300, arguing that significant margin improvement is unlikely in FY27 without stronger growth. HSBC echoed a similar stance, retaining its "hold" rating with a Rs 3,450 target, saying risk-reward appears balanced and demand commentary was positive but not beyond market expectations.

Out of 51 analysts tracking the company, 35 maintain a 'buy' rating, 12 recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target is Rs 3,609 which implies a downside of 21.9%.

The TCS scrip closed 0.86% up at Rs 3,235.70 apiece on the BSE on Monday as against 0.36% jump on the benchmark.

ALSO READ

TCS Q3 Review: Brokerages Split As Inline Quarter Meets Tepid Global Demand, FY27 Hope Intact

TCS Share Price Today

TCS Share Price Today

Bumper Dividend Announced

Investors in the IT stock, will be availing a a bumper dividend of Rs 57 per share for the third quarter of the ongoing fiscal, with a an interim dividend of Rs 11 per share and a special dividend of Rs 46 per share.

The record date for determining eligible shareholders for the payout is Jan. 17 and the amount will be paid to them on Feb. 3 as per the company's exchange filing.

The announcement surpassed the expectations of analysts tracked by Bloomberg who had estimated a dividend of Rs 34.19 per share.