Stock Market Today: All You Need To Know Going Into Trade On New Year's Eve

Stocks in the news, big brokerage calls of the day, complete trade setup and much more!

Good Morning!

The GIFT Nifty is trading at a 0.66% advance at 26,116 as of 6:45 a.m., indicating a positive bias open for the benchmark Nifty 50.

S&P 500 futures trade 0.079% lower.

Euro Stoxx 50 futures trade 0.80% higher.

Market Recap

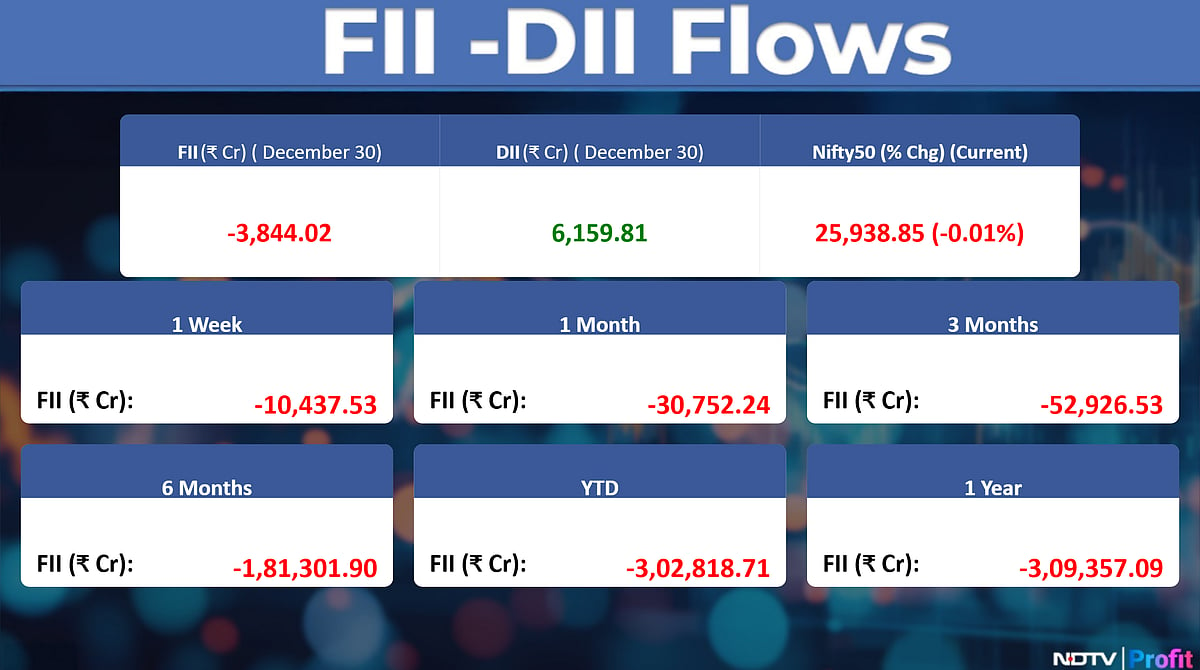

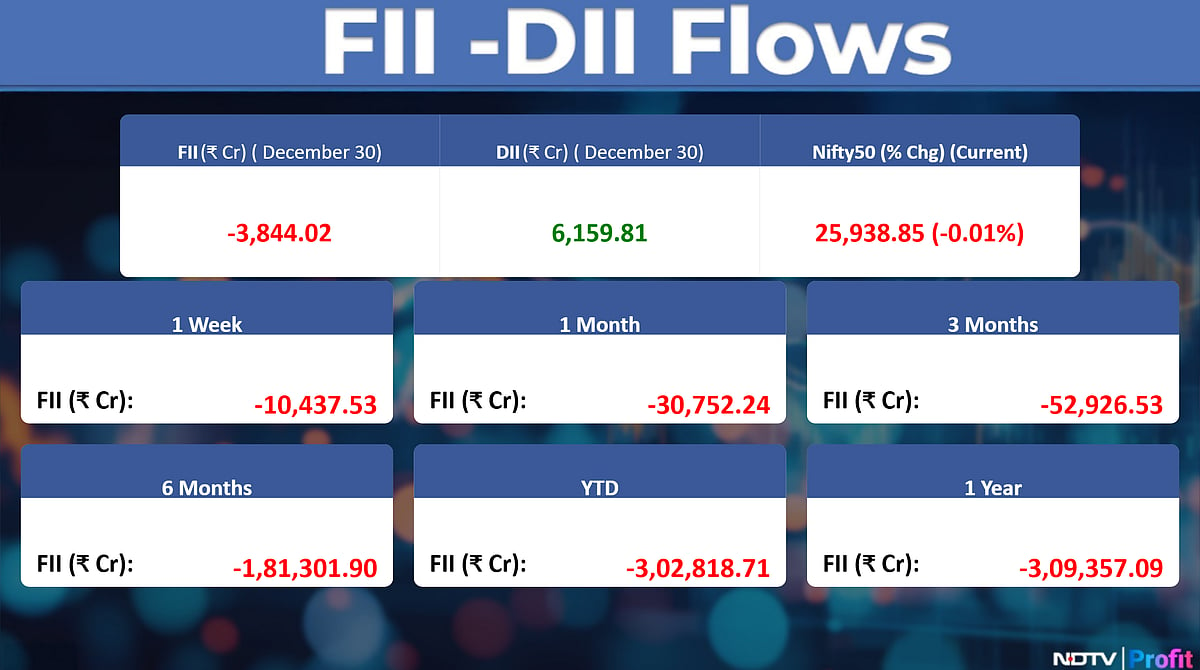

The NSE Nifty 50 declined marginally by 3.25 points or 0.01% to settle at 25,938.85, while the BSE Sensex slipped 20.46 points or 0.02% to close at 84,675.08.

The Nifty 50 ended a volatile monthly expiry virtually unchanged, while the broader market faced slight pressure. The Midcap 100 and Smallcap 100 were down 0.2% and 0.3% respectively. The Metal and Auto sectors provided a cushion against FII selling and year-end lethargy.

US Market Wrap

US stocks ended Tuesday modestly lower even after minutes from the Fed’s December meeting reinforced expectations for further rate cuts next year. Policymakers remained divided over when and how far to cut, a record of the central bank’s December meeting showed, as per Bloomberg.

Commodity Check

Gold steadied after an end-of-year dip, but is still on track for its best annual performance since 1979, along with silver.

Spot gold traded around $4,335 an ounce, after edging higher on Tuesday following a sharp drop on Monday, while silver held above $75.

Oil headed for its steepest annual loss since the pandemic in 2020, with prices undermined by concerns about a punishing surplus that’s set to dominate market sentiment and trading into the new year. (Bloomberg)

Stocks in News

Bharat Forge: The company signed a contract worth Rs 1,662 crore with defence ministry to supply 2.6 lakh indigenously developed CQB carbines to the Indian army.

Dynacons Systems & Solutions: The company receives 249 crore orders from RBI for implementation & maintenance of enterprise applications platform software.

