Overseas investors turned net sellers of Indian equities on Friday. Foreign portfolio investors offloaded stocks worth Rs 8,027.00 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained net buyers and mopped up equities worth Rs 6,341.53 crore, the NSE data showed.

Foreign institutions have been net buyers of Rs 24240 crore worth of Indian equities so far in 2024, according to data from the National Securities Depository Ltd., updated till the previous trading day.

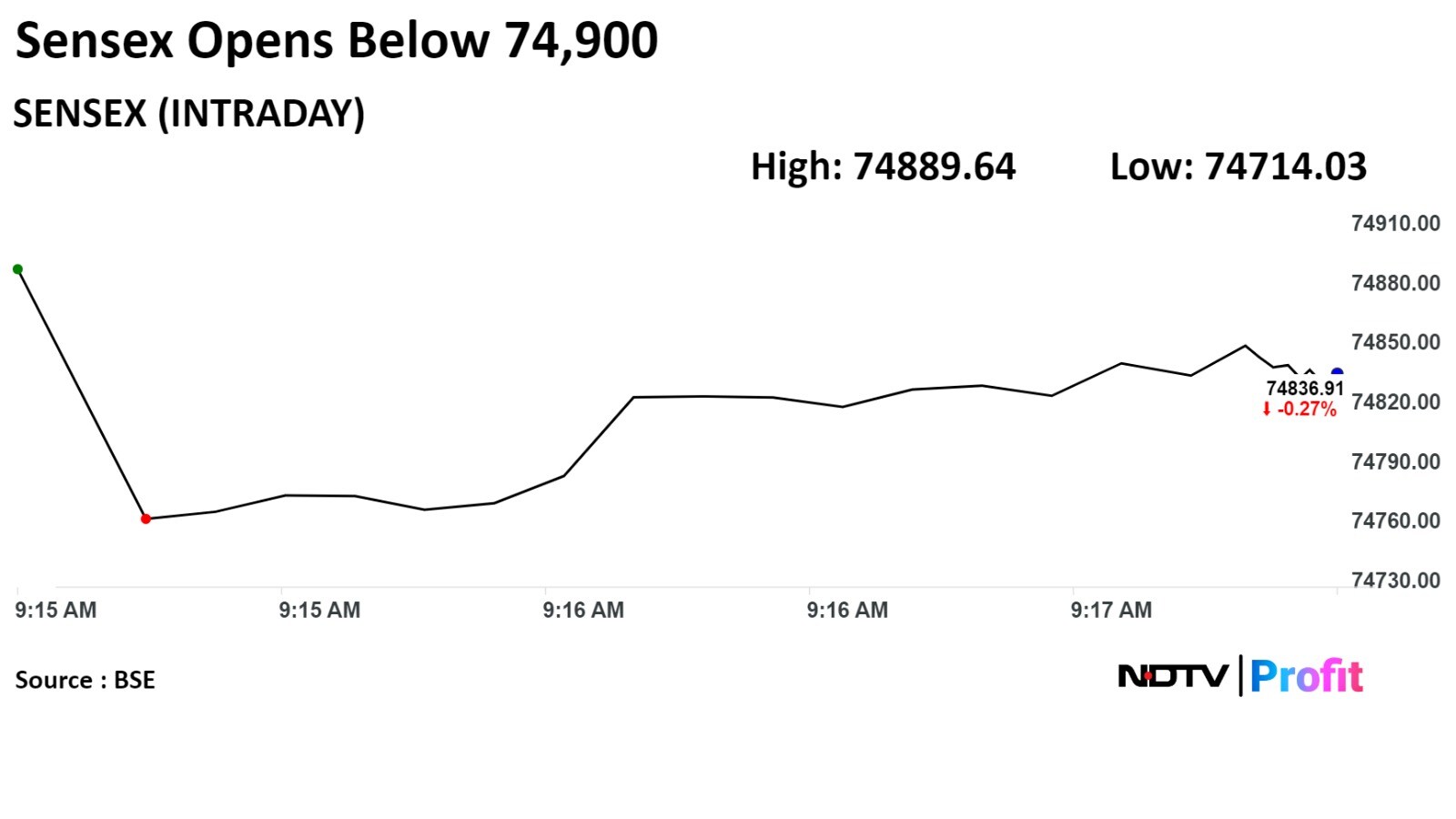

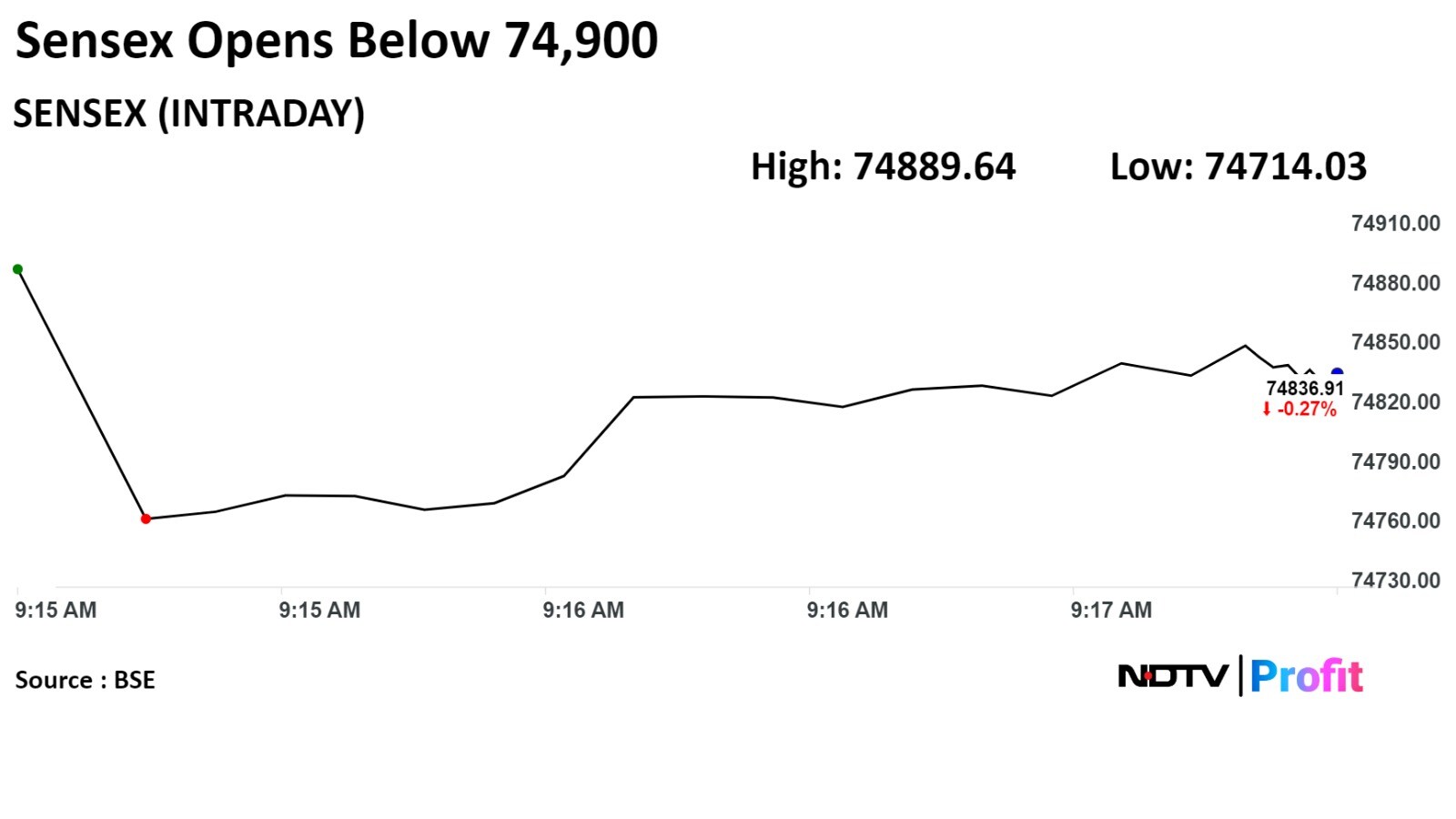

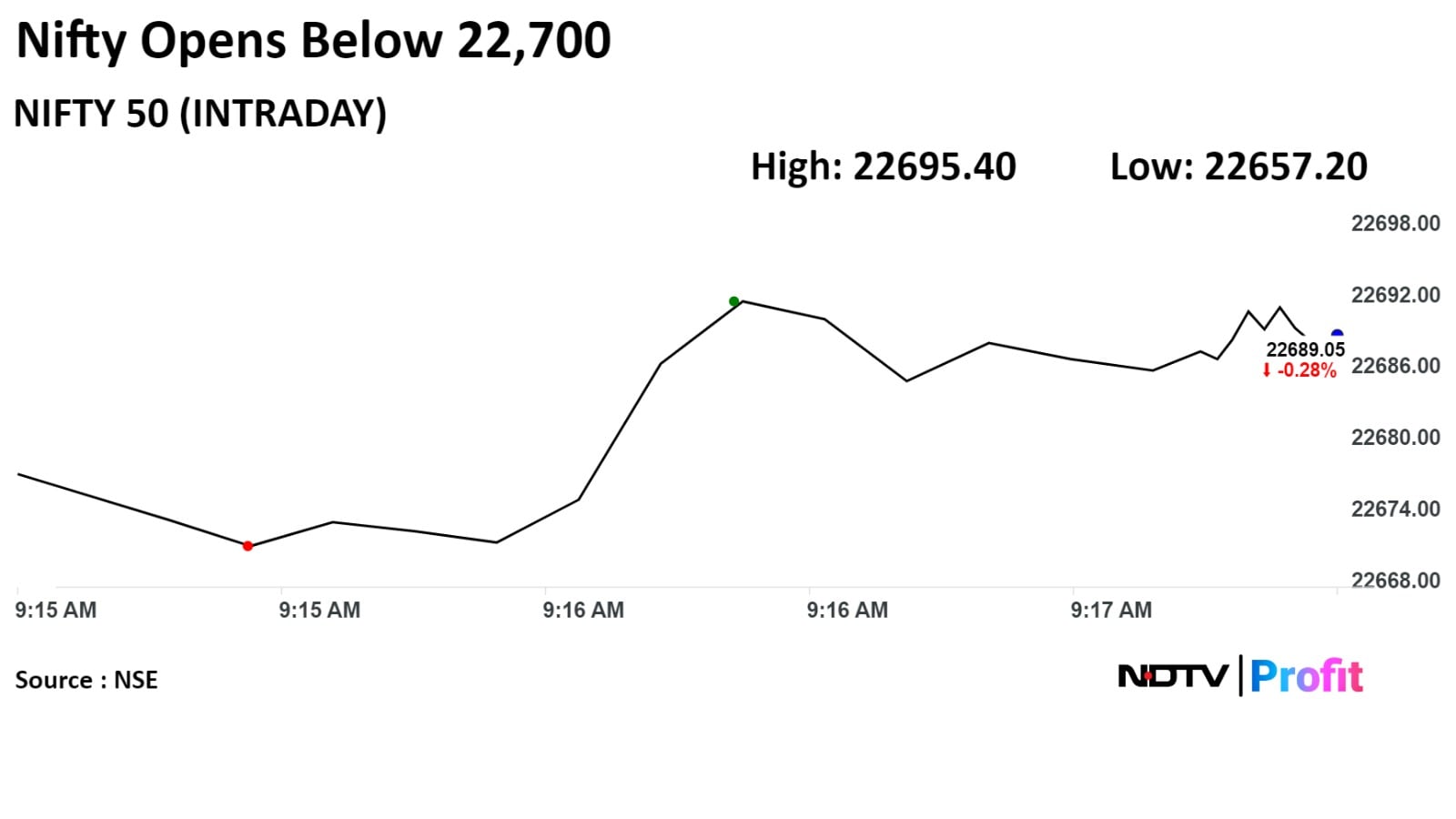

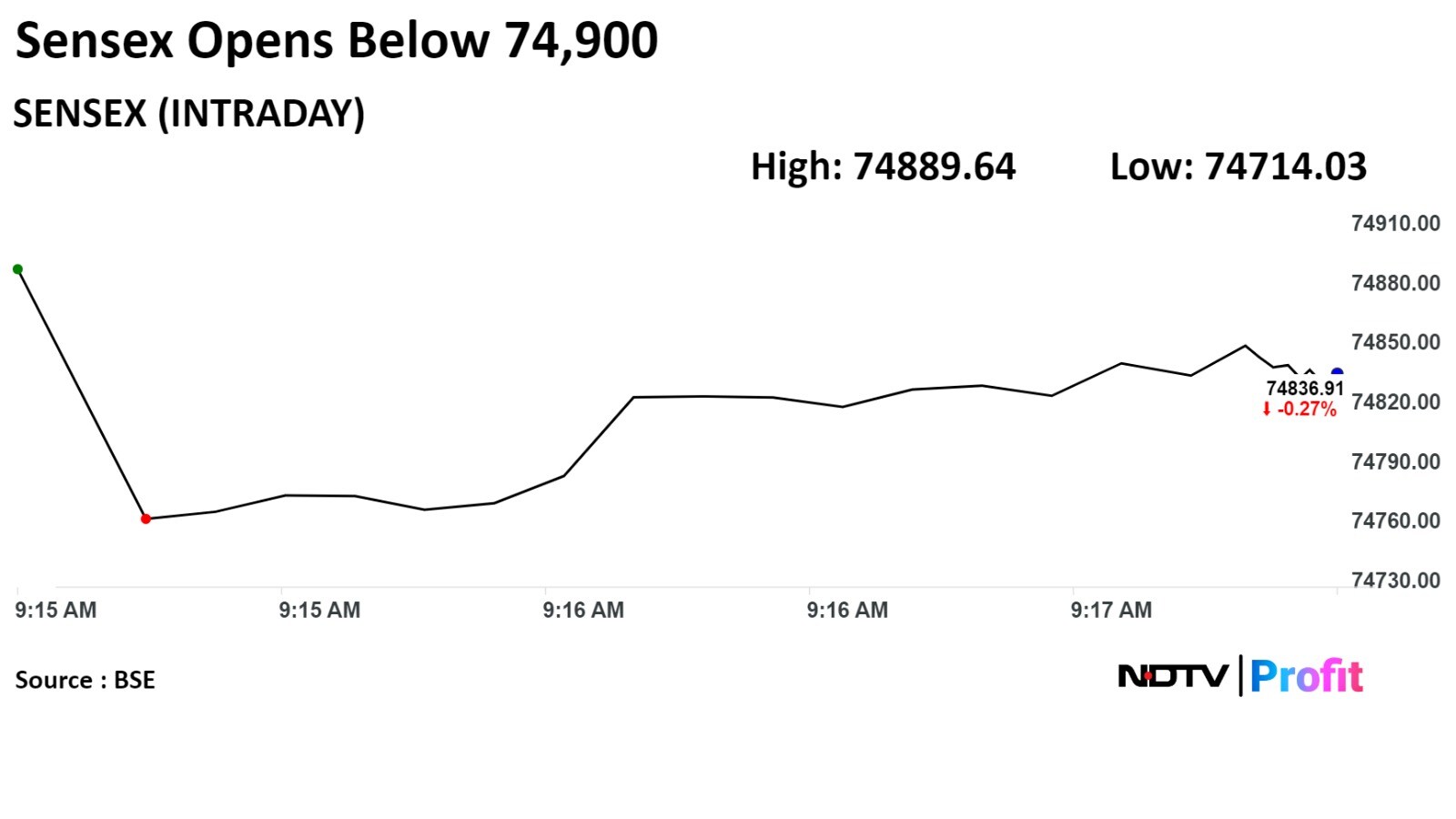

