Stock Market Today: All You Need To Know Going Into Trade On Jan 6

Stocks in the news, big brokerage calls of the day, complete trade setup and much more!

Good morning!

The GIFT Nifty is trading at a 0.28% advance at 26,392.50 as of 6:45 a.m., indicating a muted open for the benchmark Nifty 50.

S&P 500 futures trade 0.036% lower.

Euro Stoxx 50 futures trade 0.07% lower.

Markets On The Home Turf

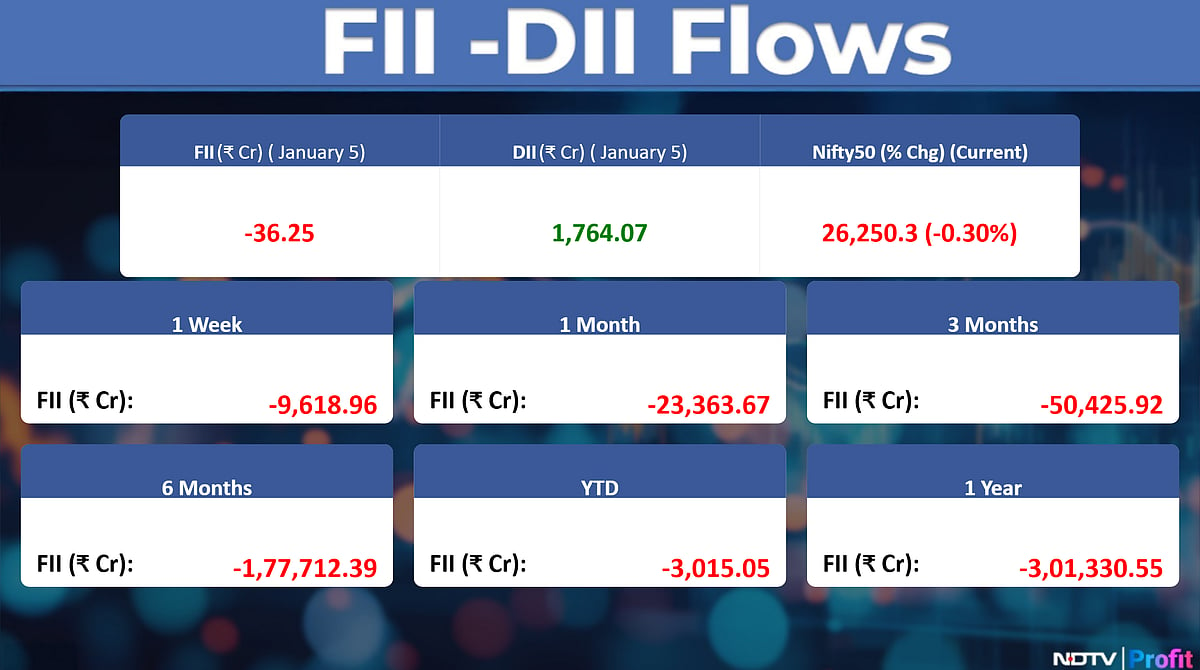

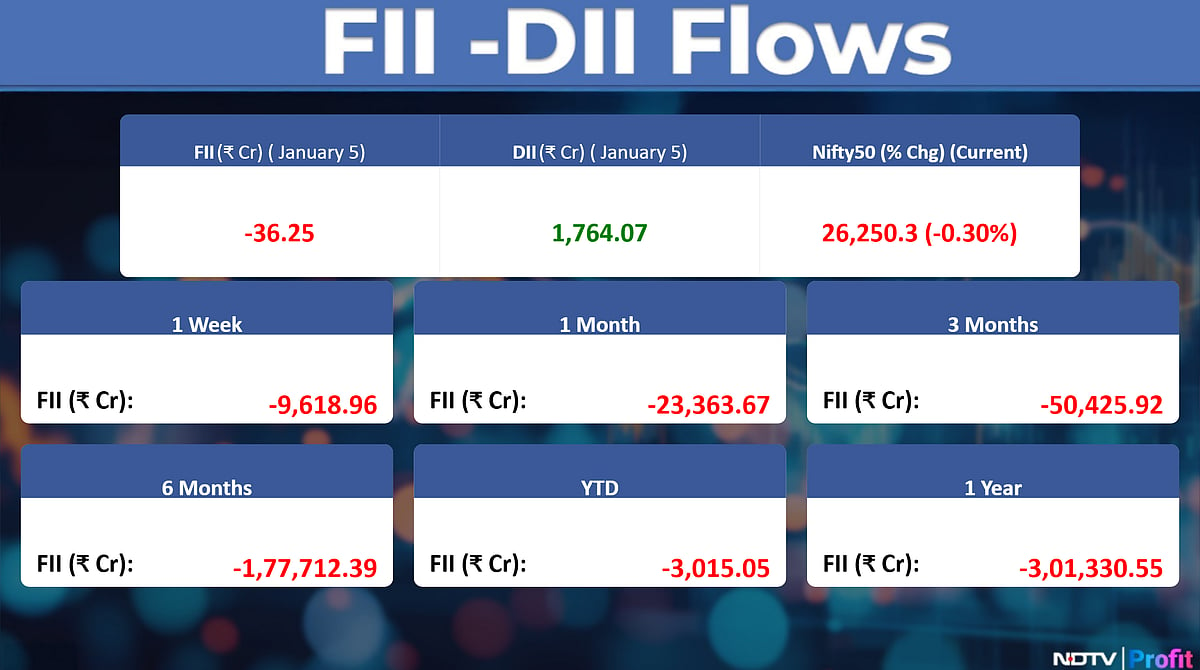

The benchmark 50 Nifty ended the session at 26,250.30, down 0.3%, after registering a fresh peak of 26,373.20 during the day, before witnessing a mild cooling toward the close. On Friday, the blue-chip index closed at an all-time high.

Optimism over healthy third quarter business updates from financials and other companies was tempered by caution surrounding the implications of US military action in Venezuela. In the broader market, Nifty Midcap100 ended 0.2% lower while Nifty Smallcap100 outperformed, gaining 0.5%.

US Market Wrap

US stocks closed higher on Monday as investors piled into technology shares, even as the capture of Venezuela’s President Nicolas Maduro heightened geopolitical concerns. Oil prices climbed alongside gold.

The Nasdaq 100 Index advanced 0.8%, led by tech giants such as Amazon.com Inc. and Tesla Inc. The S&P 500 Index also gained 0.6%, supported by rallies in energy and financial stocks, while the Dow Jones Industrial Average reached a new record high.

Asian Market Wrap

Asian equities opened higher on Tuesday, continuing a record-setting streak for global markets as investors brushed aside geopolitical concerns. The MSCI Asia Pacific Index rose for a fourth consecutive day, driven by a 1% gain in Japan’s Nikkei 225 Index.

Meanwhile, shares slipped slightly in South Korea and Australia. Futures indicated potential gains for Chinese stocks following a Wall Street rally, where megacap companies like Amazon.com Inc. and Tesla Inc. were among the top performers.

