Shares of Tanla Platforms Ltd. rose nearly 13% on Thursday as the board will meet on June 16 to consider share buyback of equity shares of the firm.

The trading window for dealing in the company's securities will remain closed for all the insiders involved in the buyback project from June 11 to June 18, according to an exchange filing on Wednesday.

If approved, this will be the third buyback by the company since its listing in 2008. The first buyback was in June 2020 and the second one was in October 2022.

In May, promoter Dasari Uday Kumar Reddy bought 18.62 lakh shares (1.38%) at Rs 470.15 apiece, while Smallcap World Fund Inc sold 1.21% stake at Rs 470.15 apiece and American Funds Insurance Series Global Small Capitalization Fund sold 0.17% stake at Rs 470.15 apiece.

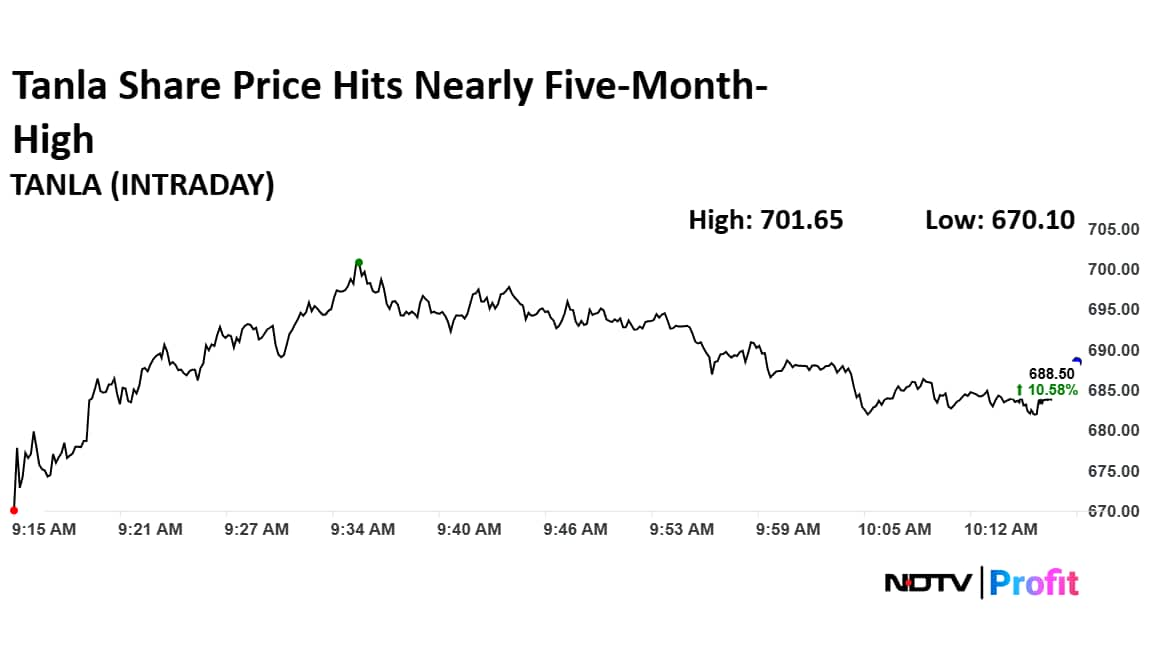

Tanla Platform Share Price Rises

Shares of Tanla Platform rose as much as 12.69% to Rs 701.65 apiece, the highest level since Jan. 21. They pared gains to trade 10.04% higher at Rs 685.15 apiece, as of 10:14 a.m. This compares to a 0.18% decline in the NSE Nifty 50.

The stock has fallen 28.68% in the last 12 months and risen 1.69% year-to-date. Total traded volume so far in the day stood at 13 times its 30-day average. The relative strength index was at 55.28.

The two analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies a downside of 11.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.