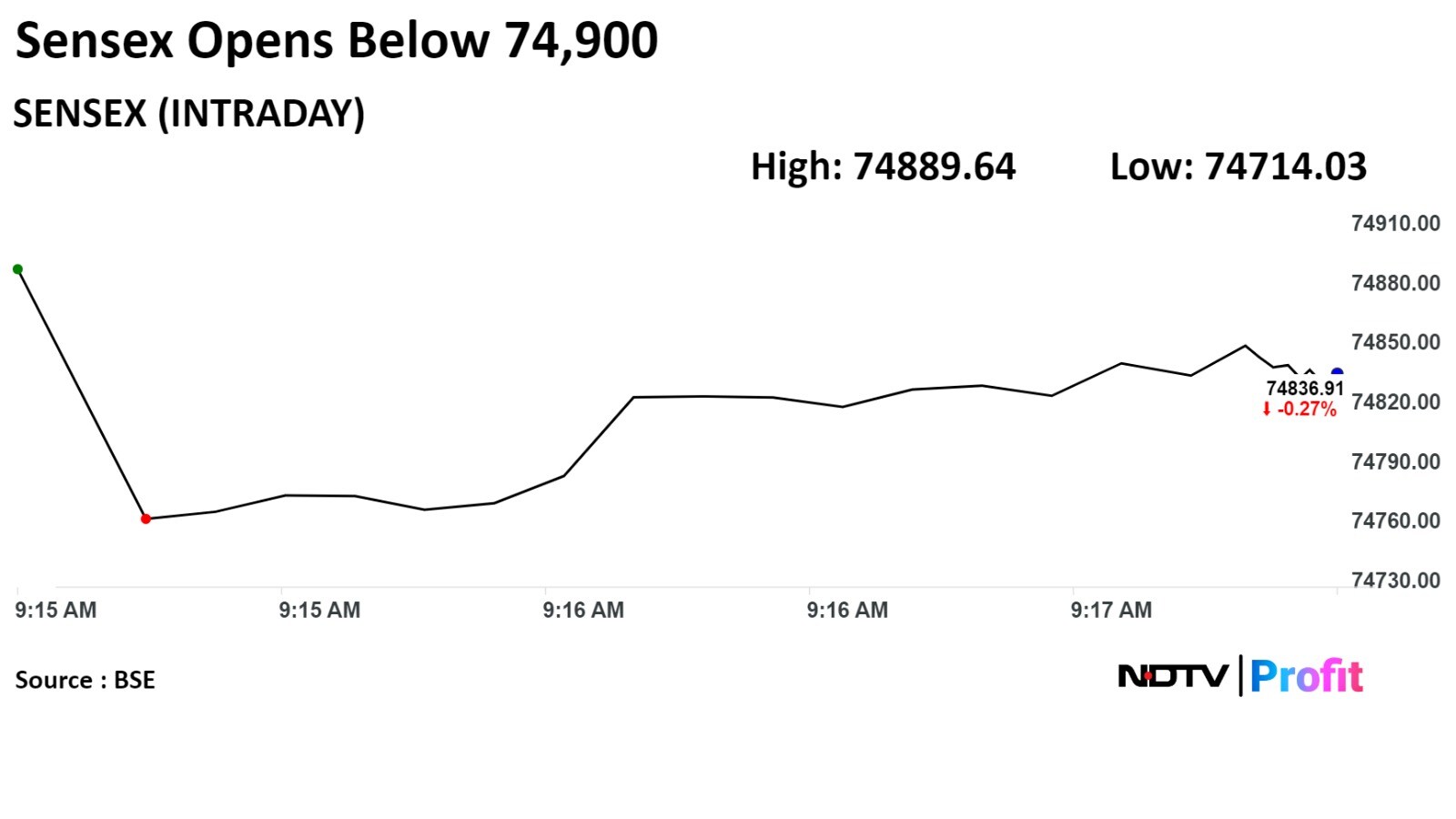

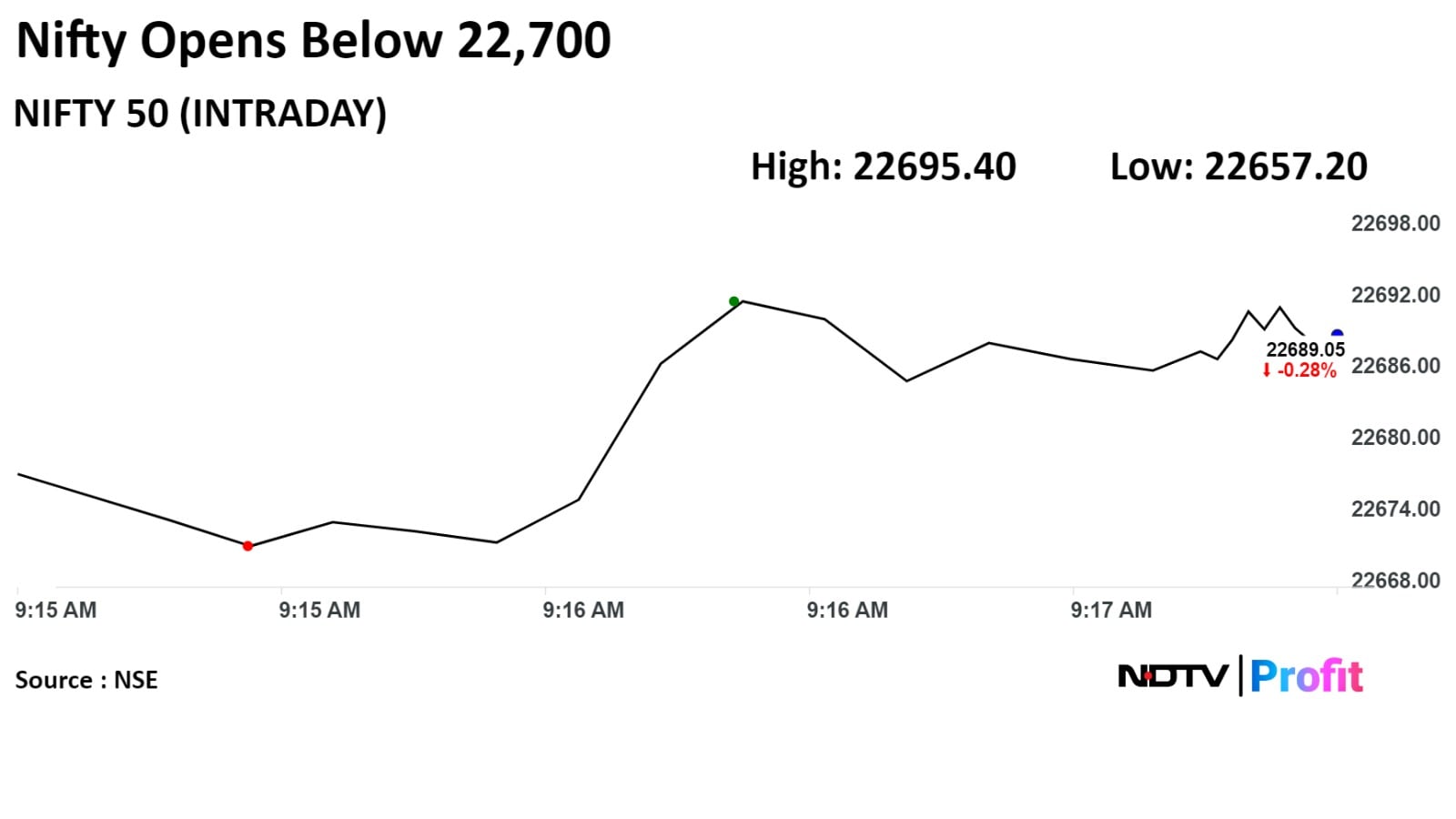

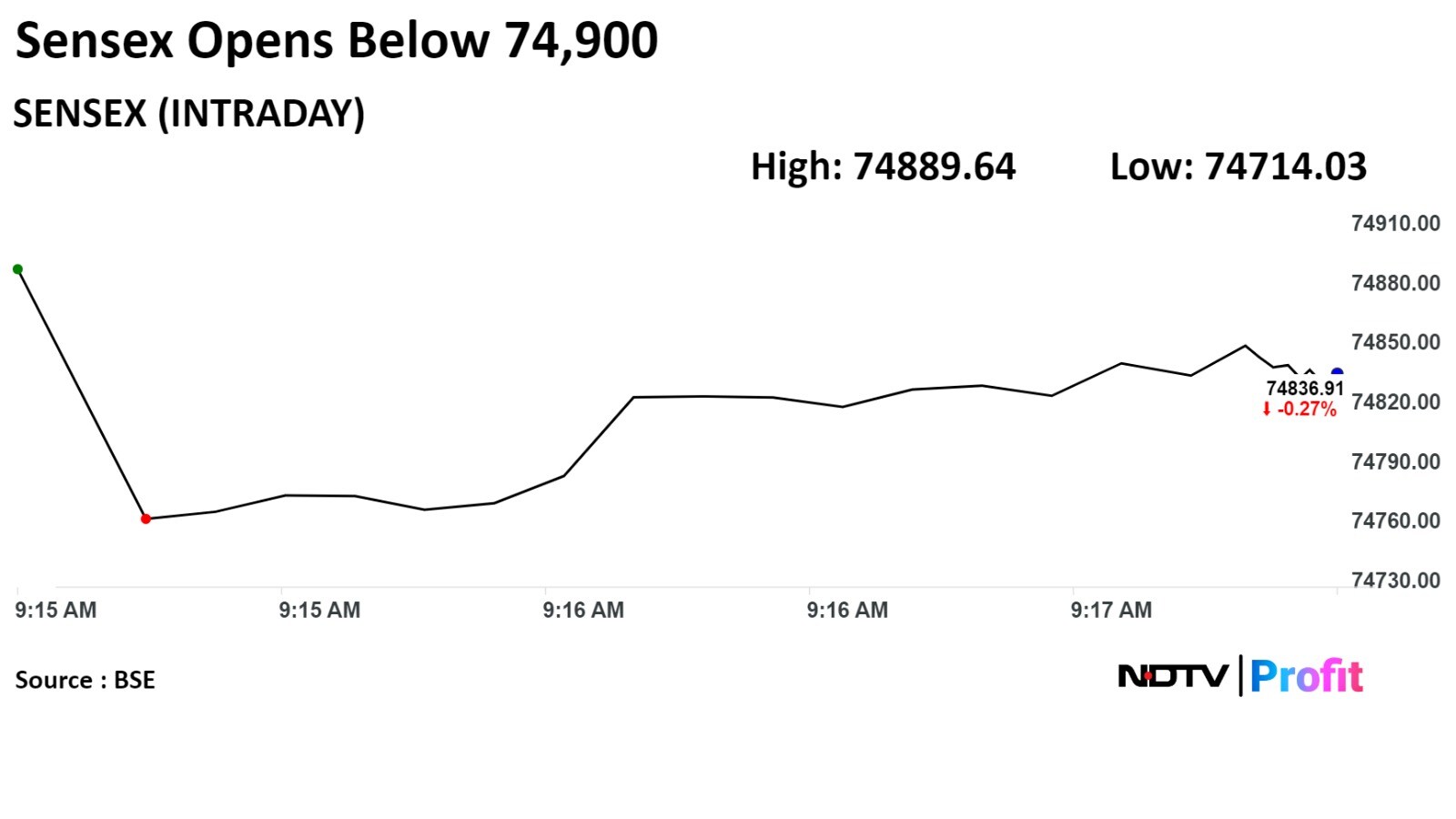

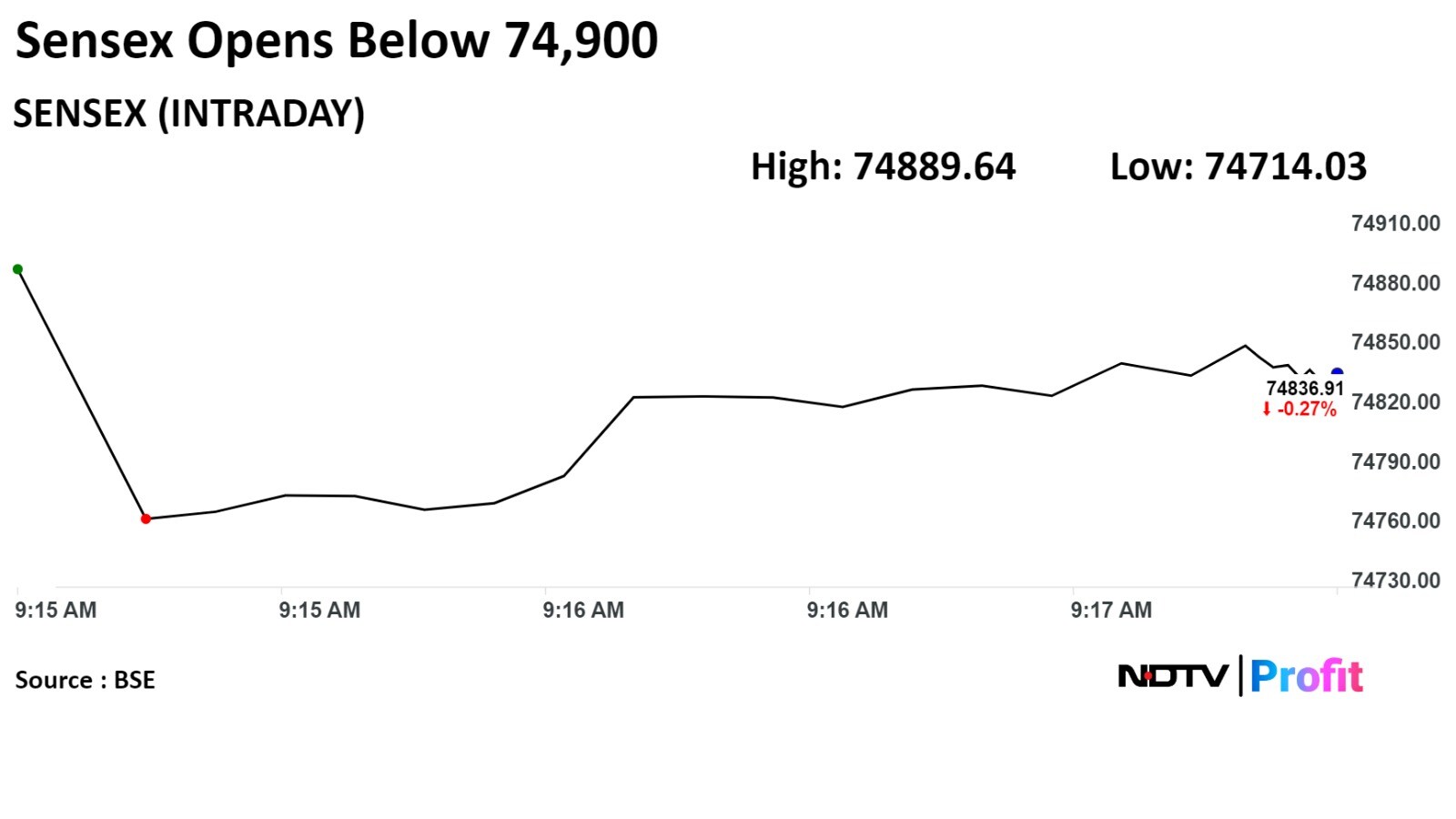

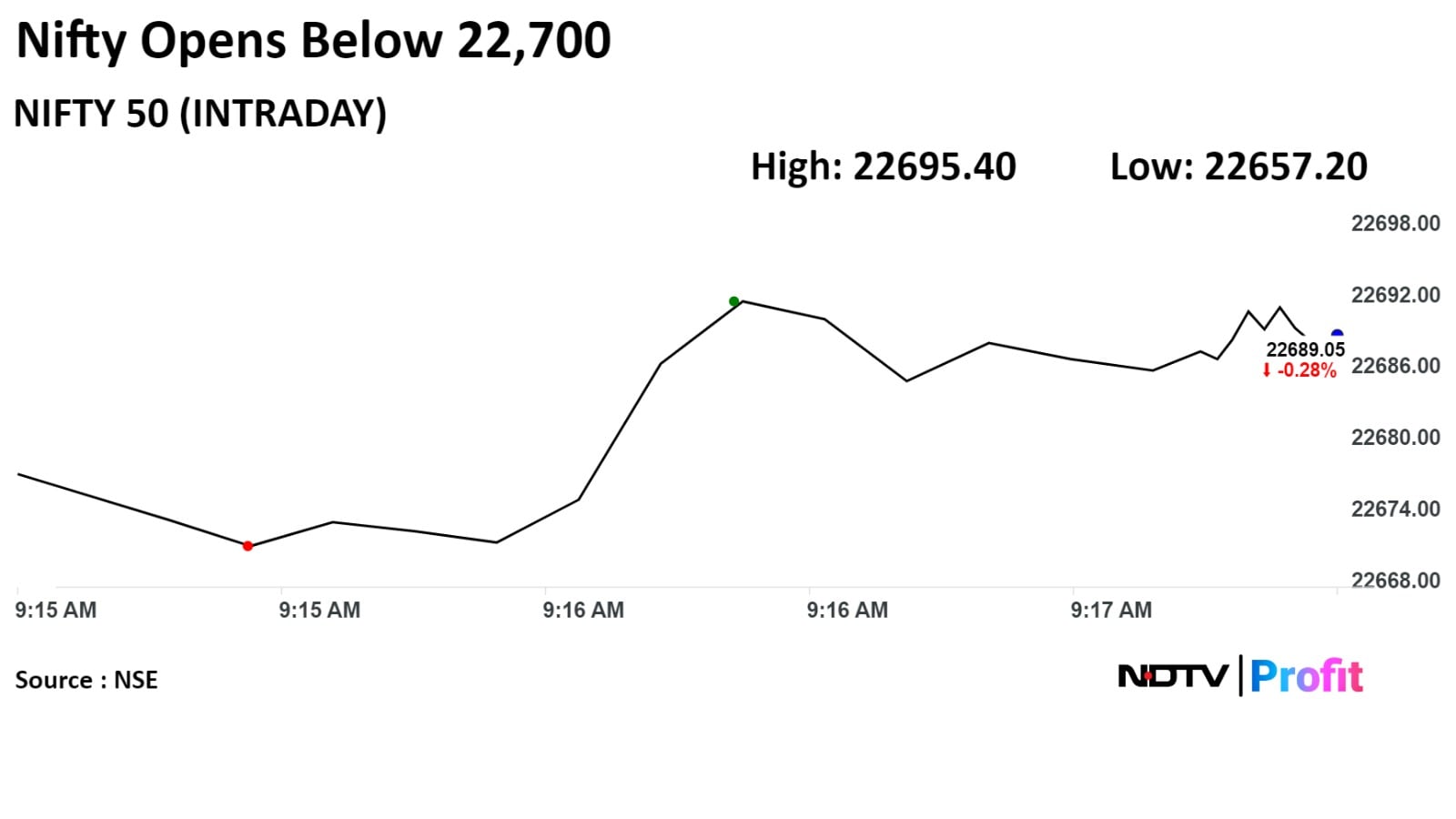

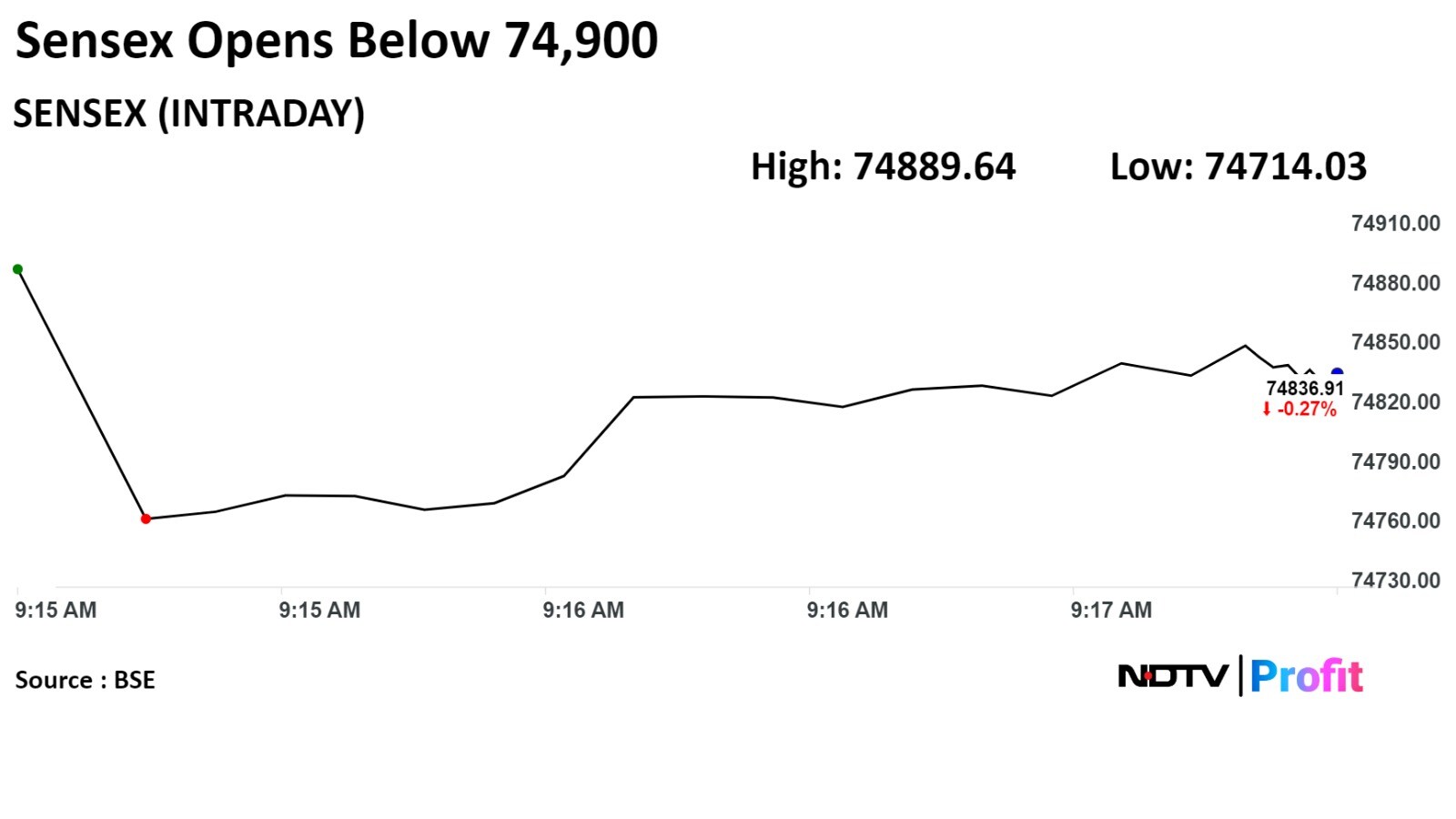

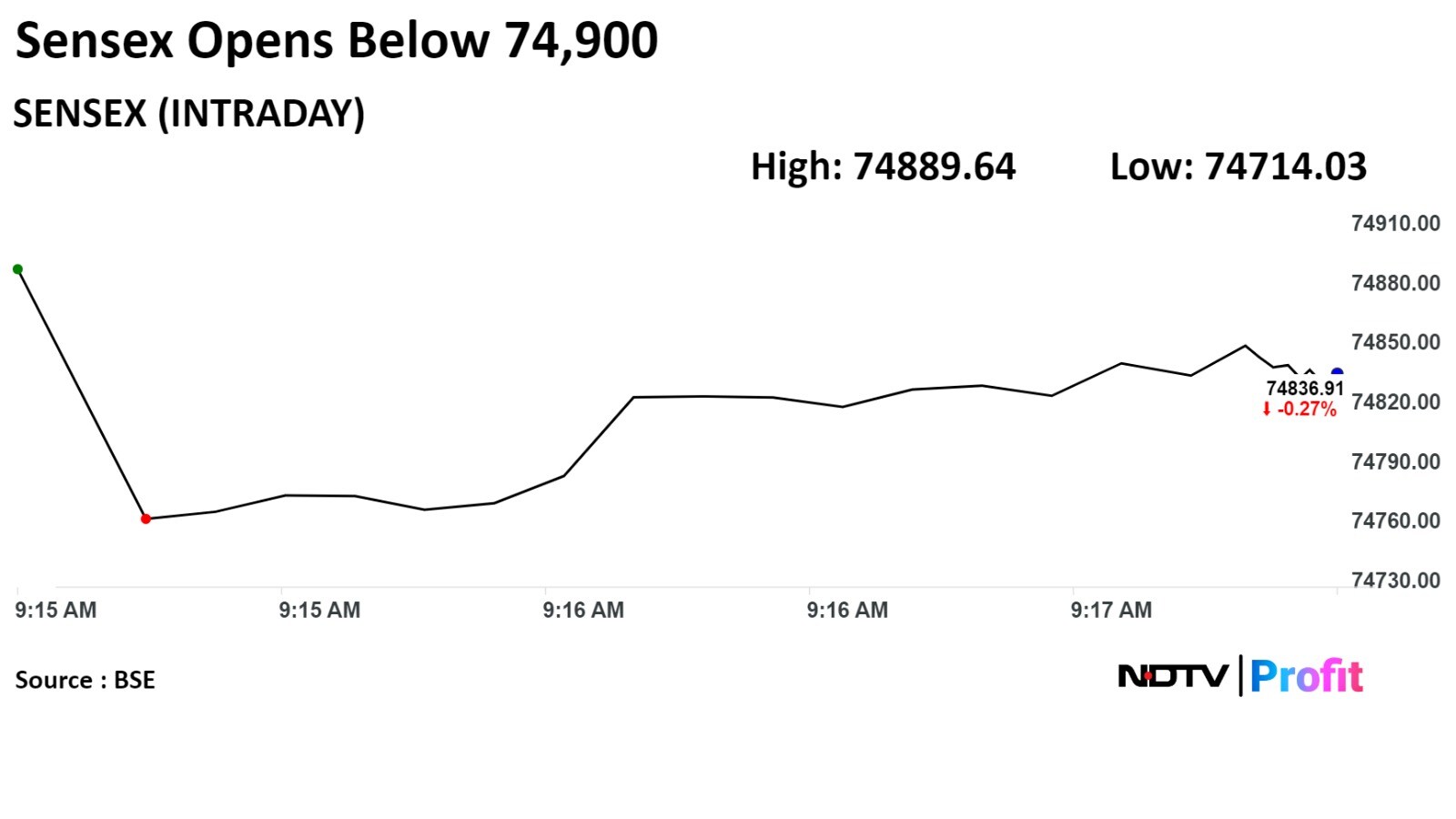

