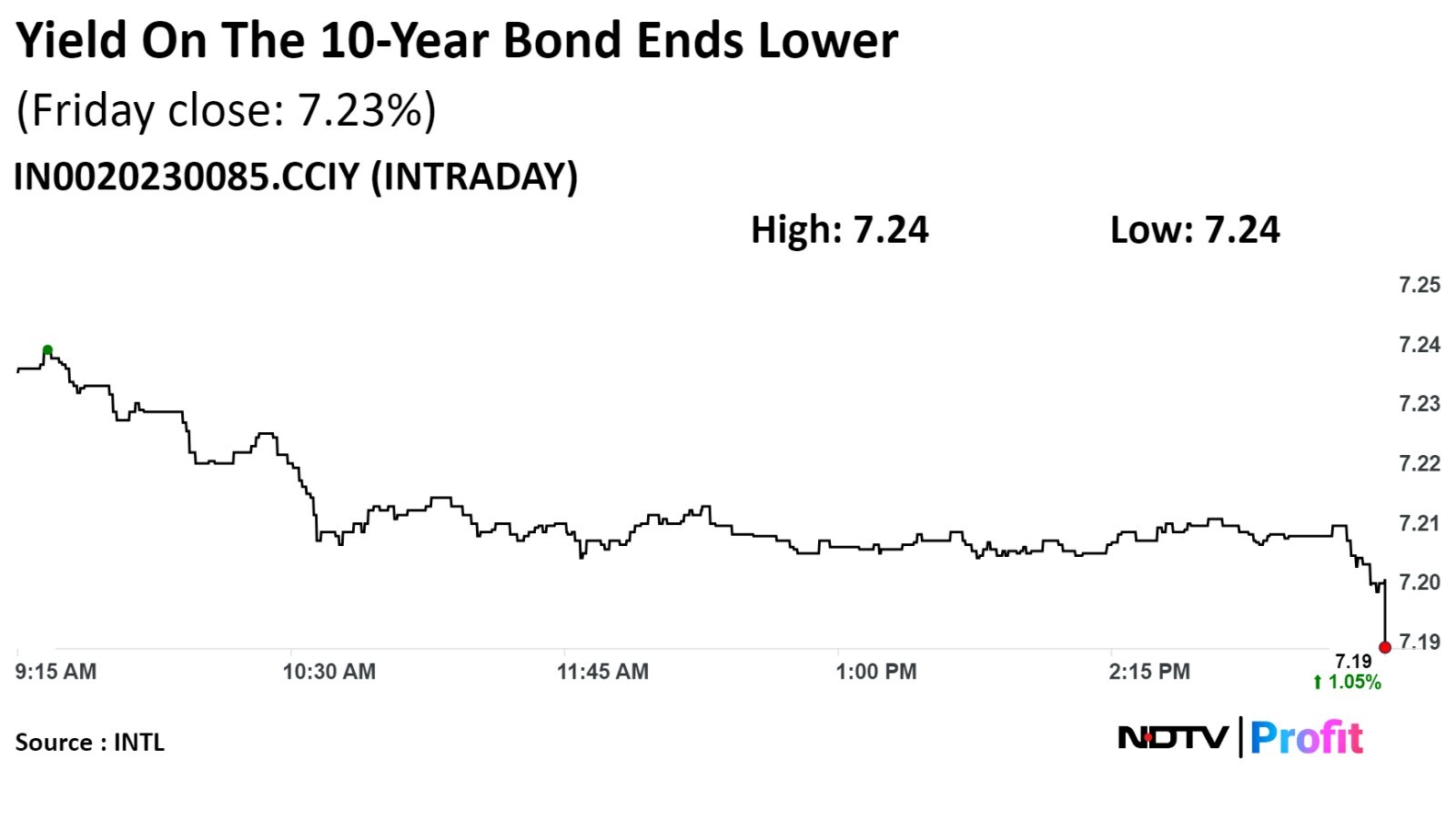

The yield on the 10-year bond closed 4 bps lower at 7.19%.

Source: Bloomberg

The yield on the 10-year bond closed 4 bps lower at 7.19%.

Source: Bloomberg

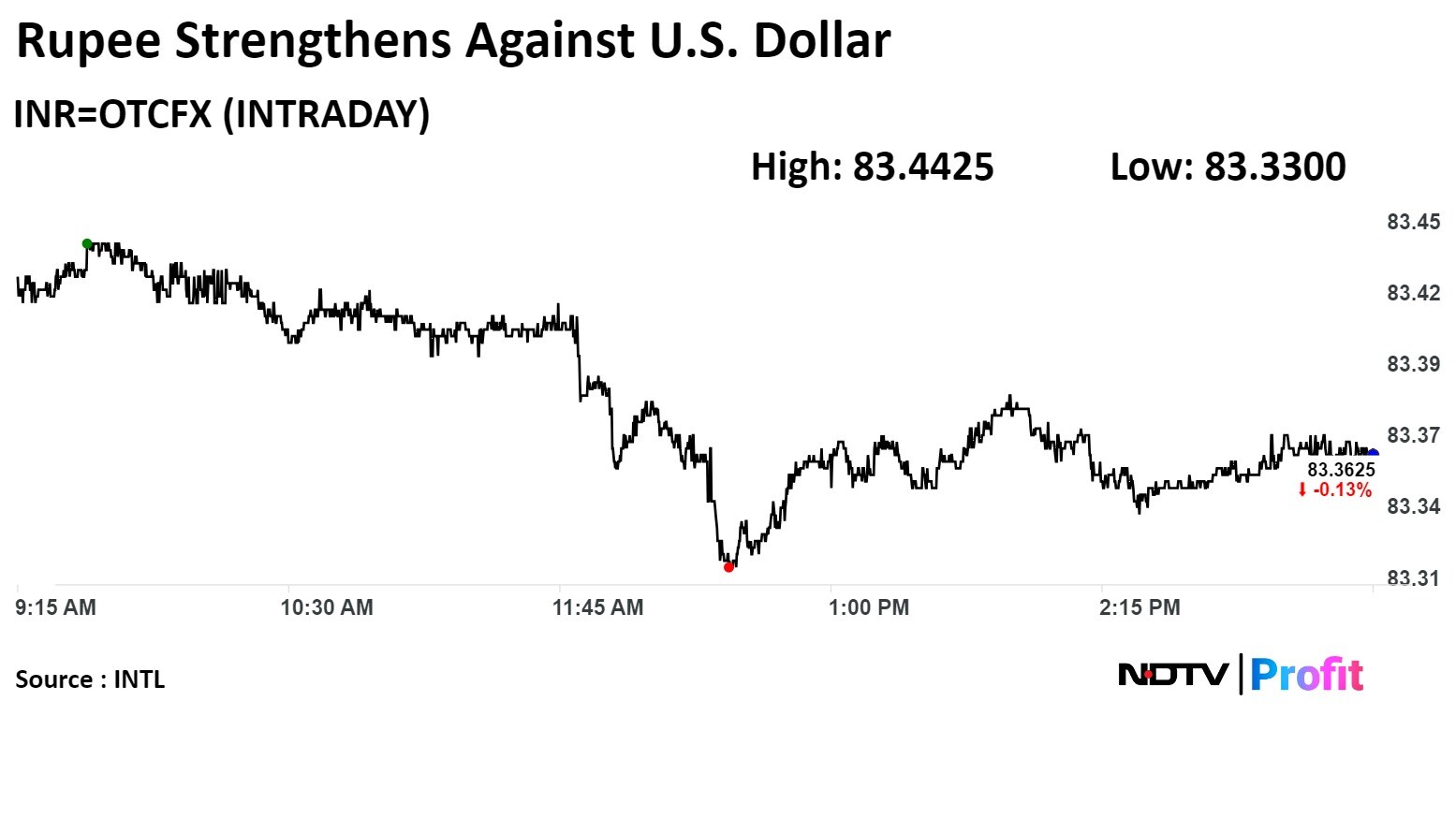

The local currency strengthened by 10 paise to close at 83.37 against the U.S. Dollar.

It closed at 83.47 a dollar on Friday.

Source: Bloomberg

The local currency strengthened by 10 paise to close at 83.37 against the U.S. Dollar.

It closed at 83.47 a dollar on Friday.

