- HSBC initiates buy rating on Tata Consumer Products with Rs 1,340 target price

- HSBC forecasts 18% EBITDA CAGR from FY25 to FY28 for Tata Consumer Products

- Growth portfolio expected to hit 26% CAGR and 28% of India revenue by 2028

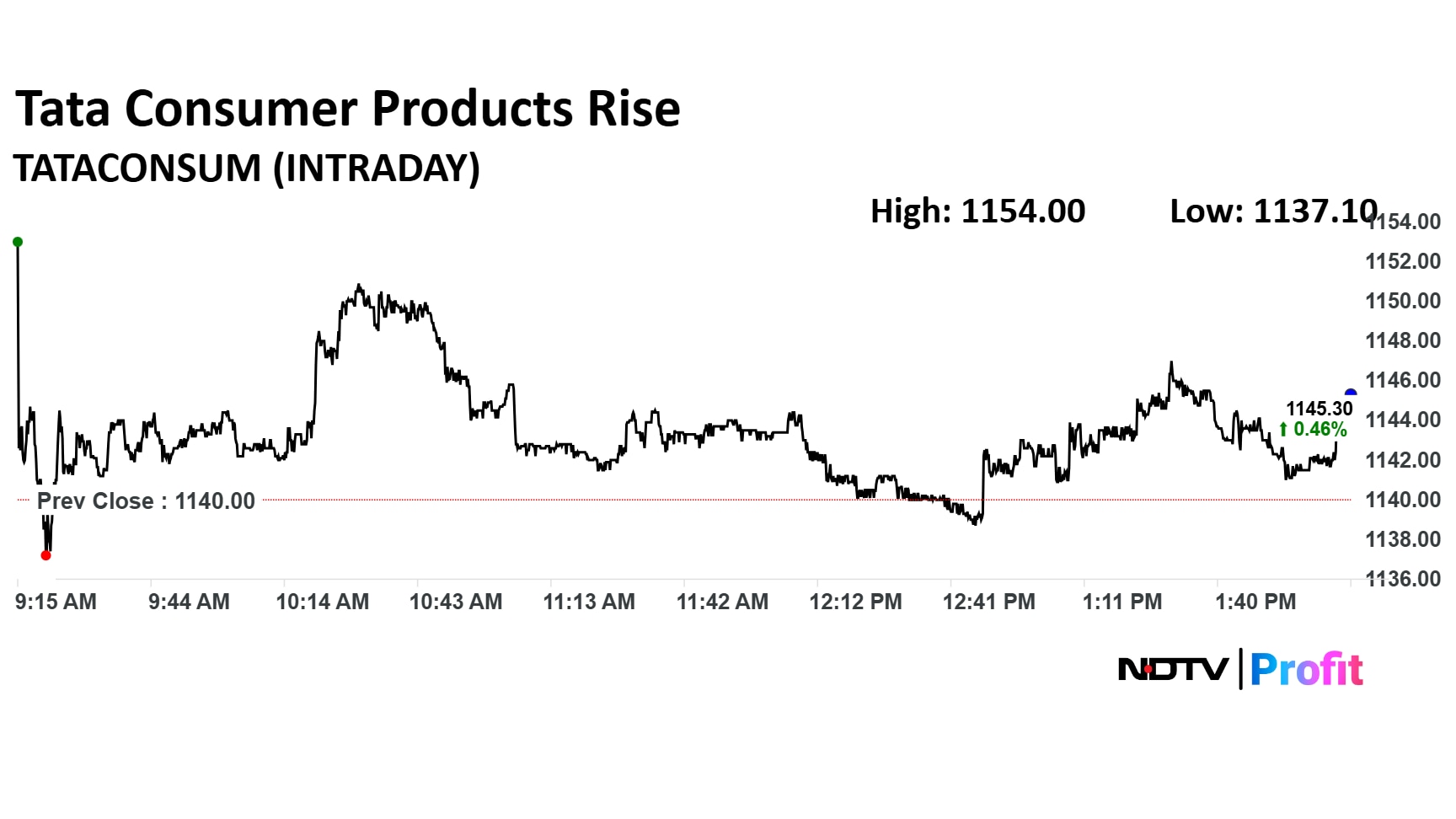

Tata Consumer Products Ltd. share price snapped a five-day losing streak as HSBC initiated coverage on the company with a buy rating. The brokerage has given a target price of Rs 1,340 apiece, which implies an 18% upside from Wednesday's close.

HSBC believes that there will likely recovery in the tea business margin and profitability will improve in the Growth business, which will drive the Ebitda CAGR of 18% over the financial year 2025 and 2028.

The brokerage has forecasted 26% CAGR for the Growth portfolio in the period from financial year 2025 to financial year 2028. This portfolio will contribute 28% to India revenue by 2028. HSBC assigned premium 55 times price-to-earning as we believe aggressive acquisition and distribution will pay off

Tata Consumer Products houses the flagship food and beverage business of Tata Group, which has the potential to grow further with deeper and wider distribution network. This segment has earned 65% of its revenue from India and the balance from international markets, HSBC said in an exchange filing.

Weakness in Growth business and margins of the international business due to increase in coffee prices are the key downside for the Tata Consumer Products Ltd., HSBC said.

Tata Consumer Products Ltd. share price rose 1.23% to Rs 1,154 apiece. It was trading 0.21% higher at Rs 1,142.4 apiece as of 2:07 p.m., as compared to flat NSE Nifty 50 index.

The stock rose 19.08% in 12 months, and 25.16% on year to date basis. Total traded volume on National Stock Exchange so far in the day stood at 3.01 times its 30-day average. The relative strength index was at 43.44

Out of 31 analysts tracking the company, 22 maintain a 'buy' rating, seven recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 12.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.