-Rupee closed 2 paise weaker at 88.80 against US dollar

-It's record low is 88.81 a dollar, hit on Sept 30

-It closed at 88.78 a dollar on Tuesday

Source: Bloomberg

Benchmarks snap 4-day gaining streak

Nifty managed to close above the 25,000 mark

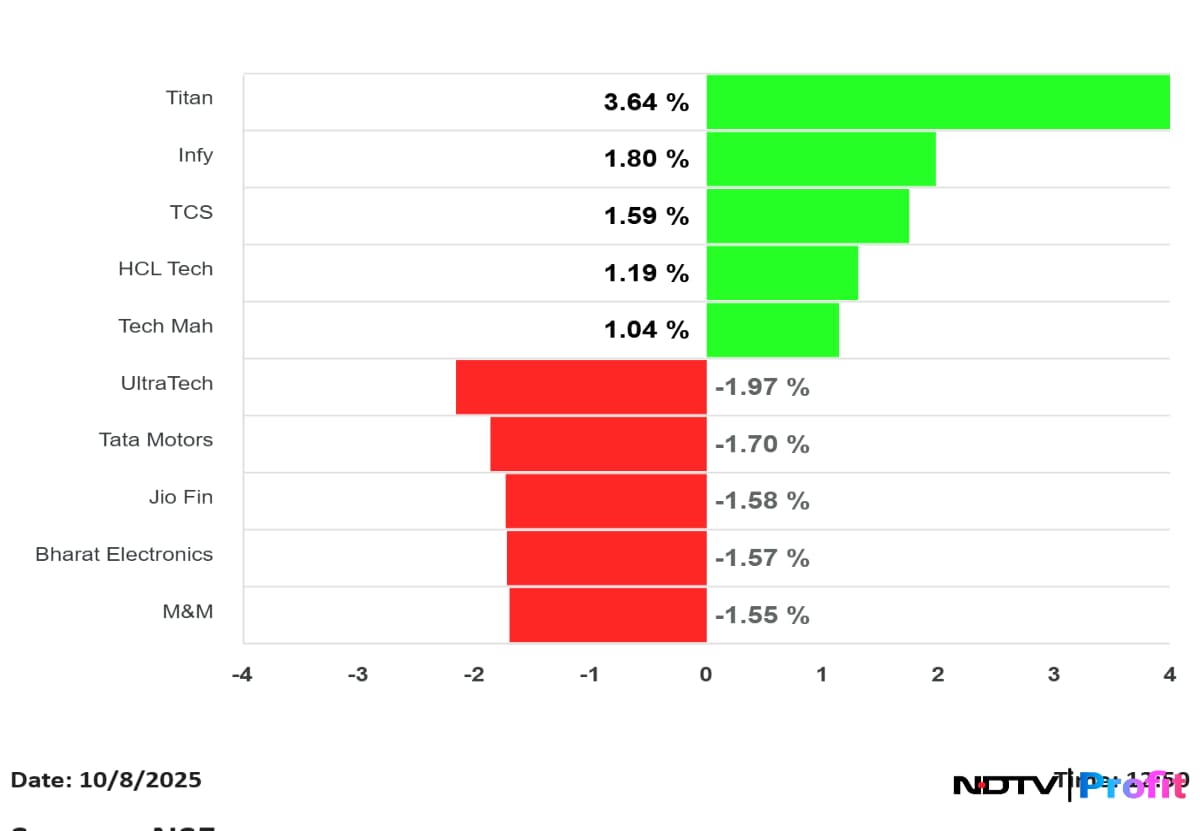

Tata Motors and Mahindra & Mahindra fell the most in Nifty

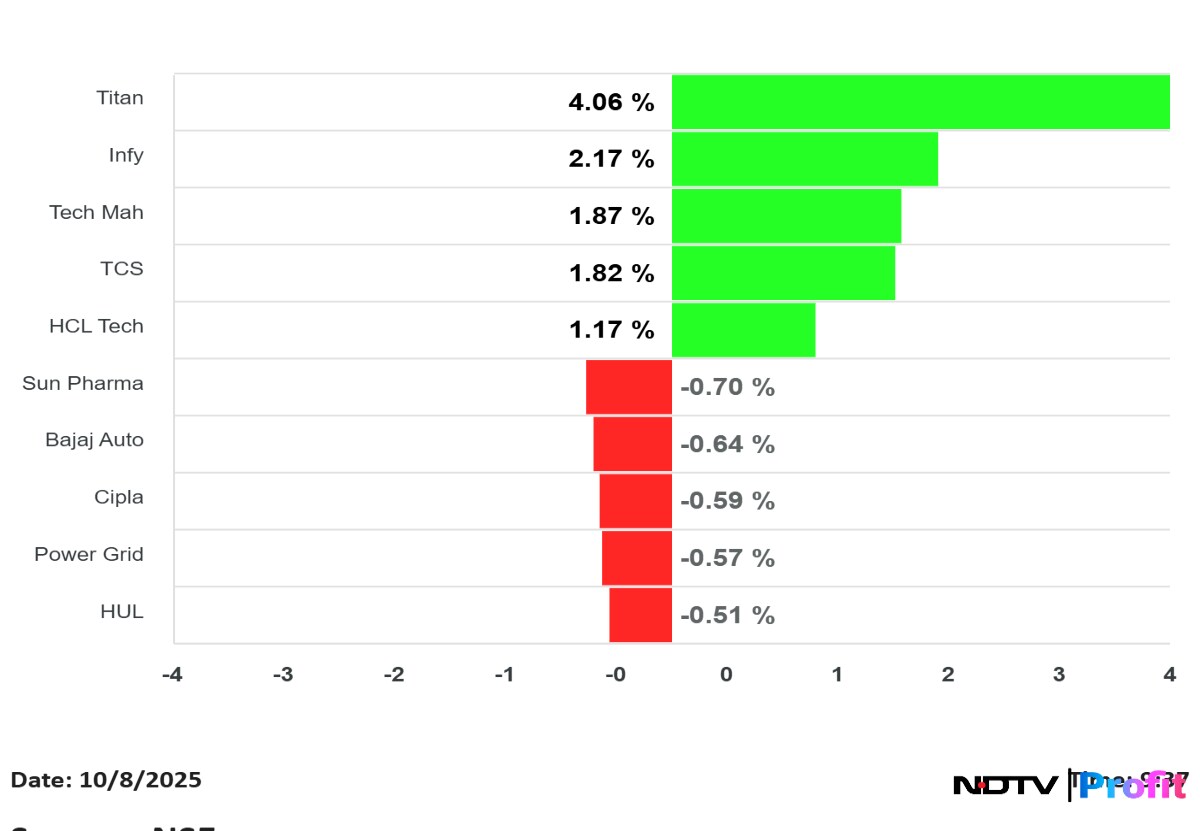

Titan and Infosys gain the most in Nifty

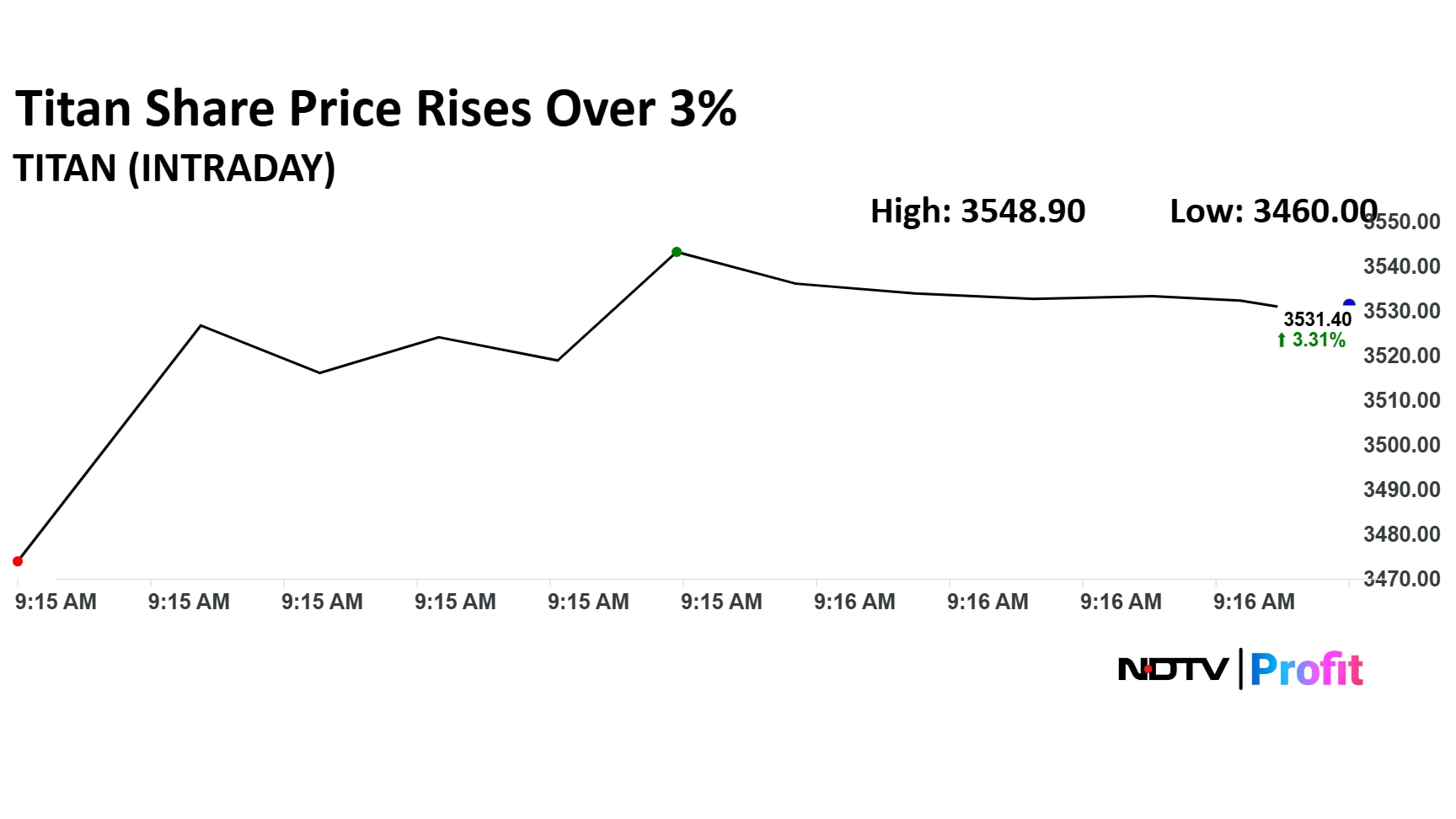

Titan rose over 4% after it strong Q2 business update; best gain since May 9, 2025

Nifty IT remain as the only gaining sector for the day; ahead of Q2 Earnings

Nifty Midcap 150 snaps 6-day gaining streak; NLC India and UNO Minda fell the most

Nifty Midcap 250 snaps 5-day gaining streak; RHI Magnesita India and Kaynes Tech fell the most.

Nifty Media, FMCG and Metal fell for the 3rd day in a row.

Nifty PSU Bank fell for the 2nd day in a row.

Oil and Gas and Pharma snaps 4-day gaining streak

Realty and Auto snaps 2-day gaining streak.

