Indian information technology stocks shed over Rs 1 lakh crore in market value on Thursday, after US President Donald Trump unleashed a tariff war that may slow growth in the world's largest economy and spark inflation.

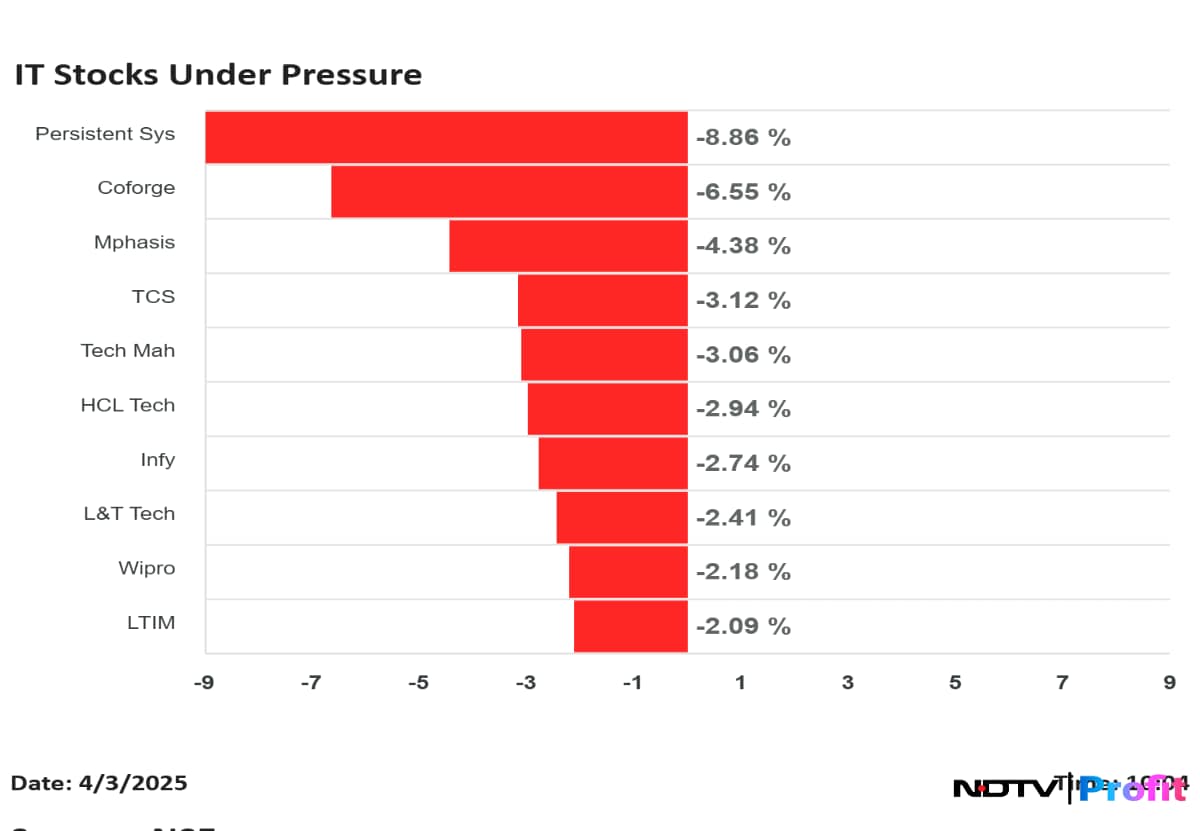

Midcap stocks like Persistent Systems Ltd., Coforge Ltd., and Mphasis Ltd. led the decline.

Persistent lost over 9% intraday as volumes surged to two times the 30-day daily moving average. Coforge sunk 6.7%, while Mphasis declined 4.6% during the session.

In comparison, shares of Tata Consultancy Services Ltd., Tech Mahindra Ltd., Infosys Ltd., and Wipro Ltd. fell over 3%.