Commodity Check

Gold and silver pulled back after earlier gains triggered by the U.S. capture of Venezuela’s President Nicolas Maduro. Gold held steady as traders shifted focus from Venezuelan tensions to a packed schedule of U.S. economic data. Bullion hovered near $4,440 an ounce, after climbing 2.7% in the previous session following Maduro’s capture.

Business Updates

Tata Motors PV

JLR Retail Sales down 25.1 % at 79,600 Units (YoY)

JLR Wholesales down 43.3% at 59,200 Units (YoY)

Volumes in Q3 initially impacted by production stoppages following cyber incident

Biocon

Completes Acquisition Of 26 core shares of BBL From Mylan, Serum Institute Life Sciences, Tata Capital Growth Fund II & Activ Pine LLP

Completes Acquisition of 7 crore shares of BBL From Mylan against cash consideration of $200 Mn

L&T Finance Q3

Retail disbursements up 49% at Rs 22,690 crore (YoY)

Retail loan book as of Dec. 31 up 21% at Rs 1.12 lakh crore (YoY)

IndusInd Bank

Net advances as of Dec. 31 down 13.1% at Rs 3.19 lakh crore (YoY)

Deposits down 3.8% at Rs 3.94 lakh crore (YoY)

Kotak Mahindra Bank

Net advances as of Dec. 31 up 16.2% at Rs 4.66 lakh crore (YoY)

CASA up 9% at Rs 2.1 lakh crore (YoY)

Total deposits up 14.7% at Rs 5.26 lakh crore (YoY)

IEX Q3

Electricity traded volume up 11.9% at 34.08 BU (YoY) Dec.

Electricity traded volume up 2.8% at 11.44 BU (YoY)

Utkarsh Small Finance Bank

Total deposits as of Dec. 31 up 4.5% at Rs 21,087 crore (YoY)

Gross loan portfolio down 3.9% at Rs 18,306 crore (YoY)

CASA ratio at 21.9% vs 20.9% (QoQ)

Axis Bank

Total deposits as on Dec. 31 up 15% at Rs 12.61 lakh crore (YoY)

Gross advances as on Dec. 31 up 14.1% at Rs 11.71 lakh crore (YoY)

Moil Q3

Manganese ore production up 3.7% at 4.77 lakh tonnes (YoY)

Trent Q3

Standalone revenue up 17% at Rs 5,220 crore (YoY)

Store portfolio as of Dec. 31 includes 278 Westside, 854 Zudio & 32 stores across other lifestyle concepts

Adani Ports

Dec. handled cargo volume up 9% at 41.9 MMT (YoY) Dec.

