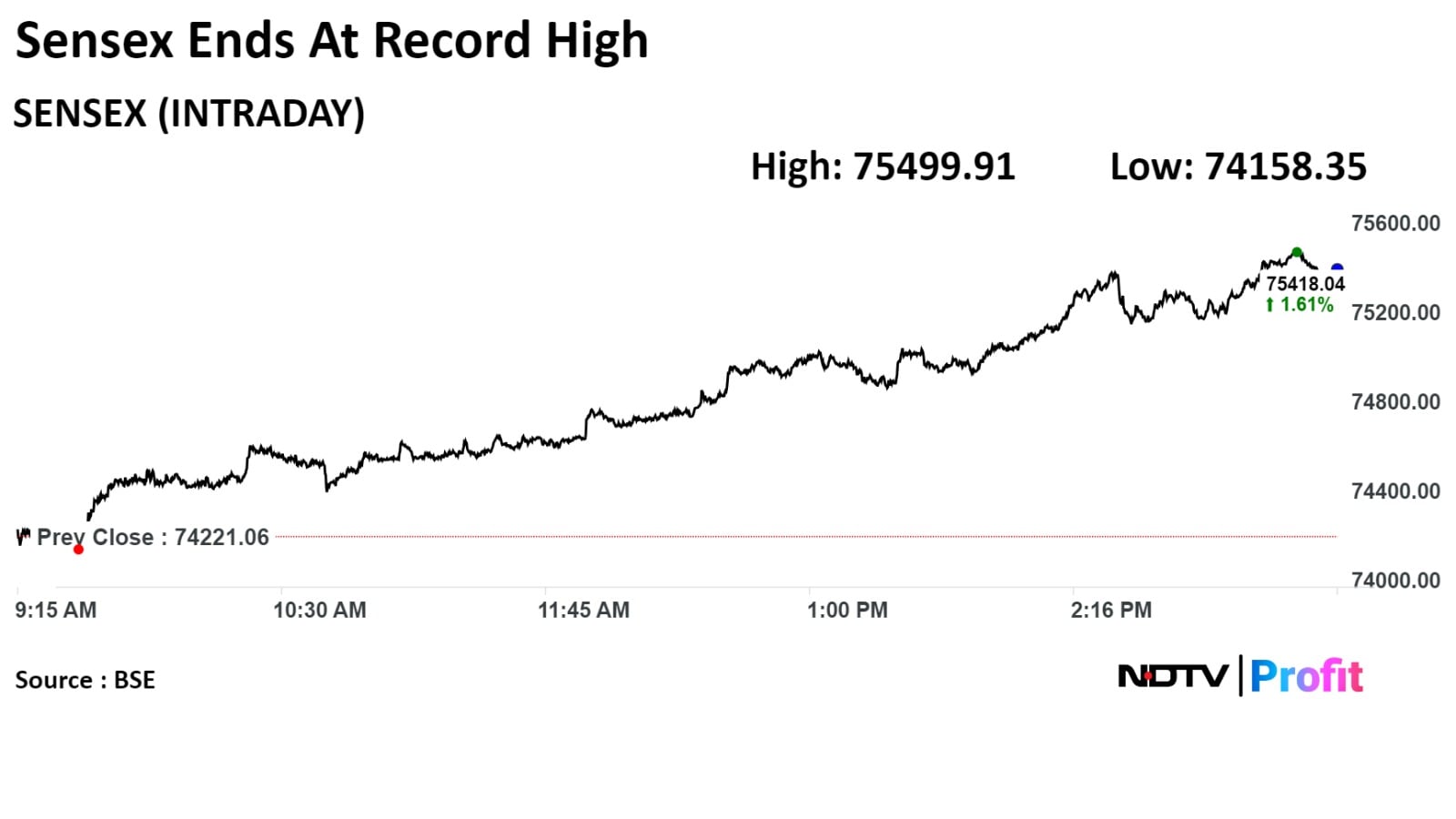

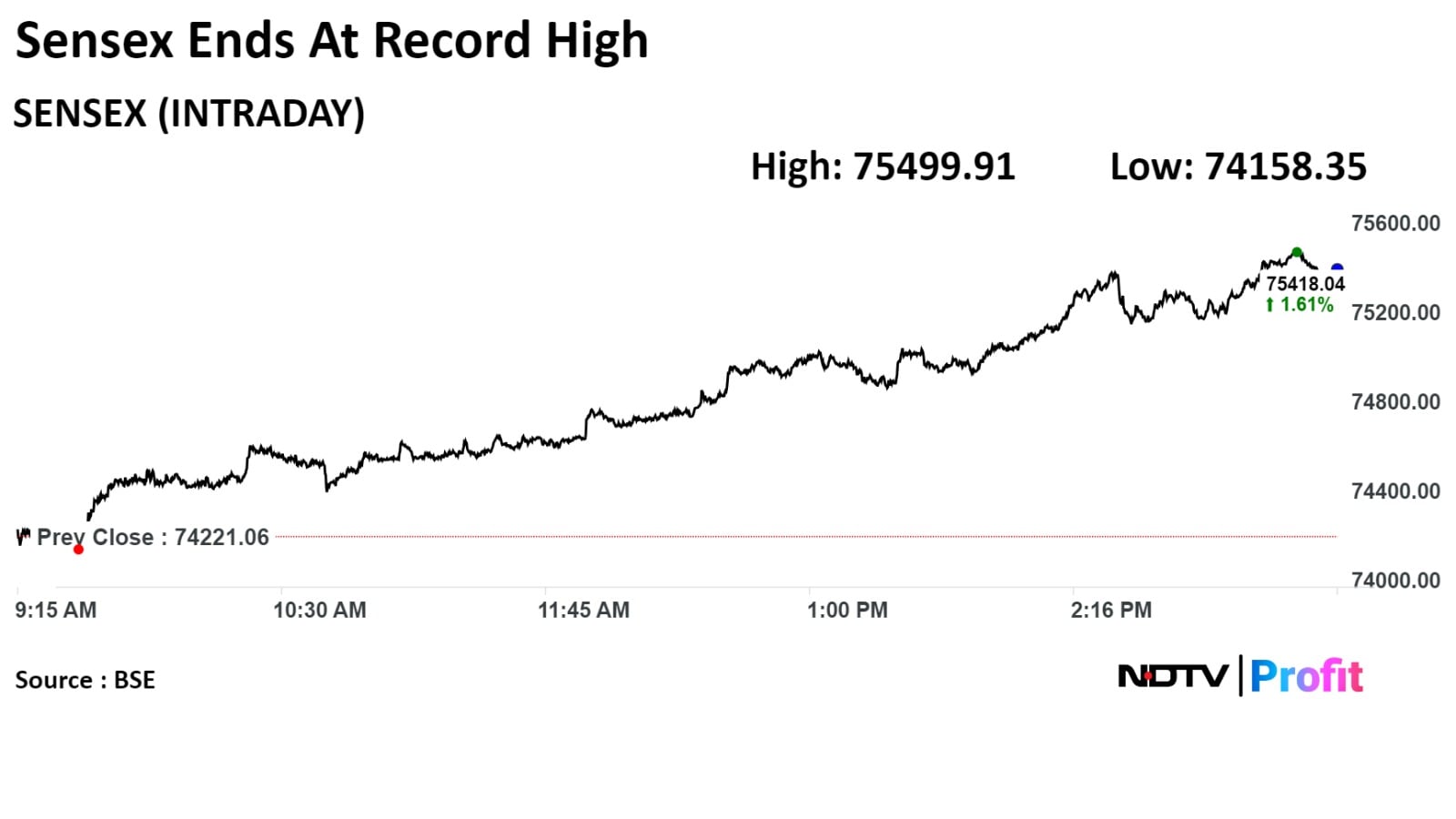

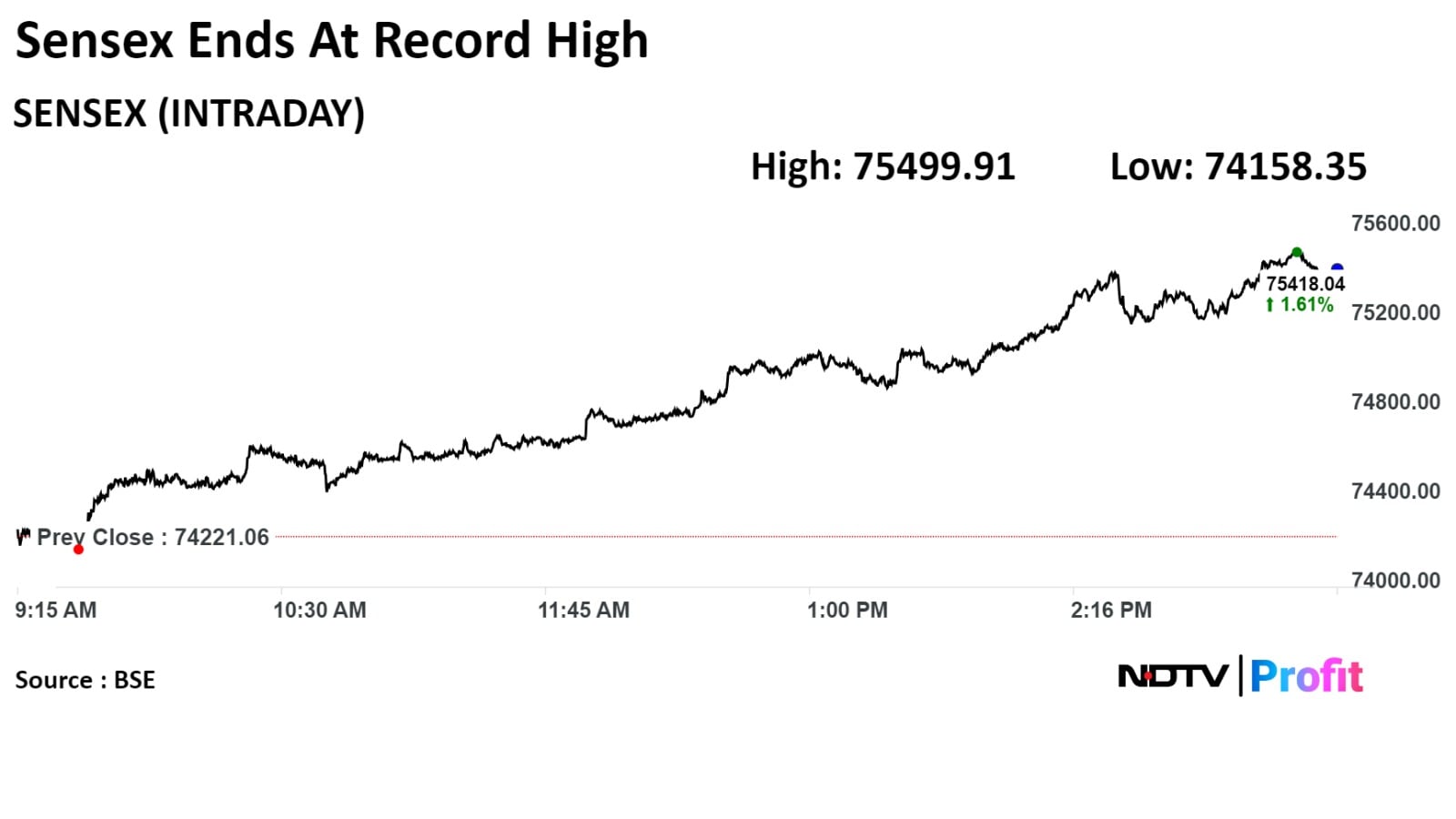

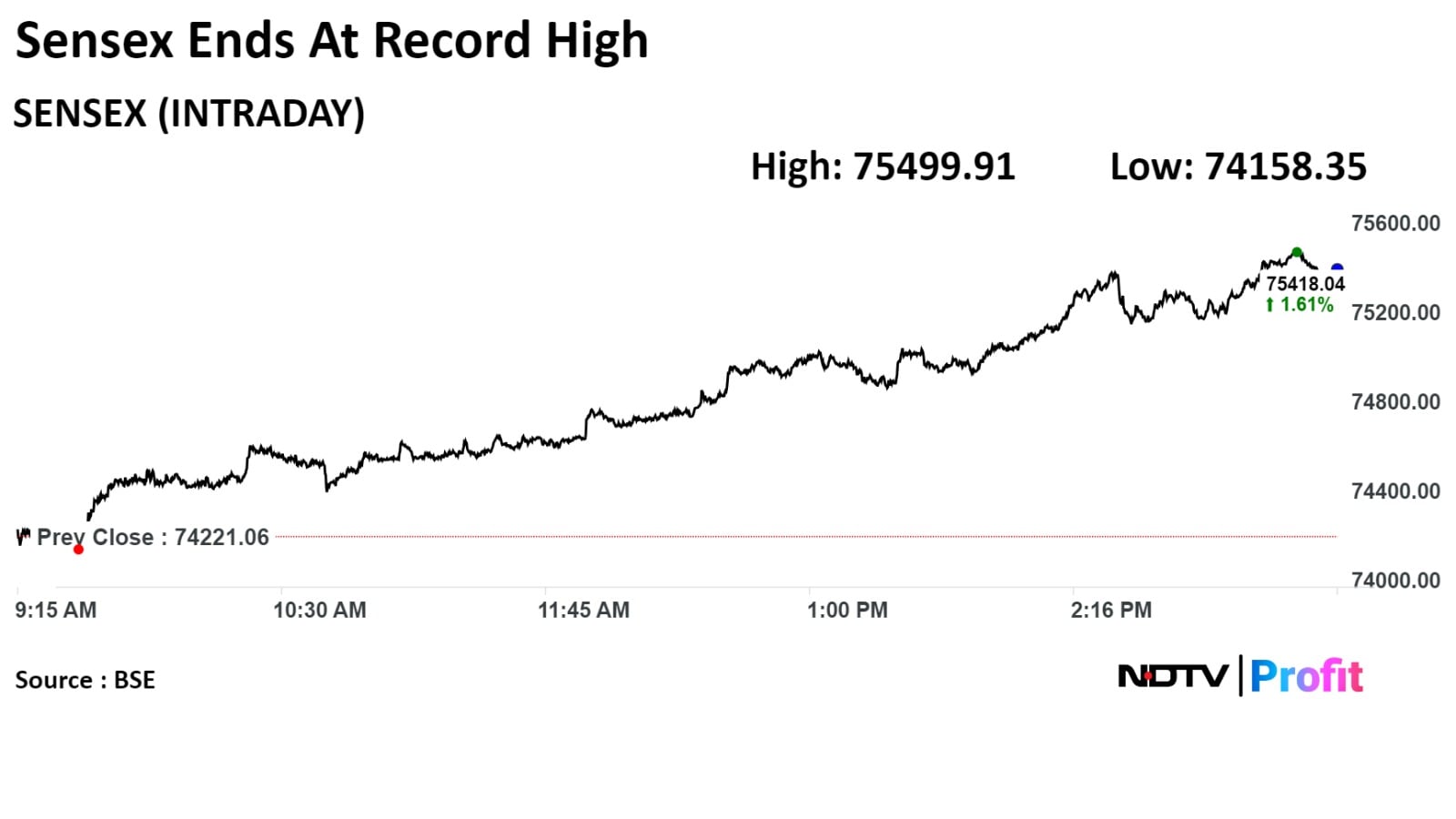

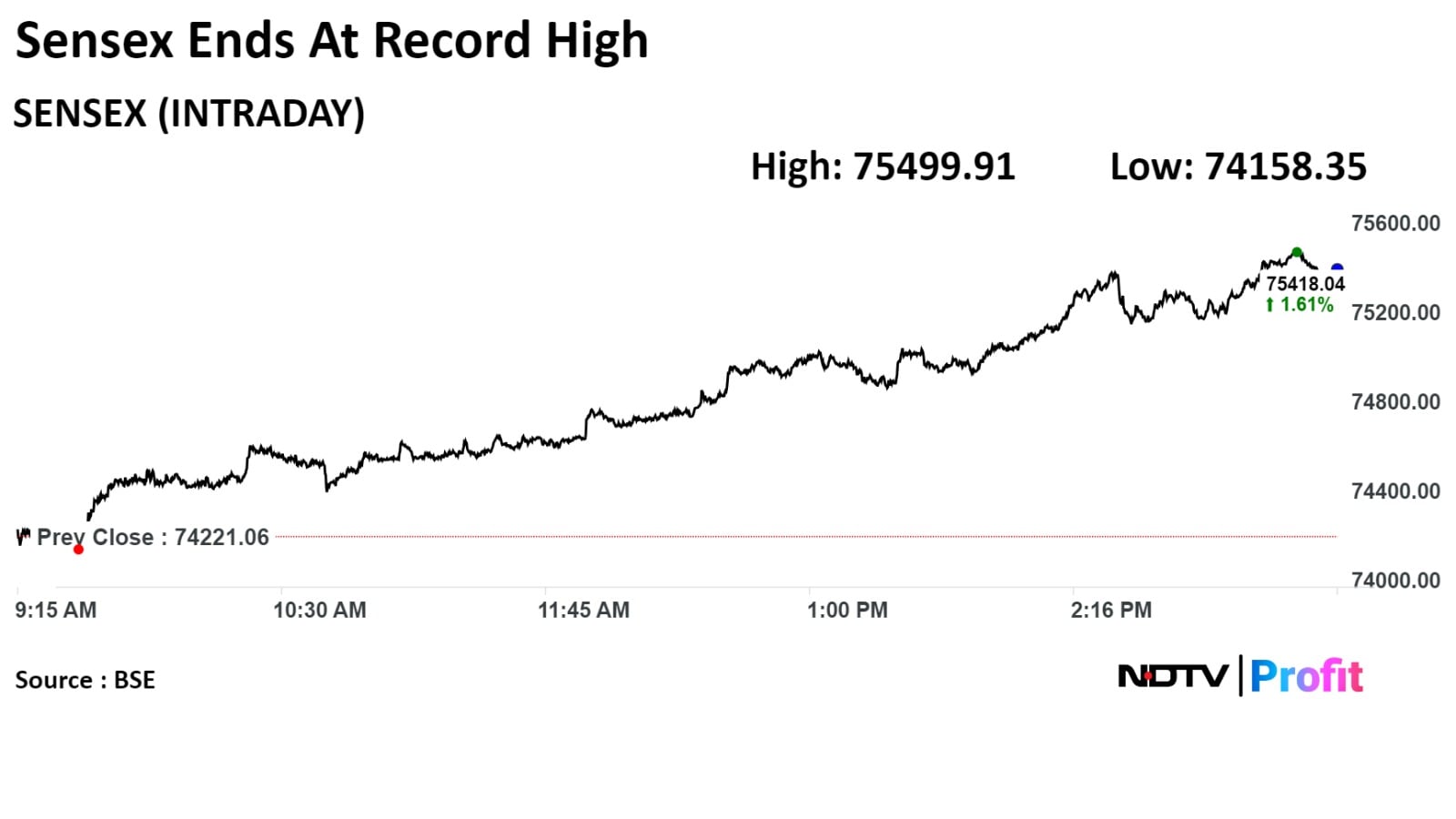

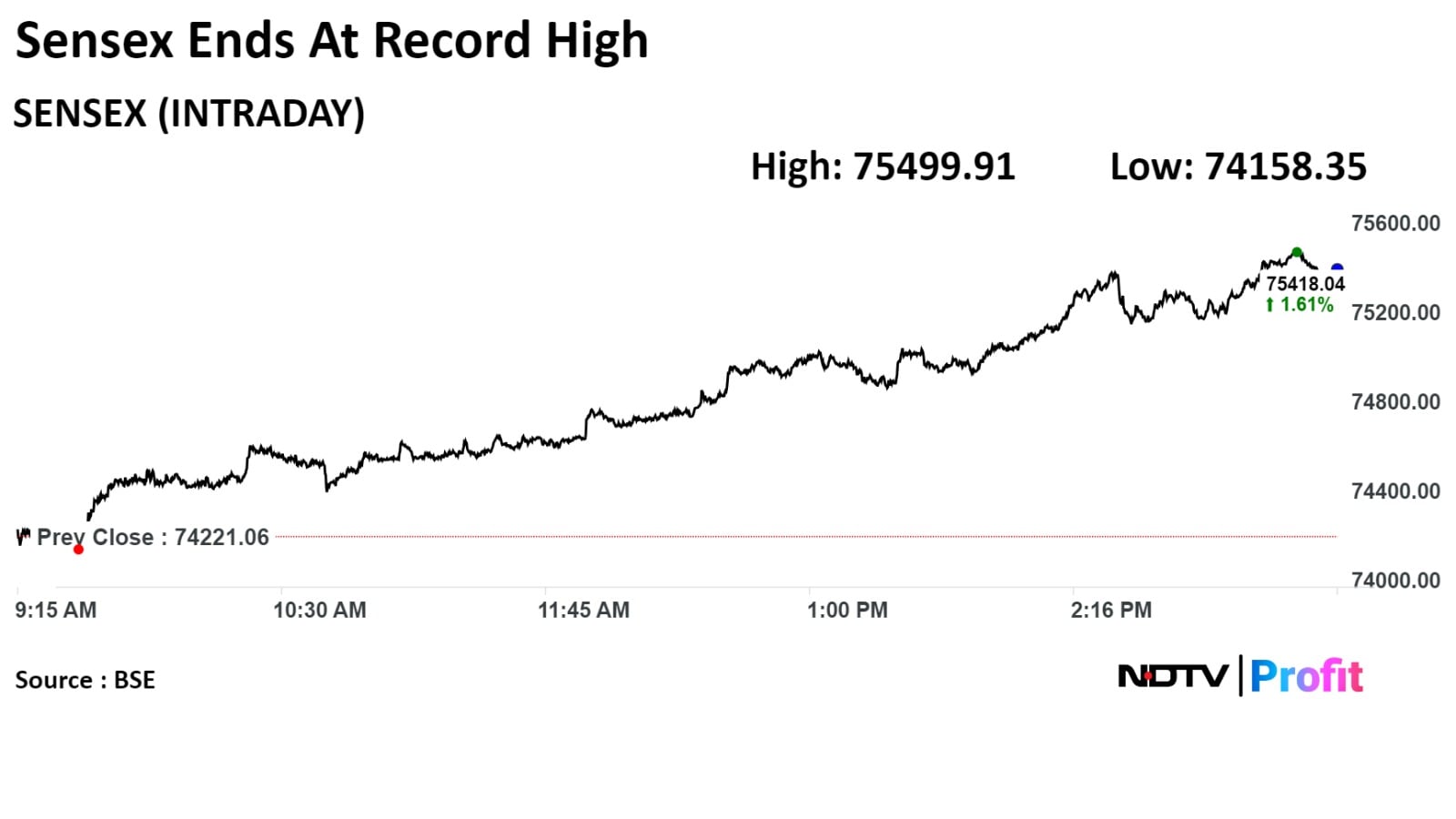

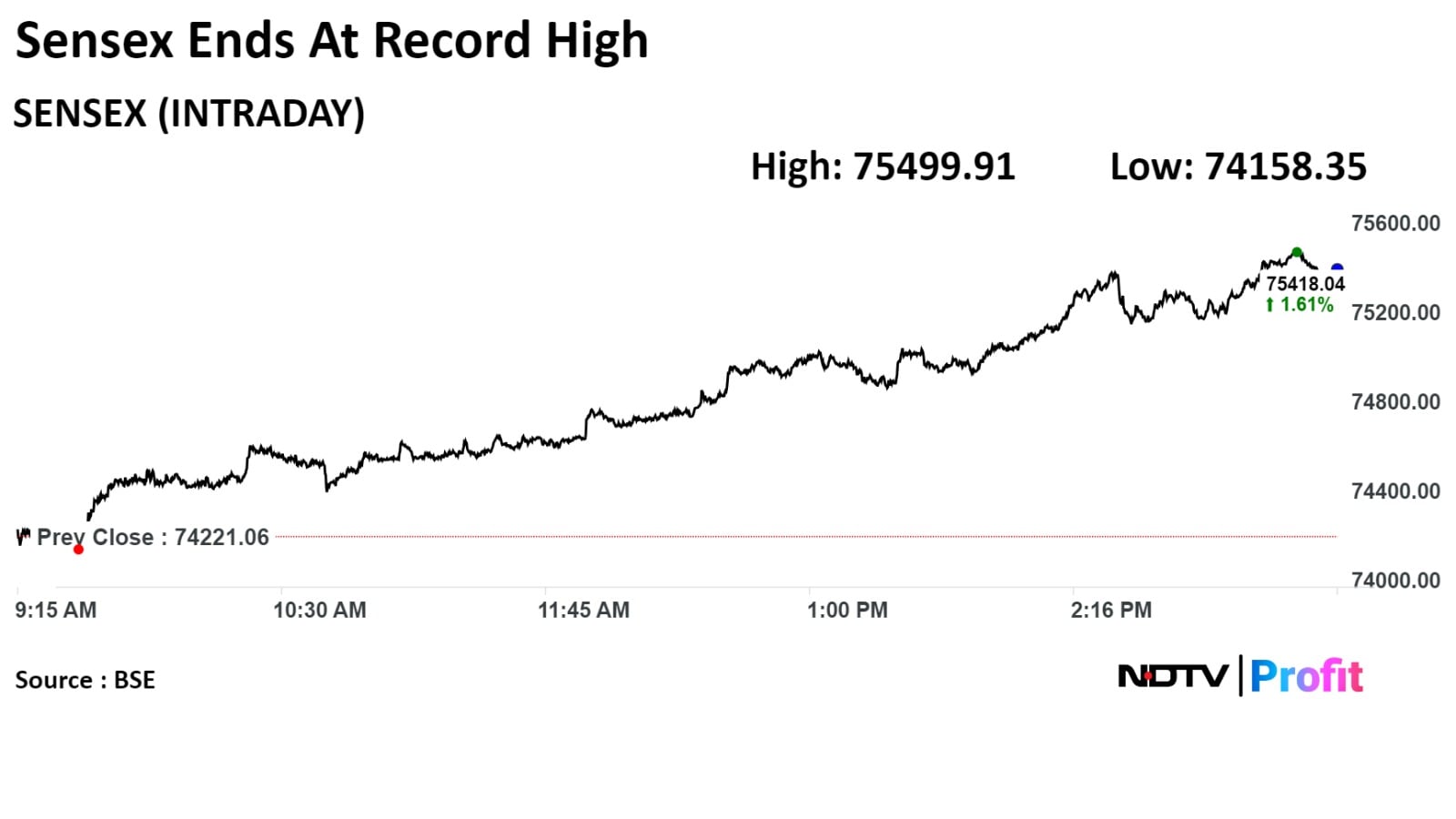

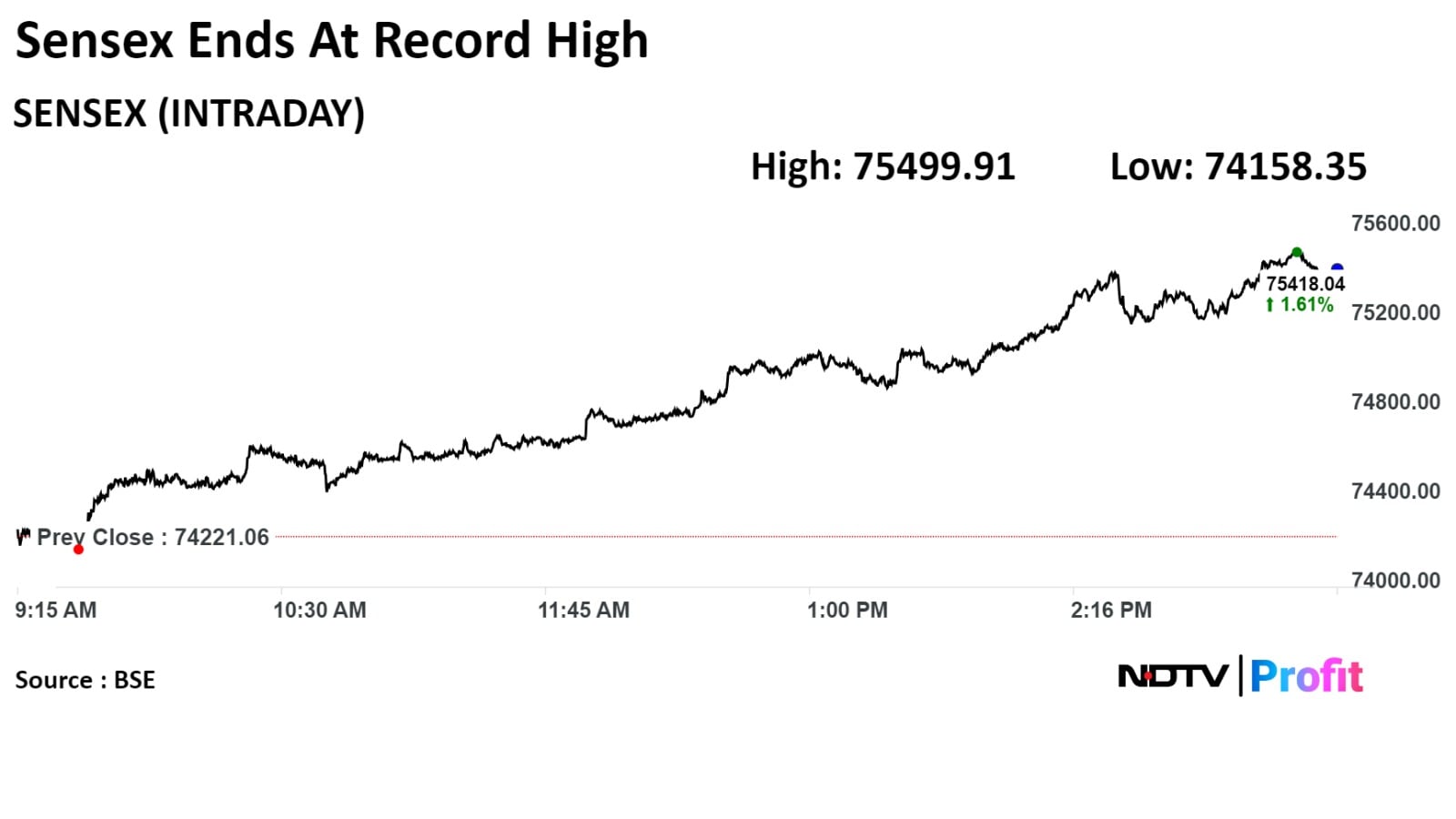

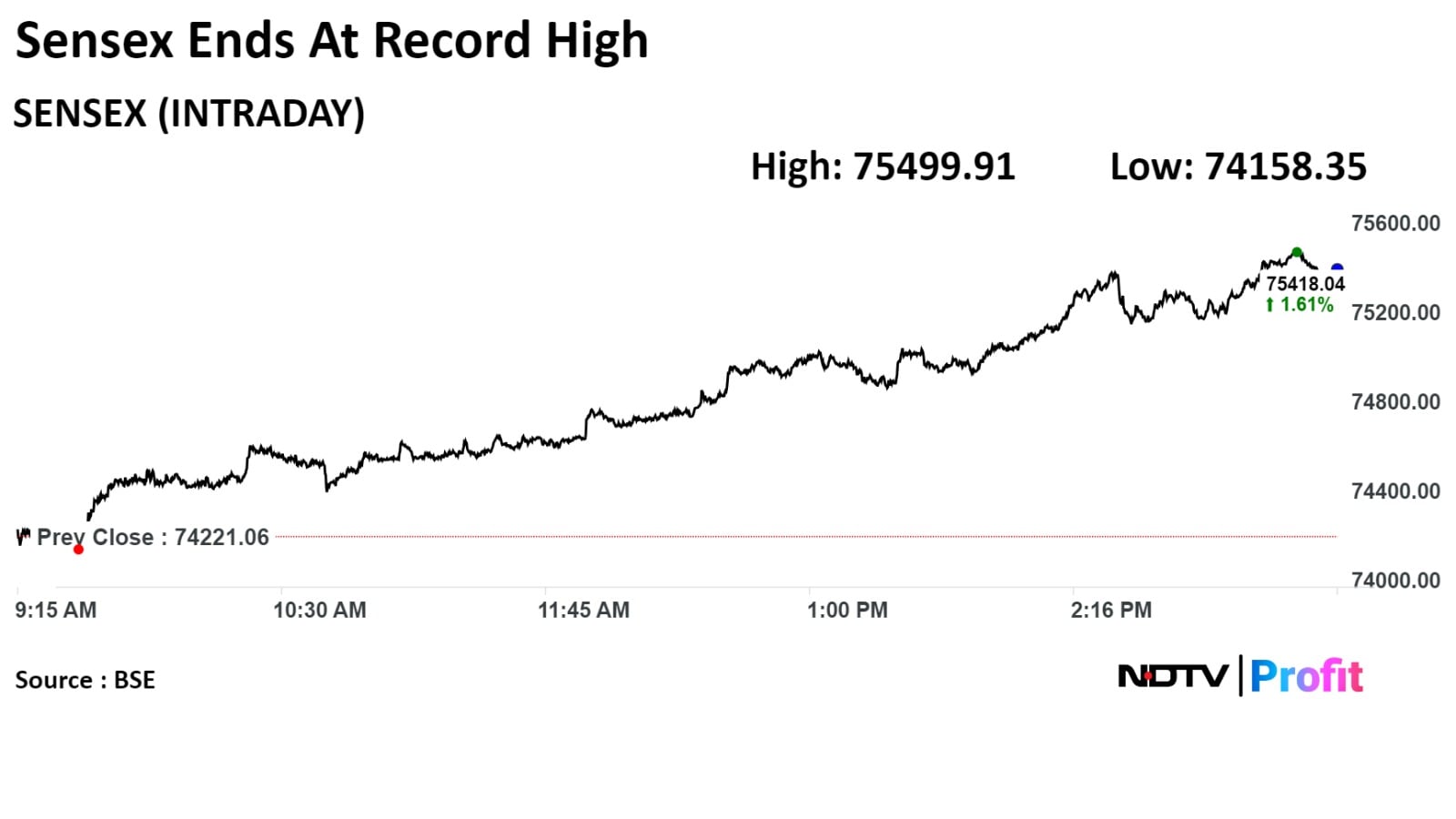

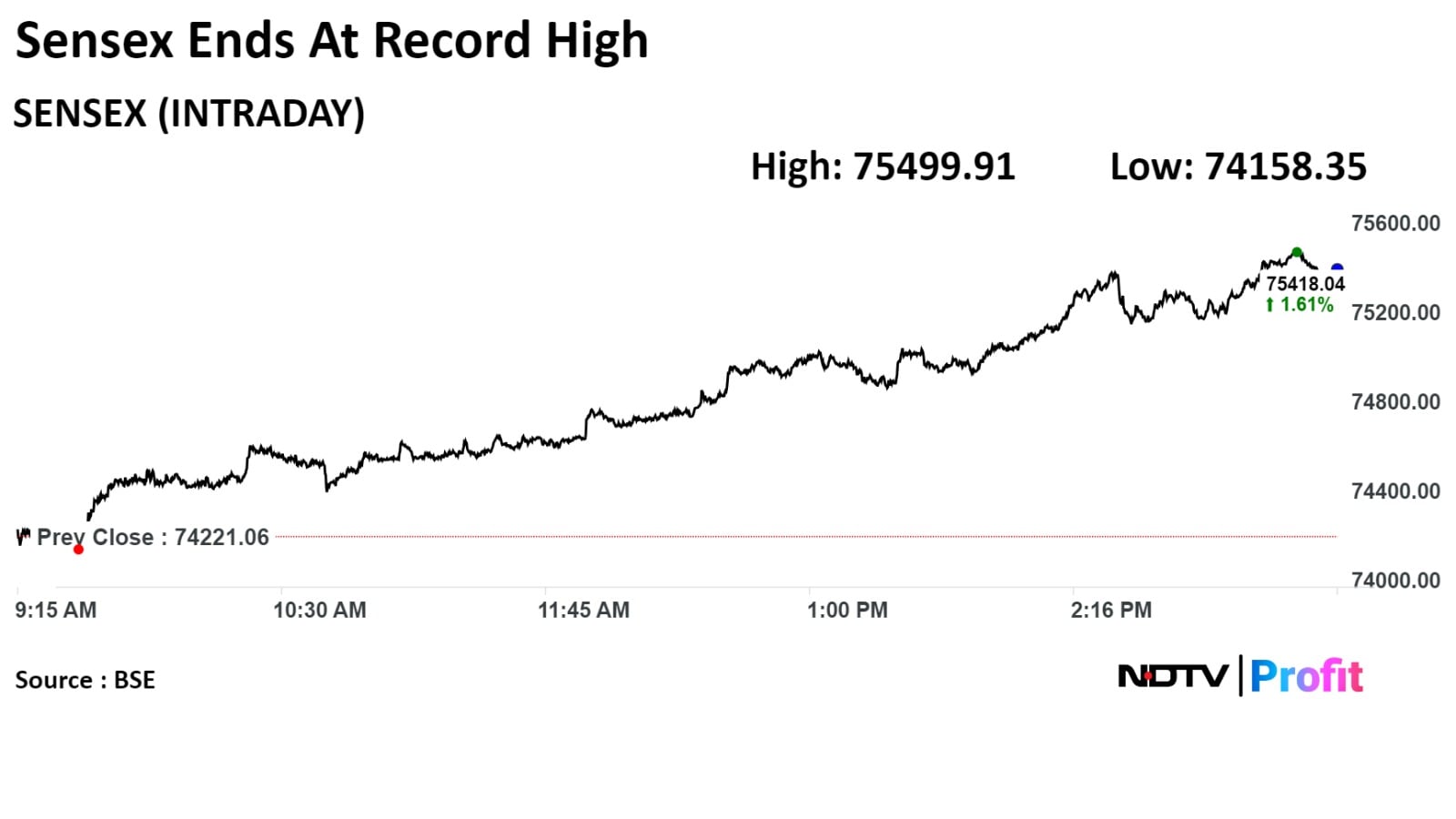

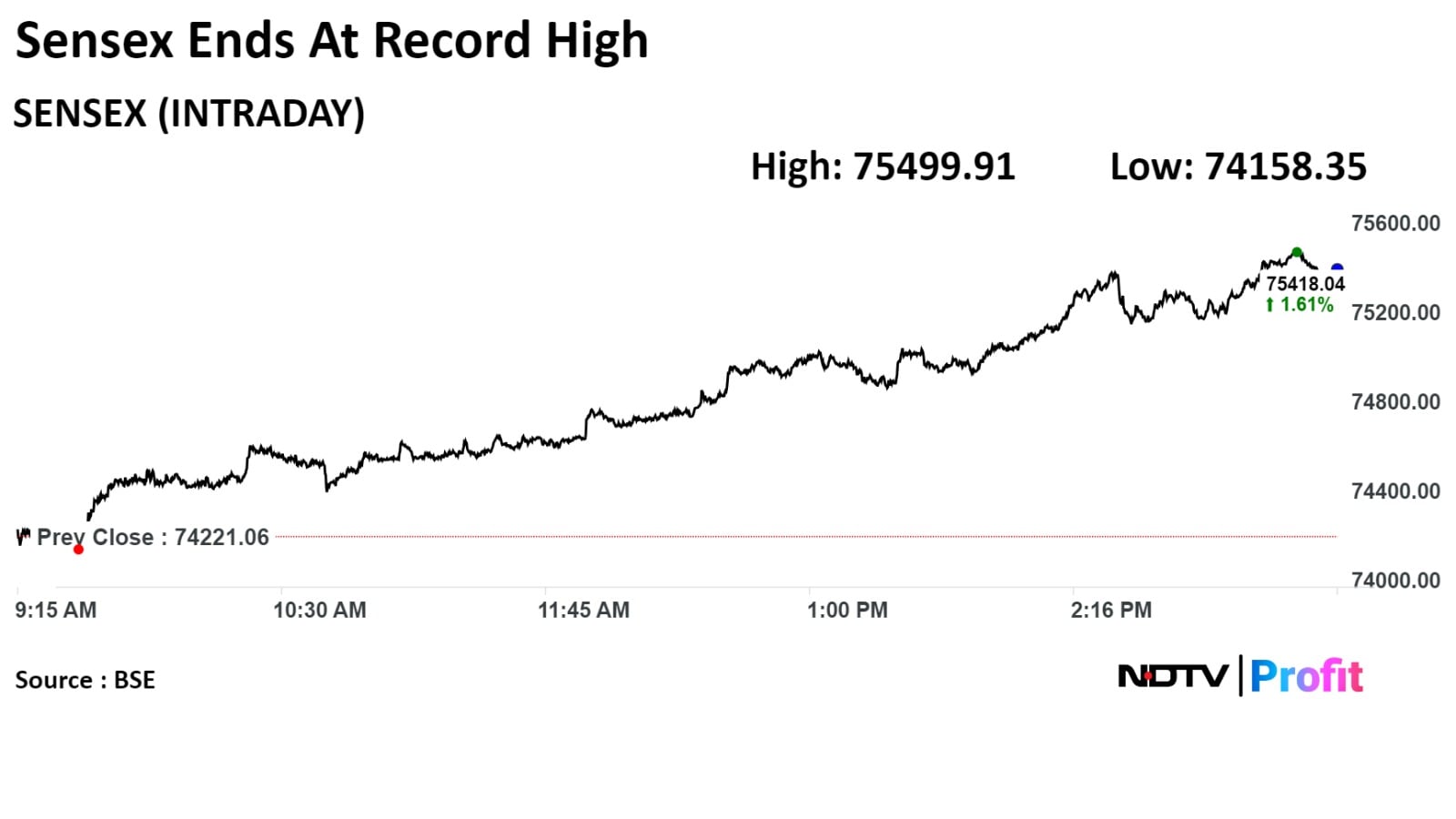

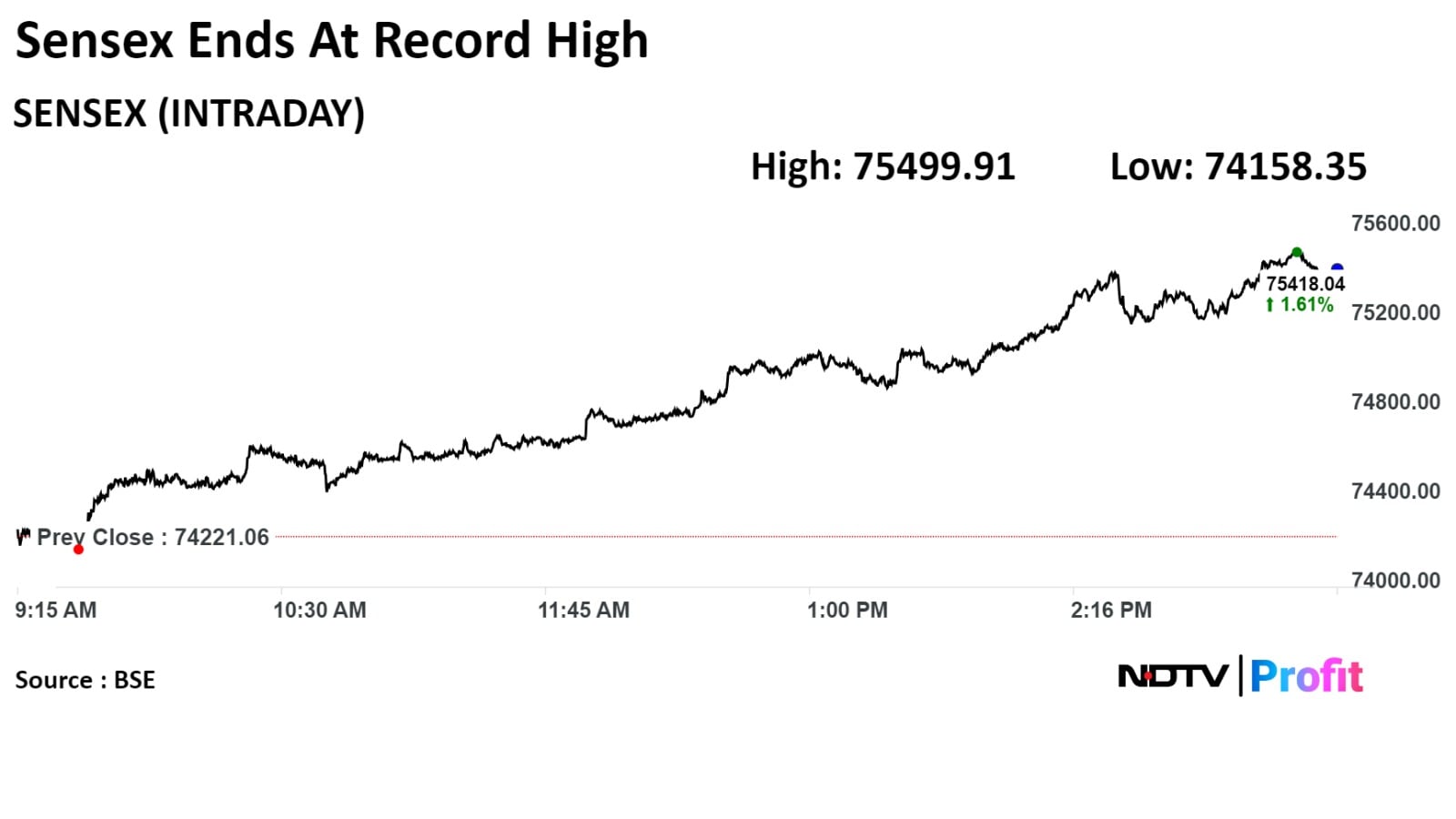

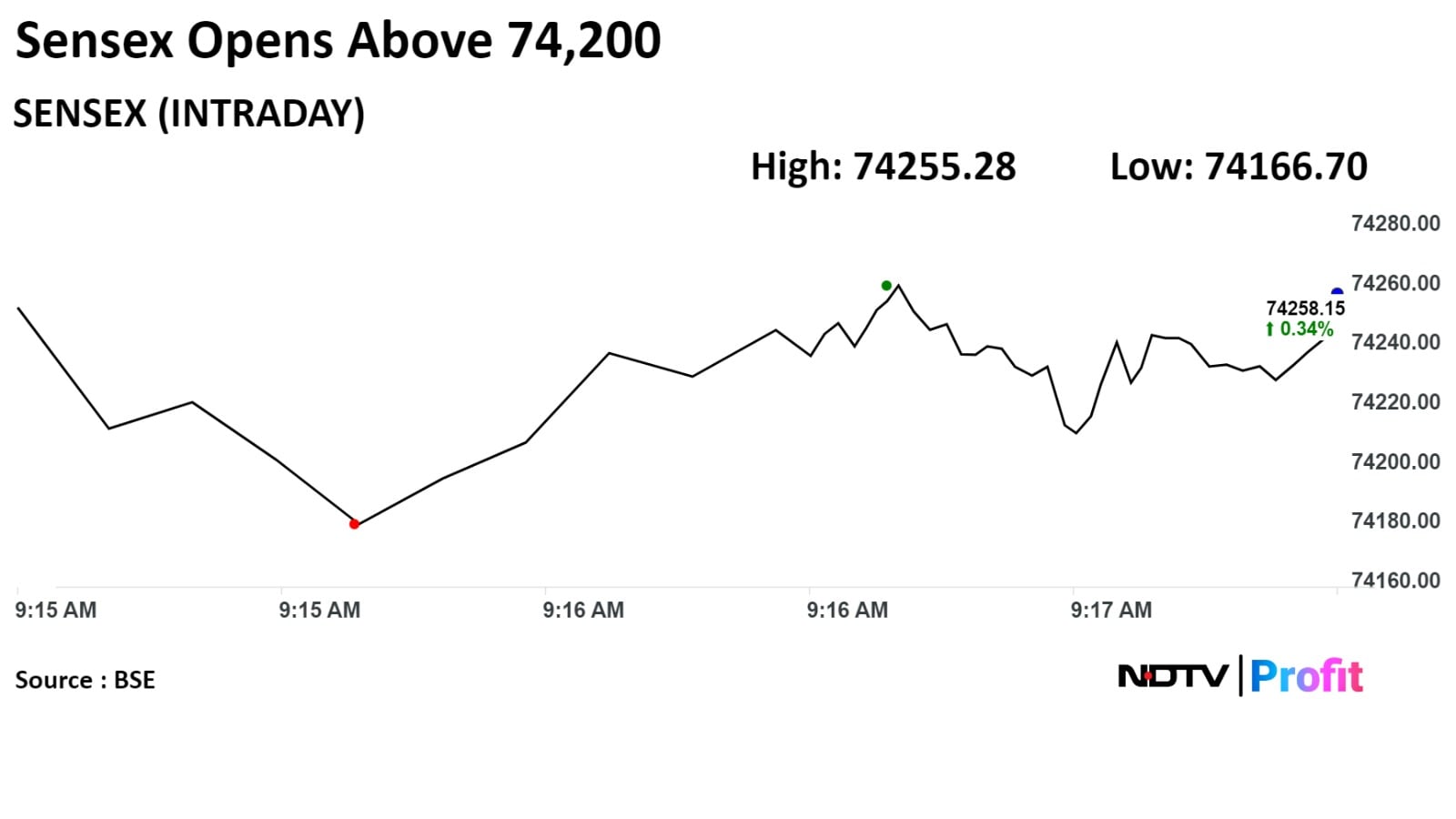

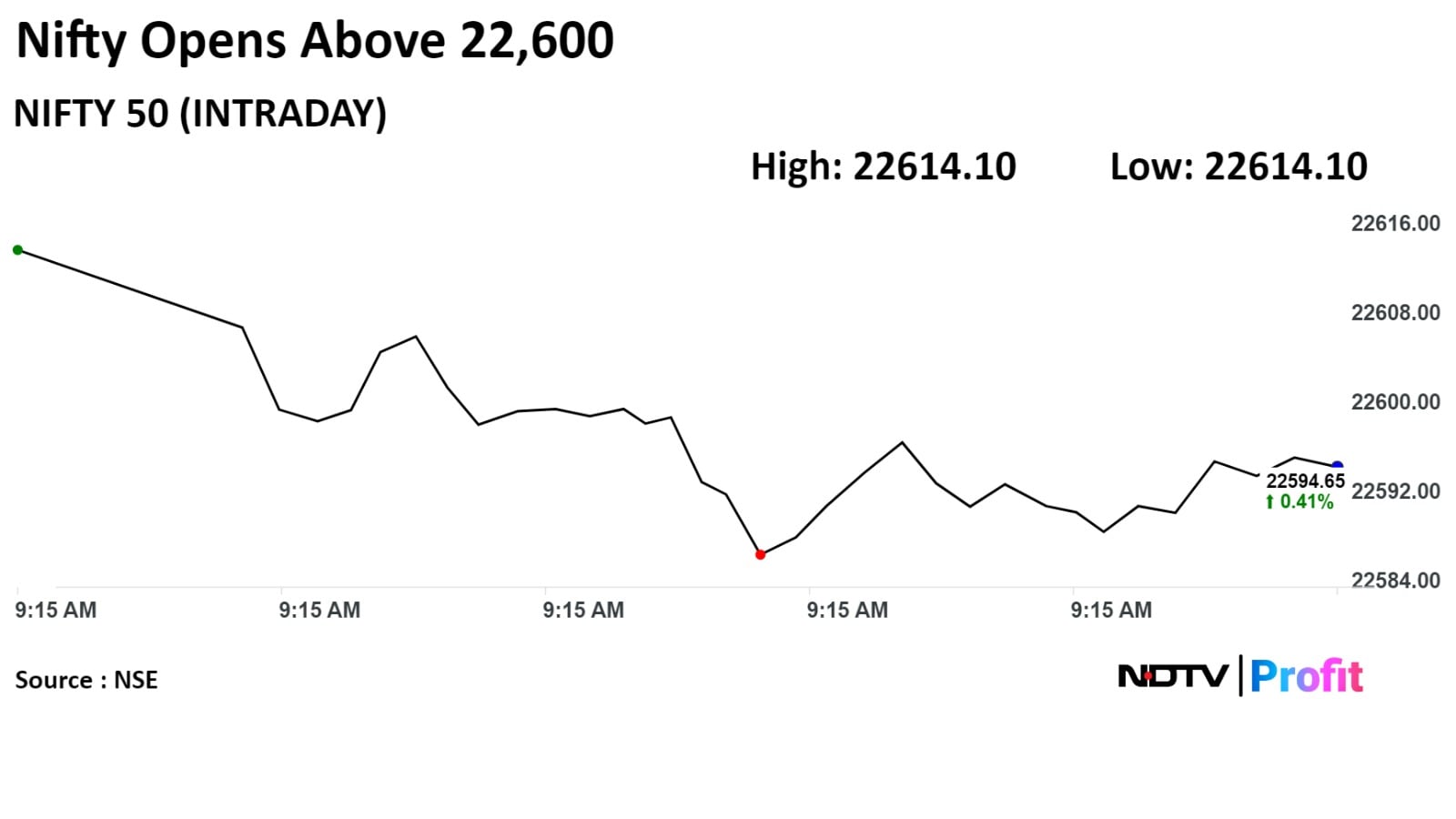

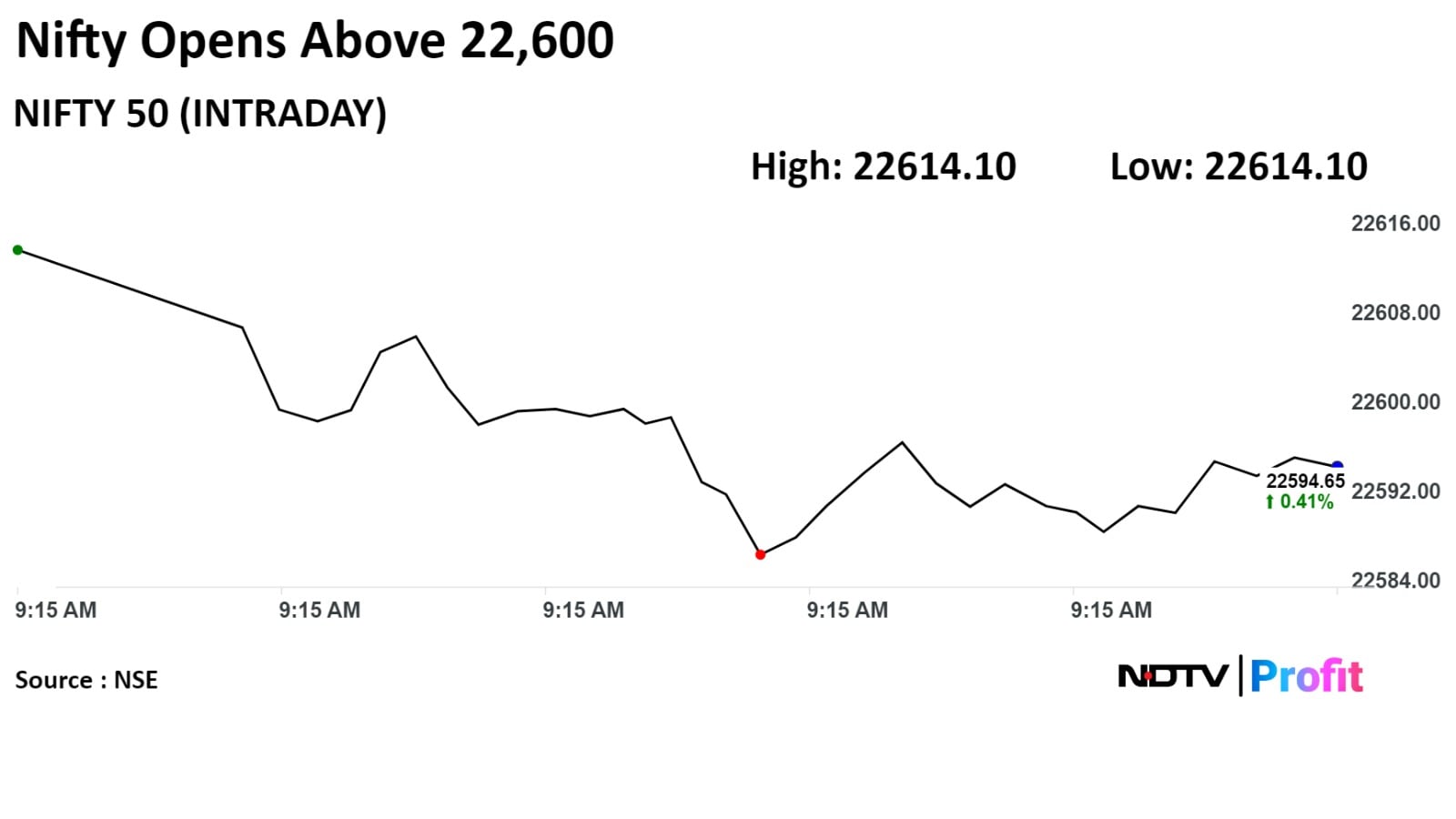

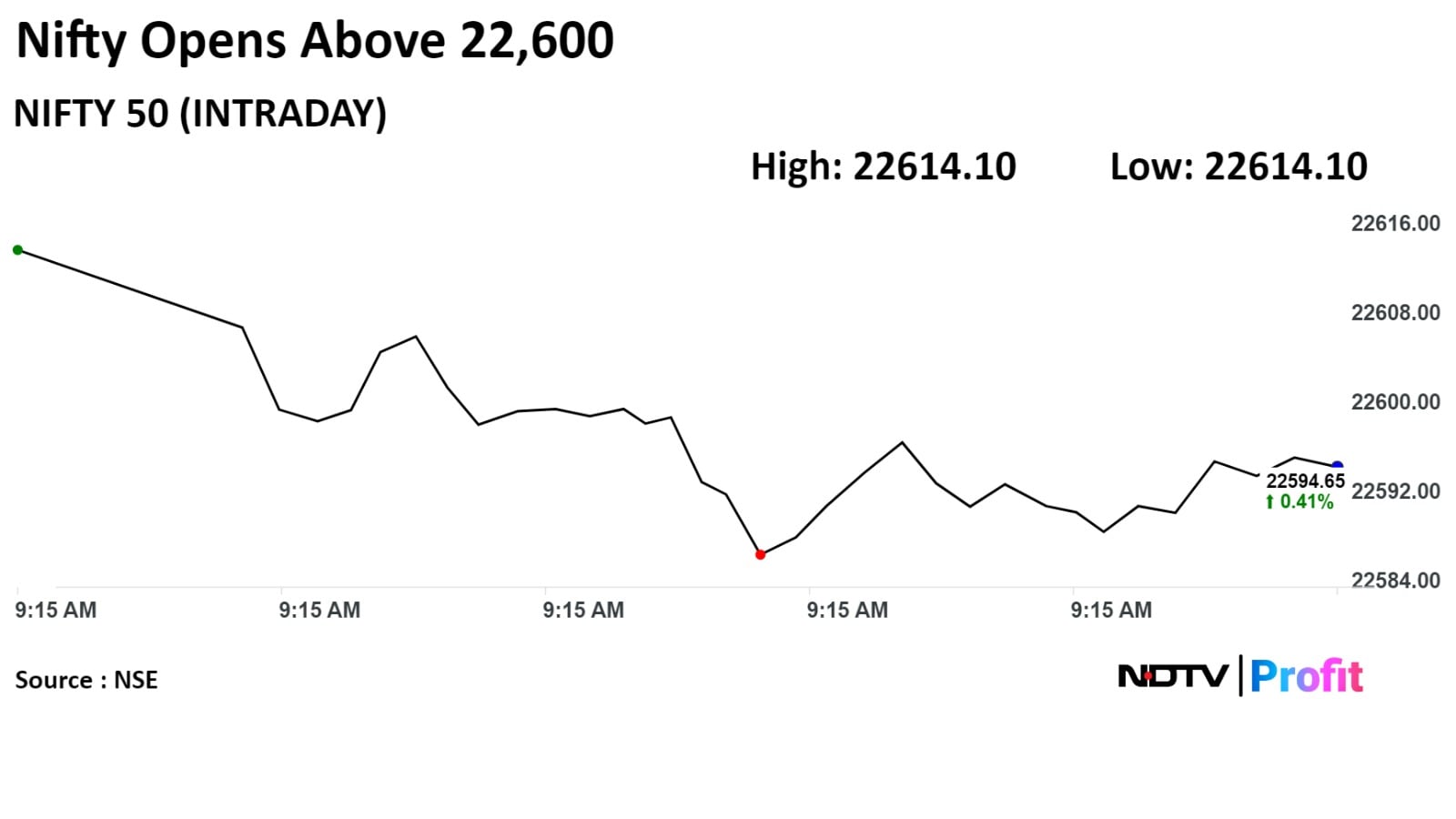