Source: Bloomberg

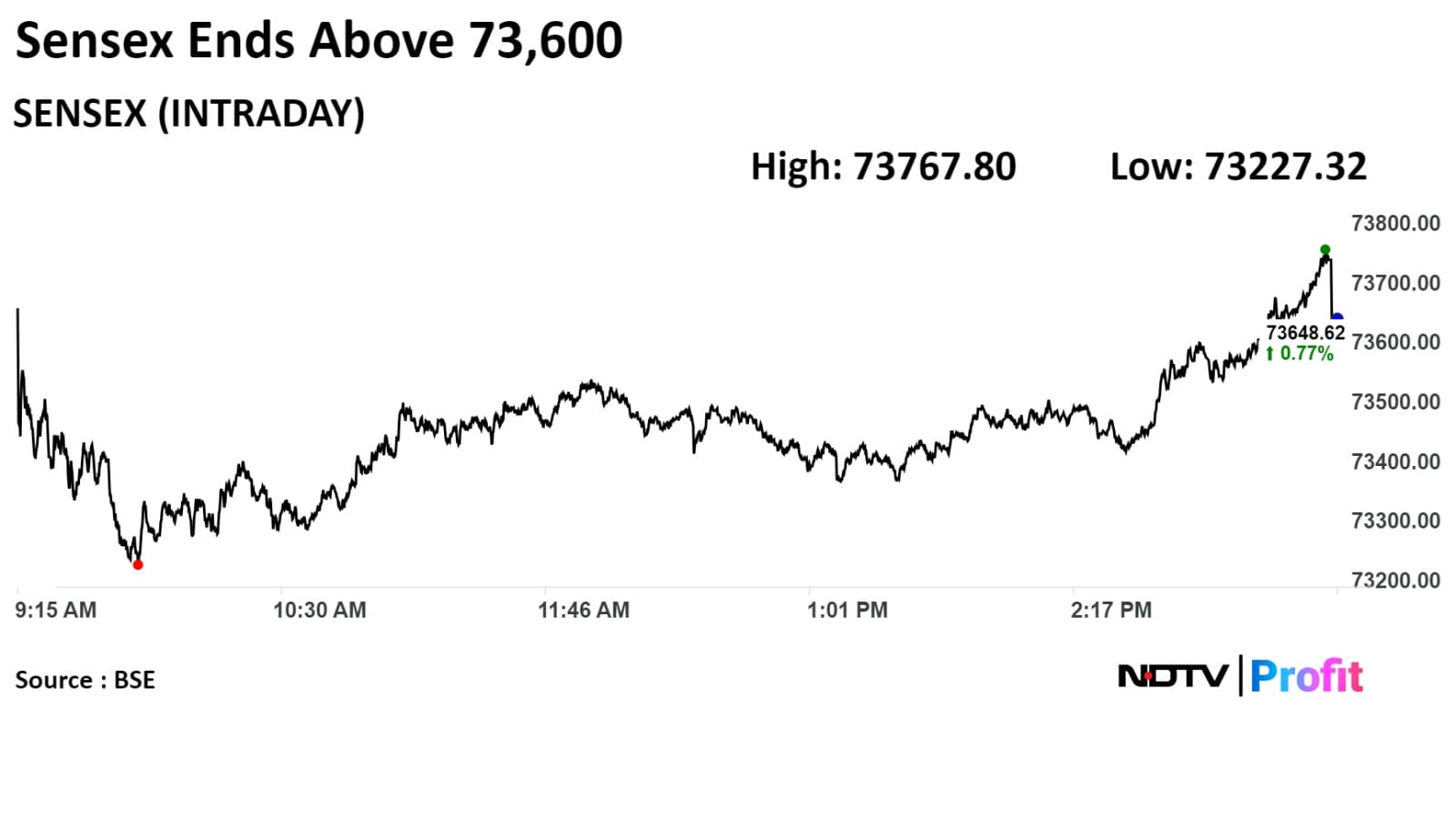

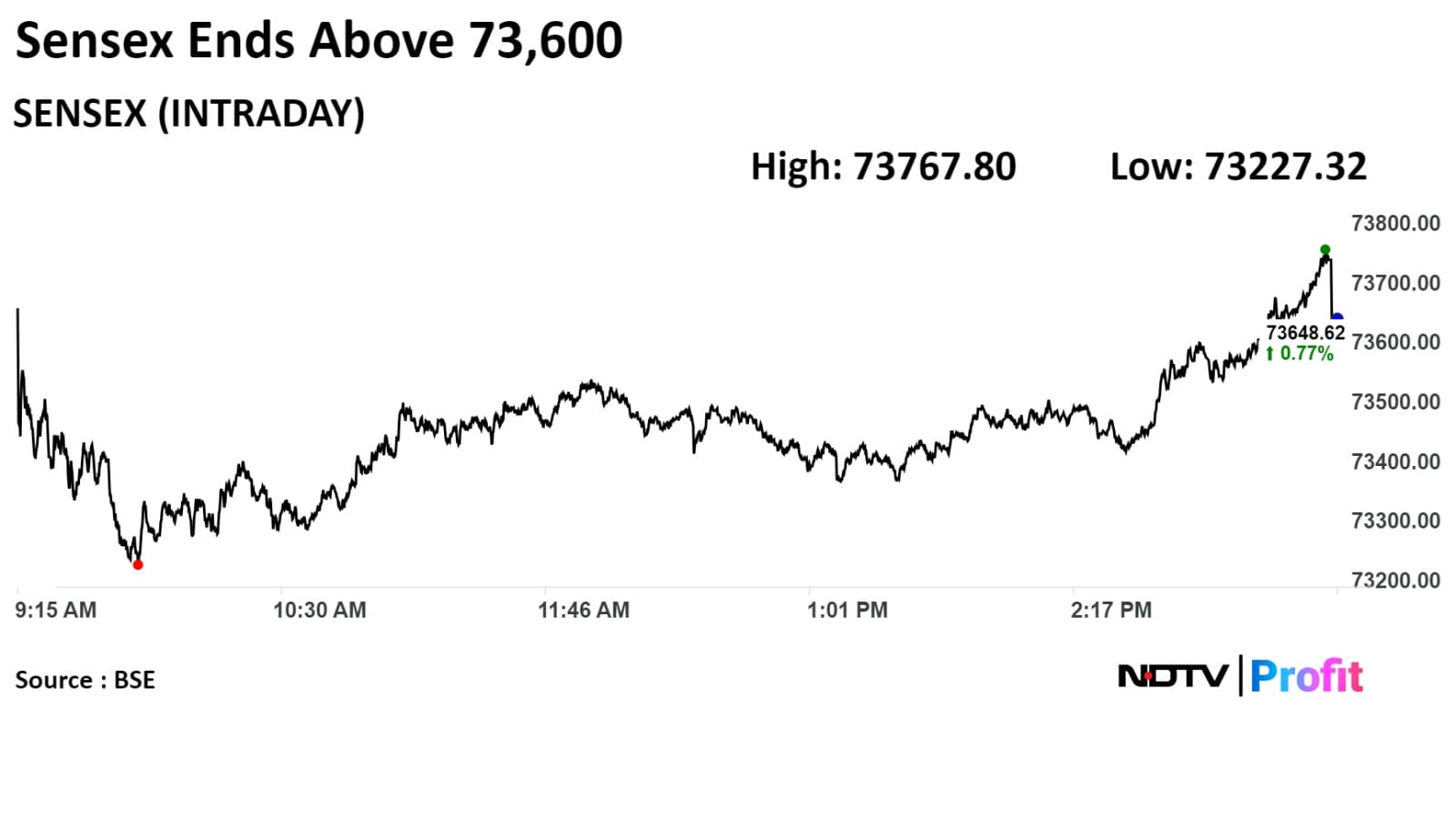

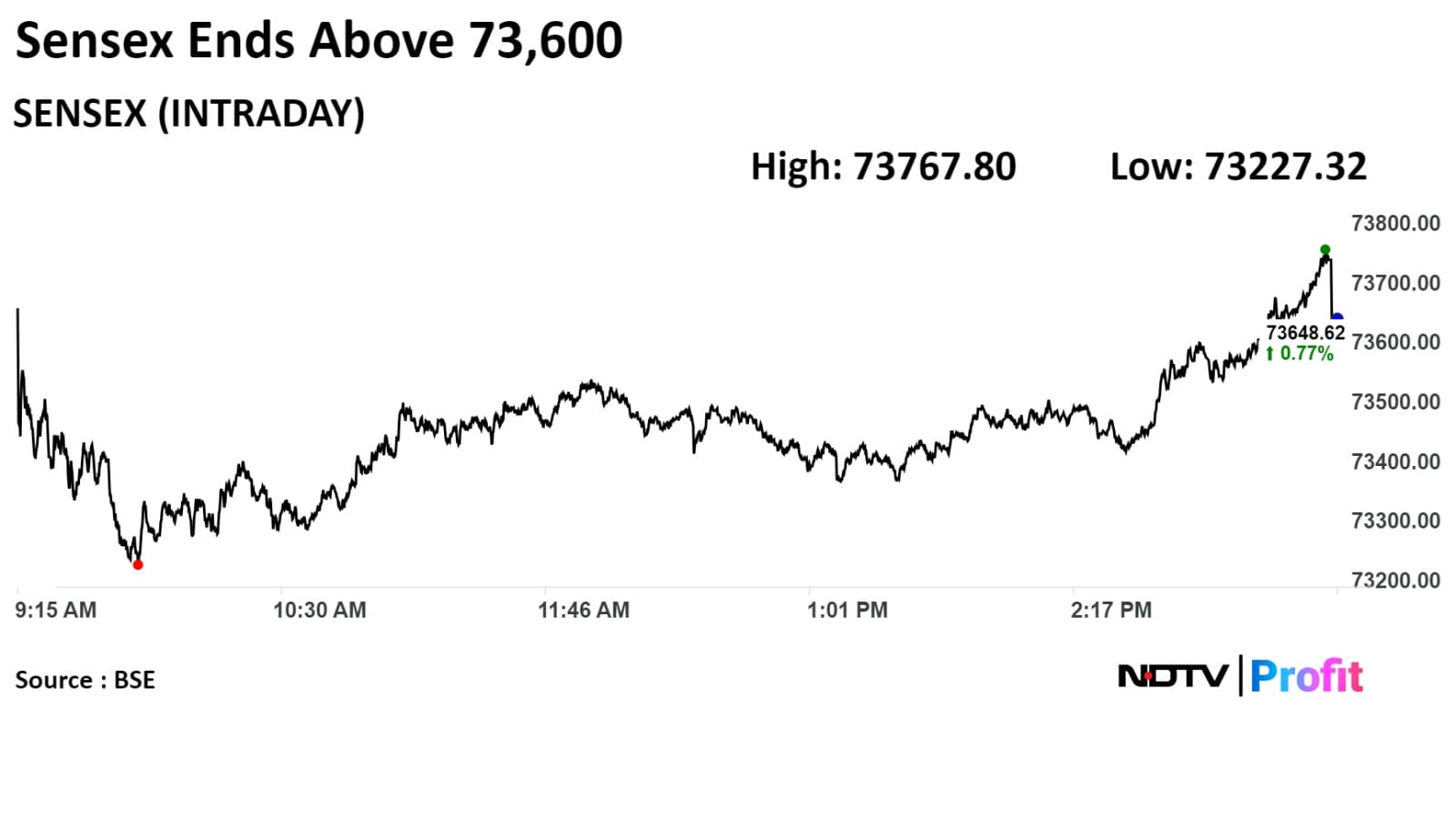

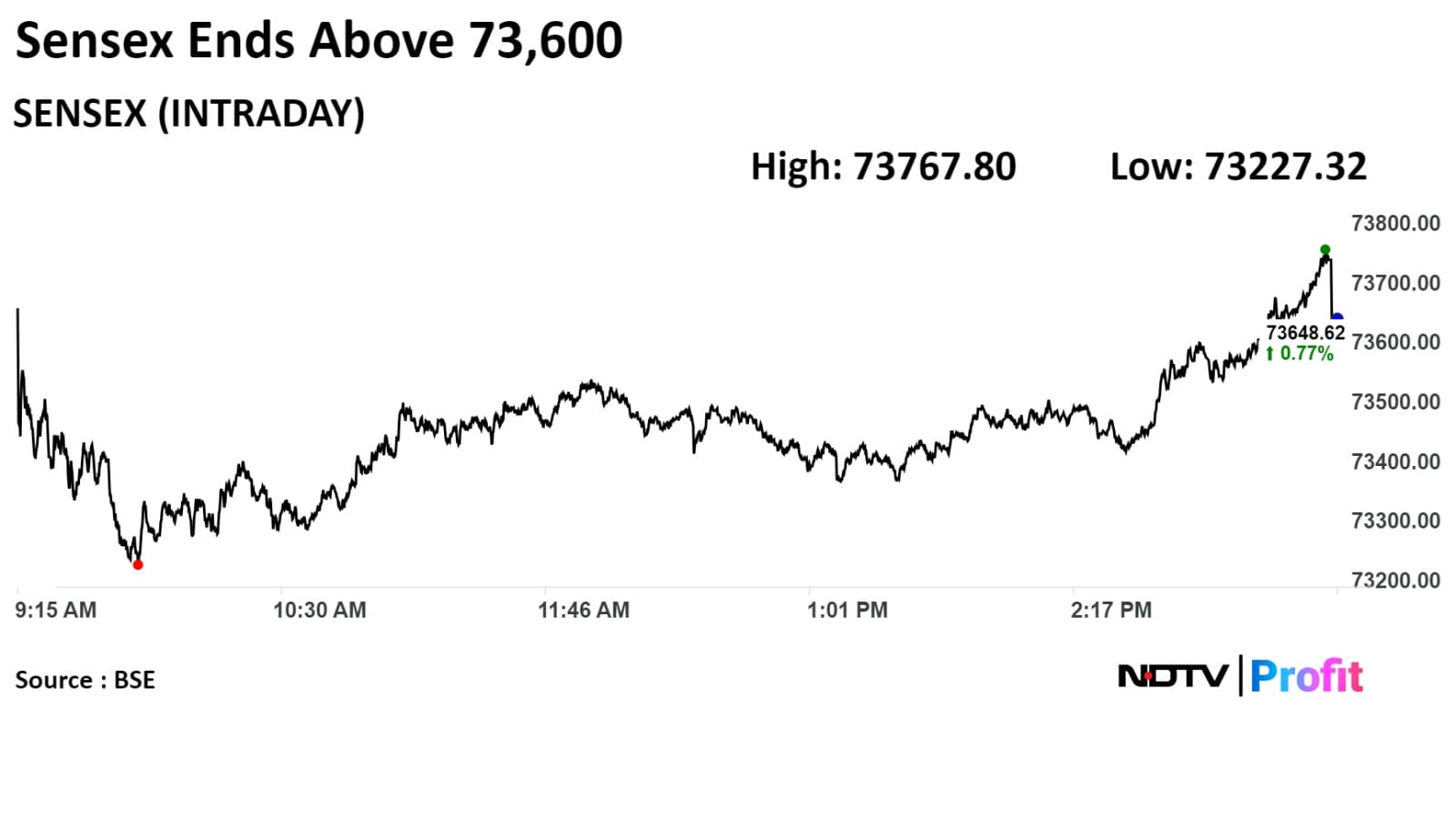

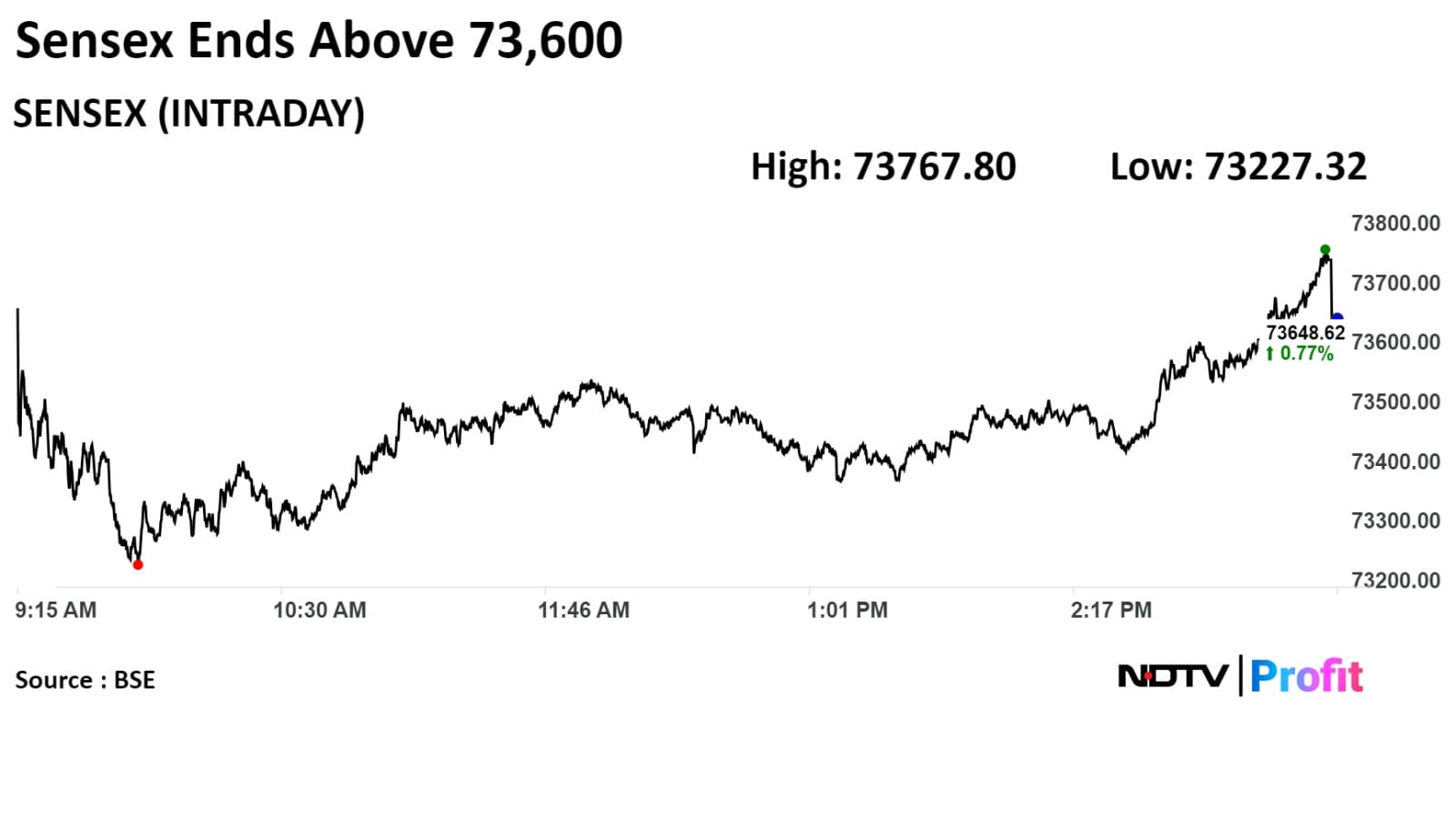

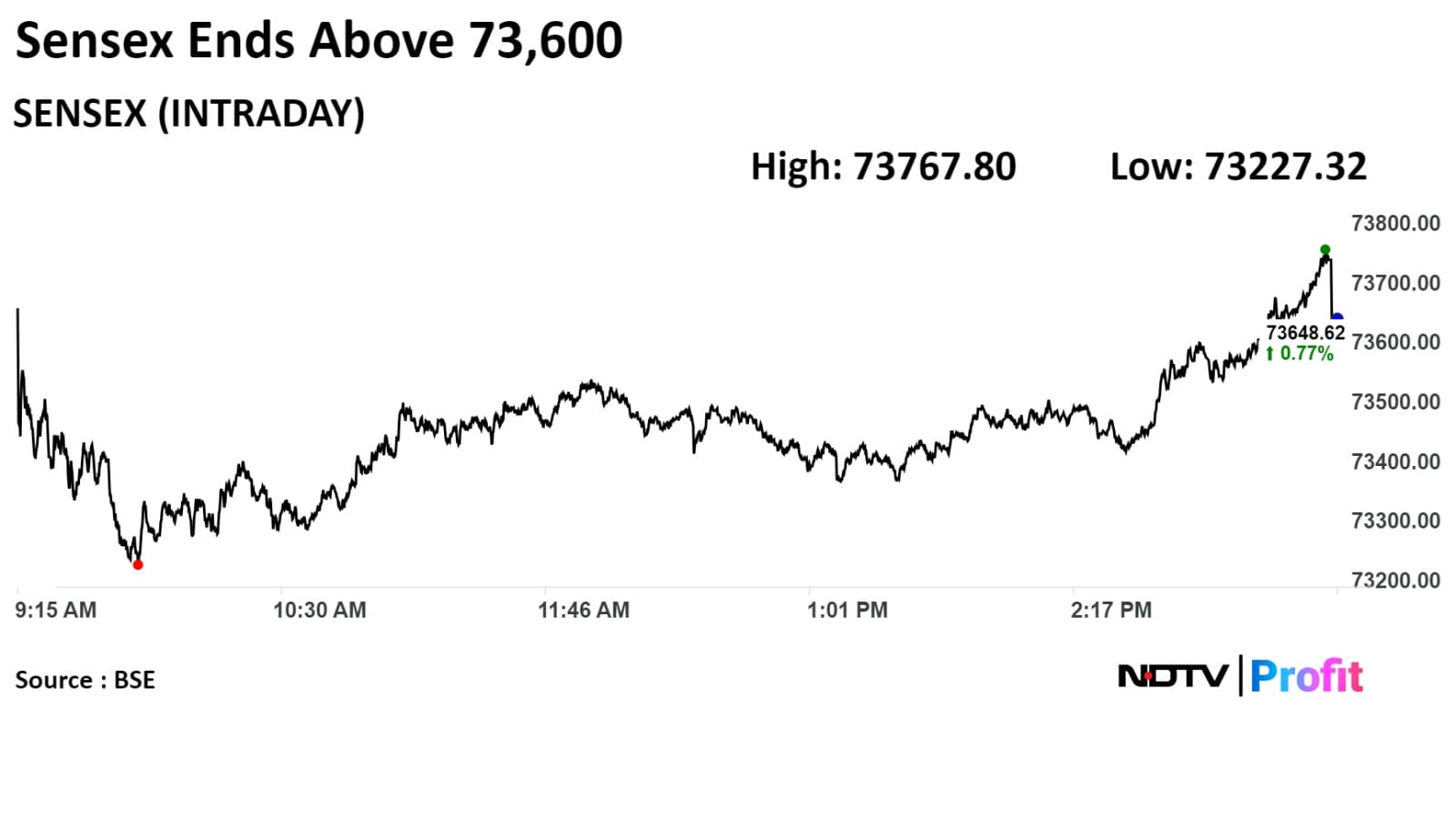

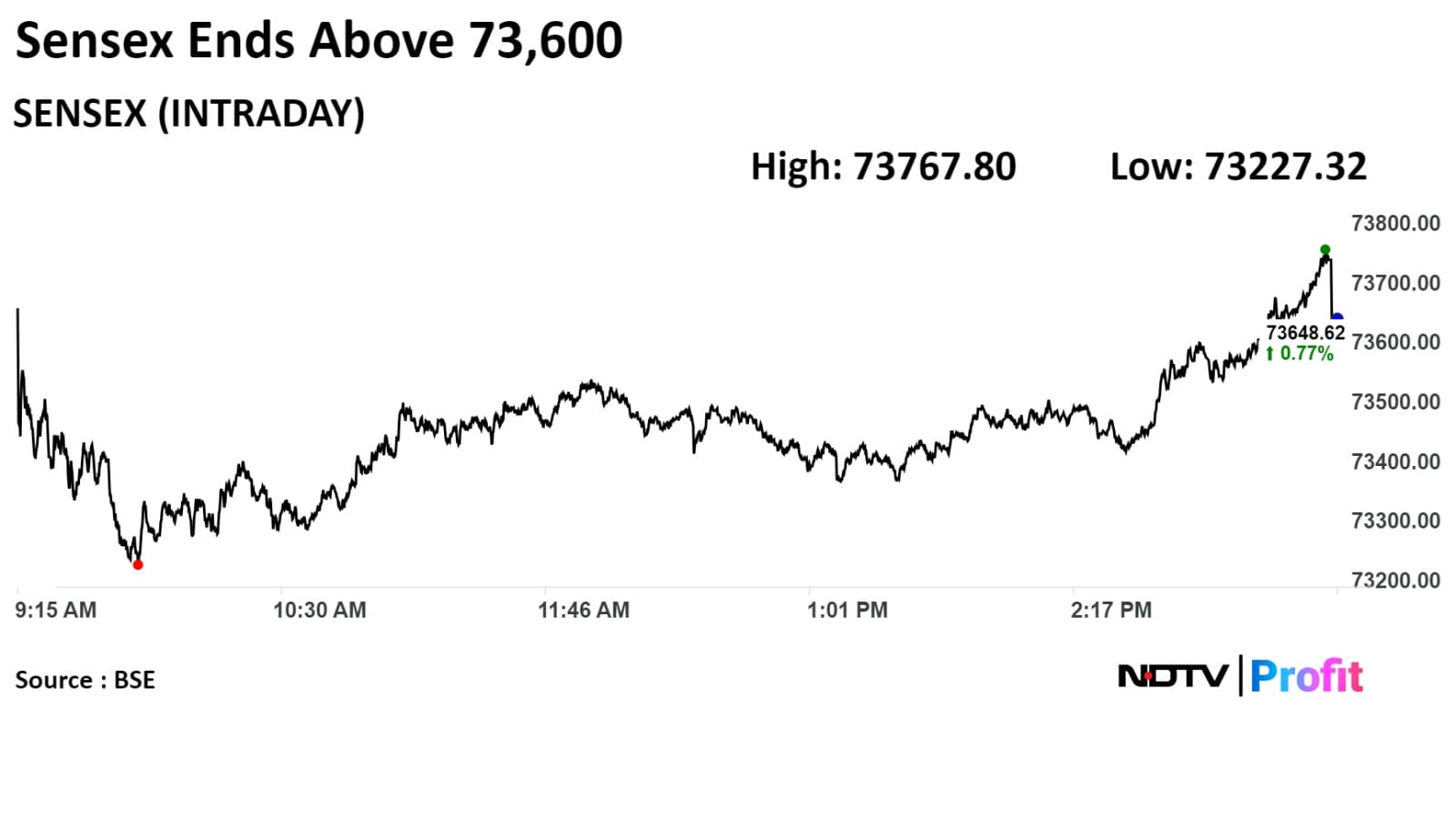

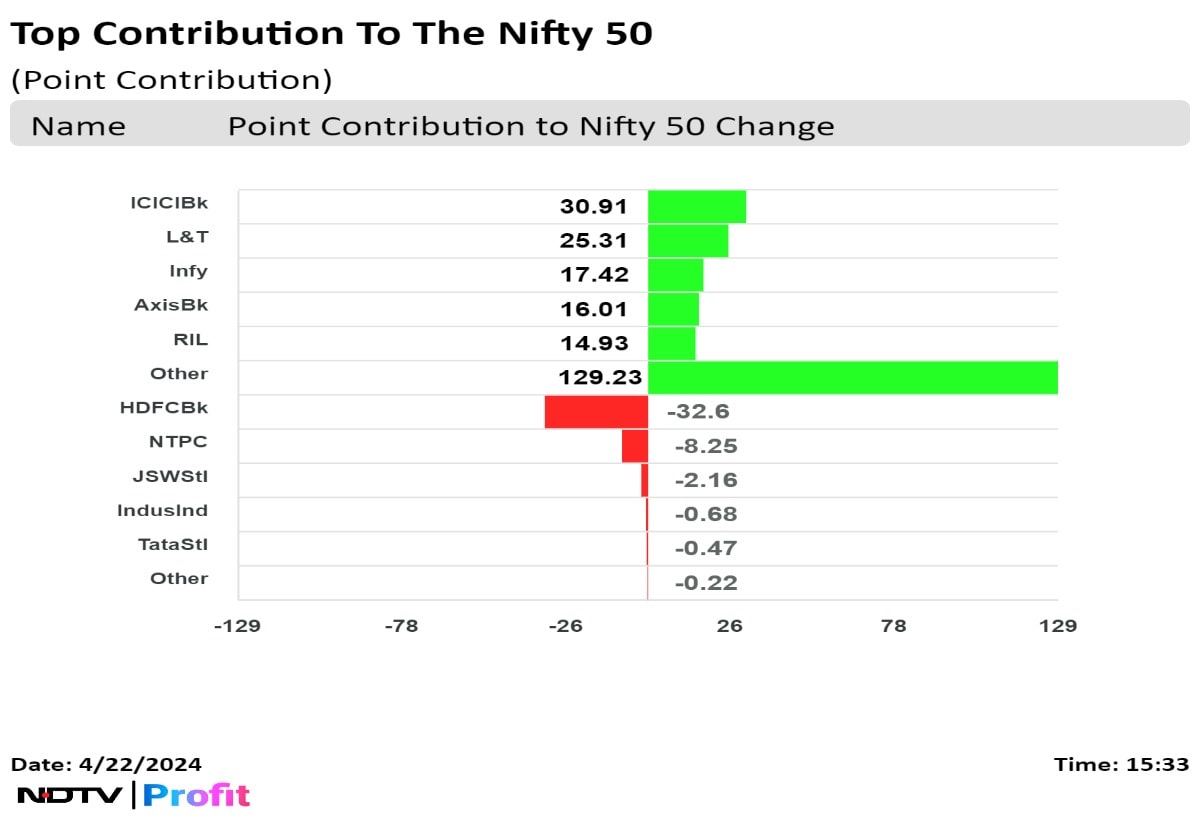

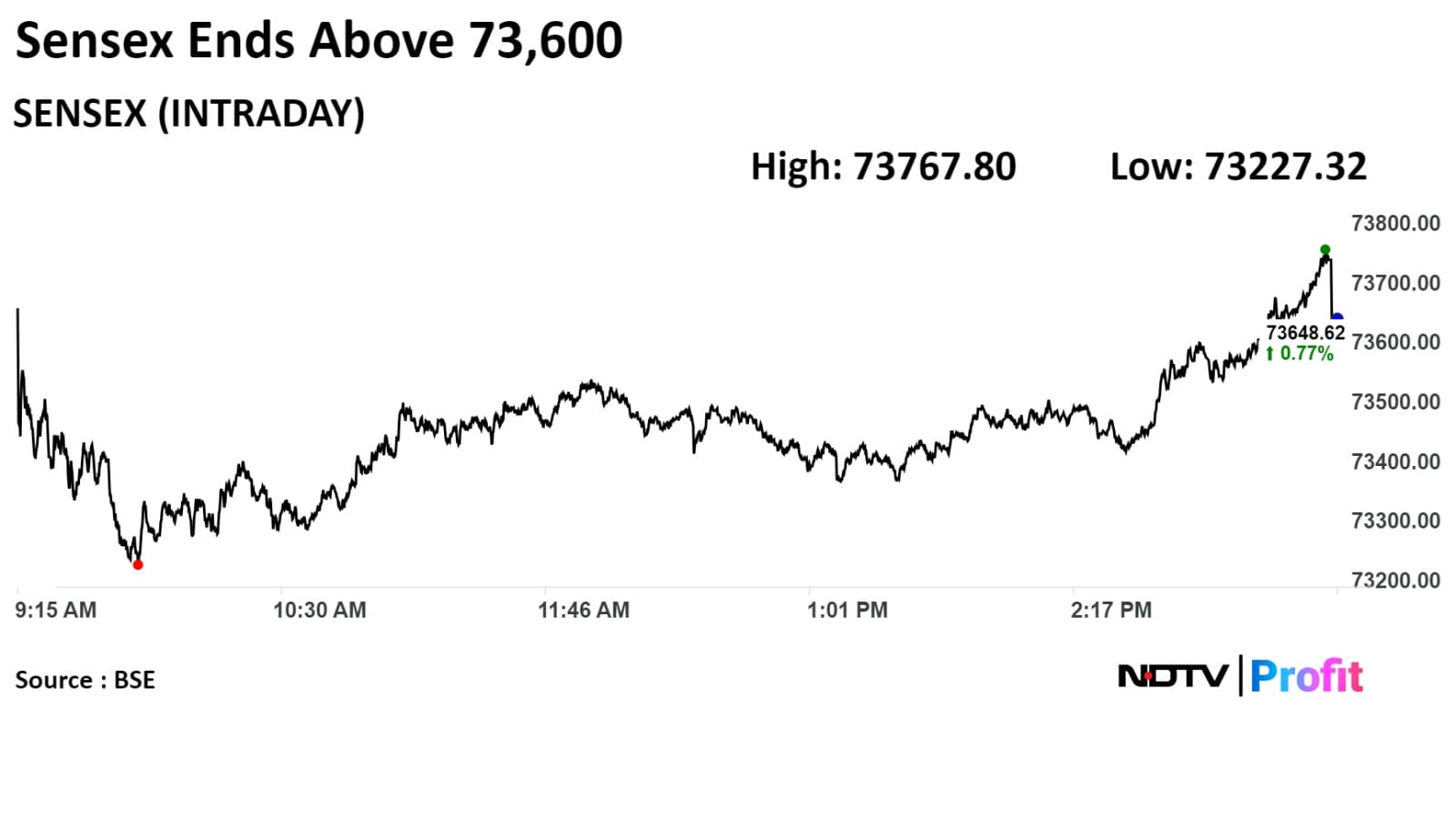

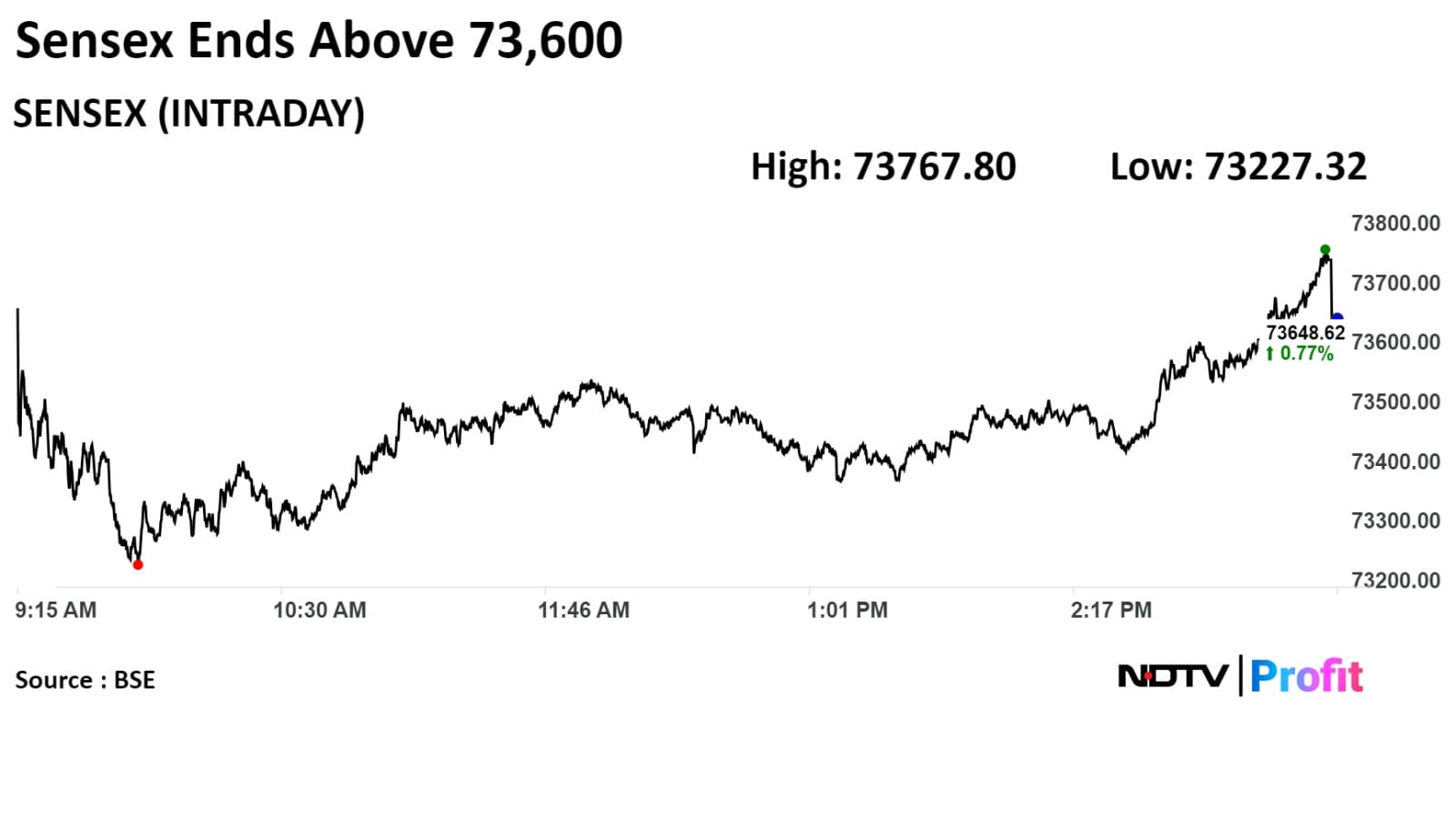

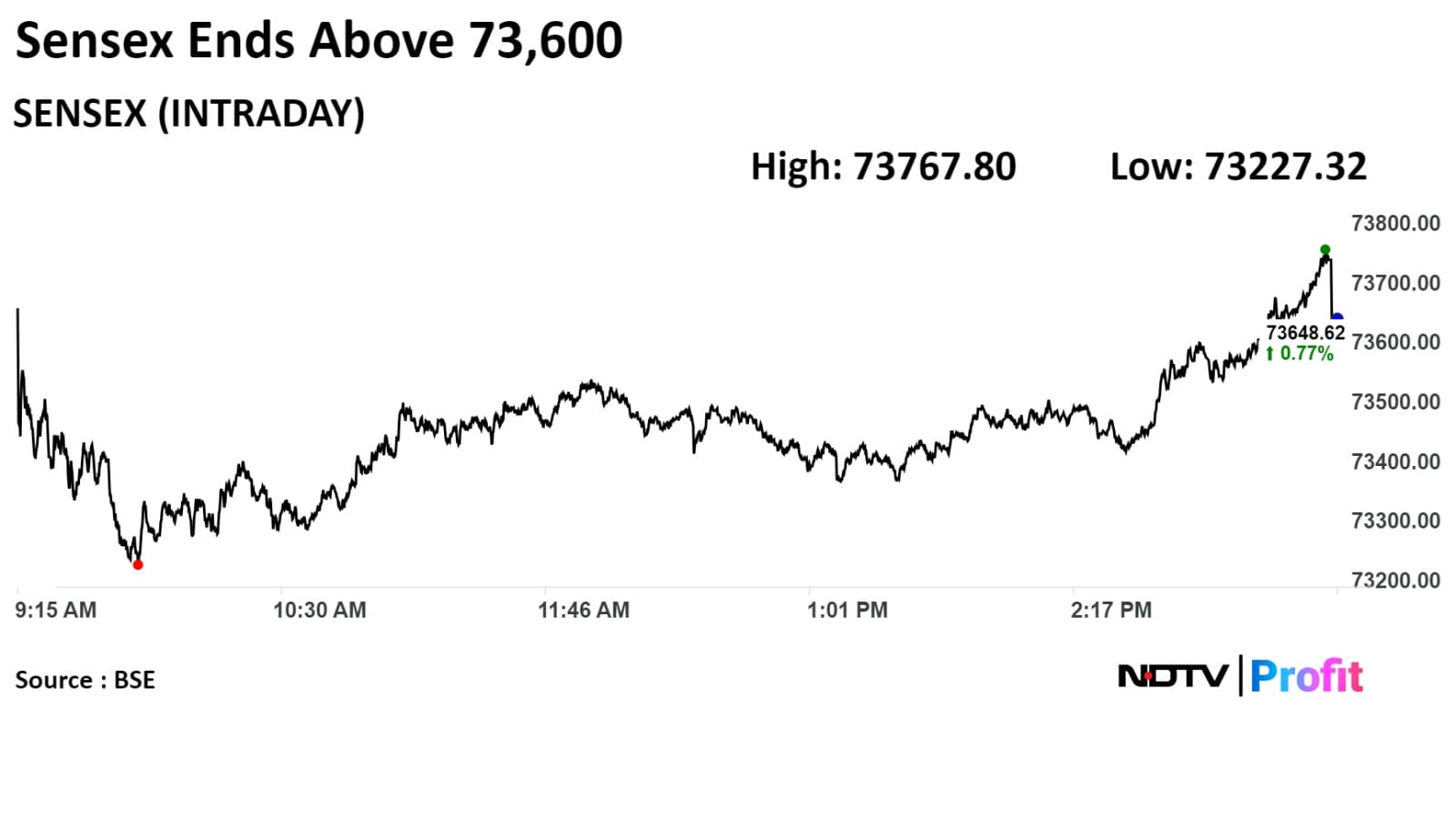

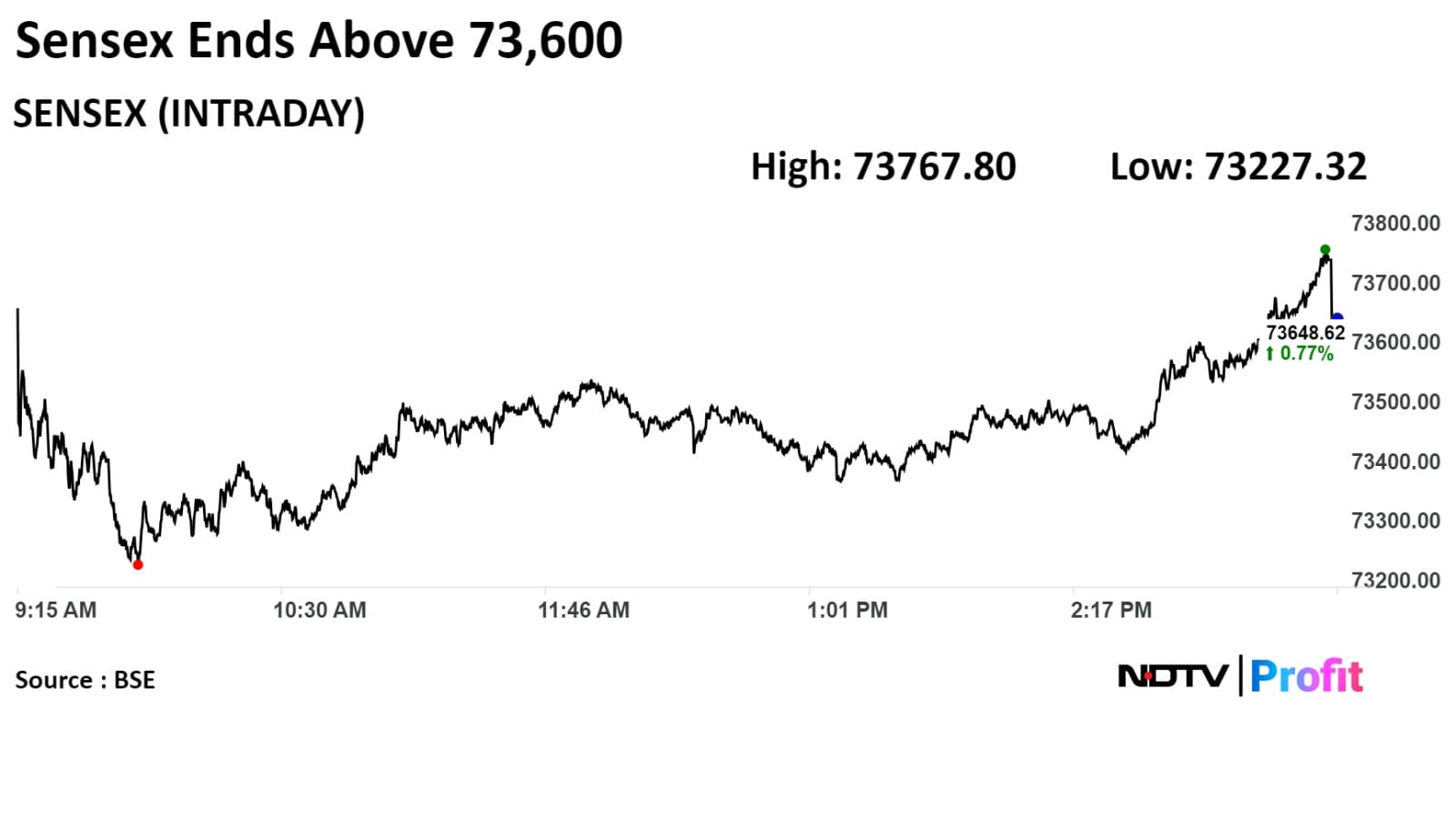

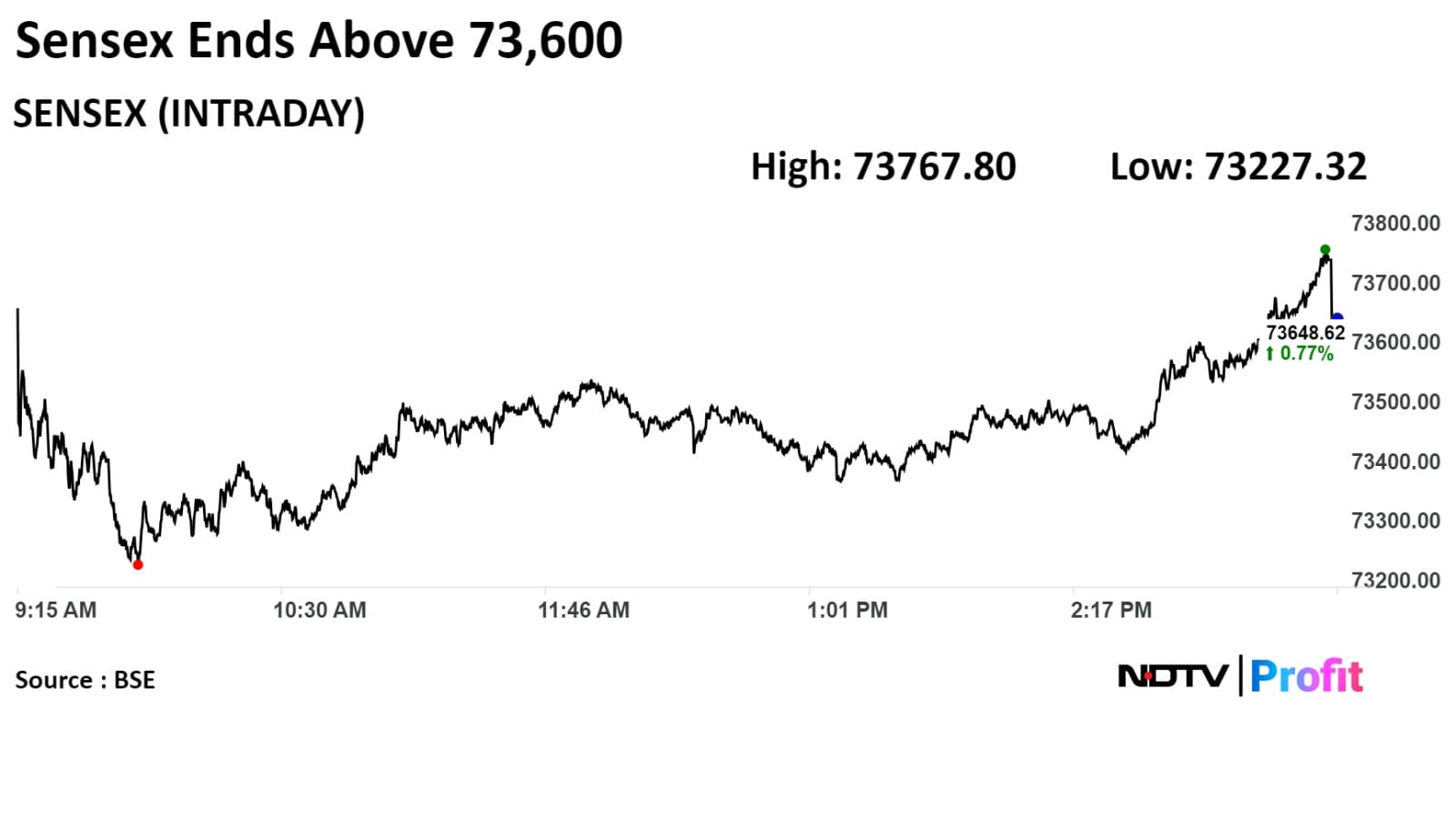

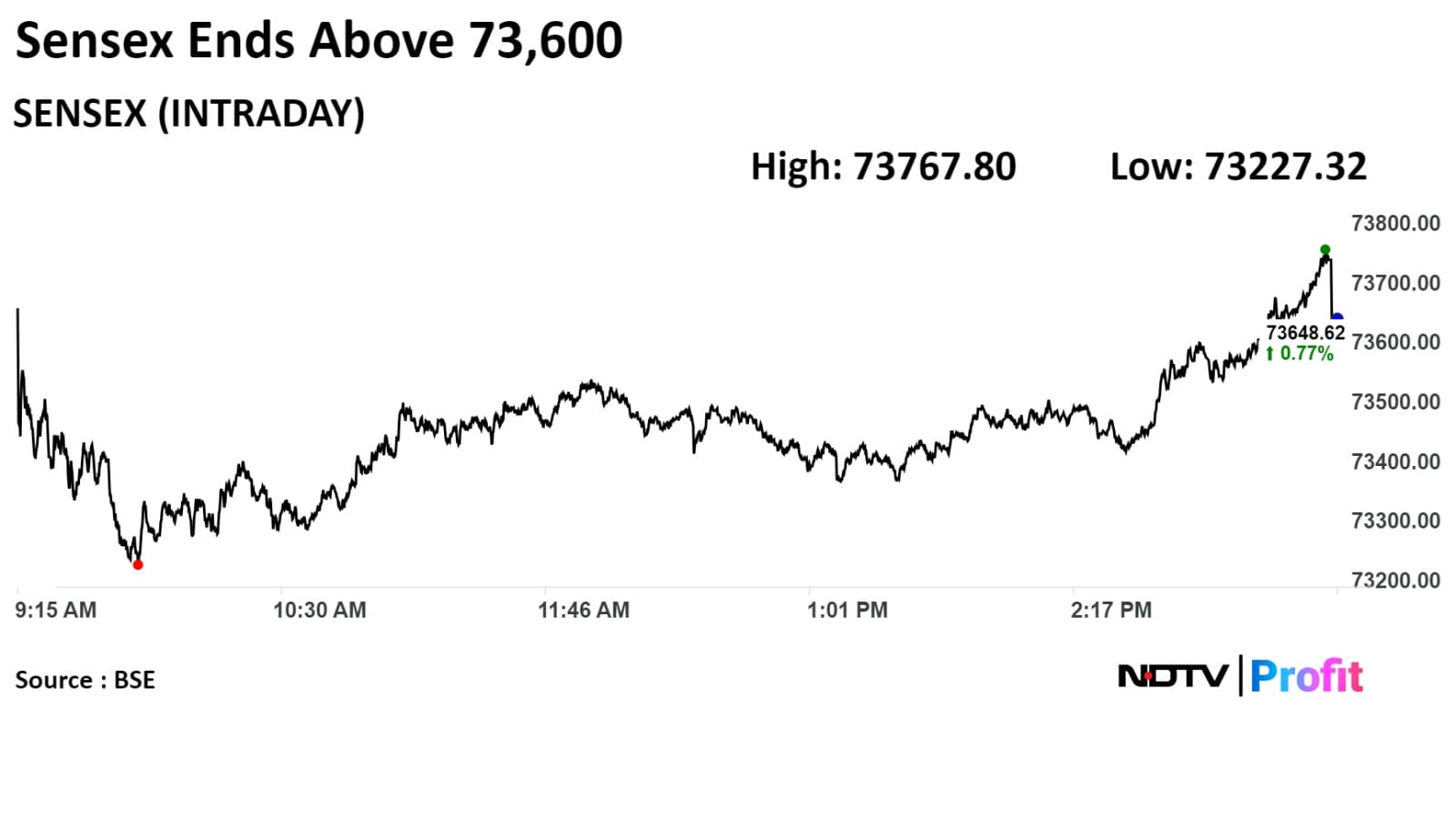

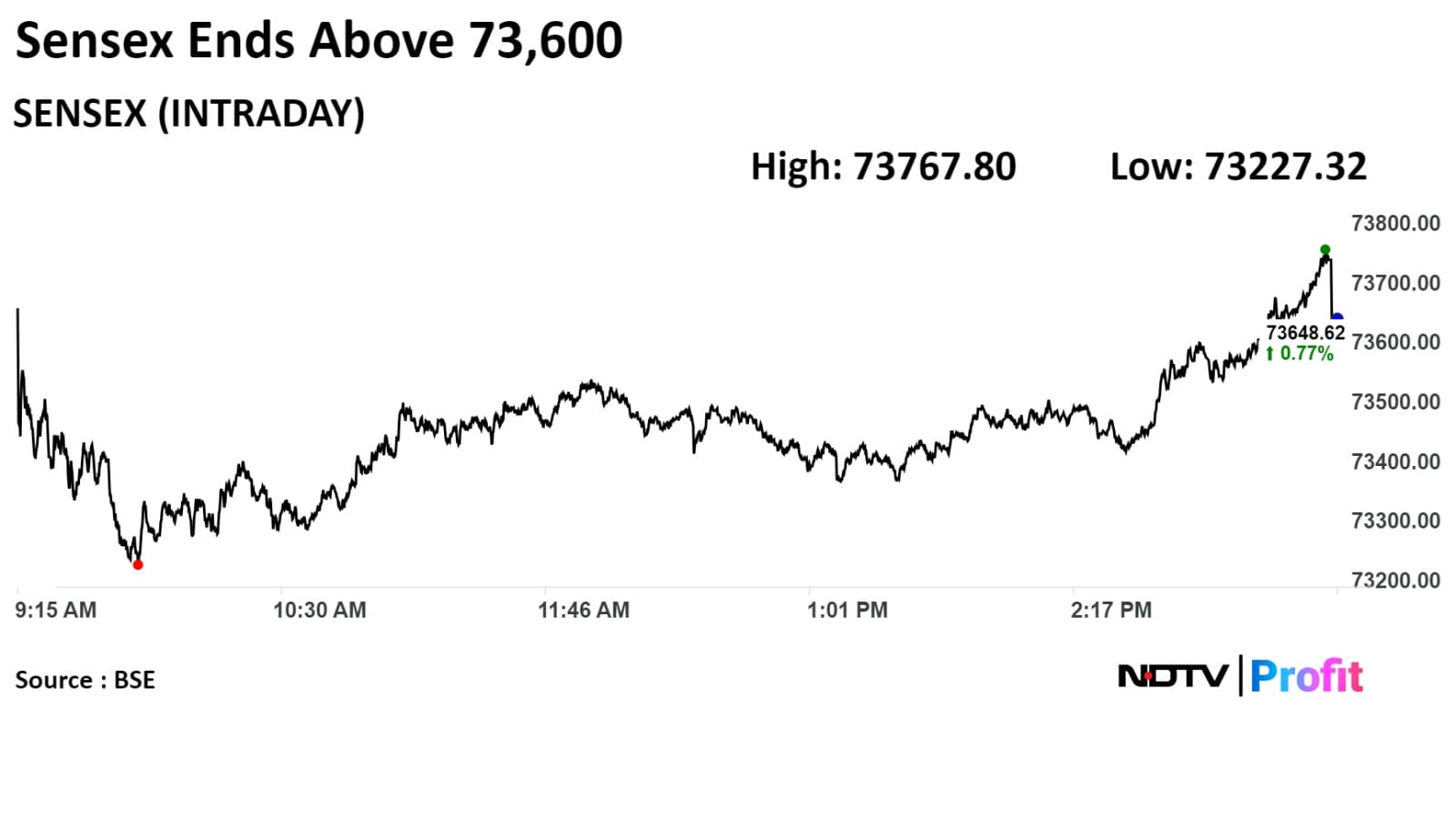

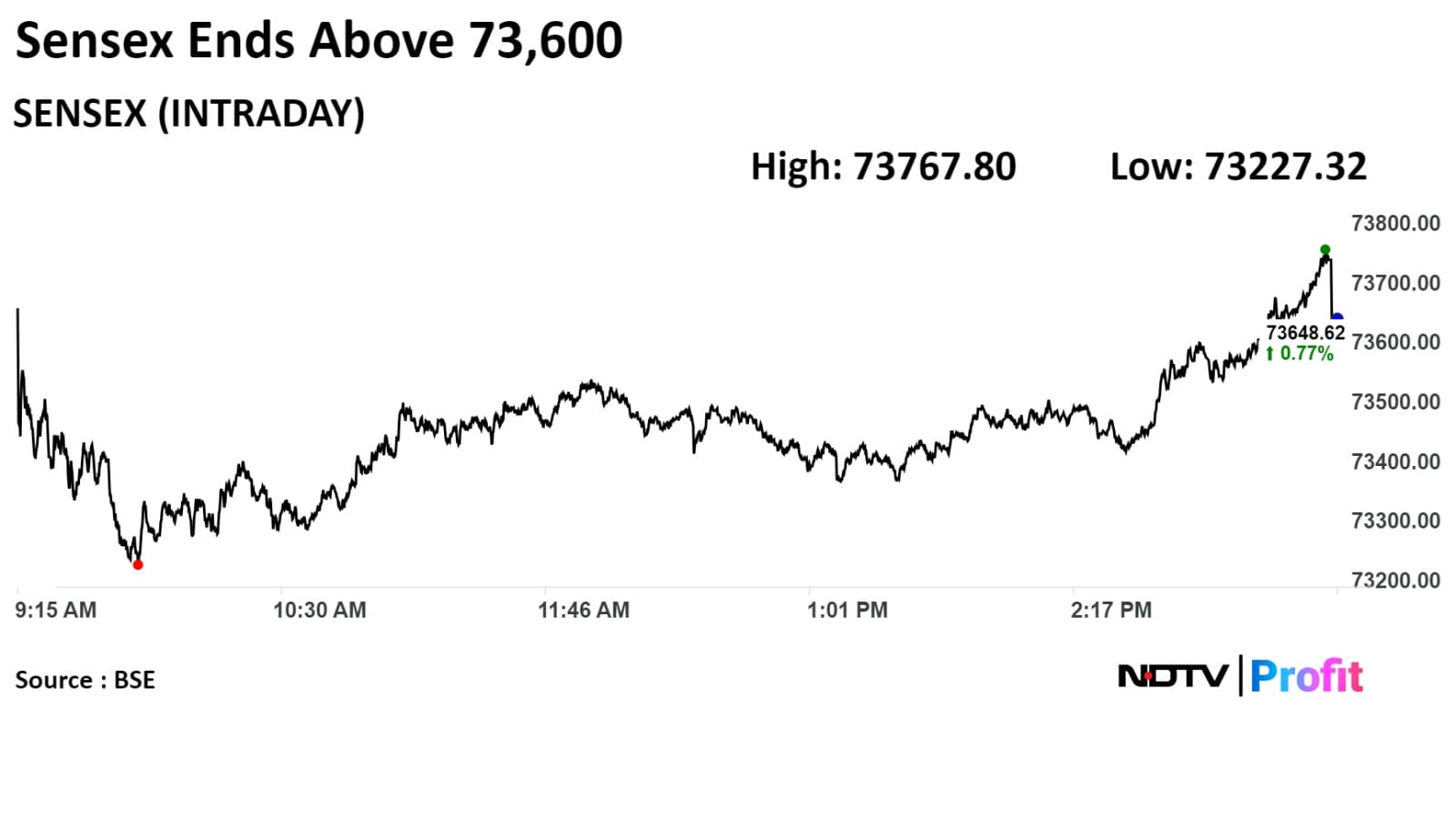

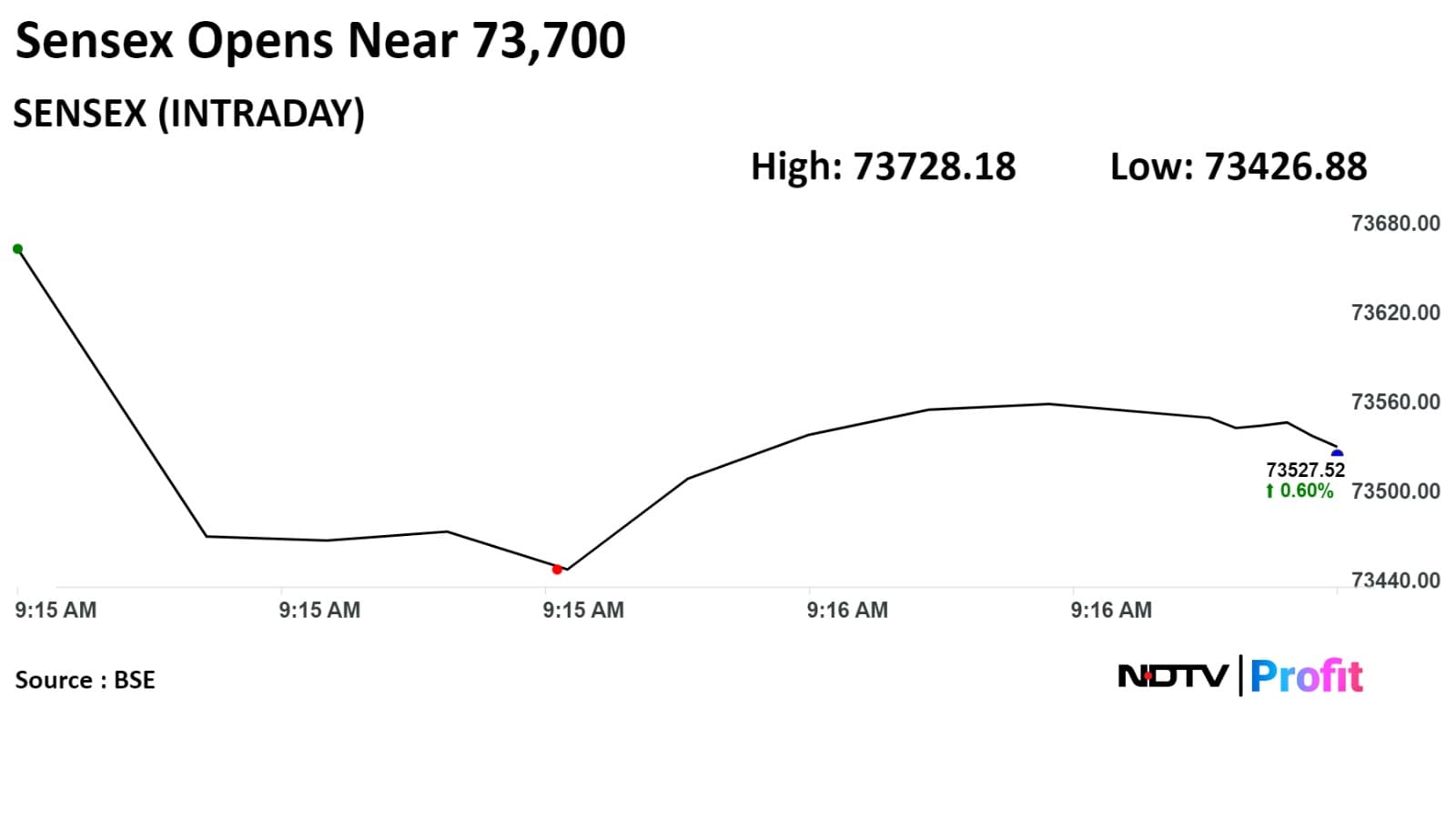

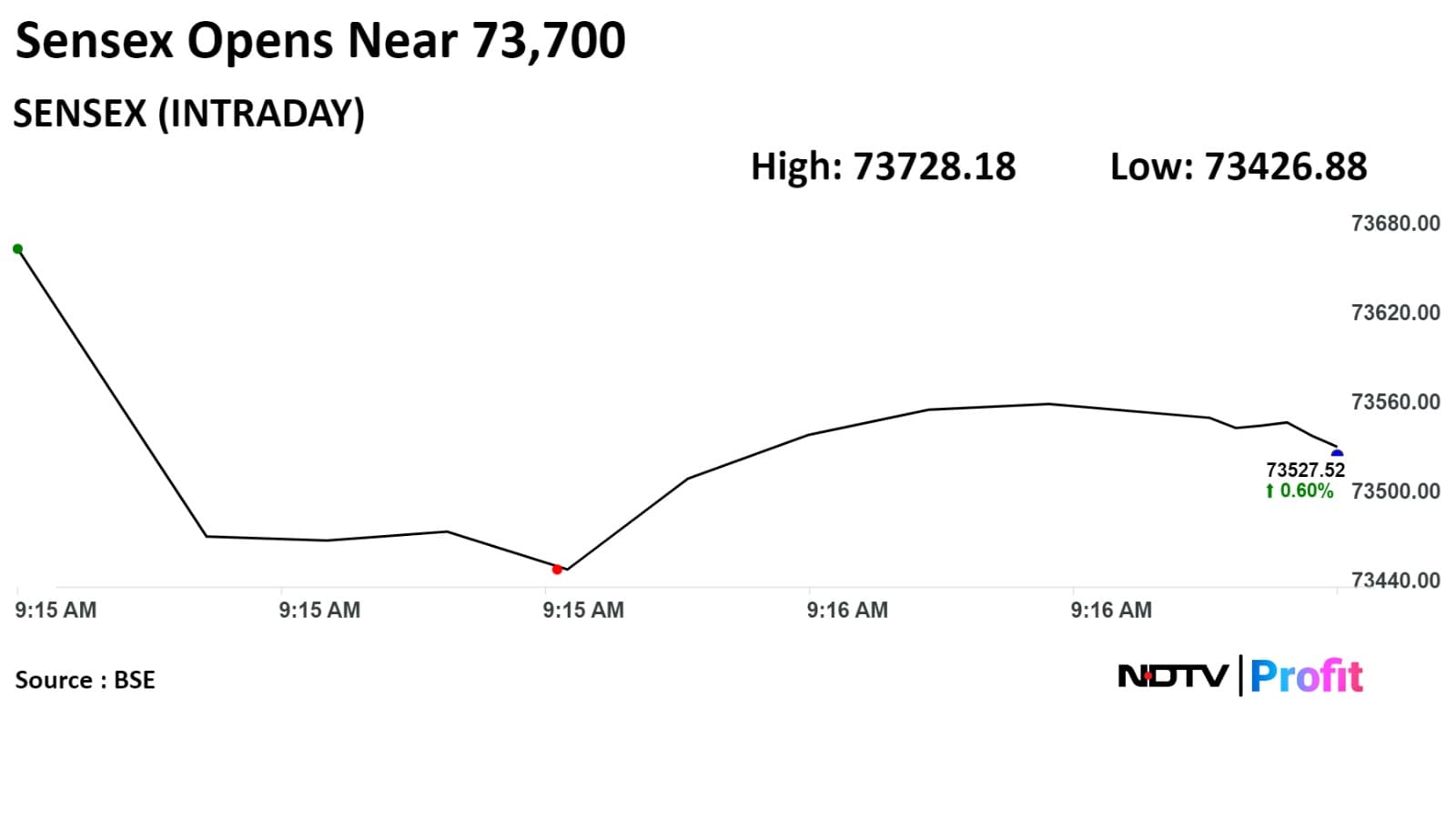

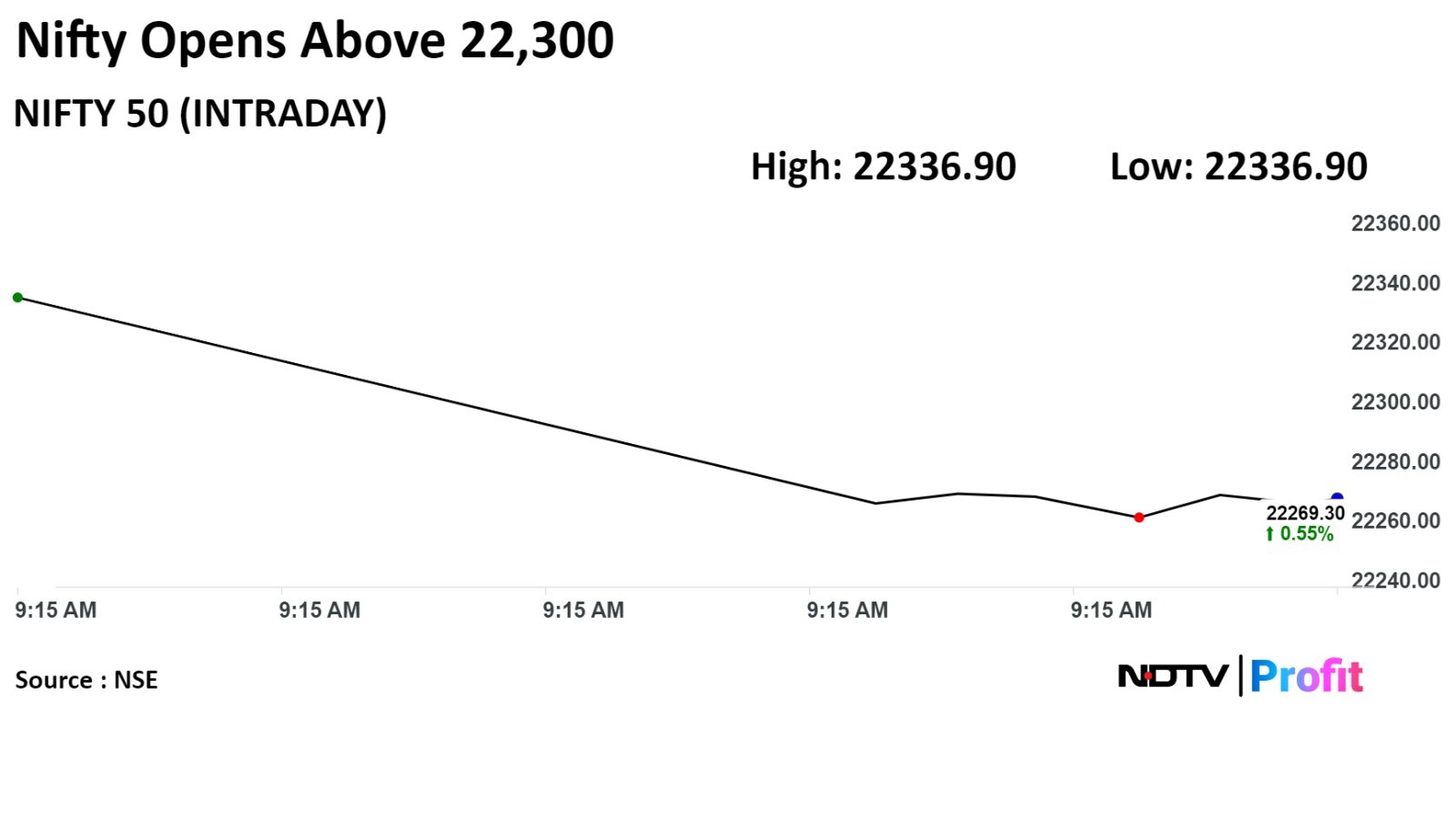

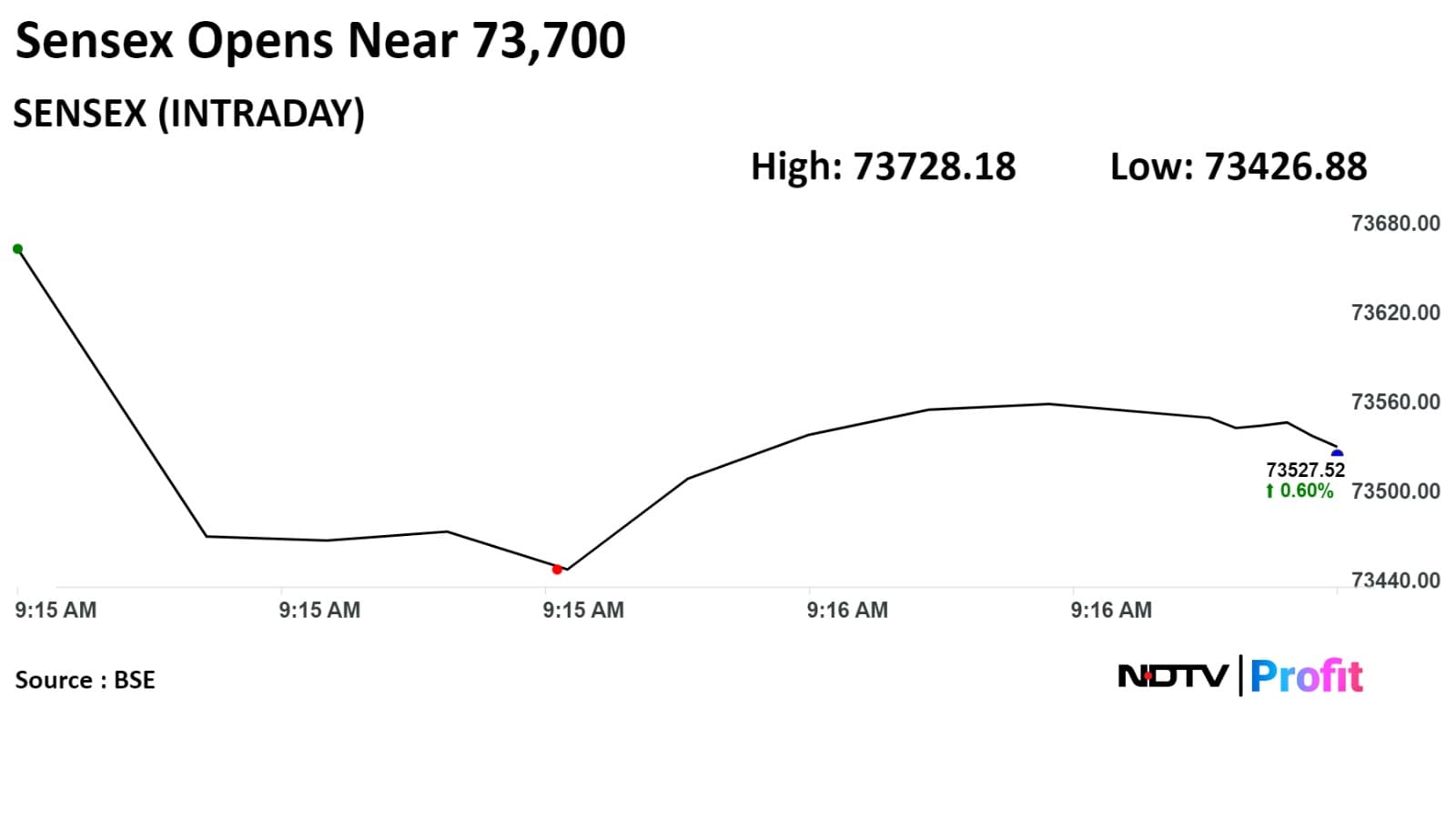

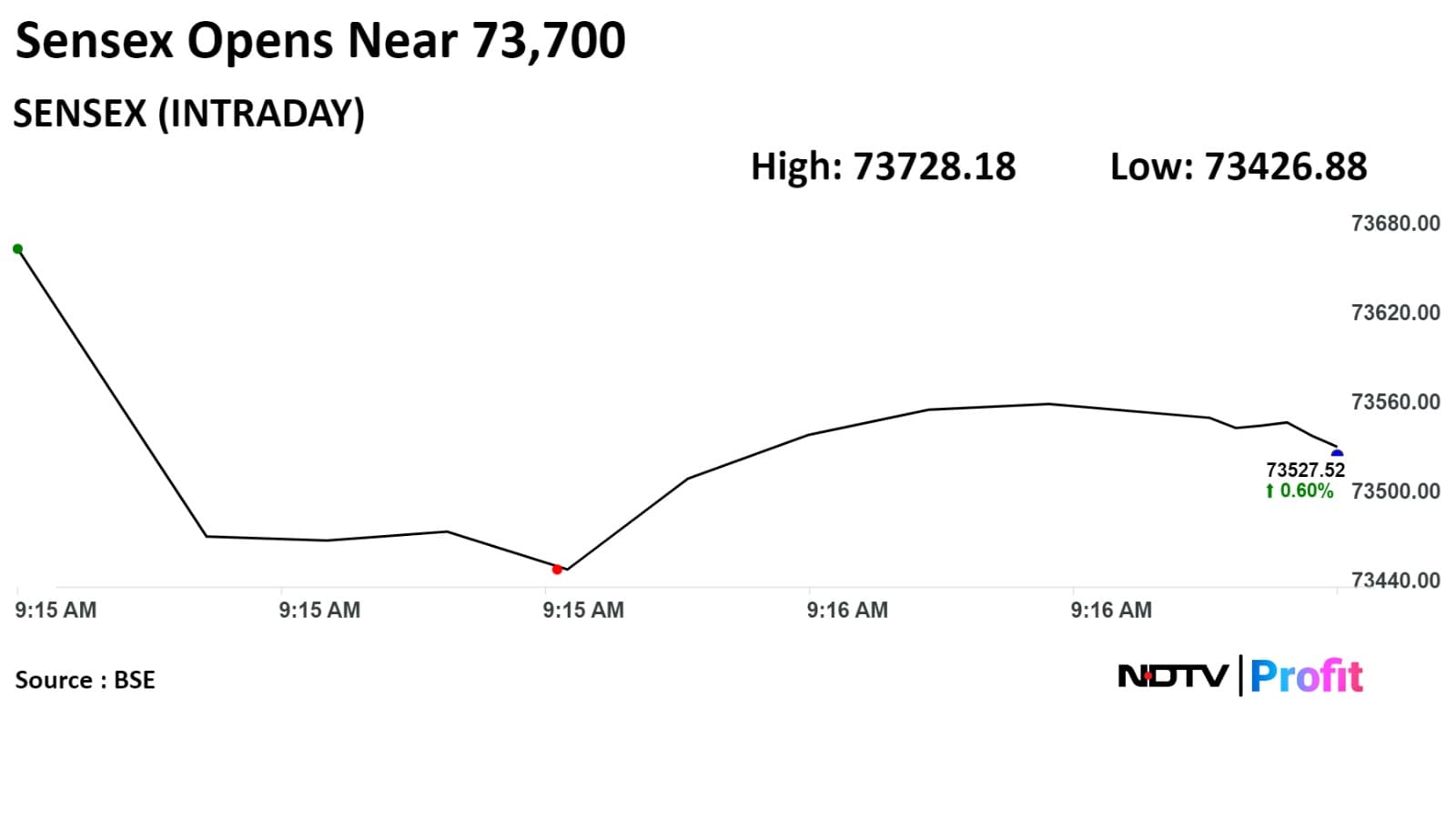

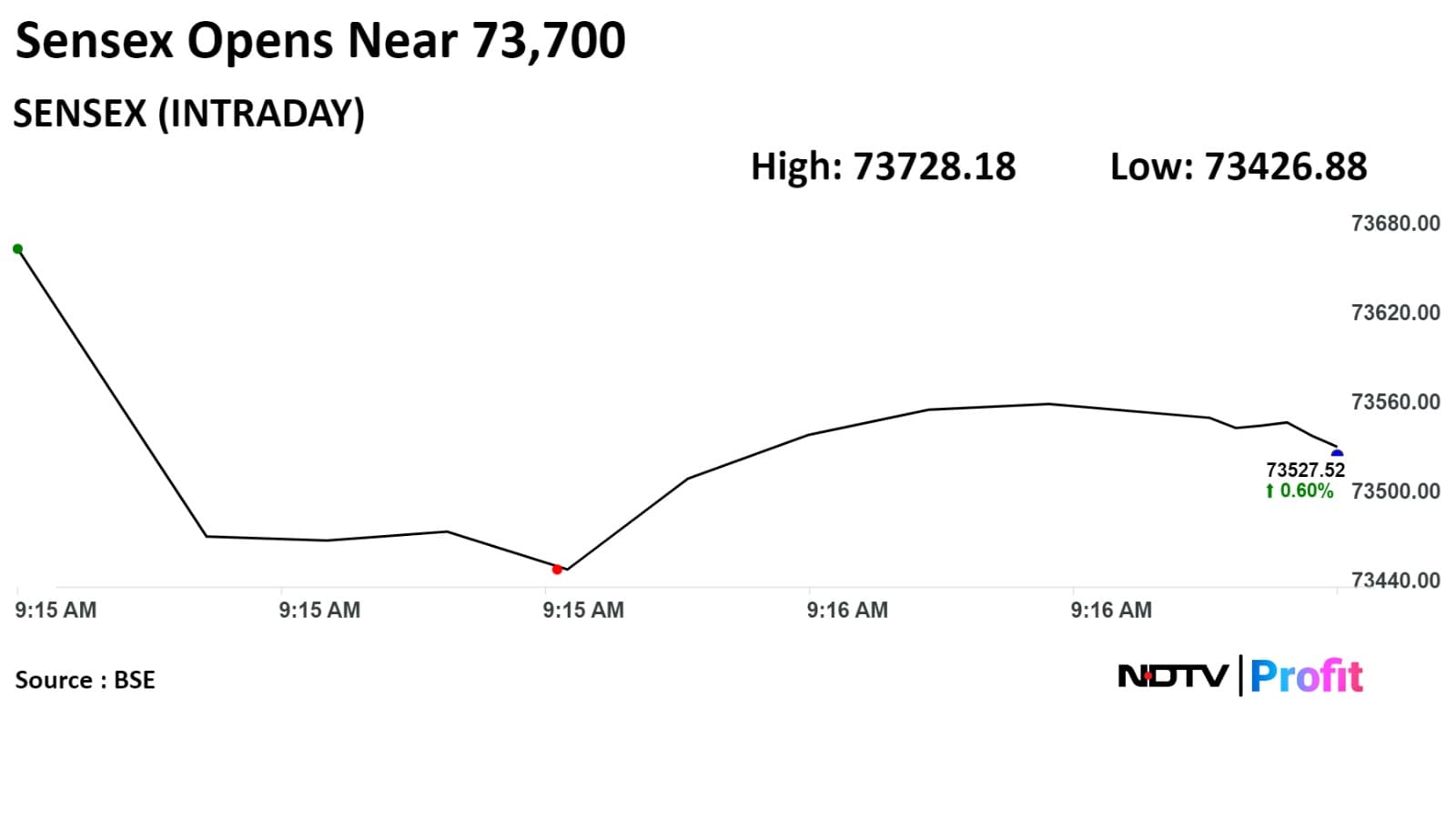

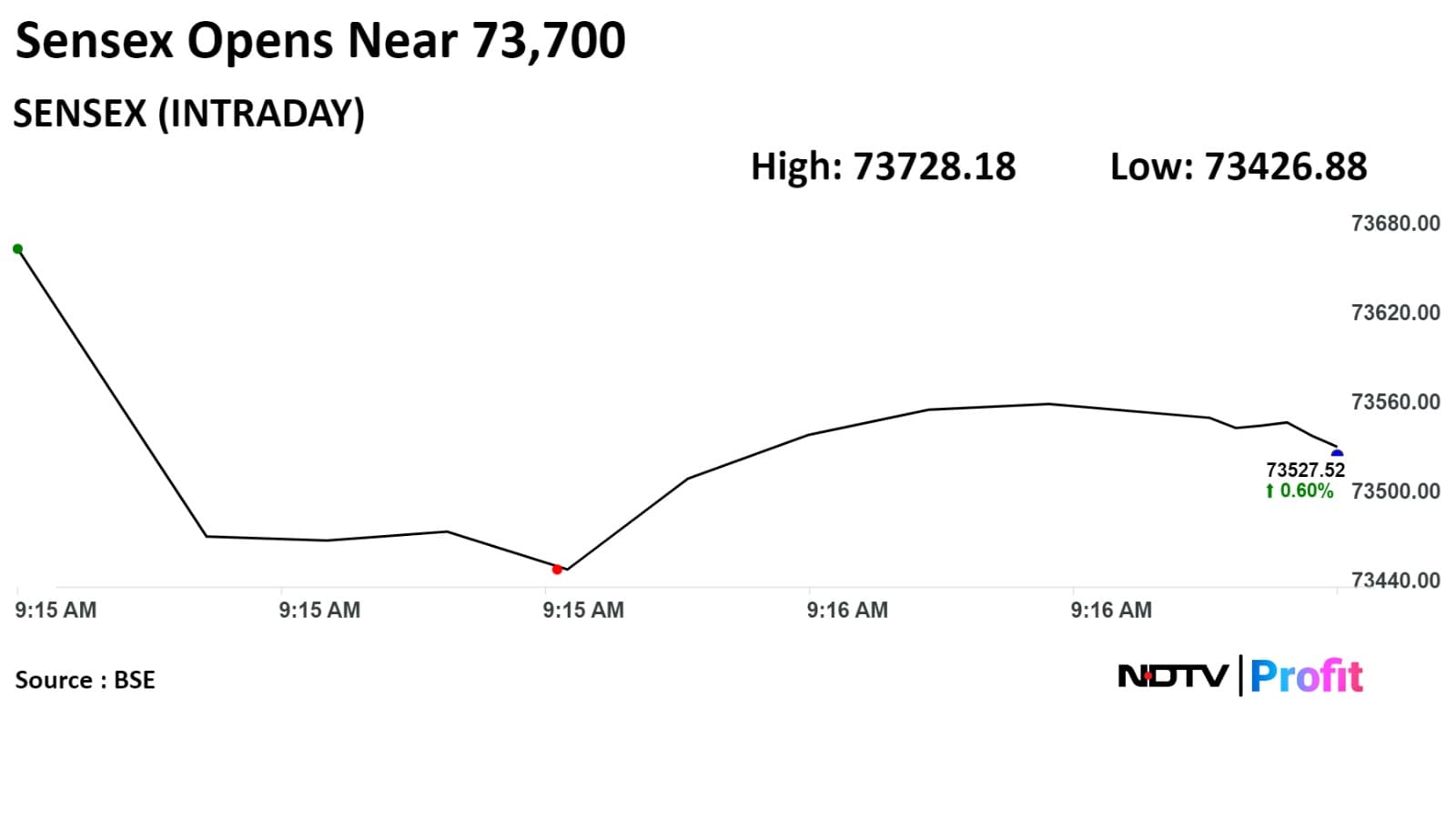

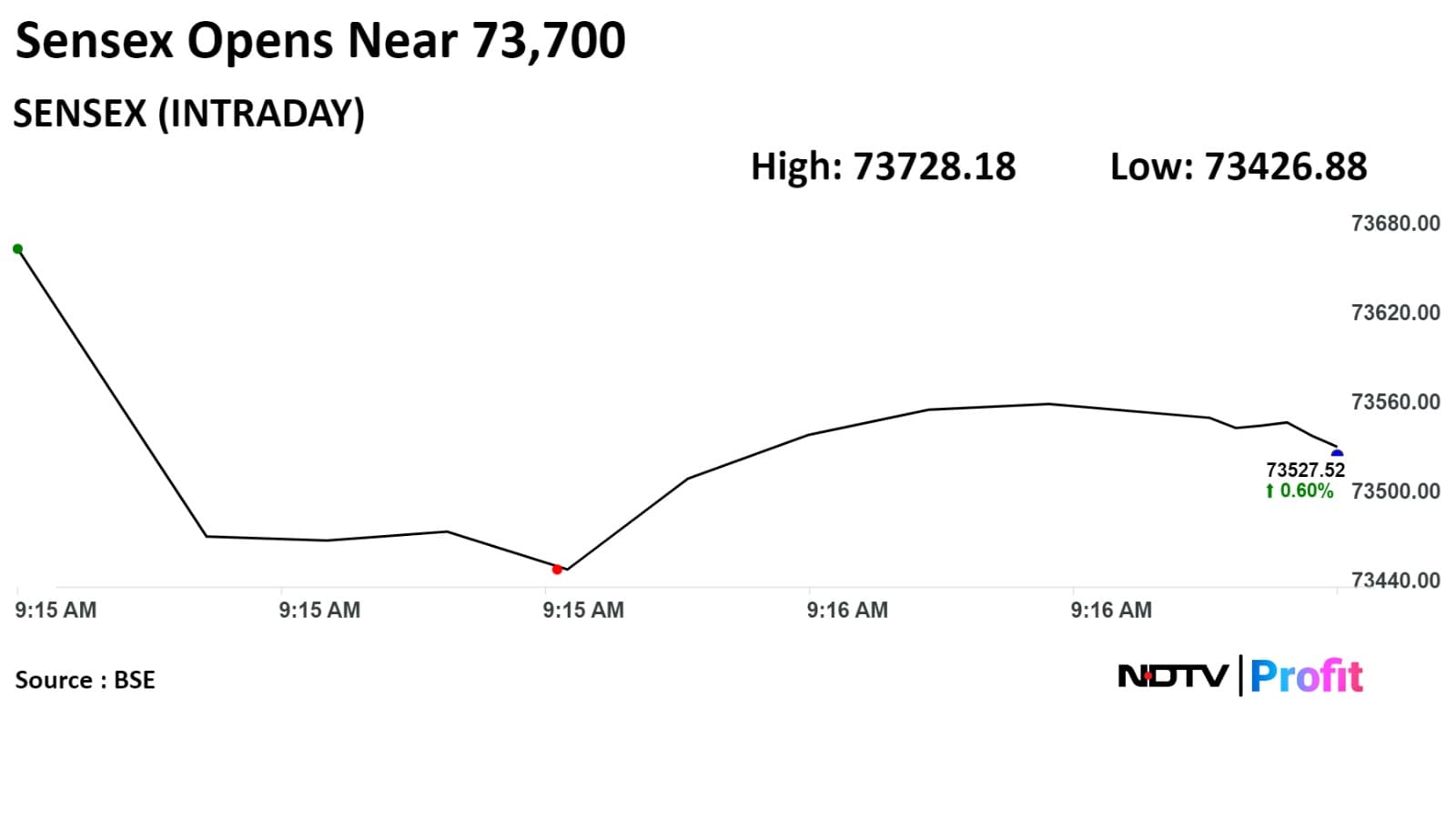

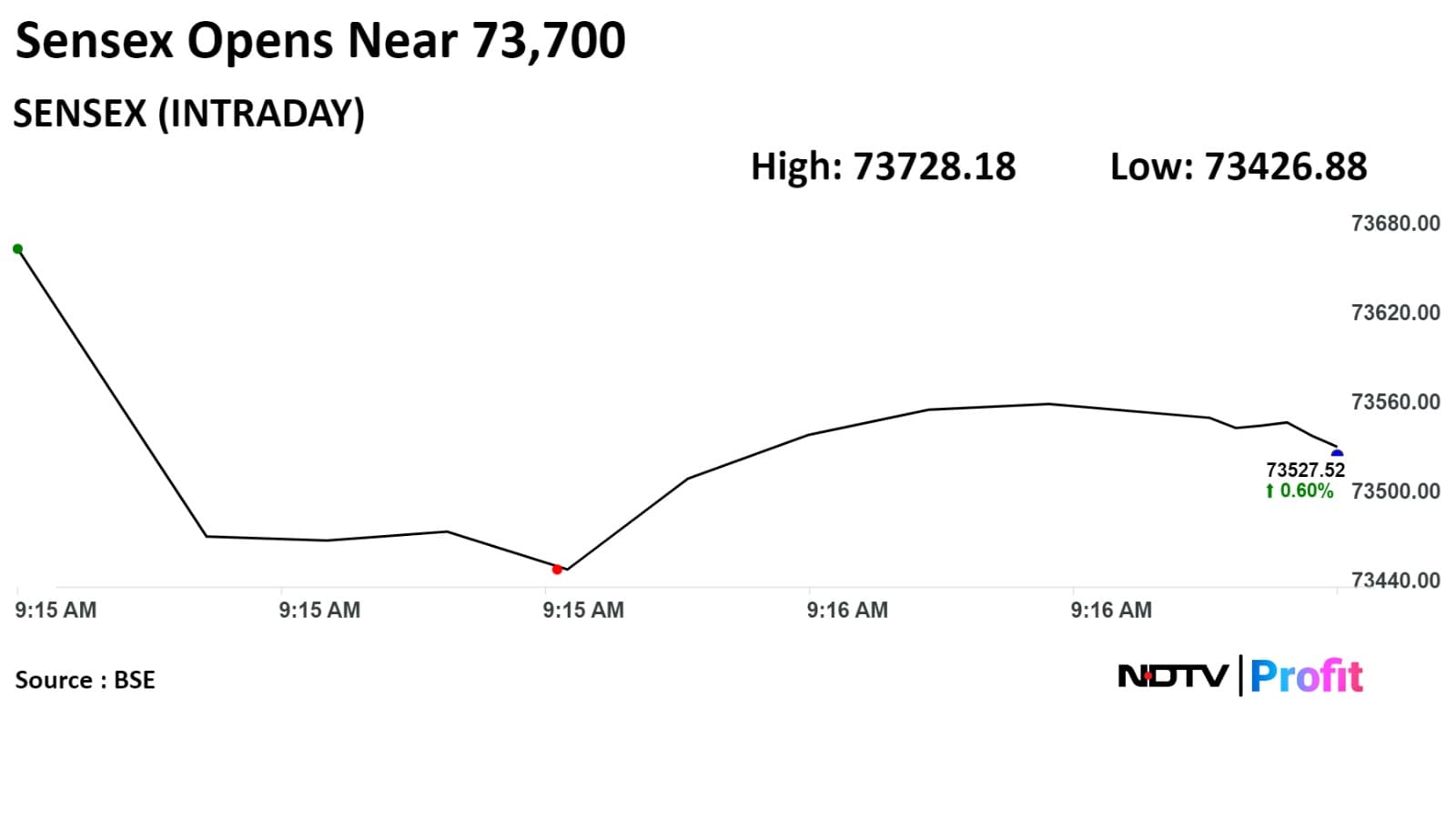

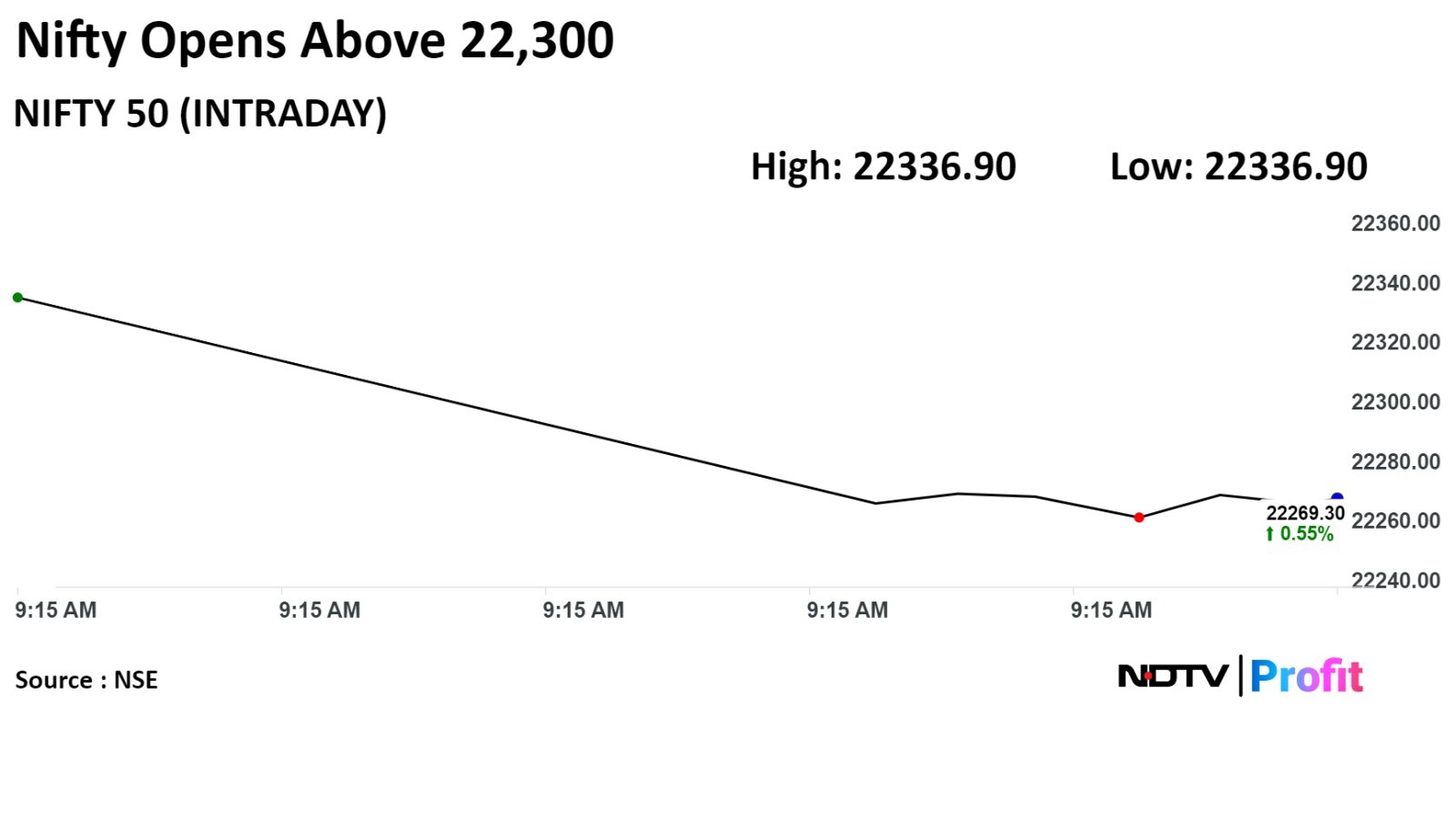

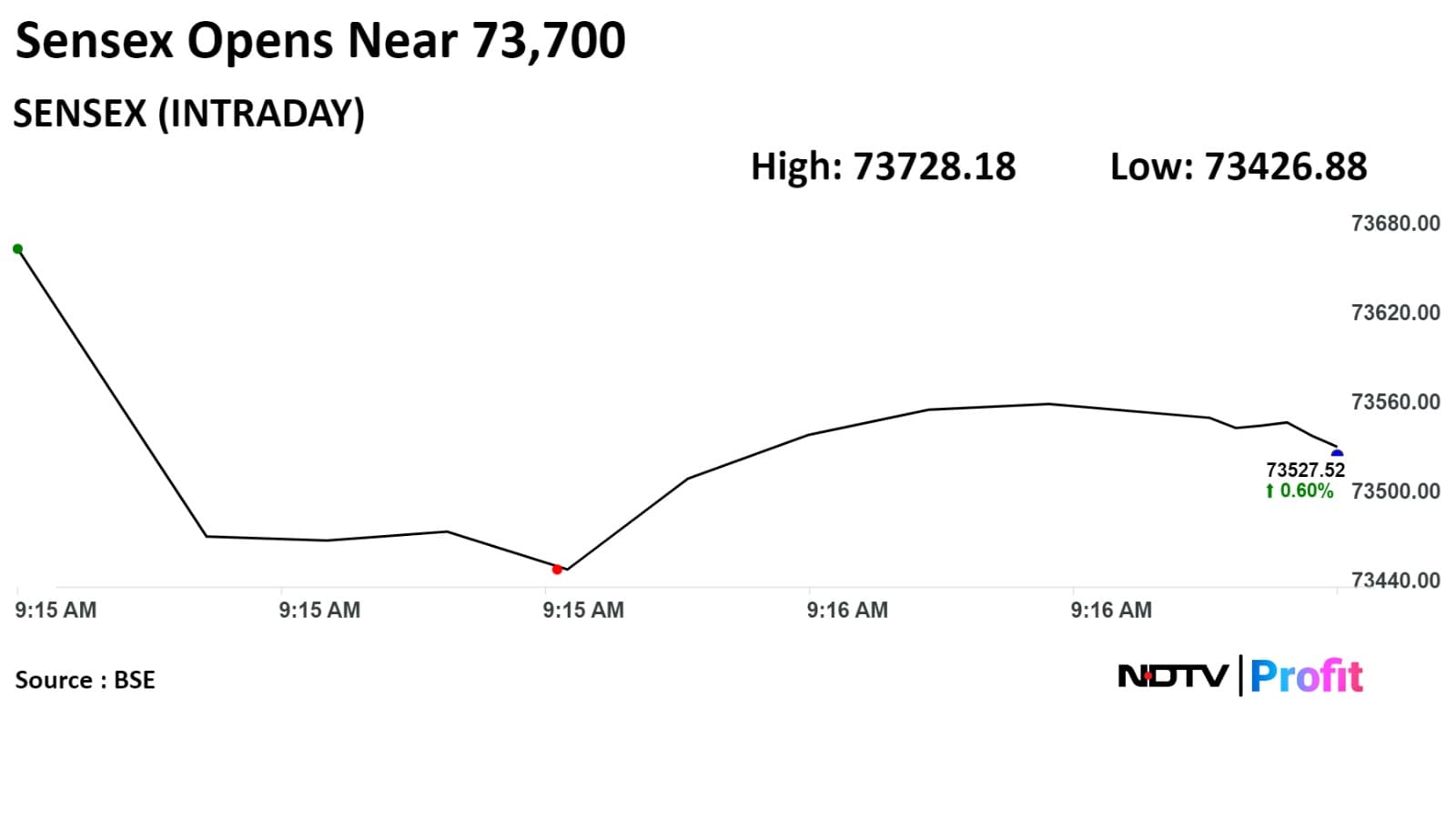

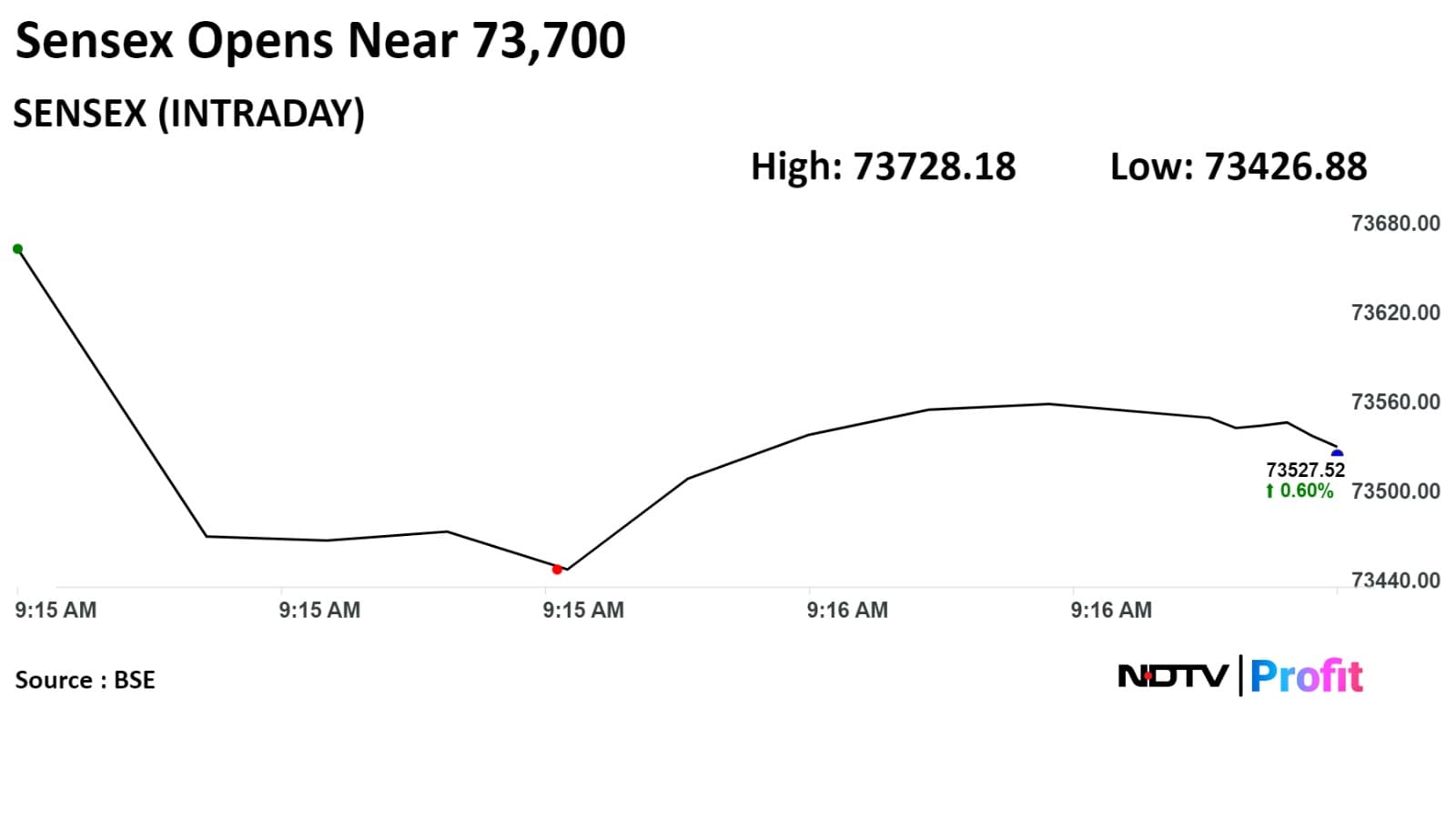

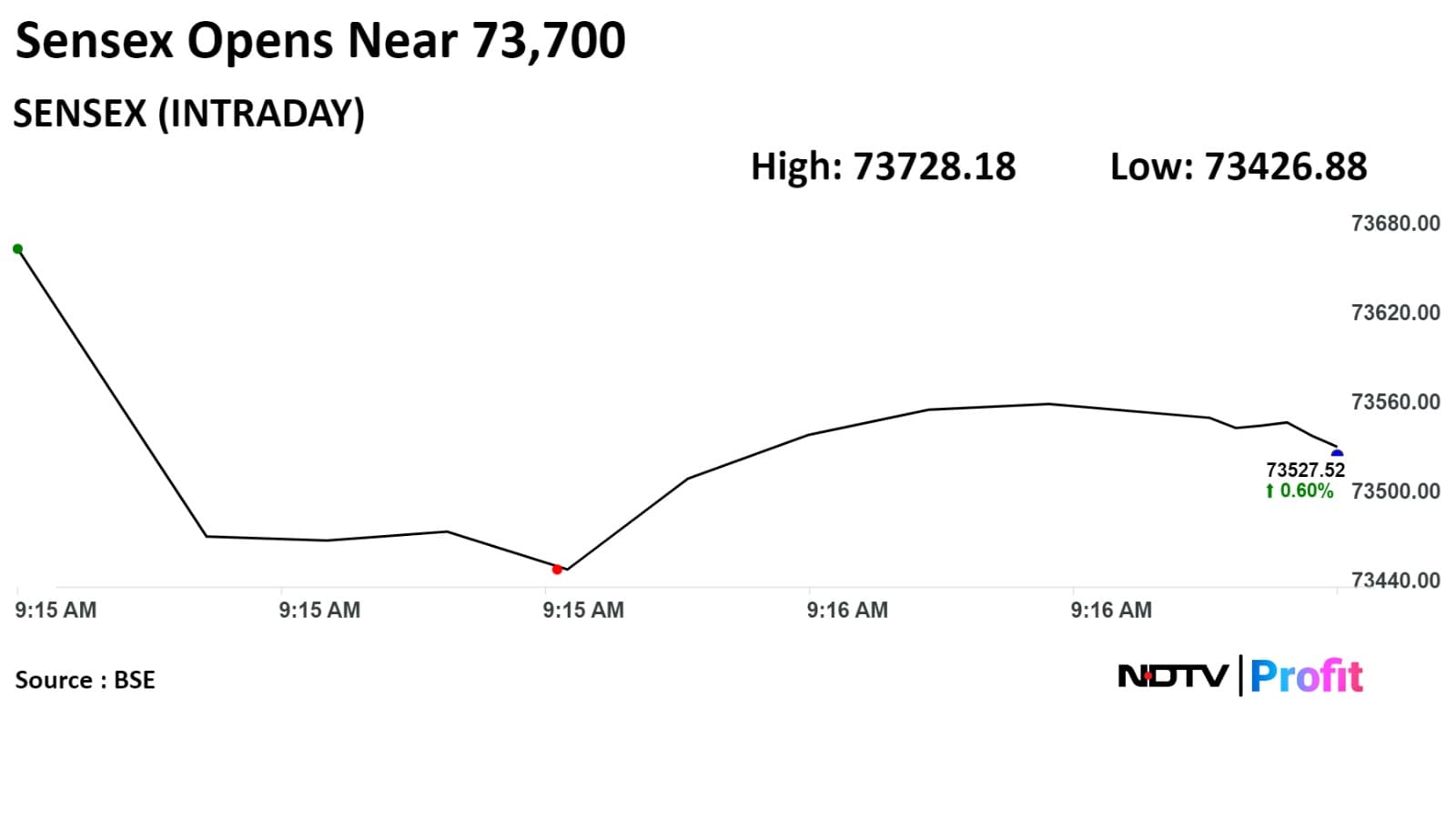

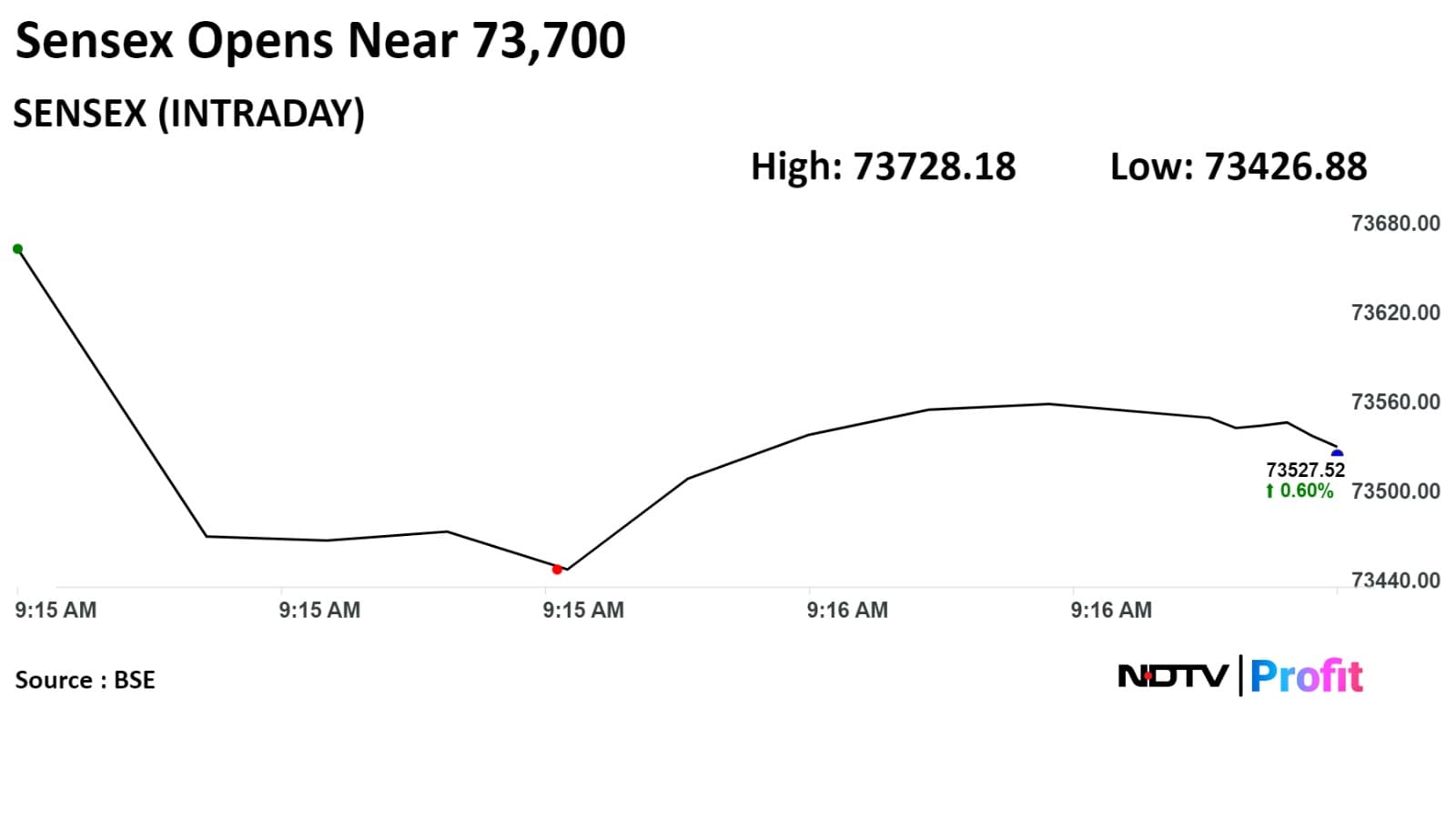

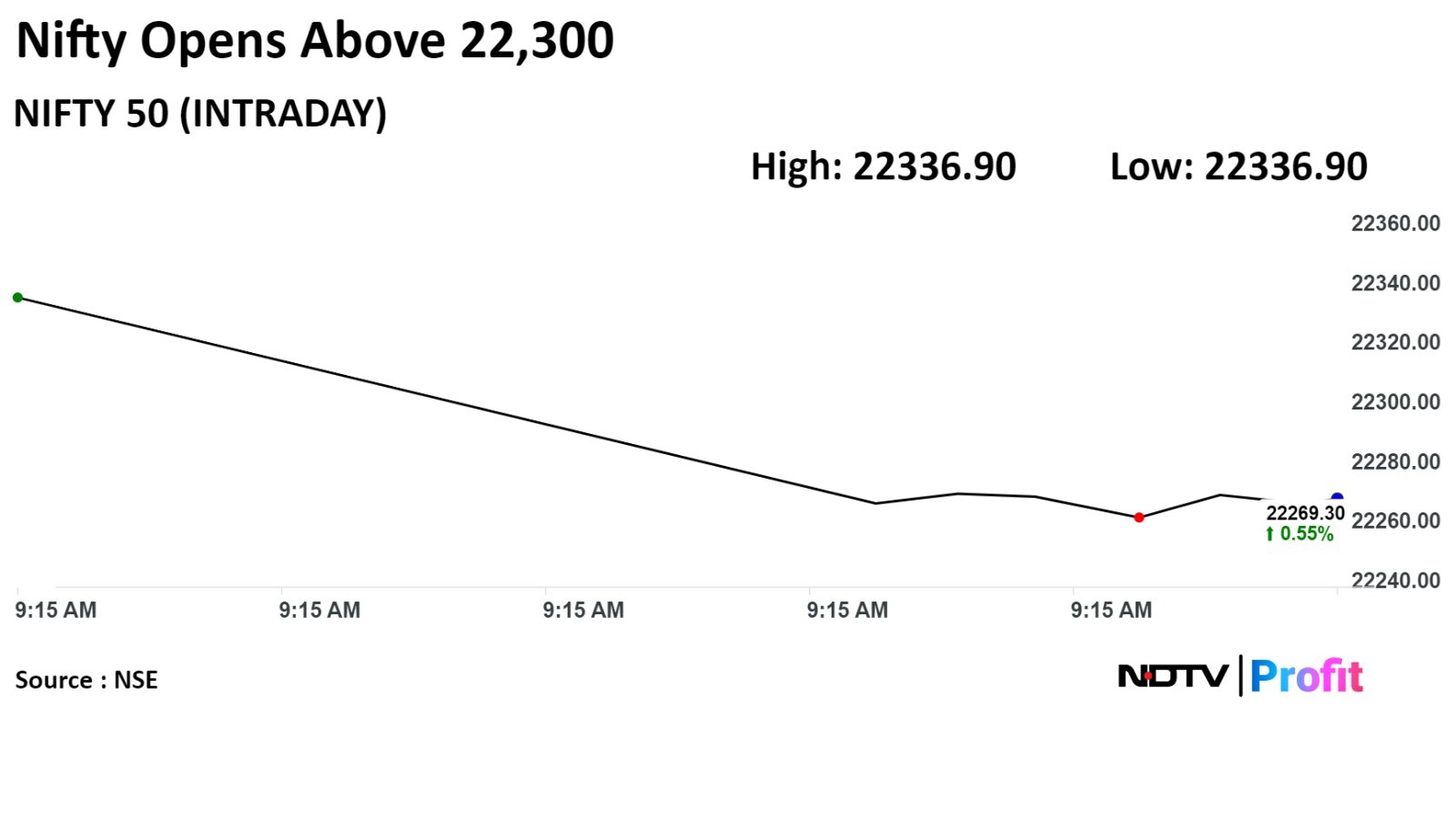

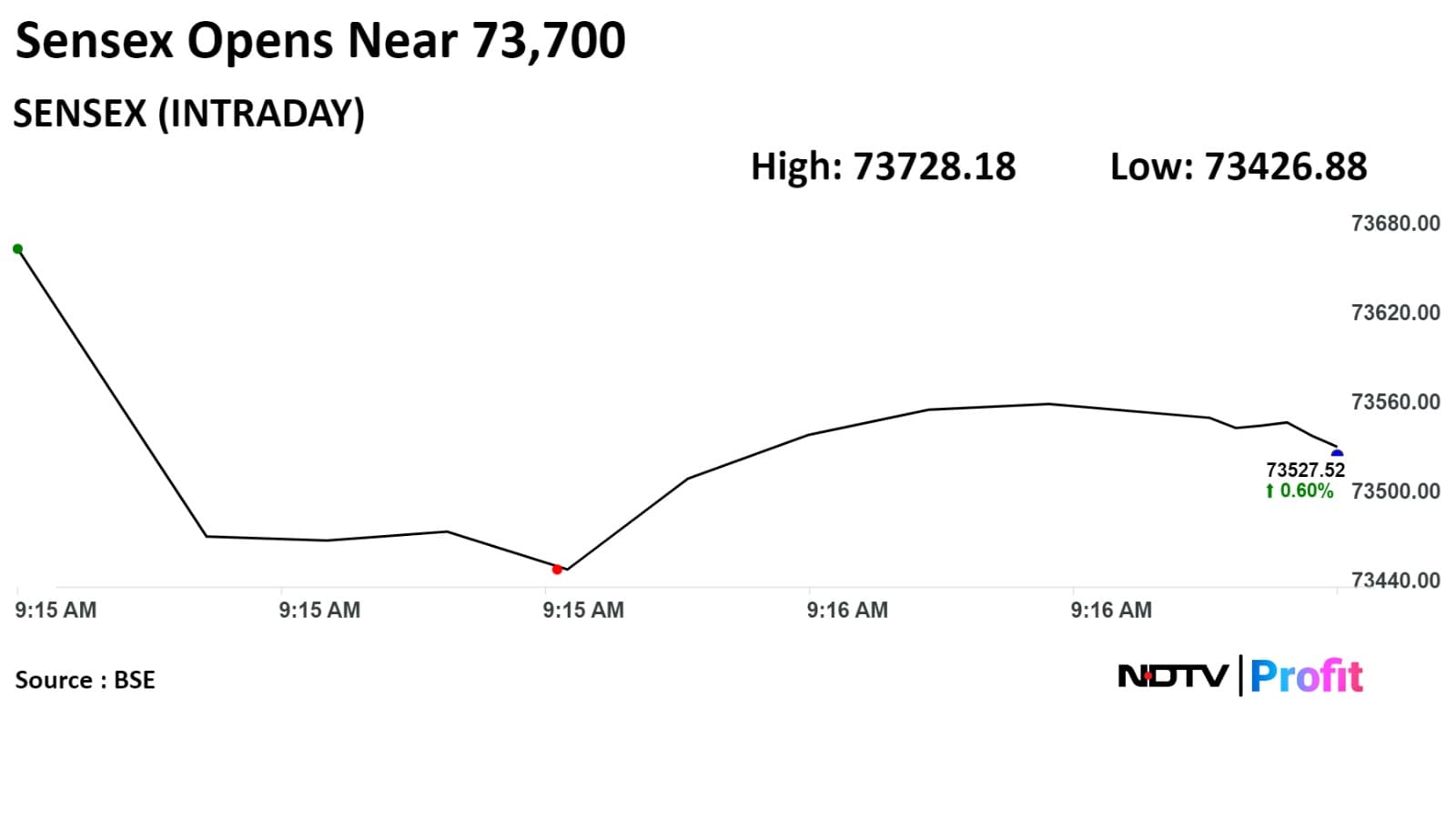

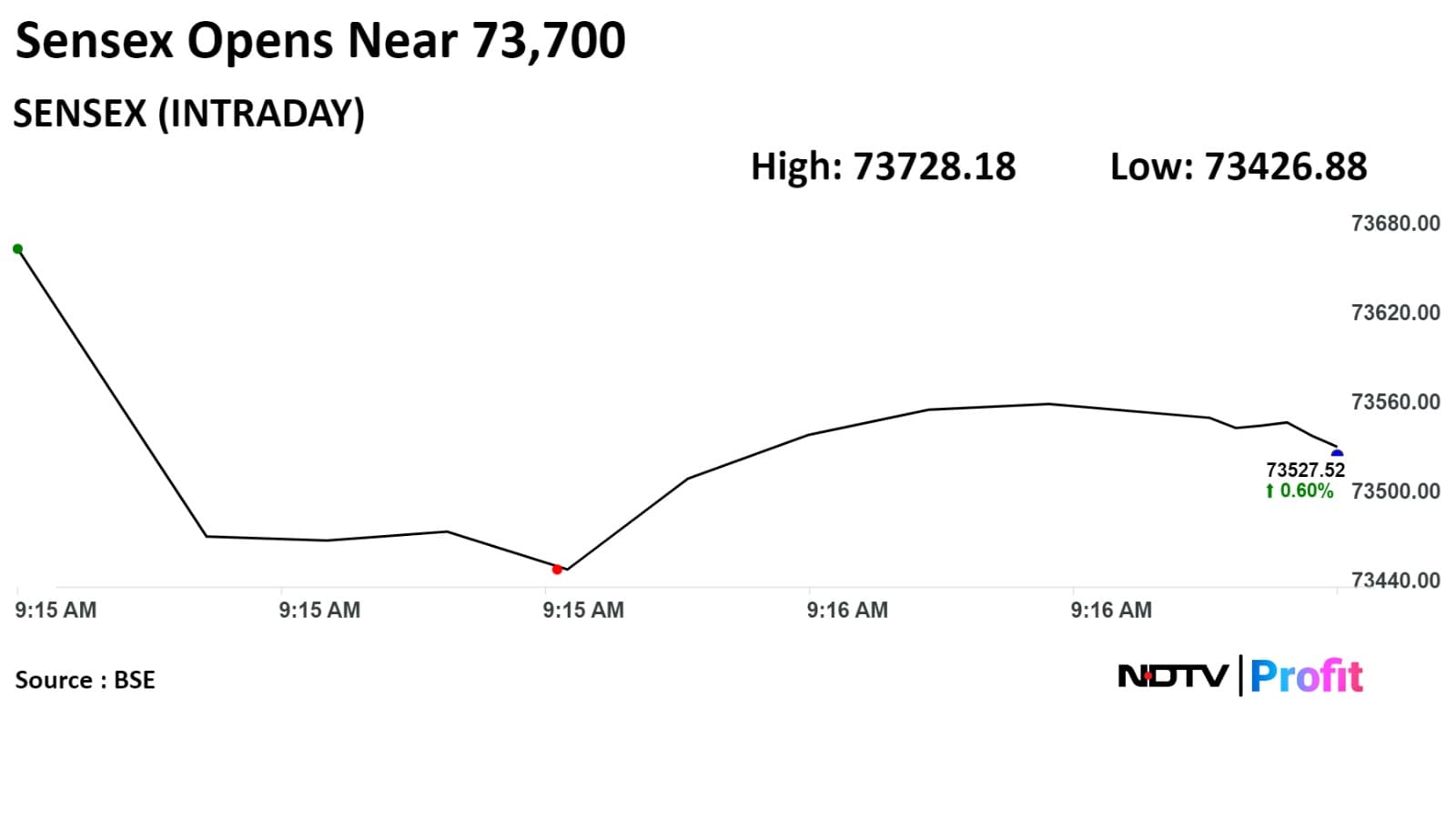

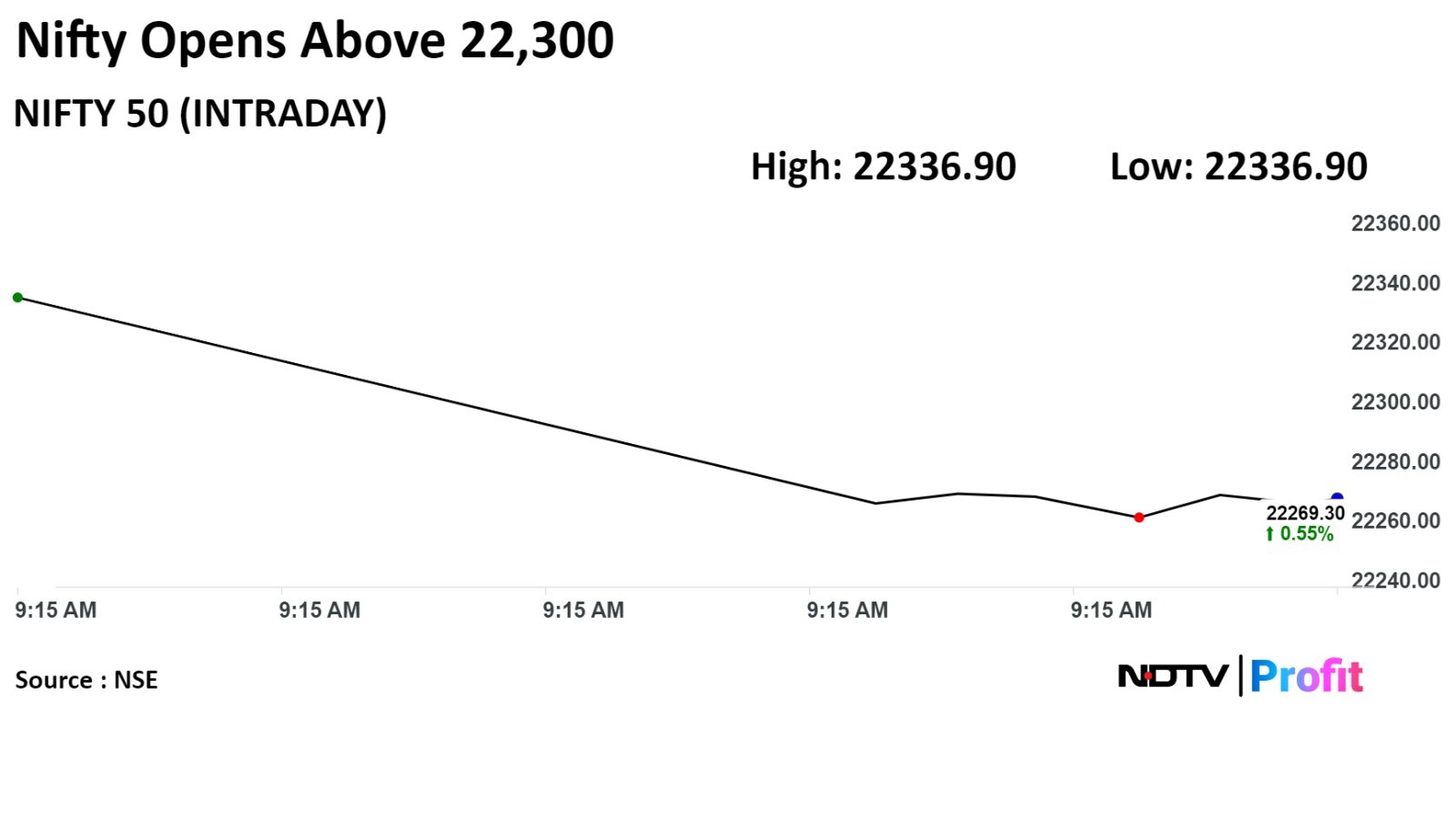

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

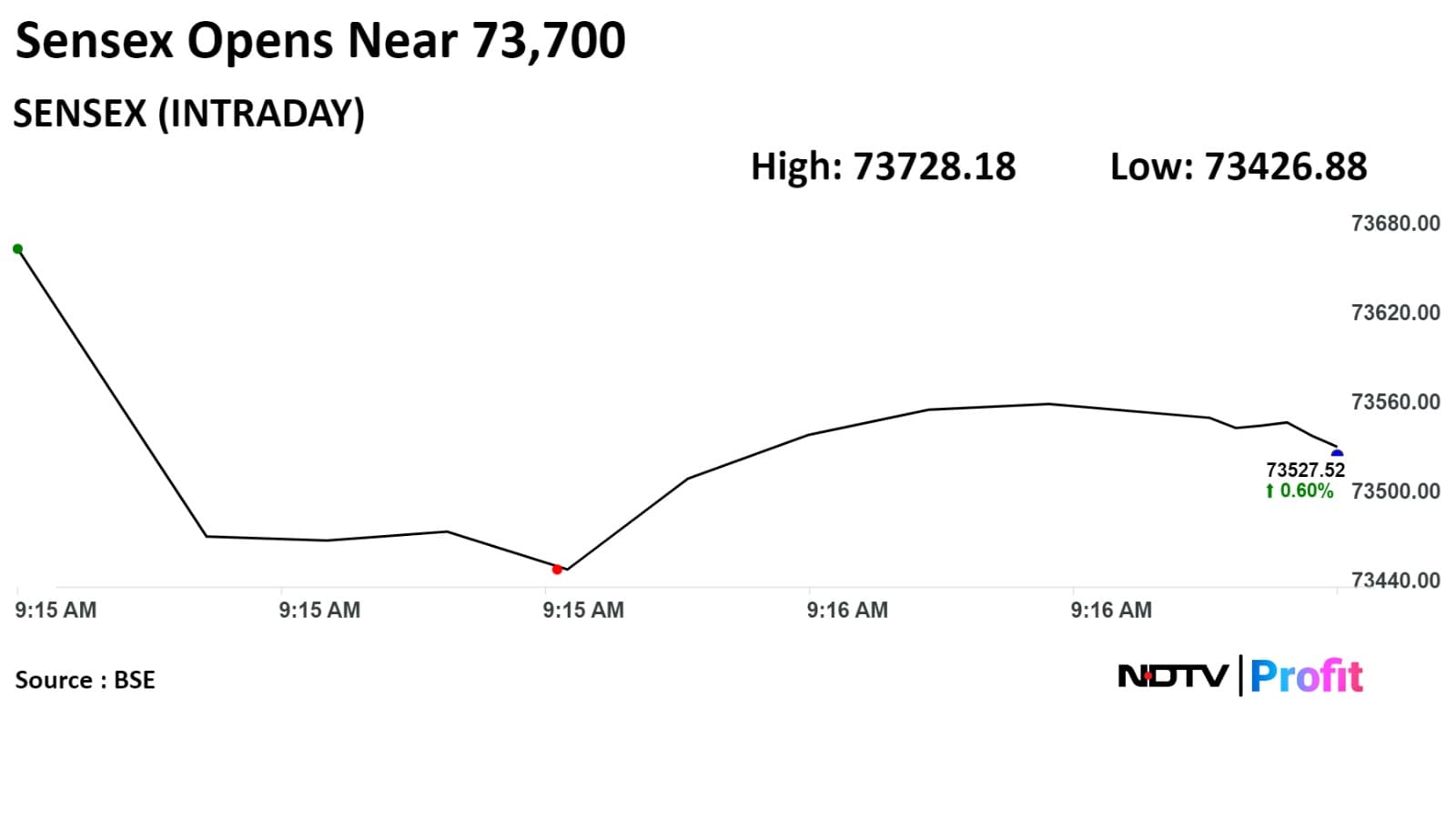