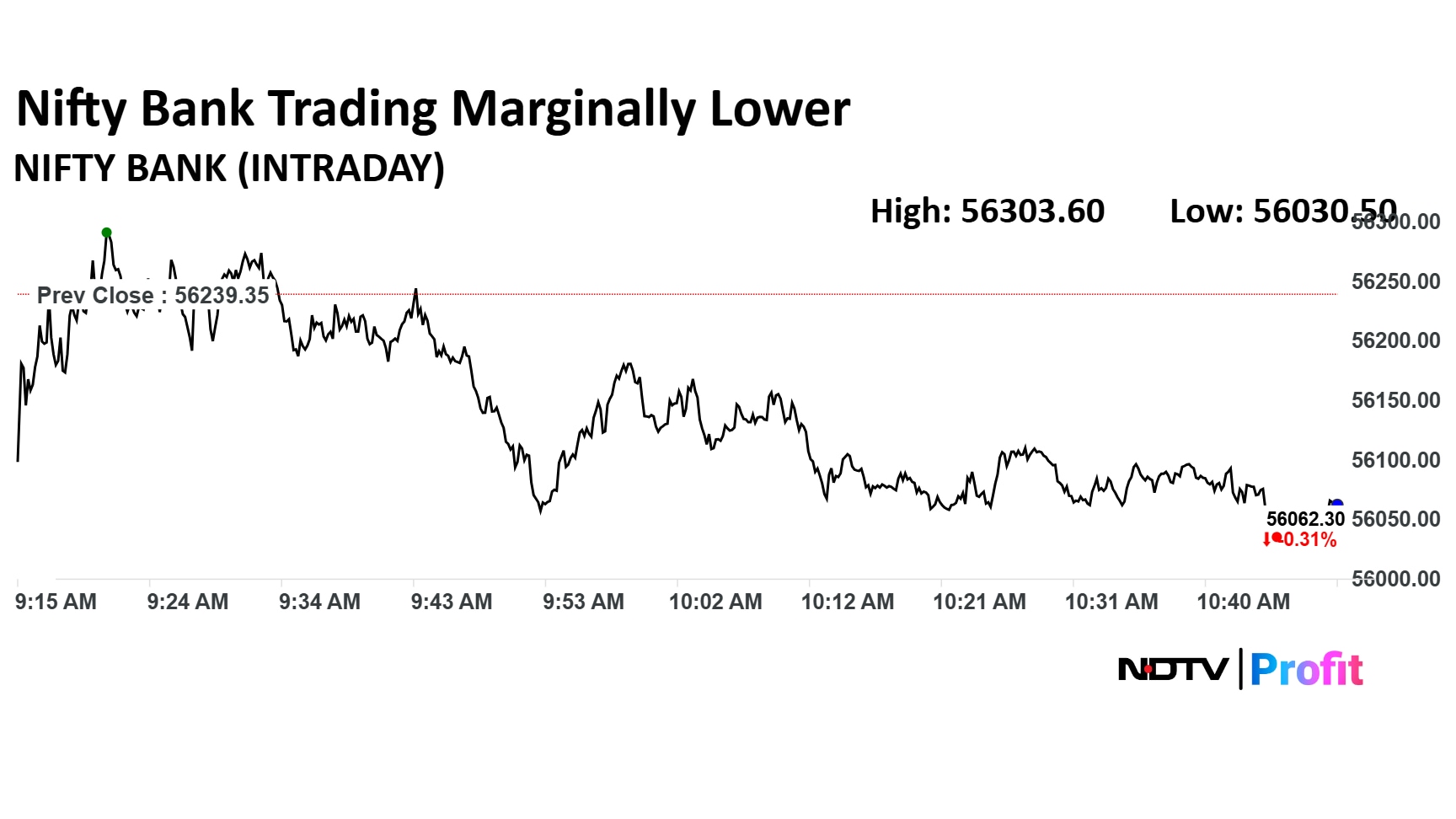

Nifty Bank/Financials snaps 6-day gaining streak

Benchmarks snap 4-day gaining streak

Nifty managed to close above the 25,000 mark

Tata Motors and Mahindra & Mahindra fell the most in Nifty

Titan and Infosys gain the most in Nifty

Titan rose over 4% after it strong Q2 business update; best gain since May 9, 2025

Nifty IT remain as the only gaining sector for the day; ahead of Q2 Earnings

Nifty Midcap 150 snaps 6-day gaining streak; NLC India and UNO Minda fell the most

Nifty Midcap 250 snaps 5-day gaining streak; RHI Magnesita India and Kaynes Tech fell the most.

Nifty Media, FMCG and Metal fell for the 3rd day in a row.

Nifty PSU Bank fell for the 2nd day in a row.

Oil and Gas and Pharma snaps 4-day gaining streak

Realty and Auto snaps 2-day gaining streak.

Nifty Bank/Financials snaps 6-day gaining streak

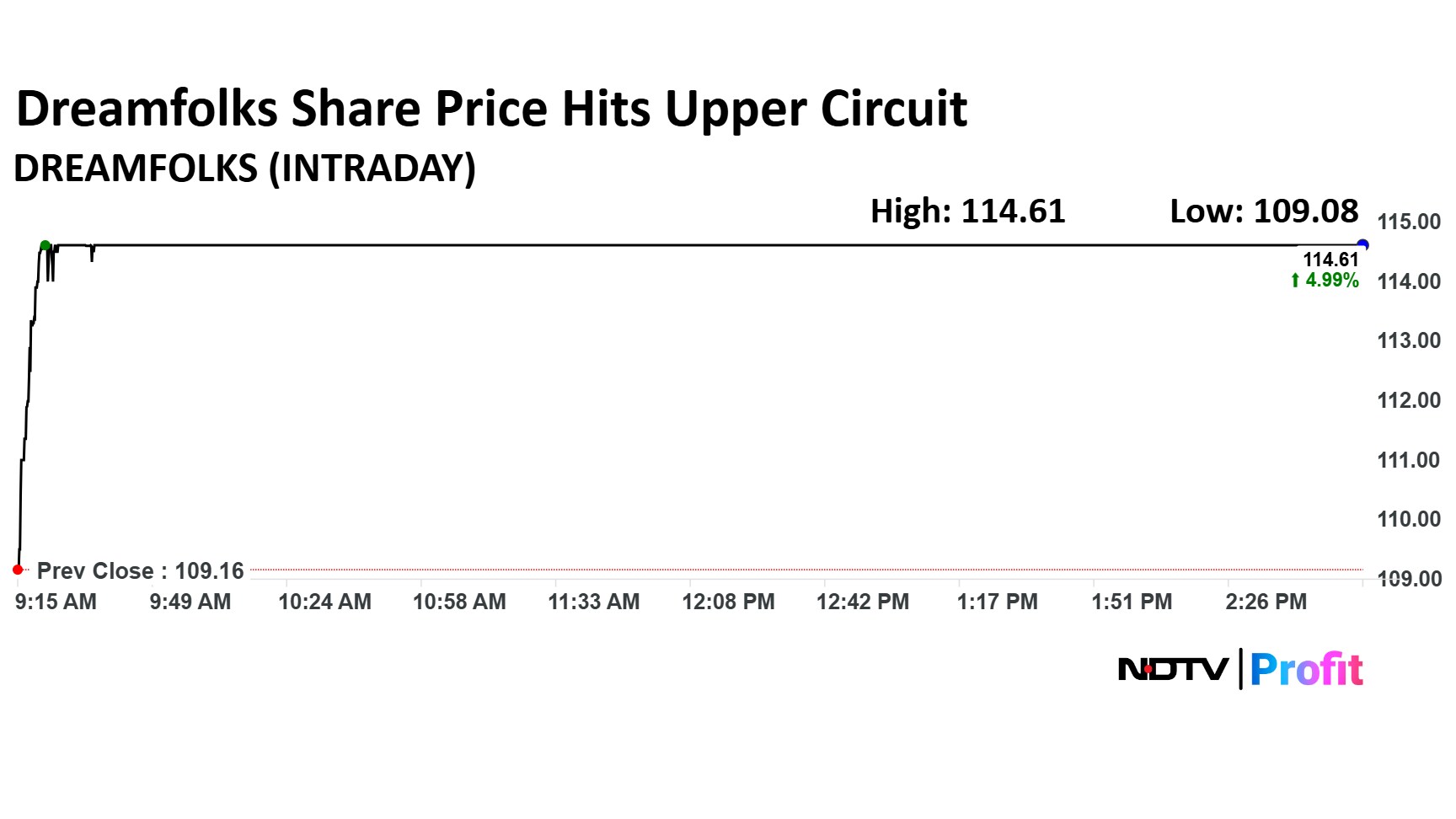

Dreamfolks Services shares hit upper circuit after the company entered a partnership with WSFx Global Pay to simplify, elevate transit experience, according to an exchange filing.

The scrip was trading at Rs 114.6, about 5% higher, compared to 0.23% decline in the Nifty 50.

Dreamfolks Services shares hit upper circuit after the company entered a partnership with WSFx Global Pay to simplify, elevate transit experience, according to an exchange filing.

The scrip was trading at Rs 114.6, about 5% higher, compared to 0.23% decline in the Nifty 50.