Powergrid: Secured 150 MW/300 MWH Battery Energy Storage Project in Andhra Pradesh.

Rites: The company received a letter of award worth $3.6 Mn from Berhard Development Corp in Zimbabwe.

Privi Speciality Chemicals: Promoters likely to sell 24.7 lakh shares or 6.32% of equity, with an upsizing option. The base deal size is Rs 700 crore. The price band is Rs 2,835–2,850 per share; 11.1% discount to the last close.

Titan: Sandhya Venugopal Sharma, IAS, has been appointed as Chairperson and Additional Director on Titan’s Board, effective 4 January 2026.

Antony Waste: Arm AG Enviro Infra projects incorporated an SPV namely Mumbai Eco Solutions, in accordance with the requirements of the awarded two collection and transportation projects by Brihanmumbai Municipal corporation.

Kalyani Steels: The company completed the acquisition of 8.6% stake in Clean Renewable Energy KK 1A.

Petronet LNG: Milind Torawane ceases to be director of the company.

The New India Assurance: Mumbai Tax Body drops tax demand of Rs 2,188 crore. The company received total show cause notice demand of Rs 2,298 crore of which Rs 2,188 crore was dropped & demand of Rs 110.1 crore was confirmed.

G R Infraprojects: The company transfers arm GR Bahadurganj Araria Highway to Indus infra trust for nearly Rs 60 crore.

Torrent Pharma: The board is to meet on Jan 5 to consider fundraising.

Prostarm: The company set up a new UPS manufacturing unit in Gujarat.

PCBL: Arm PCBL(TN) is now certified with ISCC PLUS.

Lupin: Netherlands arm Nanomi BV to buy 100% stake in Nanomi BV by Feb 28, 2026. The company had earlier notified us that the acquisition will be completed by the end of 2025.

Interglobe Aviation: The company received Rs 458 Cr penalty order from Delhi GST body for FY19-FY23. The company will contest the order, and the said order does not have any significant impact on financials, operations or other activities of the company.

Orient Tech: The company fixed Jan 5 as a record date for issue of bonus shares.