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

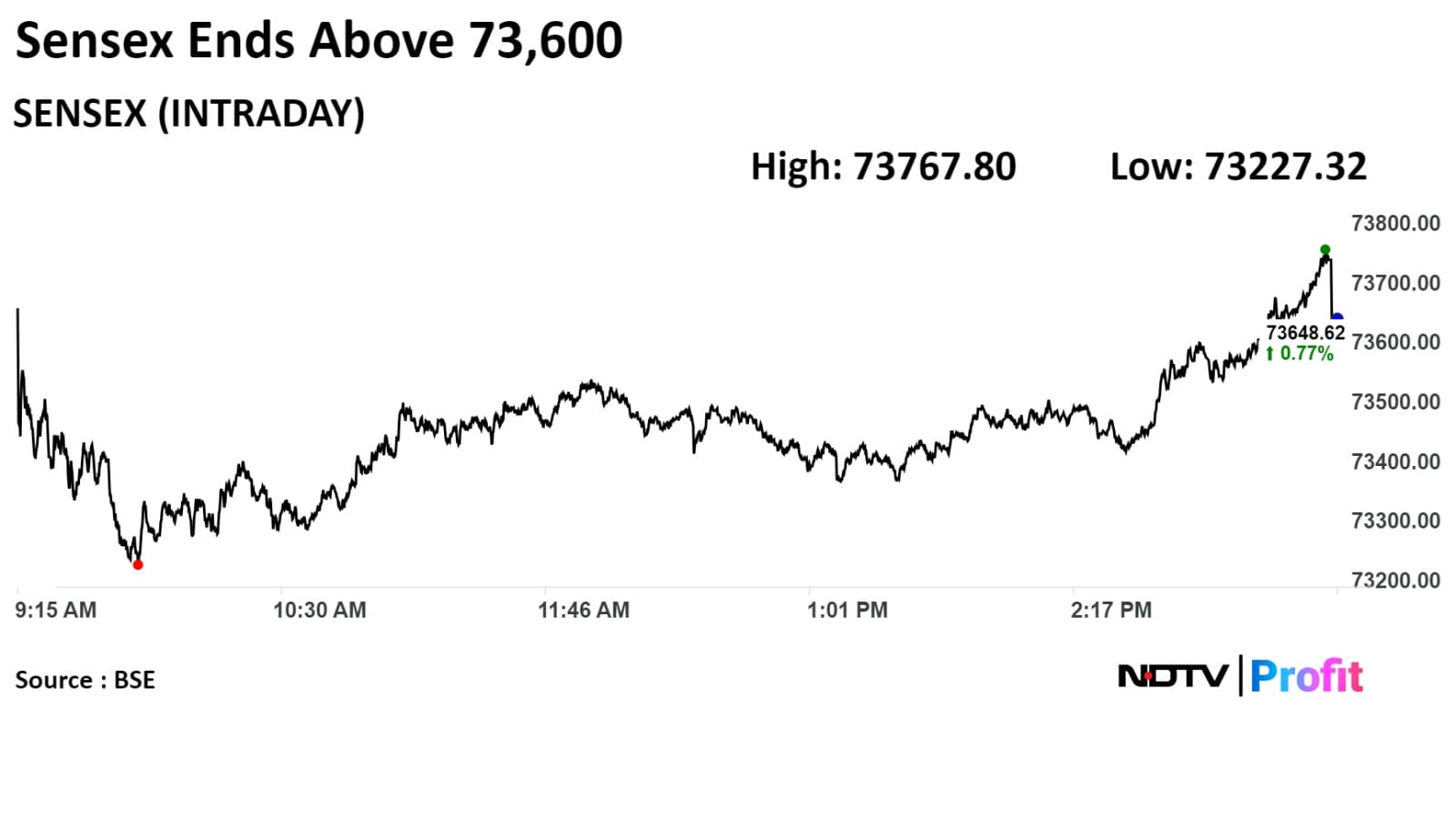

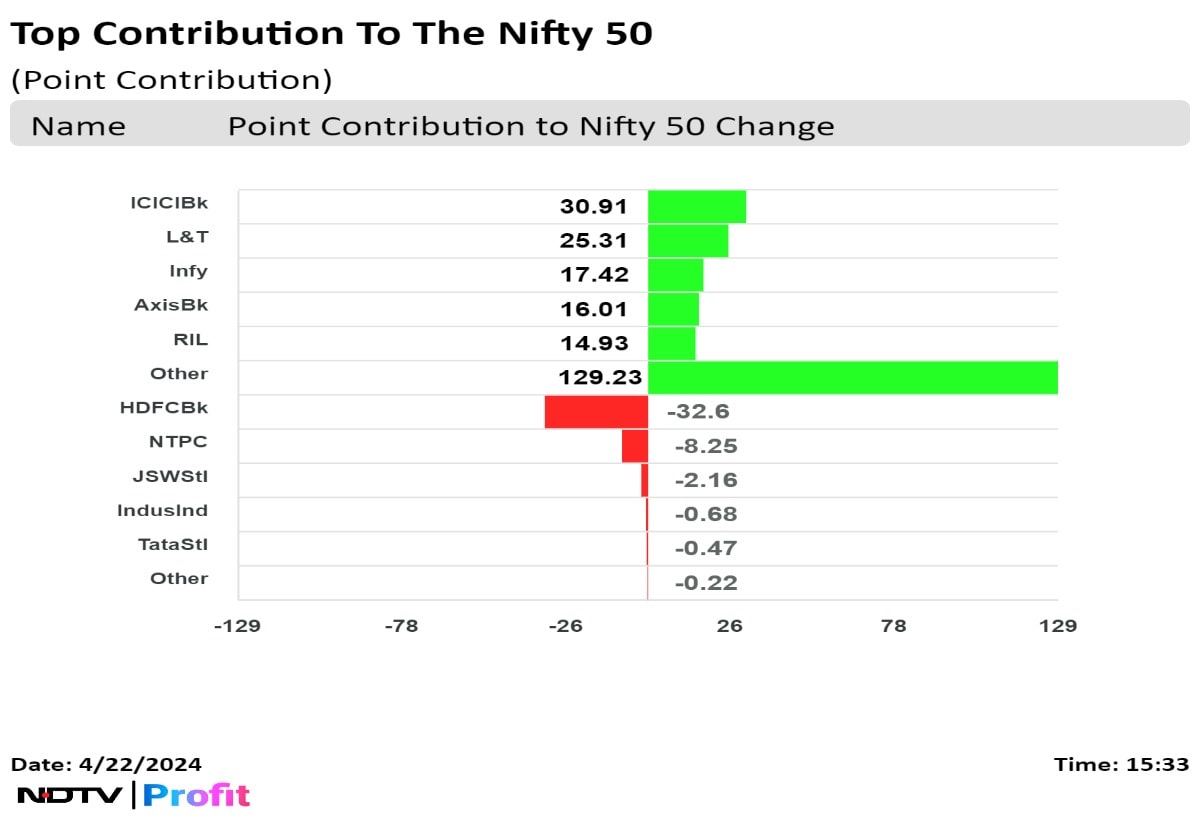

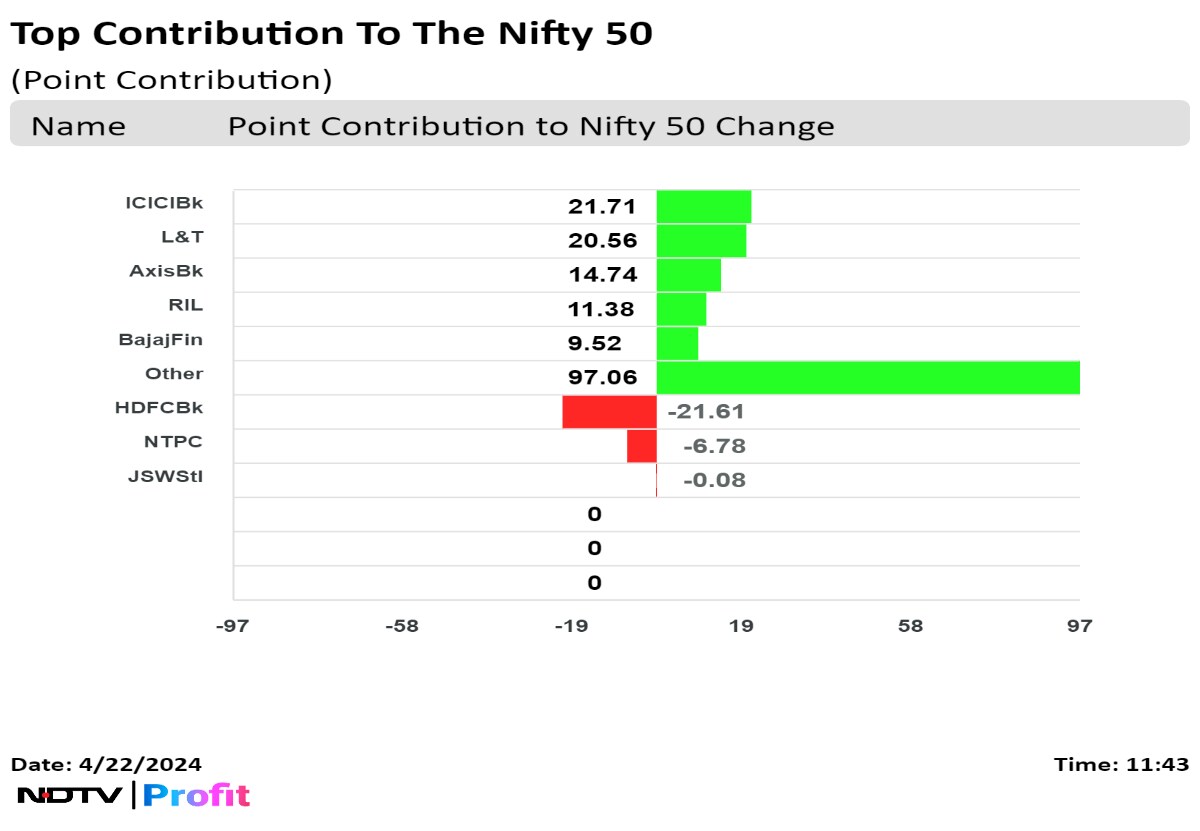

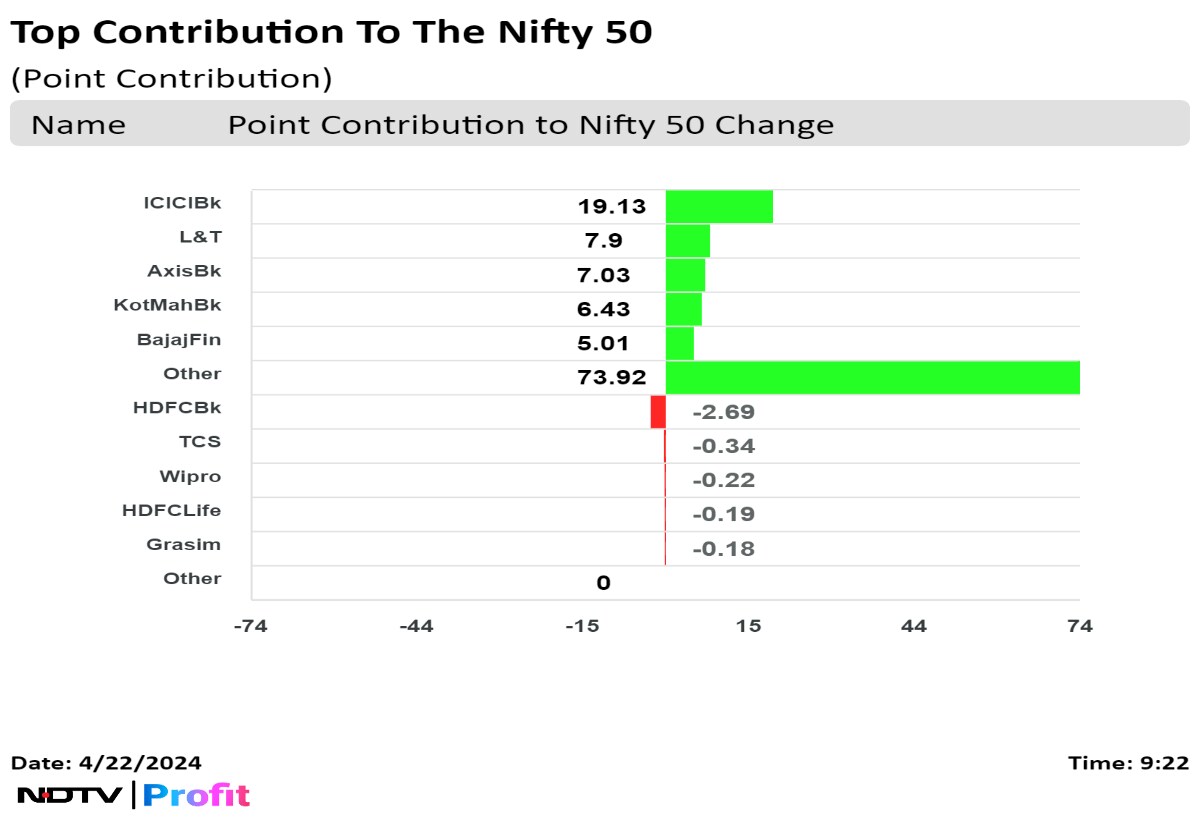

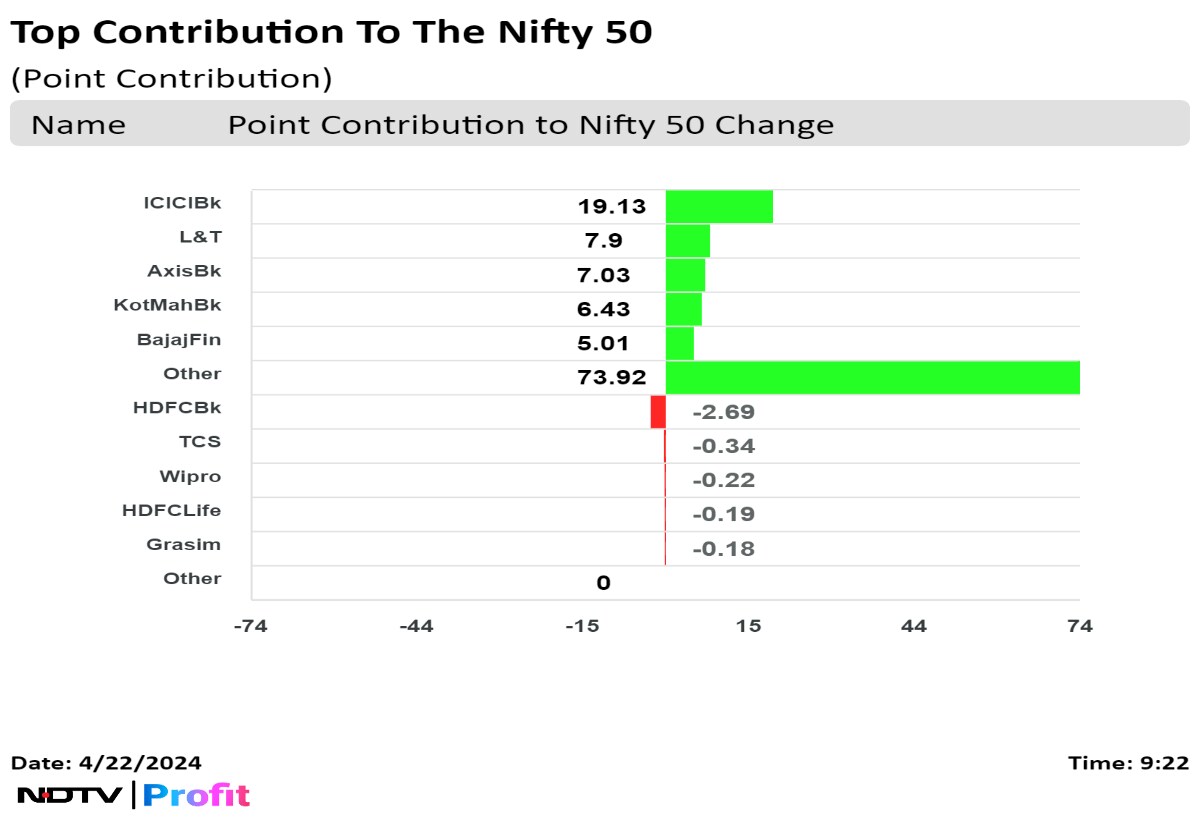

ICICI Bank Ltd., Larsen & Toubro Ltd., Infosys Ltd., Axis Bank Ltd., and Reliance Industries Ltd. added positively to the benchmark

HDFC Bank Ltd., NTPC Ltd., JSW Steel Ltd., IndusInd Bank Ltd., and Tata Steel Ltd. limited gains in the index.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

ICICI Bank Ltd., Larsen & Toubro Ltd., Infosys Ltd., Axis Bank Ltd., and Reliance Industries Ltd. added positively to the benchmark

HDFC Bank Ltd., NTPC Ltd., JSW Steel Ltd., IndusInd Bank Ltd., and Tata Steel Ltd. limited gains in the index.

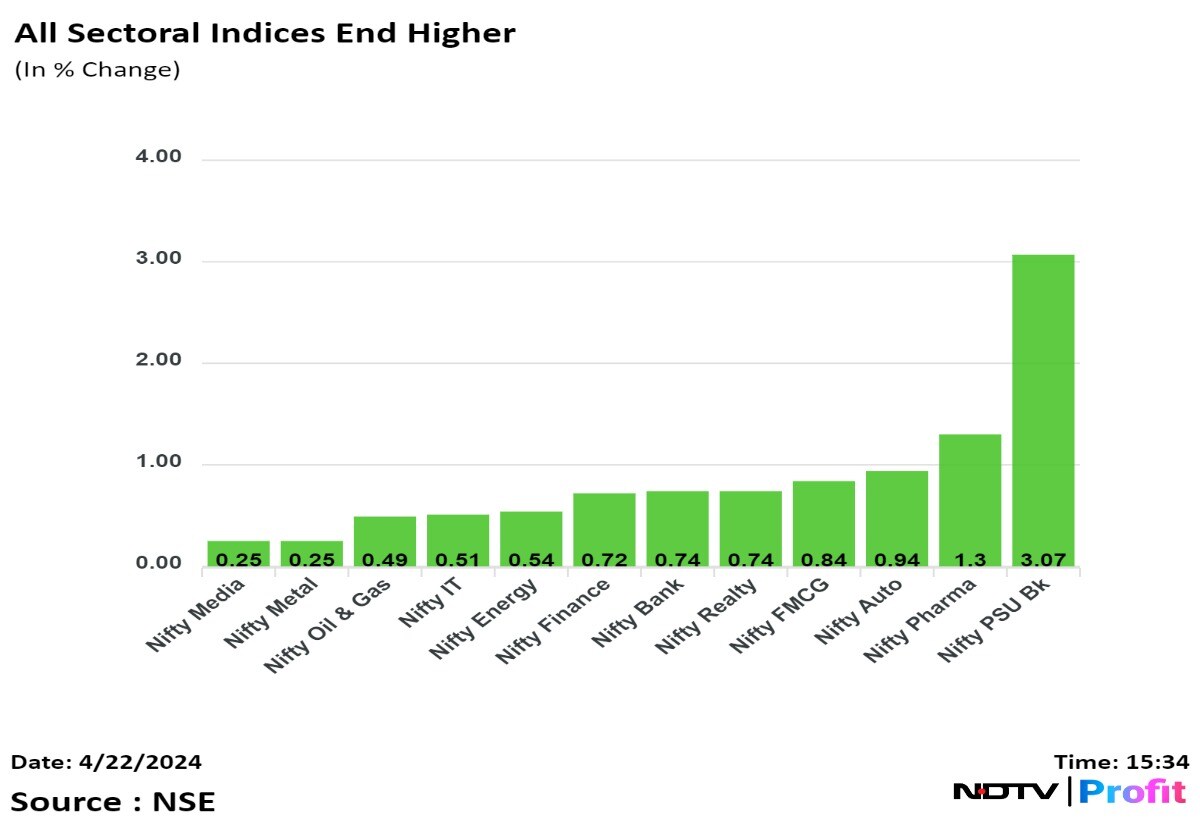

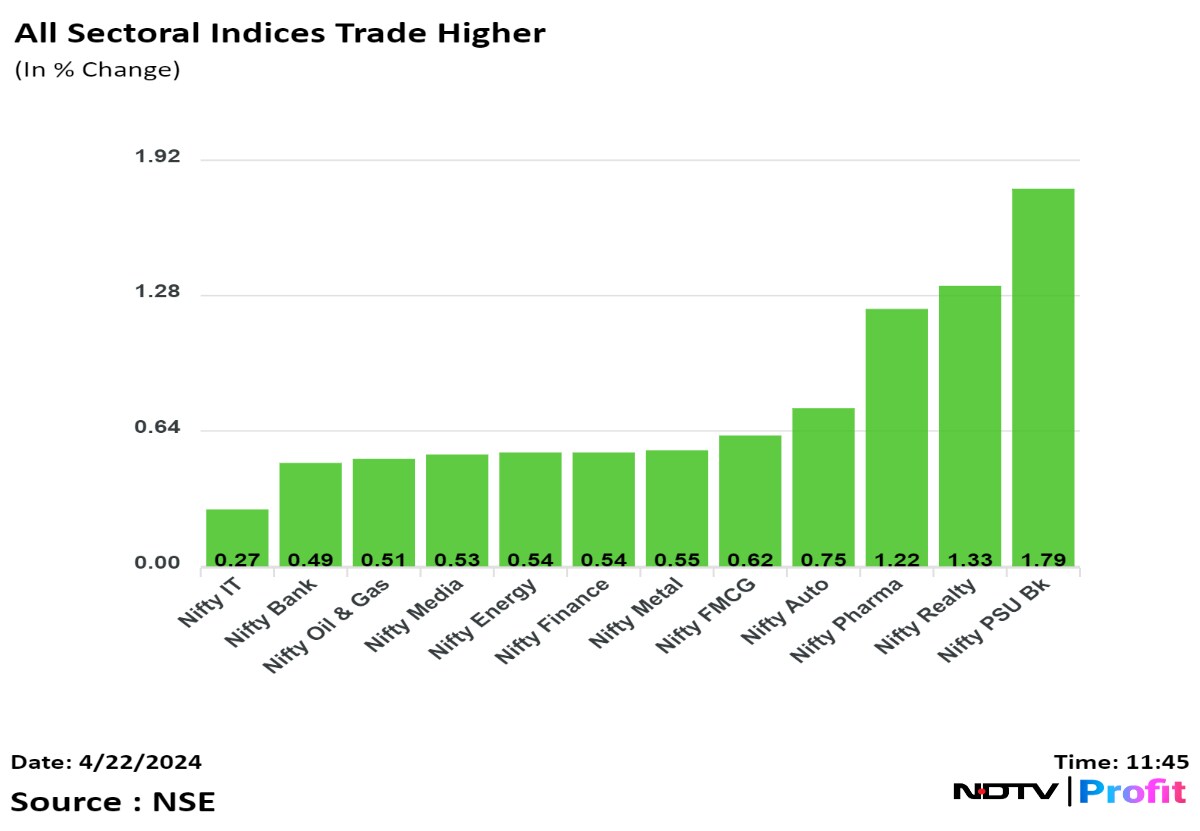

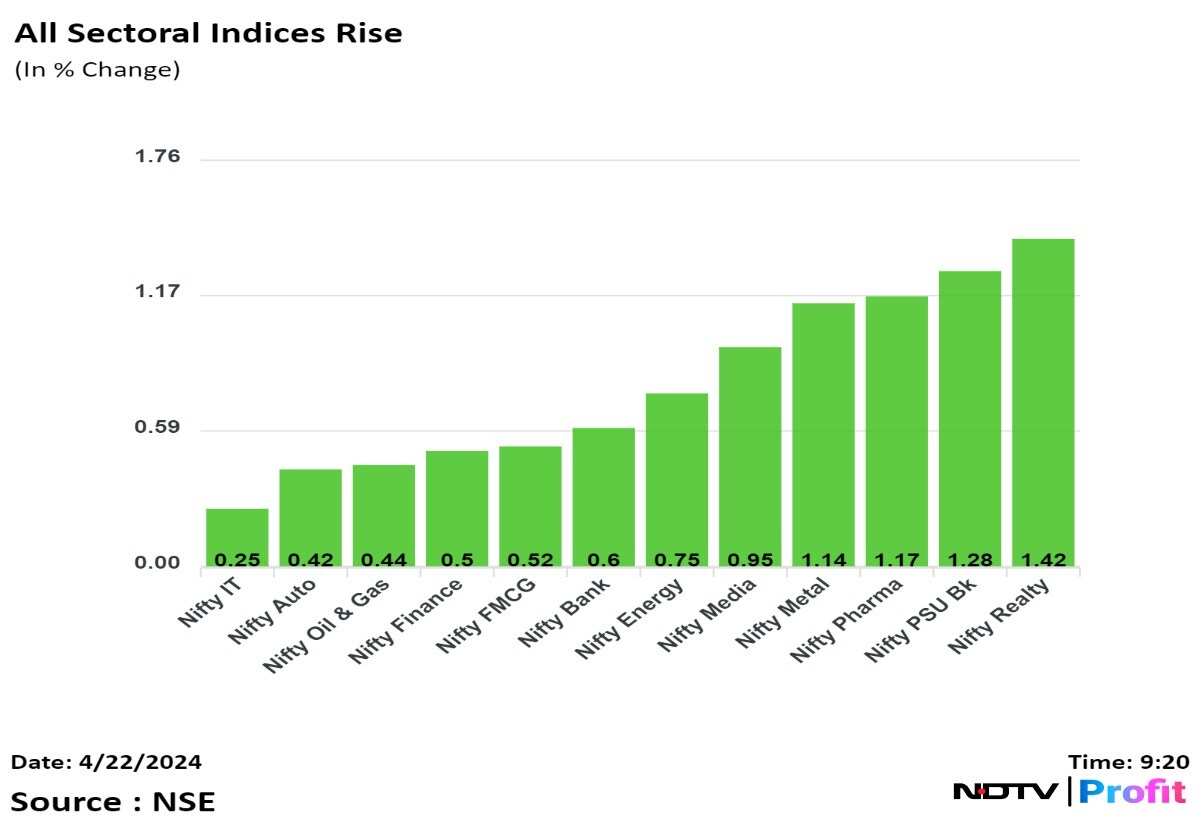

All 12 sectors ended higher on NSE, with the NSE Nifty PSU Bank index emerging as the top performer.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

ICICI Bank Ltd., Larsen & Toubro Ltd., Infosys Ltd., Axis Bank Ltd., and Reliance Industries Ltd. added positively to the benchmark

HDFC Bank Ltd., NTPC Ltd., JSW Steel Ltd., IndusInd Bank Ltd., and Tata Steel Ltd. limited gains in the index.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

India's benchmarks ended higher for second day as gains in shares of ICICI Bank Ltd., Larsen & Toubro Ltd., and Infosys Ltd. aided.

