Tata Technologies Share Price Drops 3.4% Over Soft Q3; Citi Lists Challenges, Slashes Target Price

After Tata Technologies reported its earnings for the third quarter, Citi lowered the target price to Rs 765 from Rs 835.

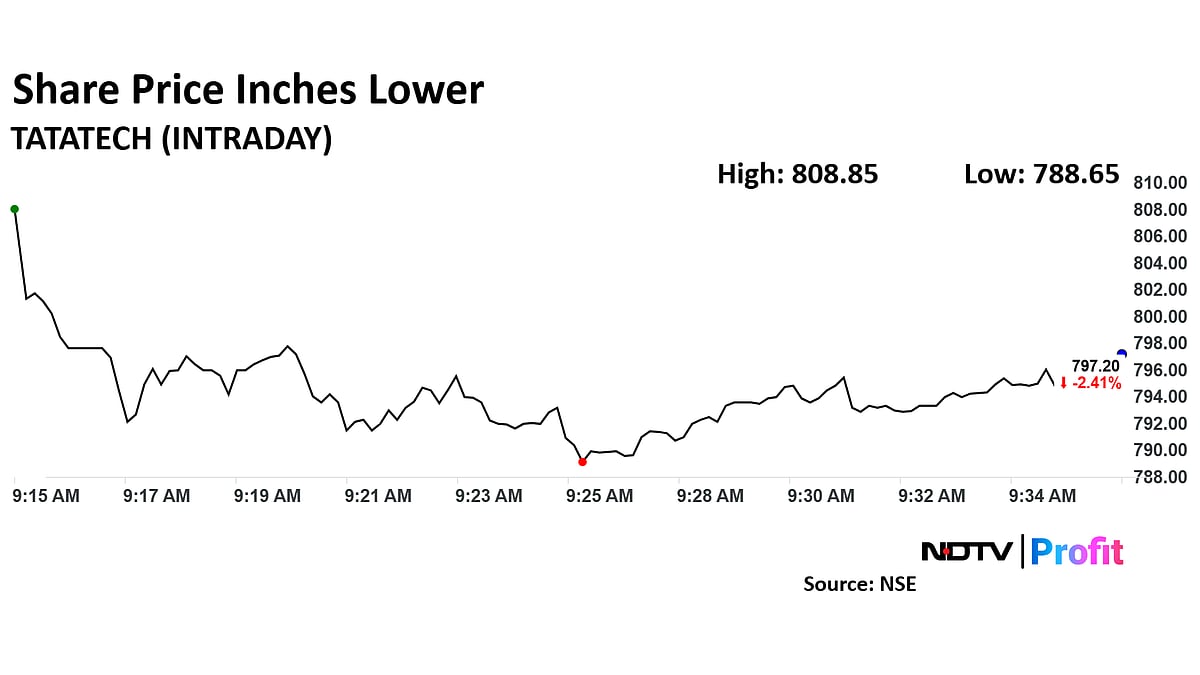

Tata Technologies Ltd.'s share price weakened by 3.45% on Wednesday following the release of its third-quarter earnings for the financial year, which showed softer-than-expected results. The stock price decline follows a bearish stance from Citi, which has downgraded its target price and revised its earnings estimates.

For the quarter ended December, Tata Technologies posted a net profit of Rs 167 crore, a 7% increase compared to the same period last year. While the net profit met analysts' estimates, the company's revenue growth was tepid, rising only marginally to Rs 1,317 crore, just shy of the expected Rs 1,336 crore. Moreover, Tata Technologies' Ebit for the quarter stood at Rs 204 crore, falling short of the consensus estimate of Rs 237 crore. The margin, at 15.5%, was also lower than the expected 17.7%, indicating some pressure on profitability.

Citi analysts expressed a cautious outlook for Tata Technologies in light of the soft Q3 earnings. Although services revenue grew by 1.1% quarter-on-quarter in constant currency terms, the performance was below expectations. The brokerage noted that the company faced challenges in the near term due to delays in decision-making in the US, weakening consumer demand, and rising competition from Chinese players in the European markets.

ALSO READ

Buy, Sell Or Hold: Hindustan Zinc, IDFC First Bank, Tata Tech, Vedanta, Mazagon Dock—Ask Profit

Despite the company securing four large deals in Q3, Citi revised its earnings estimates for FY25-FY27 down by approximately 2-4%, reflecting the challenges in Tata Technologies' key automotive vertical. Consequently, Citi lowered its target price for the stock to Rs 765 from Rs 835, citing a reduced multiple of 38x (compared to 40x previously) due to the uncertainties facing the automotive sector.

However, Tata Technologies' management in the con-call highlighted that its momentum in large deals remains strong.

Regarding hiring, Tata Technologies' headcount grew by just 0.3% year-on-year, with utilisation rates at around 88% for the quarter.

Tata Technologies share price today fell as much as 3.45% to Rs 788 apiece. But it did pare the losses to trade 2.67% lower at Rs 795 apiece, as of 09:31 a.m. This compares to a 0.26% advance in the NSE Nifty 50 Index.

It has fallen 30.41% in the last 12 months. Total traded volume so far in the day stood at 4.5 times its 30-day average. The relative strength index was at 24.

Out of 13 analysts tracking Tata Technologies, five maintain a 'buy' rating and eight suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 4%.