Man Industries: The company name of foreign arm changed from Man Overseas Metal DMCC to Man Overseas invest FZCO.

Balu Forge: Board approved the allotment of 10 lakh shares for conversion of warrants in 1:1 ratio.

IFCI: The company sold 10% stake in northeastern development finance corp for Rs 121.8 crore.

ZF Steering Gear: Arm received Rs 151 crore order from leading Indian business conglomerate for Renewable Energy business.

Greenply Industries: The company receives shareholders’ approval for re-appointment of Rajesh Mittal as ED in the capacity of Chairman & MD. The shareholders approved the re-appointment of Rajesh Mittal as ED effective Jan 1, 2026.

Devyani International: Sky Gate hospitality with Heritage foods to sell its entire 51% stake in Arm Peanutbutter for Rs 9 crore.

Signature Global: The company executed a sale deed to sell the company's investment property in Gurugram for Rs 30 crore.

Indian Hotels: The company sold 25.5% stake in Taj GVK hotels at Rs 370 per share to Shalini Bhupal.

TAJ GVK Hotels: Promoter shareholder Shalini Bhupal acquired 25.5% stake in the company at Rs 370 per share from The Indian Hotels. The company terminated the pact executed between G Indira Krishna Reddy, Shalini Bhupal, Blue Moon Trust, Moonshot Trust. Starlight Trust, The Indian Hotels & Co.

Cochin Shipyard: Govt approved to extend the tenure of Madhu Sankunny Nair as Chairman & MD till Jan 31, 2026.

IIFL Capital Services: The company executed a business transfer pact to transfer PMS business to IIFL Capital Asset Management Via slump sale.

Birlanu: Nine Promoters sold a total of 39.57% stake in the company. Promoter Central India lndustries sells 18.65% stake in the company.

Arfin India: Received Order worth Rs 321 crore from Diamond Power Infra for the supply of Aluminium sector conductor.

Muthoot Finance: Arm Muthoot Money allotted 3.3 lakh shares to the company to raise funds worth Rs 500 crore via rights issue.

Satin Creditcare: The board is to meet on Jan 5 to consider raising funds on a private placement basis.

Tega Industries: NSE & BSE granted trading approval for 85.9 lakh shares allotted to Promoters & Non-Promoters on preferential basis.

Afcom Holdings: Third aircraft successfully inducted at Chennai International Airport.

Bulk Deals

Ramkrishna Forgings: Morgan Stanley Asia Singapore Pte bought 18.75 lakh shares (1.17%) at Rs 506.7 apiece, while Societe Generale sold 14.75 lakh shares (0.92%) at Rs 506.75 apiece.

HFCL: Necta Bloom VCC- Necta Bloom One sold 79.54 lakh shares (0.55%) at Rs 64.59 apiece.

Goldiam International: Dhwaja Shares & Securities Pvt Ltd sold 6.5 lakh shares (0.59%) at Rs 354.63 apiece.

Taj GVK Hotels & Resorts: Nippon India Equity Opportunities AIF - Scheme 7 bought 8.12 lakh shares (1.29%) at Rs 420 apiece, while Nippon India Equity Opportunities AIF- Scheme 9 bought 7.08 lakh shares (1.12%) at Rs 420 apiece.

Insider Trade

D. B. Corp: Promoter D B Power Limited bought 32,976 shares.

John Cockerill India: Promoter Johncockerill Sa sold 5,399 shares.

KPI Green Energy: Promoter Quyosh Energia bought 11.2 lakh shares.

Sangam India: Promoter Anjana Soni Thakur bought 25,030 shares.

Trading Tweak

Price band change from 20% to no band: Swiggy, Waaree Energies, Premier Energies, Bajaj Holdings Investment.

Price band change from no band to 20%: Cyient, HFCL, NCC, Titagarh Rails Systems.

Board Meeting: Gayatri Projects, Jindal Poly Films, NACL Industries, Sigachi Industries.

Share to exit anchor Lock-in: Kalpataru (54%), Akme Finance (20%)

List of securities shortlisted in Short - Term ASM Framework Stage - I: Dynamic Services & Security, Hindustan Copper, MMTC.

List of securities to be excluded from ASM Framework: Walchandnagar Industries.

F&O Cues

Nifty January futures up by 0.05% to 26,135 at a premium of 197 points.

Nifty January futures open interest up by 47%.

Nifty Options on Jan 6: Maximum Call open interest at 26,000 and Maximum Put open interest at 26,000.

Securities in ban period: Nil

Currency Check

Rupee closed 20 paise stronger on Tuesday at 89.78. The local currency had closed at 89.98 on Monday.