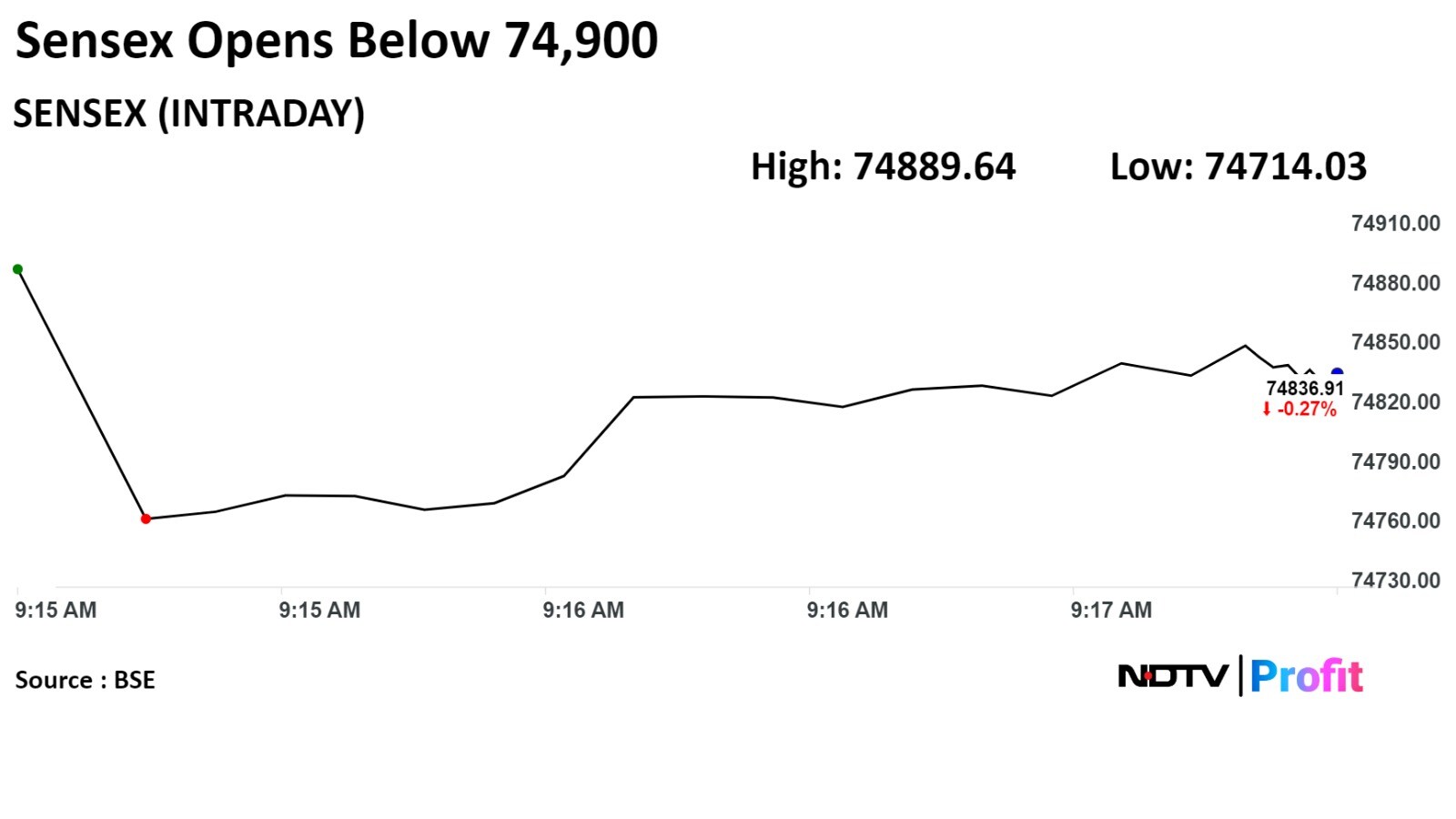

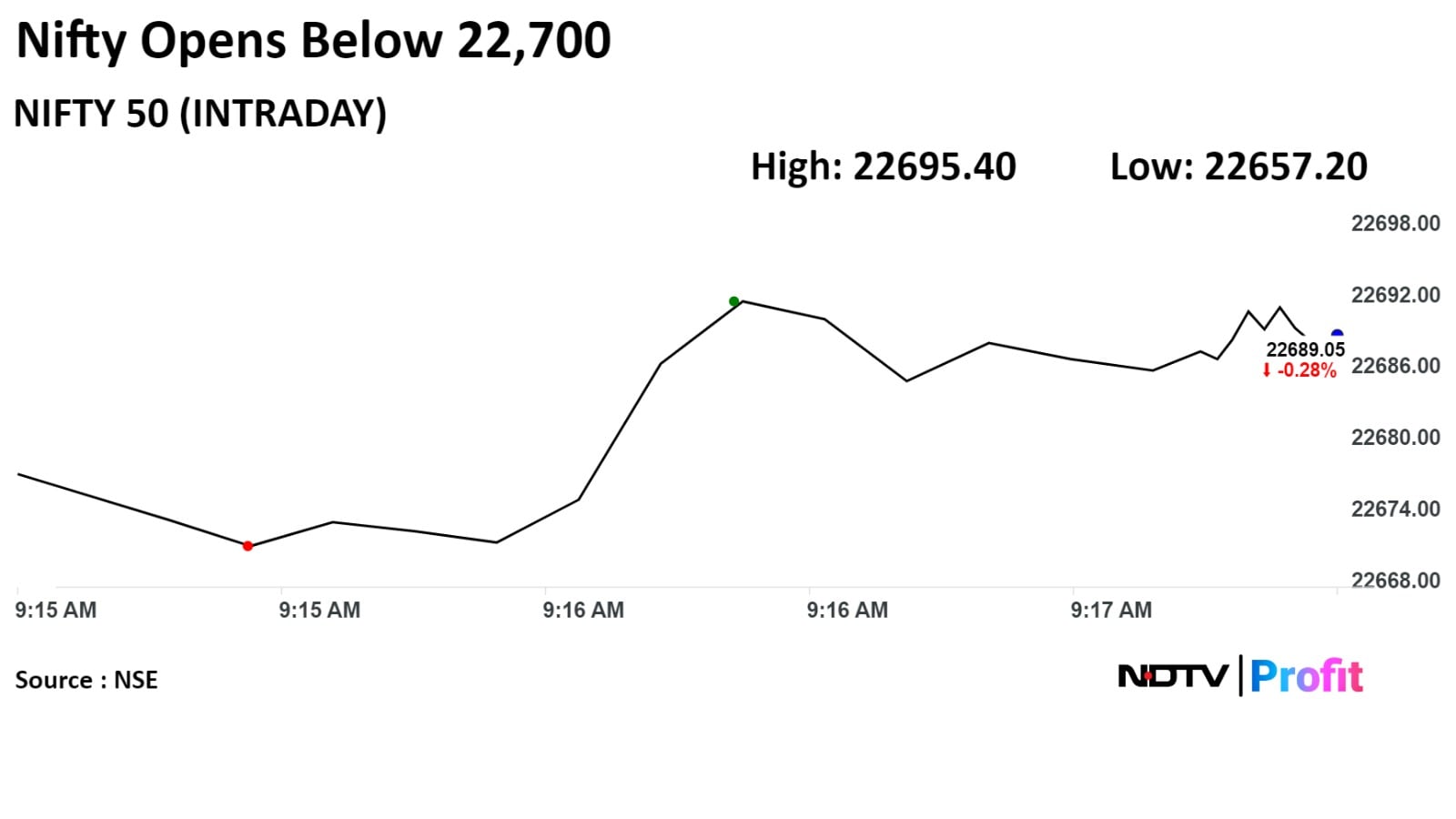

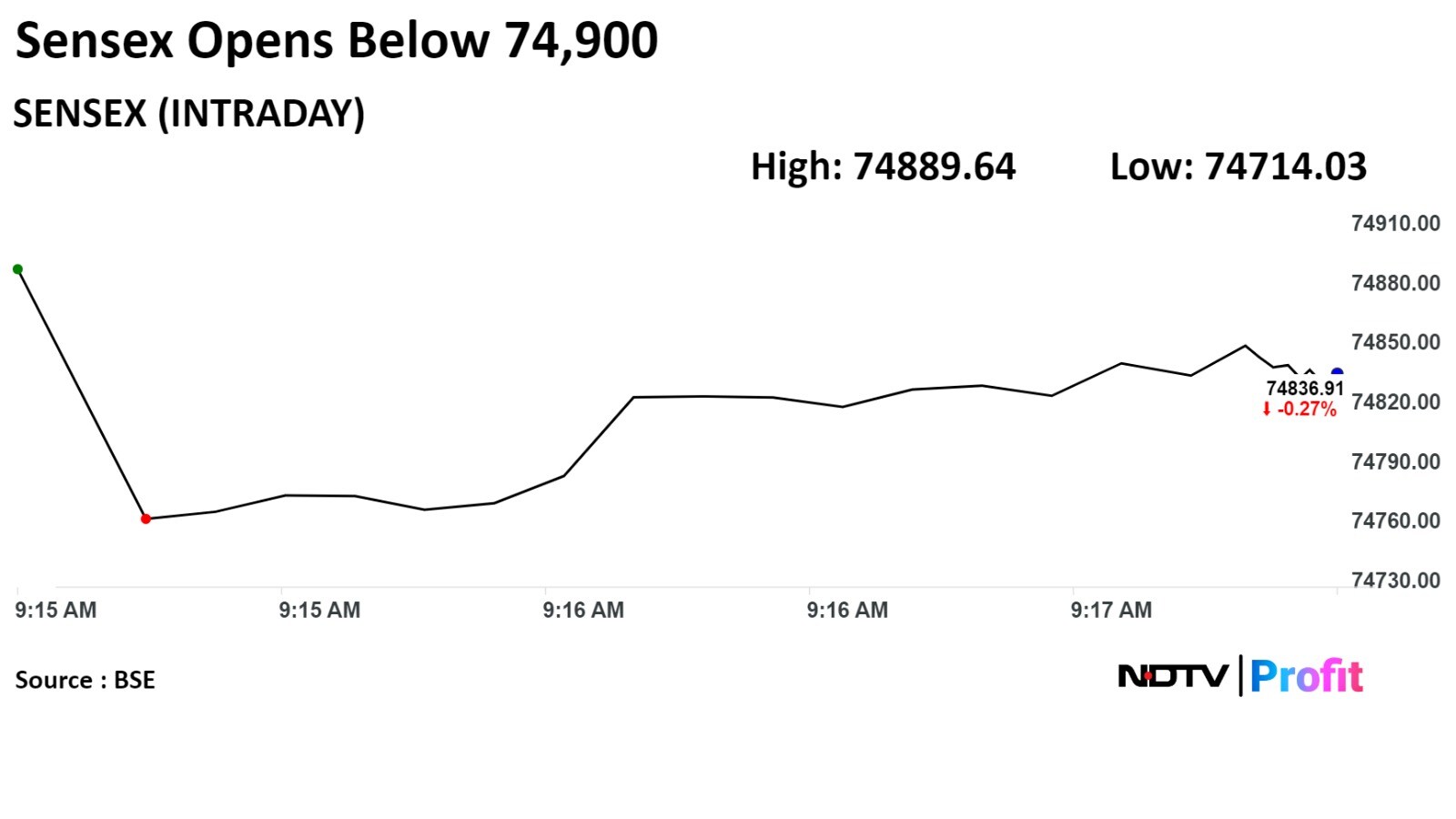

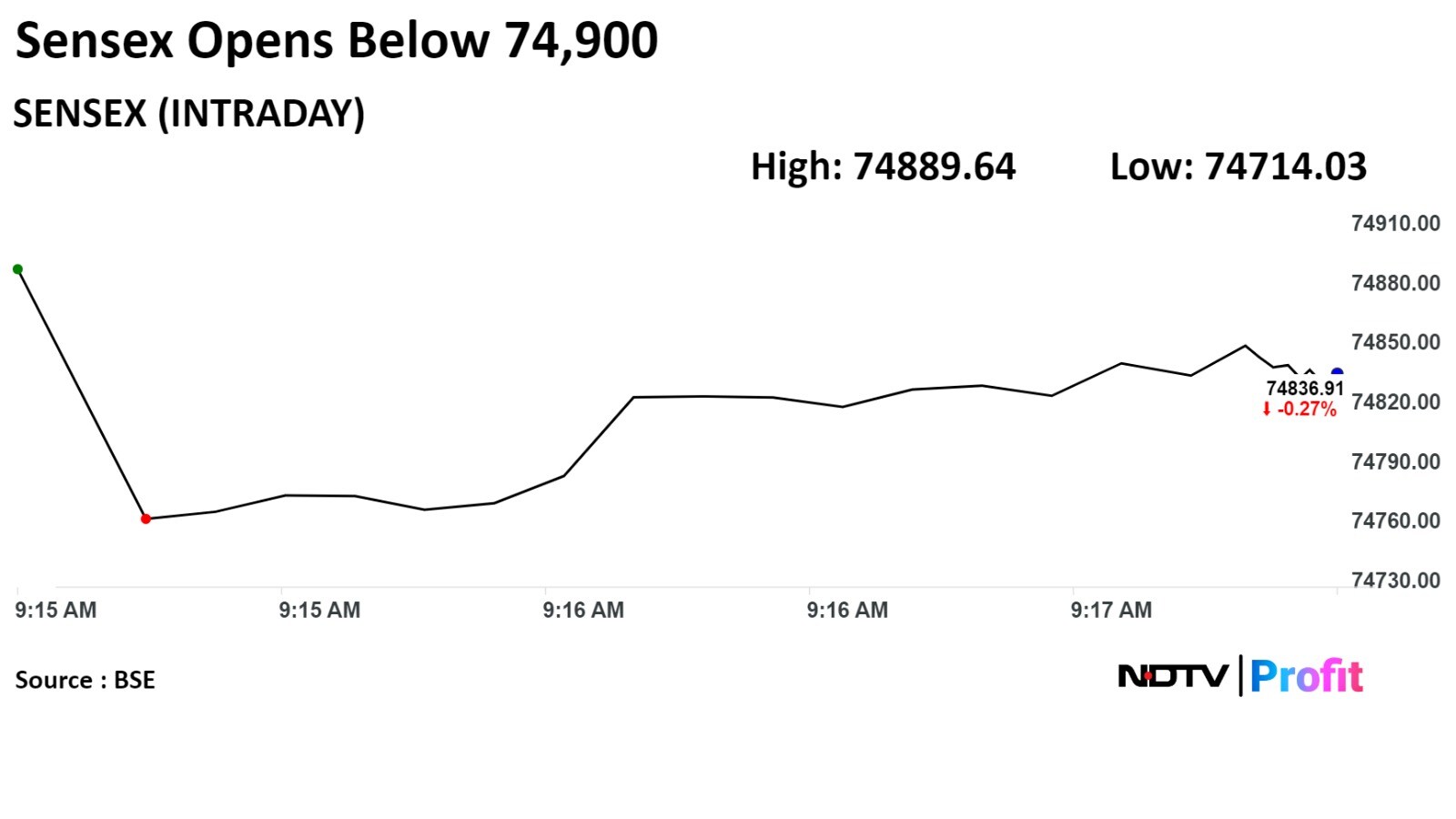

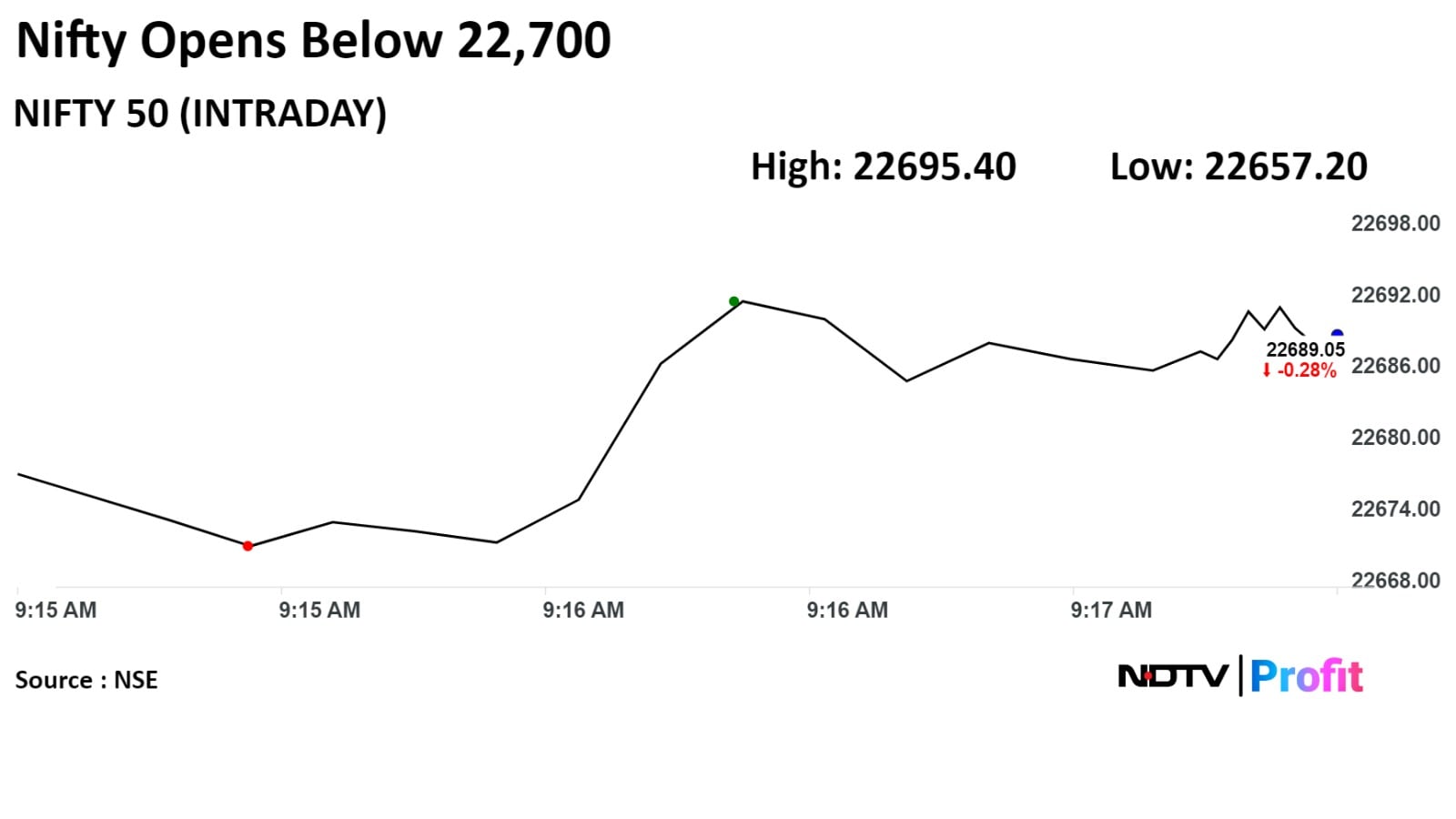

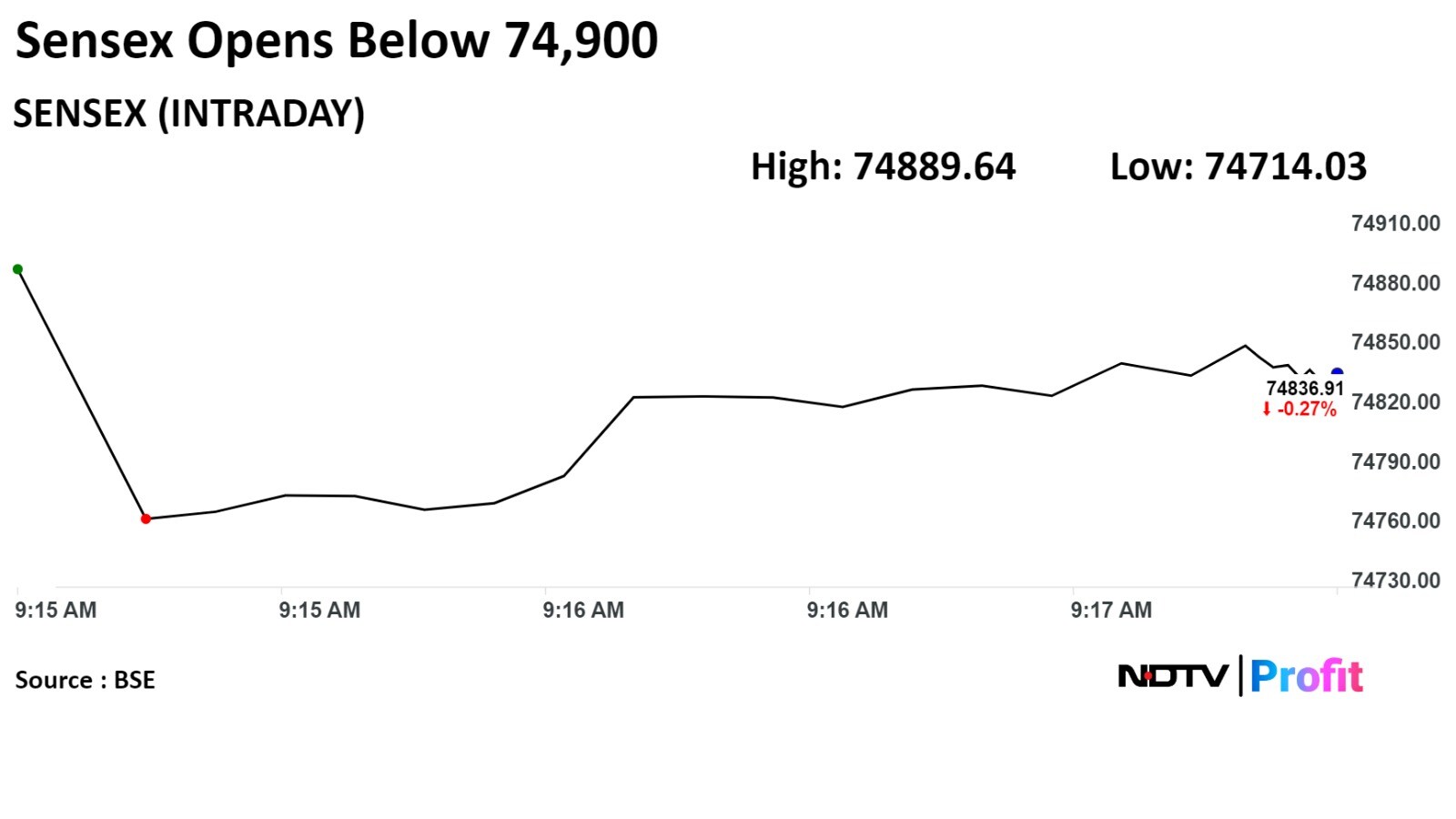

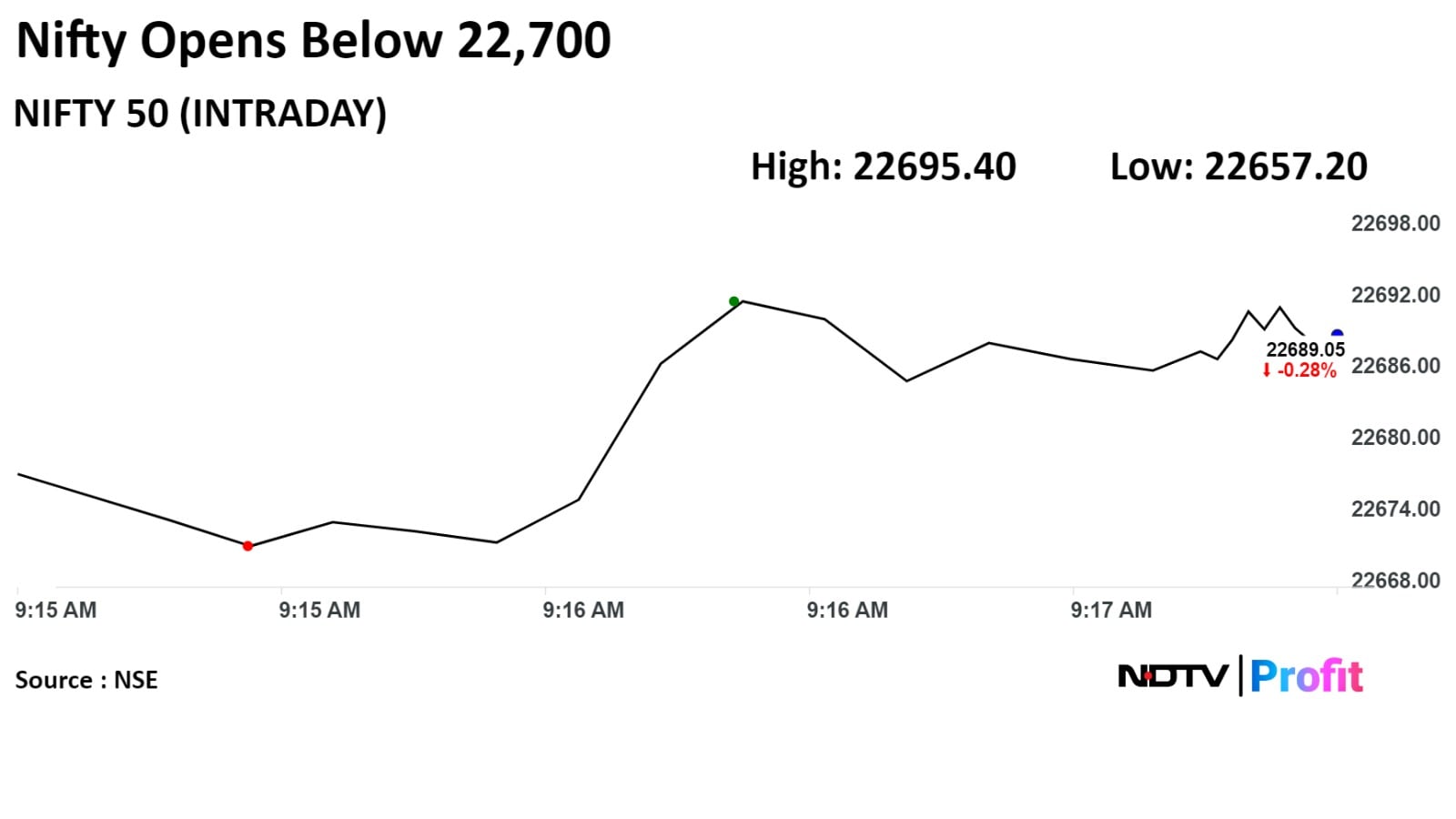

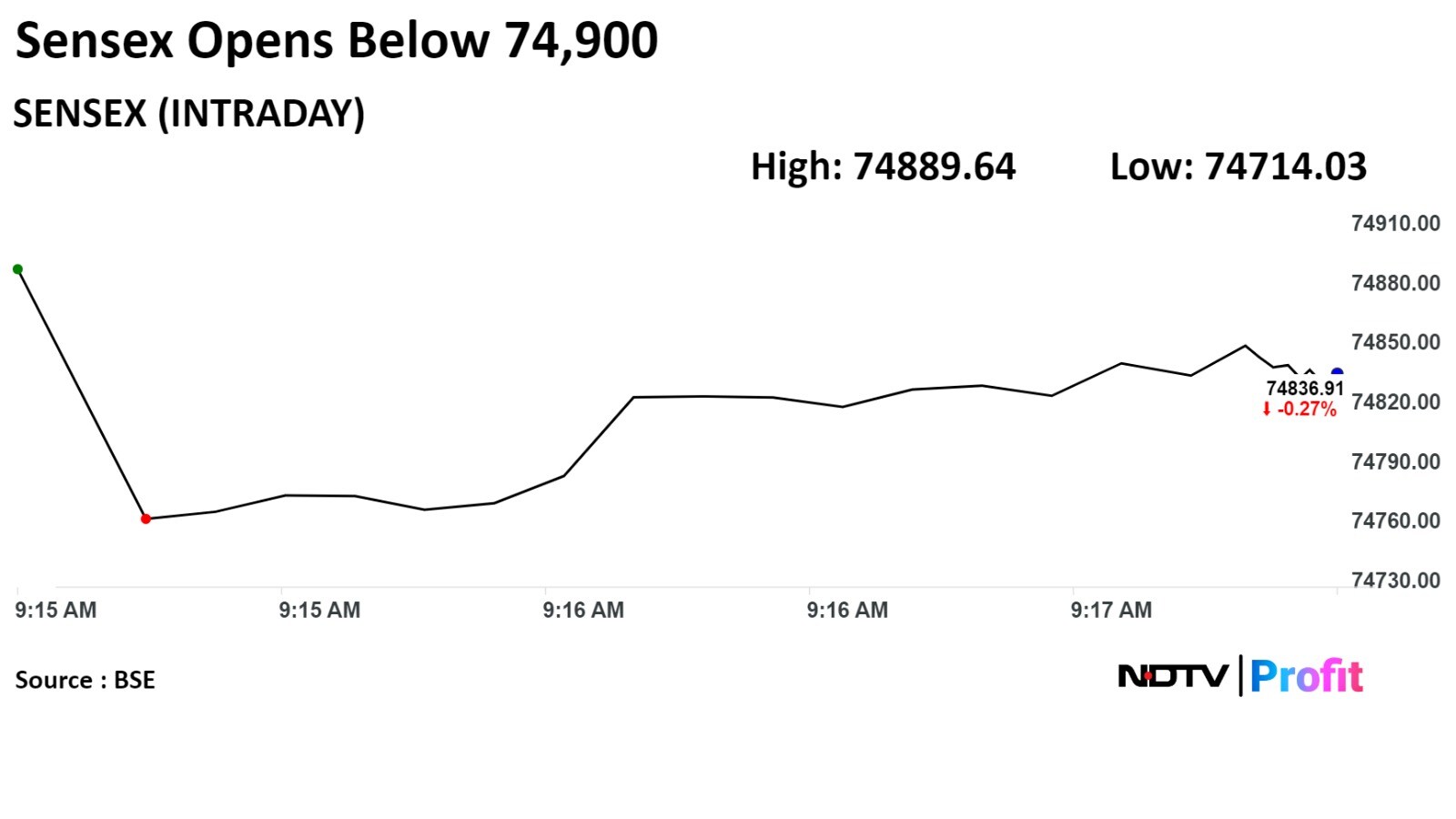