As investors gear up for the auspicious Diwali Muhurat trading session, SBI Securities has come up with a list of top stocks worth investing for Samvat 2082.

SBI Securities' features a mix of large-gap stalwarts and high-growth midcap companies, including the likes of TVS Motor, Apollo Hospitals and HDFC Bank, among others.

Mercedes-Benz India on Wednesday announced its best-ever quarterly sales in Q2 FY2026, clocking 5,119 units sold. This record performance was underpinned by the brand's highest-ever September sales, which grew by 36% compared to the previous year.

The company said it sold a record of over 2,500 units in the 9 days of Navratri in September, the highest ever for Mercedes-Benz in India.

Read the full story below:Mercedes-Benz India Records Highest-Ever Sales

Swiss engineering major ABB announced on Wednesday it will divest its robotics division to Japan's SoftBank Group Corp. for an enterprise value of nearly $5.4 billion and not pursue its earlier intention to spin-off the business as a separately listed company.

The transaction is subject to regulatory approvals and is expected to close in mid-to-late 2026, the company said in a statement.

Read the full story below:

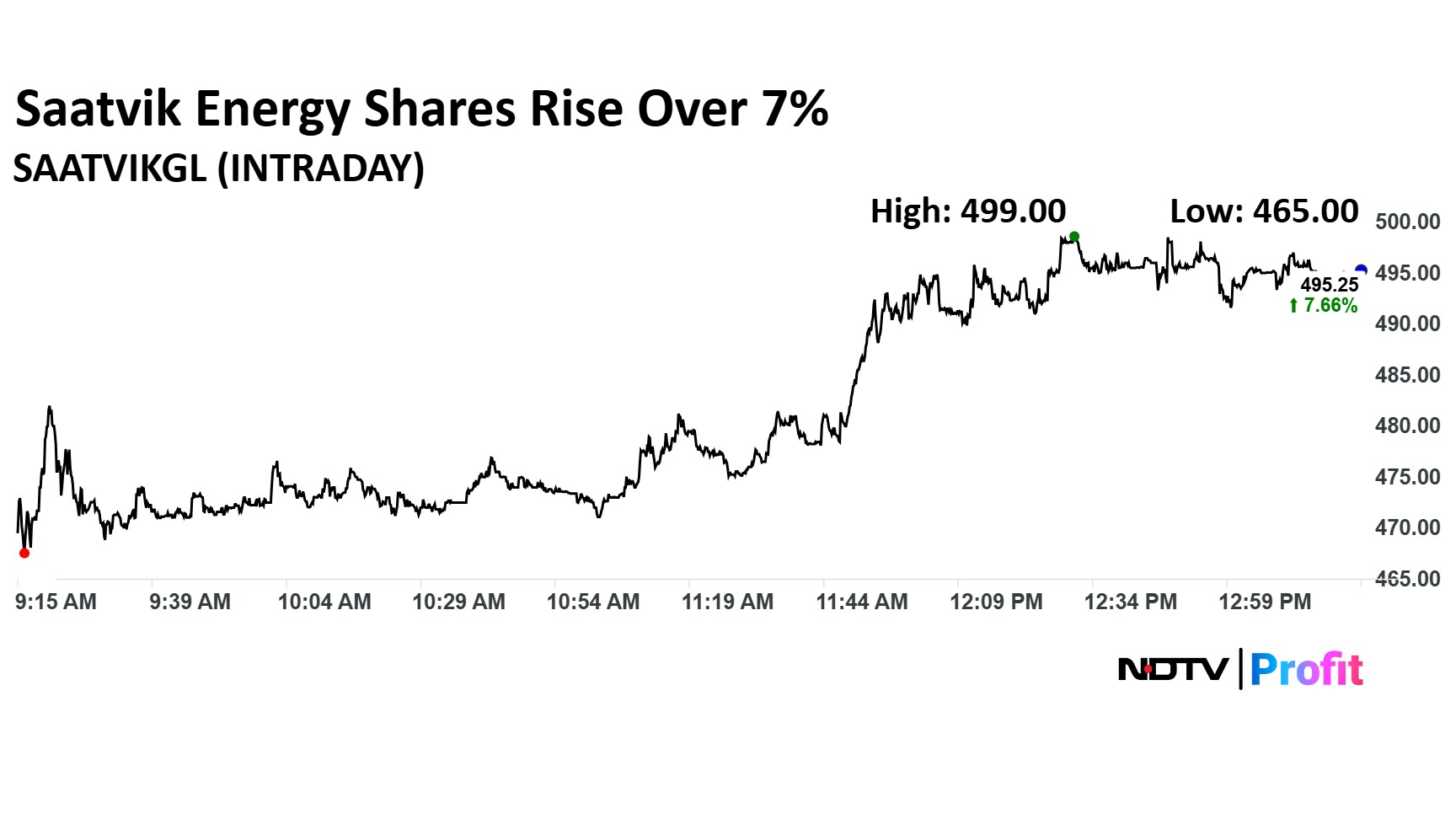

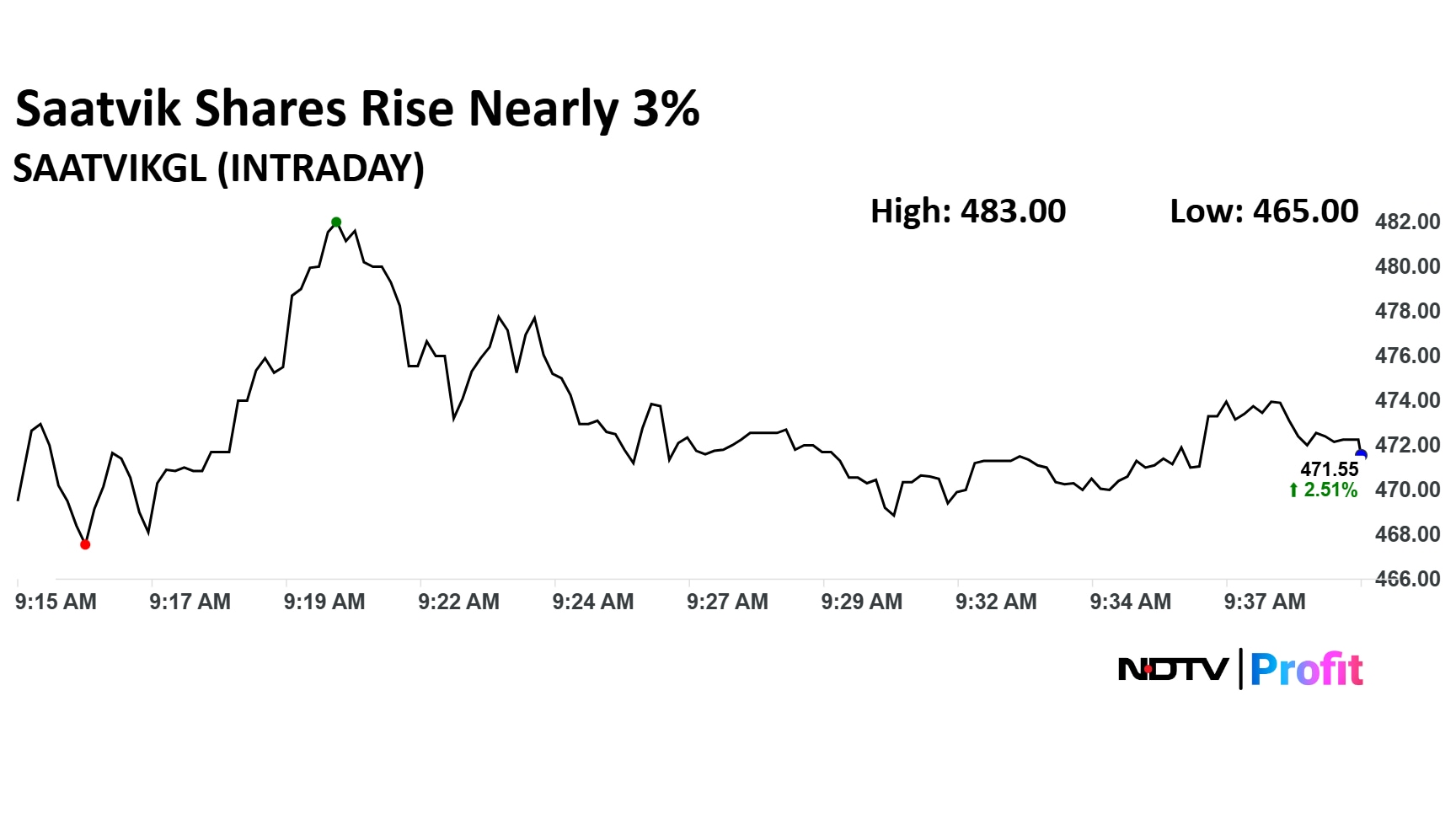

