Asian equities climbed close to their record and US equity-index futures advanced as strong earnings from Amazon.com Inc. and Apple Inc. lifted sentiment after a brief pause in the global stock rally.

MSCI's regional stocks index climbed 0.4%, while Japanese shares advanced 1%. Gauges in mainland China and Hong Kong retreated. Apple rose in late trading as it beat revenue estimates and offered a bullish holiday forecast. Amazon surged 13% in extended trading after reporting its fastest cloud unit growth in nearly three years.

Futures on the S&P 500 rose 0.7% and those on the Nasdaq 100 gained 1.2% after the underlying indexes slipped Thursday amid weakness in tech stocks. Investors also weighed a series of risk events, including the US-China trade talks and a Federal Reserve warning that a December rate cut isn't guaranteed.

After-market gains in Apple and Amazon offered investors a brief respite from Thursday's bruising session for megacap techs, amid lingering doubts over whether heavy AI spending will pay off. Meta Platforms Inc. drew record demand for its $30 billion bond sale, signaling that investors are looking past those concerns and continuing to bet on a rally that has added $17 trillion in market value since April.

“None of this means that the AI bubble is going to burst and that we're on the cusp of a major reversal in the stock market,” said Matt Maley at Miller Tabak. “However, it does raise the odds that we could see a short-term pullback.”

Elsewhere, Treasury yields steadied after rising across the curve Thursday. A gauge of the dollar edged lower after two consecutive days of advances, while the yen rose after inflation in Tokyo advanced at a faster pace.