Logistics rail volume at 59,037 TEUs, flat YoY

Allcargo Terminals

Dec. CFS volumes jump 18% YoY at 61,200 Teus

Earnings In Focus

KSH International

Revenue up 50.7% at Rs 712 crore versus Rs 472 crore

EBITDA up 74.2% at Rs 46.1 crore Vs Rs 26.5 crore

Margin At 6.5% versus 5.6%

Net Profit at Rs 29.6 crore Vs Rs 12.9 crore

Stocks In News

Waaree Energies: The company's arm raises Rs 1,003 crore for Lithium-Ion cell & battery manufacturing unit

Tata Power: The company’s arm achieves 1 GWP rooftop solar installation capacity in 9 months of FY26

LG Electronics: The company signs and concludes Advance Pricing Agreement with CBDT; contingent liabilities of Rs 172.4 crore related to direct taxes to become nil; contingency amount of Rs 315.3 crore related to royalty payments to LG Electronics Inc., Korea to become nil

ONGC: The gas leak incident reported during workover operations at Well Mori#5 in Andhra Pradesh; no injury or loss of life reported due to the gas leak and the company has signed JV pact with Mitsui OSK Lines for ethane shipping

Prabha Energy: Shail Manoj Savla resigns as Managing Director effective Dec. 31, 2025

Awfis Space: Ravi Dugar resigns as CFO effective Feb. 2, 2026; board appoints Sumit Rochlani as CFO

Suraj Estate Developers: The company records Rs 200 crore gross bookings from flagship commercial project ‘Suraj One Business Bay’ in 45 days of launch

Ddev Plastiks: The board approves proposal to venture into BESS business within the renewable energy sector with capex of Rs 150-200 crore

Satin Creditcare: The company approves issuance of NCDs worth Rs 100 crore on private placement basis

Dabur: The company expects Q3 consolidated net profit to grow faster than revenue; consolidated revenue to grow in mid-single digits; India home & personal care business to grow in double digits; healthcare business to report low single-digit growth in Q3

NBCC: The company gets 2 work orders worth Rs 134 crore in Odisha

Rajesh Power Services: The company gets 65 MW/130 MWh standalone BESS project in Gujarat

DCX Systems: The company gets order worth Rs 11 crore for manufacture and supply of cable and wire harness assemblies

Raymond Lifestyle: Prasad Ellatch Chathuar joins as senior management personnel and CFO

Hatsun Agro: The key personnel accidentally leaked draft Q3 financials on WhatsApp and company has reported the same to exchanges

AWL Agri: The company recorded low single-digit volume growth in Q3; growth driven by uptick in edible oil and food & FMCG segments; most products on E-commerce saw solid growth; distribution footprint expanded with total outlets up nearly 18% YoY

M&M: The company launches new XUV 7XO at starting price of Rs 13.66 lakh (ex-showroom)

SAIL: The company reported a 37% YoY growth in sales to 2.1 million tonnes in Dec. 2025

Fusion Finance: The company has received an amount of Rs 395.30 crore, representing approx. 99% of the total amount called on the first and final call of the rights issue of the company

ALSO READ

Buy, Sell Or Hold: Godfrey Phillips, Lodha Developers, HG Infra, PN Gadgil, ITC — Ask Profit

Bulk Deals

Tourism Finance Corporation: Unity Associates sold 30 lakh shares (0.65% stake) at Rs 51; Setu Securities Pvt Ltd sold 18 lakh shares (0.39% stake) at Rs 51; Ekta Halwasiya acquired 92 lakh shares (2.01% stake) at Rs 56.01; Irage Broking Services LLP purchased 18.10 lakh shares (0.39% stake) at Rs 61.32

Brainbees Solutions Ltd: SBI Mutual Fund net bought 21.77 lakh shares worth Rs 65 crore

Cupid Limited: Hrti Private Ltd net sold 4.42 lakh shares (Rs 17.14 crore); QE Securities LLP net sold 0.91 lakh (Rs 3.53 crore); Junomoneta Finsol net sold 0.68 lakh (Rs 2.61 crore); IRAGE Broking net sold 0.95 lakh (Rs 3.30 crore); Mathisys Advisors net sold 0.86 lakh (Rs 5.17 crore); Mansi Share & Stock Broking net bought 0.50 lakh (Rs 1.60 crore)

Block Deals

Swiggy: Serum Institute of India Pvt. Ltd. sold 11.3 lakh shares (0.04% stake) at Rs 377 and founder Cyrus Soli Poonawalla bought 11.3 lakh shares (0.04% stake) at Rs 377.

Trading Tweaks

Share to exit anchor Lock-in: We Work-8%

List of securities shortlisted in Short - Term ASM Framework Stage - I:

List of securities to be excluded from ASM Framework: Mangalam Drugs, Shivalic Power

Price band changed from 20% to 10%: Orient Tech

F&O Cues

Nifty January futures down by 0.48% to 26,331 at a premium of 81 points.

Nifty January futures open interest up by 1.05%.

Nifty Options on Jan 6: Maximum Call open interest at 26300 and Maximum Put open interest at 26,000.

Securities in ban period: Sail and Sammaan capital

Currency Check

The Indian rupee extended losses for a fourth session and closed 8 paise lower at 90.28 against the US dollar on Monday.