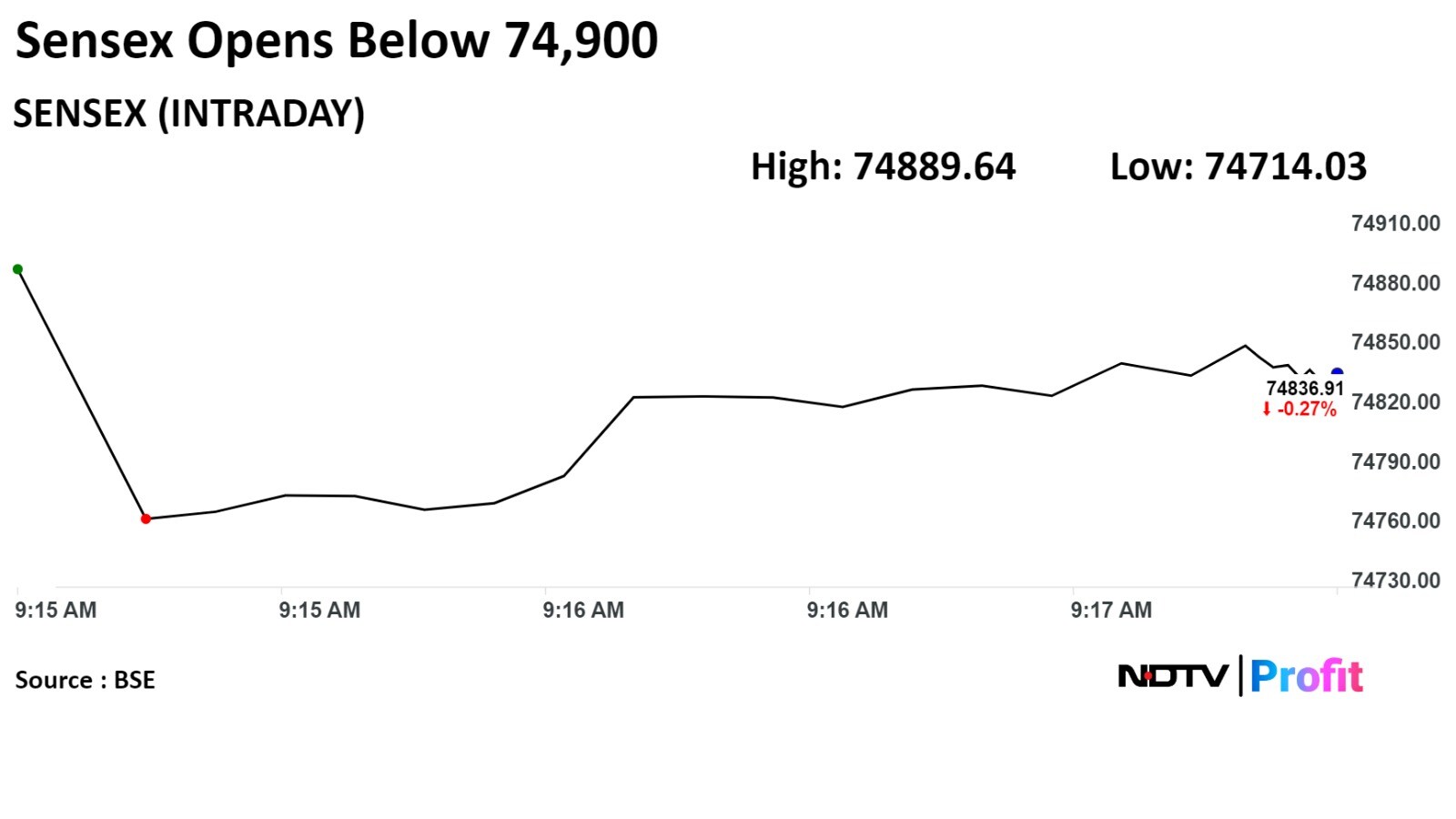

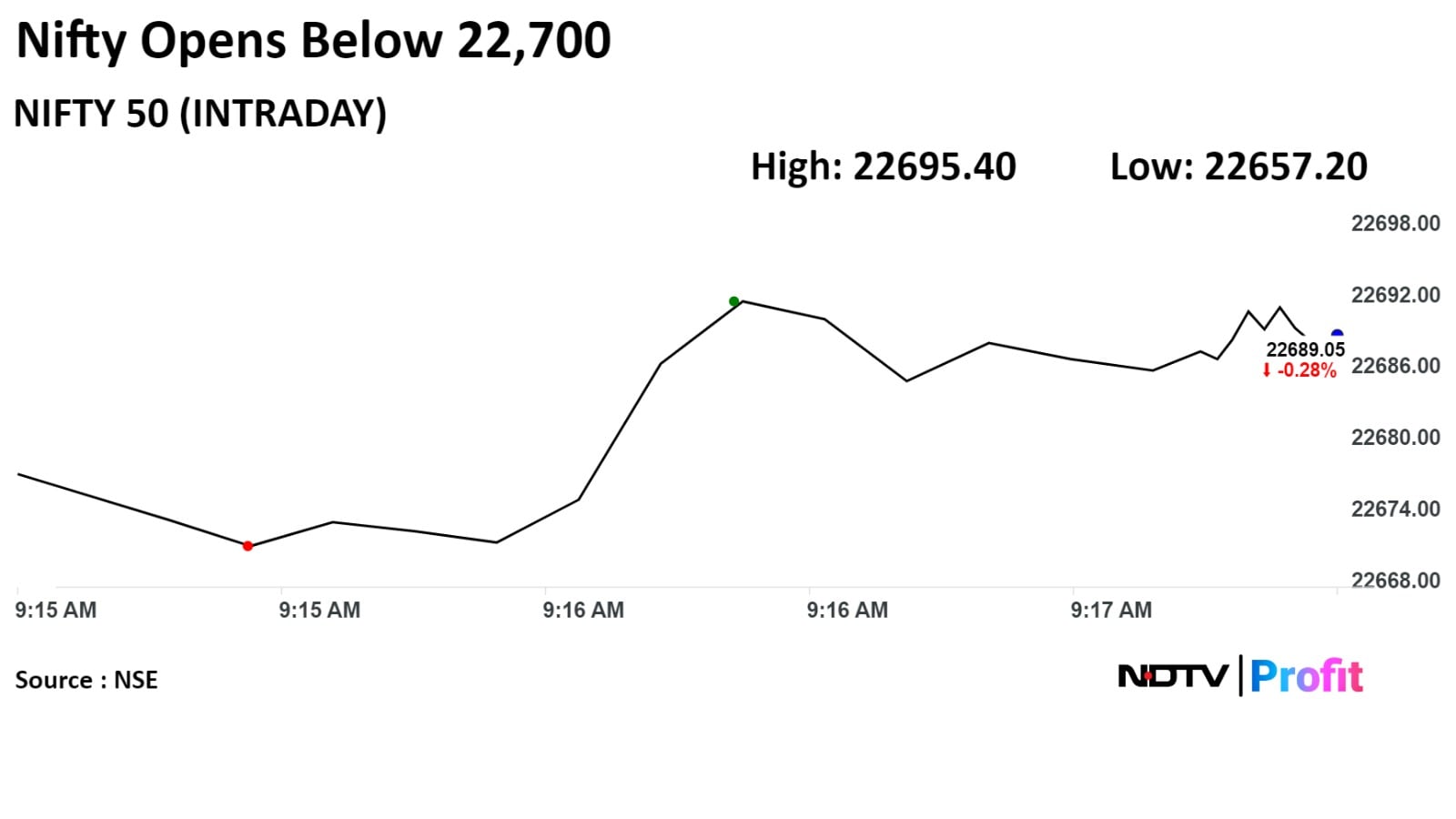

The NSE Nifty 50 closed 234.40 points, or 1.03%, lower at 22,519.40, and the BSE S&P Sensex declined 793.25 points, or 1.06%, to end at 74,244.90.

The yield on the 10-year bond closed 7 bps higher at 7.18%.