The shares of Saatvik Green Energy shares rose 7% after the company received an order worth Rs 488 crore for supply of solar PV modules from a group of renowned independent power producers.

The company also received Rs 219.62 crore worth of orders from three independent power producers for solar PV module supply.

The shares of Saatvik Green Energy shares rose 7% after the company received an order worth Rs 488 crore for supply of solar PV modules from a group of renowned independent power producers.

The company also received Rs 219.62 crore worth of orders from three independent power producers for solar PV module supply.

In the Nifty 50, Titan continued to lead the gains of the index with nearly 4% gains. The other counters in green are Infosys, TCS, HCL Tech and Tech Mahindra.

The names dragging the index are Ultratech, Tata Motors and Jio Finance.

In the Nifty 50, Titan continued to lead the gains of the index with nearly 4% gains. The other counters in green are Infosys, TCS, HCL Tech and Tech Mahindra.

The names dragging the index are Ultratech, Tata Motors and Jio Finance.

Overall Subscription is at 1 times as QIBs lead with 1.2 times subscription. The NII subscription is at 1.1 times, and the retail investors subscription at 84%.

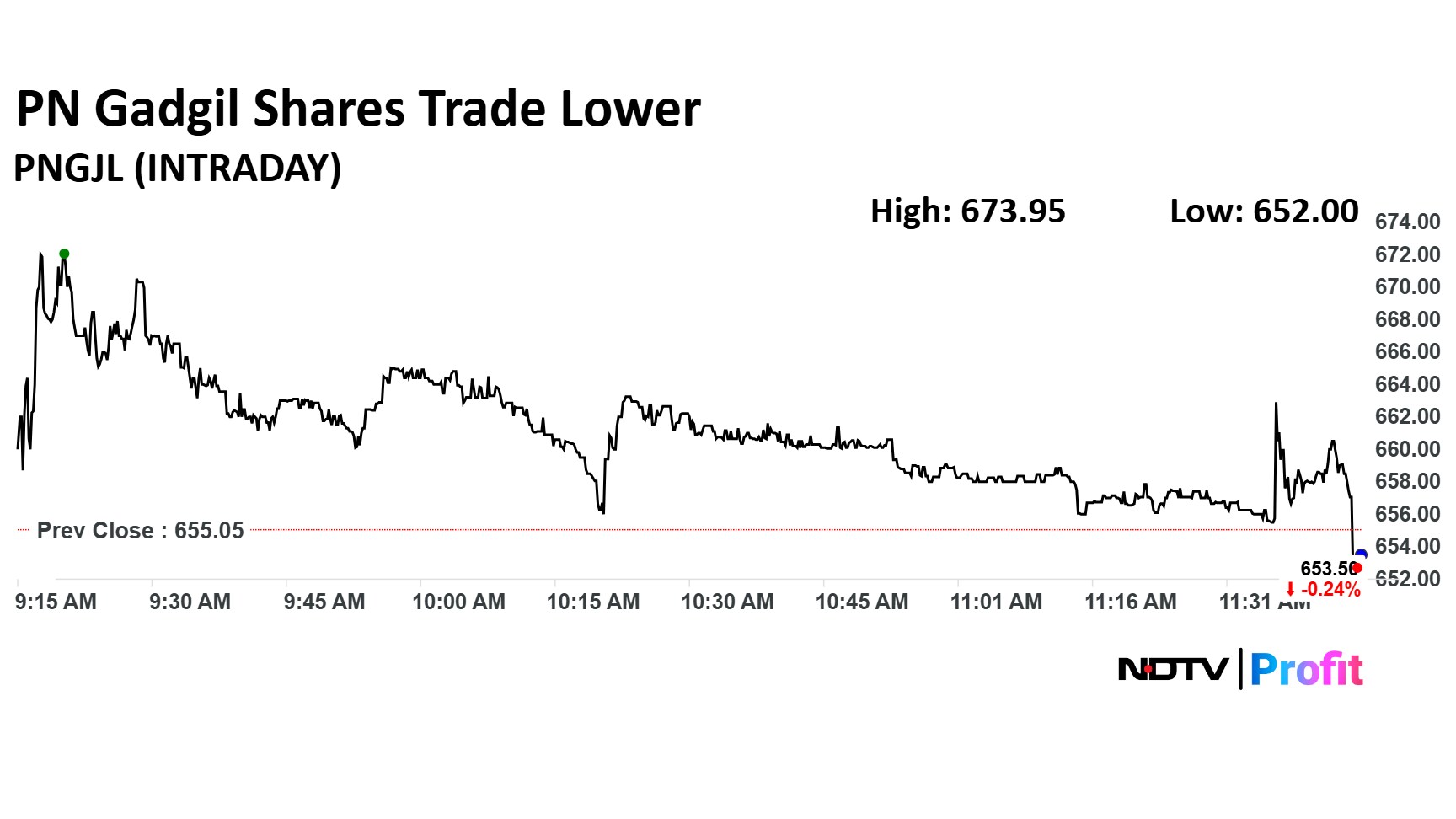

PN Gadgil in the second quarter reported a revenue growth of 8.6% to Rs 2,173 crore year-on-year. The festive season continues to remain key drives of growth.