The NSE Nifty 50 settled 189.40 points or 0.86% higher at 22,336.40, and the S&P BSE Sensex ended 560.29 points or 0.77% higher at 73,648.62.

Intraday, the NSE Nifty 50 rose 1.03% to 22,375.65, and the S&P BSE Sensex rose 0.93% to 73,767.80.

The Indian market extended last Friday's relief rally as Middle East tension saw some respite, though the situation remains fluid, said Vinod Nair, head of research, Geojit Financial Services. The recovery was broad-based across sectors, with renewed interest in mid- and small caps. Gold and oil prices showed some relief but are still at elevated levels. Hawkish remarks from the U.S. Federal Reserve, driven by persistent inflation and robust economic data, spurred a rally in bond yields. The prevailing higher interest rate environment is expected to persist longer than expected which, along with the moderating earnings growth, suggests a continuation of the consolidation in the near-term."

The earnings season will remain in focus, with several prominent companies, including Bajaj Finance Ltd., HCL Technologies Ltd., Maruti Suzuki India Ltd., Nestle India Ltd., Reliance Industries Ltd., and Tech Mahindra Ltd. are expected to report their Q4 financial results this week, said Avdhut Bagkar, technical and derivatives analyst, StoxBox.

ICICI Bank Ltd., Larsen & Toubro Ltd., Infosys Ltd., Axis Bank Ltd., and Reliance Industries Ltd. added positively to the benchmark

HDFC Bank Ltd., NTPC Ltd., JSW Steel Ltd., IndusInd Bank Ltd., and Tata Steel Ltd. limited gains in the index.