Source: Bloomberg

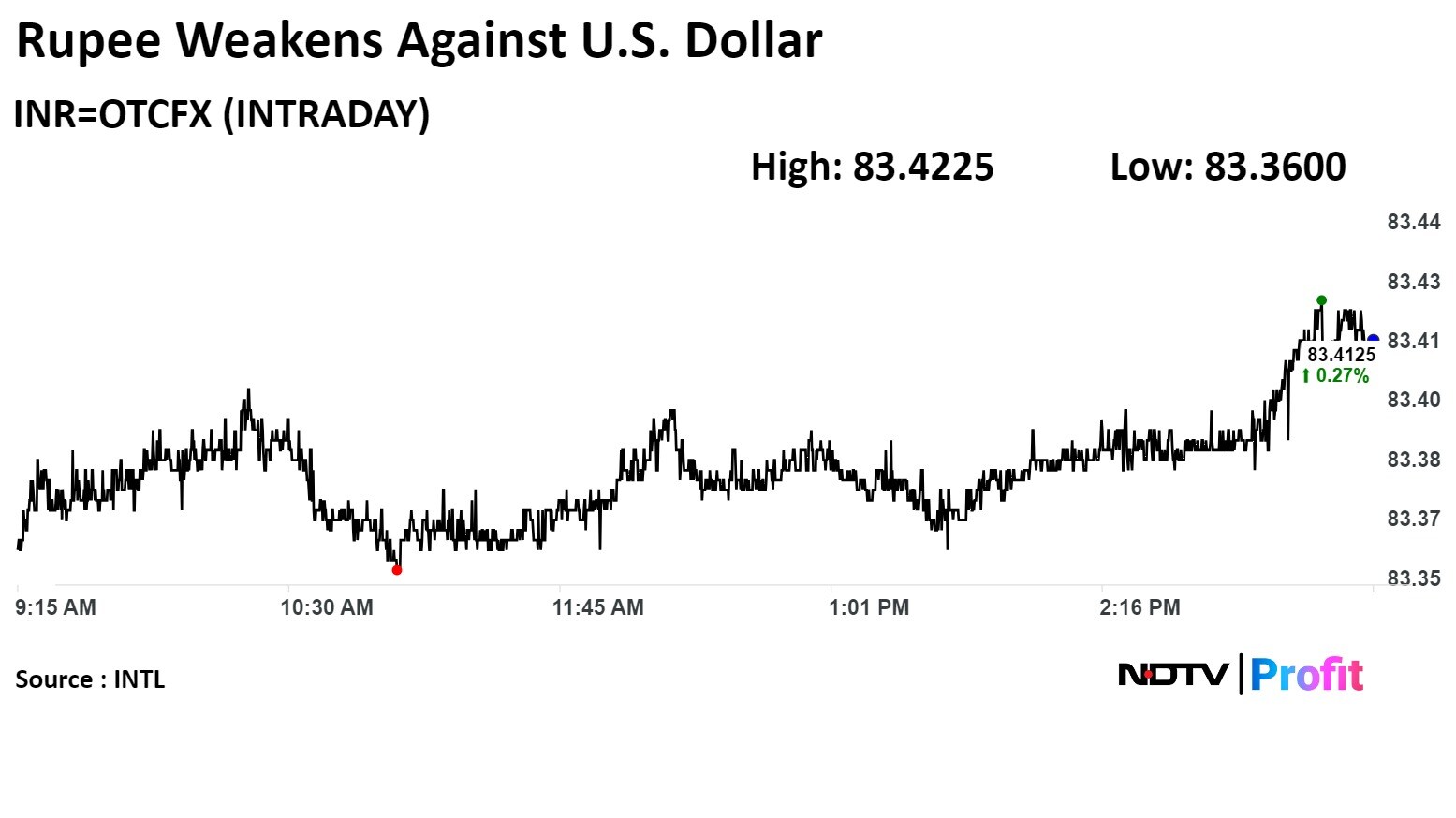

The local currency weakened by 23 paise to close at 83.42 against the U.S dollar.

It closed at 83.19 on Wednesday.

Source: Bloomberg

The local currency weakened by 23 paise to close at 83.42 against the U.S dollar.

It closed at 83.19 on Wednesday.