The Same Store Sales Growth was up 29% compared to the previous quarter. While the e-Commerce segment contribution to revenue stood at 6.6%, according to an exchange filing.

PN Gadgil in the second quarter reported a revenue growth of 8.6% to Rs 2,173 crore year-on-year. The festive season continues to remain key drives of growth.

The Same Store Sales Growth was up 29% compared to the previous quarter. While the e-Commerce segment contribution to revenue stood at 6.6%, according to an exchange filing.

The shares of Vodafone Idea slipped over 1% ahead of the Supreme Court hearing. The SC earlier this week had deferred the hearing on a plea filed by the company against the duplication of AGR dues.

The top court will now hear the matter on Oct. 13. Solicitor General Tushar Mehta had requested the apex court to postpone the matter till next week.

S&P Global's outlook on Indian banks, according to Informist, is optimistic yet highlights potential risks.

The sector's credit growth is expected to revive from the second half of FY26 onward.

They project credit growth to be in the range of 11.5-12.5% over FY26 and FY27.

New Non-Performing Asset (NPA) formation is anticipated at 1.7-1.8% over the next two years.

This expected rise in NPAs is attributed to retail slippages.

Indian banks are seen as well-positioned to handle challenges like tariffs, rate cuts, and a weak Rupee.

The sector is considered poised for growth despite global economic uncertainty.

S&P Global's outlook on Indian banks, according to Informist, is optimistic yet highlights potential risks.

The sector's credit growth is expected to revive from the second half of FY26 onward.

They project credit growth to be in the range of 11.5-12.5% over FY26 and FY27.

New Non-Performing Asset (NPA) formation is anticipated at 1.7-1.8% over the next two years.

This expected rise in NPAs is attributed to retail slippages.

Indian banks are seen as well-positioned to handle challenges like tariffs, rate cuts, and a weak Rupee.

The sector is considered poised for growth despite global economic uncertainty.

Top Tata Trusts leaders have dialed the government as internal tensions widen within one of India’s most powerful philanthropic and corporate institutions. Amid escalating discord among trustees, the Centre has taken cognisance of the rift and advised Tata Trusts to maintain institutional stability and resolve differences internally, sources told NDTV Profit.

Read the full story below:

The shares of SML Isuzu rose over 2% to Rs 3,152 after SML Isuzu's total production for September rose by 21.6% year-over-year, reaching 1,049 units.

The company's total sales in September grew by 17.8% YoY, totalling 812 units. Total exports in September saw a significant jump, rising to 138 units compared to 67 units in the same month last year.

The shares of SML Isuzu rose over 2% to Rs 3,152 after SML Isuzu's total production for September rose by 21.6% year-over-year, reaching 1,049 units.

The company's total sales in September grew by 17.8% YoY, totalling 812 units. Total exports in September saw a significant jump, rising to 138 units compared to 67 units in the same month last year.

The initial public offering of Tata Capital Ltd. will close for subscription on Wednesday, October 8. The biggest IPO of 2025 received a decent response from investors as the public issue was booked 0.75 times on Tuesday.

The IPO garnered bids for 24,96,66,472 shares against 33,34,36,996 shares on offer, according to details available with the BSE on October 7.

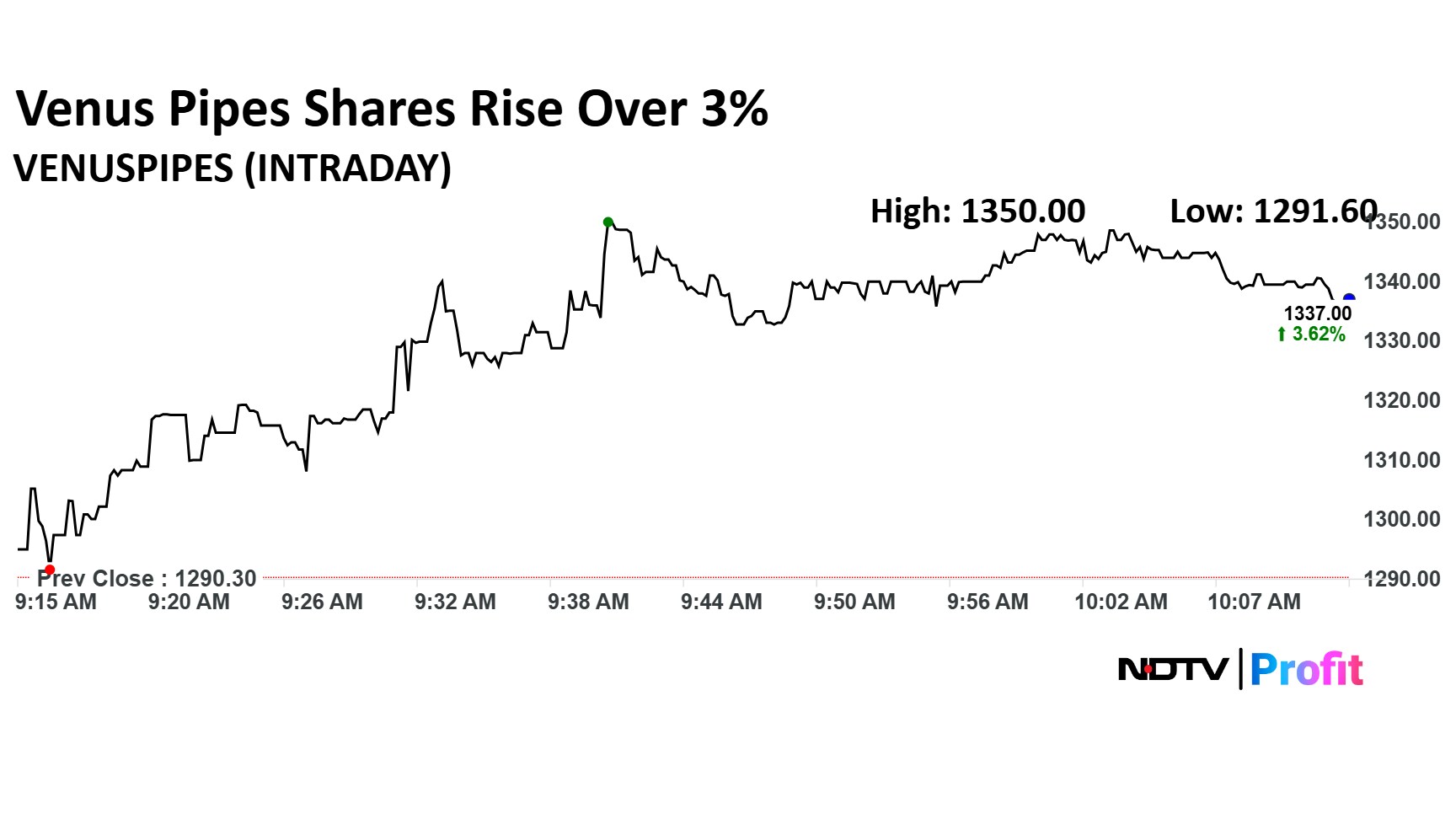

The shares of Venus Pipes rose over 3% in trade so far. The surge come after the company approved the allotment of 1.2 lakh equity shares at an issue price of Rs 1,700 per share to warrant holders.