All 12 sectors ended higher on NSE, with the NSE Nifty PSU Bank index emerging as the top performer.

Broader markets ended higher on BSE. The S&P BSE Midcap index settled 0.93% higher and the S&P BSE Smallcap index rose 1.23%.

On BSE, 20 sectors ended higher with the S&P BSE Consumer Durables index rising the most among sectoral indices.

Market breadth was skewed in favour of the buyers. Around 2,622 stocks rose, 1,281 stocks declined, and 154 stocks remained unchanged on BSE.

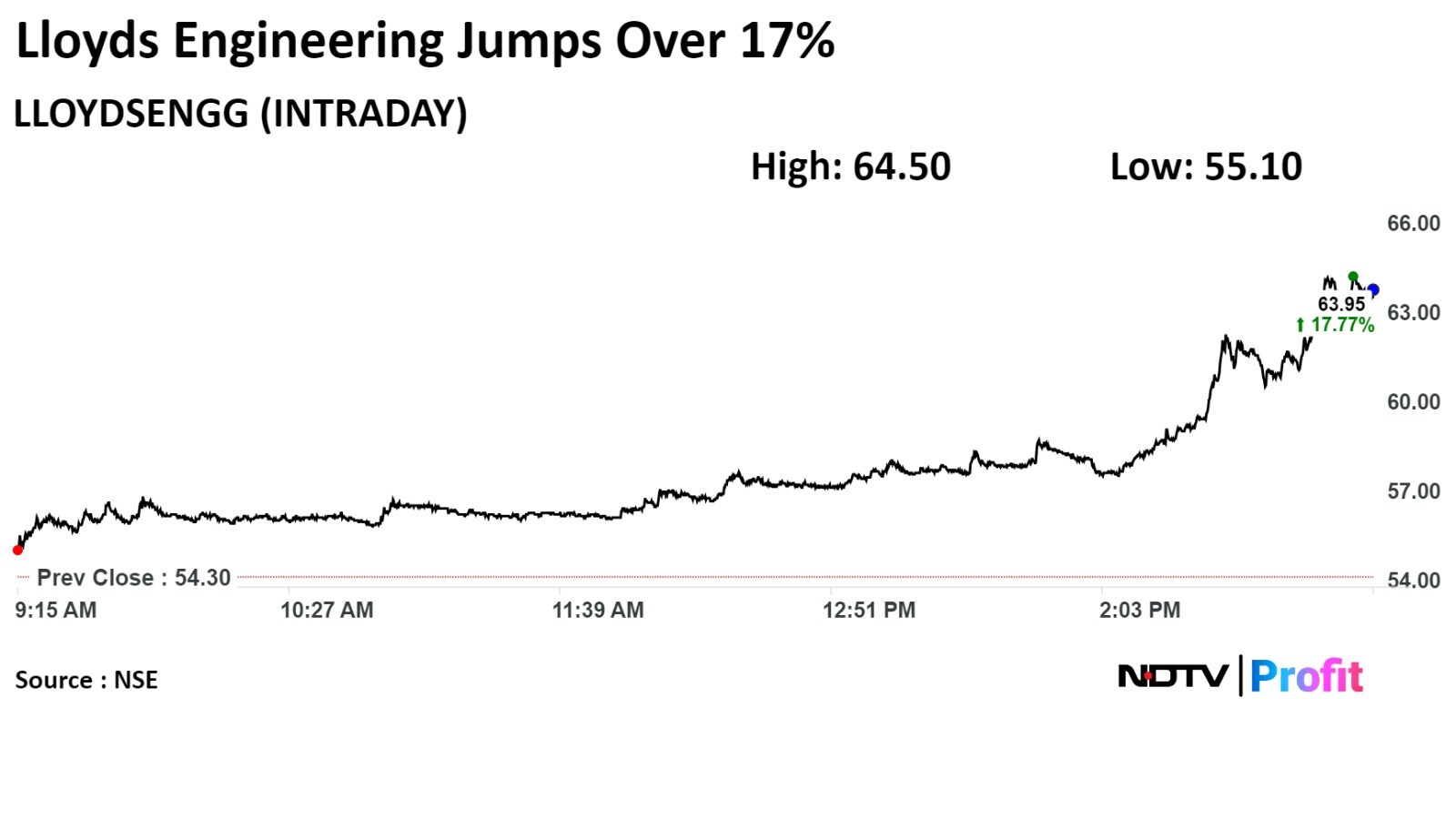

Lloyds Engineering secured naval equipment orders worth over Rs 81 crore.

Source: Exchange Filing

Lloyds Engineering secured naval equipment orders worth over Rs 81 crore.

Source: Exchange Filing

Patel Engineering Ltd. likely to launch QIP soon

Fund raise of close to Rs 350-400 crore

QIP likely at a discount to CMP

Source: People In The Know To NDTV Profit

Retail subscription at 61% as of 2:42 pm on day 3

NII subscription at 2.95x as of 2:42 pm on day 3

QIB subscription at 8.93x as of 2:42 pm on day 3

Overall subscription at 3.49x as of 2:42 pm on day 3

Coforge has approved appointment of Om Prakash Bhatt as Chairman effective June 29.

Source: Exchange filing

Revenue up 9% to Rs 249 crore from Rs 219 crore

Ebitda up 2% at Rs 34.4 crore from Rs 33.8 crore

Margin down 100 bps at 14.4% from 15.4%

Net profit down 0.2% at Rs 20.2 crore from Rs 20.3 crore

Sanghi Industries approved raising Rs 2,200 crore via preference shares.

Source: Exchange filing

Bharti Airtel Ltd. has introduced international roaming packs at Rs 133 per day.