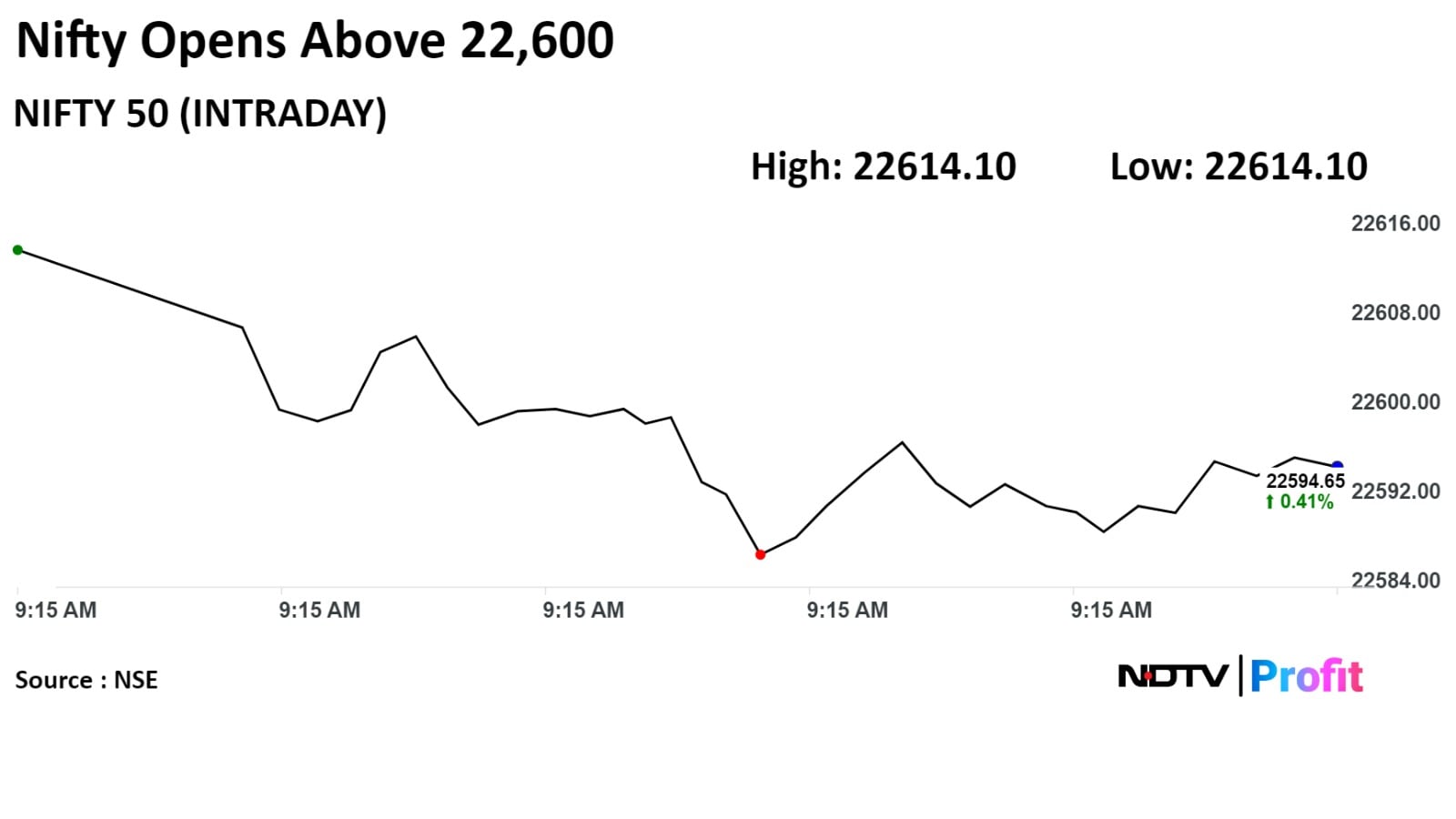

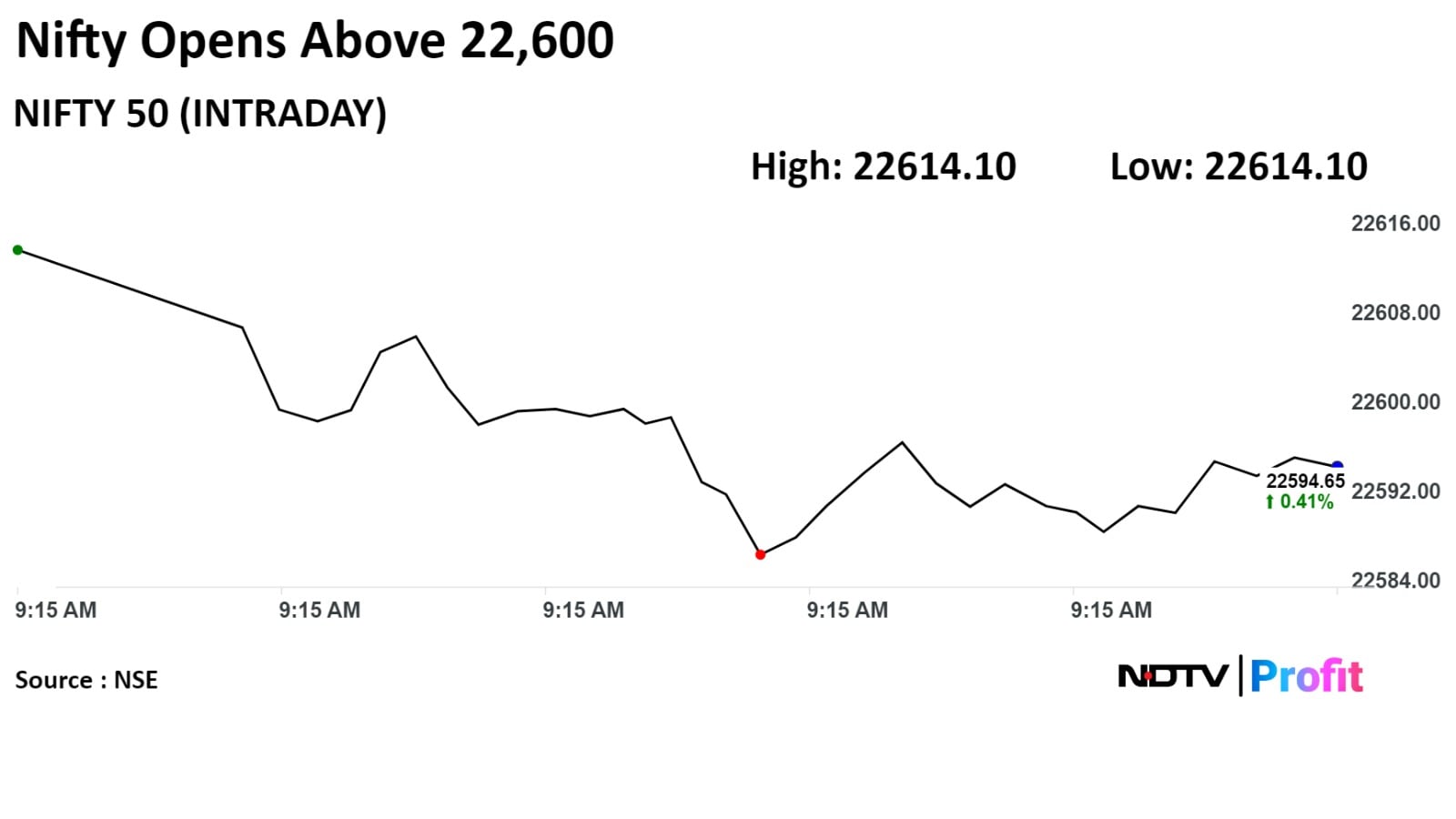

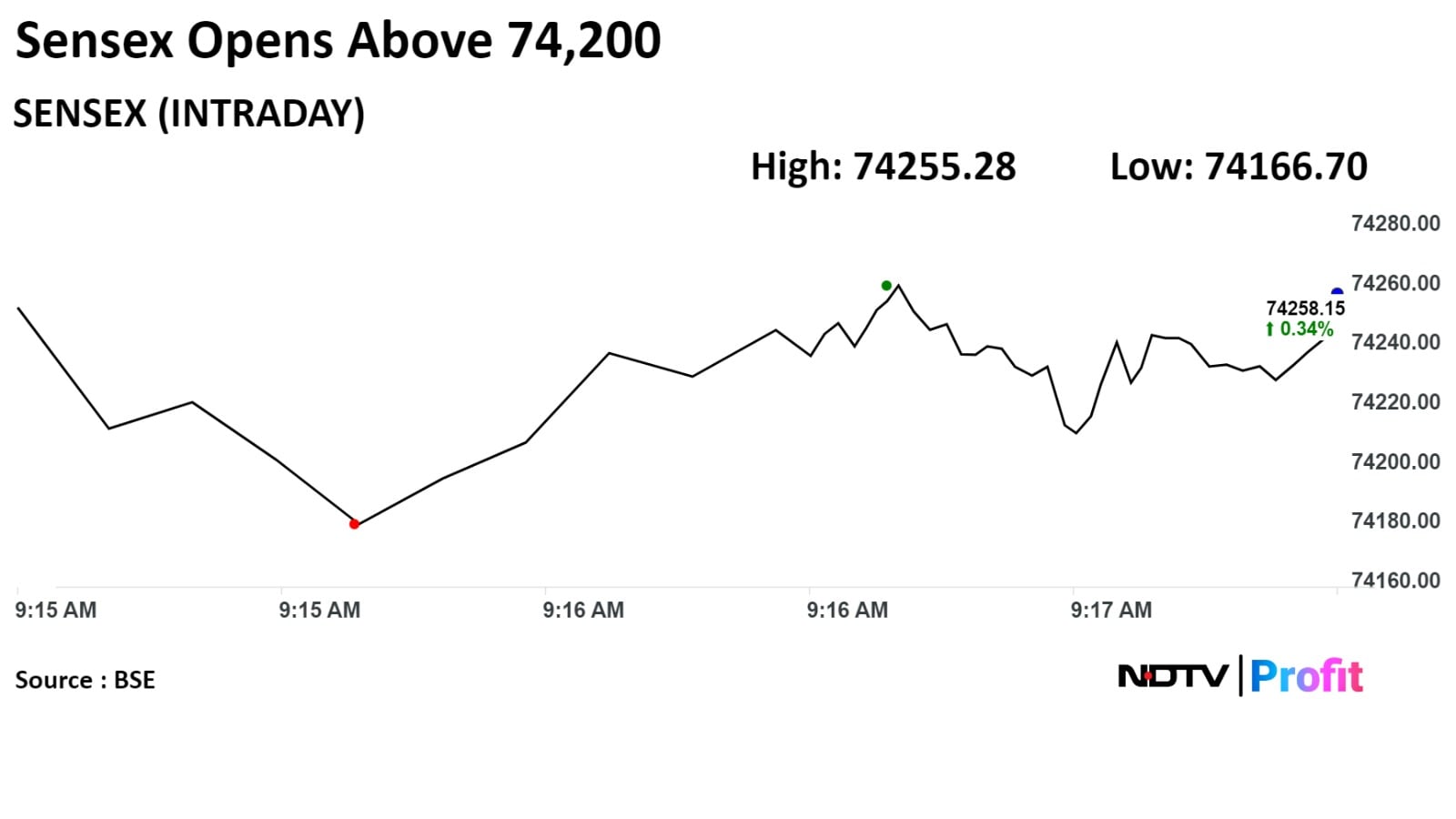

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

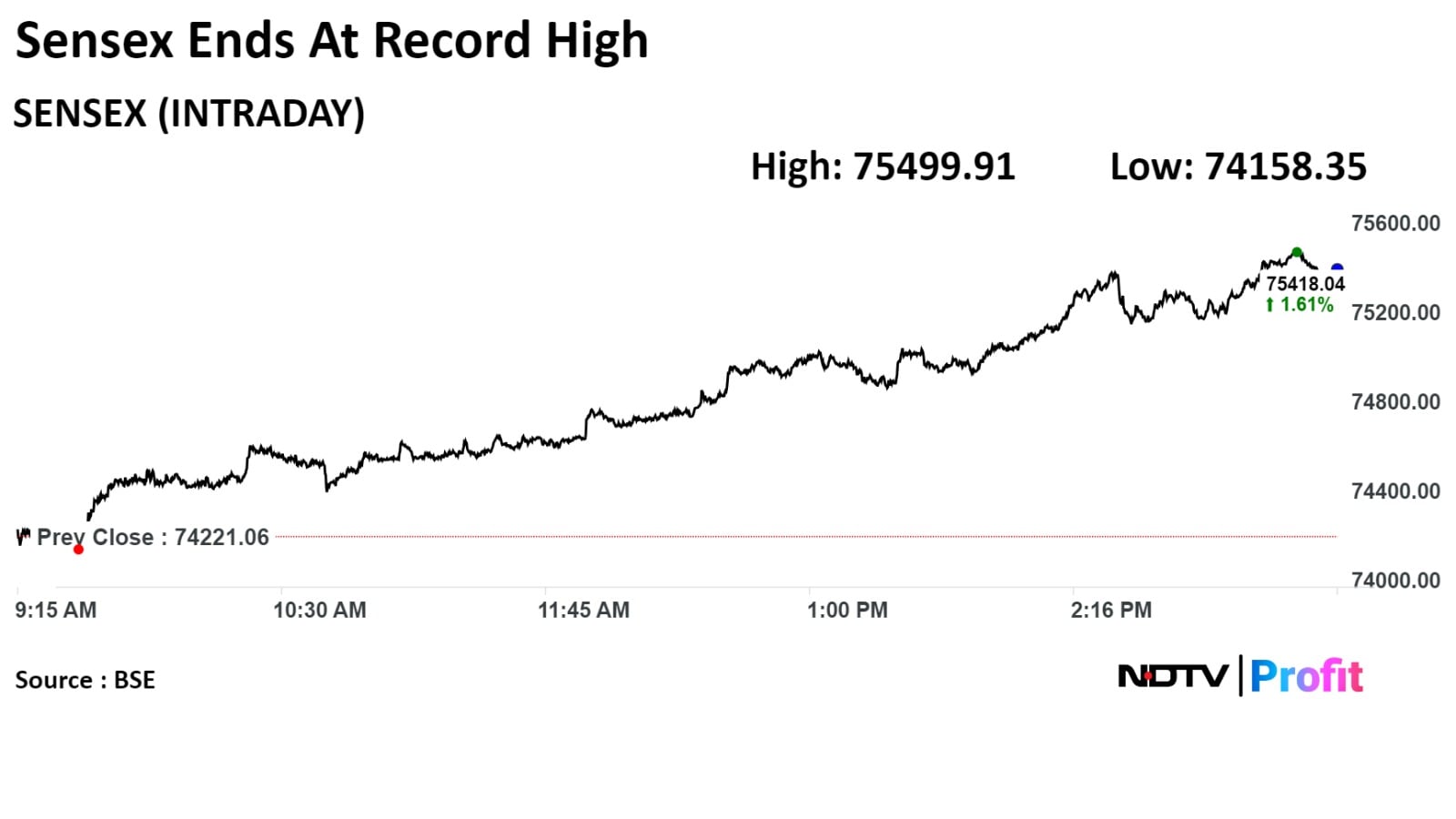

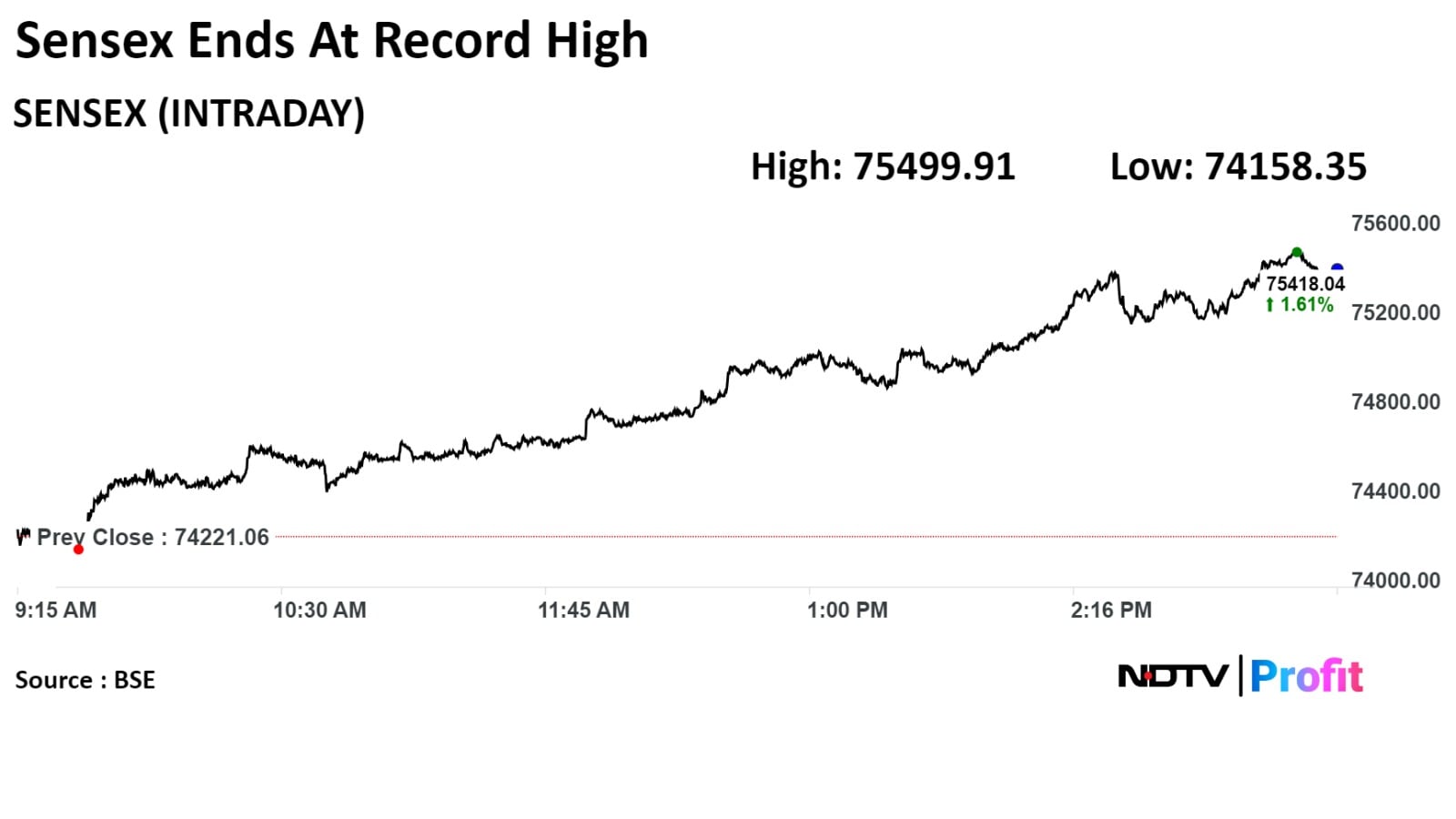

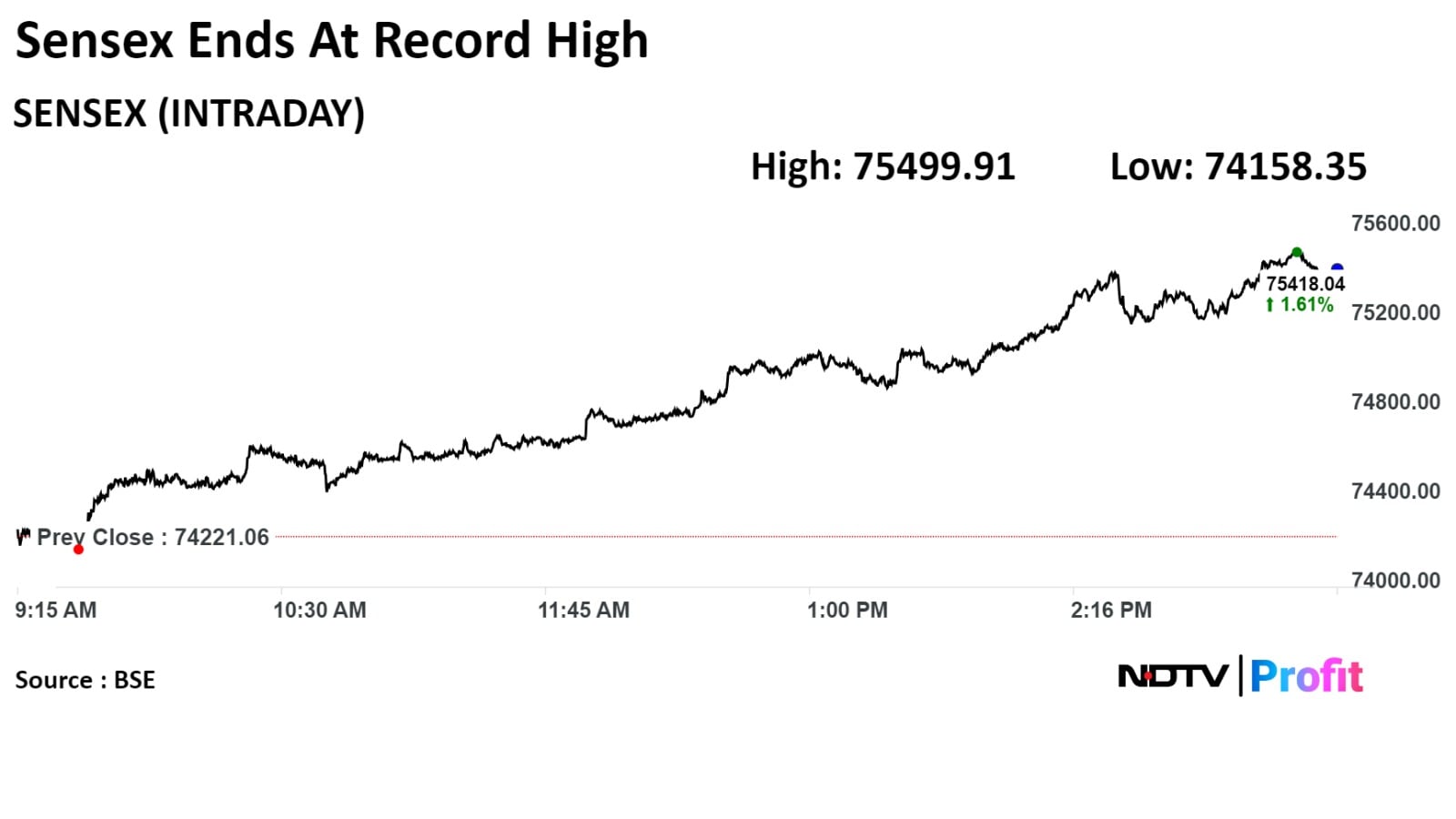

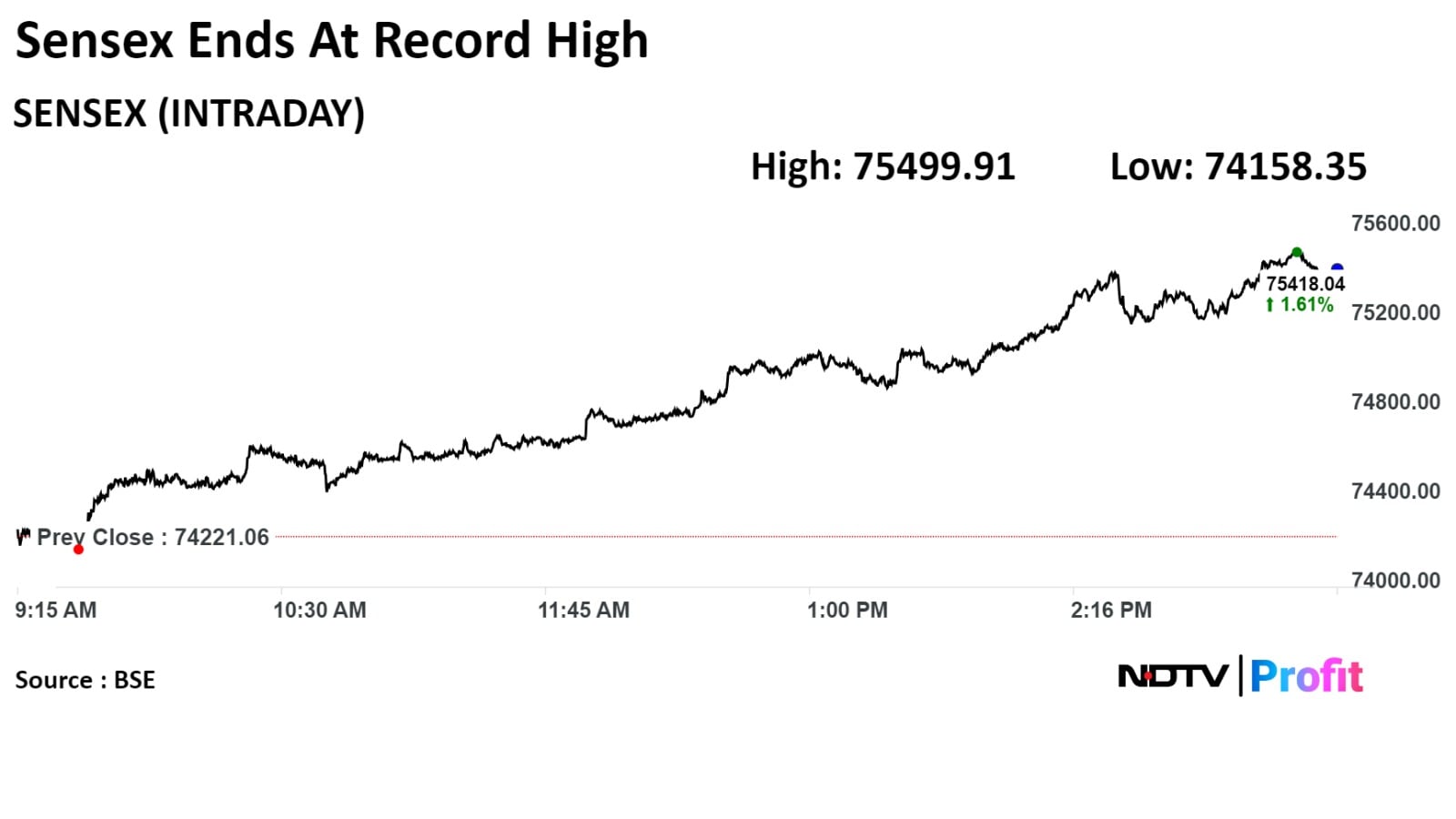

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

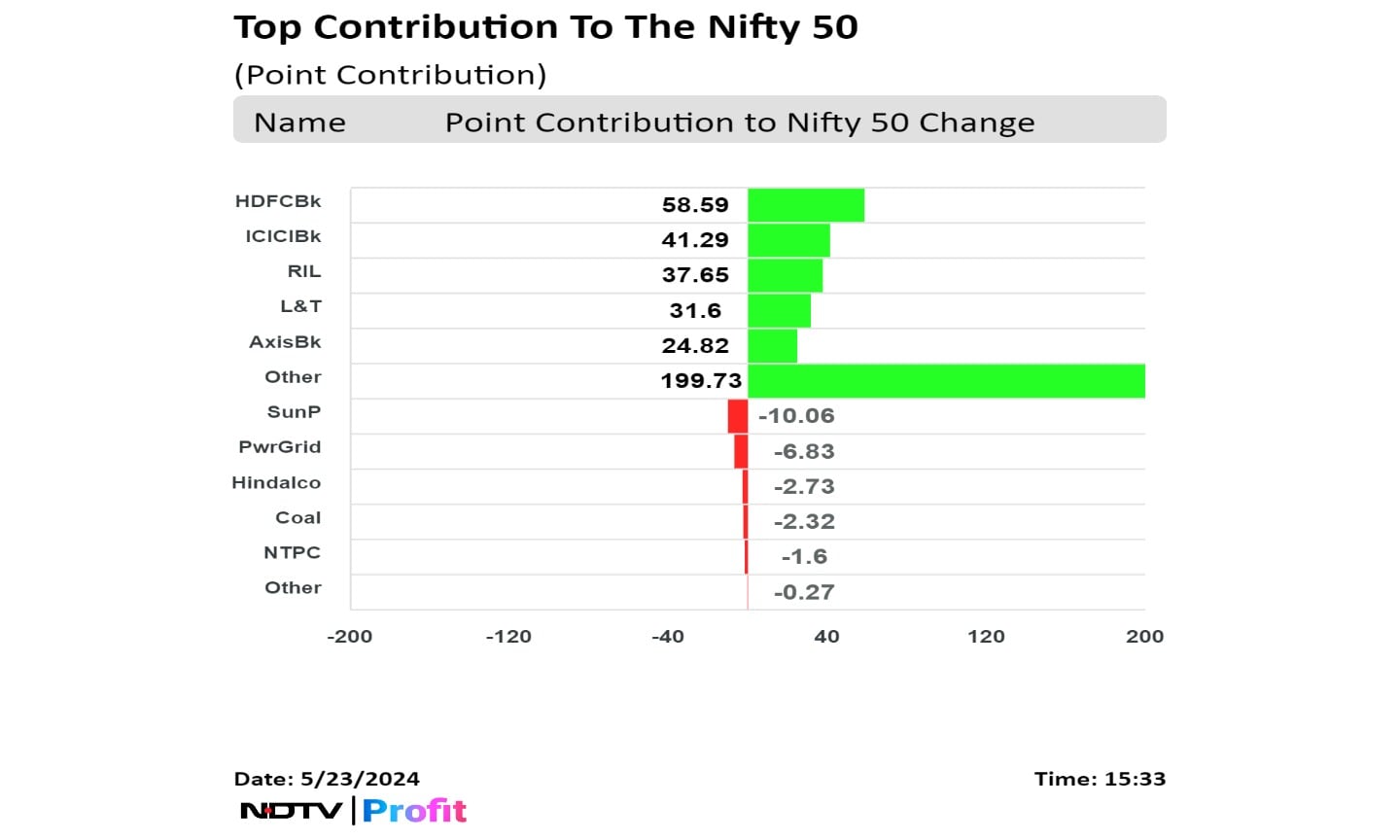

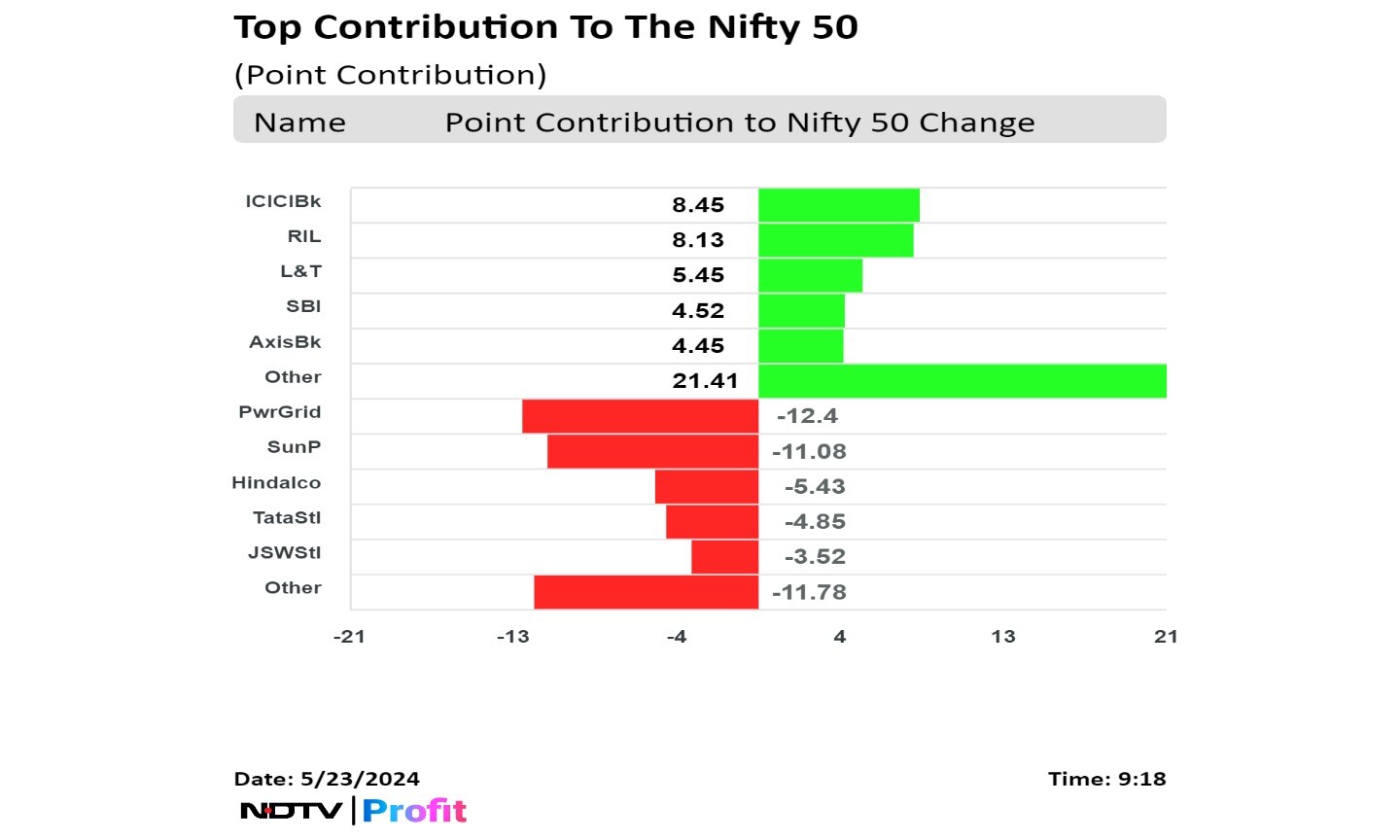

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

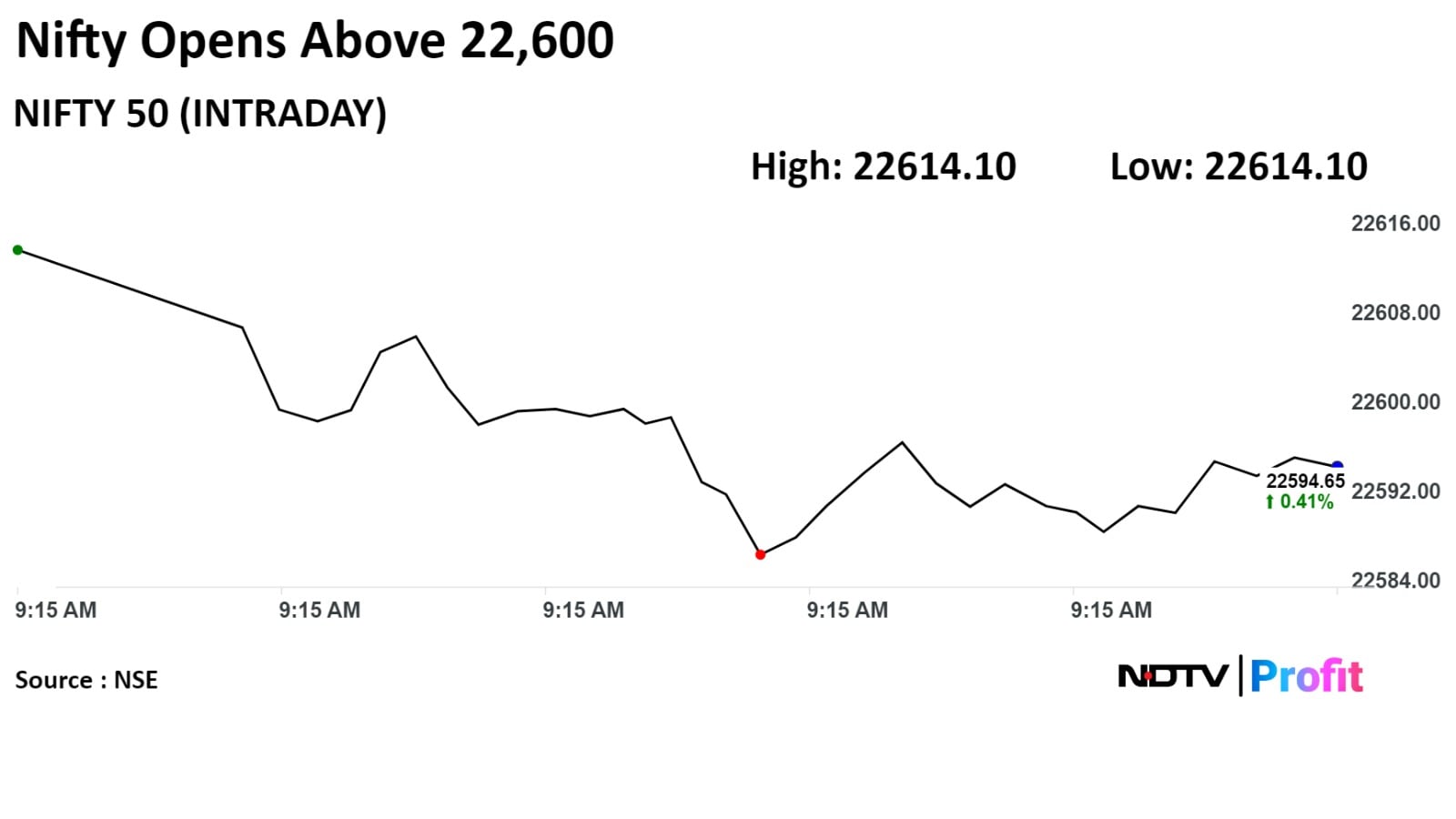

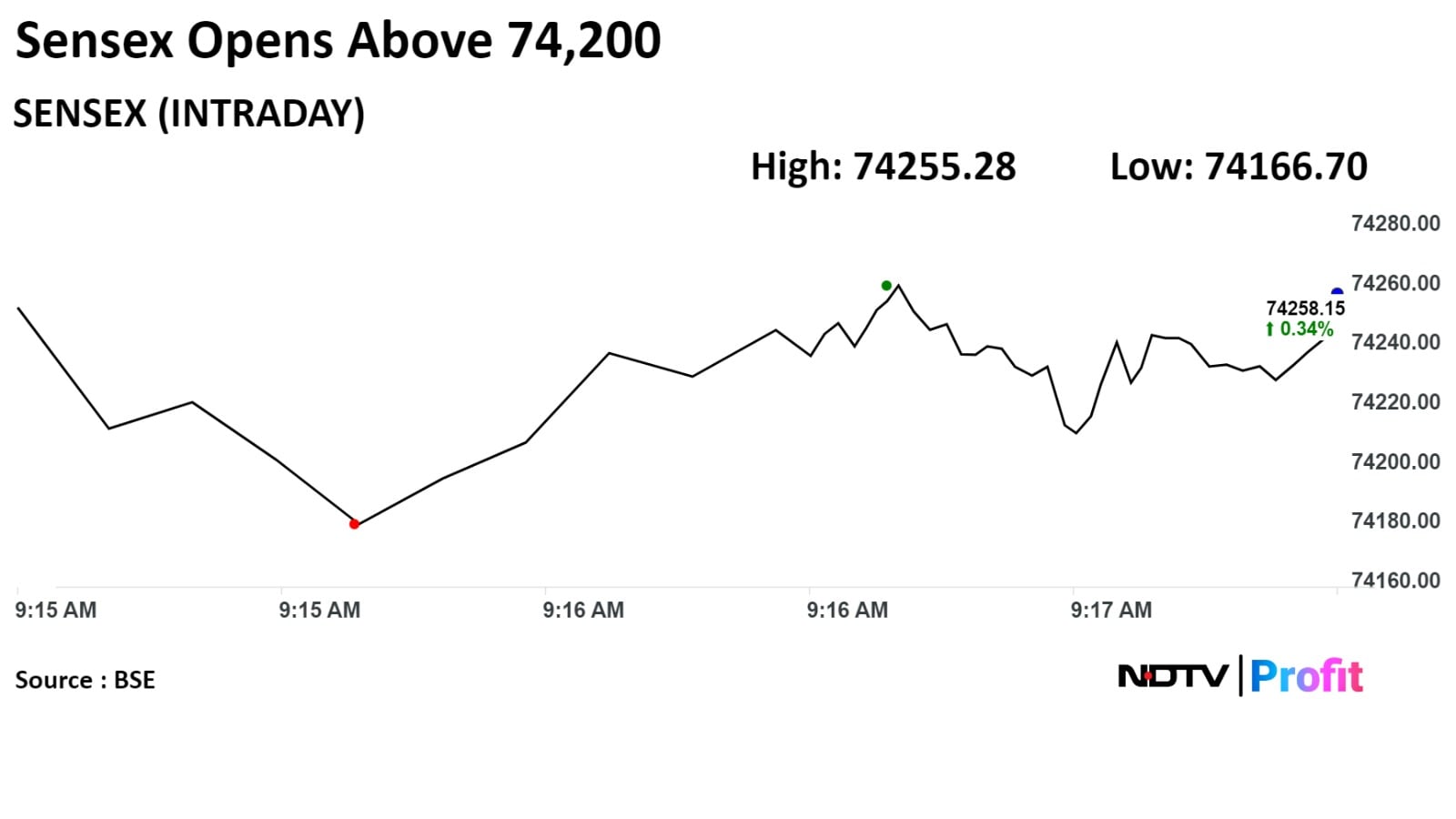

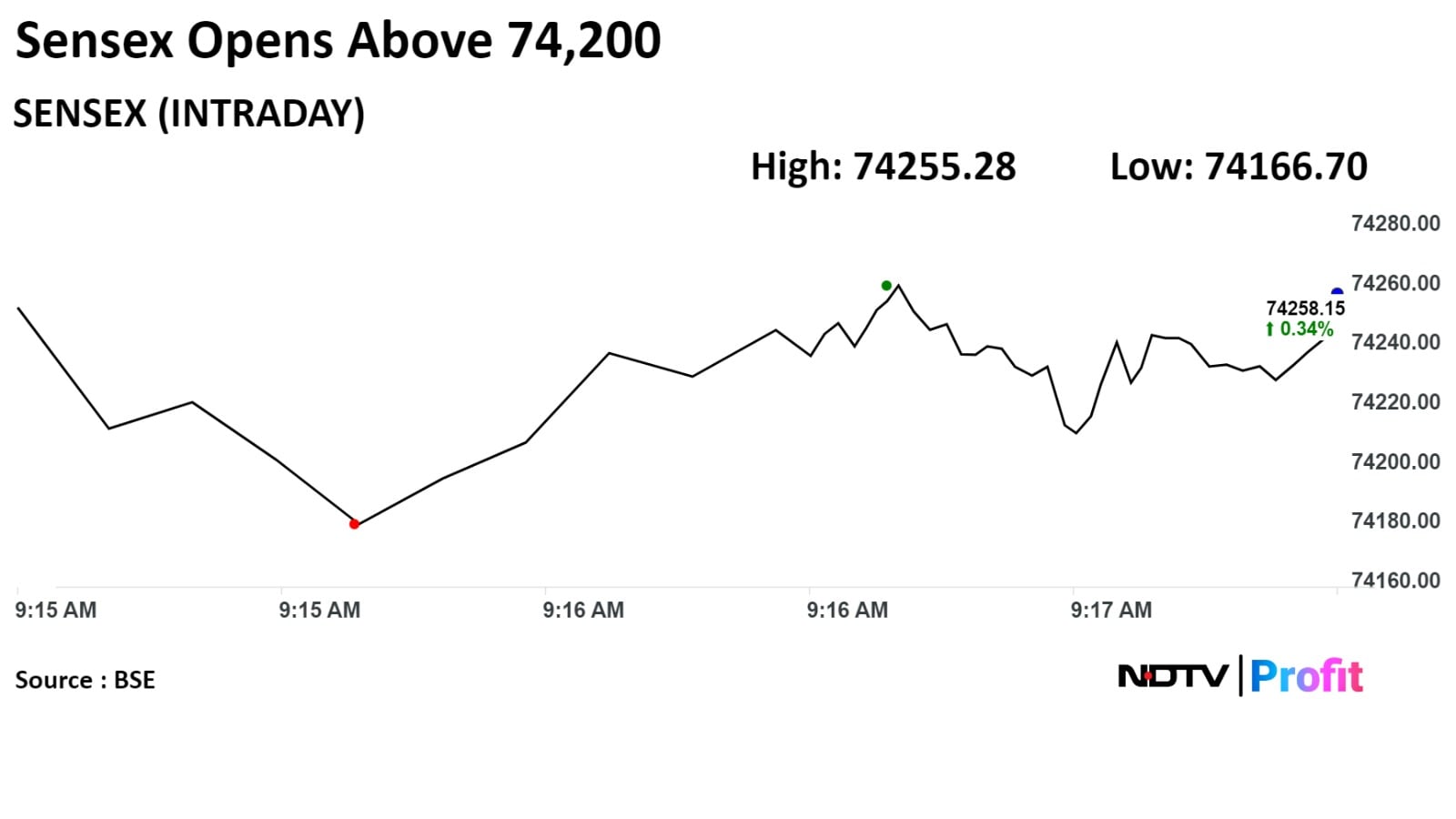

