- Suzlon Energy secured an 838 MW contract from Tata Power Renewable Energy Ltd for FDRE projects

- The project includes 266 S144 turbines across Karnataka, Maharashtra, and Tamil Nadu

- FDRE projects integrate energy storage to provide round-the-clock renewable power

Suzlon Energy Ltd. share price advanced during early trade on Tuesday after the company announced a large contract from a subsidiary of Tata Power Co.

The wind energy company secured its largest order in the current financial year of 838 megawatts with Tata Power Renewable Energy Ltd. as part of its Firm and Dispatchable Renewable Energy (FDRE) project, a statement said. The monetary value of the order has not been disclosed.

"The project will comprise 266 of Suzlon's S144 wind turbines, each with a rated capacity of 3.15 MW, strategically located across Karnataka (302 MW), Maharashtra (271 MW), and Tamil Nadu (265 MW). The project is part of the FDRE bids awarded to SJVN and NTPC," the company said.

The new contract is Suzlon's second-largest order ever, following its record 1,544 MW order from NTPC Green Energy Ltd.

The FDRE projects are renewable energy projects that are integrated with energy storage systems. They provide round-the-clock power often by integrating storage or hybrid solutions, thereby improving grid reliability and reducing dependence on fossil-based backup.

Suzlon has been consistently building its domestic order pipeline with large-scale project wins. The company also plans to enter international markets, focusing on the Middle East and Europe, with export orders expected to begin by the end of the financial year 2026.

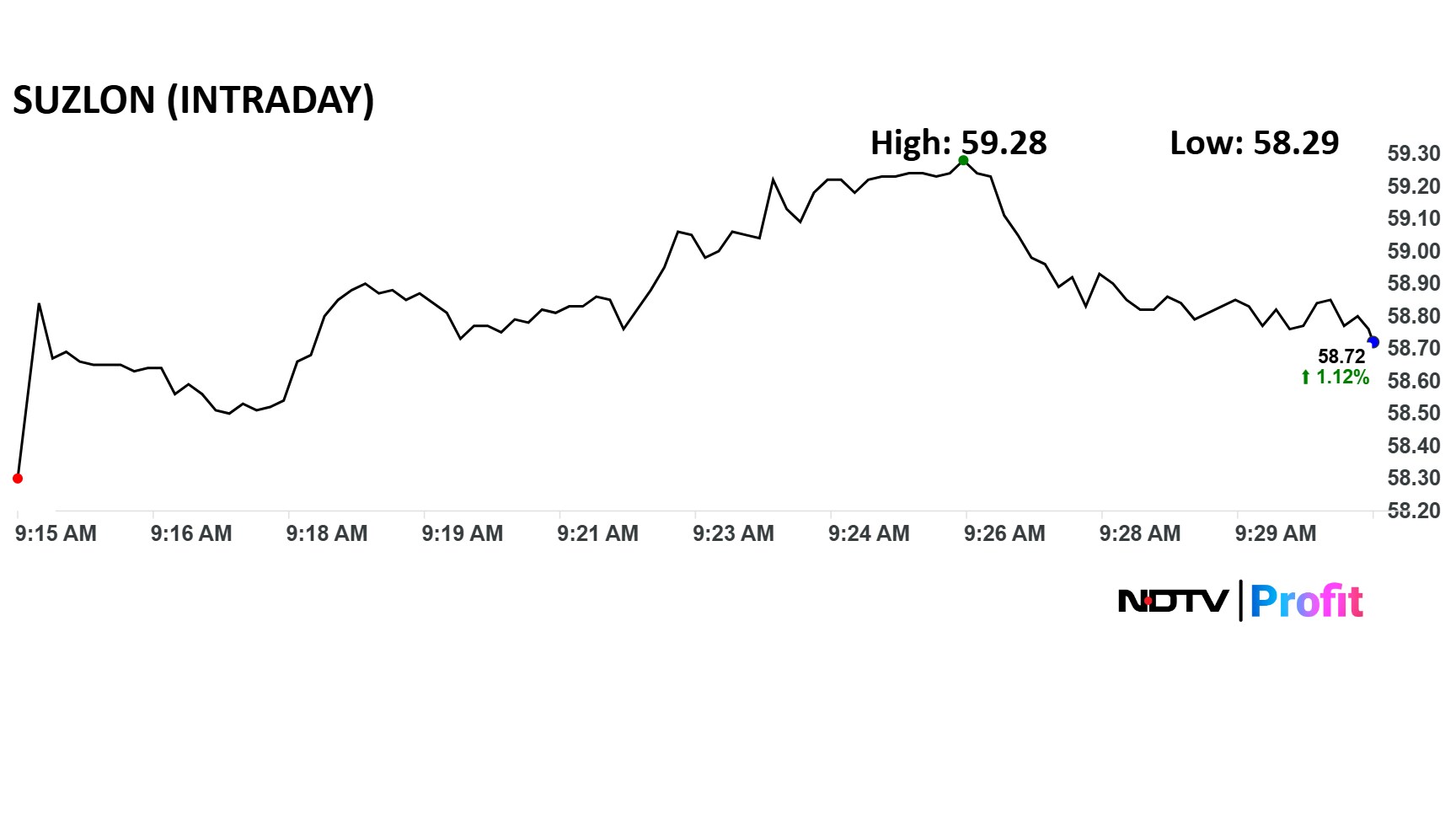

Suzlon Energy share price advanced over 2% intraday to Rs 59.28 apiece. The benchmark NSE Nifty 50 was up 0.2%. The relative strength index was at 54.

The stock has fallen 30% in the last 12 months and 6% on a year-to-date basis.

Eight out of the nine analysts tracking Suzlon have a 'buy' rating on the stock, and one recommends a 'hold', according to Bloomberg data. The average of 12-month analyst price target of Rs 76.11 implies a potential upside of 29%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.