Source: Exchange filing

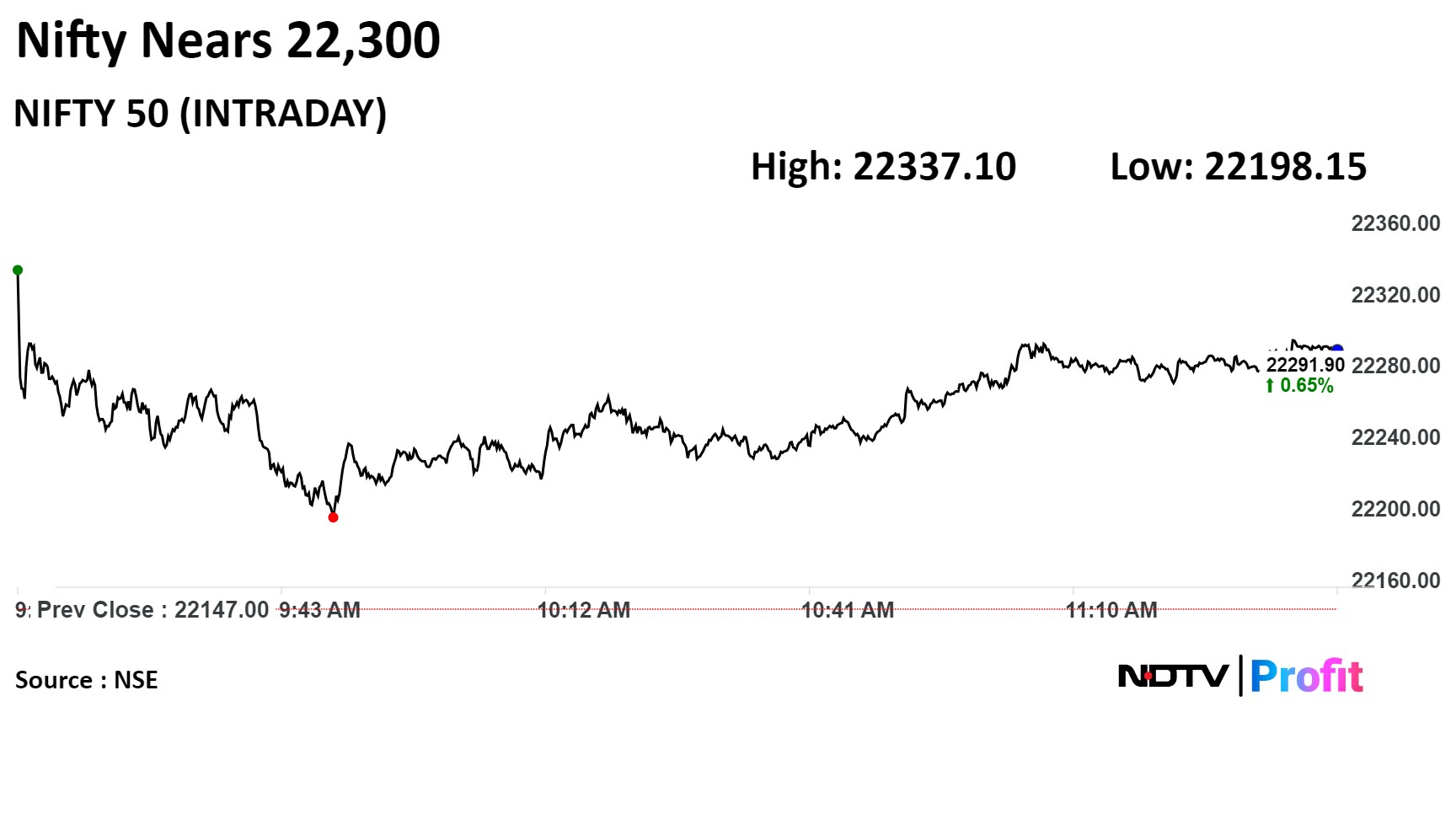

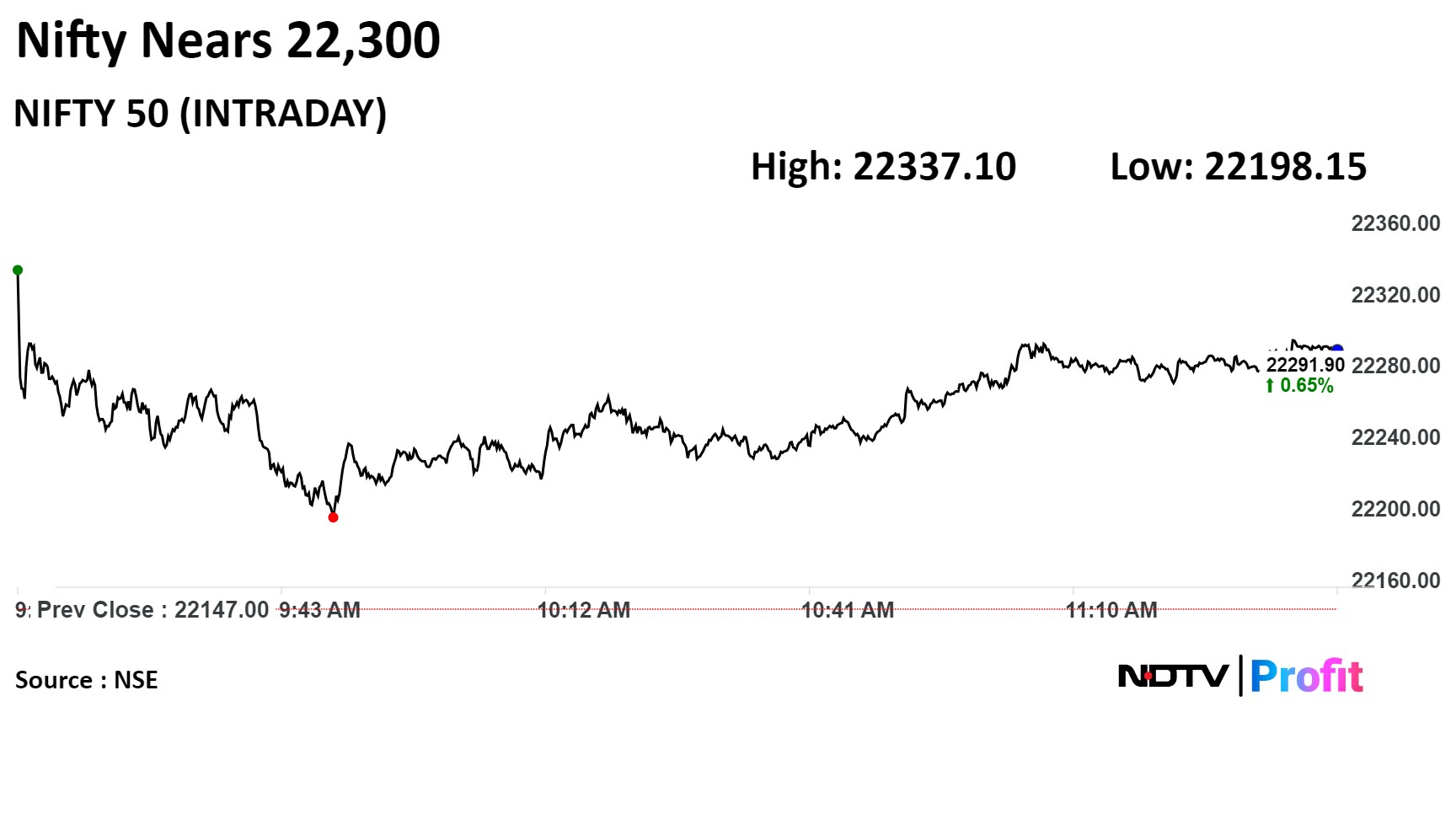

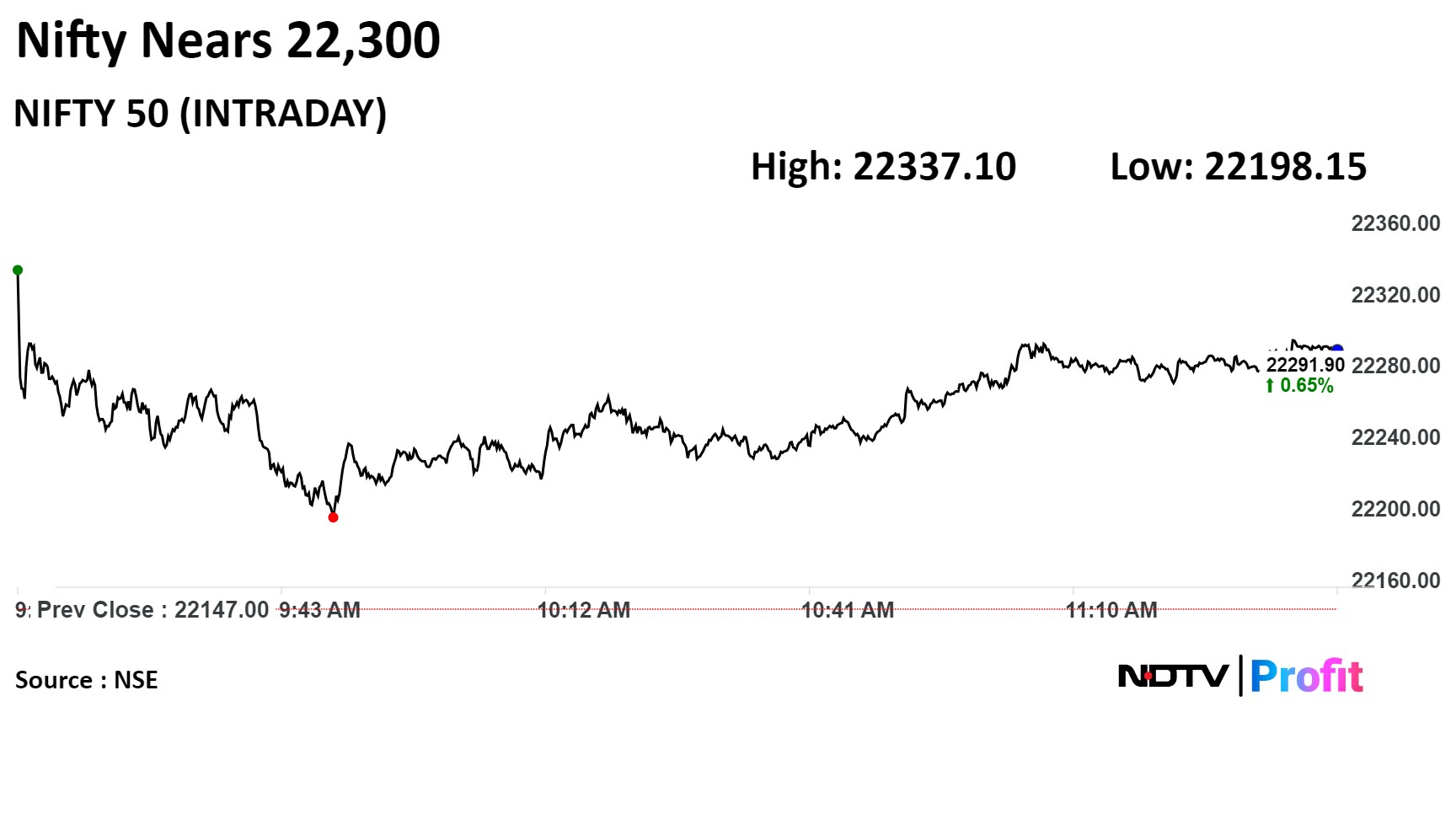

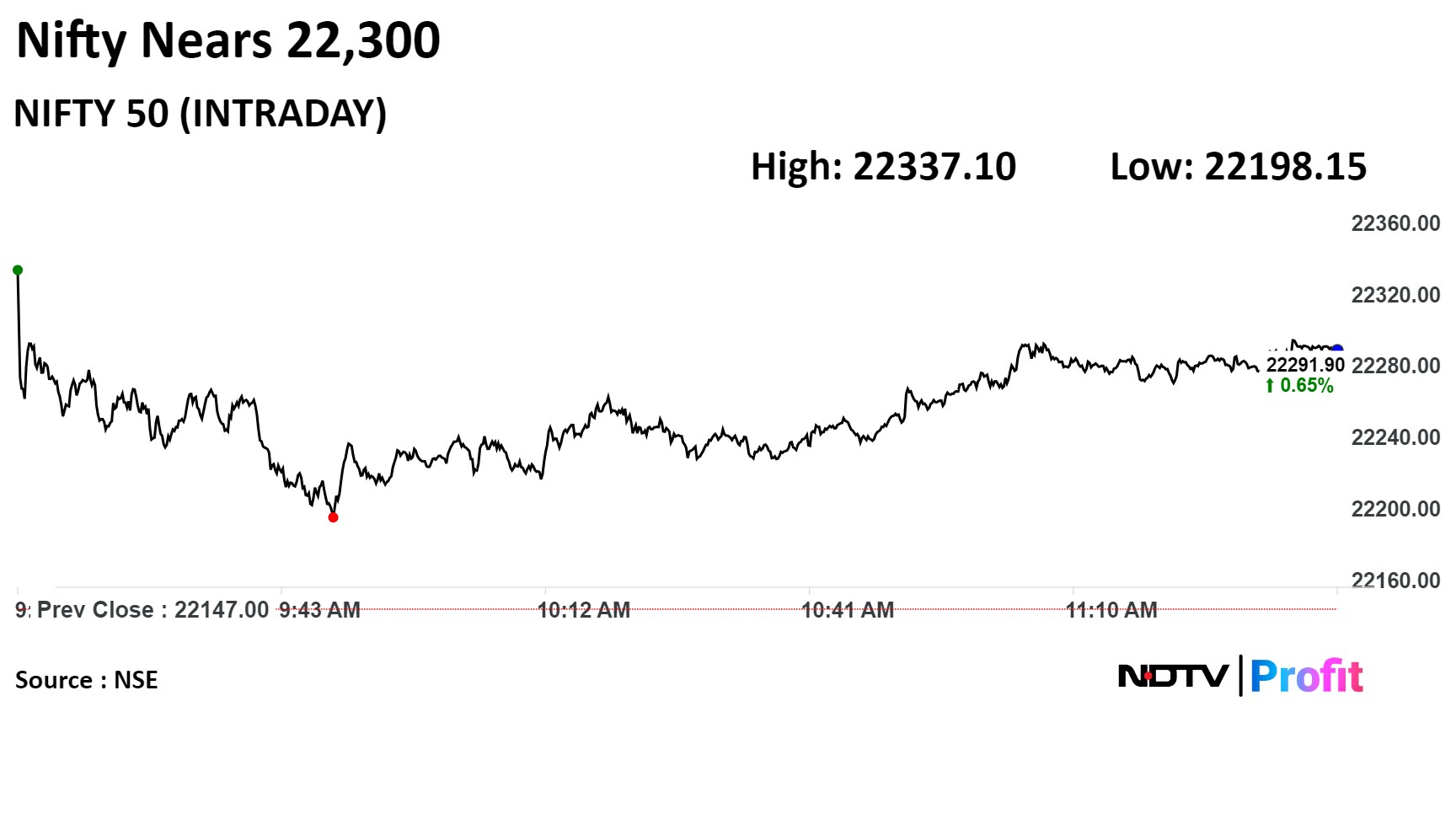

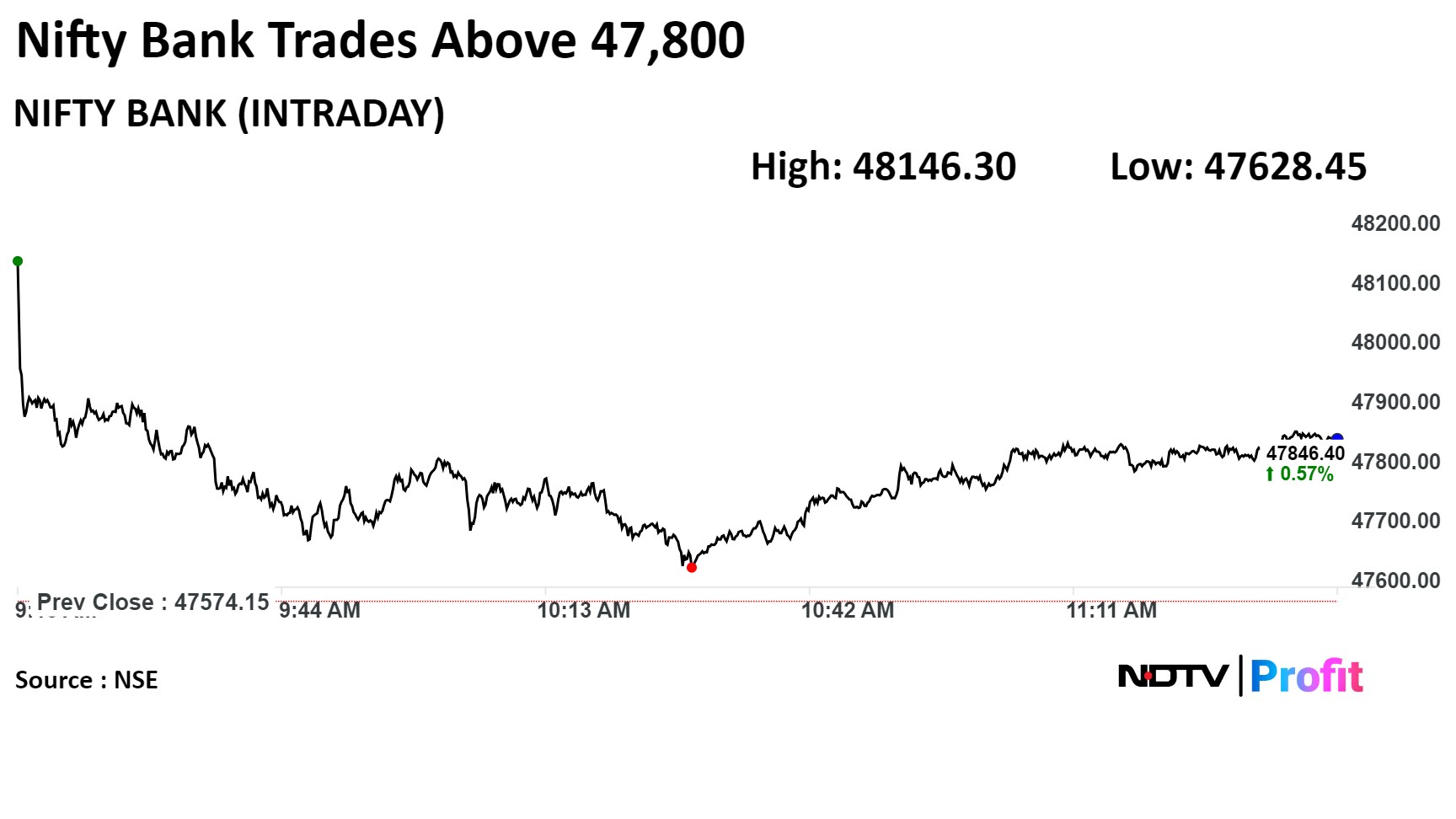

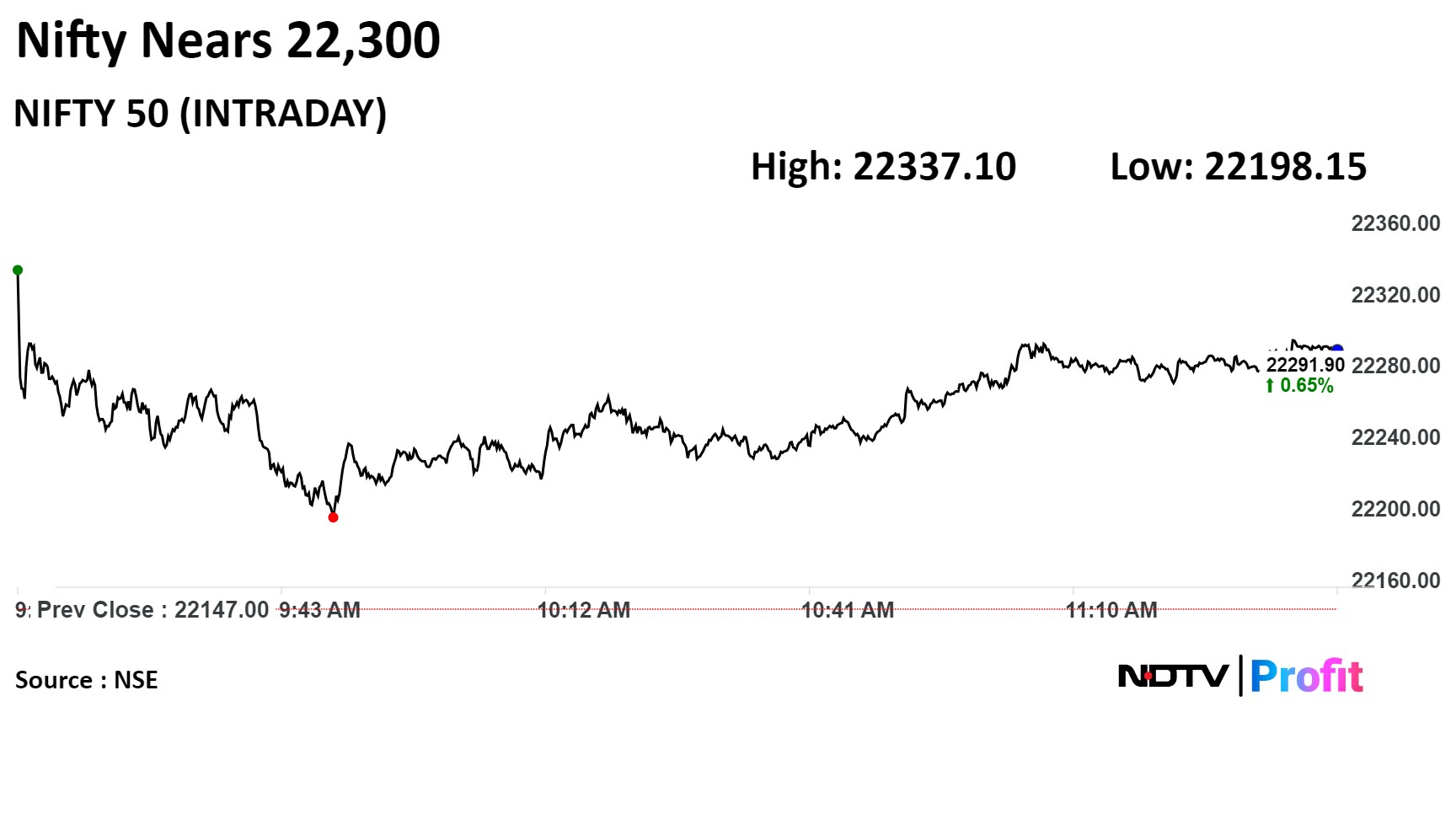

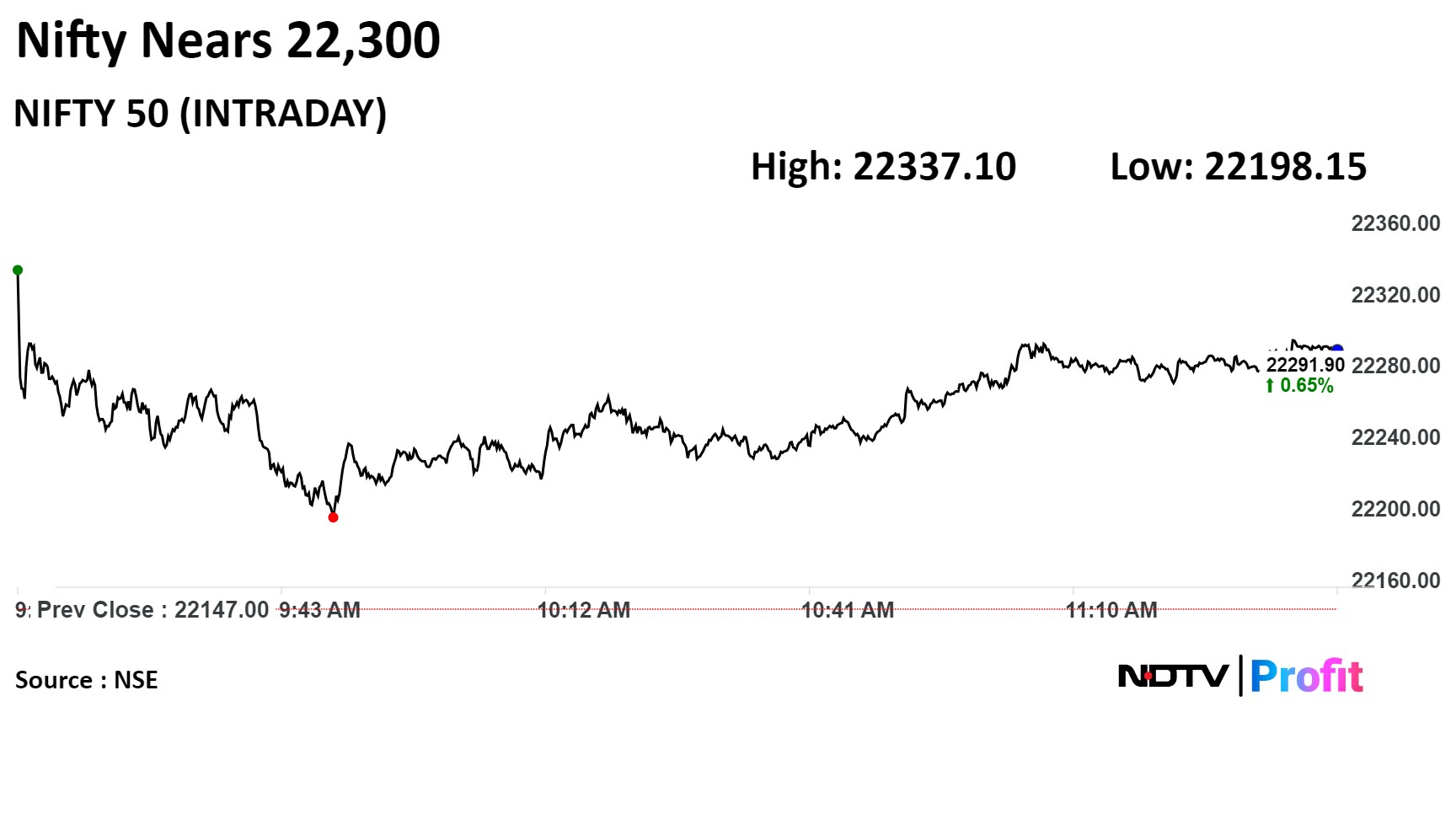

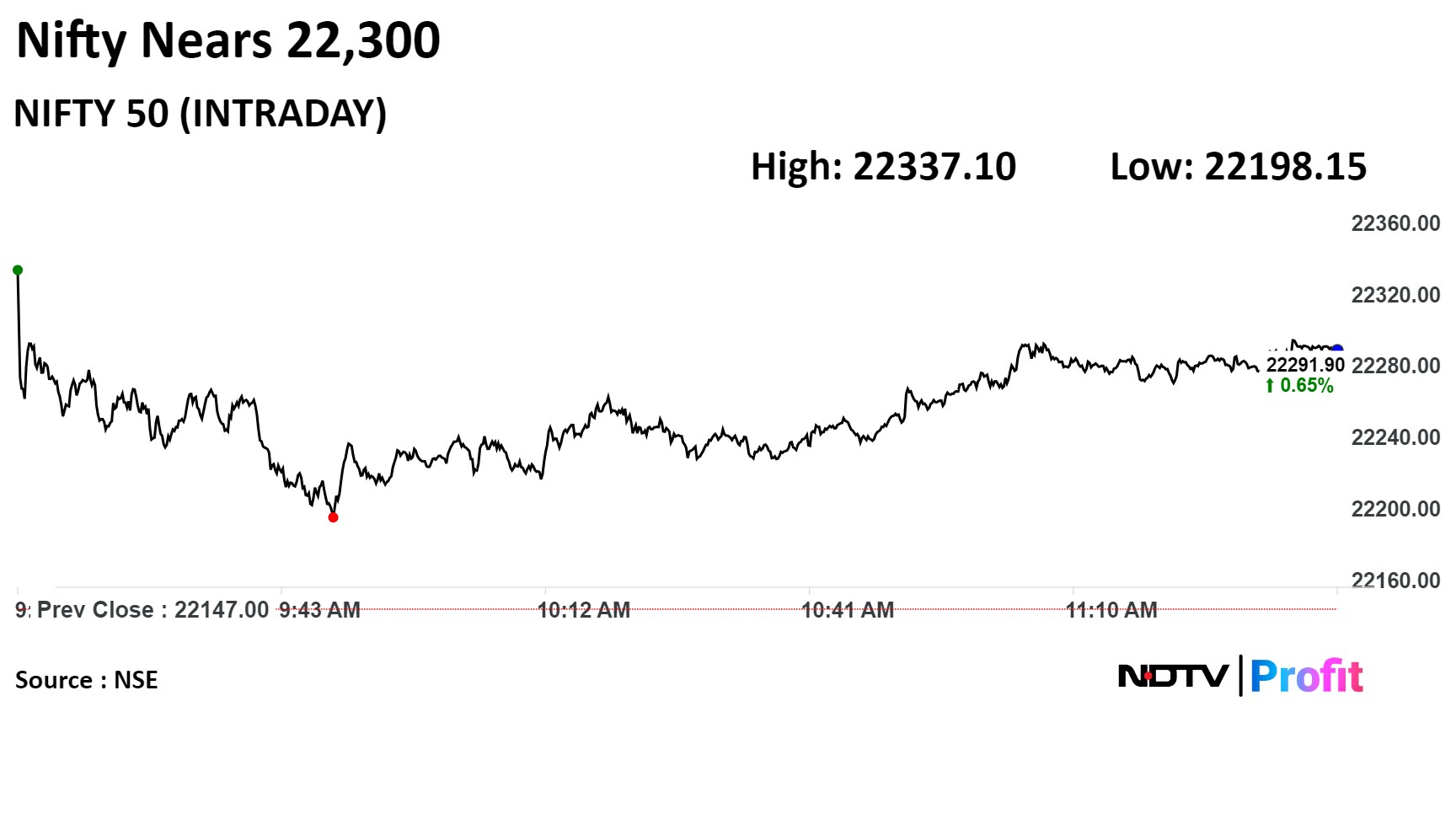

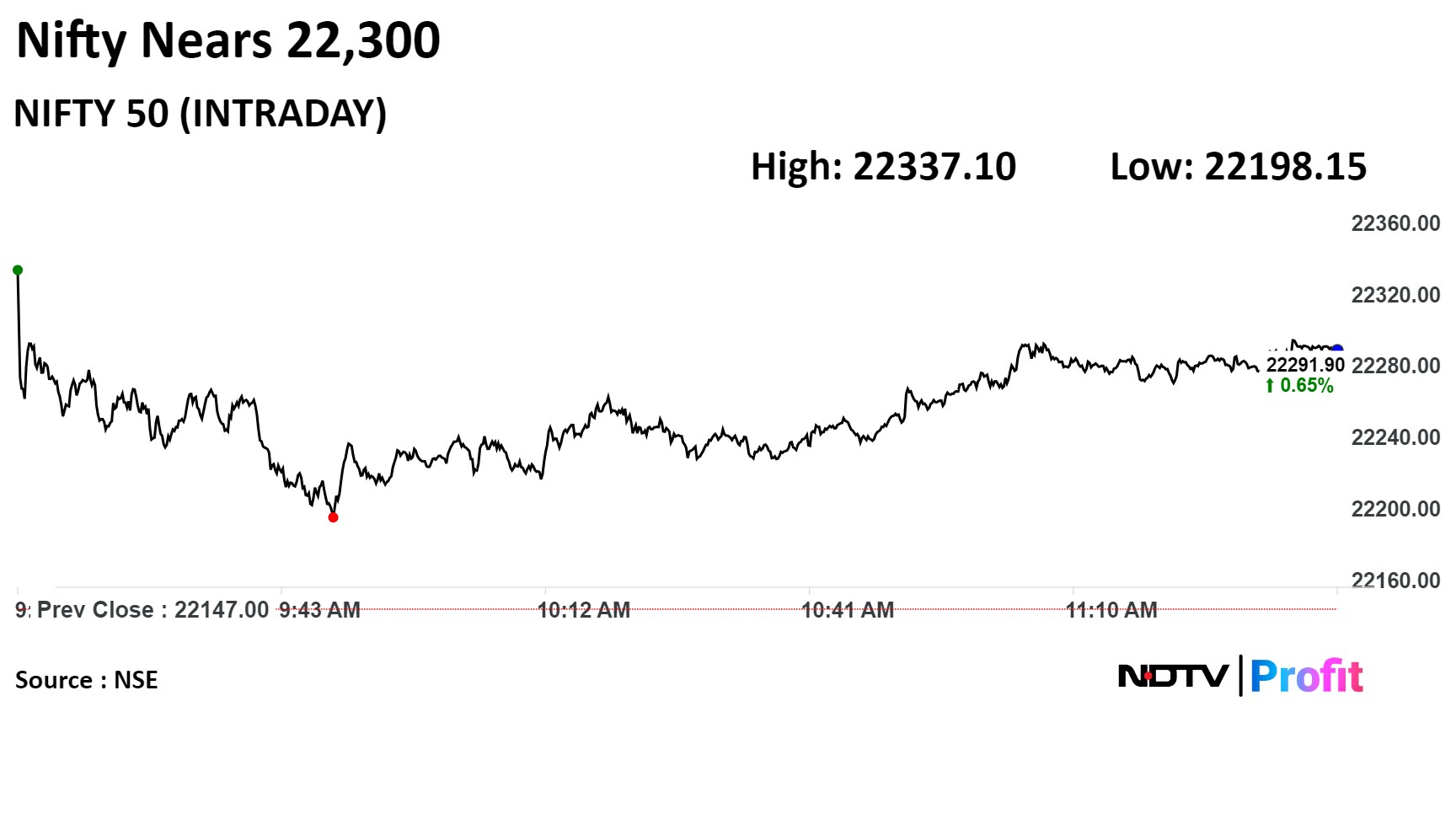

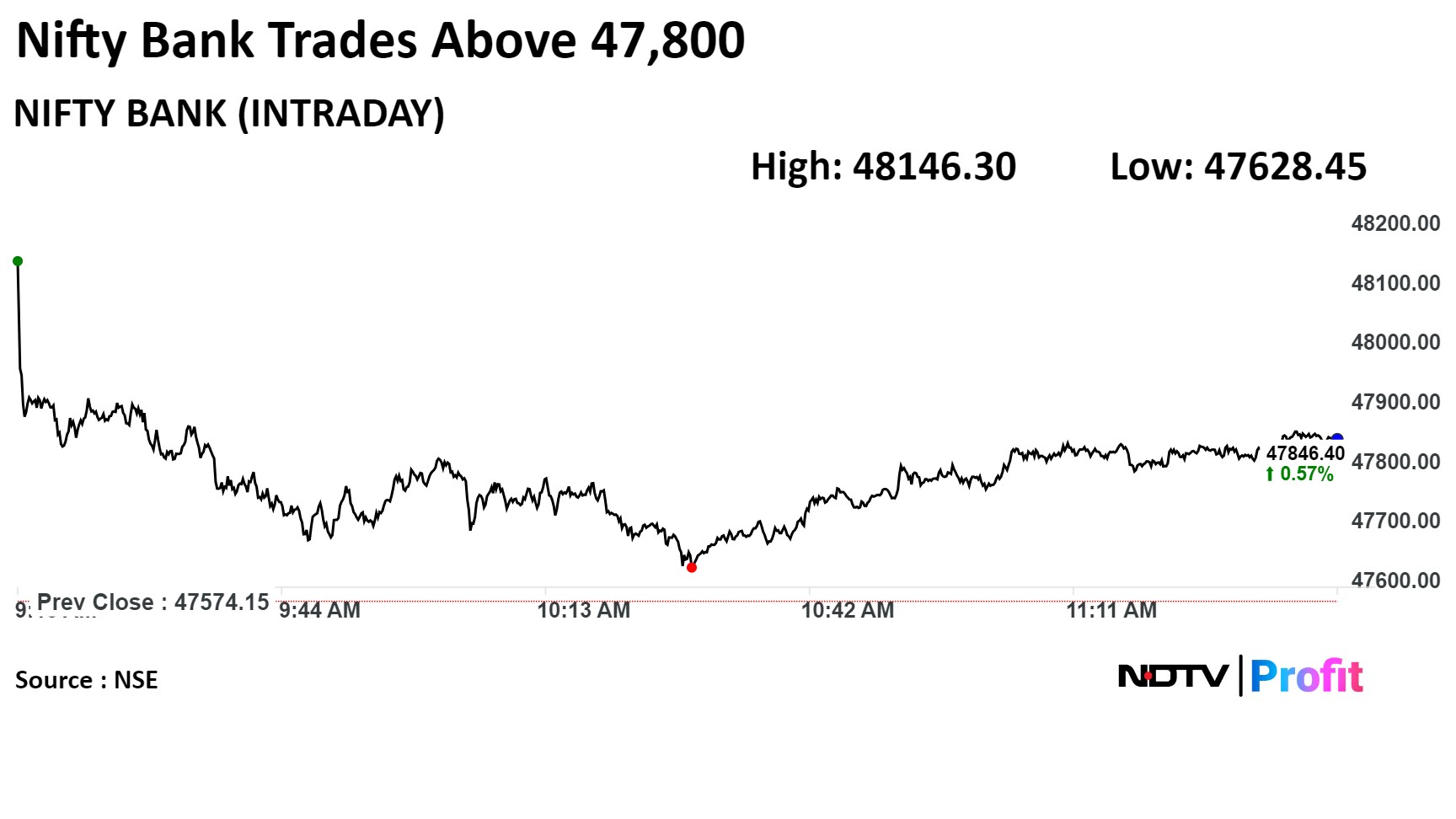

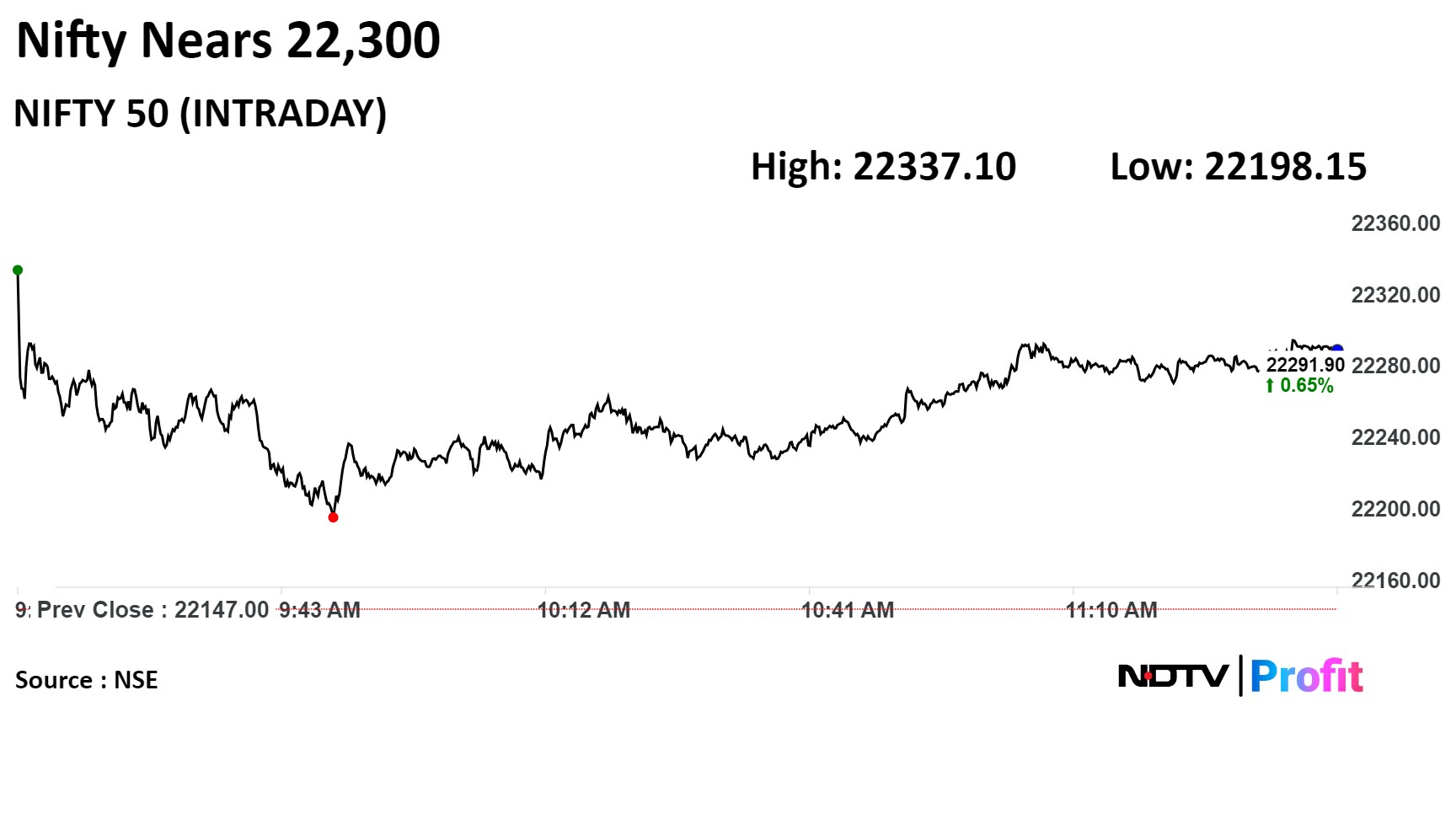

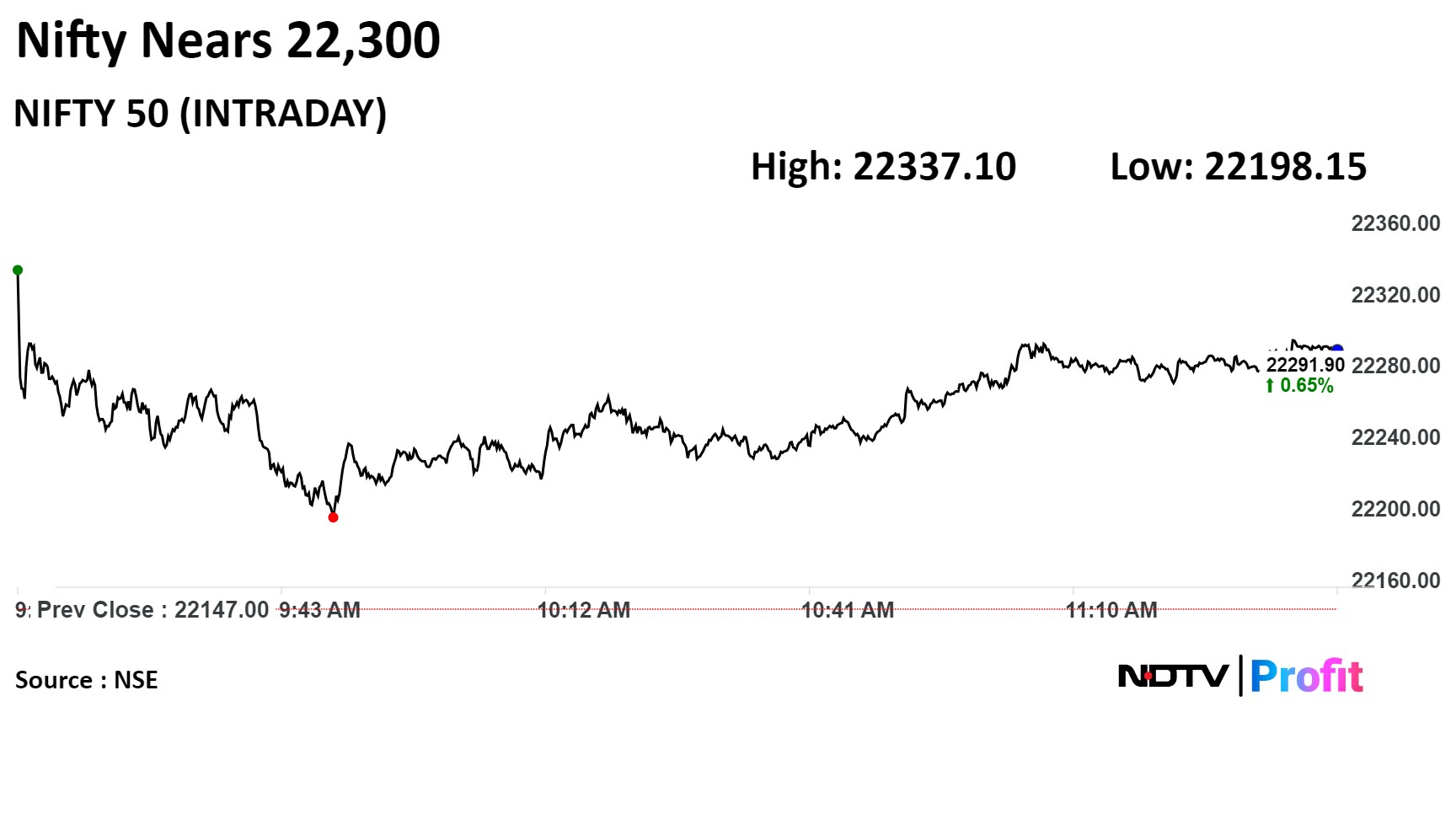

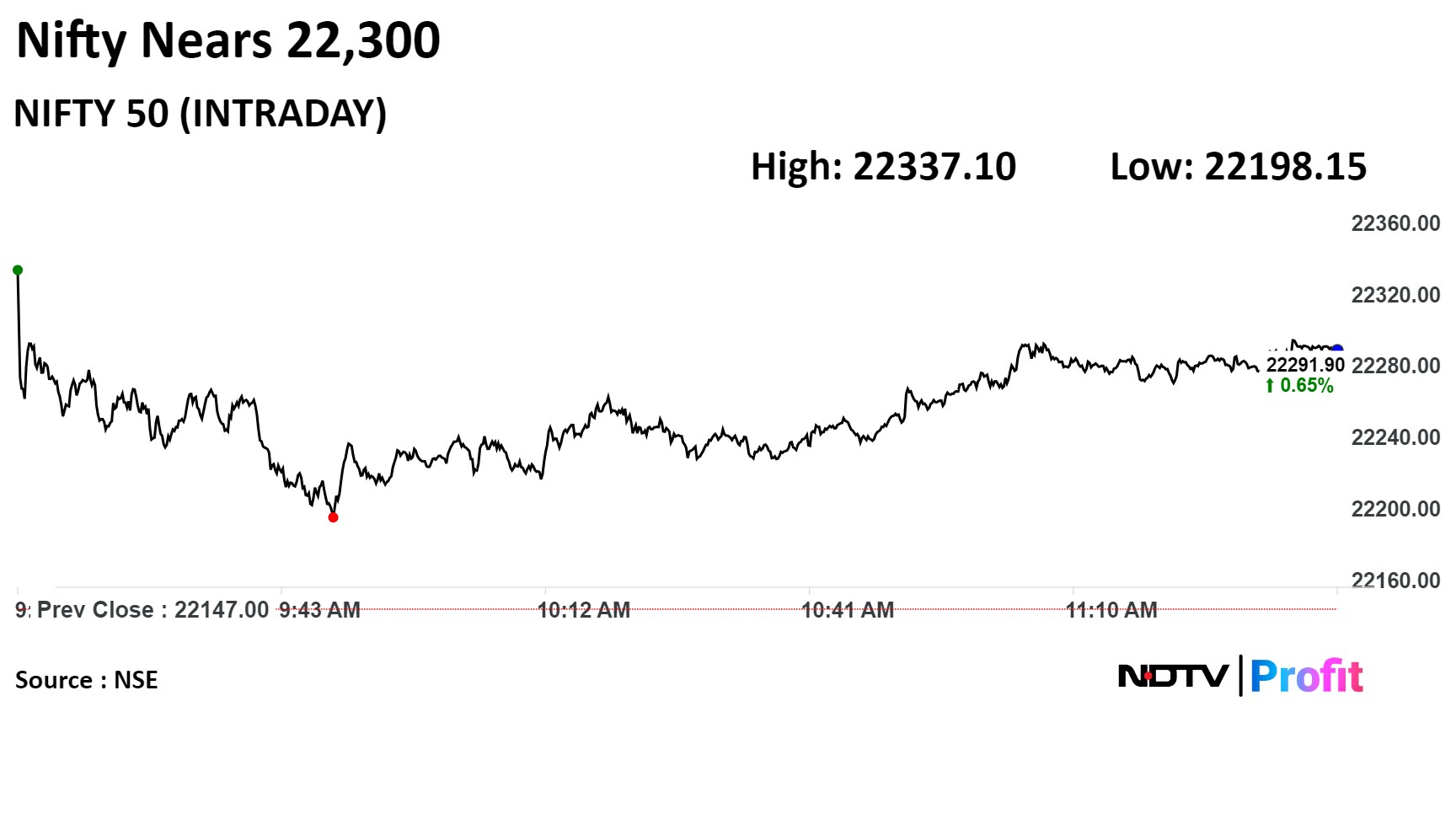

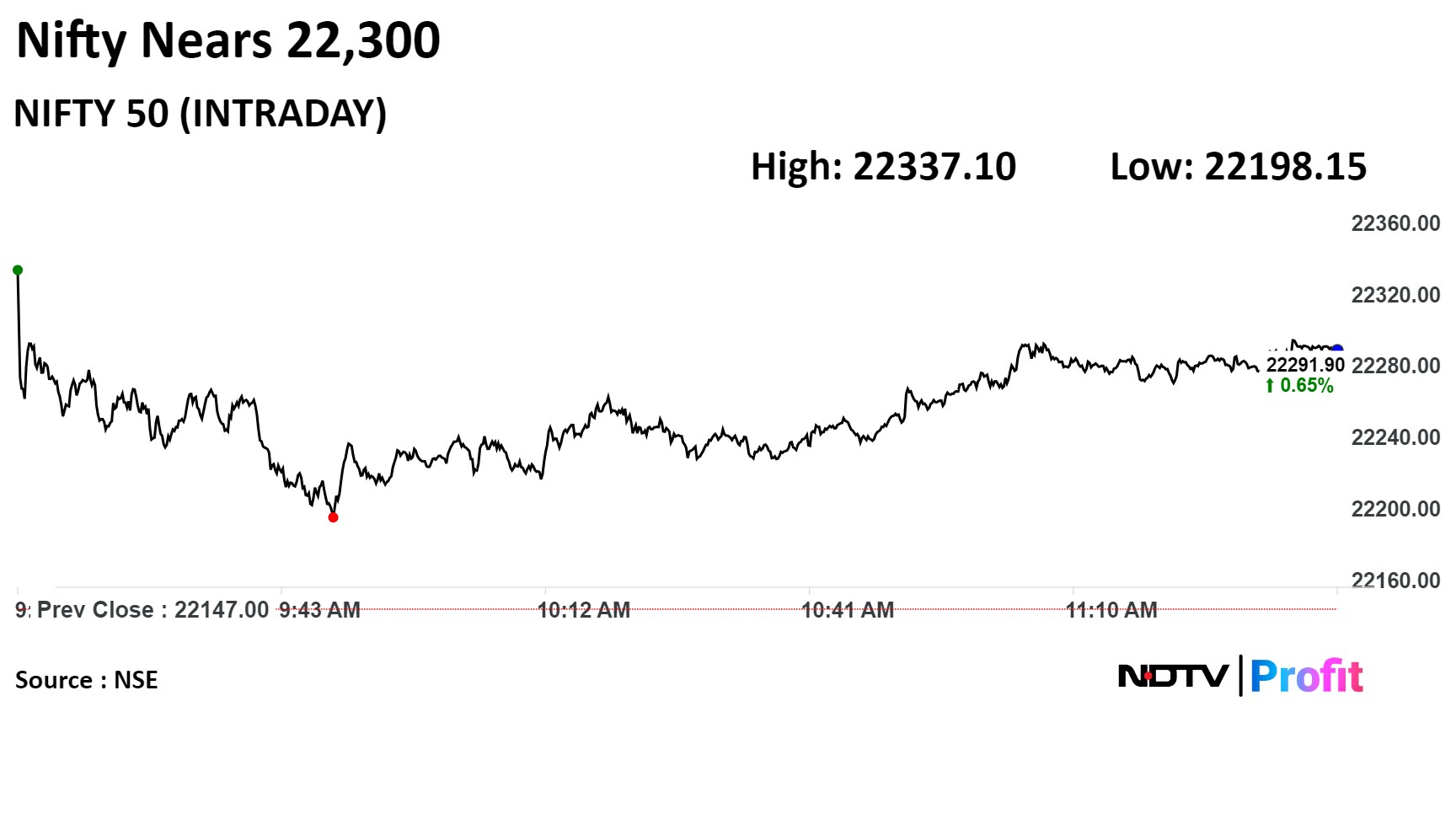

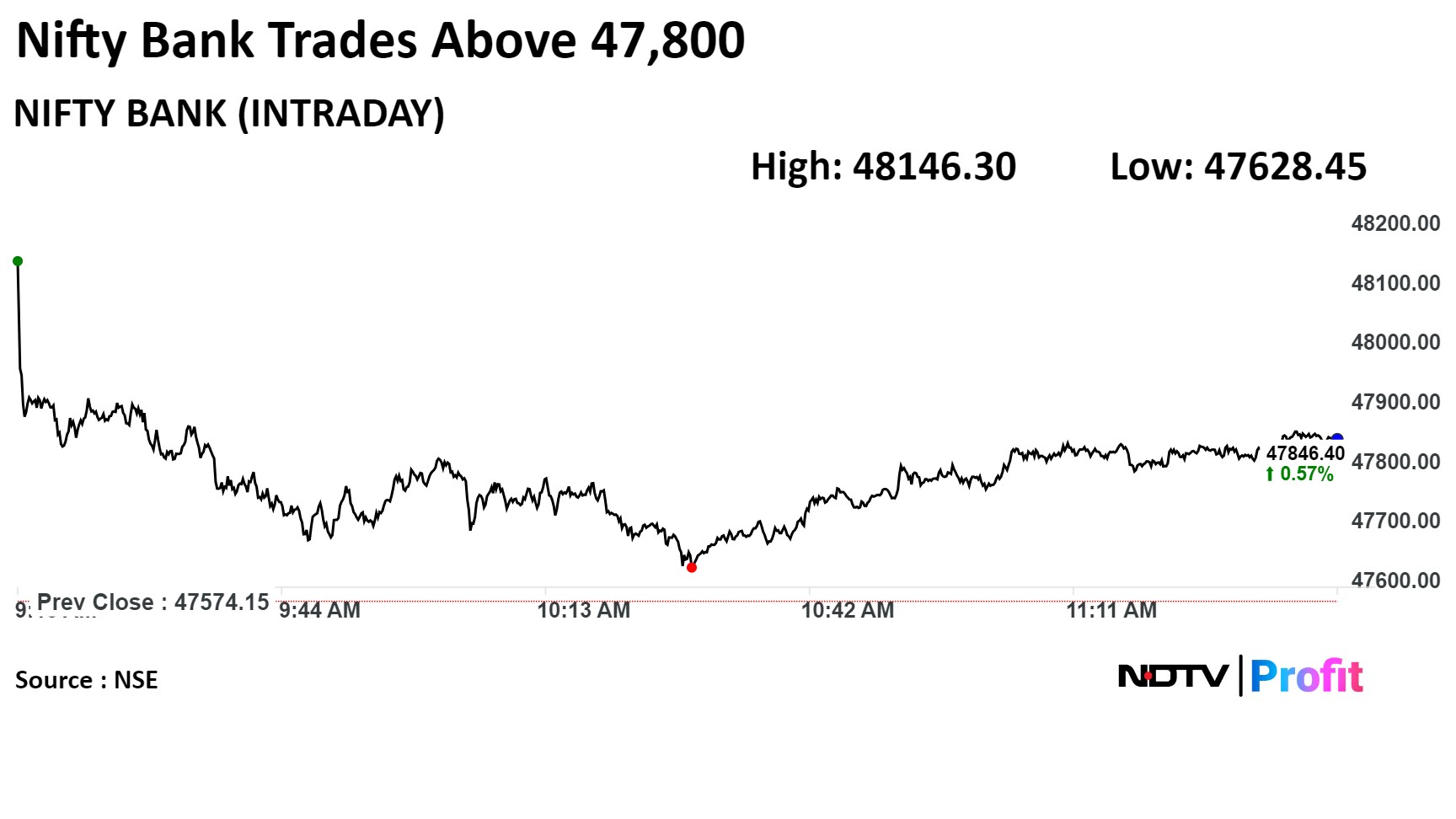

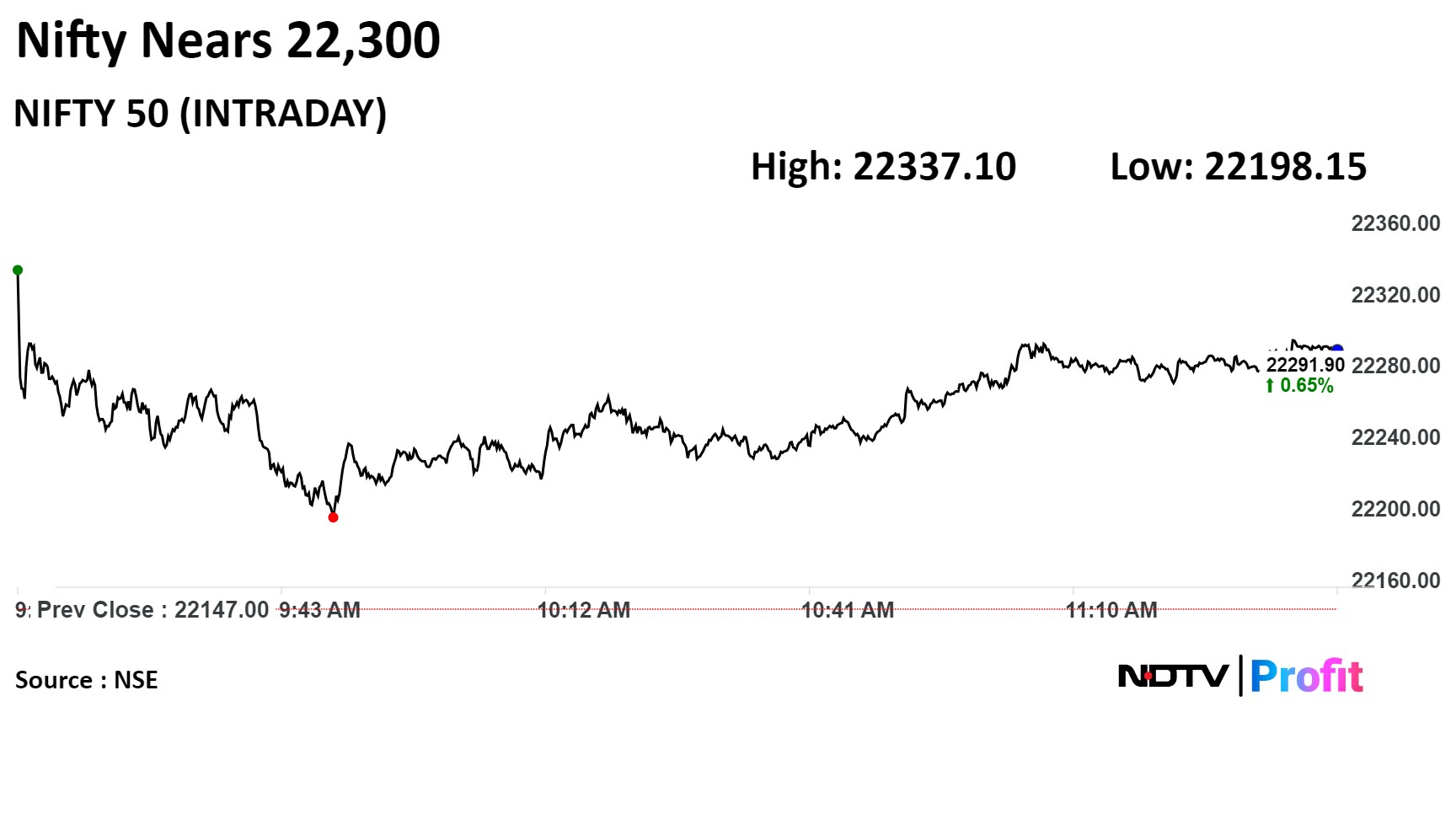

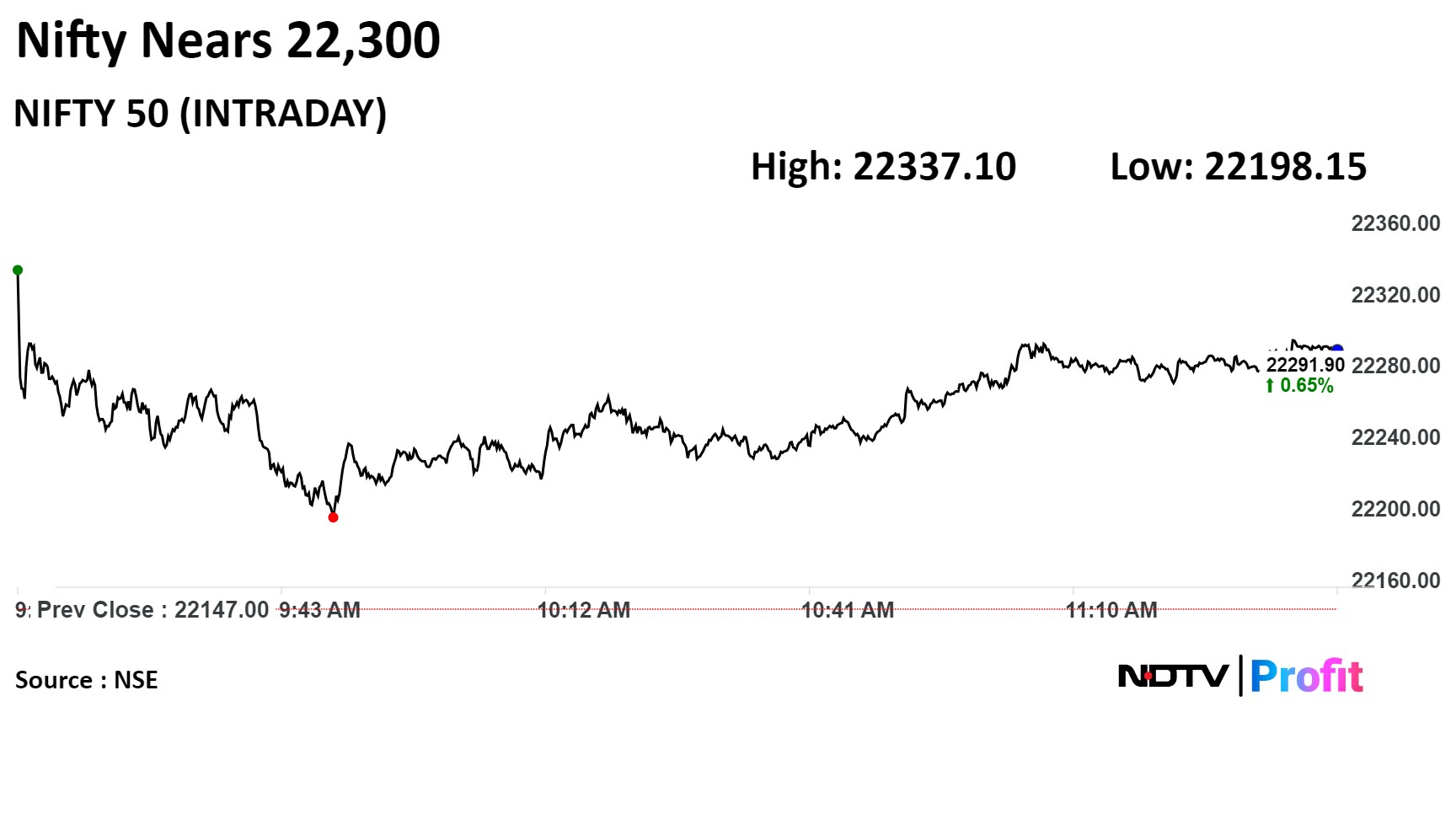

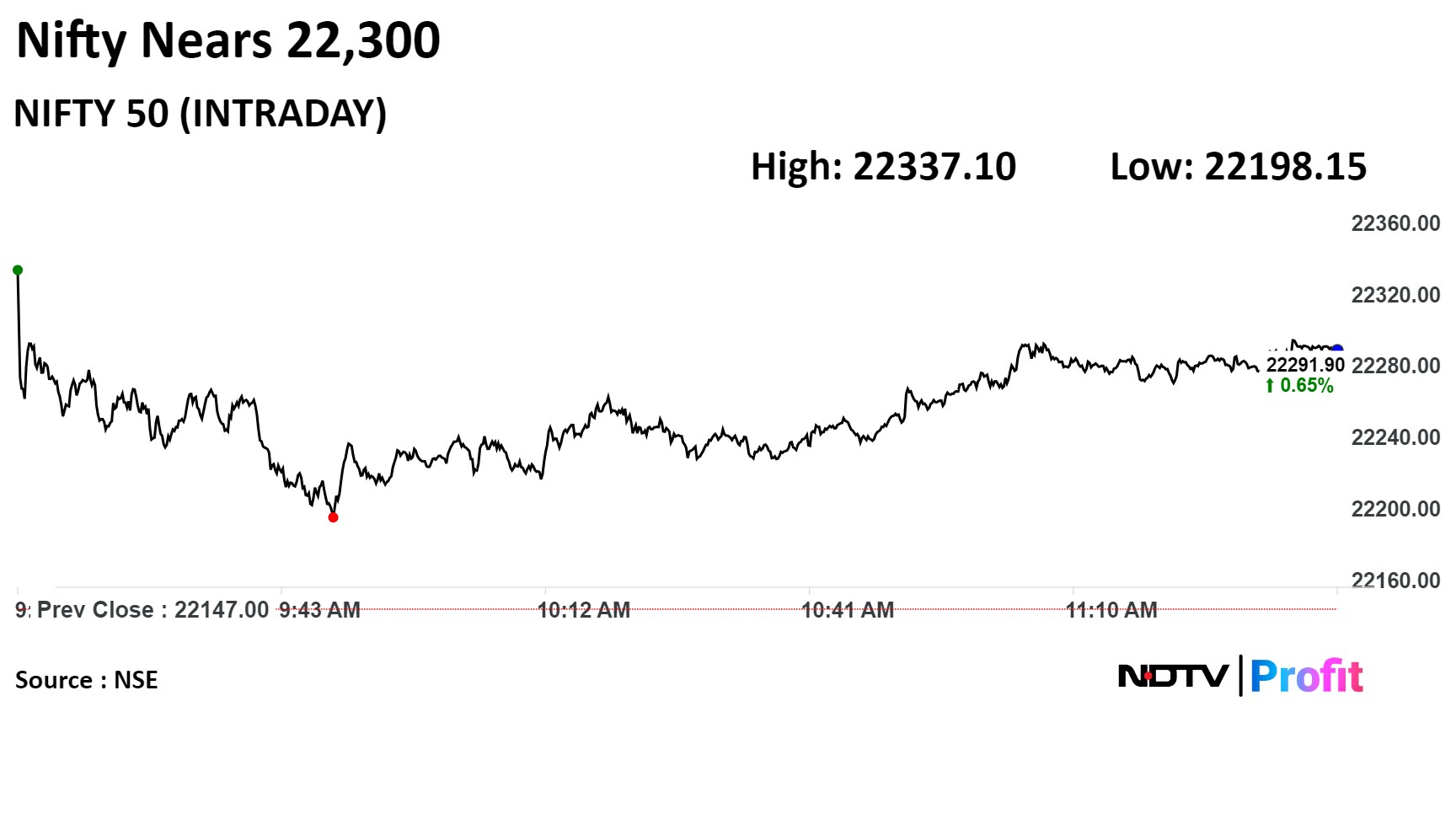

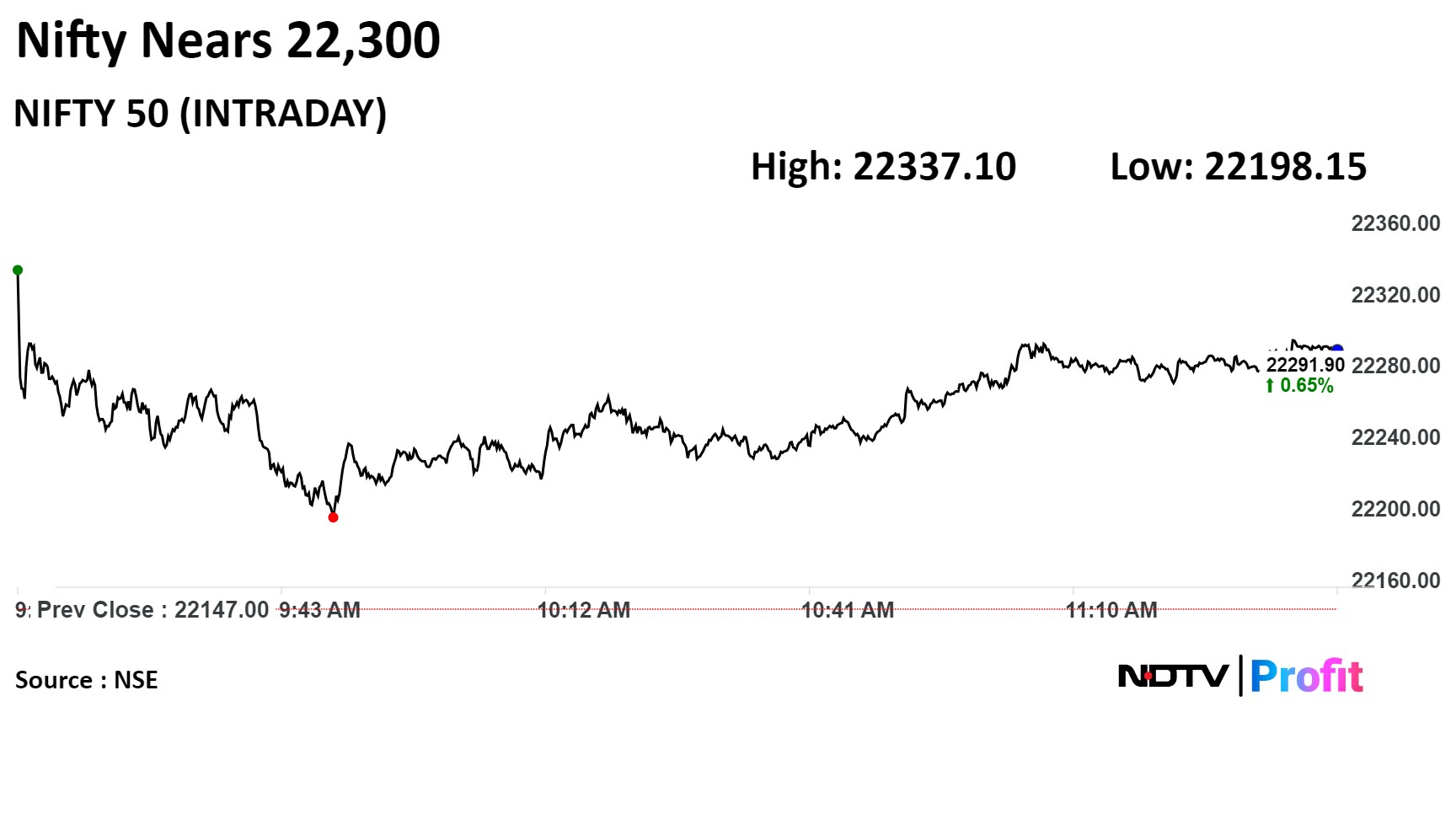

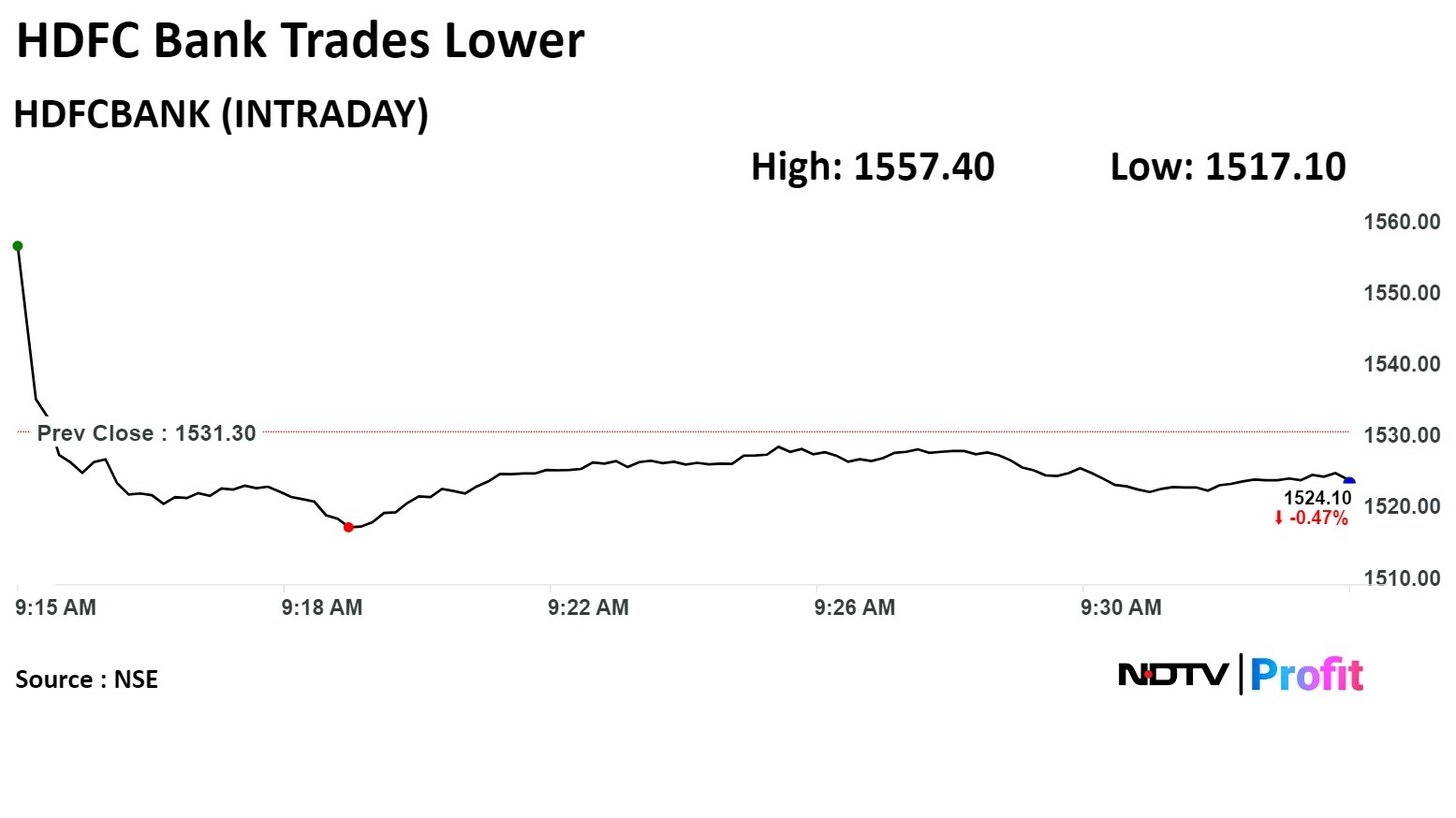

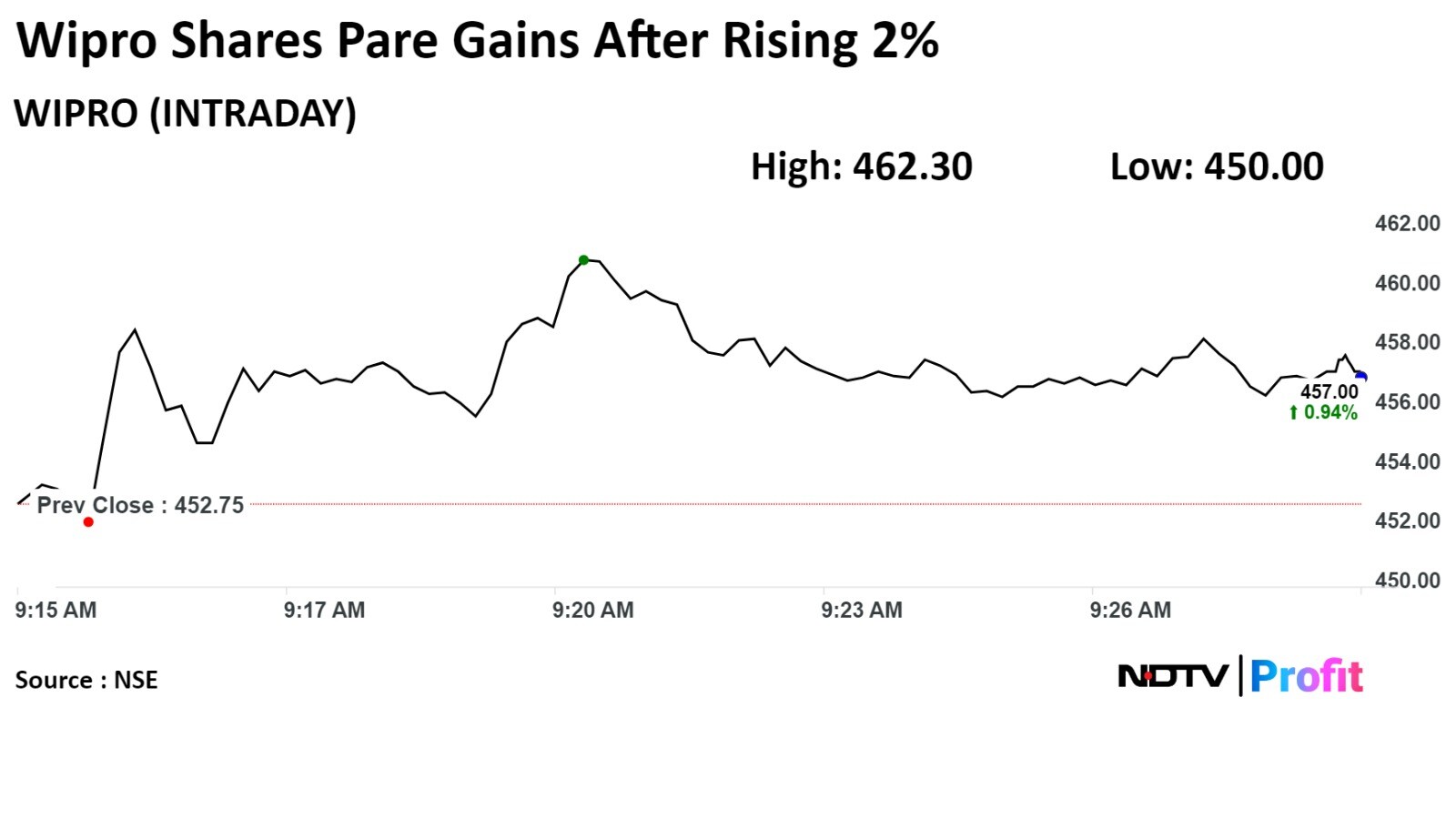

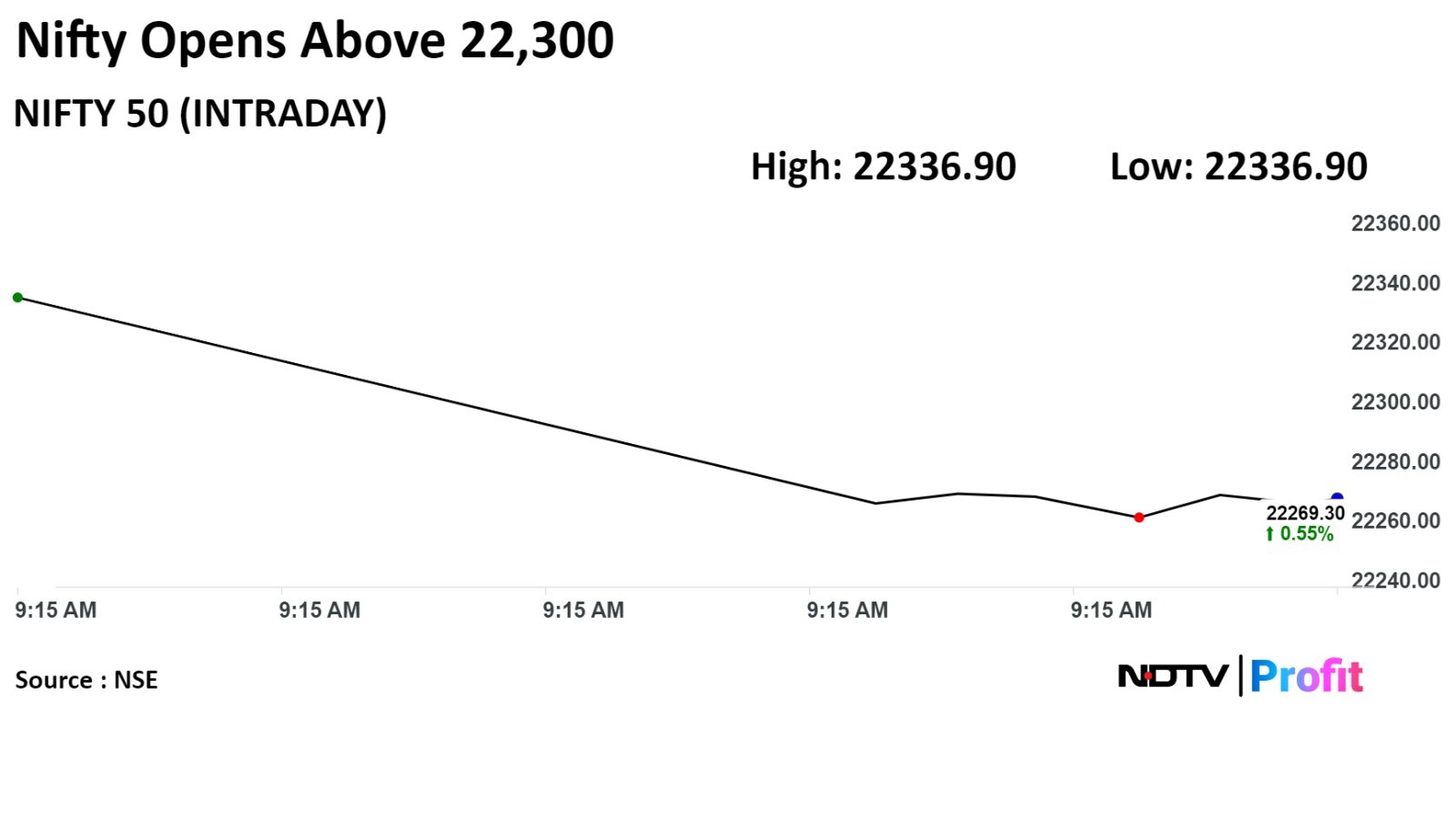

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

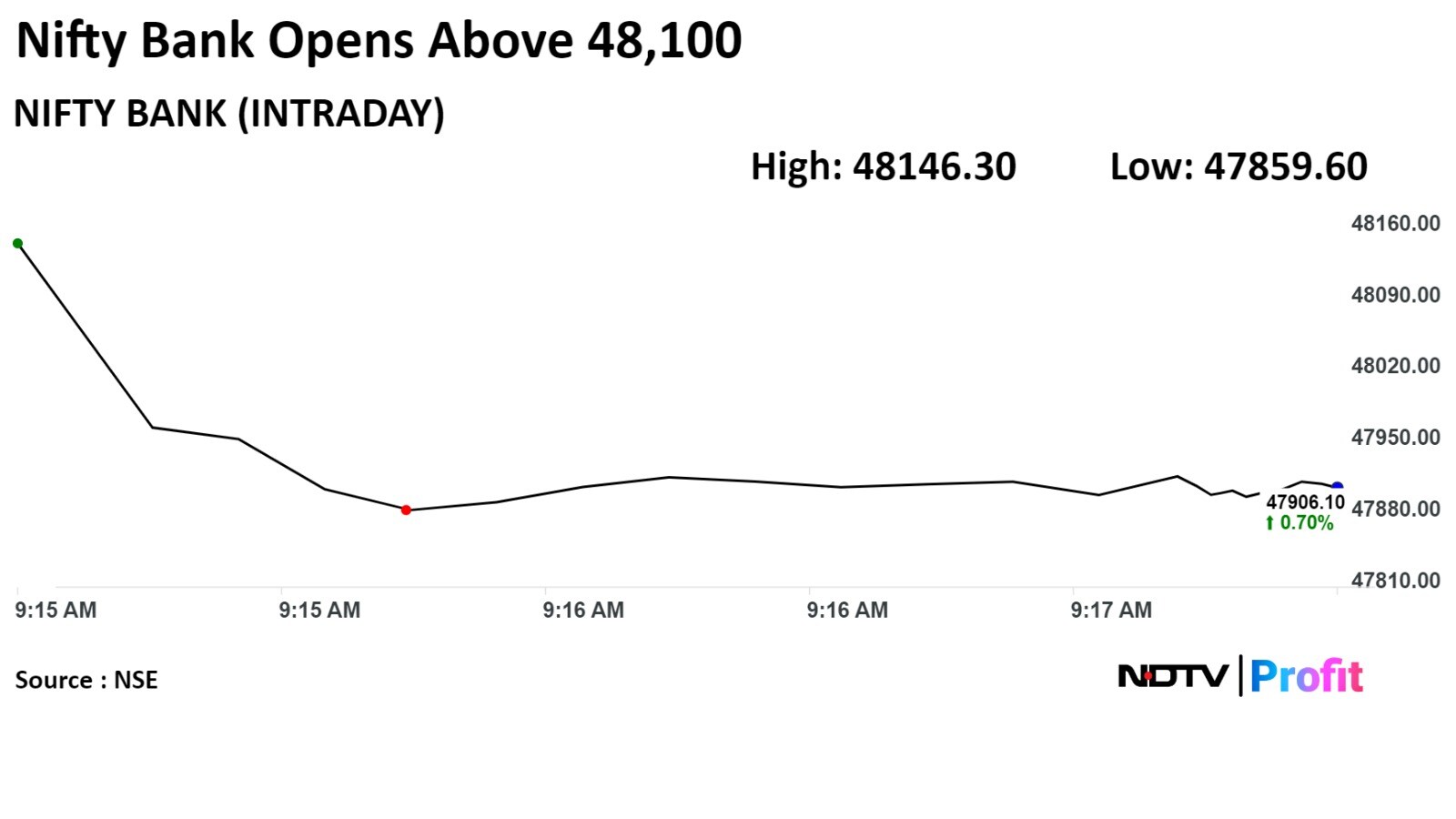

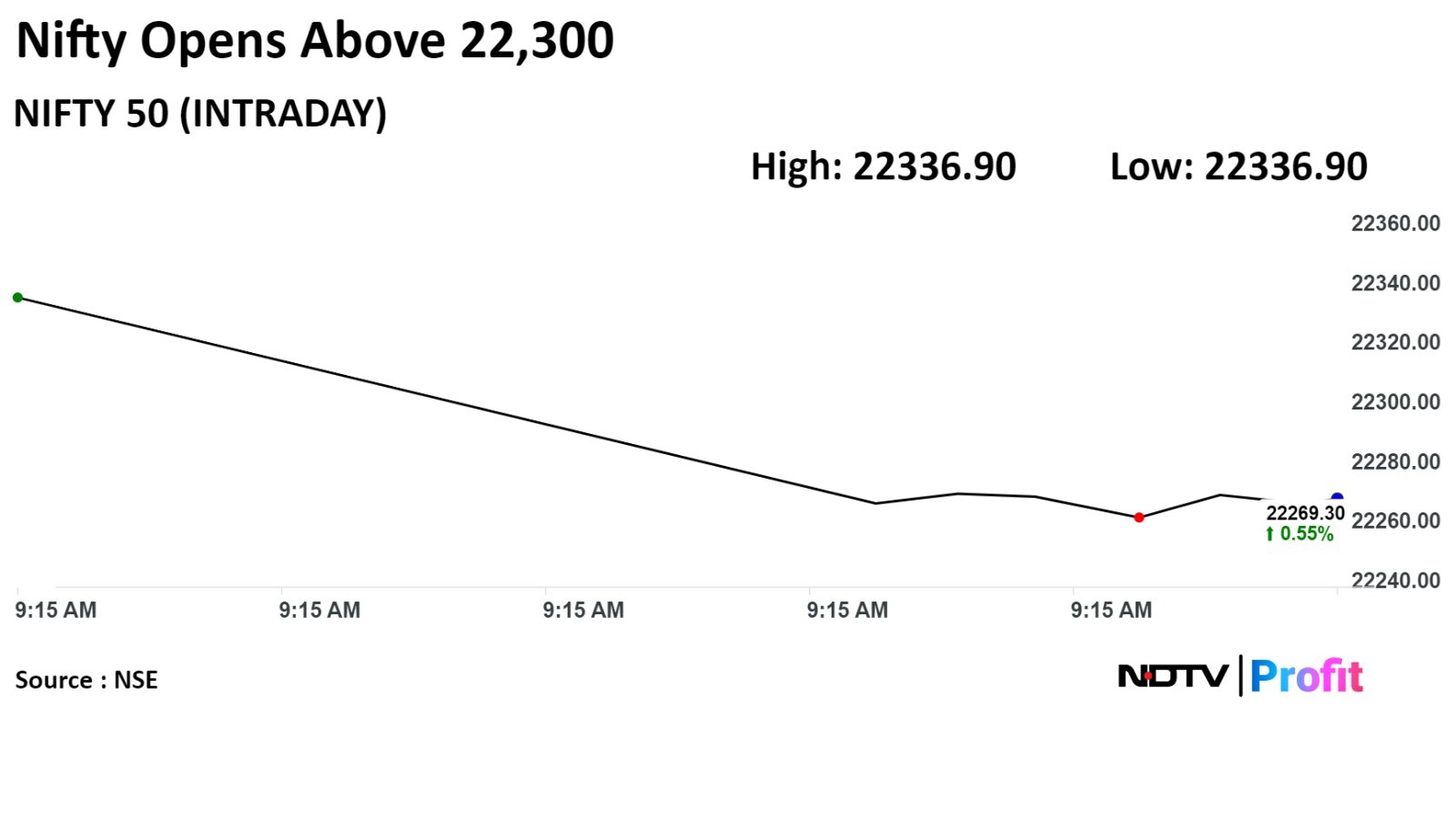

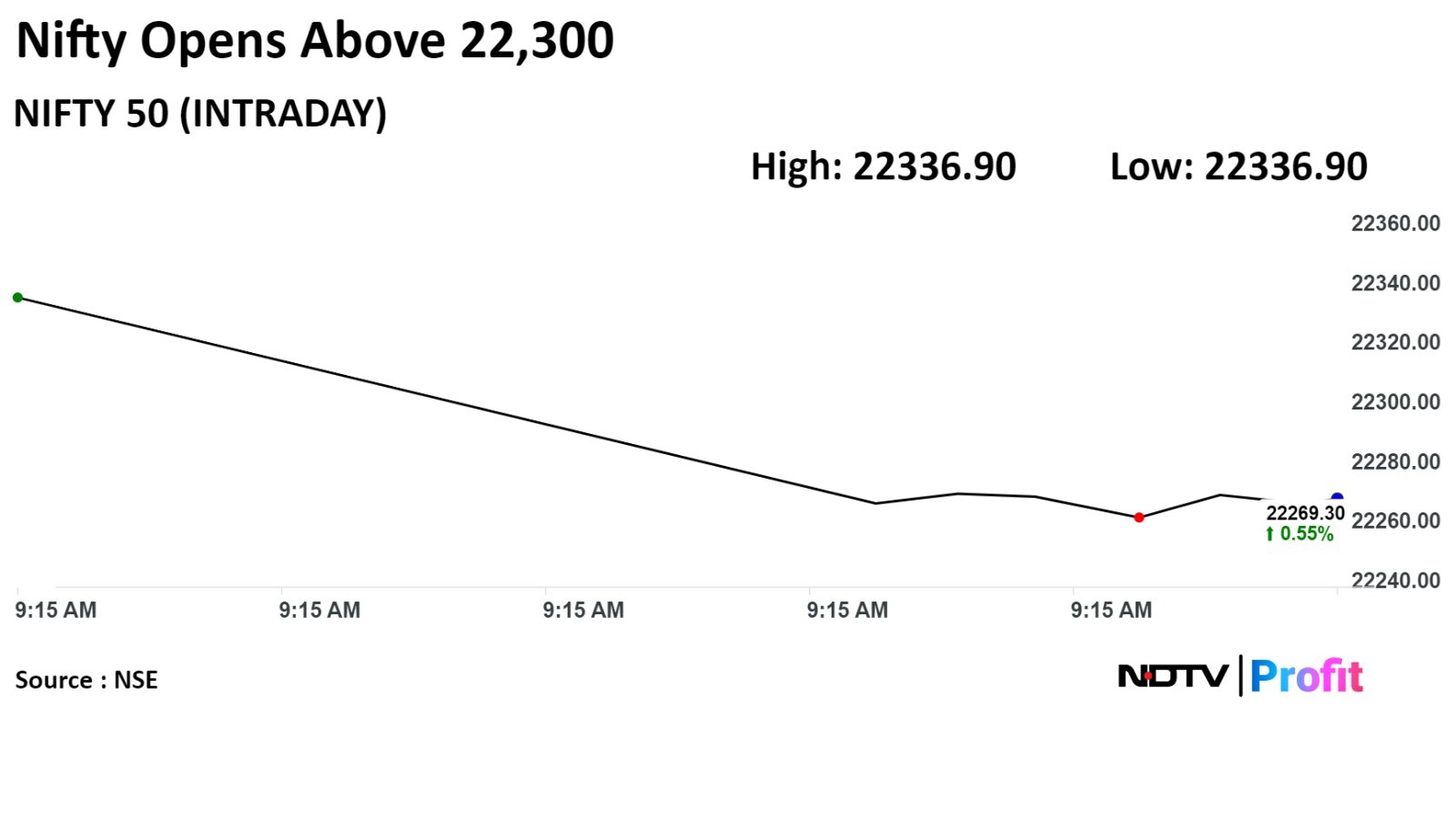

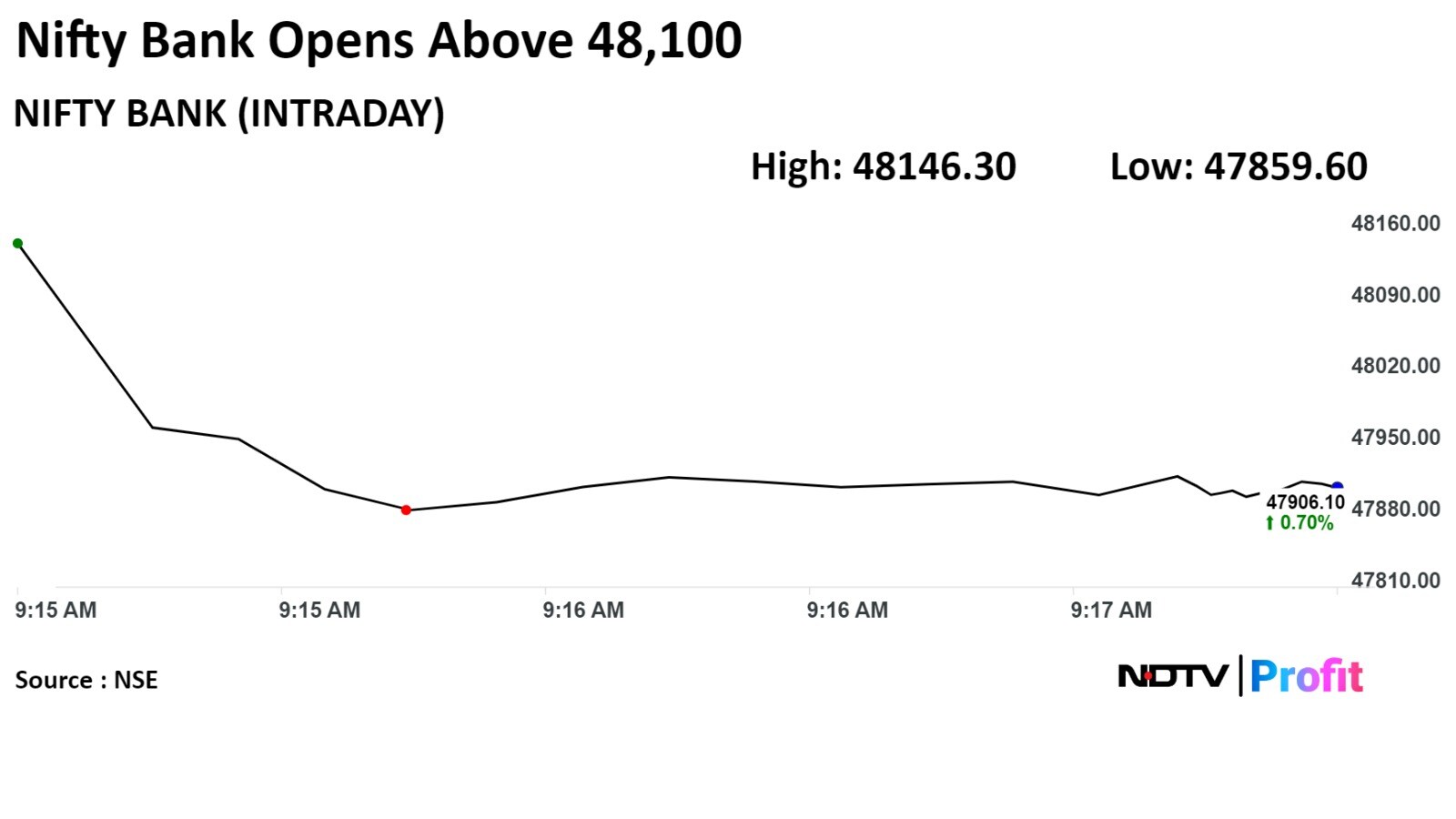

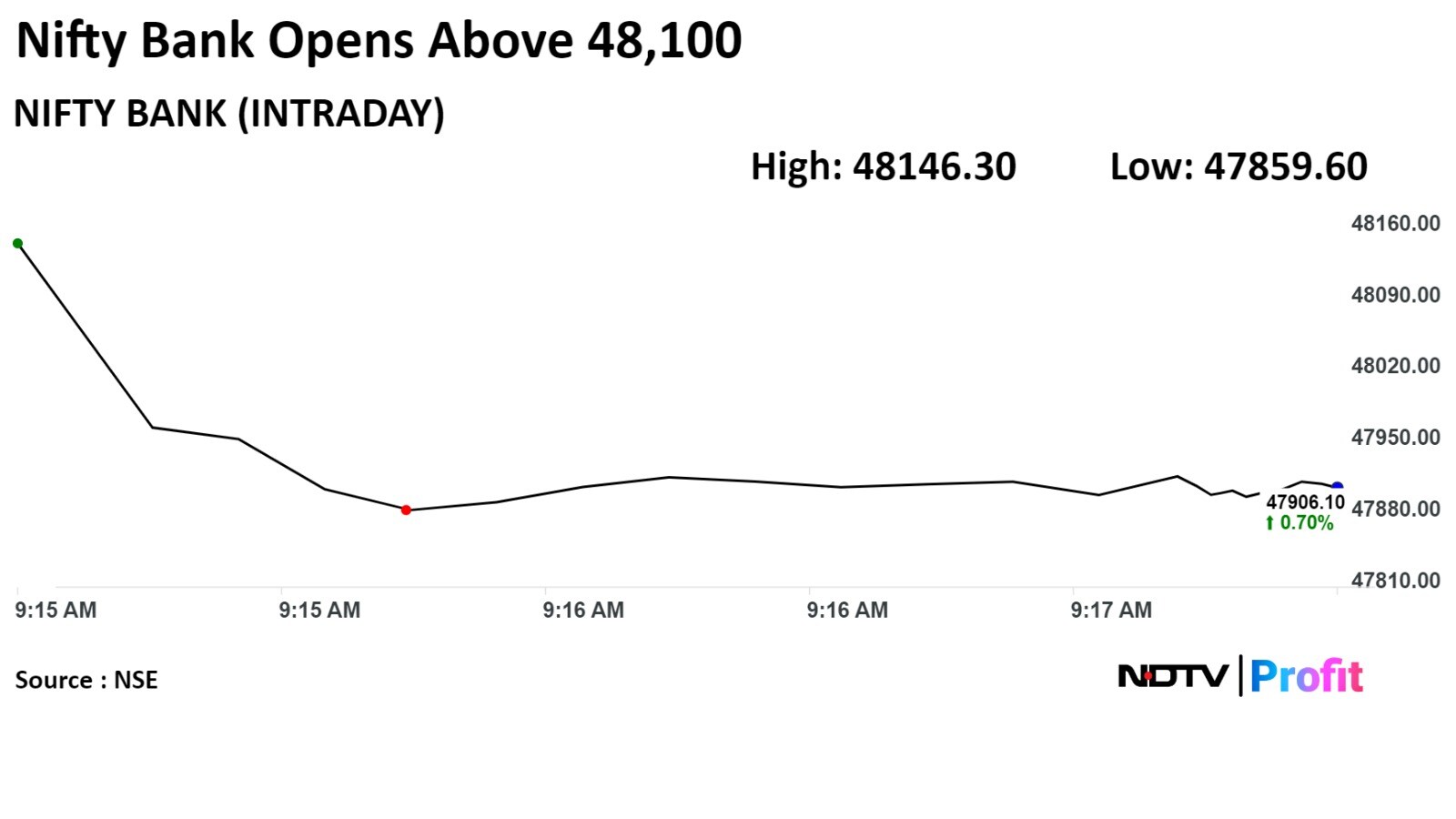

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

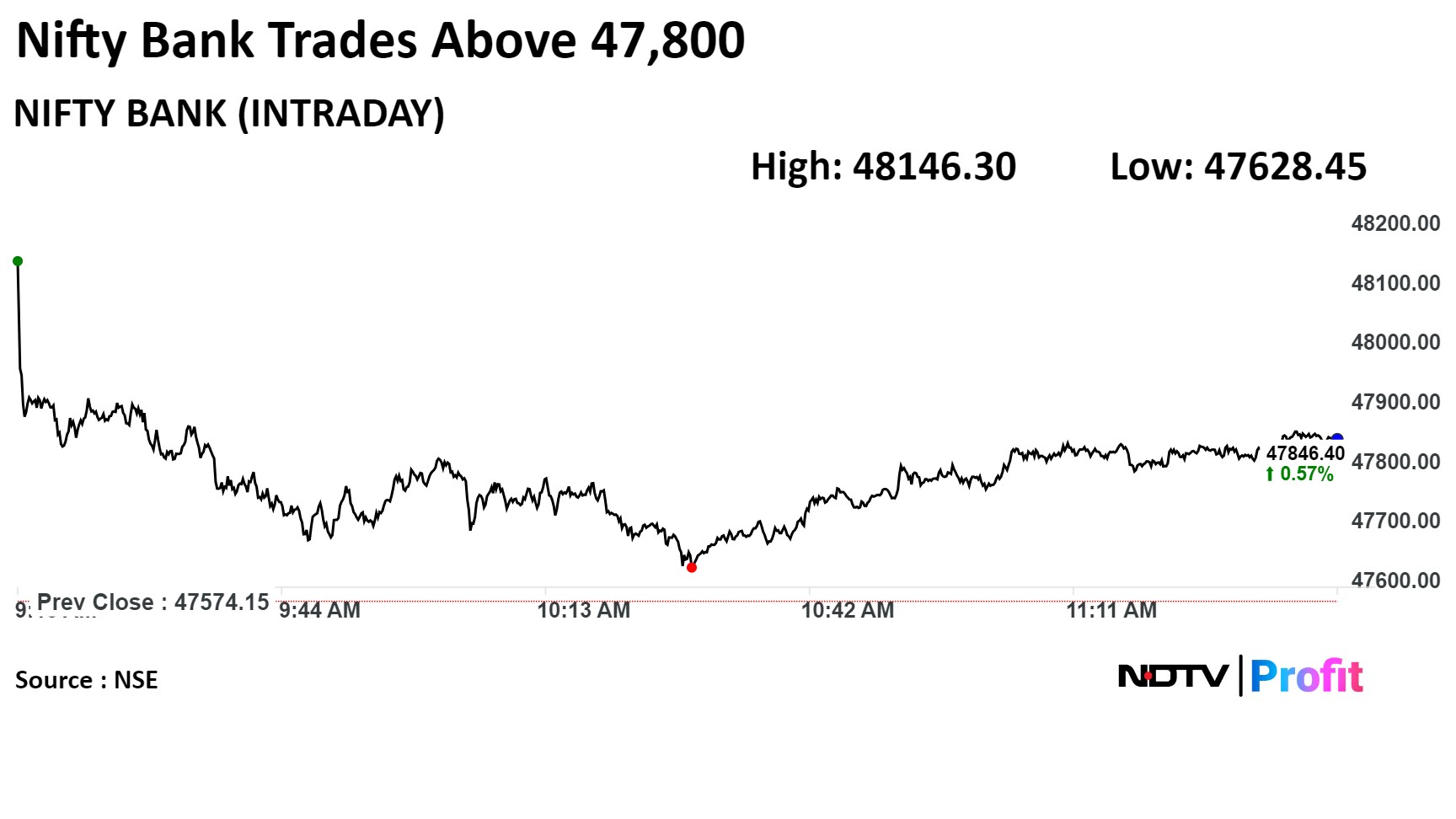

Shares of ICICI Bank Ltd., Larsen & Toubro Ltd., Axis Bank Ltd., Reliance Industries Ltd., and Bajaj Finance Ltd. contributed the most to Nifty gains while those of HDFC Bank Ltd., NTPC Ltd., and JSW Steel Ltd. weighed on the index.

Gains were across sectors with Nifty PSU Bank, Nifty Realty, and Nifty Pharma jumping over 1%.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

Shares of ICICI Bank Ltd., Larsen & Toubro Ltd., Axis Bank Ltd., Reliance Industries Ltd., and Bajaj Finance Ltd. contributed the most to Nifty gains while those of HDFC Bank Ltd., NTPC Ltd., and JSW Steel Ltd. weighed on the index.

Gains were across sectors with Nifty PSU Bank, Nifty Realty, and Nifty Pharma jumping over 1%.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

Shares of ICICI Bank Ltd., Larsen & Toubro Ltd., Axis Bank Ltd., Reliance Industries Ltd., and Bajaj Finance Ltd. contributed the most to Nifty gains while those of HDFC Bank Ltd., NTPC Ltd., and JSW Steel Ltd. weighed on the index.

Gains were across sectors with Nifty PSU Bank, Nifty Realty, and Nifty Pharma jumping over 1%.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