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

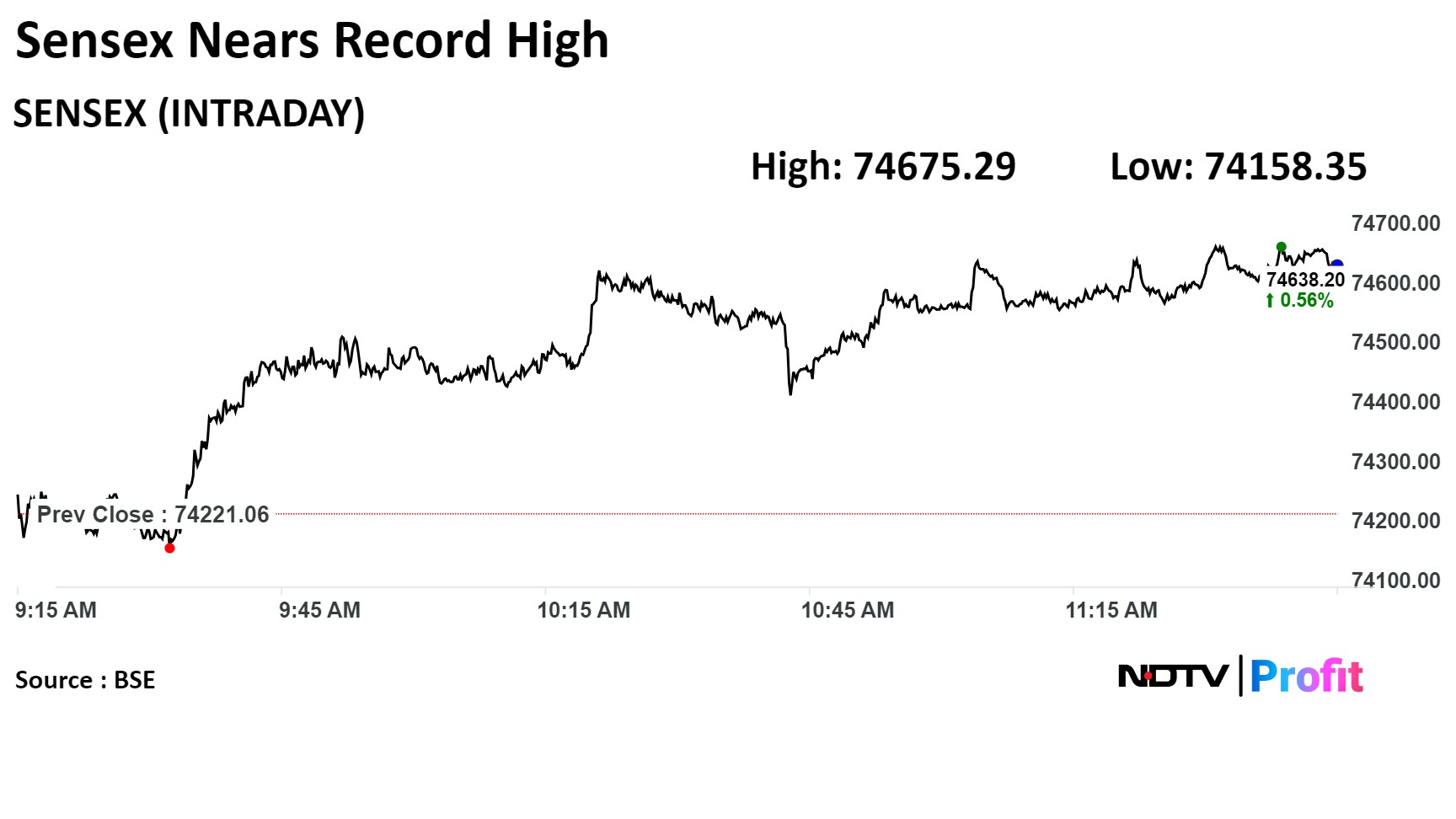

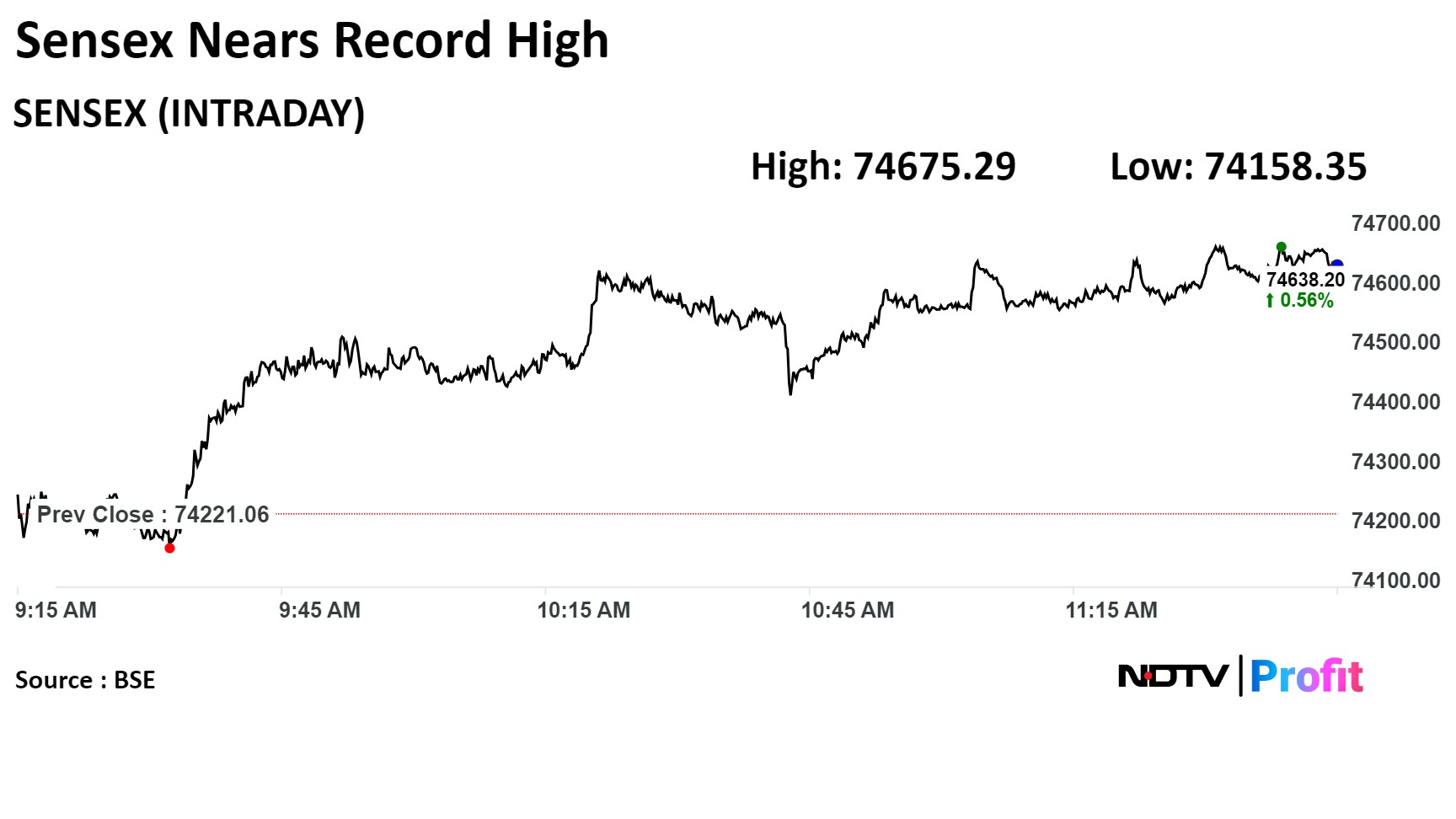

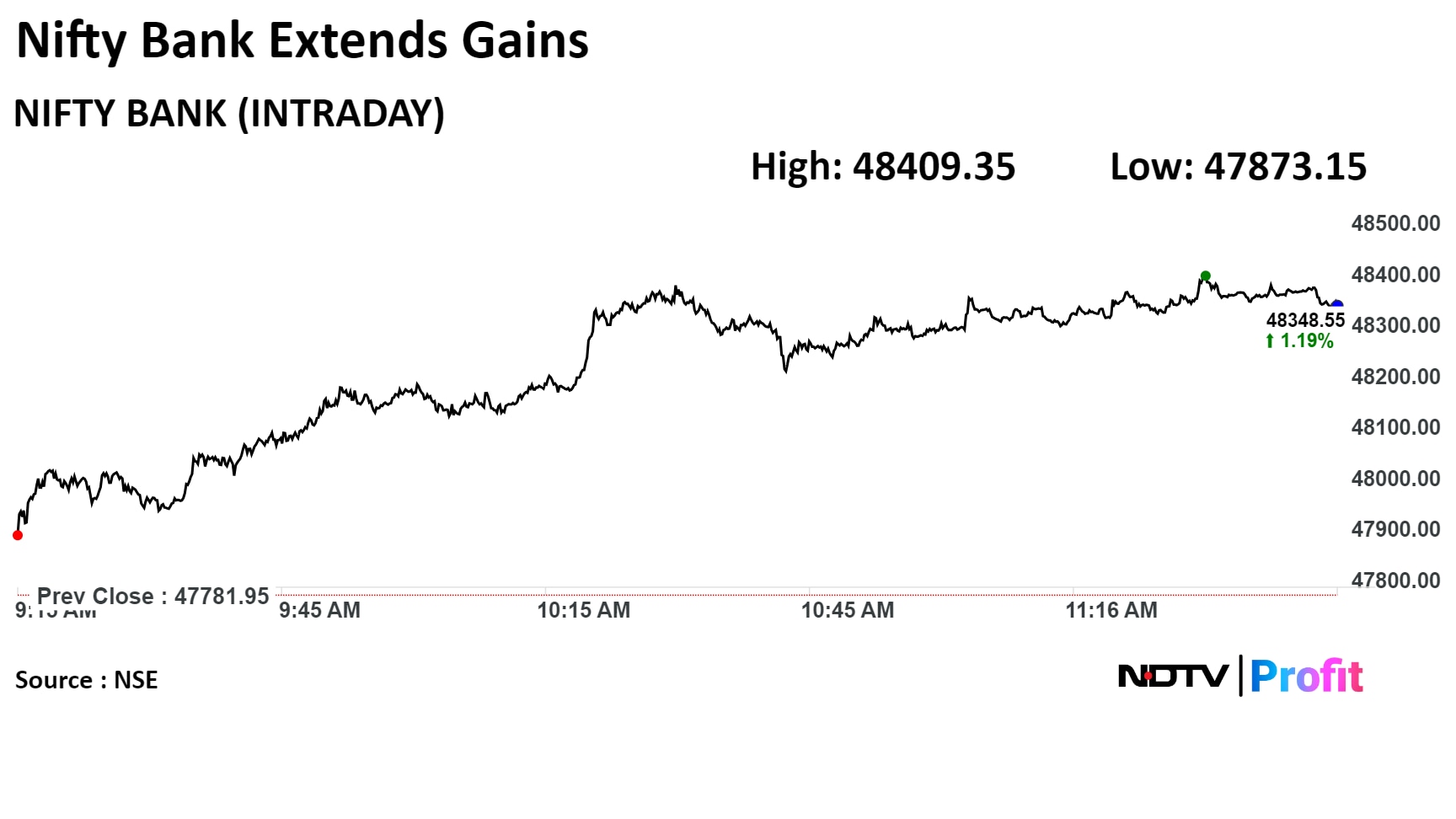

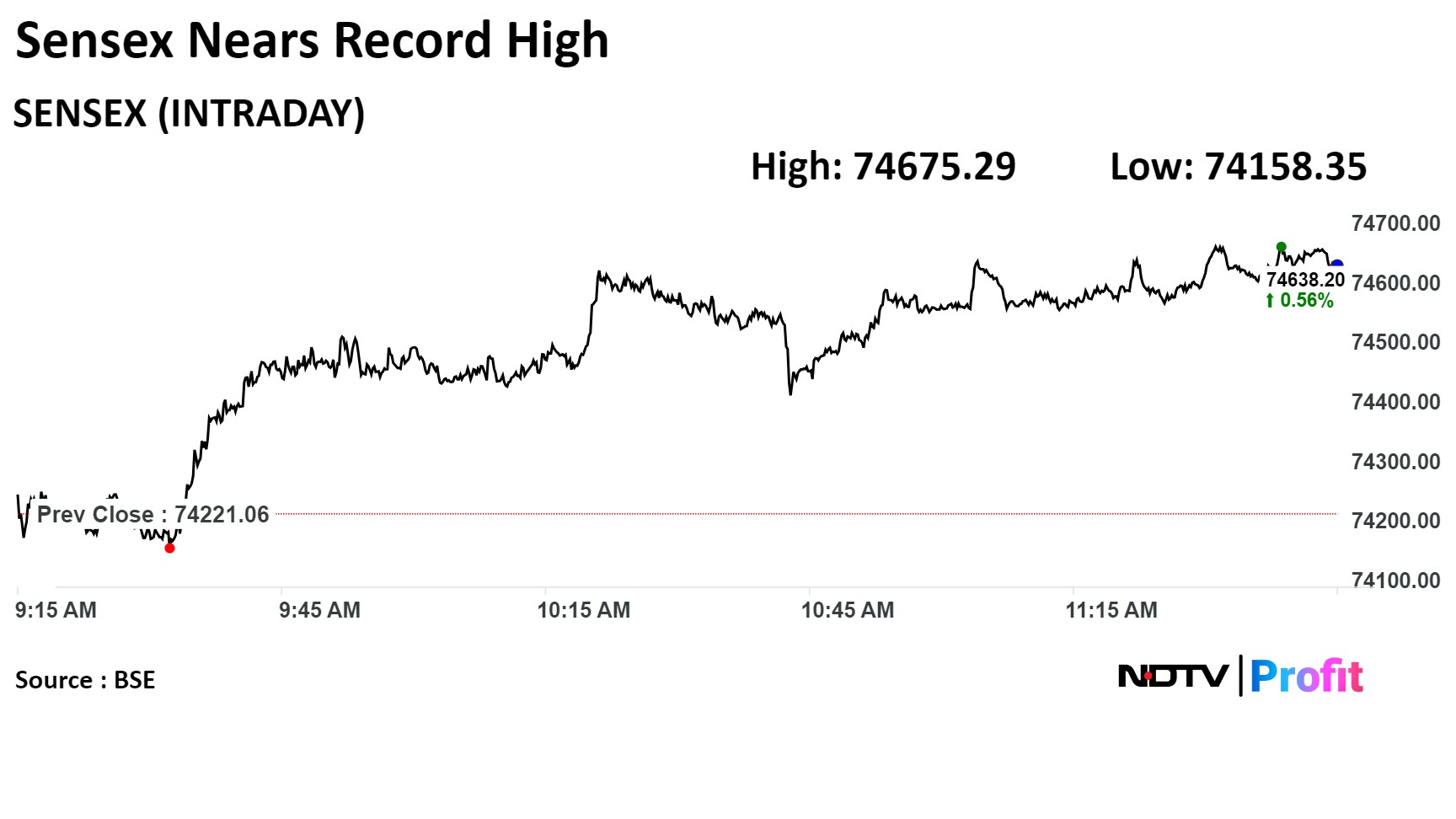

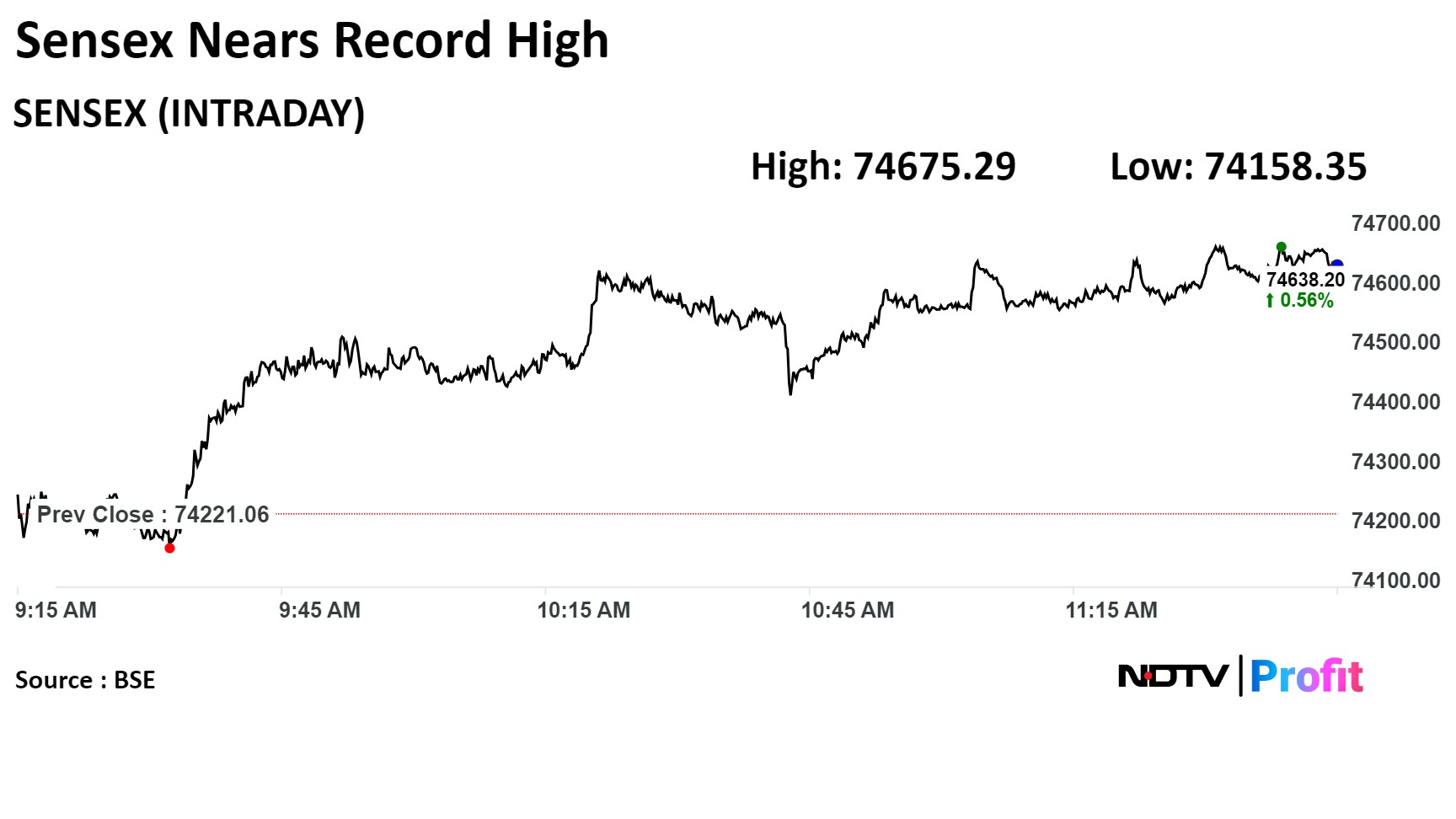

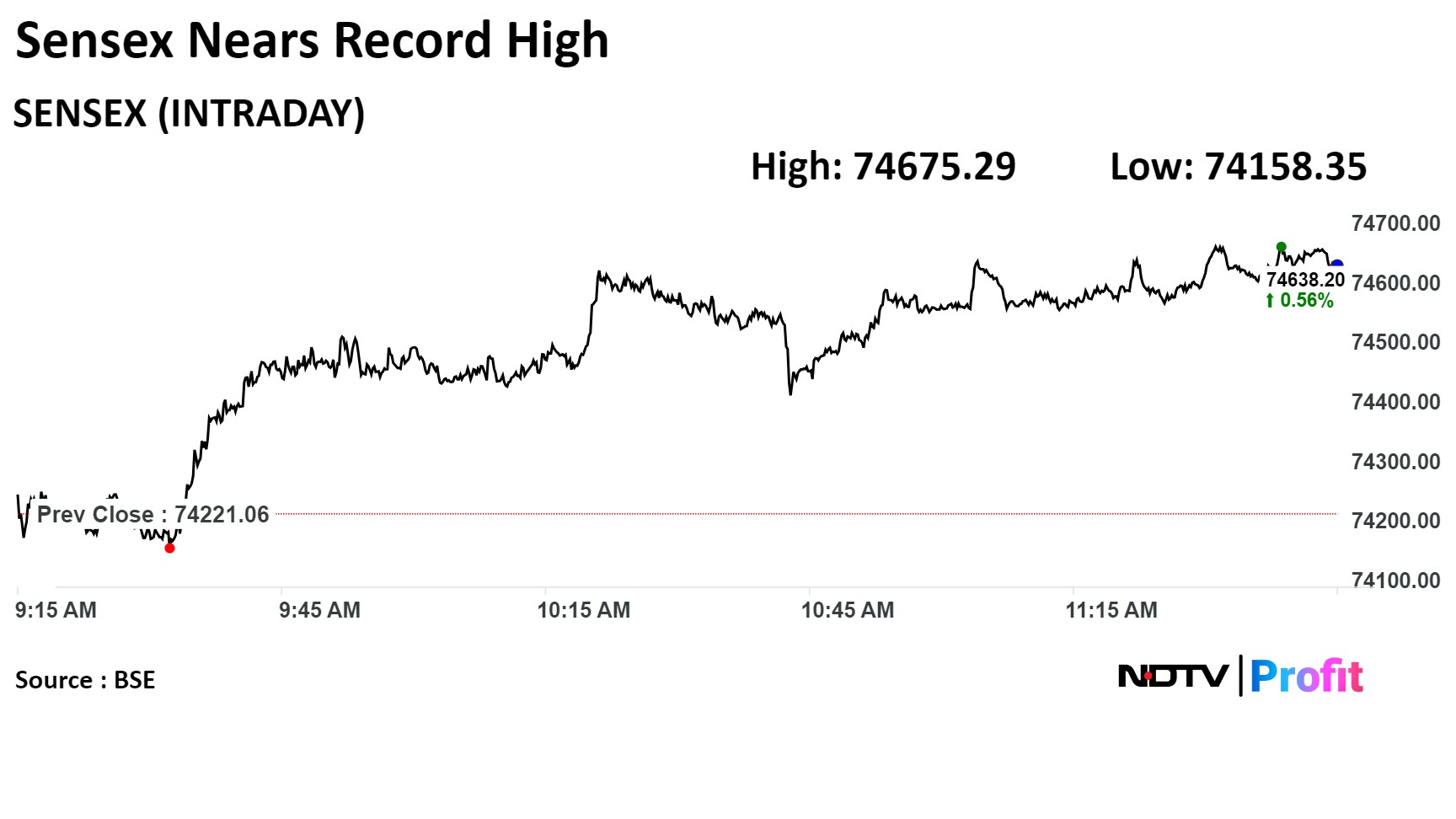

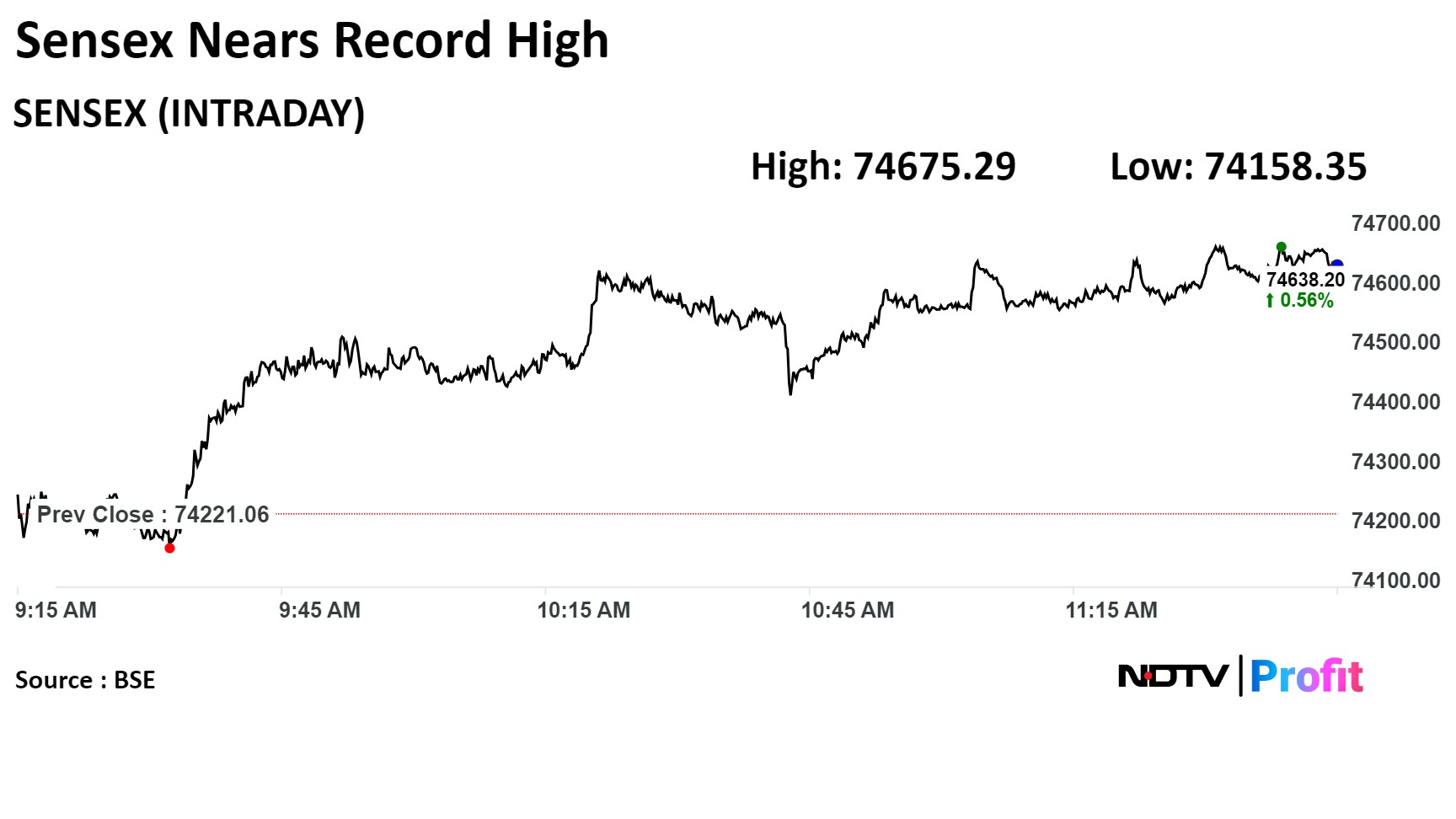

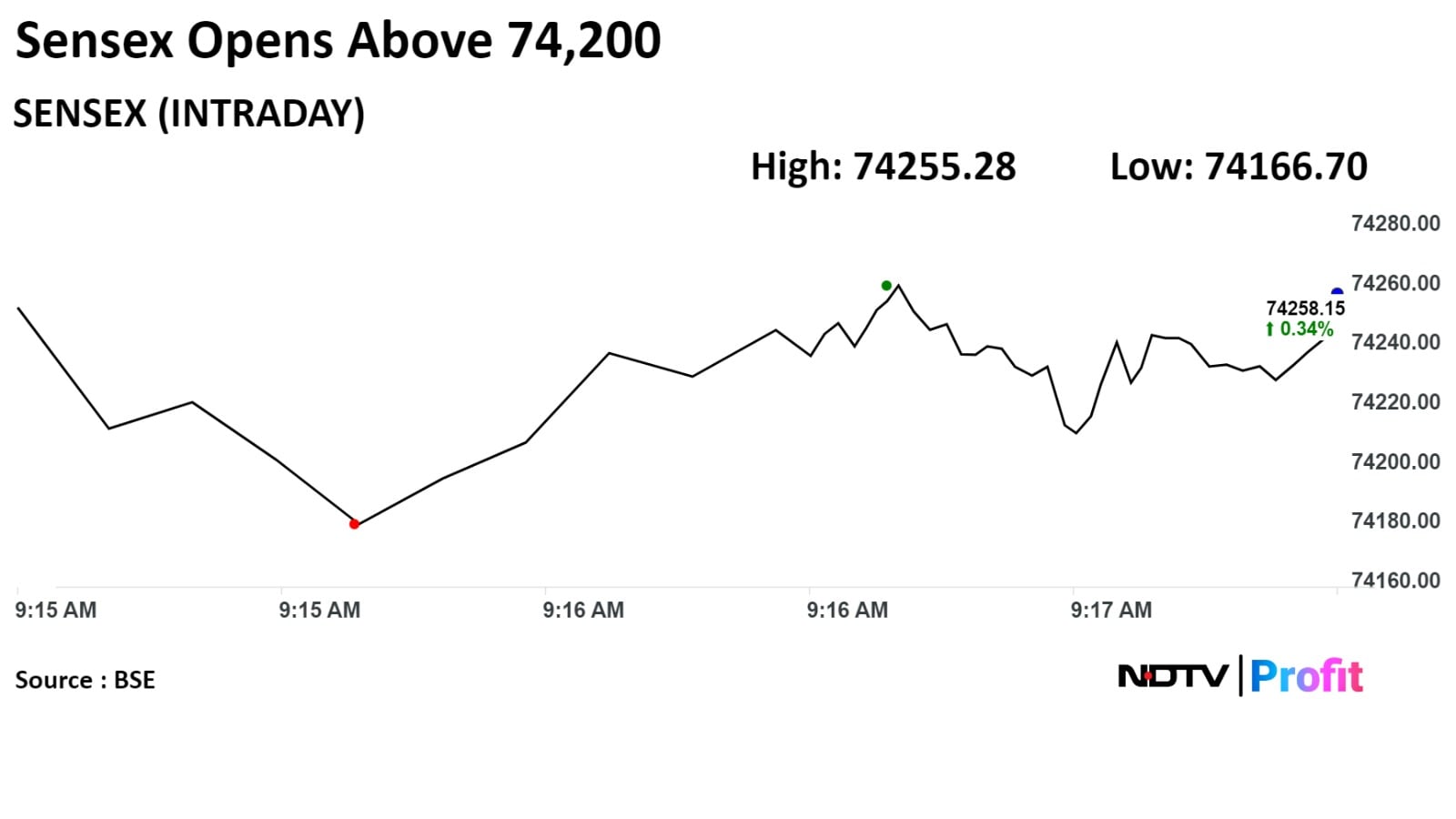

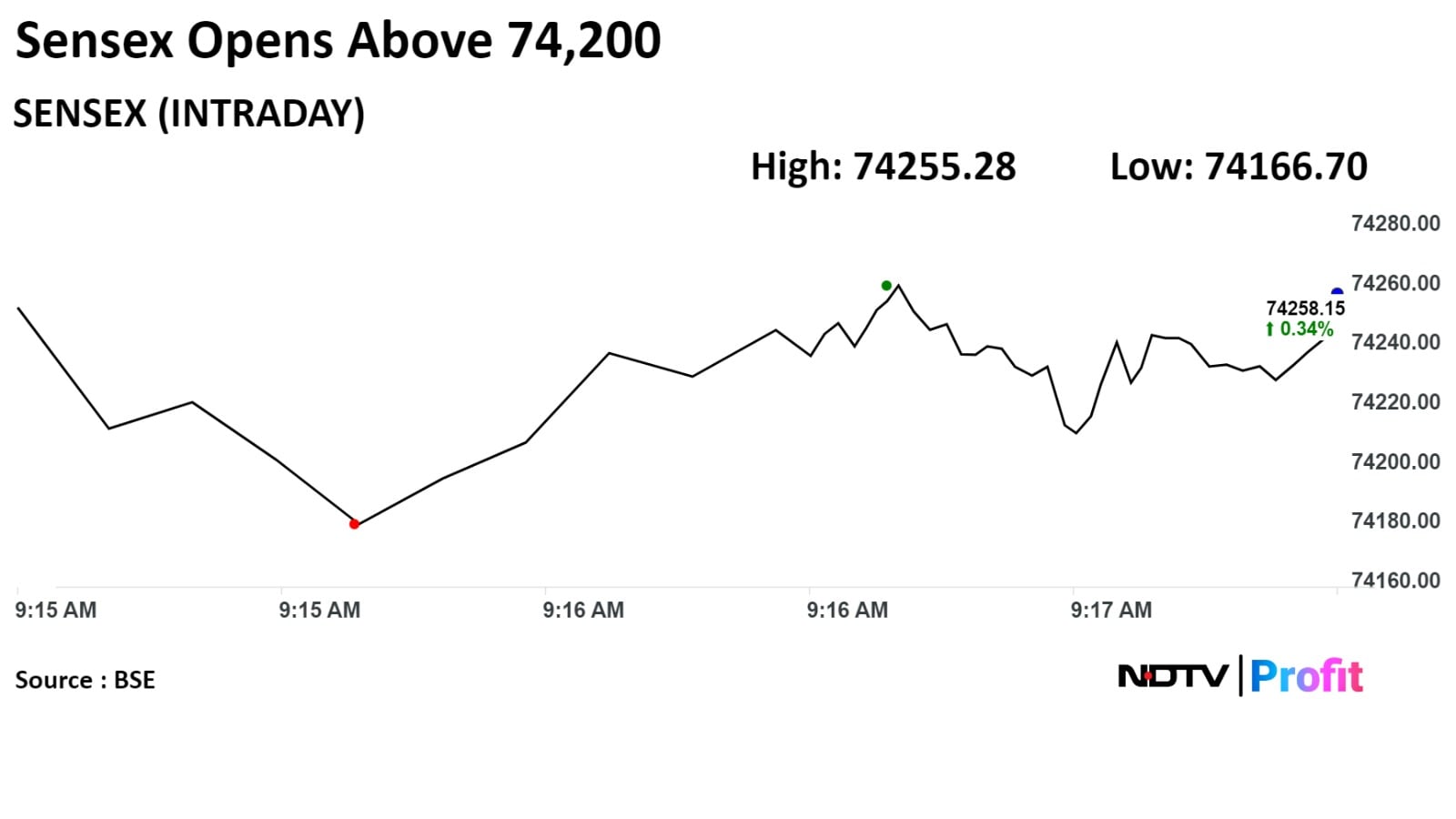

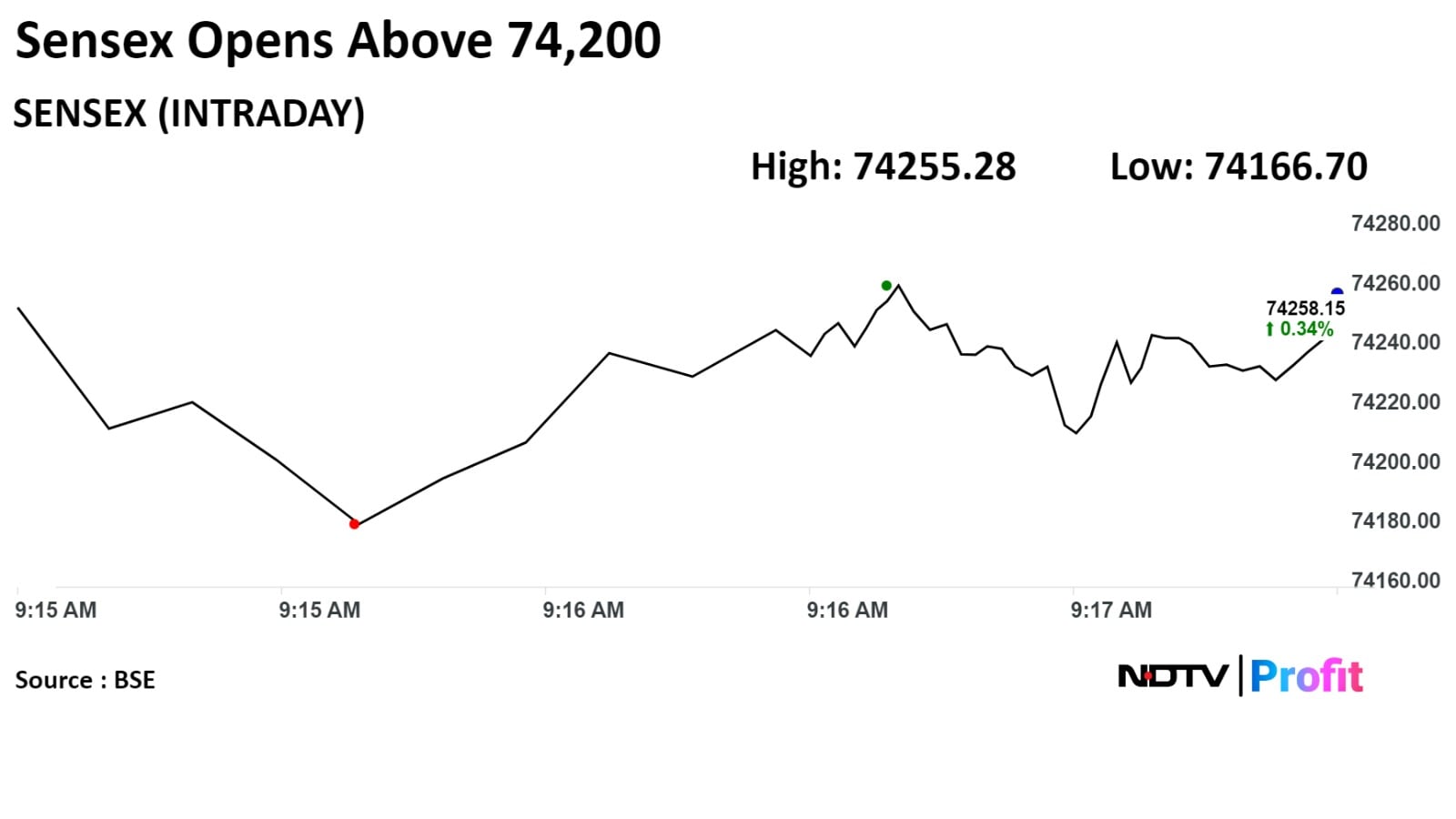

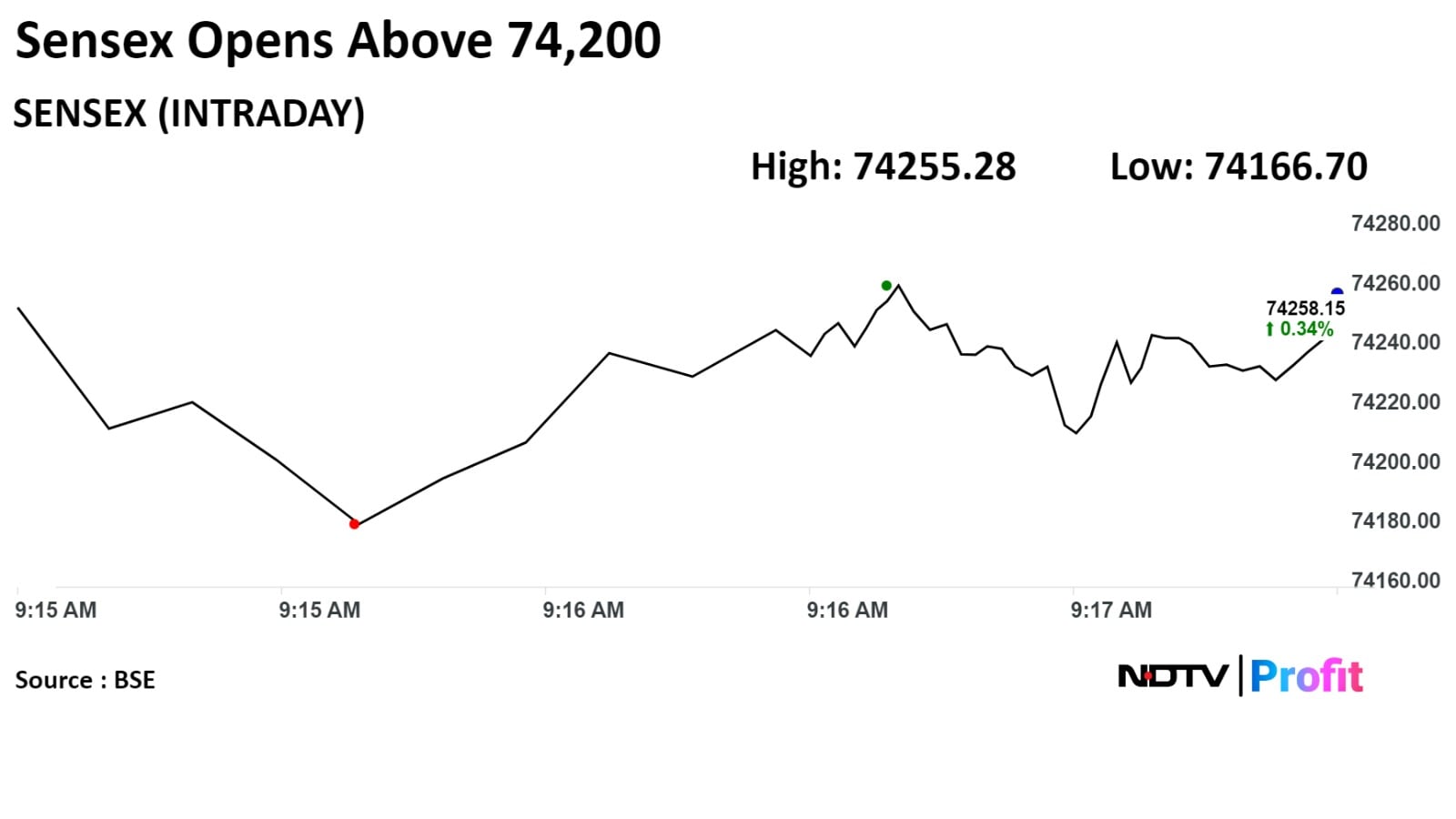

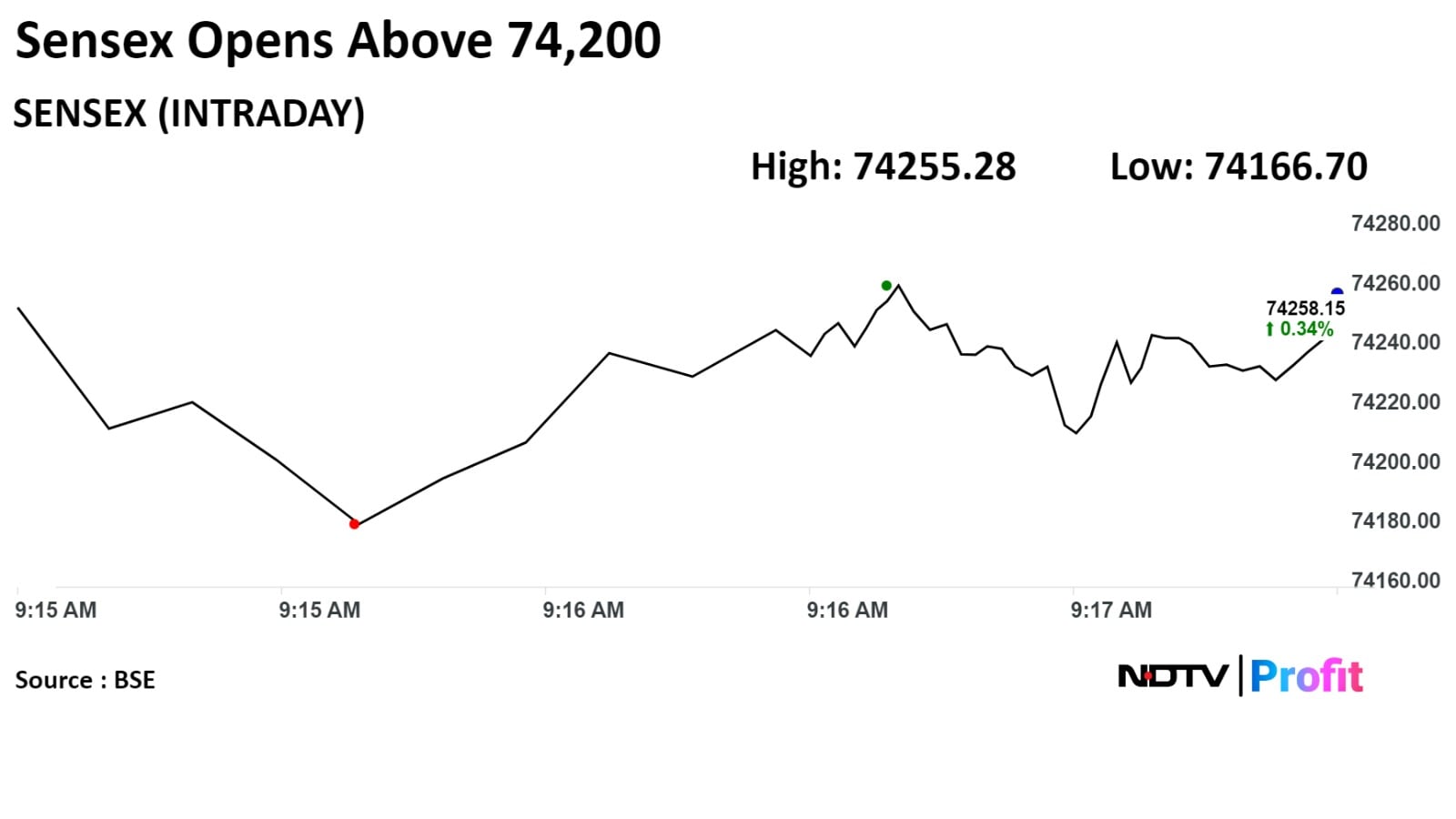

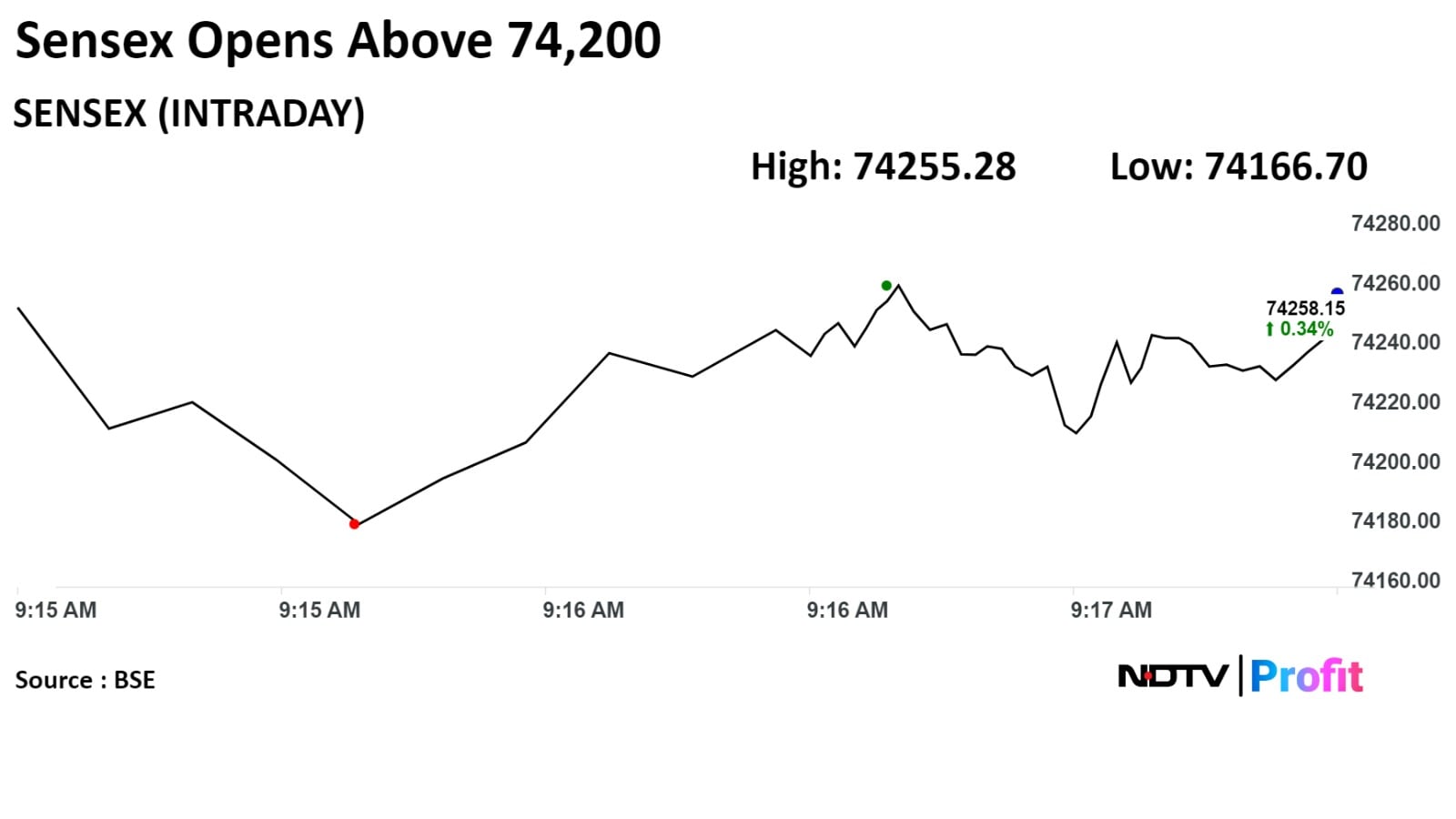

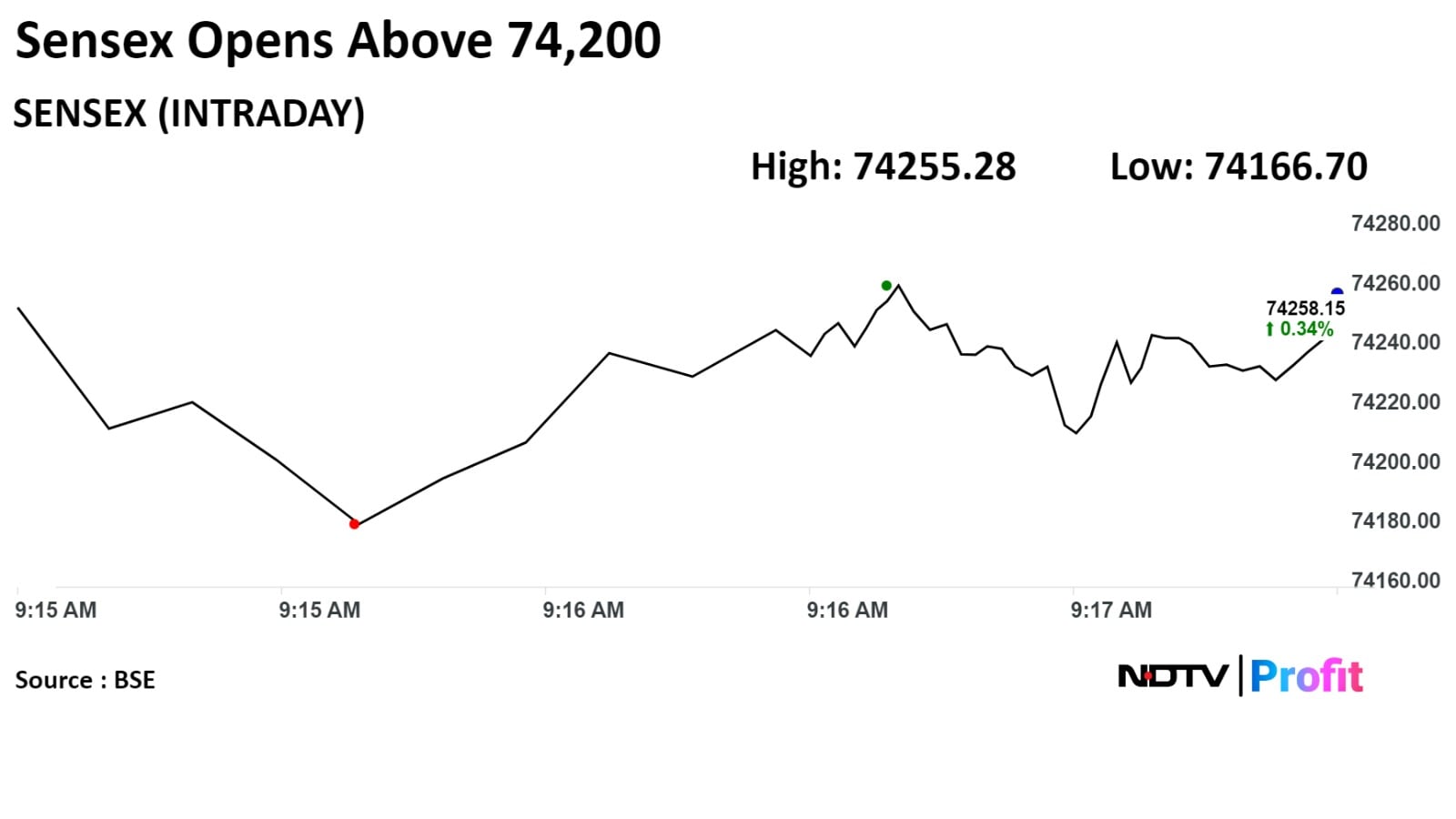

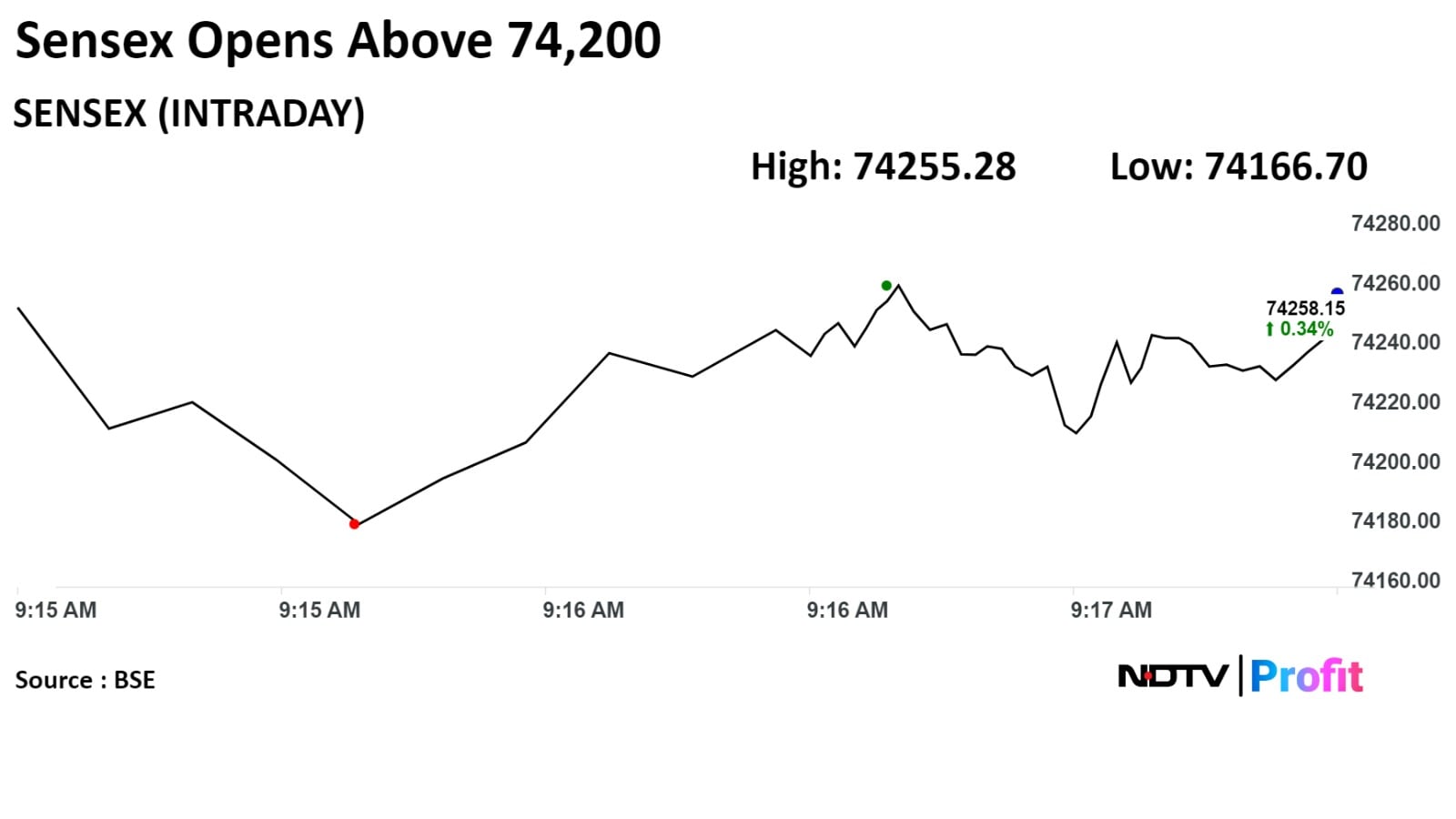

