The shares of Tata Elxsi Ltd. rose over 3% on Monday despite its fourth-quarter performance falling short of expectations and brokerages remaining cautious on near-term prospects.

For the quarter under review, the technology services provider's net profit dropped 13% sequentially to Rs 172 crore. Its revenue fell 3.3% quarter-on-quarter to Rs 908 crore. Earnings before interest and taxes declined 17.1% to Rs 183 crore, according to an exchange filing on Thursday.

Its EBIT margin contracted to 20.1% in the quarter ended March in comparison to 23.5% in the previous quarter.

The management remains optimistic about a recovery in fiscal 2026, buoyed by recent deal wins and expectations of improved momentum in the auto and healthcare segments. However, Morgan Stanley and JPMorgan have maintained their Underweight ratings while lowering target prices.

JPMorgan flagged that auto revenues declined 9.7% quarter-on-quarter, hampered by delays in project ramp-ups and uncertainty due to tariffs, while media and telecom saw a 6.3% quarter-on-quarter drop amid cautious R&D spending. It has lowered its target price to Rs 4,400 from Rs 4,500 per share.

Morgan Stanley echoed concerns, noting that despite deal wins, the media segment continues to underperform, and auto recovery is likely to be gradual given macroeconomic challenges. The brokerage has cut its target price to Rs 4,660 from its earlier Rs 5,400 apiece.

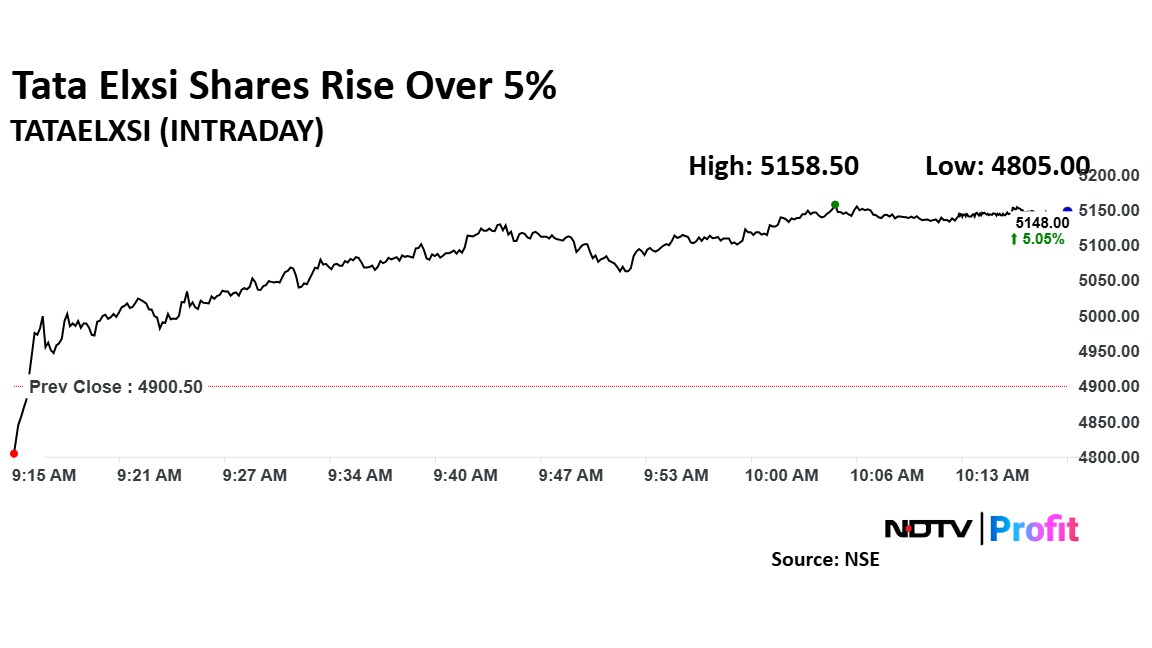

Tata Elxsi Share Price Rise

The shares of Tata Elxsi rose as much as 5.26% to Rs 5,158.50 apiece, the highest level since April 4. It pared gains to trade 3.81% higher at Rs 5,087 apiece, as of 10:12 a.m. This compares to a 0.80% advance in the NSE Nifty 50 Index.

It has fallen 30.96% in the last 12 months and 24.31% year-to-date. Total traded volume so far in the day stood at 9.3 times its 30-day average. The relative strength index was at 52.43.

Out of 14 analysts tracking the company, two maintain a 'buy' rating, one recommends a 'hold,' and 11 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 6.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.