India's benchmark stock indices pared gains through midday trade on Monday, weighed by losses in heavyweight HDFC Bank Ltd. Growing pessimism over the Federal Reserve's cutting interest rates soon also dented sentiment, limiting the rise in the indices.

At 11:46 a.m., the Nifty was trading 142.50 points, or 0.64%, higher at 22,289.50, and the Sensex rose 379.46 points or 0.52% to trade at 73,467.79.

Jatin Gedia, a technical research analyst at Sharekhan, told NDTV Profit that he is bullish on both Nifty and Nifty Bank. However, the upside in the Nifty 50 will only be limited to 22,500–22,600 levels in the current-month contract, he said.

Nifty Bank is likely to witness a pullback from its recent fall and may rise to the 48,500 level, said Gedia.

Shares of ICICI Bank Ltd., Larsen & Toubro Ltd., Axis Bank Ltd., Reliance Industries Ltd., and Bajaj Finance Ltd. contributed the most to Nifty gains while those of HDFC Bank Ltd., NTPC Ltd., and JSW Steel Ltd. weighed on the index.

Gains were across sectors with Nifty PSU Bank, Nifty Realty, and Nifty Pharma jumping over 1%.

The broader markets outperformed their larger peers, with the S&P BSE Midcap rising 0.96% and the S&P BSE Smallcap gaining 1.37% through midday on Monday.

On BSE, all 20 sectors advanced with the S&P BSE Consumer Durables leading.

Market breadth was skewed in favour of buyers. On BSE, 2,663 stocks rose, 1,027 stocks declined, and 181 remained unchanged.

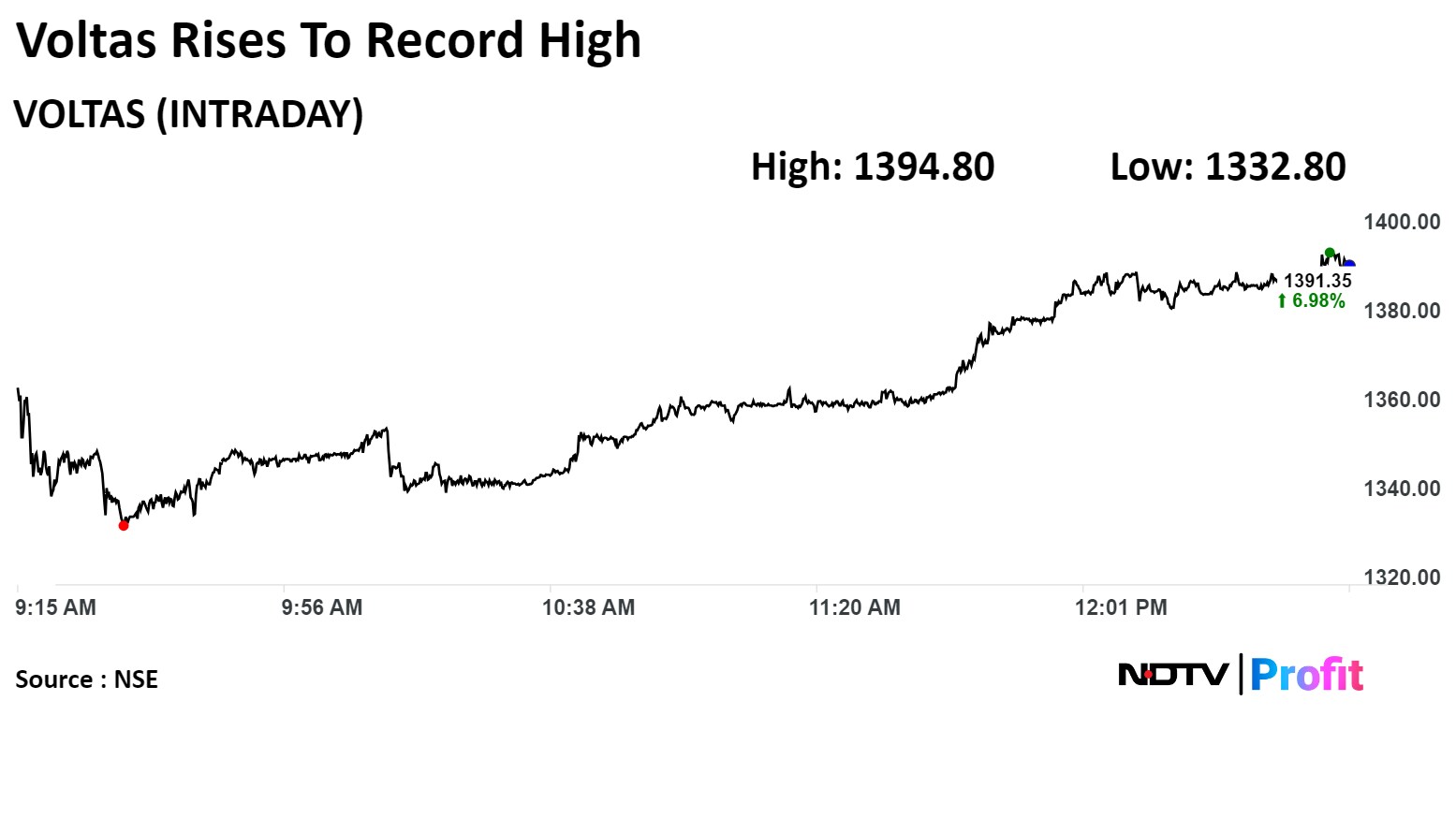

Voltas Ltd. rose 7.25% to 1,394.80, the highest level since its listing on Jul 2, 1997. The shares rose as the UBS upgraded the stock to 'Buy' with target price Rs 1,800, which implied an upside of 40%.

The scrip was trading 6.82% higher at Rs 1,389.30, as compared to 0.66% advance in the NSE Nifty 50 index.

Voltas Ltd. rose 7.25% to 1,394.80, the highest level since its listing on Jul 2, 1997. The shares rose as the UBS upgraded the stock to 'Buy' with target price Rs 1,800, which implied an upside of 40%.

The scrip was trading 6.82% higher at Rs 1,389.30, as compared to 0.66% advance in the NSE Nifty 50 index.

Radovan Sikorsky resigns as United Breweries Ltd.'s CFO due to change of role as Regional CFO for Asia effective July 1.

Source: Exchange filing

Hinduja Global Solutions Ltd.'s CelerityX launched network-as-a-service solution 'OneX'.

OneX solutions cover network management, security, and LAN-side control.

CelerityX to offer OneX to over 40,000 bank branches in Maharashtra.

CelerityX can serve over 1 lakh branches nationwide.