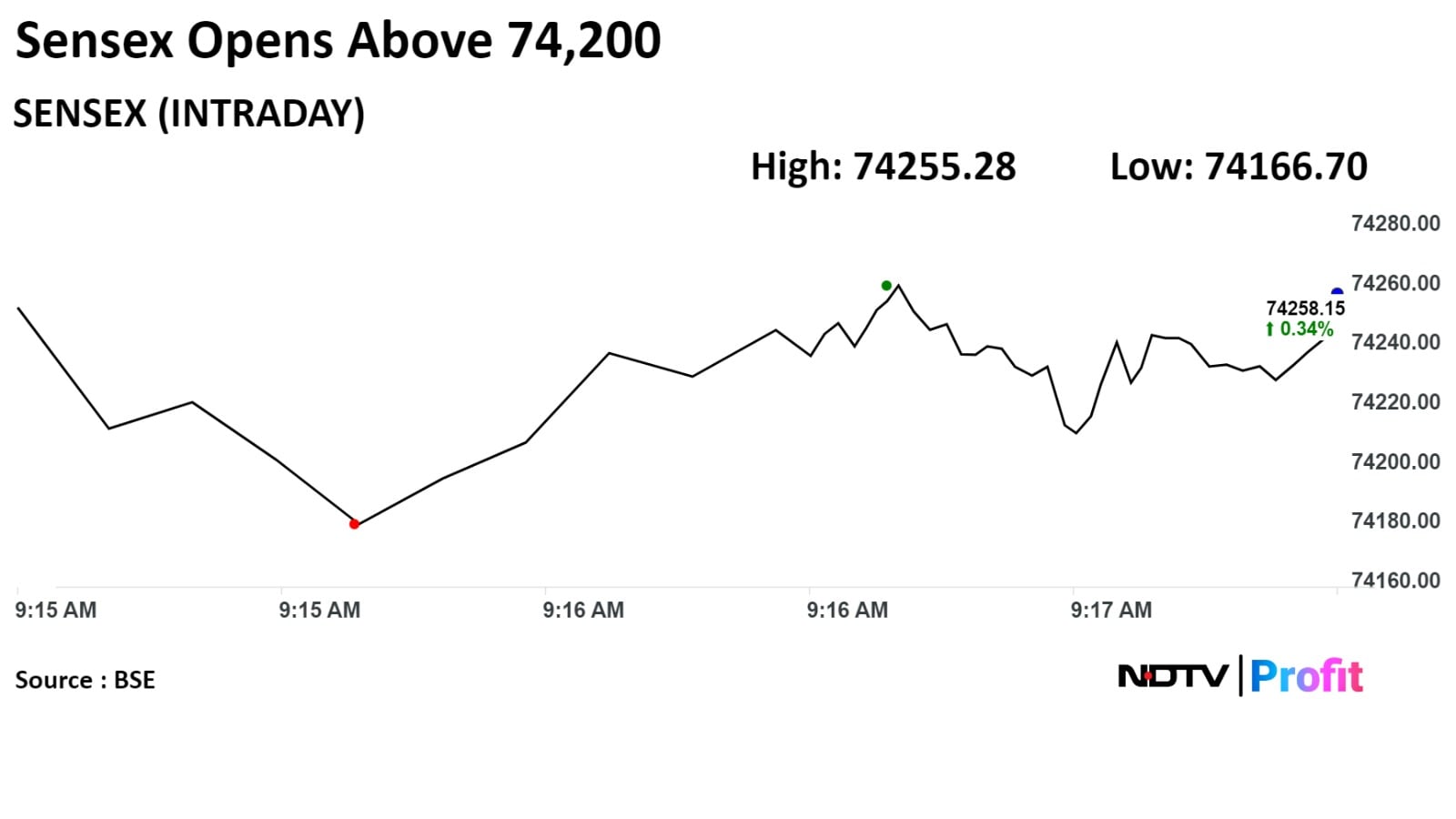

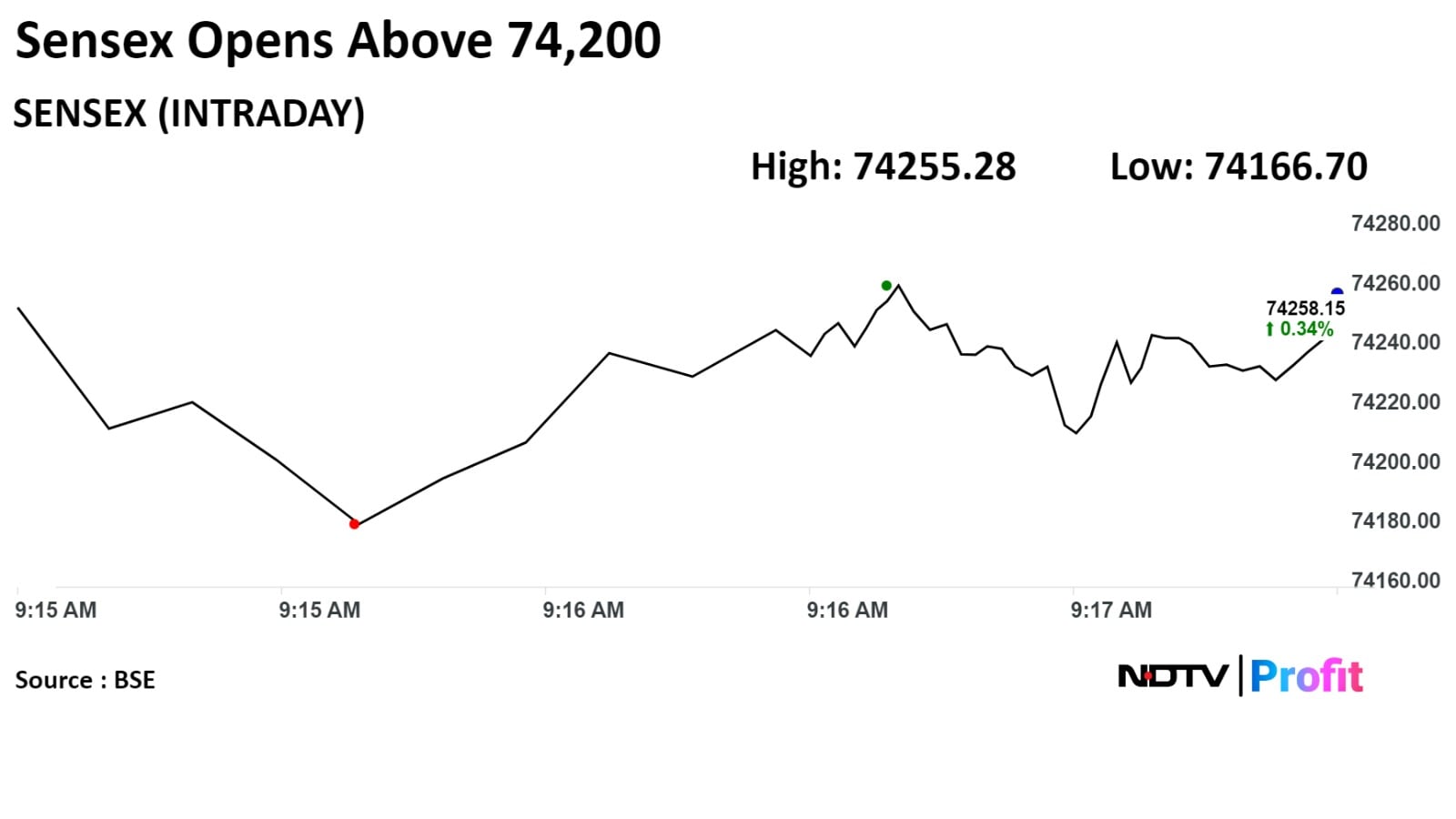

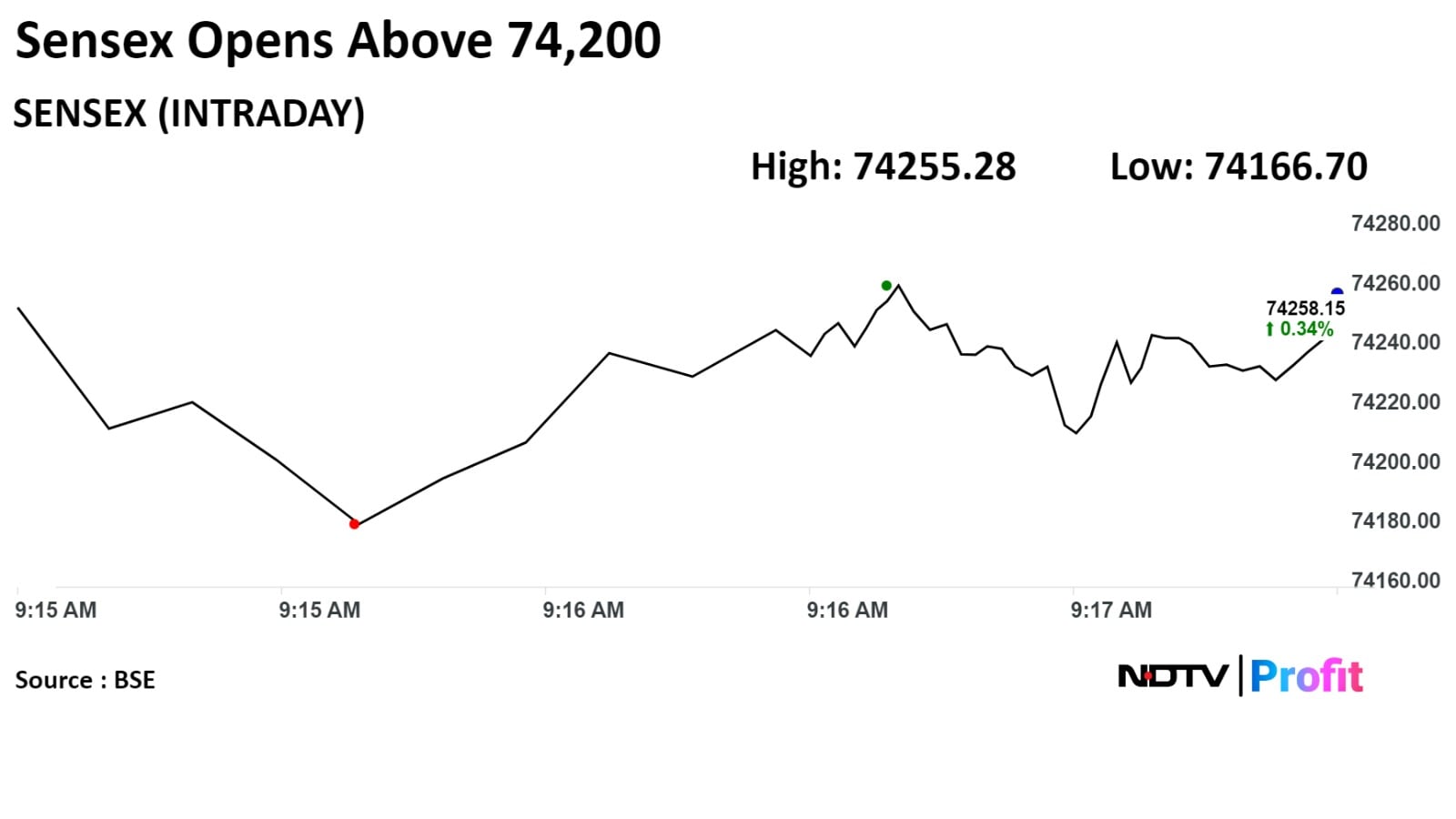

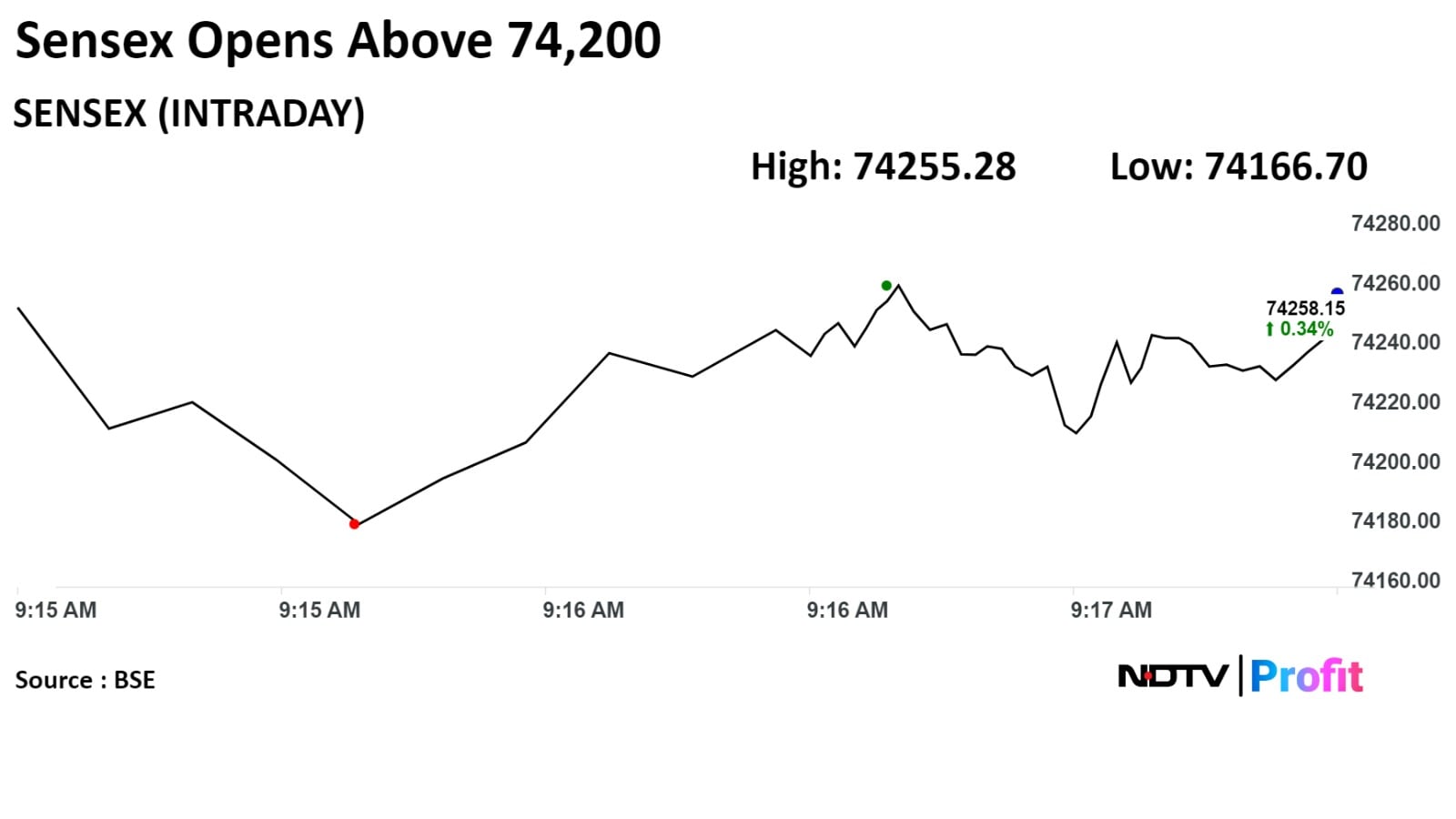

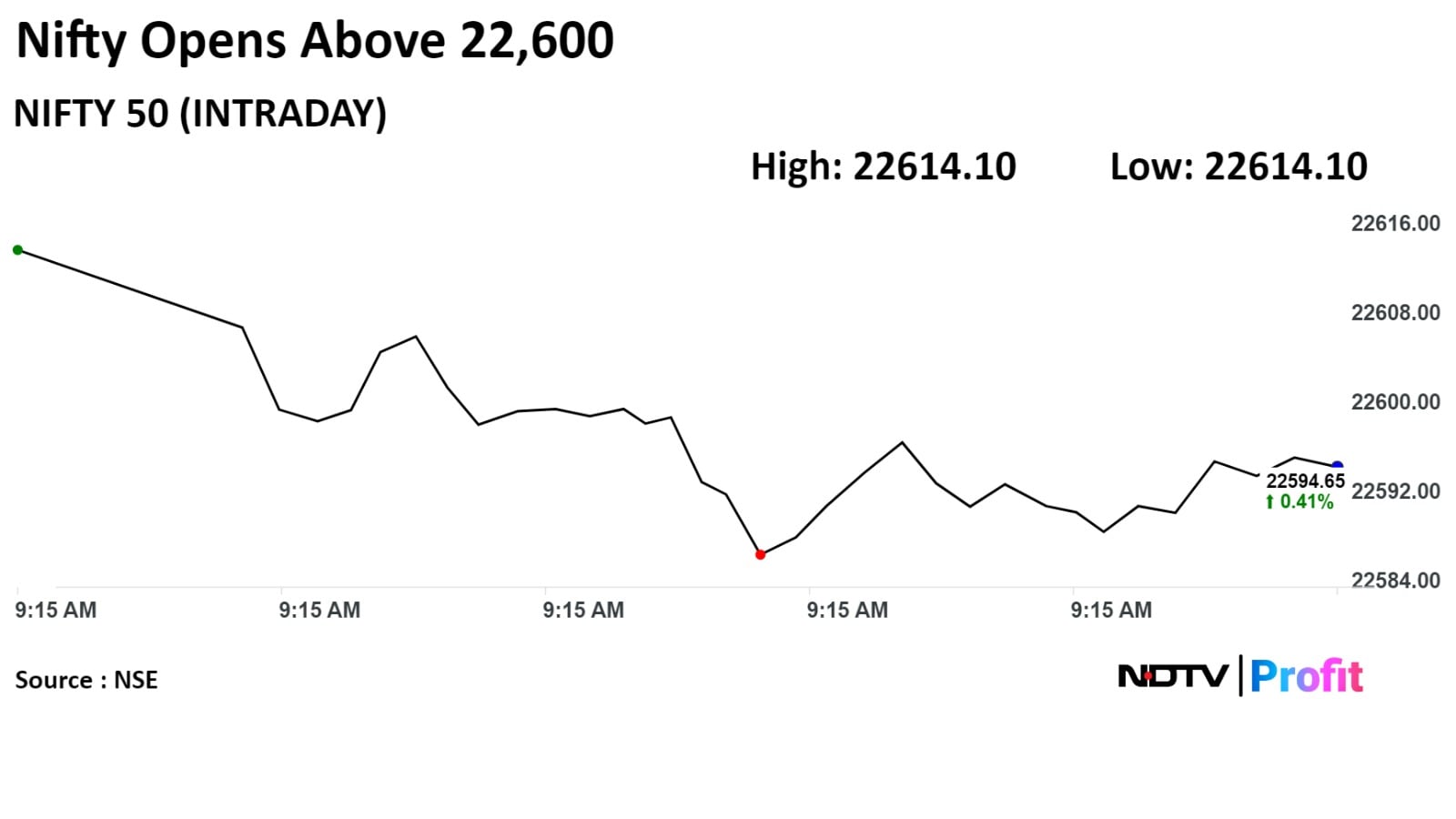

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

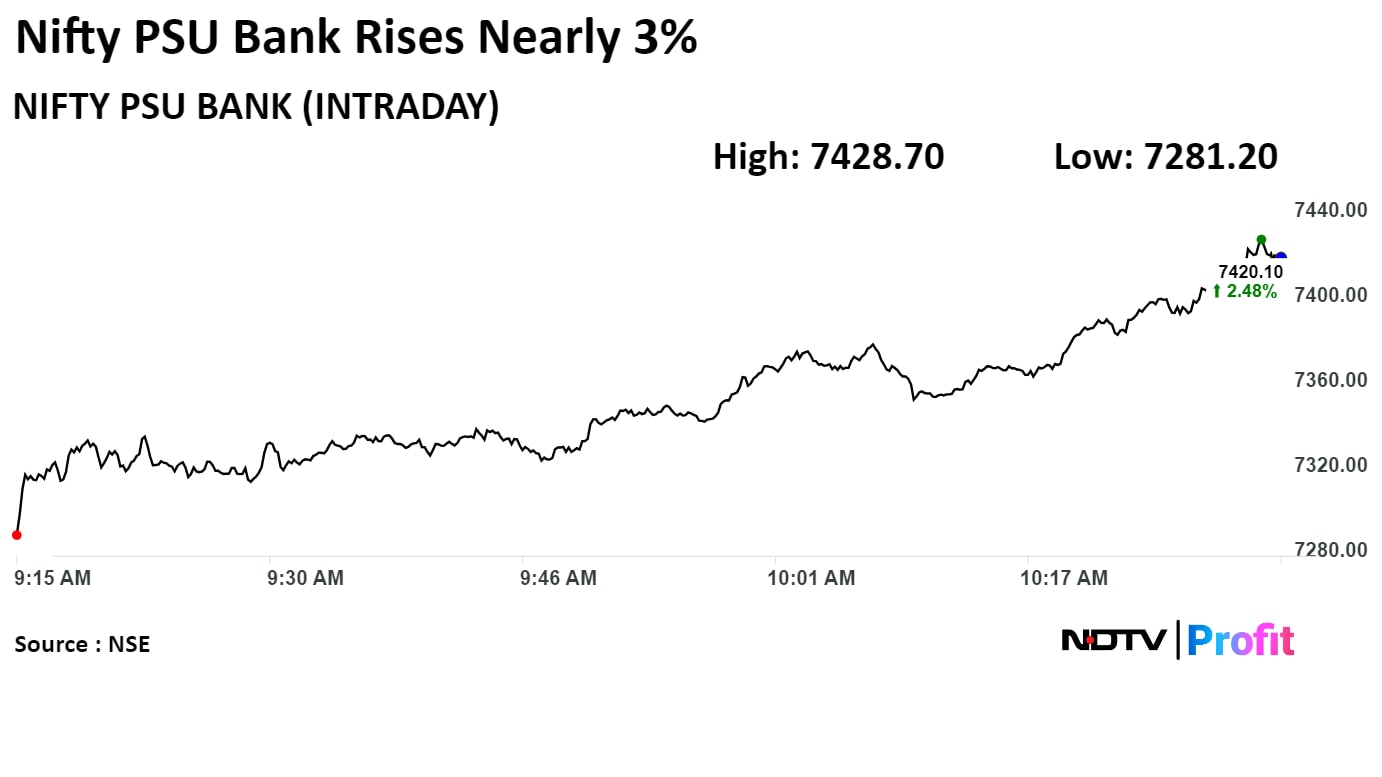

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

.jpeg)

"Bulls dominated today's trade and the Index kept on compounding its gains to end the weekly expiry trade at a record level of 22,967.65 with gains of 369.85 points," said Aditya Gaggar, director, Progressive Shares.

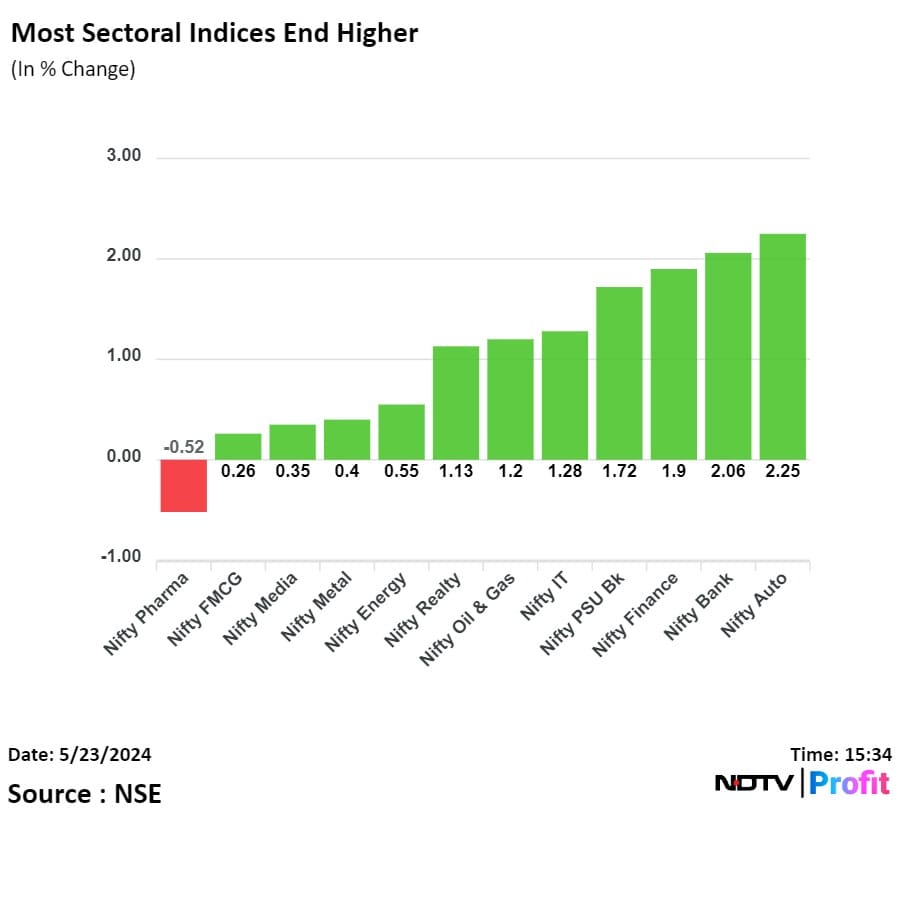

