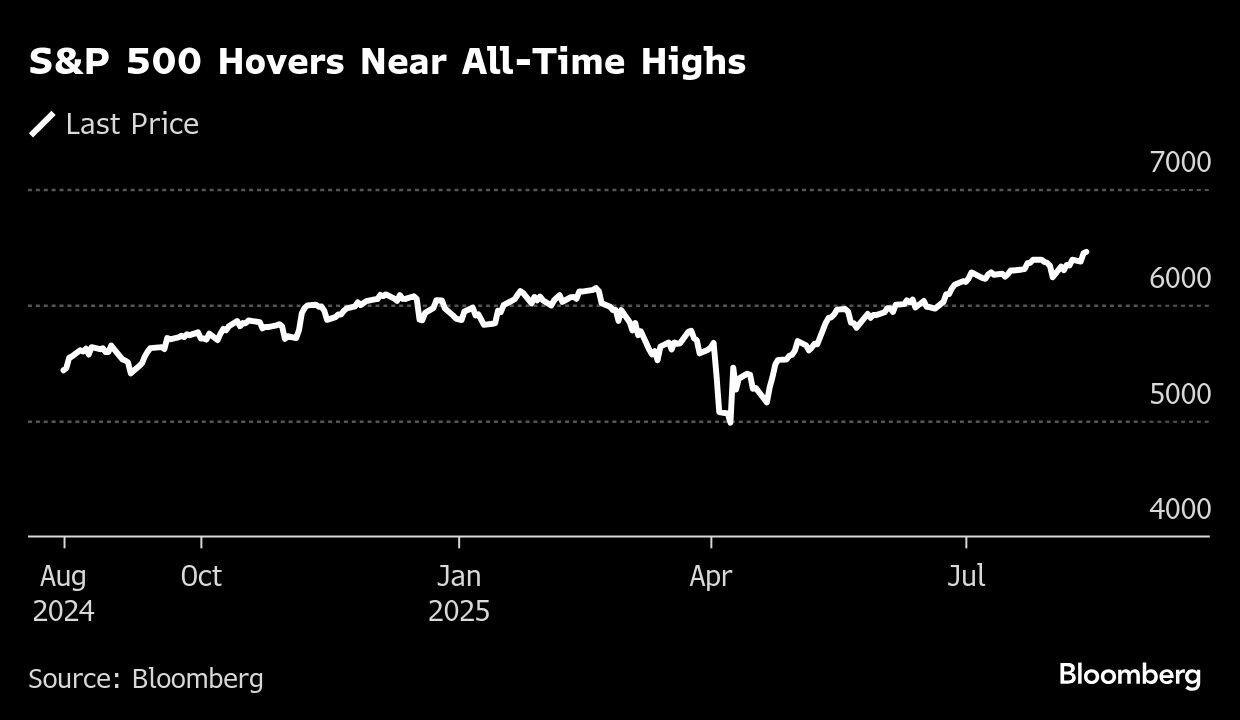

Wall Street traders kept piling into bets the Federal Reserve will soon cut interest rates, with bond yields falling alongside the dollar and stocks hovering near record highs.

Just a day after benign inflation data spurred rallies in Treasuries and equities, speculation grew the Fed will reduce rates next month - with some wagers pointing to a jumbo-sized cut. Those expectations were bolstered by Treasury Secretary Scott Bessent's remarks that “we could go into a series of rate cuts here, starting with a 50 basis-point rate cut in September.”

Stocks rise on Fed bets.

