Swiggy's share price fell on Tuesday, as the lock-in period for its pre-IPO investors concluded. The six-month lock-in period for non-promoter shareholders ended on May 13, 2025, which could have potentially led to increased selling pressure on the stock.

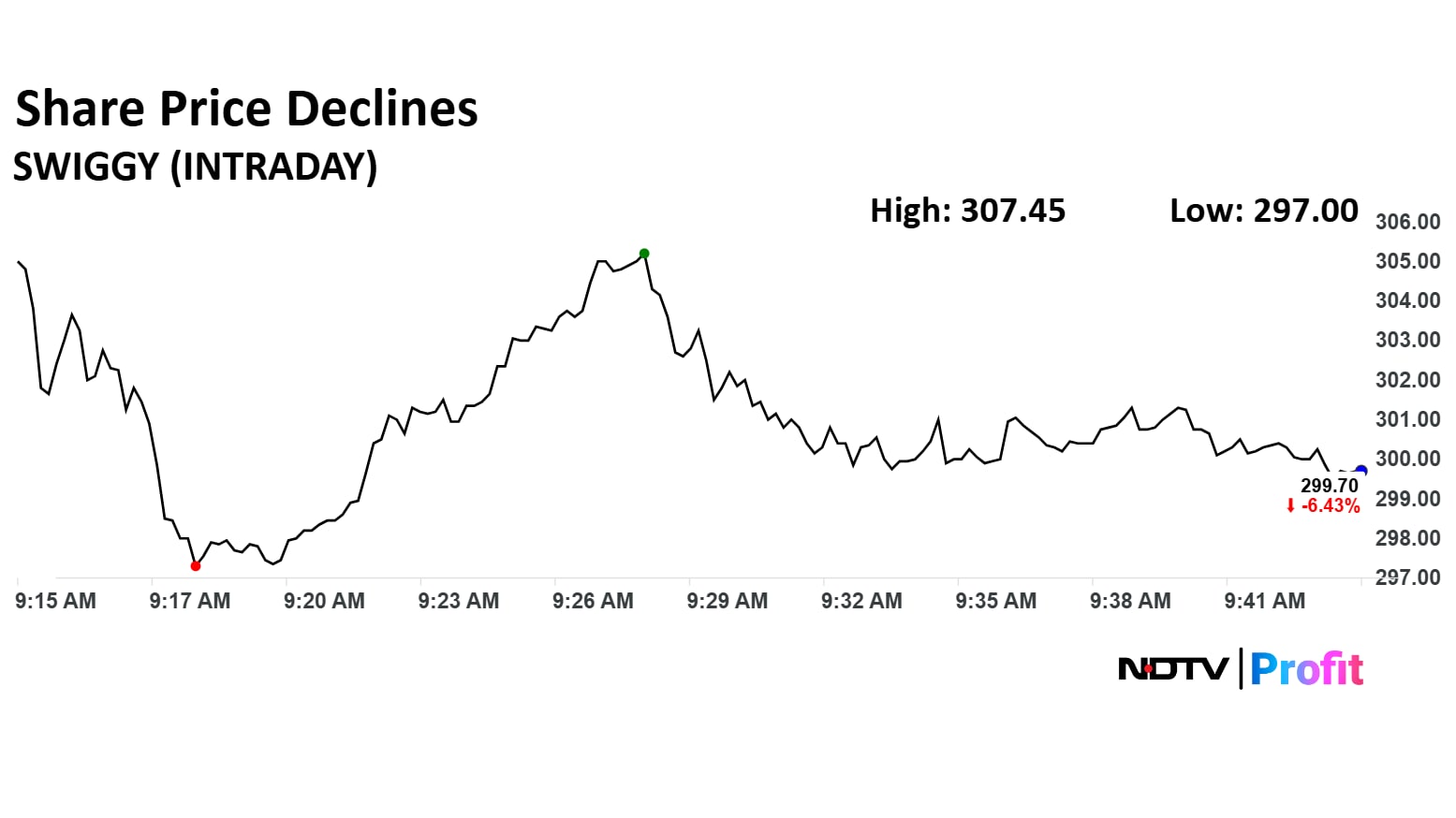

The share price declined 7.27% on Tuesday.

With the expiration of the lock-in period, approximately 83% of Swiggy's shareholding, or 189.75 crore equity shares, became available for trading on May 13. The total value of these shares is estimated to be around Rs 62,000 crore.

The end of the lock-in period does not necessarily mean that all these shares will be sold; it simply means they are now eligible for trading in the secondary market.

The food delivery service company went public on Nov. 13, 2024. The company's initial public offering set the share price at Rs 390. On the day of listing, Swiggy's shares opened at a premium of Rs 410 per share, indicating strong investor confidence and interest. The IPO raised approximately Rs 11,327 crore.

Swiggy Share Price Today

The scrip fell as much as 7.27% to Rs 297 apiece. It pared losses to trade 6.34% lower at Rs 300 apiece, as of 09:46 a.m. This compares to a 0.71% decline in the NSE Nifty 50.

It has fallen 34.21% in the last 12 months. Total traded volume so far in the day stood at 25 times its 30-day average. The relative strength index was at 37.

Out of 20 analysts tracking the company, 14 maintain a 'buy' rating, three recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 37.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.