Tata Motors Ltd.'s shares fell to one-month low after CLSA downgraded the auto giant from High Conviction Outperform to Outperform, slashing its target price from Rs 930 to Rs 765. The revision reflects concerns over Jaguar Land Rover's performance in financial year 2026, particularly in the US market, due to rising import tariffs.

Currently, JLR is exporting from the UK to the US and from fiscal 2026, the US will impose a 25% import tariff on cars, up from 2.5%. This is expected to lead to a 14% year-on-year decline in JLR's global volumes, with a 26% fall in US volumes alone, said the brokerage.

JLR's luxury segment that accounts 60% of US sales is priced above $85,000 and is less price sensitive. CLSA expects a 10% volume drop in this segment. Similarly, the mid-range segment which constitutes 40% of the US sales is priced between $50,000 and $85,000 and the brokerage expects a 50% demand drop in this segment.

JLR's EBIT margin is projected to decline from 9% in fiscal 2025 to 7% in financial year 2026–27 due to lower sales. CLSA also lowered JLR's EV/EBITDA valuation multiple from 2.5x to 2.0x, given near-term growth headwinds. However, JLR is expected to remain free cash flow positive with an estimated £575 million FCF in financial year 2026, despite potential capex reductions.

Tata Motors' planned demerger in the second half of financial year 2026 is seen as well-timed. CLSA expects the commercial vehicle cycle to bottom out in fiscal 2026, setting up a recovery from financial year 2027.

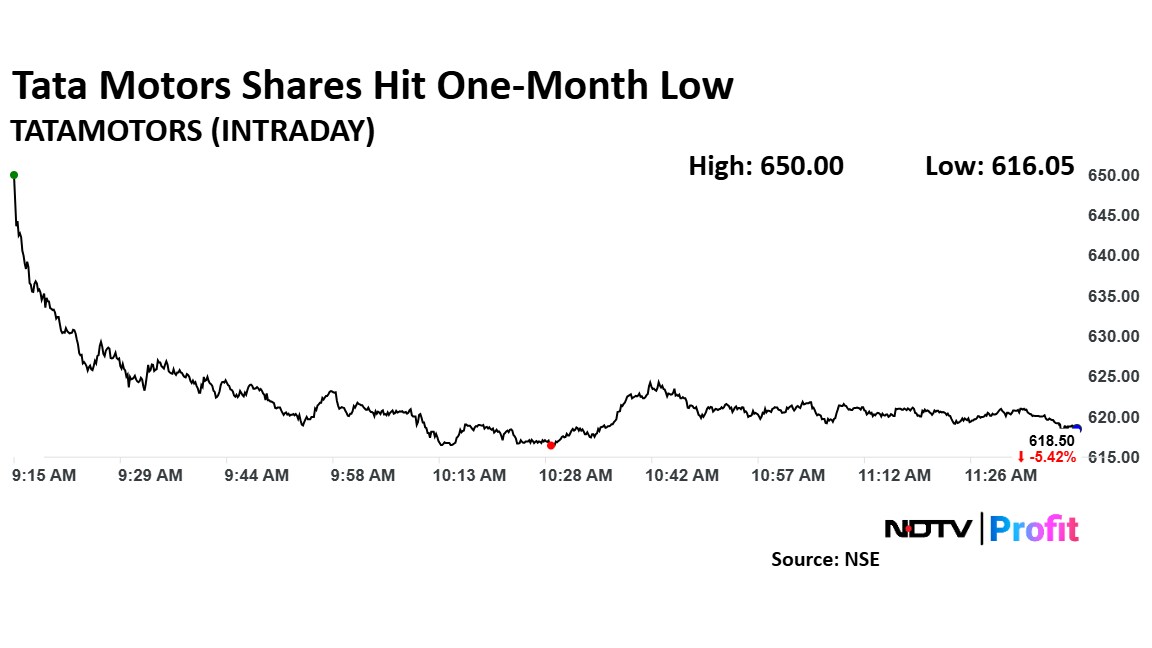

Tata Motors Share Price Decline

The shares of Tata Motors fell as much as 5.80% to Rs 616.05 apiece, the lowest level since March 4. The stock pared losses to trade 5.03% lower at Rs 621 apiece, as of 11:34 a.m. This compares to a 0.98 decline in the NSE Nifty 50 Index.

It has fallen 38.82% in the last 12 months and 17.47% year-to-date. Total traded volume so far in the day stood at 2.4 times its 30-day average. The relative strength index was at 32.

Out of 34 analysts tracking the company, 21 maintain a 'buy' rating, eight recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 30.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.