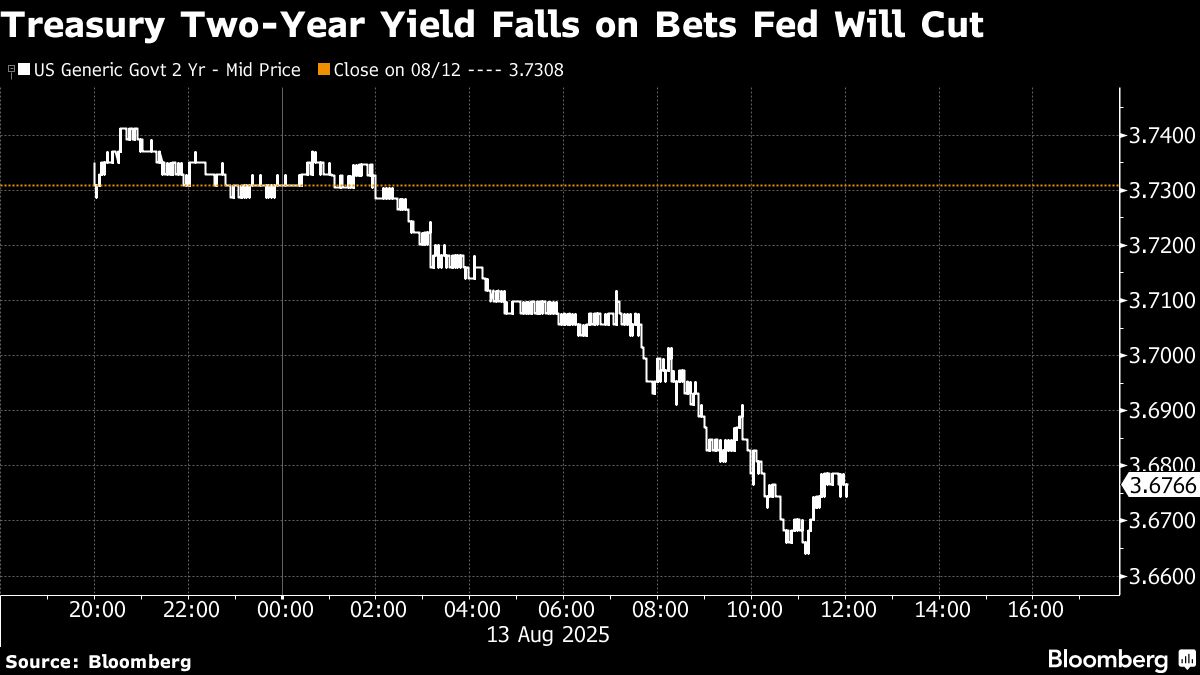

Treasury two-year yields dropped five basis points to 3.68%. The dollar fell against most major currencies. While the S&P 500 was little changed, most of its shares rose. Smaller firms outpaced the market, with the Russell 2000 rising over 1%. A gauge of big techs fell, with Nvidia Corp. leading losses.

Fed policymakers last month kept their benchmark at a target range of 4.25% to 4.5%. Bessent said officials might have cut rates if they'd been aware of the revised data on the labor market that came out a couple of days after the latest meeting.

“As the labor market continues to weaken, we think the US central bank will resume interest rate cuts next month, with 25-basis-point cuts at each meeting through January 2026 for a total of 100 basis points,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management.

Meantime, The Trump administration is considering several private sector candidates for chair of the Fed when the role opens in May, including a strategist at Jefferies and an executive at BlackRock Inc., according to an administration official.

For weeks, investors have piled into swaps, options and outright Treasury longs to wager that subdued inflation will allow the Fed to lower borrowing costs in coming months. There's some vindication for that view, with traders lifting the odds of a September rate cut.

Secured Overnight Financing Rate options flow Wednesday included continued demand for upside around September tenors, looking to target additional easing beyond a 25 basis-point cut being priced into the September policy meeting.

“As the market continues to digest the shift in the trajectory of the real economy following the combination of July's inflation and employment data, it follows intuitively that the question has become: how large of a cut should Powell deliver?” said Ian Lyngen at BMO Capital Markets.

“We don't expect a 50 basis-point move, although we certainly see scope for a meaningful probability of one to be priced in during the coming weeks,” he added.

As for stocks, Rich Mullen at Pallas Capital Advisors says that while he believes it still makes sense to stay invested, much of this year's gains are likely already in.

“Inflation has been tame, and while many businesses have been able to avoid passing on higher costs to consumers, there are still questions on how much longer this trend can last,” he said.

Data this week showed underlying US inflation accelerated in July, but the cost of tariff-exposed goods didn't rise as much as feared. A government report on producer prices due Thursday will offer insights on additional categories that feed directly into the Fed's preferred price gauge — which is scheduled for later this month.

“Tariff-related costs are still being absorbed by corporate profit margins rather than passed on to consumers, giving the Fed room to pivot without sparking inflationary risk,” said Fawad Razaqzada at City Index.

Some companies have been holding off on price increases for fear that consumers will pull back on spending, which will heighten interest for Friday reports on retail sales and consumer sentiment.