Source: Bloomberg

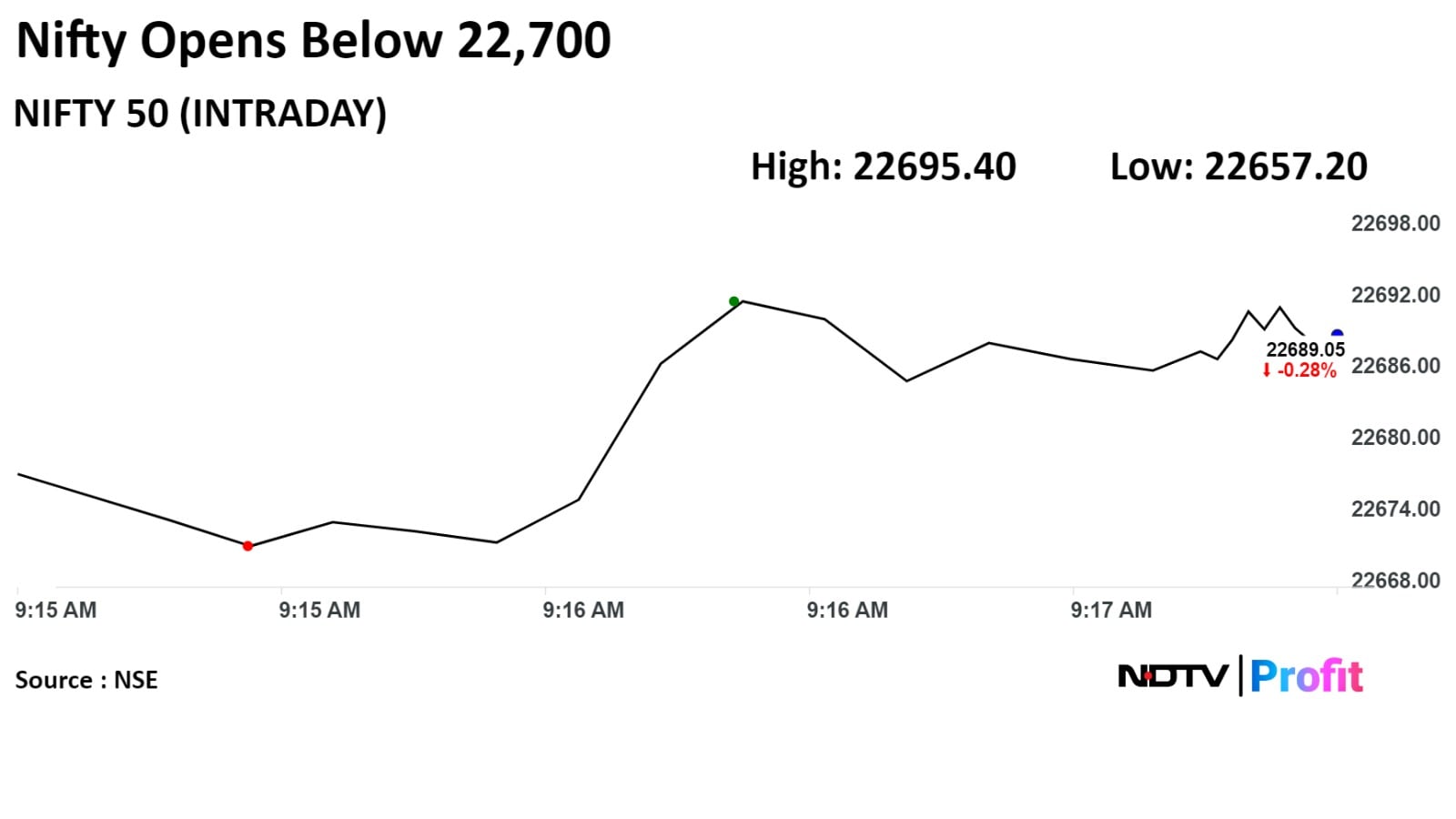

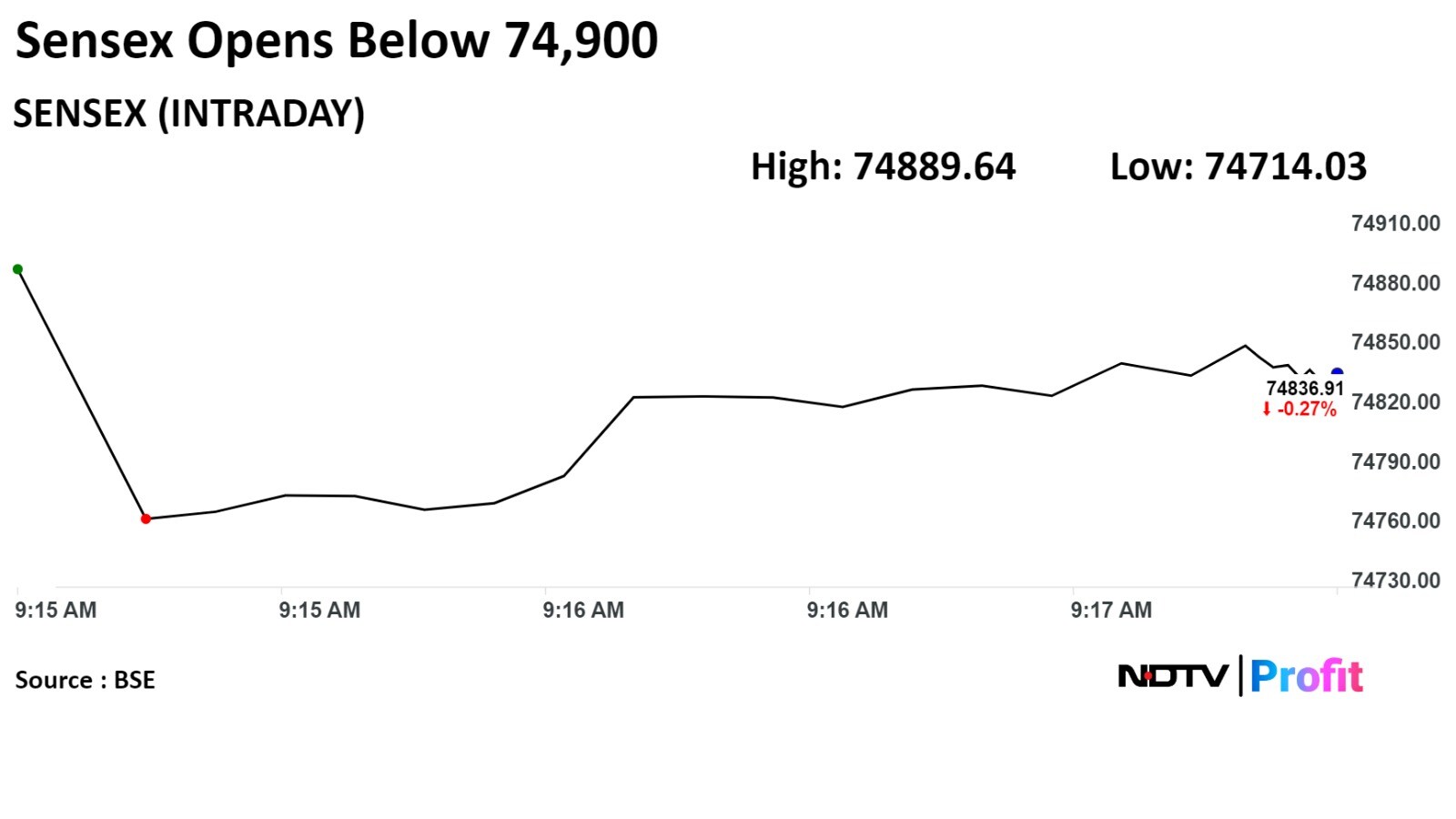

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

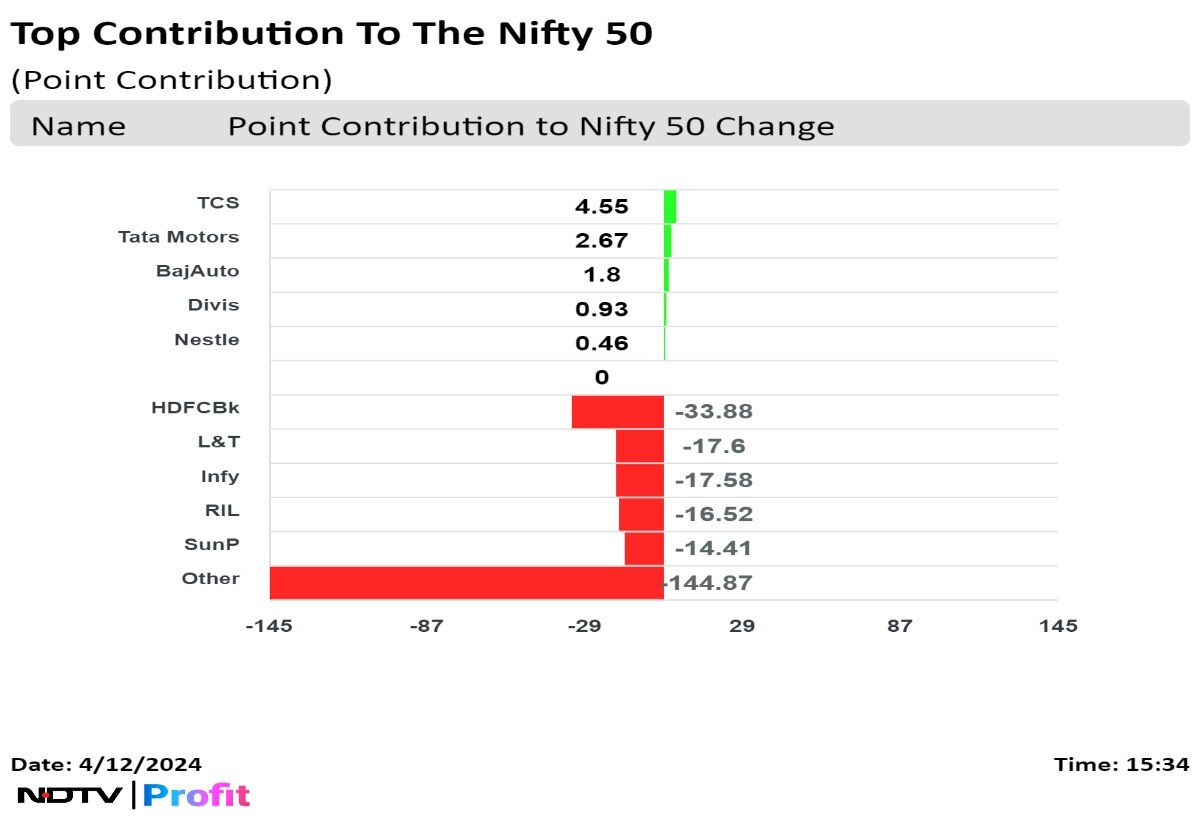

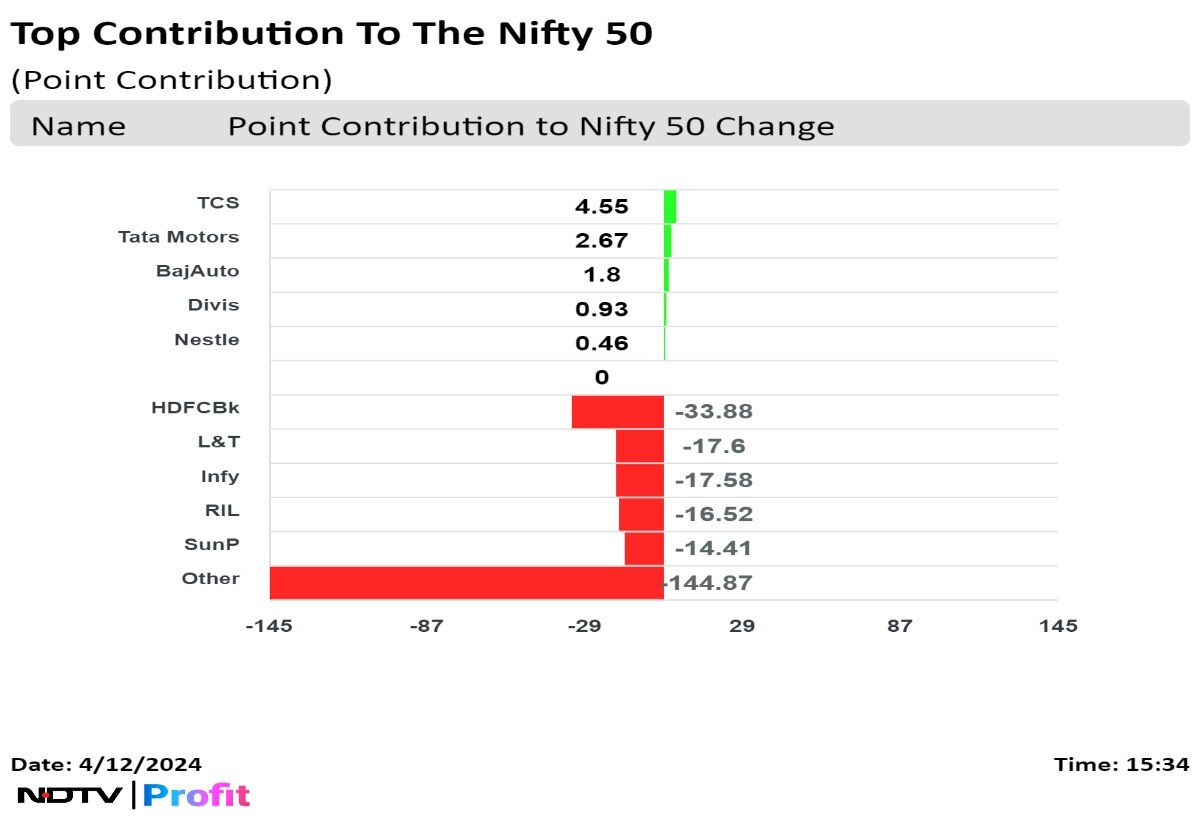

The benchmark indices ended the week flat. The NSE Nifty 50 declined 0.03%, and the S&P BSE Sensex settled flat.

