IGL Share price spiked over 1.5% on Wednesday, after it rose over 6% on Tuesday following changes in the tax implications on gas that is sourced from Gujarat. This marks two straight session of gains for the stock.

Source to NDTV Profit said earlier that, previously a 15% Value Added Tax was charged, but from October 1, a 2% Central Sales Tax will be charged.

This move is expected to reduce the cost incurred by IGL in sourcing the gas and hence has the potential to have a positive impact on the company's margins.

Indraprastha Gas Ltd's Earnings Before Interest, Taxes, Depreciation, and Amortisation can see a boost by Rs 1–1.5 per standard cubic meter (scm), representing a more than 24% increase from current levels. In Q1 FY26, IGL's Ebitda stood at Rs 6.2 per scm.

Indraprastha Gas Ltd. is a leading Indian city gas distribution (CGD) company that supplies compressed natural gas (CNG) and piped natural gas (PNG) to consumers primarily in the Delhi National Capital Region (NCR) and other authorised areas.

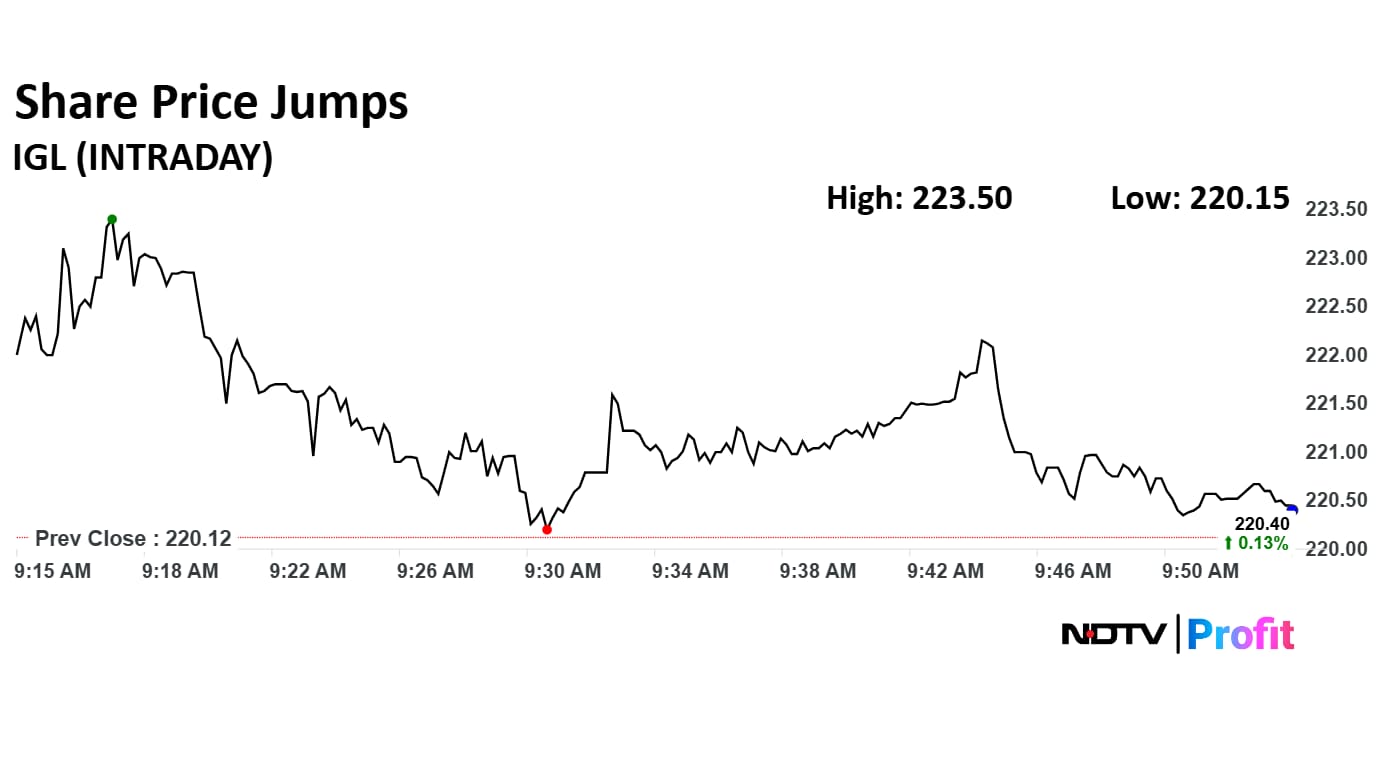

The scrip rose as much as 1.54% to Rs 223.50 apiece. It pared gains to trade 0.29% higher at Rs 220.48 apiece, as of 09:52 a.m. This compares to a 0.16% advance in the NSE Nifty 50 Index.

It has fallen 17.26% in the last 12 months. Total traded volume so far in the day stood at 9.5 times its 30-day average. The relative strength index was at 64.

Out of 31 analysts tracking the company, 19 maintain a 'buy' rating, five recommend a 'hold,' and seven suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 15.5%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.