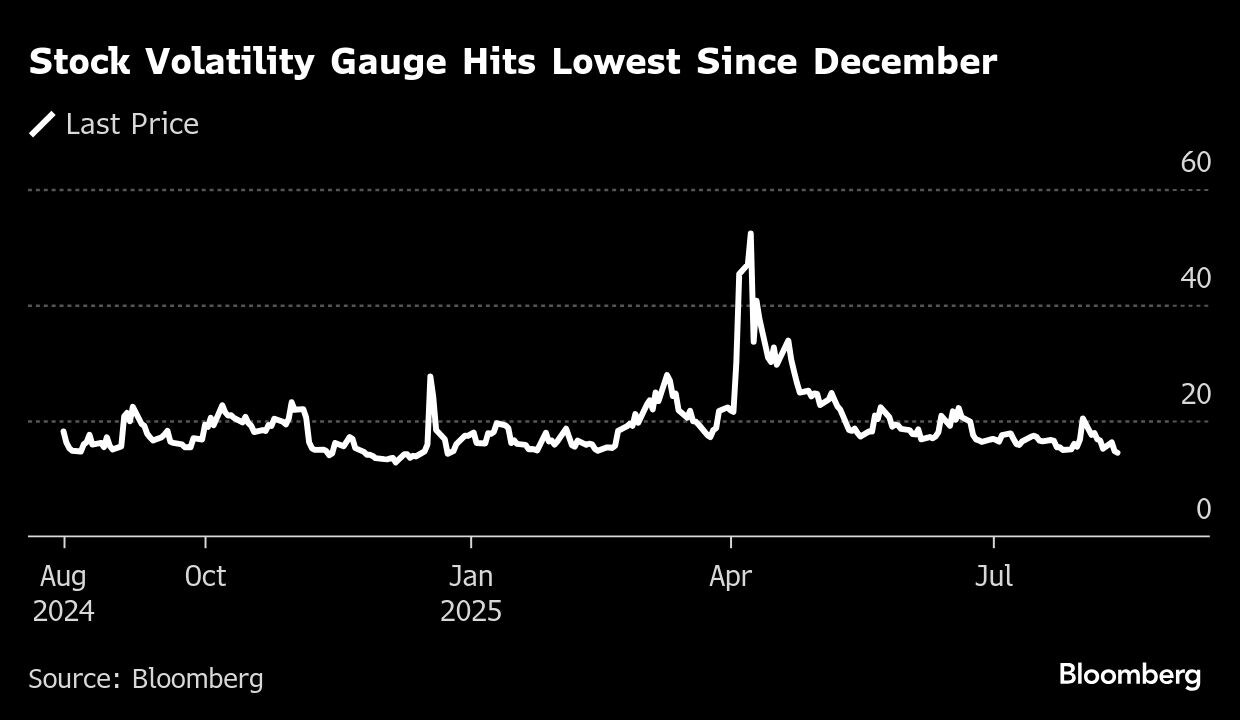

Across equity, bond and currency markets, gauges of volatility are slumping to their lowest levels of the year. The Cboe Volatility Index hit its lowest since December.

“Broadening participation in this bull market is essential for its sustainability,” said Craig Johnson at Piper Sandler. “We believe there is still room to run higher this summer, as the prevailing F.O.M.O. attitude among overly cautious investors and short-sellers helps drive prices higher.”

To Mark Hackett at Nationwide, the path of least resistance for the market is higher as the S&P 500 broke out of the recent trading range.

“Retail investors are increasingly validated in the buy-the-dip approach, given the speed of the recovery from the recent selloff, potentially creating a self-fulfilling prophecy the next time the market experiences a minor selloff,” he said.

Corporate Highlights:

Treasury Secretary Scott Bessent said the recent deal to allow Nvidia Corp. and Advanced Micro Devices Inc. to resume lower-end AI chip sales to China, on the condition they give the US government a 15% cut of the related revenue, could serve as a model for others.

Top US chip-equipment supplier Applied Materials Inc. was sued by a rival in China over what that company characterized as trade secret theft, a further escalation in the technology war between the world's two largest economies.

Amazon.com Inc. plans to offer same-day grocery delivery in 2,300 cities by the end of the year, more than doubling the current number and marking a major expansion in its effort to compete with traditional grocers.

Tesla Inc. is looking to hire someone to test its driver-assistance technology on the streets of New York City, suggesting the carmaker could be looking to expand its ride-hailing services to the largest US metropolis.

Oracle Corp. is cutting jobs in its closely watched cloud unit, the latest company taking steps to control costs amid heavy spending on AI infrastructure.

Tencent Holdings Ltd. promised prudence in AI spending despite faster-than-anticipated growth across its gaming and advertising businesses, suggesting the company intends to adopt a more measured approach to artificial intelligence development than many of its global rivals.

A union representing workers at Boeing Co.'s St. Louis-area defense factories urged US lawmakers from Missouri to intervene and nudge the planemaker to reach a deal.

Cava Group Inc. trimmed its annual sales guidance, as skittish diners spent less on restaurant meals.

CoreWeave Inc. gave a disappointing earnings outlook, reflecting margin pressures from a rapid AI data center expansion.

Gildan Activewear Inc. agreed to buy US underwear maker Hanesbrands Inc. — aiming to double its annual sales — for about $2.2 billion in cash and stock.

Hillenbrand Inc. is exploring strategic options, including a potential sale, people familiar with the matter said.

Circle Internet Group Inc. and a group of shareholders including co-founder and Chief Executive Officer Jeremy Allaire announced an offering to sell a combined 10 million shares.

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 6:21 a.m. New York time

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.3%

The Stoxx Europe 600 rose 0.4%

The MSCI World Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index fell 0.4%

The euro rose 0.4% to $1.1725

The British pound rose 0.5% to $1.3574

The Japanese yen rose 0.4% to 147.29 per dollar

Cryptocurrencies

Bitcoin rose 0.2% to $120,402.26

Ether rose 1.8% to $4,702.74

Bonds

The yield on 10-year Treasuries declined four basis points to 4.25%

Germany's 10-year yield declined five basis points to 2.69%

Britain's 10-year yield declined three basis points to 4.59%

Commodities

West Texas Intermediate crude fell 0.8% to $62.69 a barrel

Spot gold rose 0.5% to $3,364.94 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.