Barring Pharma, all sectors ended the session in green with Auto and BankNifty being the performers. Major buying was witnessed in the Index-based stocks, resulting in an underperformance by the Broader markets. On the daily chart, Nifty50 has given a breakout from an Ascending Triangle Formation, indicating a continuation of an uptrend with an approximate target of 23,850. Considering today's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support, he added.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

.jpeg)

"Bulls dominated today's trade and the Index kept on compounding its gains to end the weekly expiry trade at a record level of 22,967.65 with gains of 369.85 points," said Aditya Gaggar, director, Progressive Shares.

Barring Pharma, all sectors ended the session in green with Auto and BankNifty being the performers. Major buying was witnessed in the Index-based stocks, resulting in an underperformance by the Broader markets. On the daily chart, Nifty50 has given a breakout from an Ascending Triangle Formation, indicating a continuation of an uptrend with an approximate target of 23,850. Considering today's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support, he added.

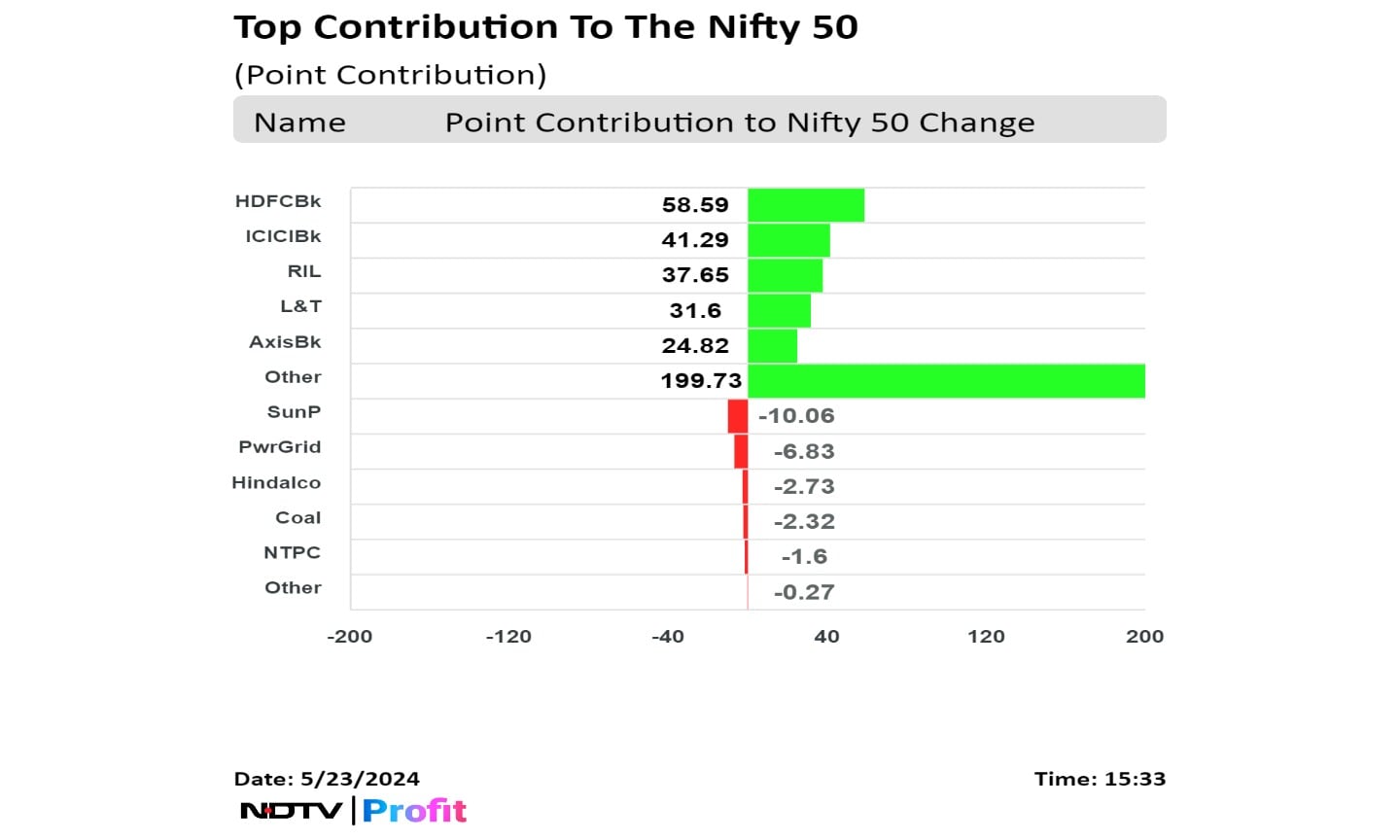

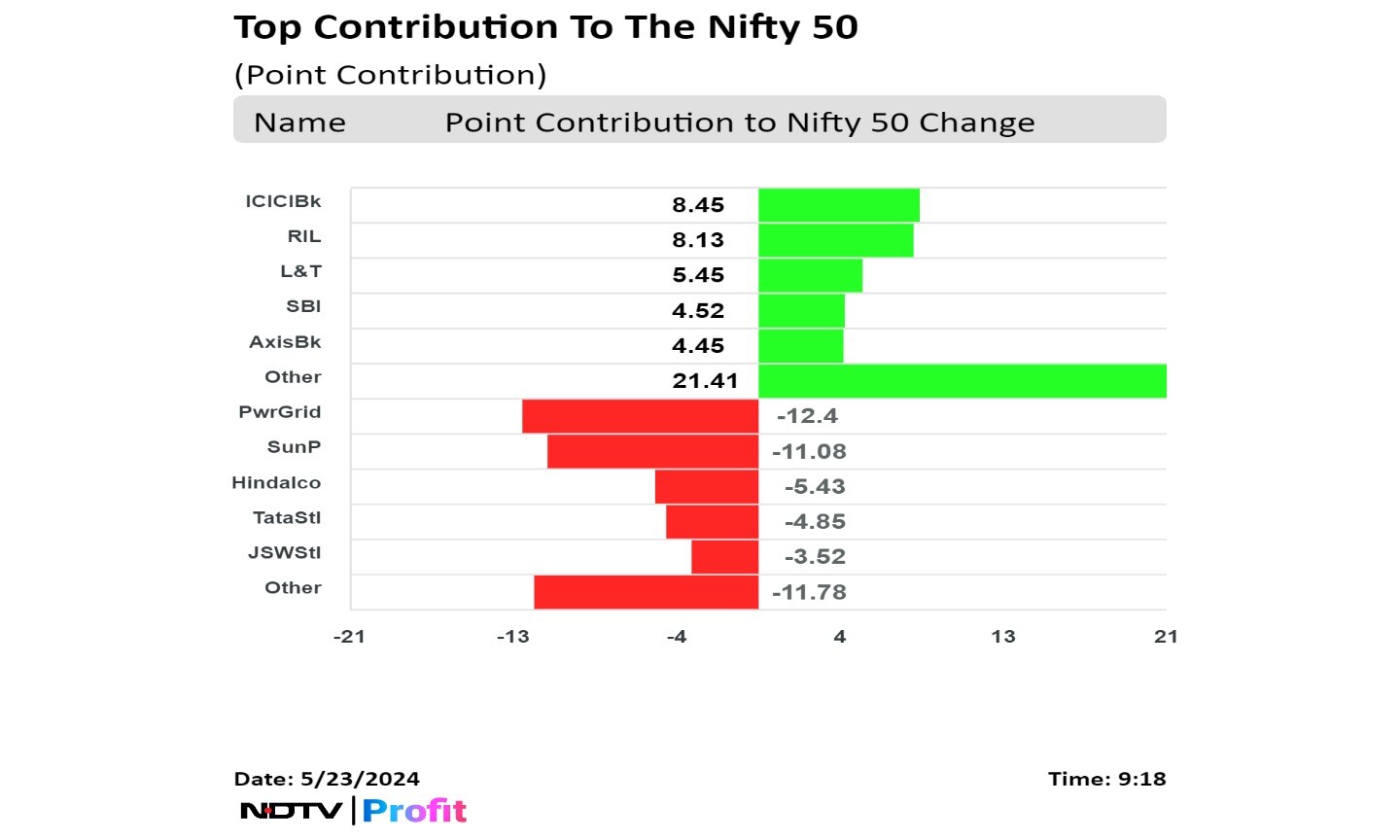

HDFC Bank Ltd., ICICI Bank Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., and Axis Bank Ltd. added to the index.

