- Shares of Tata Motors fell nearly 1% after a 7% drop in domestic passenger vehicle dispatches in August

- Total domestic dispatches declined 2% year-on-year to 68,482 units in August 2024

- Total wholesale sales rose 2% year-on-year to 73,178 units in August 2024

Shares of Tata Motors Ltd fell nearly 1% on Tuesday, after the company reported a 7% decline in total passenger vehicle dispatches in the domestic market to 41,001 units last month from 44,142 units in August 2024.

The company's total domestic dispatches declined 2% year on year to 68,482 units last month as against 70,006 units in August last year, as per the official statement on Monday. However, the company's total wholesale rose 2% year-on-year to 73,178 units last month as compared with 71,693 units in August 2024.

Though, total domestic commercial vehicle sales stood at 27,481 units last month, an increase of 6% as compared to 25,864 units in August last year.

On Monday, the company's unit Jaguar Land Rover shared that it is working to resolve "global IT issues" that are impacting its business operations.

"We are working at pace to resolve global IT issues impacting our business. We will provide an update as appropriate in due course," the company said in a stock exchange filing late Monday.

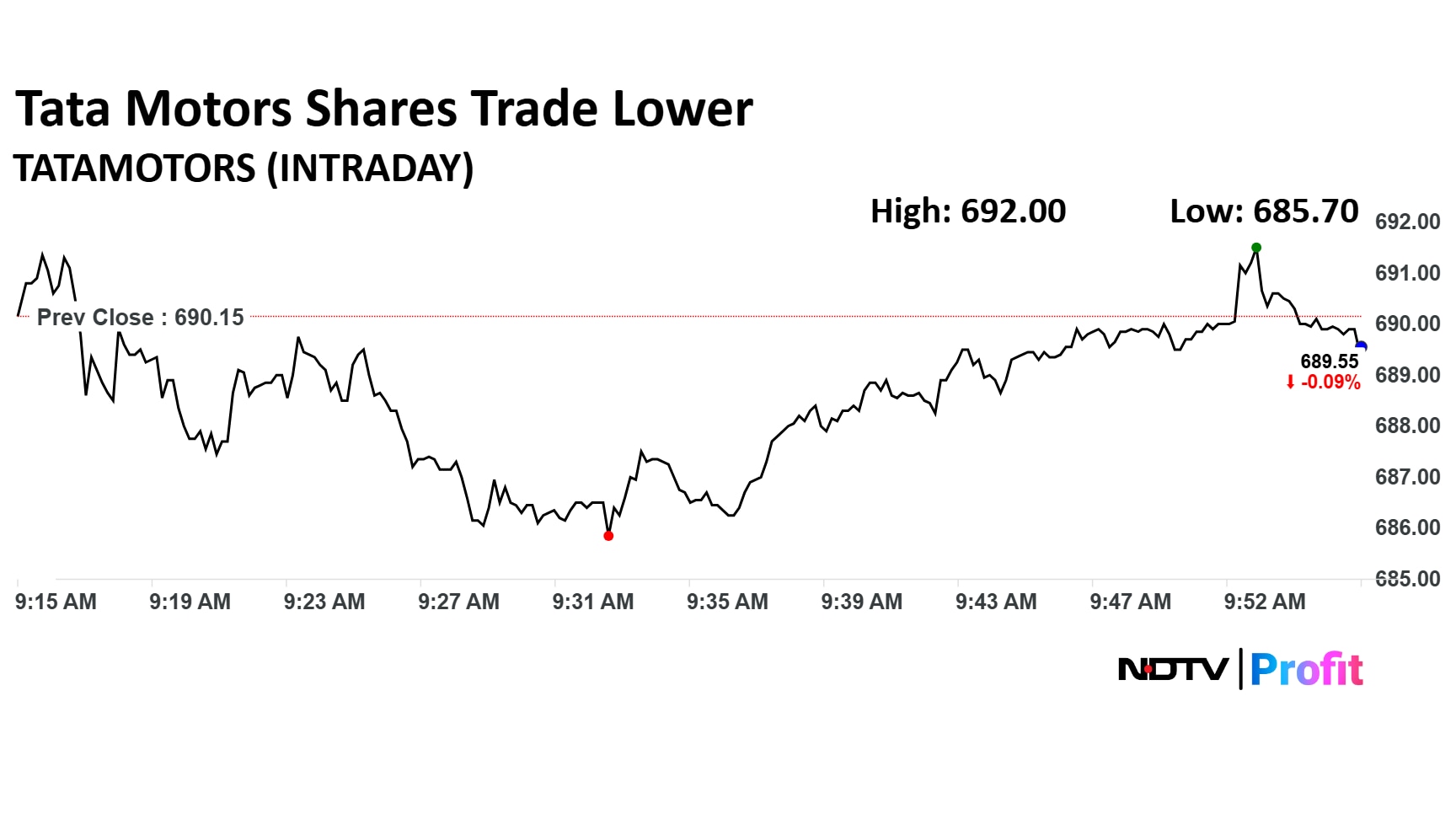

Tata Motors Share Price

Shares of Tata Motors fell as much as 0.64% to Rs 685.70 apiece. They pared losses to trade 0.09% lower at Rs 689.55 apiece, as of 10:00 a.m. This compares to a 0.45% advance in the NSE Nifty 50.

The stock has fallen 36.76% in the last 12 months and 6.69% year-to-date. Total traded volume so far in the day stood at 1.32 times its 30-day average. The relative strength index was at 65.81.

Out of 34 analysts tracking the company, 18 maintain a 'buy' rating, 10 recommend a 'hold' and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.