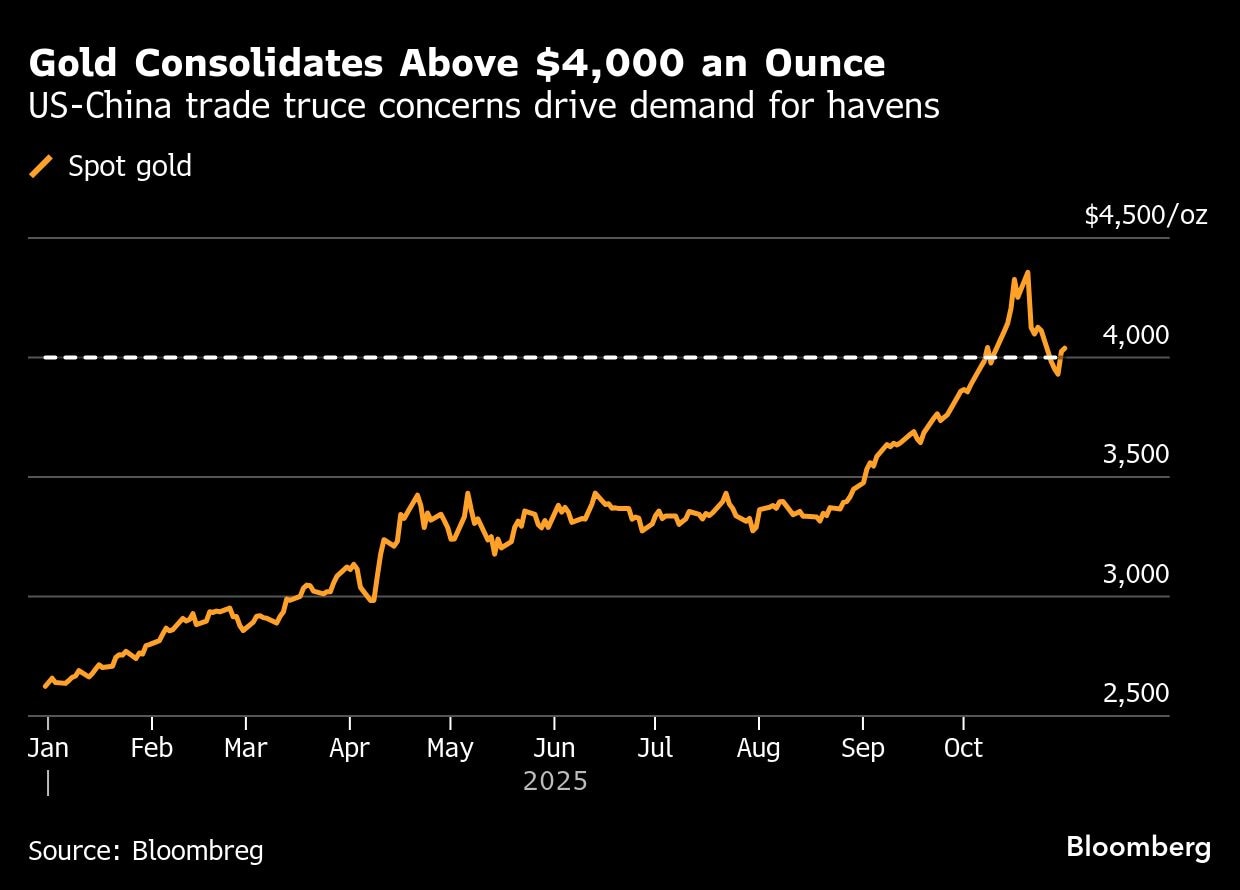

Gold held its gains to trade once again above the $4,000-an-ounce level as the Fed's rate cut and US-China detente were priced in, drawing in technical buyers, wrote Dilin Wu, a strategist at Pepperstone Group Ltd., in a note.

The moves came after a selloff in several megacaps dragged down US stocks Thursday. Microsoft Corp. slid on underwhelming results, while Nvidia Corp. dropped as President Donald Trump said he didn't discuss approving sales of Blackwell chips to China with Xi Jinping.

The largest technology companies are betting on an AI future powered by gigantic data centers filled with humming servers. Now that the staggering cost of this push is coming into sharper focus, it's testing nerves on Wall Street.

“The only takeaway that investors care about from big tech earnings is evidence of which company can stay in the AI race the longest,” said David Trainer at New Constructs. “None of these companies can keep up this huge spending on AI forever, and so those that find a way to profit first and the most from AI will be the winners.”

What Bloomberg strategists say...

Bubble concerns seem to have been pushed back further by the latest set of earnings. The AI boom is alive and well and broadening out far beyond just the US. There's been plenty of volatility across markets this week as Presidents Trump and Xi finally met, but the AI theme is where investors look for signals regarding global equities.

Selling in US government debt reflected Fed Chair Jerome Powell's warning that investors need to rein in expectations for a December rate cut as US policymakers grapple over the outlook for jobs and inflation.

Fed officials voted 10-2 to lower the target range for the federal funds rate by a quarter percentage point on Wednesday. It was the second straight rate cut, but for the first time in six years, there were dissents in both directions — with one official advocating a larger reduction and another preferring to stay on hold.

The decision was hawkish “because the moderates are pushing back,” said Andrew Brenner at NatAlliance Securities. If the Fed fails to cut again in December, investors should “expect fewer cuts next year,” as “the bar of employment gets raised,” he said.

On the trade front, Treasury Secretary Scott Bessent said he sees the US back at the negotiating table with China in a year. That came after Trump and Xi agreed to extend a tariff truce, roll back export controls and reduce other trade barriers in a landmark summit on Thursday.

“The much-anticipated US-China trade agreement showed both sides willing to step away from recent escalations, but not willing to stand down from a longer-term competition,” said Paul Christopher at Wells Fargo Investment Institute.

Corporate News:

Intel Corp. is in preliminary talks to buy artificial intelligence chip startup SambaNova Systems Inc., according to people familiar with the matter.

ANZ Group Holdings Ltd. said cash profit for the second half of this year will be impacted by significant items amounting to A$1.1 billion ($720 million).

Netflix Inc. is actively exploring a bid for Warner Bros Discovery's studio and streaming business, Reuters reported, citing three sources familiar with the matter. Netflix also approved a 10-for-1 stock split.

BYD Co. reported another slump in quarterly profit as intensifying domestic competition and growing industry scrutiny pile pressure on the Chinese carmaker's sales outlook.

Hitachi shares jumped as much as 12%, the most since April, after posting better-than-expected quarterly income driven largely by its AI-related business.

Key Events This Week

For top events, click here.

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.7% as of 10:49 a.m. Tokyo time

Japan's Topix rose 0.4%

Australia's S&P/ASX 200 rose 0.5%

Hong Kong's Hang Seng fell 0.4%

The Shanghai Composite fell 0.4%

Euro Stoxx 50 futures were little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1572

The Japanese yen rose 0.2% to 153.76 per dollar

The offshore yuan was little changed at 7.1104 per dollar

Cryptocurrencies

Bitcoin rose 2% to $109,684.26

Ether rose 2.4% to $3,846.4

Bonds

The yield on 10-year Treasuries was little changed at 4.09%

Japan's 10-year yield was unchanged at 1.650%

Australia's 10-year yield was little changed at 4.31%

Commodities

West Texas Intermediate crude fell 0.5% to $60.27 a barrel

Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.