Sun Pharmaceutical Industries Ltd., Powergrid Corp of India Ltd., Hindalco Industries Ltd., Coal India Ltd., and NTPC Ltd. limited gains in the index.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

.jpeg)

"Bulls dominated today's trade and the Index kept on compounding its gains to end the weekly expiry trade at a record level of 22,967.65 with gains of 369.85 points," said Aditya Gaggar, director, Progressive Shares.

Barring Pharma, all sectors ended the session in green with Auto and BankNifty being the performers. Major buying was witnessed in the Index-based stocks, resulting in an underperformance by the Broader markets. On the daily chart, Nifty50 has given a breakout from an Ascending Triangle Formation, indicating a continuation of an uptrend with an approximate target of 23,850. Considering today's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support, he added.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

.jpeg)

"Bulls dominated today's trade and the Index kept on compounding its gains to end the weekly expiry trade at a record level of 22,967.65 with gains of 369.85 points," said Aditya Gaggar, director, Progressive Shares.

Barring Pharma, all sectors ended the session in green with Auto and BankNifty being the performers. Major buying was witnessed in the Index-based stocks, resulting in an underperformance by the Broader markets. On the daily chart, Nifty50 has given a breakout from an Ascending Triangle Formation, indicating a continuation of an uptrend with an approximate target of 23,850. Considering today's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support, he added.

HDFC Bank Ltd., ICICI Bank Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., and Axis Bank Ltd. added to the index.

Sun Pharmaceutical Industries Ltd., Powergrid Corp of India Ltd., Hindalco Industries Ltd., Coal India Ltd., and NTPC Ltd. limited gains in the index.

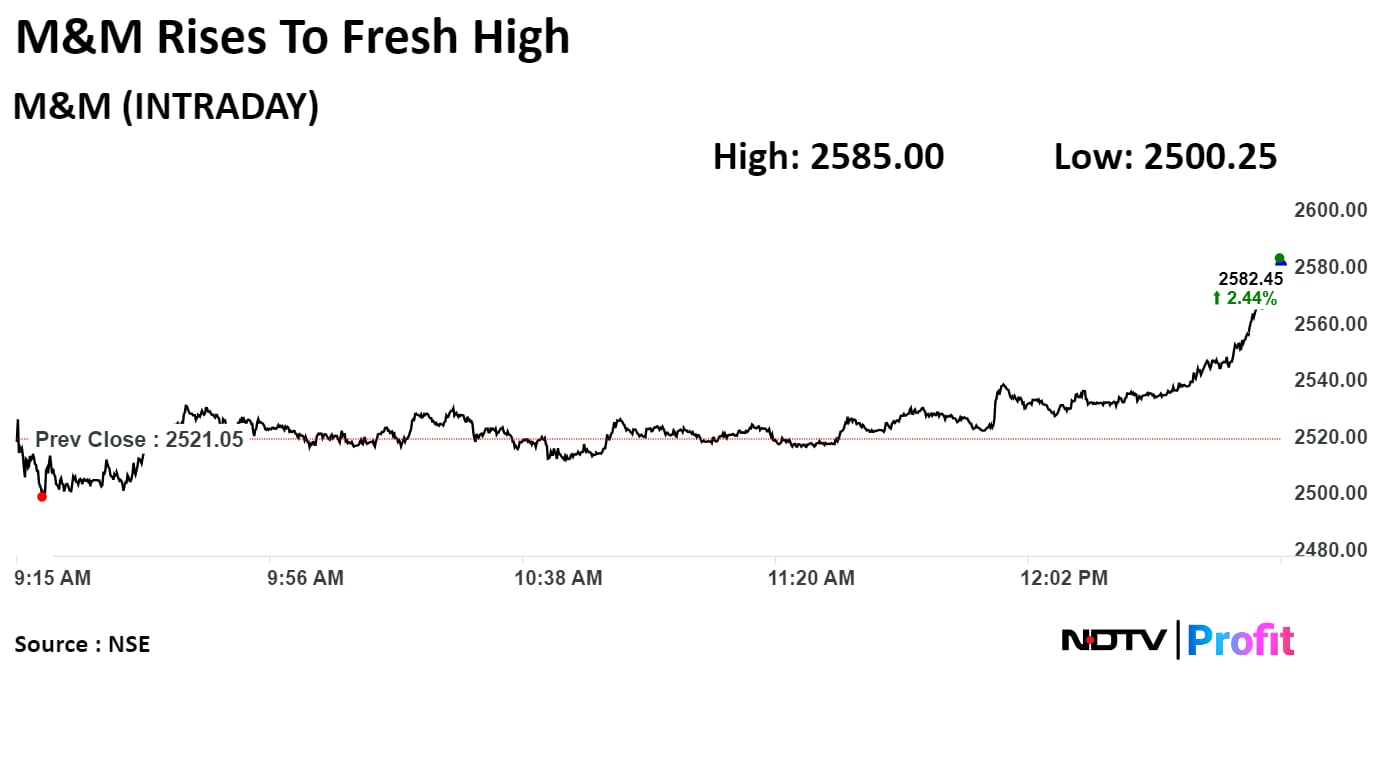

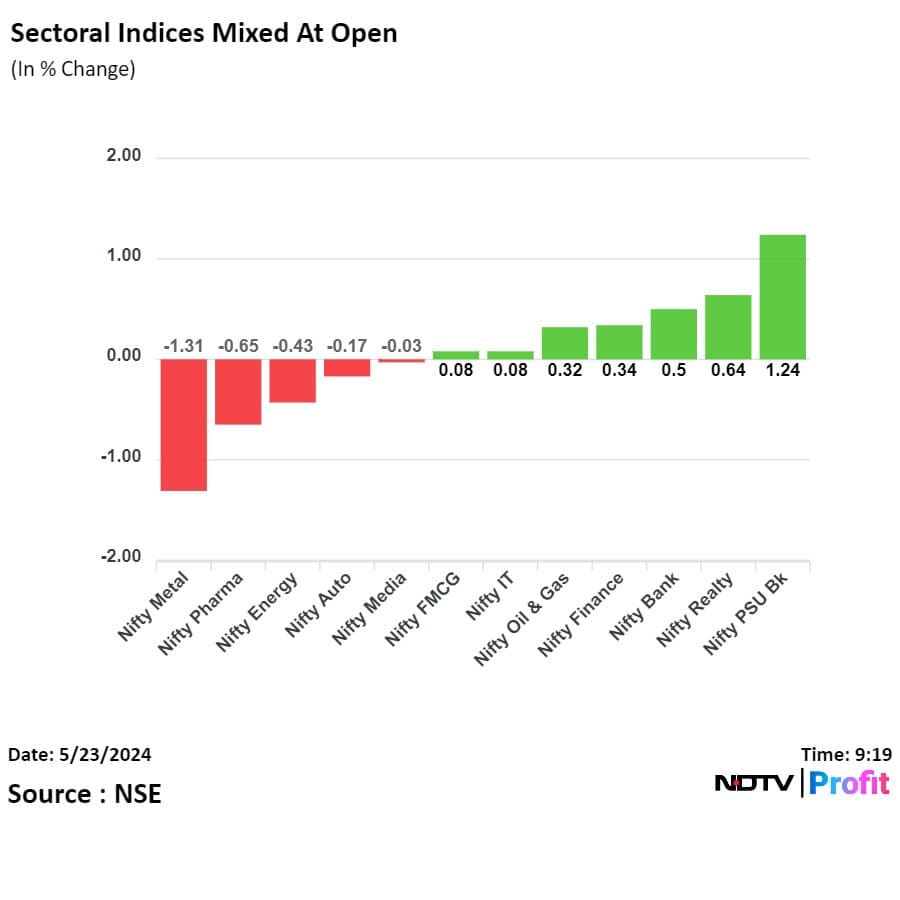

On NSE, 11 sectors advanced out of 12 with the NSE Nifty Auto rising over 2% to emerge as the top performing sector. The NSE Nifty Pharma sector was the top loser on Thursday.

Earlier in the day, the NSE Nifty Auto rose to 2.36% to record high of 23,874.75.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

.jpeg)

"Bulls dominated today's trade and the Index kept on compounding its gains to end the weekly expiry trade at a record level of 22,967.65 with gains of 369.85 points," said Aditya Gaggar, director, Progressive Shares.

Barring Pharma, all sectors ended the session in green with Auto and BankNifty being the performers. Major buying was witnessed in the Index-based stocks, resulting in an underperformance by the Broader markets. On the daily chart, Nifty50 has given a breakout from an Ascending Triangle Formation, indicating a continuation of an uptrend with an approximate target of 23,850. Considering today's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support, he added.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

.jpeg)

"Bulls dominated today's trade and the Index kept on compounding its gains to end the weekly expiry trade at a record level of 22,967.65 with gains of 369.85 points," said Aditya Gaggar, director, Progressive Shares.

Barring Pharma, all sectors ended the session in green with Auto and BankNifty being the performers. Major buying was witnessed in the Index-based stocks, resulting in an underperformance by the Broader markets. On the daily chart, Nifty50 has given a breakout from an Ascending Triangle Formation, indicating a continuation of an uptrend with an approximate target of 23,850. Considering today's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support, he added.

HDFC Bank Ltd., ICICI Bank Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., and Axis Bank Ltd. added to the index.

Sun Pharmaceutical Industries Ltd., Powergrid Corp of India Ltd., Hindalco Industries Ltd., Coal India Ltd., and NTPC Ltd. limited gains in the index.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

.jpeg)

"Bulls dominated today's trade and the Index kept on compounding its gains to end the weekly expiry trade at a record level of 22,967.65 with gains of 369.85 points," said Aditya Gaggar, director, Progressive Shares.

Barring Pharma, all sectors ended the session in green with Auto and BankNifty being the performers. Major buying was witnessed in the Index-based stocks, resulting in an underperformance by the Broader markets. On the daily chart, Nifty50 has given a breakout from an Ascending Triangle Formation, indicating a continuation of an uptrend with an approximate target of 23,850. Considering today's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support, he added.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

India's benchmark indices ended at record high level tracking sharp gains in informational technology, and financial services stocks.

The NSE Nifty 50 settled 369.85 points or 1.64% up at the highest closing level of 22,967.65. The S&P BSE Sensex ended 1,196.98 points or 1.61% up at 75,418.04, the highest closing.

HDFC Bank Ltd., Reliance Industries Ltd., and ICICI Bank Ltd. were the top gainers in the benchmarks on Thursday.

The NSE Nifty 50 gained 1.75% or 395.80 points to record high level of 22,993.60. The intraday percentage gain is the highest since March 28, when the index posted 1.77% gain.

The S&P BSE Sensex rose 1.72% or 1,278.85 points to fresh high of 75,499.91. The index posted the biggest intraday rise since January 29.

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

.jpeg)

"Bulls dominated today's trade and the Index kept on compounding its gains to end the weekly expiry trade at a record level of 22,967.65 with gains of 369.85 points," said Aditya Gaggar, director, Progressive Shares.

Barring Pharma, all sectors ended the session in green with Auto and BankNifty being the performers. Major buying was witnessed in the Index-based stocks, resulting in an underperformance by the Broader markets. On the daily chart, Nifty50 has given a breakout from an Ascending Triangle Formation, indicating a continuation of an uptrend with an approximate target of 23,850. Considering today's sharp uptick, we expect a pullback in the Index where a level of 22,780 will be considered as immediate support, he added.

HDFC Bank Ltd., ICICI Bank Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., and Axis Bank Ltd. added to the index.

Sun Pharmaceutical Industries Ltd., Powergrid Corp of India Ltd., Hindalco Industries Ltd., Coal India Ltd., and NTPC Ltd. limited gains in the index.

On NSE, 11 sectors advanced out of 12 with the NSE Nifty Auto rising over 2% to emerge as the top performing sector. The NSE Nifty Pharma sector was the top loser on Thursday.

Earlier in the day, the NSE Nifty Auto rose to 2.36% to record high of 23,874.75.

On BSE, 18 sectors advanced out of 20, and two declined. The S&P BSE Auto was the top performing sector, and the S&P BSE Healthcare fell the most.

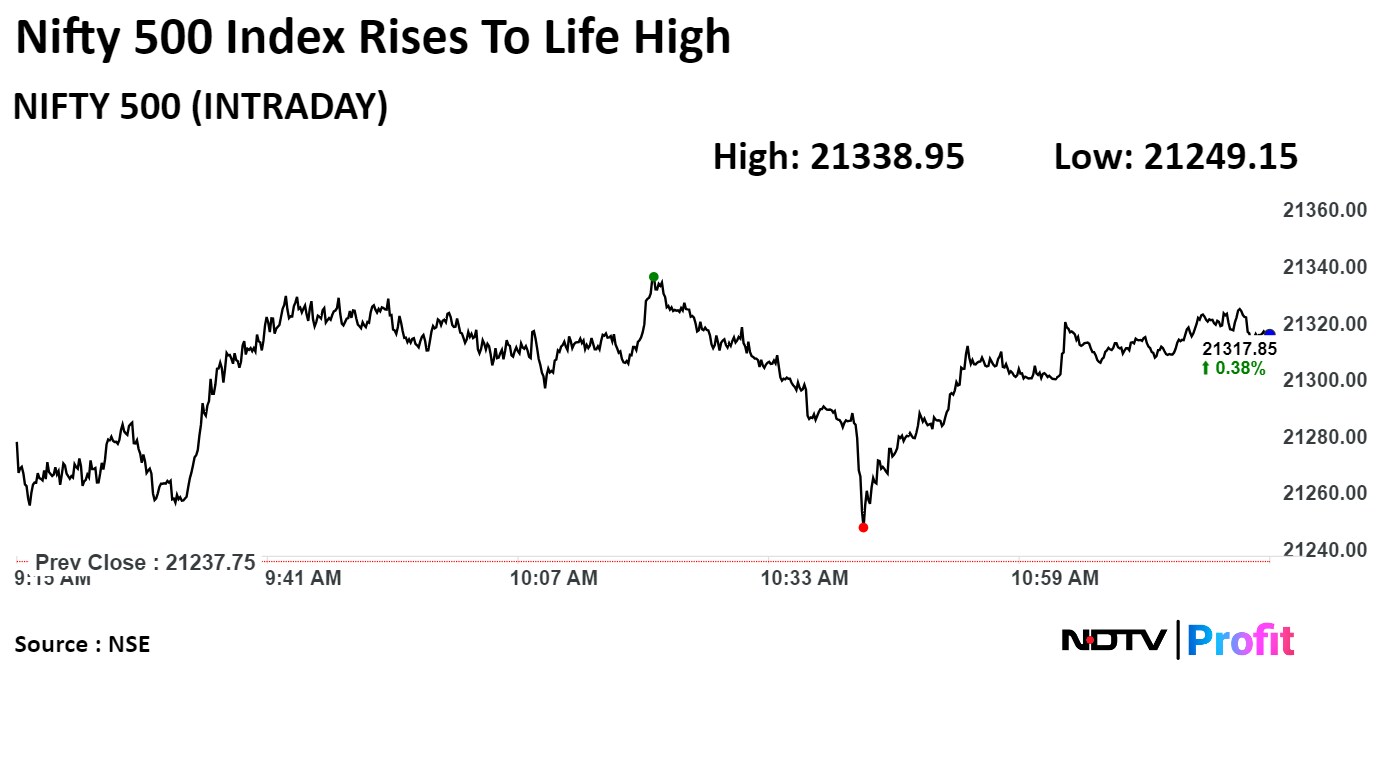

Broader markets underperformed benchmark indices. The S&P BSE Midcap ended 0.58% higher, and the S&P BSE Smallcap settled 0.27% higher.

Market breadth was skewed in favour of sellers. Around 2,010 stocks declined, 1,822 stocks rose, and 113 remained unchanged on BSE.

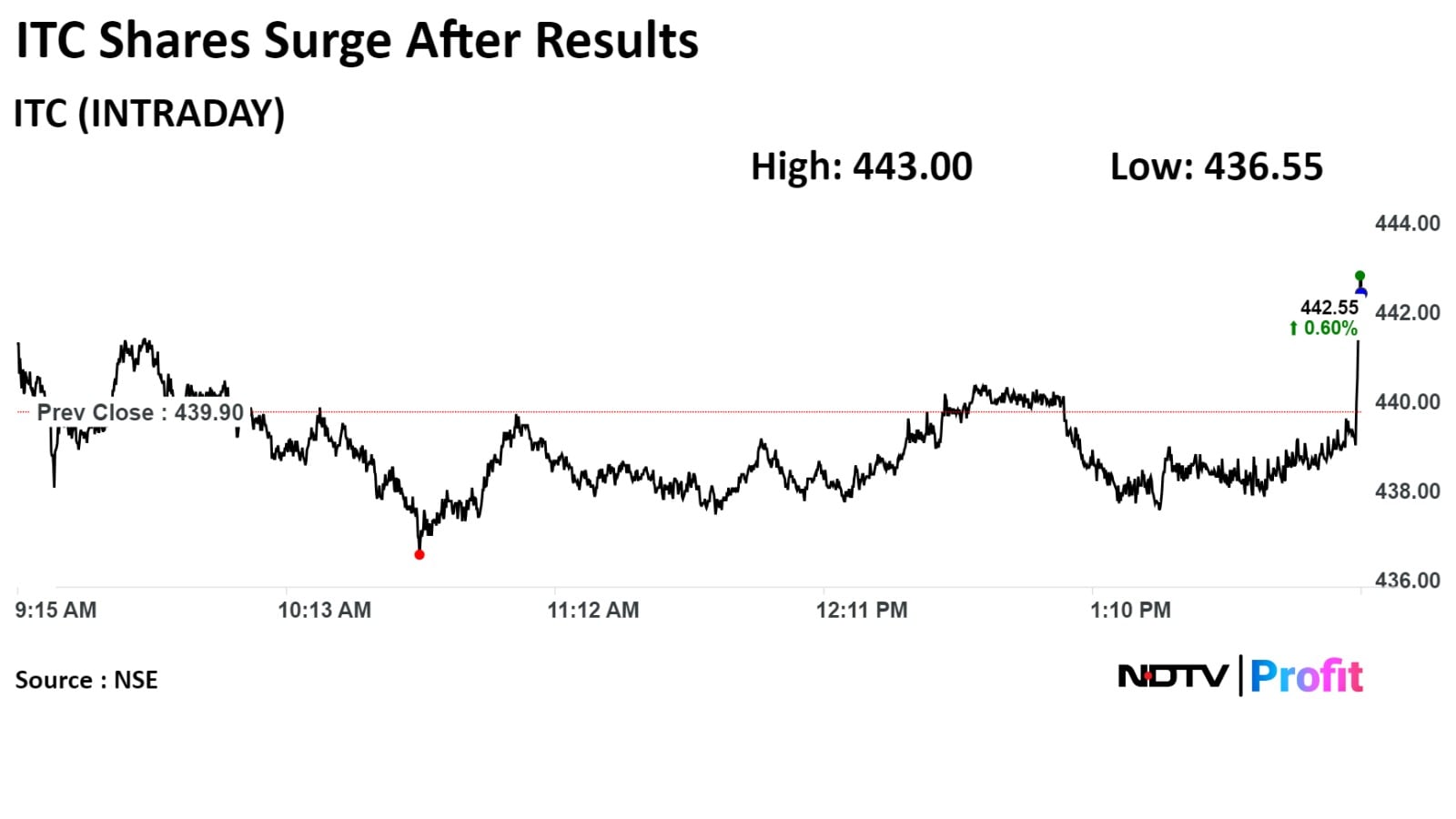

Revenue rose 6.3% to Rs 1,069 crore from Rs 1,005 crore

Ebitda rose 1.3% to Rs 110 crore from Rs 108 crore

Margin at 10.3% vs 10.8%

Net profit at Rs 516 crore vs Rs 47 crore

Revenue rose 1.1% to Rs 16,579 crore from Rs 16,398 crore

Ebitda fell 0.8% to Rs 6,162 crore from Rs 6,209 crore

Margin fell 70 basis points to 37.2% from 37.9%

Net profit fell 1.3% to Rs 5,020 crore from Rs 5,087 crore

Cigarettes revenue rose 8% to Rs 7,925 crore from Rs 7,356 crore

Hotels revenue rose 15% to Rs 898 crore from Rs 782 crore

Agri-Business revenue fell 13.4% to Rs 3,100 crore from Rs 3,579 crore,

Board recommends final dividend of Rs 7.5 per share

"What triggers this (markets' record rally) is of course the RBI bonanza. The finance ministry has an advantage. Now, we are looking at different interest rates scenario, very different fiscal management, which will surely going to bring back the foreign institutional investors, who were sitting on short," said Ajay Srivastava, managing director, Dimension Consulting.

Indian markets were under invested in large-cap and bank stocks. Today, what you see is a retail frenzy to get into those stocks. And for the first time a Prime Minister made a statement saying the banking industry made a profit of this many lakh crore. That showed a very clear trajectory for banks that a good time is going to come, Srivastava said.

This Rs 2.11 lakh crore dividend can really change the dynamics of the country's next year's fiscal dramatically, he added.

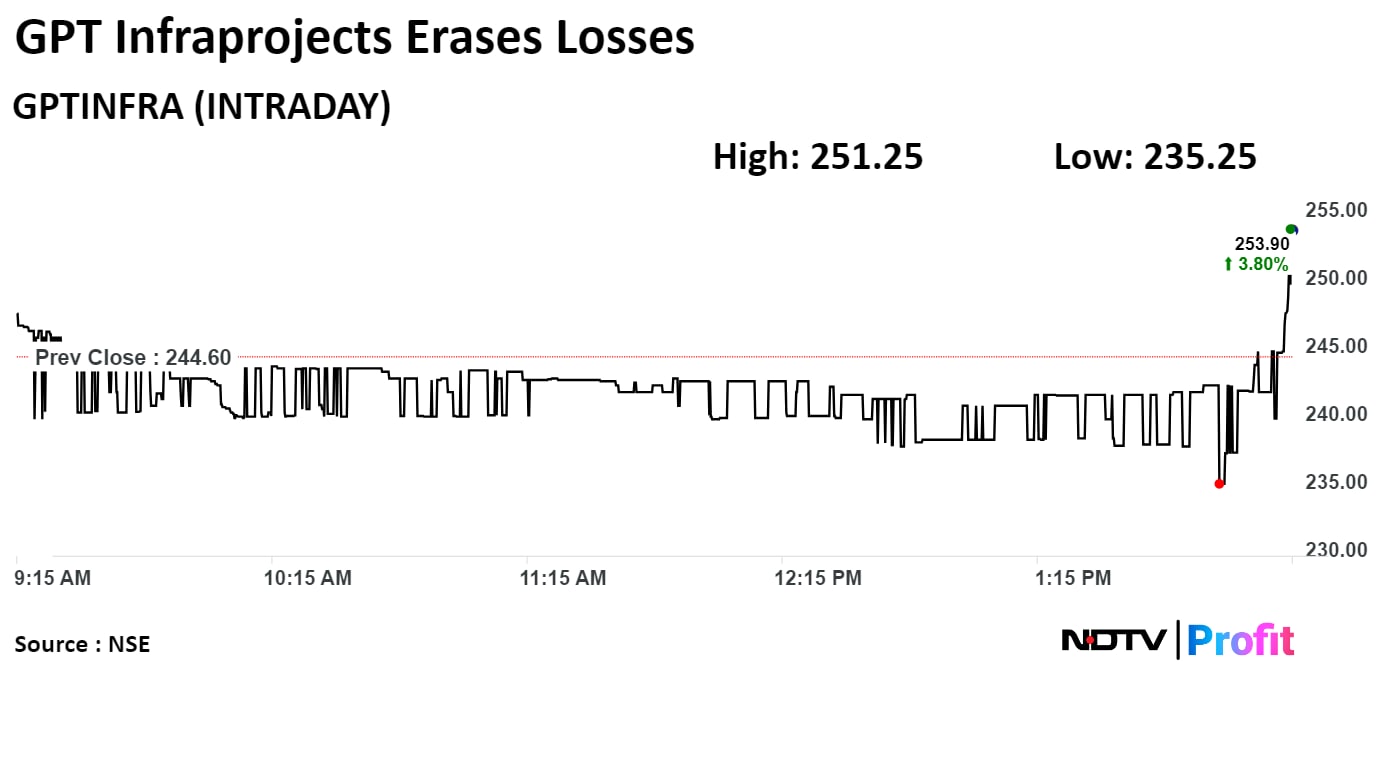

GPT Infraprojects Ltd. emerged as the lowest bidder for project worth Rs 555 crore.

Source: Exchange filing

GPT Infraprojects Ltd. emerged as the lowest bidder for project worth Rs 555 crore.

Source: Exchange filing

The S&P BSE Sensex rose 1.25% to Rs 75,150.63, the highest level since its incorporation. The index was trading 939.44 points or 1.27% higher at 75,160.50 as of 2:08 p.m.

The S&P BSE Sensex rose 1.25% to Rs 75,150.63, the highest level since its incorporation. The index was trading 939.44 points or 1.27% higher at 75,160.50 as of 2:08 p.m.

.png)

.png)