The scrip has risen as much as 4.63% so far and is currently trading 3.81% higher at Rs 1,339 as of 10:16 a.m. These gains compare to a 0.14% gain in the Nifty 50.

The shares of Venus Pipes rose over 3% in trade so far. The surge come after the company approved the allotment of 1.2 lakh equity shares at an issue price of Rs 1,700 per share to warrant holders.

The scrip has risen as much as 4.63% so far and is currently trading 3.81% higher at Rs 1,339 as of 10:16 a.m. These gains compare to a 0.14% gain in the Nifty 50.

The shares of Saatvik Green Energy was up nearly 3% during trade so far to Rs 471.9 apiece on the NSE. The scrip surged after the company received an order worth Rs 488 crore for supply of solar PV modules from a group of renowned independent power producers.

The company also received Rs 219.62 crore worth of orders from three independent power producers for solar PV module supply.

The shares of Saatvik Green Energy was up nearly 3% during trade so far to Rs 471.9 apiece on the NSE. The scrip surged after the company received an order worth Rs 488 crore for supply of solar PV modules from a group of renowned independent power producers.

The company also received Rs 219.62 crore worth of orders from three independent power producers for solar PV module supply.

Anantam Highways Trust Ltd.'s initial public offer opened for its second day of subscription on Wednesday. The IPO was subscribed 0.41 time or 41% on its first day of subscription on Tuesday.

The infrastructure investment trust's Rs 400 crore IPO would conclude on Oct. 9. The price band has been fixed at Rs 98-100 per unit.

Shares of Advance Agrolife Ltd. listed at premium of 14% over the IPO price on Wednesday. The scrip opened at Rs 114 on the NSE and Rs 113 on the BSE, compared to the issue price of Rs 100.

Read the full story below for details:

Spot gold futures crossed $4,000 per ounce on Tuesday, driven by economic uncertainty and safe-haven demand. In India, prices climbed past Rs 1,21,000. Financial planners said investors should adopt a cautious and measured approach.

Global gold touched $3,992.27 per ounce, while Indian rates reached Rs 1,21,180, according to India Bullion Co. Analysts said the surge reflects fears of a US government shutdown and growing expectations of interest rate cuts. Gold has gained over 50% this year, its largest annual rise since 1979, supported by geopolitical tensions and central bank buying.

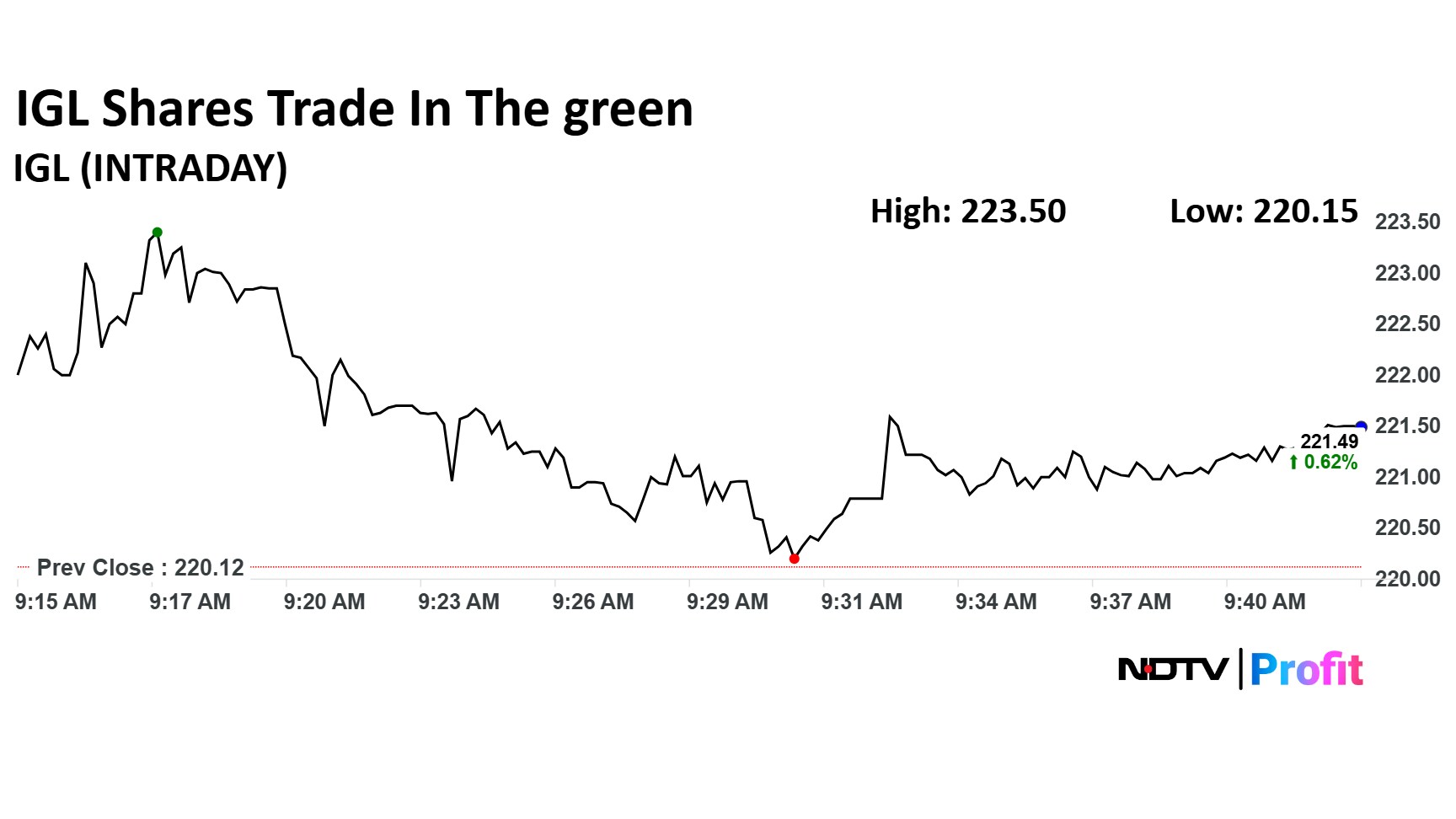

Indrapratha Gas Ltd., shares are trading in the green after the changes in tax implications for gas sourced from Gujarat. Earlier, a tax of 15% VAT was charged, but from Oct. 1, a 2% CST will be charged, now this will lead to lower gas sourcing costs for IGL.