Source: Press release

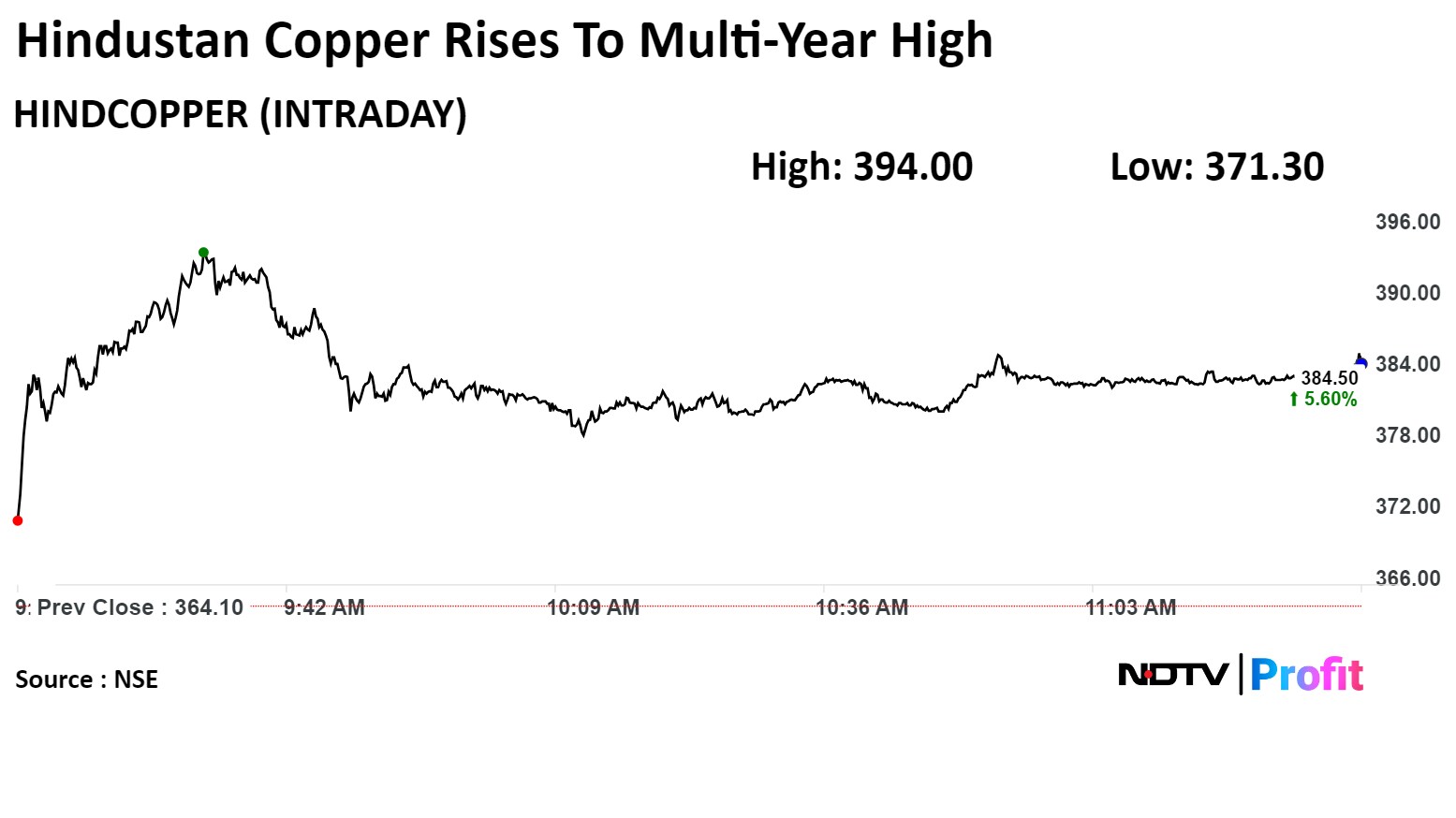

Shares of Hindustan Copper Ltd. rose as much as 8.21% to 394.00, the highest level since Nov 11, 2010. It pared gains to trade 5.41% higher at 383.90 as of 11:34 a.m., compared to 0.68% advance in the NSE Nifty 50 index.

Shares of Hindustan Copper Ltd. rose as much as 8.21% to 394.00, the highest level since Nov 11, 2010. It pared gains to trade 5.41% higher at 383.90 as of 11:34 a.m., compared to 0.68% advance in the NSE Nifty 50 index.

Zomato Ltd. has hiked platform fees from Rs 4 to Rs 5 per order in selective markets.

Raised convenience fee fourth time over last one year.

Increase in each Re1 convenience fee to lead positive impact of Rs85-90 crore on EBITDA, the brokerage said.

Estimates to do 85-90 crore orders annually (FY25).

Positive impact on EBITDA could be mere 1-2% as hike effective only in selective markets.

Expect platform fee to move towards Rs8-10 per order over medium term in select metro markets.

Overall subscription at 67% as of 10:36 am

NII subscription at 1.3x as of 10:36 am

QIB subscription at 94% as on 10:36 am

Retail subscription at 25% as on 10:36 am

Source: BSE

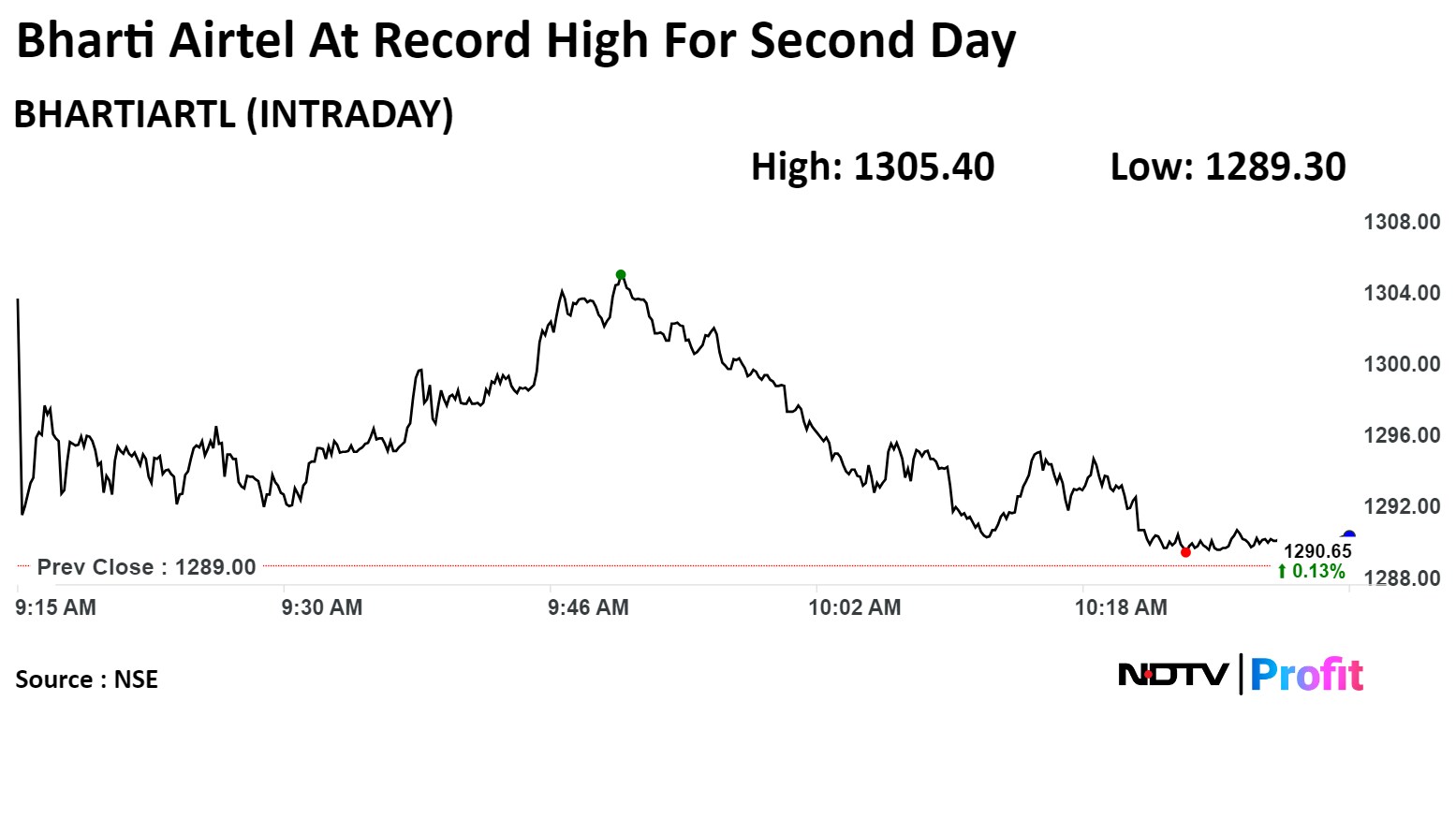

Shares of Bharti Airtel Ltd. rose as much as 1.27% to Rs 1,305.40, the highest level since its listing on Nov 2, 2021. It was trading 0.99% higher at Rs 908.45 as of 10:37 a.m., compares to 0.39% advance in the NSE Nifty 50 index.

Shares of Bharti Airtel Ltd. rose as much as 1.27% to Rs 1,305.40, the highest level since its listing on Nov 2, 2021. It was trading 0.99% higher at Rs 908.45 as of 10:37 a.m., compares to 0.39% advance in the NSE Nifty 50 index.

Welspun Corp Ltd. received multiple orders worth Rs 872 crore in India and overseas markets.

Source: Exchange filing

Escorts Kubota Ltd.'s Agricultural machinery business division is to increase prices of its tractors effective May 1.

Increase in prices to vary across models and geographies.

Source: Exchange filing

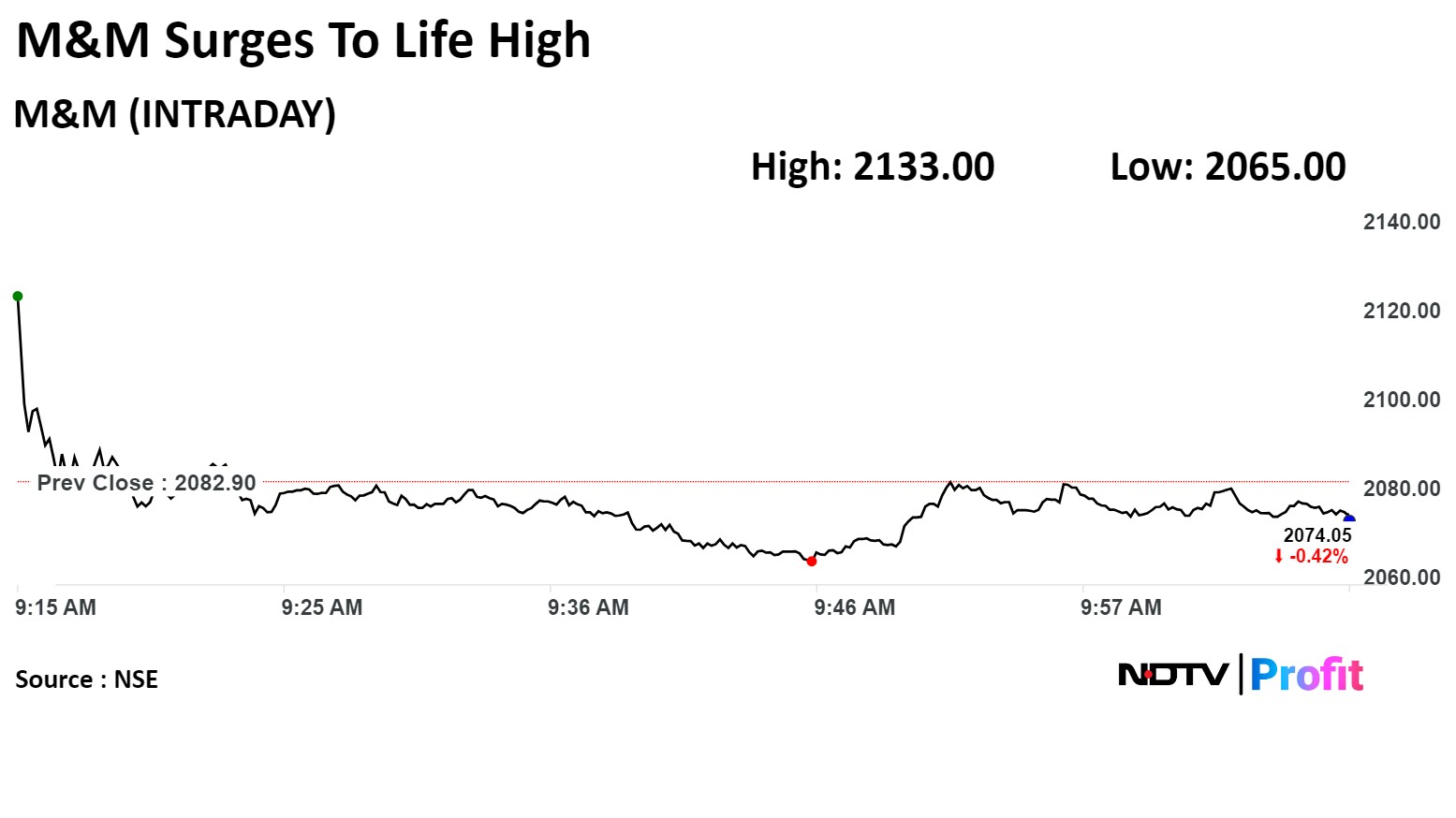

Mahindra & Mahindra Ltd. rose as much as 2.41% to Rs 2,133 apiece, the highest level since its listing on Jan 3, 1996. It erased gains to trade at 0.67% lower at Rs 2,068.95 apiece, as of 10:12 a.m. This compares to a 0.46% advance in the NSE Nifty 50 Index.

It has risen 71.19% in 12 months. Total traded volume so far in the day stood at 0.28 times its 30-day average. The relative strength index was at 64.52.