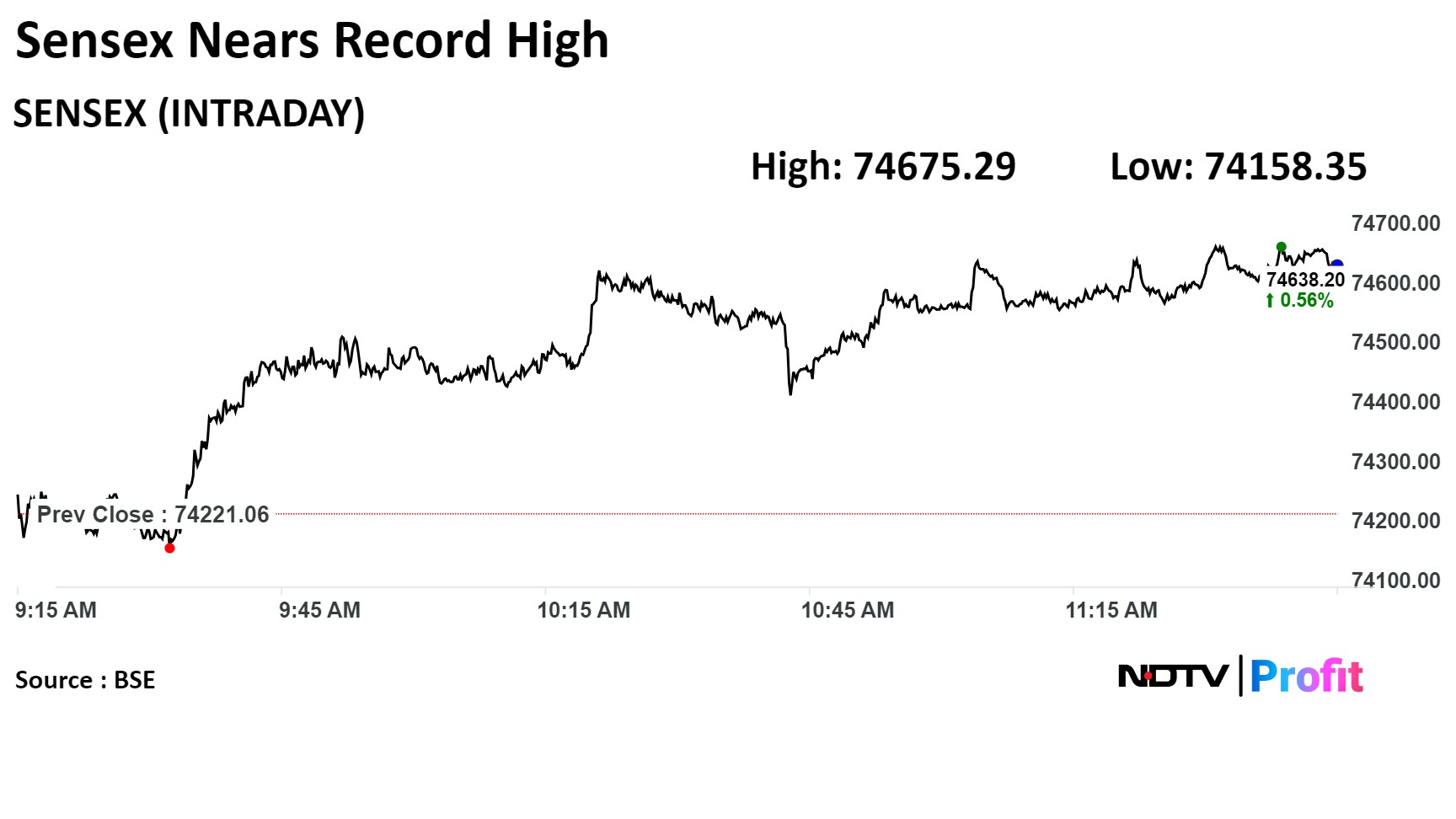

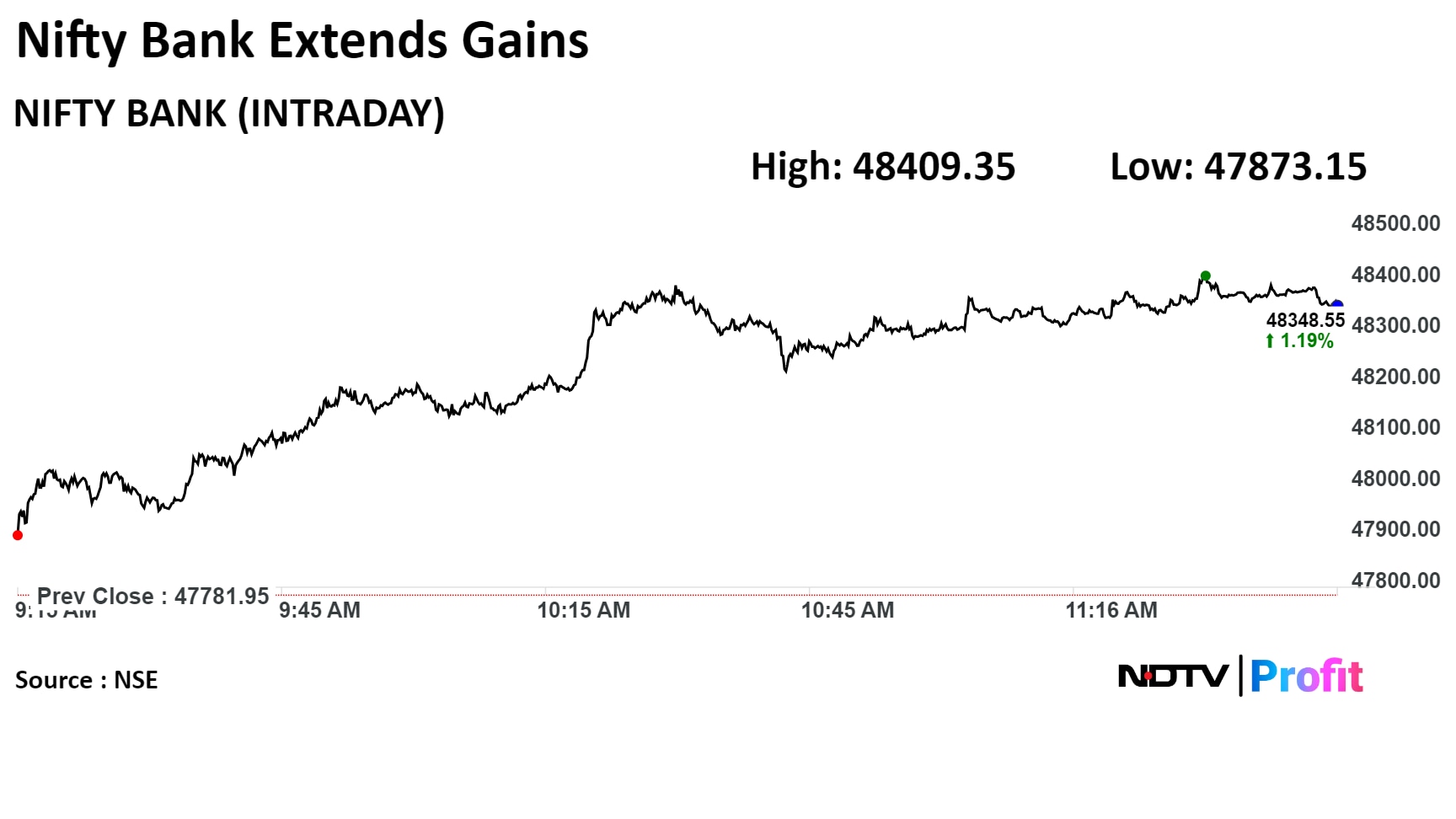

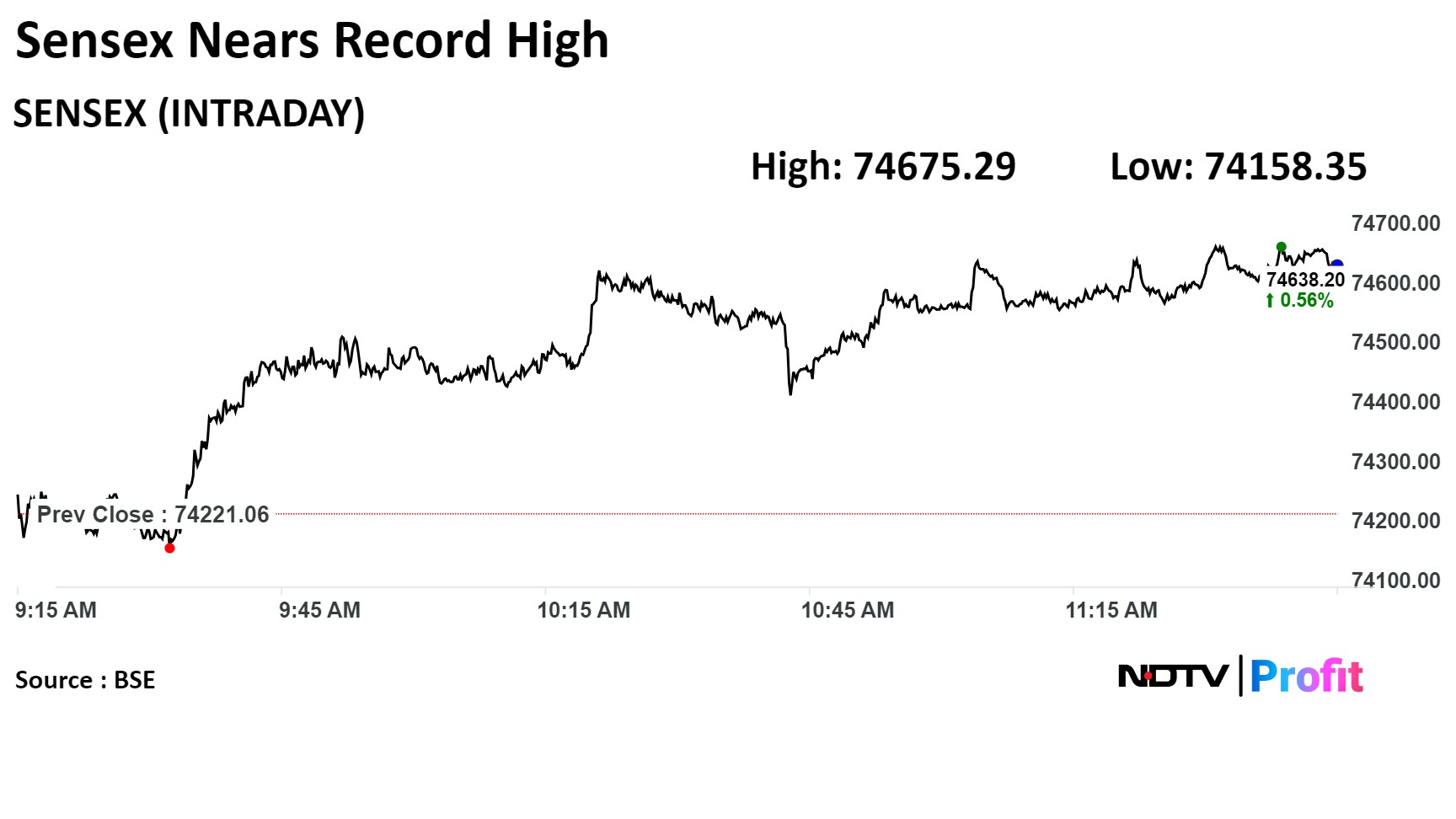

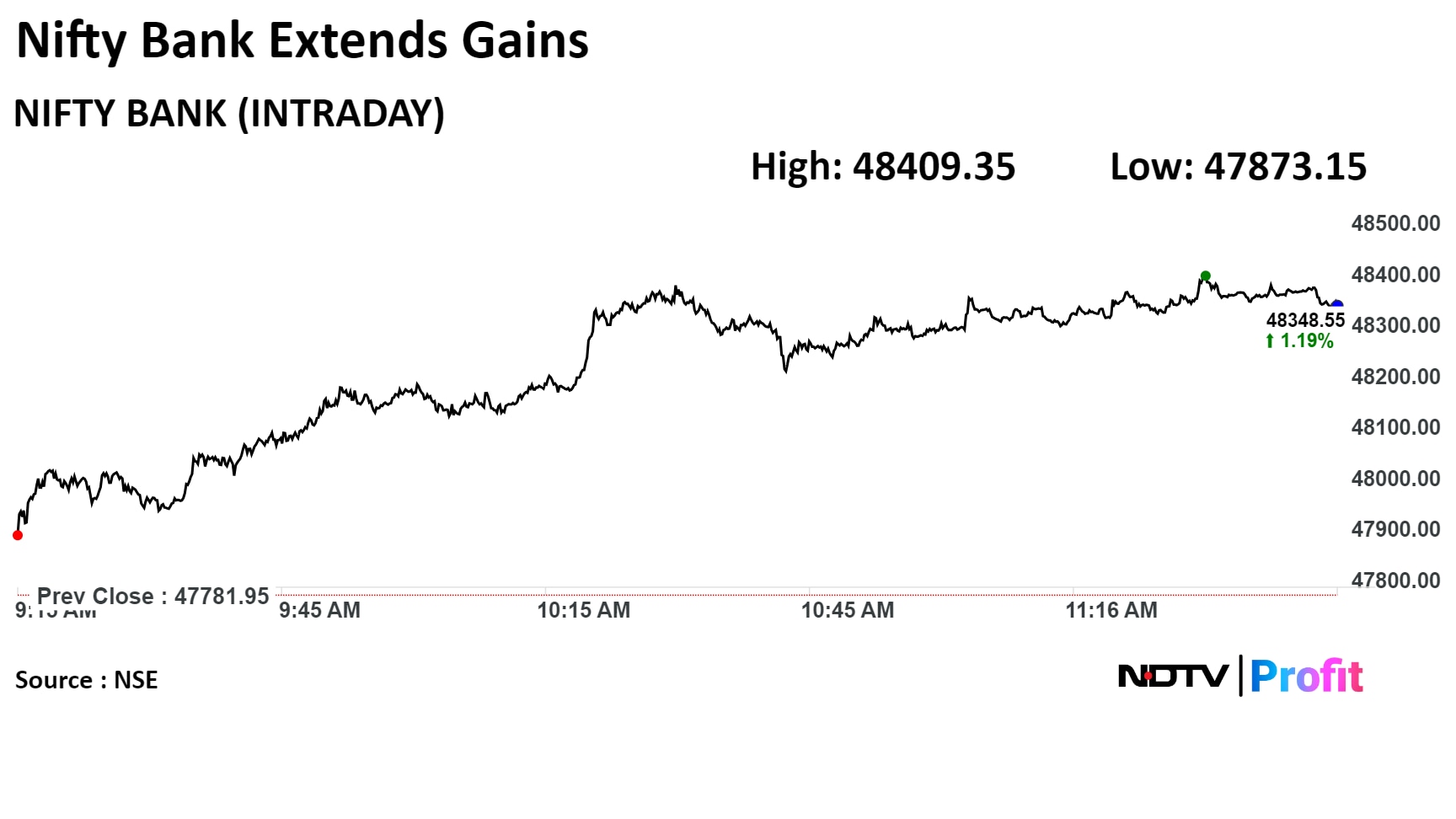

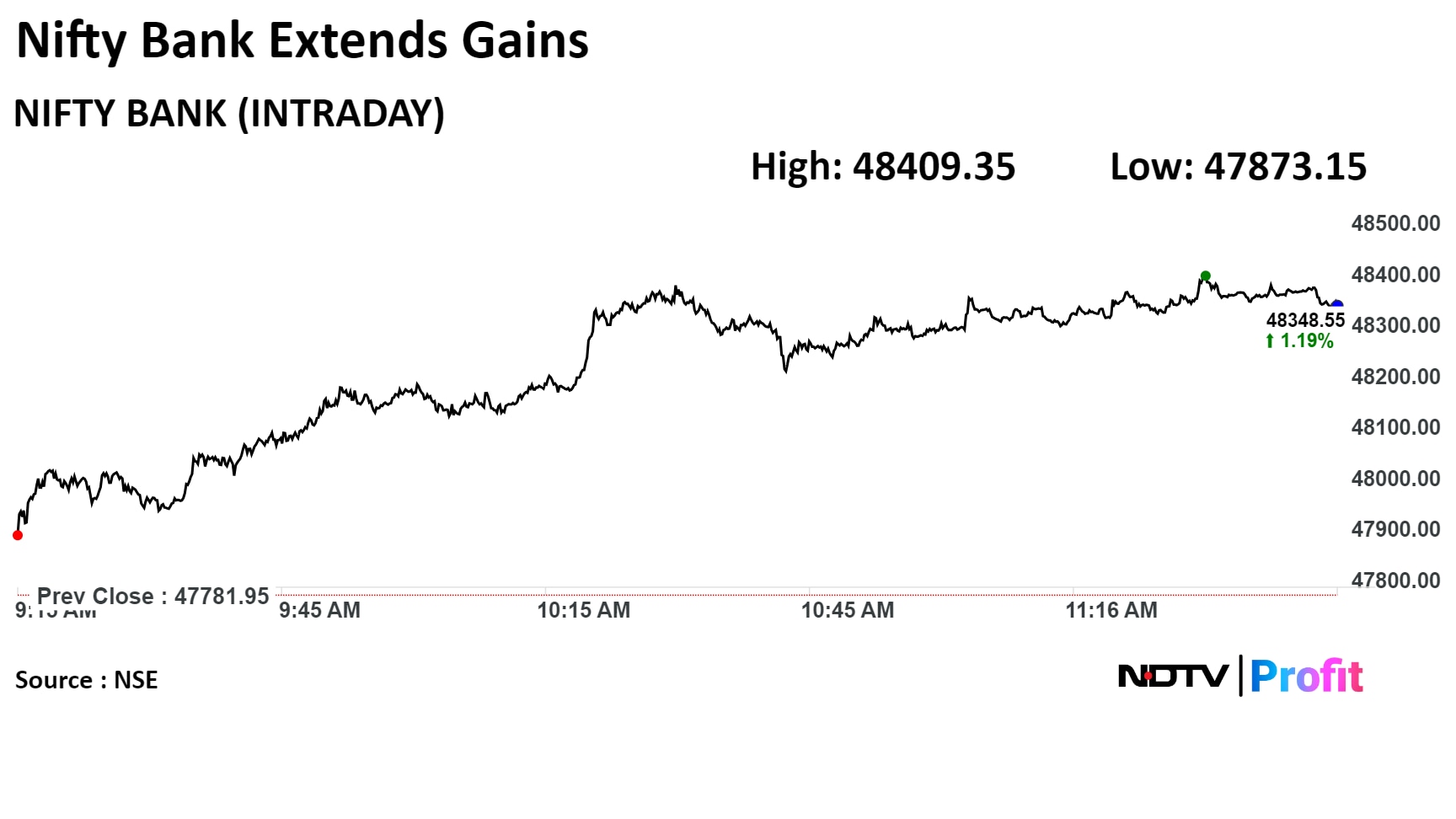

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

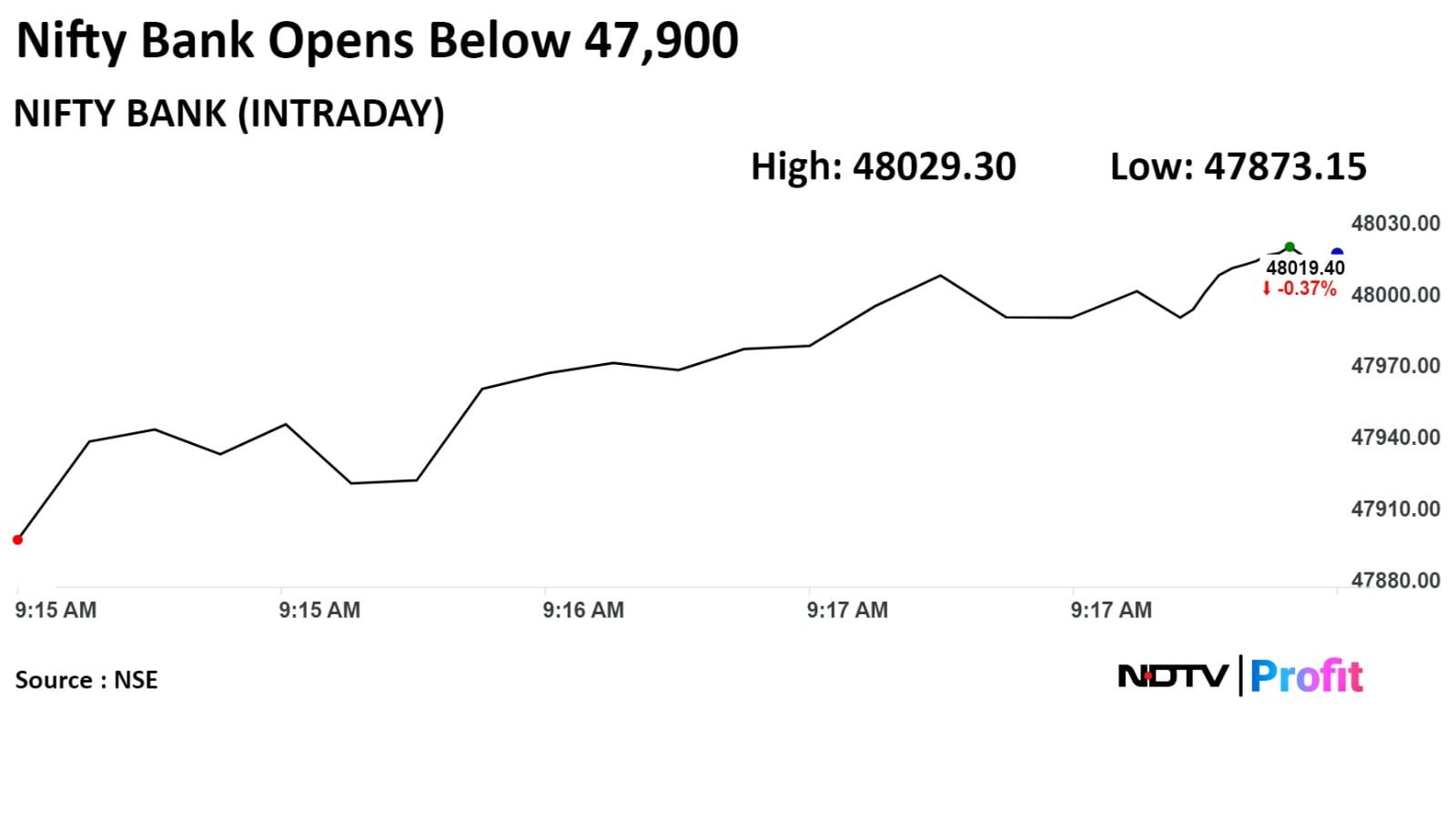

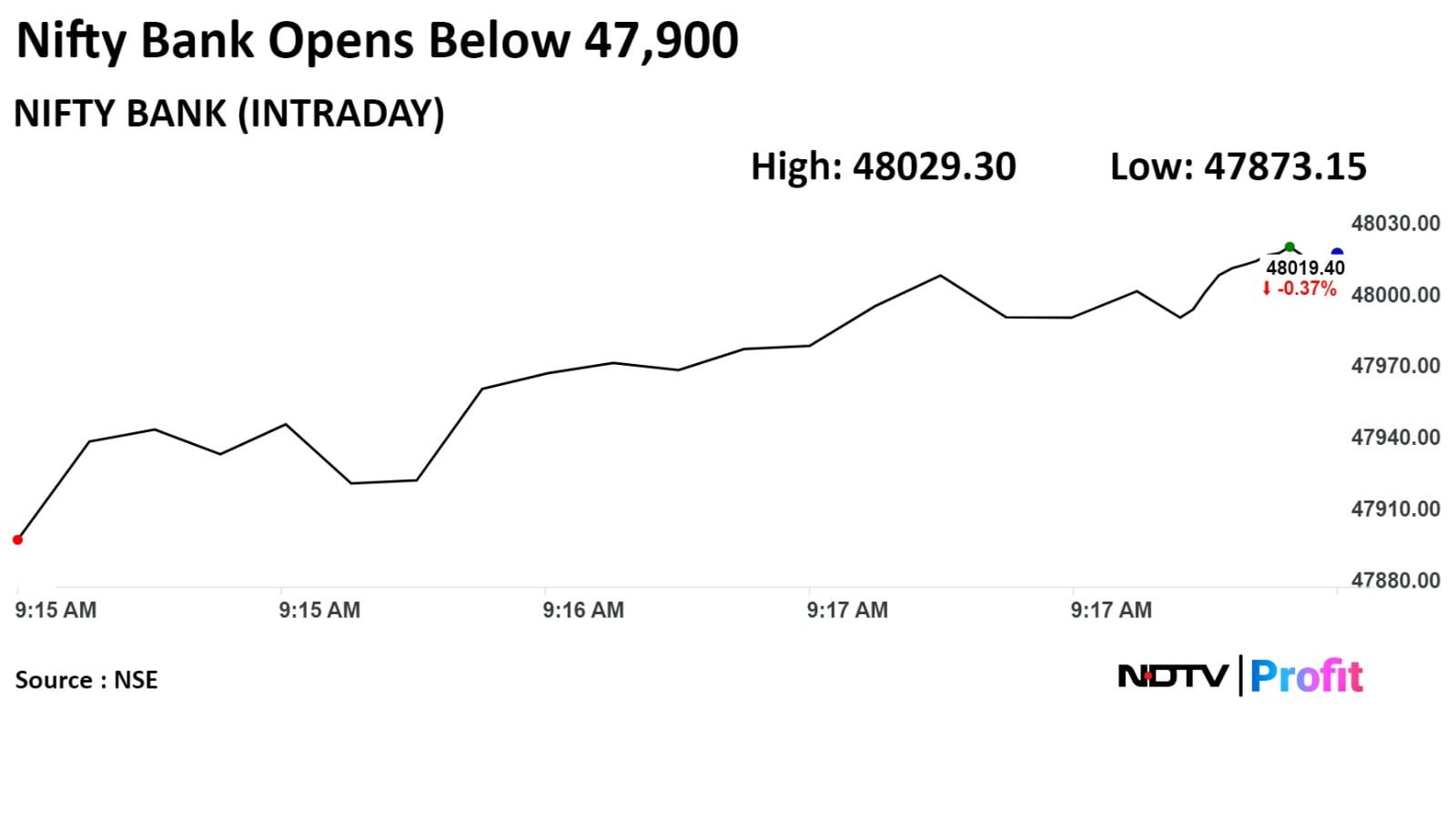

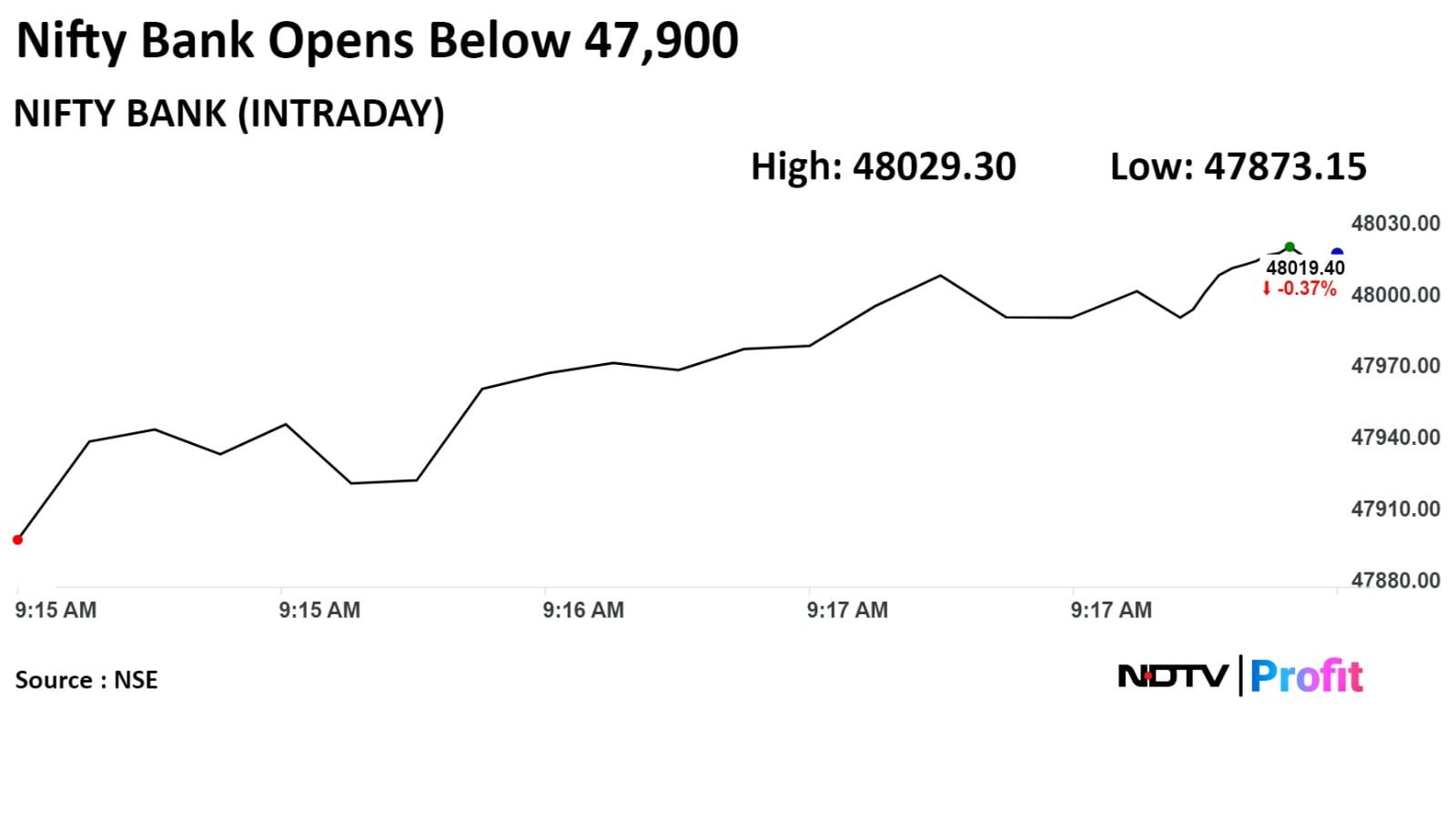

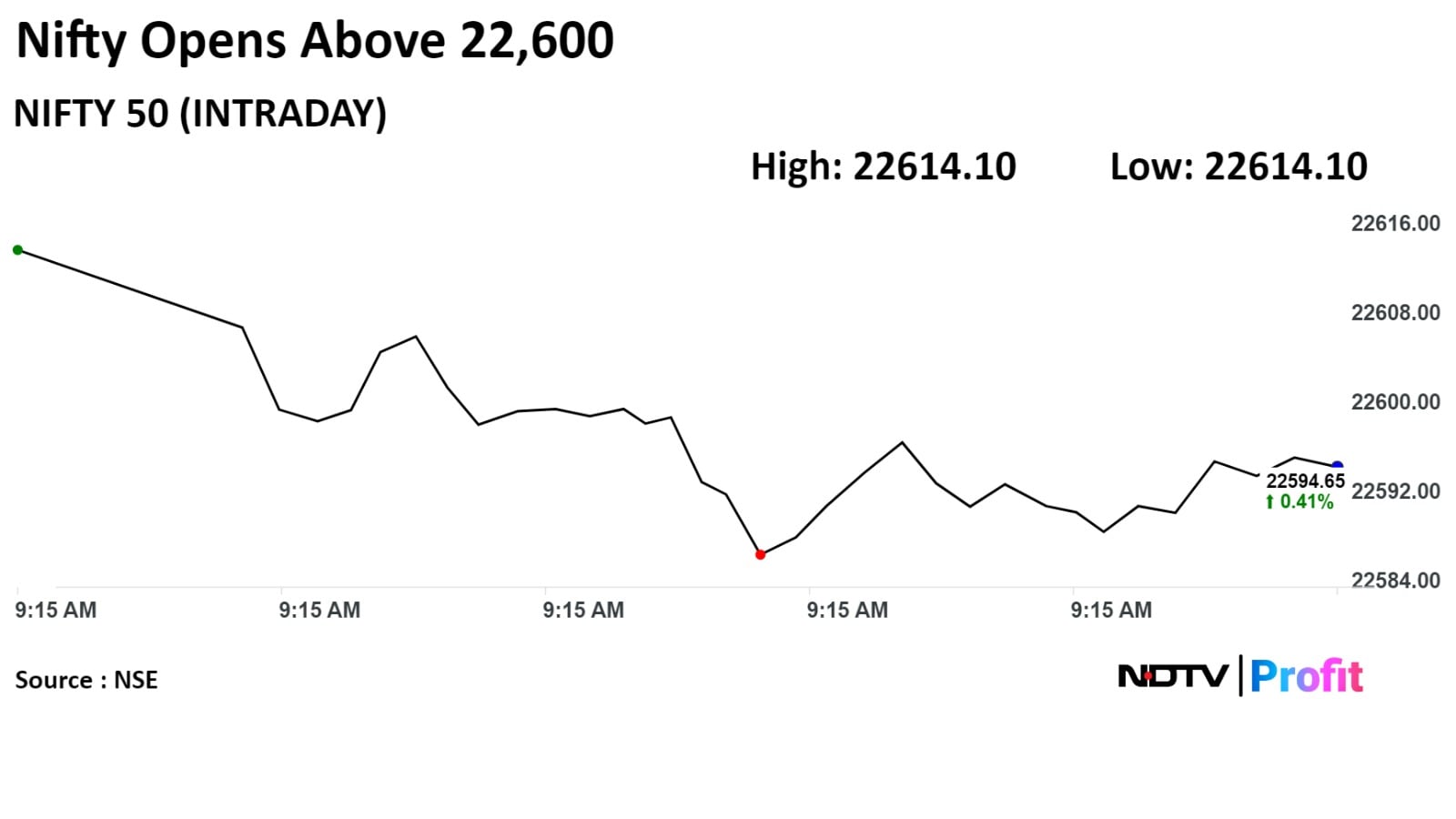

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

Shares of ICICI Bank Ltd., Larsen & Toubro Ltd., Axis Bank Ltd., HDFC Bank Ltd., and Infosys Ltd. contributed the most to gains in the Nifty.

While those of Power Grid Corp. Of India, Sun Pharmaceutical Industries Ltd., Hindalco Industries Ltd., Coal India Ltd., and ITC Ltd. weighed the index.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

Shares of ICICI Bank Ltd., Larsen & Toubro Ltd., Axis Bank Ltd., HDFC Bank Ltd., and Infosys Ltd. contributed the most to gains in the Nifty.

While those of Power Grid Corp. Of India, Sun Pharmaceutical Industries Ltd., Hindalco Industries Ltd., Coal India Ltd., and ITC Ltd. weighed the index.

.png)

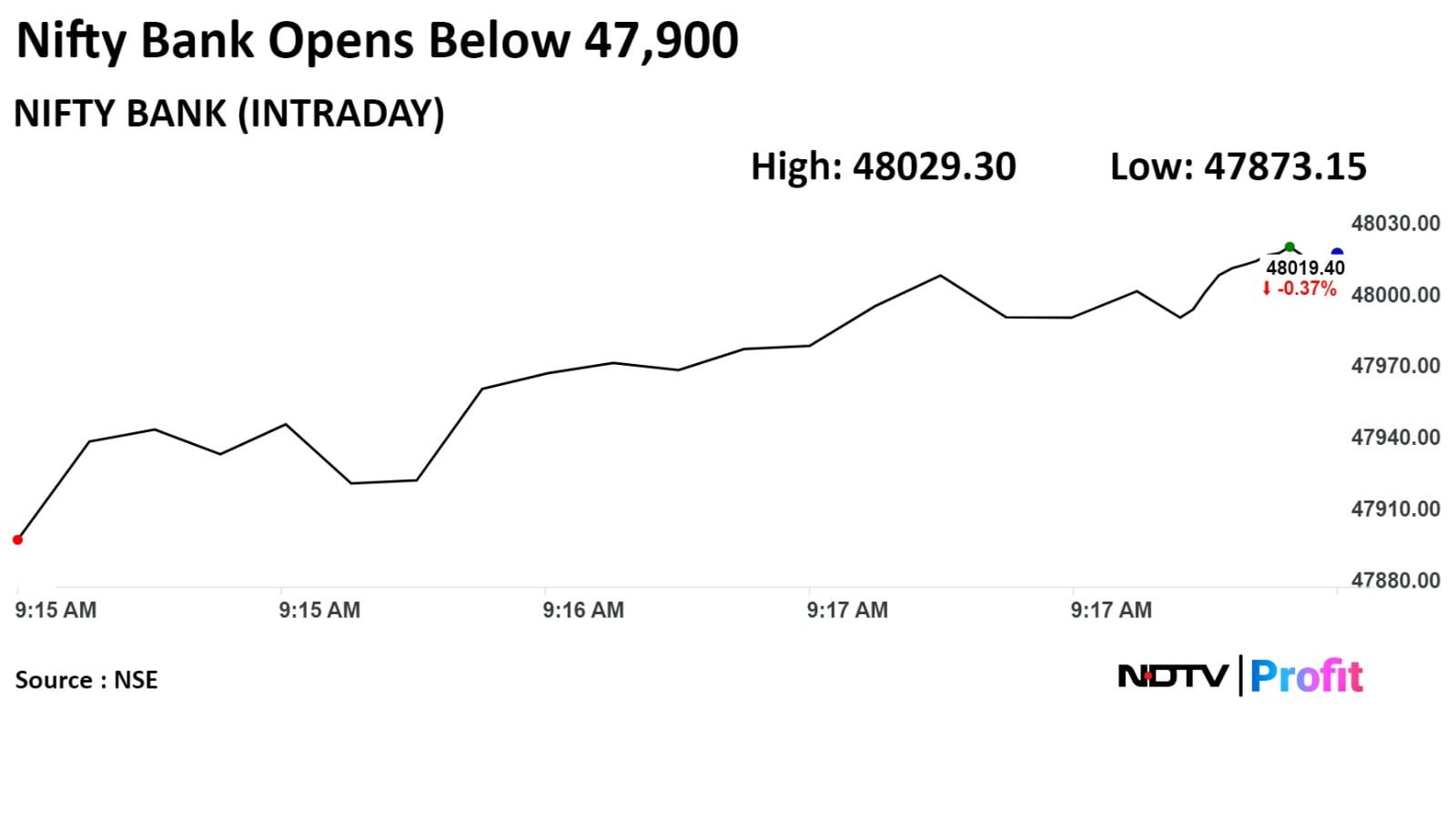

Most sectoral indices were higher on NSE, with Nifty PSU Bank, Nifty IT, and Nifty Bank gaining more than 1%.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.

The Nifty 50 hit a record high by midday trade on Thursday due to a rally in financial services stocks after the Reserve Bank of India gave a Rs 2 lakh crore dividend to the government.

"The market had those jitters a few weeks back on low voter outcomes, but it has recovered from that, and now you see more brokers come out with positive view points," Andrew Holland, chief executive officer of Avendus Capital, told NDTV Profit. The market hasn't had the pre-election rally, but it can catch up to the global market, he said.

Bank stocks are leading after underperforming in the recent sessions, noted Nilesh Jain, head AVP, technical and derivatives research, at Centrum Broking Ltd. "I think it's time for Bank Nifty to lead from here," he said, adding that 48,800–49,000 will act as resistance.

Nifty 50 is set to hit 22,800, and any dip can be used as a buying opportunity, according to Jain.

At 12:32 p.m., the NSE Nifty 50 was trading 192.00 points, or 0.85%, higher at 22,789.80 after hitting its lifetime high of 22,806.20, and the S&P BSE Sensex gained 598.78 points, or 0.81%, to trade at 74,819.84.