According to sources speaking to NDTV Profit, this could increase IGL’s unit Ebitda. The scrip is currently trading nearly a percent higher at Rs 221.5 apiece on the NSE.

Indrapratha Gas Ltd., shares are trading in the green after the changes in tax implications for gas sourced from Gujarat. Earlier, a tax of 15% VAT was charged, but from Oct. 1, a 2% CST will be charged, now this will lead to lower gas sourcing costs for IGL.

According to sources speaking to NDTV Profit, this could increase IGL’s unit Ebitda. The scrip is currently trading nearly a percent higher at Rs 221.5 apiece on the NSE.

Within the Nifty 50 pack, the gains were led by Titan, marking over 4% gains. Counters like Infosys gained over 25 while Tech Mahindra also record nearly 2% gains. Names like TCS, HCL Tech were also trading in the green.

The names dragging the index are Sun Pharma, Bajaj Auto and Cipla.

Within the Nifty 50 pack, the gains were led by Titan, marking over 4% gains. Counters like Infosys gained over 25 while Tech Mahindra also record nearly 2% gains. Names like TCS, HCL Tech were also trading in the green.

The names dragging the index are Sun Pharma, Bajaj Auto and Cipla.

The shares of Titan surged over 3% after the company posted its second quarter business highlights.

The scrip has risen 3.41% to Rs 3,534.5 apiece on the NSE. These gains compare to the 0.18% gains in the benchmark index Nifty 50 as of 9:21 a.m.

The shares of Titan surged over 3% after the company posted its second quarter business highlights.

The scrip has risen 3.41% to Rs 3,534.5 apiece on the NSE. These gains compare to the 0.18% gains in the benchmark index Nifty 50 as of 9:21 a.m.

At market open Nifty 50 open above the 25,000 levels while the Sensex opened flat. The stocks in focus, leading gains within the Nifty 50 pack are Titan following the Q2 update and Maruti Suzuki.

At market open Nifty 50 open above the 25,000 levels while the Sensex opened flat. The stocks in focus, leading gains within the Nifty 50 pack are Titan following the Q2 update and Maruti Suzuki.

The yield on the 10-year bond opened flat at 6.50%

Source: Cogencis

Rupee opened 3 paise stronger at 88.75 against US dollar

It closed at 88.78 a dollar on Tuesday

Source: Cogencis

At the pre-open session, as of 9:10 a.m. the Nifty 50 was trading near 25,000 marking marginal losses of 0.20%. The Sensex plunged by over 600 points at pre-open, slipping to levels below 81,300.

Brokerages UBS and Morgan Stanley have maintained cautious views on Dabur India Ltd. following its Q2 FY26 business update, citing subdued revenue growth and continued pressure in key segments. While UBS finds the performance broadly in line when adjusted for GST-related disruptions, Morgan Stanley flagged the results as weaker than expected, highlighting a miss on its revenue estimates.

Read the full story below:

Nifty October futures is up 0.17% to 25,229 at a premium of 121 points.

Nifty October futures open interest down by 1.52%

Nifty Options Oct. 14 Expiry: Maximum Call open interest at 25,200 and Maximum Put open interest at 25,000.

Securities in ban period: RBL Bank.

Nifty October futures is up 0.17% to 25,229 at a premium of 121 points.

Nifty October futures open interest down by 1.52%

Nifty Options Oct. 14 Expiry: Maximum Call open interest at 25,200 and Maximum Put open interest at 25,000.

Securities in ban period: RBL Bank.

Tata Consultancy Services has cancelled its scheduled press conference for its second quarter FY26 earnings result, which was initially slated for Oct. 9.

The company has confirmed that the cancellation was due to the date coinciding with the anniversary of Ratan Tata, the former Chairman of Tata Sons and a towering figure in the Tata Group. While the press event has been scrapped, the company's analyst call, where the financial performance and management commentary are shared is set to proceed as planned.

Om Freight Forwarders: The company is a third-generation logistics company based in Mumbai, India. The company's shares will debut on the stock exchange on Wednesday at an issue price of Rs 135 apiece. The public issue was subscribed to 3.87 times on the last day. The bids were led by qualified institutional investors (3.97 times), non-institutional investors (7.39 times), retail investors (2.75 times).

Advance Agrolife : The company is engaged in the manufacturing of a wide range of agrochemical products that support the entire lifecycle of crops. The company's shares will debut on the stock exchange on Wednesday at an issue price of Rs 100 apiece The public issue was subscribed to 56.85 times on day three. The bids were led by qualified institutional investors (27.31 times ), non-institutional investors (175.30 times), retail investors (23.06 times)

Petronet LNG stocks, Dabur India Ltd., Titan Co. Ltd., Canara Bank Ltd., PNB Ltd., Union Bank Ltd., Indraprastha Gas Ltd., and Lodha Developers Ltd., are among the companies garnering brokerage commentary today.

Analysts have shared their insights and, in several cases, revised their target prices based on their updated fundamental outlooks for these firms. Here are the key analyst calls to watch out for today.

Read the full story for stock picks:

Asian equities posted a modest drop at the open after Wall Street’s pullback from record highs sparked caution among investors. MSCI’s regional stock gauge dropped 0.2% with technology shares among the losers. An index of US-listed Chinese shares fell the most since the end of August ahead of Hong Kong’s return from a holiday, Bloomberg reported.

Chinese and South Korean markets are closed today.

Nikkei up 0.3%

S&P/ASX 200 down 0.3%

US stocks ended their longest winning streak since May on Tuesday, spurred by a rotation out of big tech shares.

The S&P 500 fell 0.4%, interrupting seven consecutive sessions of gains.

The Nasdaq 100 declined roughly 0.6% and the Dow Jones Industrial Average slipped 0.2%.

Gold futures spiked to a new record high, touching $4,000 per ounce, driven by factors like safe-haven demand due to the ongoing political upheaval and economic uncertainty. The prices were further pushed higher by the hopes for more US interest rate cuts.

Gold prices in India today were trading at levels above the Rs 1,21,000 mark, amid the festive season. Gold price today stands at Rs 1,21,180 according to the India Bullion Co.

Good morning! Welcome to NDTV Profit's live coverage of the Indian equity markets. Here we bring you real-time updates, sharp analyst insights, top stock picks, and all the market-moving news you need. Stay tuned and stay ahead of the curve.

The GIFT Nifty was trading flat but marginally lower near 25,200 on Wednesday morning. The futures contract based on the benchmark Nifty 50 was trading 0.04% lower at 25,213 as of 6:35 a.m., indicating a muted start for the Indian markets.

The benchmark indices of the NSE Nifty 50 and BSE Sensex on Tuesday exhibited gains for a fourth consecutive session, after which they closed flat. The Nifty 50 closed 0.12% higher at 25,108.30, while the Sensex closed 0.17% higher at 81,926.75.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.