CLSA expects Jaguar Land Rover's profitability to remain strong and Tata Motors Ltd. to gain market share in the domestic passenger vehicle segment.

Retail volume for Jaguar Land Rover rose 4.5% year-on-year in February 2024. The brokerage attributed the muted volume growth to a 46% year-on-year drop in Chinese volumes. This was because of the high base from last year, as the Chinese lunar new year holiday fell in February this year compared to January last year, it said in a March 22 note.

CLSA expects more than 24% year-on-year growth in wholesale volume (ex-China JV) in FY24 to reach 3,98,000 units.

The research firm has maintained an 'outperform' rating on the stock with an unchanged target price of Rs 1,133 per share, implying an upside of 17%.

Incentives Likely To Increase

The incentive cost per vehicle has increased significantly in the last four months for both Jaguar and Land Rover. The incentive cost per vehicle for June 2023 for Jaguar and Land Rover was $619 per unit and $378 per unit respectively, which has increased to $6,049 per unit and $2,046 per unit in February 2024, CLSA said.

The U.S. inventory level for JLR remained at healthy levels in February 2024. "However company is still likely to report >7.5% EBIT margin, led by richer product mix and decline in commodity costs," the note said.

JLR On A Strong Footing

Tata Motors has raised JLR EBIT margin guidance to 8% in FY24 and expects it to reach 10% by FY26.

JLR's net debt declined to £1.6 billion as it made £626 million of free cash flow in third quarter. CLSA expects the net debt to fall to less than £1 billion by end of FY24.

"We expect JLR volumes to grow by 24% YoY in FY24 and 6% YoY in FY25. We expect Ebit margin to remain around 7-8% range in FY24 and FY25. Range Rover Electric waiting list has opened in December and company has already received 16,000 sign-up in 28 days," it said.

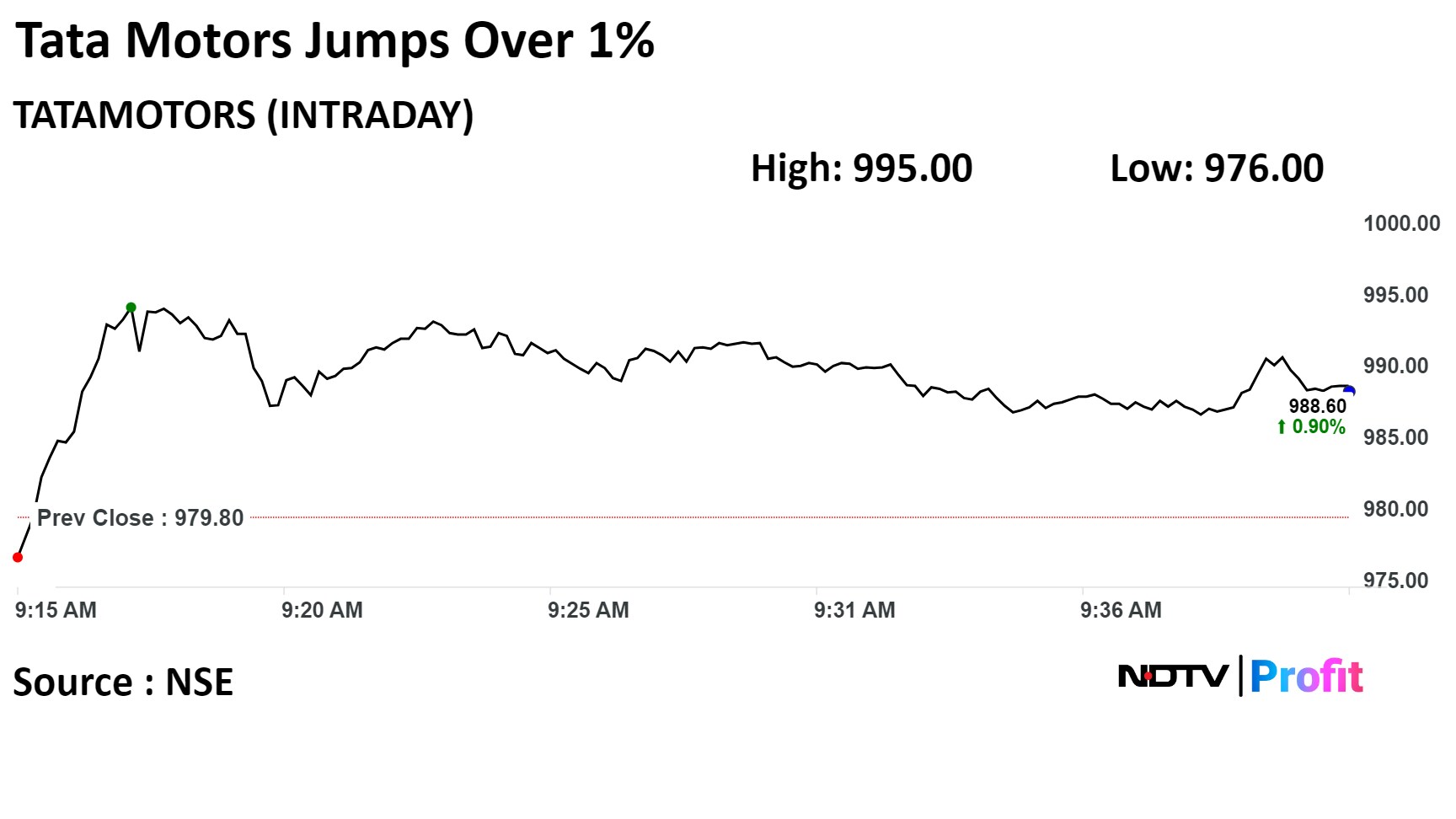

Shares of Tata Motors rose 1.55%, before paring gains to trade 0.78% higher as of 9:50 a.m., compared to 0.25% decline on NSE Nifty 50.

The stock has risen 139.63% in past 12 months. The relative strength index was at 57.

Of the 33 analysts tracking the company, 24 maintain a 'buy' rating, five recommend a 'hold,' and four suggest a 'sell', according to Bloomberg data. The average 12-month analysts' price target implies a downside of 0.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.