India's top e-commerce stocks have outpaced local indexes and regional peers over the past month, as a rapid rebound fuels bets on their ability to edge out rivals and boost profitability.

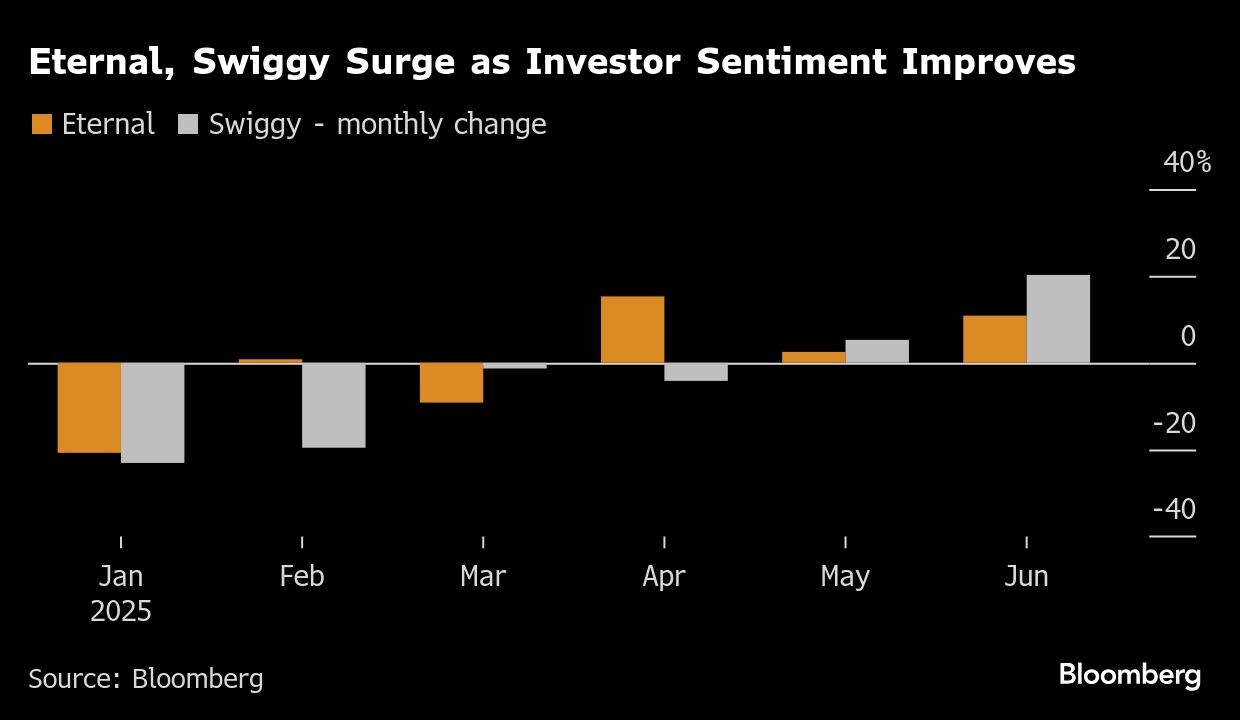

Shares of Swiggy Ltd. climbed 20% last month, topping the NSE Nifty 100 Index, while Eternal Ltd. advanced 11%. The rally in India's fast-growing quick-commerce sector — which delivers daily essentials in just minutes — contrasts sharply with losses for counterparts in China, where a fierce price war has battered food-delivery firms.

Even with new entrants including Amazon.com Inc. and Walmart Inc.'s Flipkart India Pvt., analysts say incumbents Swiggy, Eternal, and unlisted Zepto are likely to retain market share, thanks to their entrenched supplier networks and first-mover advantage.

“Established players have shown they can manage delivery costs effectively, especially in paying and utilizing riders efficiently,” said Nirav Karkera, a fund manager and head of research at Fisdom. “New entrants, however, will still need to prove they can do this in a sustainable way,” he added.

Quick commerce is reshaping India's online retail landscape, with companies racing to tap into a market that Bloomberg Intelligence estimates could reach $100 billion by 2030. The segment promises delivery of essentials like groceries of personal care items in as little as 10 minutes.

For now, Eternal's Blinkit, Swiggy's Instamart and Zepto collectively control around 88% of the quick-commerce market share in India, according to data compiled by JM Financial Ltd. Blinkit has led the segment since its 2022 acquisition by Eternal, which also owns food-delivery platform Zomato.

These established businesses have invested heavily in expanding their warehouse and “dark store” fulfillment-center networks to more and more cities. That's put pressure on profit margins along with price cuts intended to lure customers.

Such costly expansion is expected to ease for the early movers this year, however, allowing them to focus on profitability while newer entrants still need to invest in order to gain share. Major players are also moving toward better monetization by incentivizing high-value purchases and charging fees for new related services.

E-commerce platforms are raising average order sizes, applying more discipline to their discounts and increasingly focusing on improving their economics, JM Financial analysts including Swapnil Potdukhe wrote in a June 26 note. “Losses may have already peaked” for both Blinkit and Instamart, they added.

In China meanwhile, the e-commerce delivery sector continues to struggle with hostile competition. The leaders Meituan and JD.com Inc. have shed more than $70 billion in combined market value since March peaks.

Challenges also remain in India. Inroads by Zepto have taken the most market share from Instamart, according to JM Financial's data. And Swiggy is still unprofitable, though analyst sentiment has been improving, with its ratio of analyst buy recommendations climbing to the highest since its late 2024 listing.

Plans for an eventual stock market listing by Zepto may draw some investment allocations away from Eternal and Swiggy, according to Fisdom's Karkera. Nevertheless, they're all seen benefiting from expansion of a market that is still growing.

“The incumbents continue to stretch their lead in users as well as in store networks, despite lowering discounts and levying delivery and handling fees,” said Aditya Soman, an analyst at CLSA Ltd. “We remain positive on the quick-commerce opportunity. We believe there is enough room for the incumbents and a couple of new entrants.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.