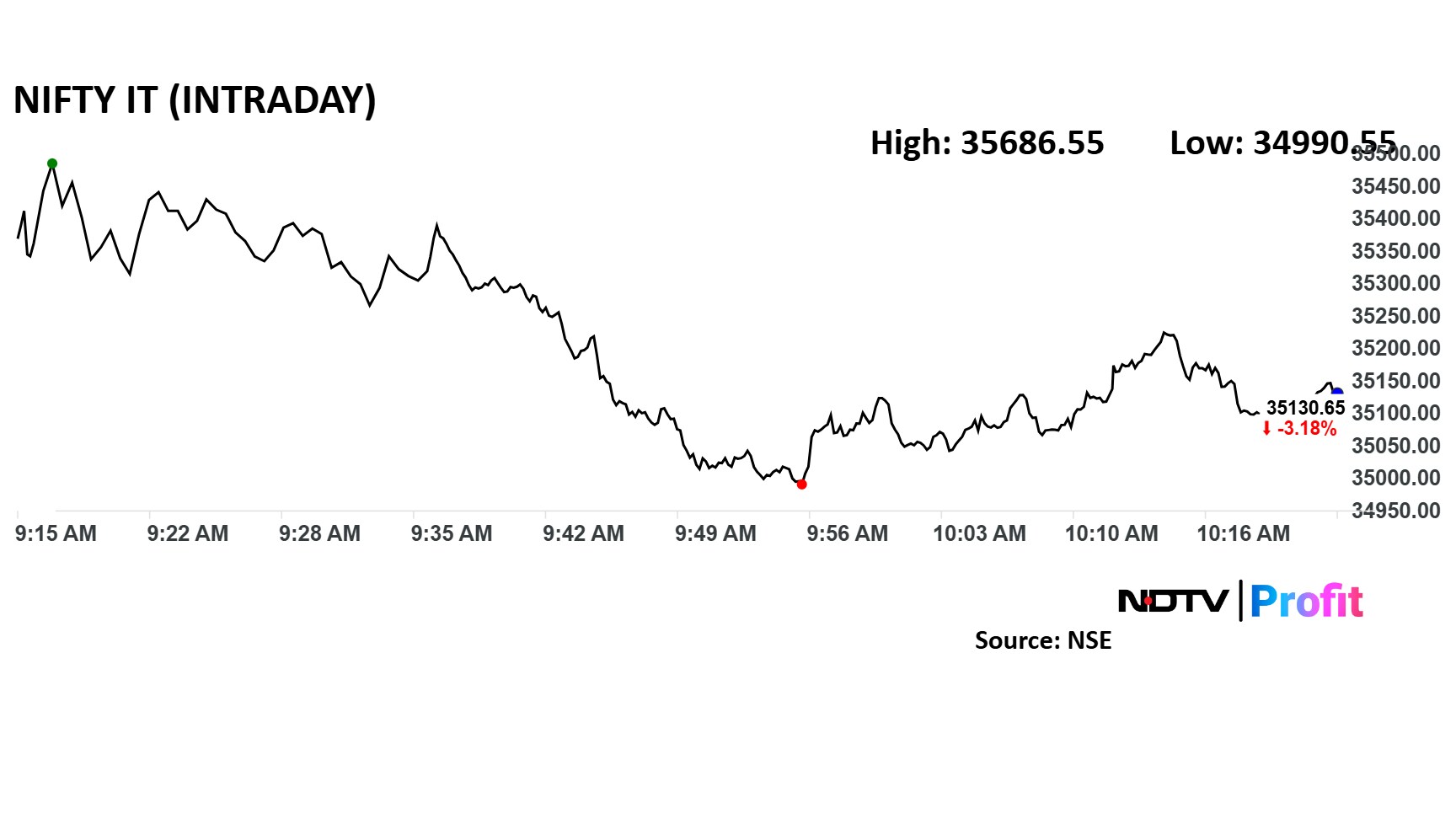

The Nifty IT sunk 3.6% intraday to a nine-month low. This compared to a 0.8% fall in the benchmark Nifty 50.

Trump will impose a 10% baseline tariff on all imports to the US and higher duties on some of the country's biggest trading partners. The tariffs will take effect on April 9. Indian goods will see a 26% tariff.

Notably, India's weighted average tariff rate on American imports is 12%, compared to the US' previous rate of 3% on Indian goods.

The IT sector fortunes are highly linked to the US macro environment as discretionary spending by American companies drive IT services demand. A slowdown or even a recession in the US, as projected by experts, will impact Indian software exporters.

While the IT sector is not directly affected by Trump's tariff order, there may be indirect impacts due to slower GDP growth resulting from higher tariffs, Jefferies analysts noted. This could lead to decreased demand from manufacturing, logistics, and retail verticals, despite potential rate cuts.

However, certain IT companies with favourable vertical exposure, such as Tech Mahindra Ltd., HCL Technologies Ltd., Inventurus Knowledge Solutions Ltd., and Sagility India Ltd., may be better positioned. Additionally, IT firms may benefit from potential on-shoring trends and tighter immigration norms in the future, making them more resilient to these risks, Jefferies said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.