UBS Research downgraded Syngene International Ltd. on Tuesday, citing headwinds in revenue growth.

The research firm has cut the contract research services firm's rating to 'sell' and reduced the target price to Rs 700 apiece from Rs 875 earlier, implying a potential downside of 4.8%, according to a note. "Our earlier thesis of easing headwinds for Syngene's discovery and dedicated segments (about 60% of revenue) is not playing out."

The outlook remains subdued with a tough macroeconomy, tight budgets for large global pharma companies, and muted venture-capital funding for biotech. The performance has diverged from other contract research organisations, suggesting that the market is not fully pricing in these headwinds for the company, according to UBS.

The stock has corrected 12% from its peak in the past three months, with UBS anticipating more downside, citing likely earnings cuts and the risk of soft guidance for the next financial year.

VC funding for biotech has been muted in the past few quarters, leading to fewer early-stage discovery projects. UBS expects this pressure to persist for most of 2024 due to the tough macro.

Syngene's revenue exposure to medium-sized and small bio-pharma firms is generally 15–20%, and it is likely to face significant revenue-growth pressure, according to the brokerage firm. UBS sees challenges for large pharma companies in 2024 due to the increased risk of additional measures on drug pricing in an election year.

The brokerage expects weak demand for the discovery and dedicated segments, which may put pressure on Syngene's near-term revenue growth. There are delays in the ramp-up of its active-pharmaceutical-ingredient unit in Mangaluru, which may result in a consensus earnings cut.

Here's What UBS Has To Say

Downgrade to 'sell' with a target price of Rs 700 apiece.

The performance has diverged from other CROs, suggesting the market is not fully pricing these headwinds.

Anticipates more downside to the stock, led by earnings cut and risk of soft guidance for the next fiscal.

Expects an 18% compound annual growth rate for revenue and 31.5% Ebitda margin.

Cuts the earnings-per-share estimates for fiscal 2025–26 to account for the revenue-growth headwinds.

Positive on Syngene's structural story but find risk reward unattractive.

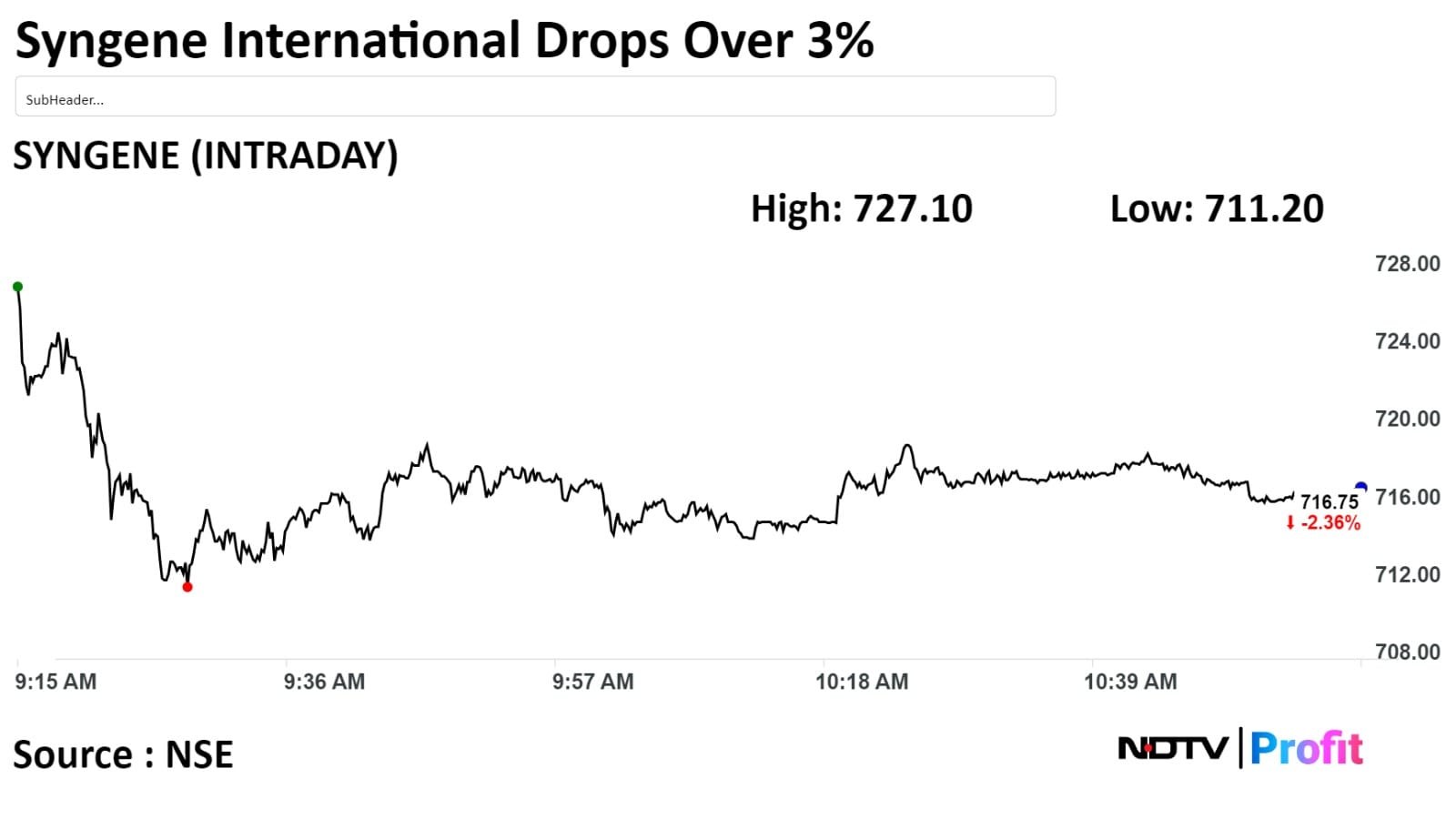

Syngene's stock dropped as much as 3.12% during the day to Rs 711.20 apiece on the NSE. It was trading 2.4% lower at Rs 716.45 apiece compared to a 0.07% advance in the benchmark Nifty 50 at 11:10 a.m.

Five out of the 10 analysts tracking the company have a 'buy' rating on the stock, two recommended a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 3.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.