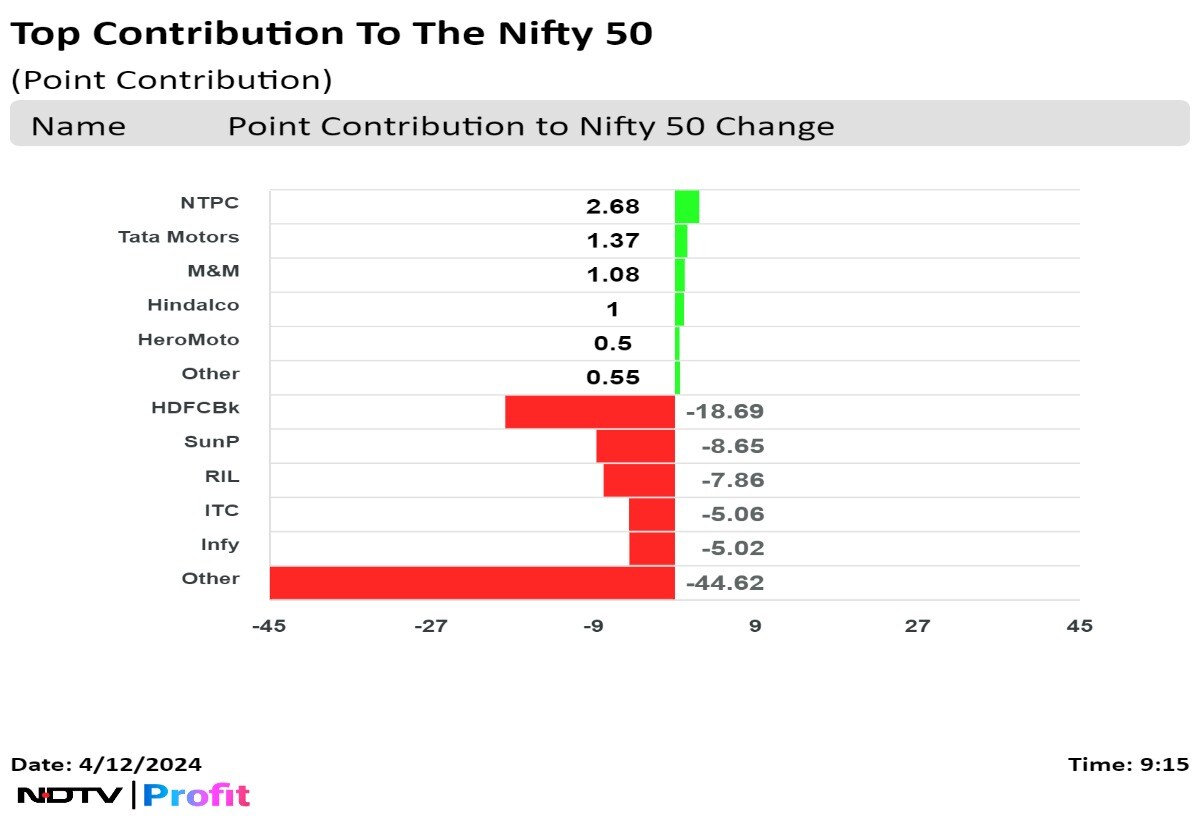

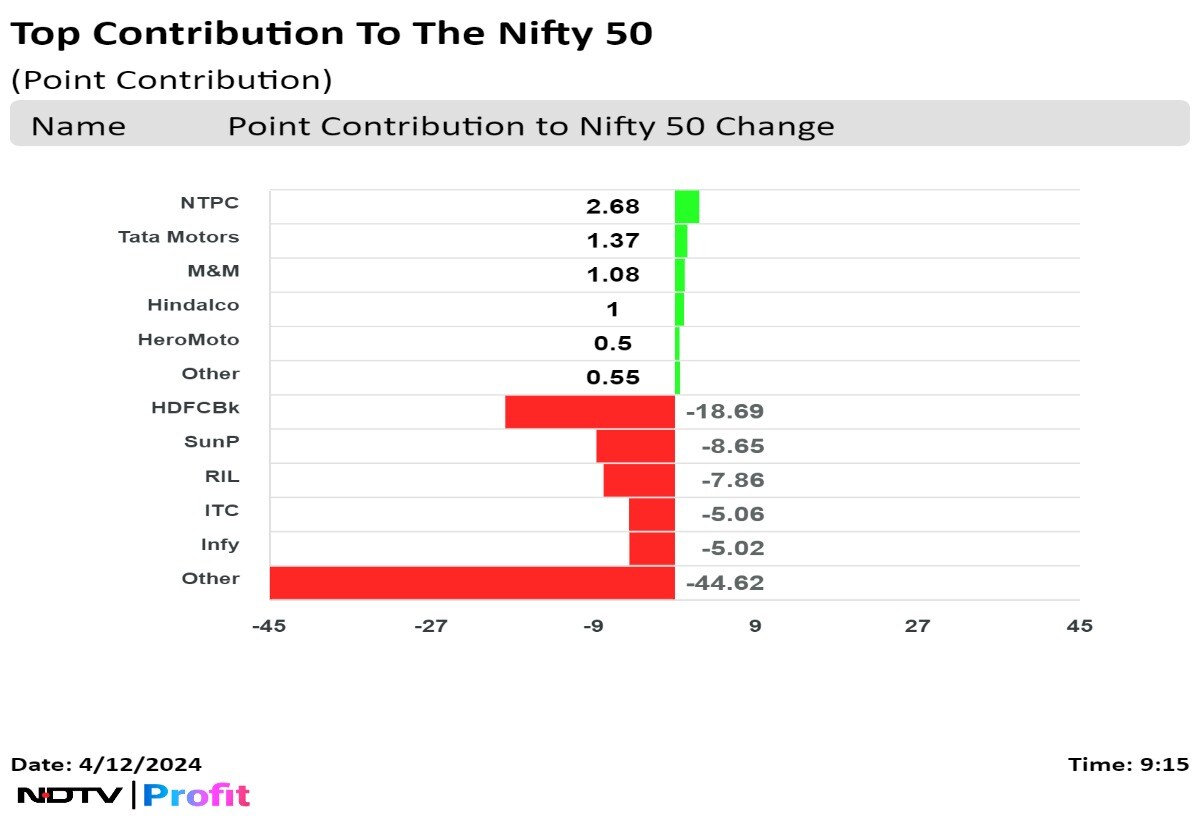

HDFC Bank Ltd., Larsen & Toubro Ltd., Infosys Ltd., Reliance Industries Ltd., and Sun Pharmaceutical Industries Ltd. weighed on the benchmark index.

Tata Consultancy Services Ltd., Tata Motors Ltd., Bajaj Auto Ltd., Divi's Laboratories Ltd., and Nestle India Ltd. limited losses in the benchmark index.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

The benchmark indices ended the week flat. The NSE Nifty 50 declined 0.03%, and the S&P BSE Sensex settled flat.

HDFC Bank Ltd., Larsen & Toubro Ltd., Infosys Ltd., Reliance Industries Ltd., and Sun Pharmaceutical Industries Ltd. weighed on the benchmark index.

Tata Consultancy Services Ltd., Tata Motors Ltd., Bajaj Auto Ltd., Divi's Laboratories Ltd., and Nestle India Ltd. limited losses in the benchmark index.

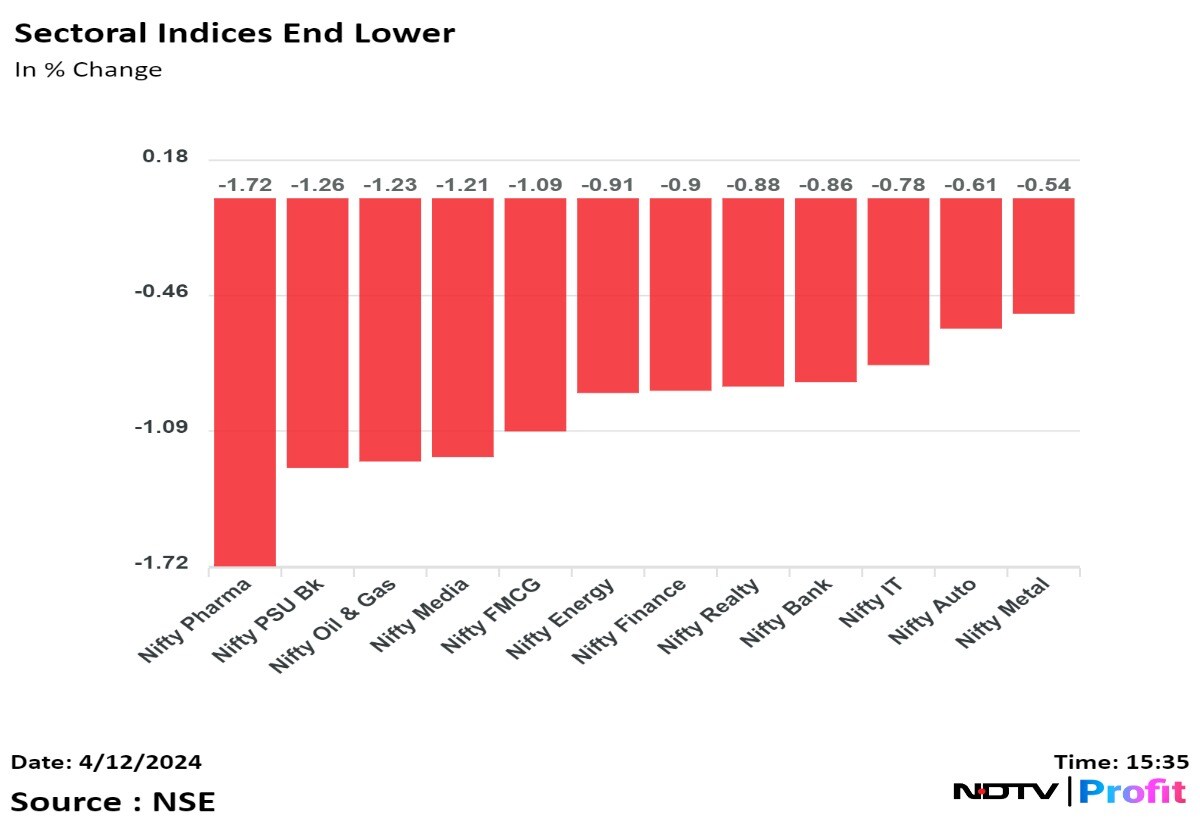

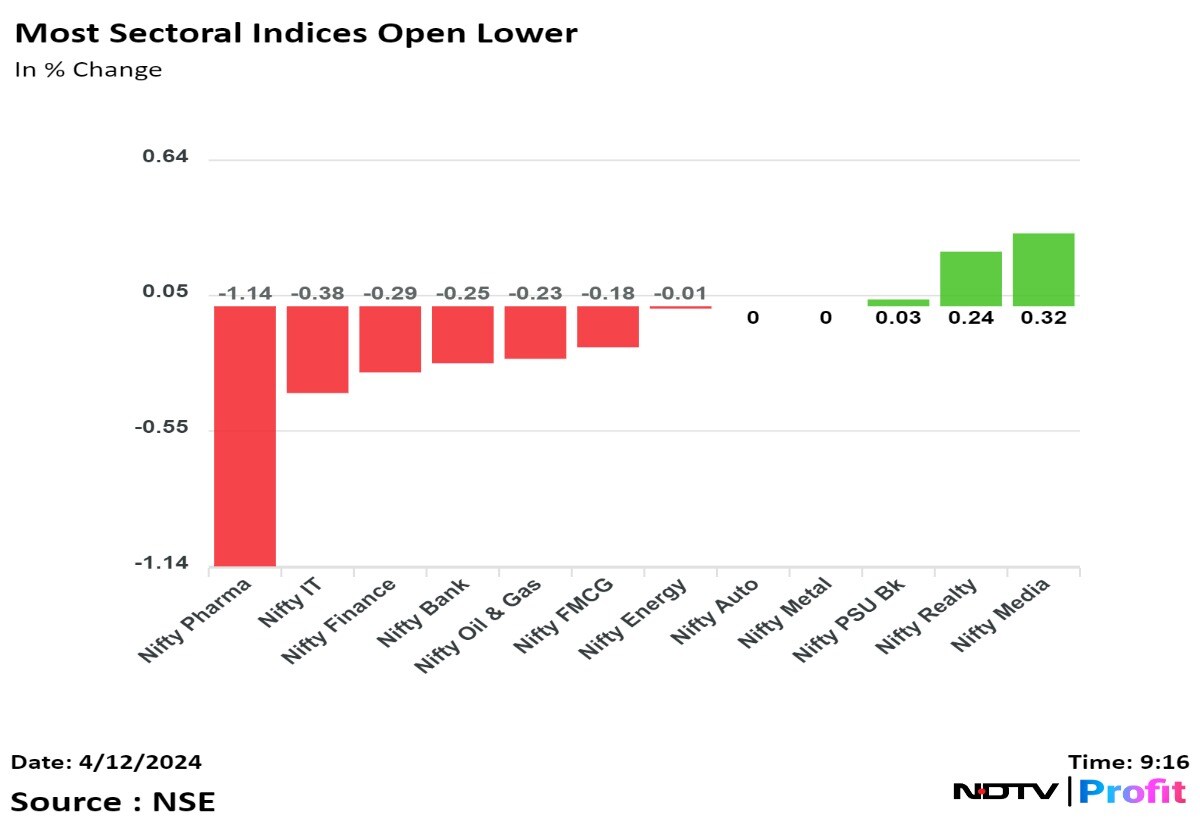

All 12 sectors ended in negative on NSE. The NSE Nifty Pharma index fell the most among peer indices tracking sharp losses in Sun Pharmaceutical Industries Ltd. The NSE Nifty Metal was the best performing sector.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

The benchmark indices ended the week flat. The NSE Nifty 50 declined 0.03%, and the S&P BSE Sensex settled flat.

HDFC Bank Ltd., Larsen & Toubro Ltd., Infosys Ltd., Reliance Industries Ltd., and Sun Pharmaceutical Industries Ltd. weighed on the benchmark index.

Tata Consultancy Services Ltd., Tata Motors Ltd., Bajaj Auto Ltd., Divi's Laboratories Ltd., and Nestle India Ltd. limited losses in the benchmark index.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

India's benchmark indices ended sharply lower on profit booking and as heavy-weight HDFC Bank Ltd., Larsen & Toubro Ltd. dragged.

The Nifty closed at 22,519.40, down 234.40 points or 1.03% while the Sensex ended 793.25 points or 1.06% lower at 74,244.90.

In terms of the week, the benchmark indices snapped three-week winning streak to end the week flat.

Intraday, the NSE Nifty 50 fell 1.06% to 22,512.70, the S&P BSE Sensex declined 1.10% to 74,213.76.

"Nifty slipped lower as it experienced a consolidation breakdown in the lower timeframe. The sentiment appears somewhat negative for the short term. However, there is observed support at 22500 on a closing basis. As long as it maintains above 22500 on a closing basis, we do not anticipate a significant correction in the market. Sustained trading above 22500 could potentially push the index towards 22650-22700 once more. Conversely, a drop below 22500 might initiate a correction of 200-250 points on the downside," said Rupak De, senior technical analyst, LKP Securities.

The benchmark indices ended the week flat. The NSE Nifty 50 declined 0.03%, and the S&P BSE Sensex settled flat.

HDFC Bank Ltd., Larsen & Toubro Ltd., Infosys Ltd., Reliance Industries Ltd., and Sun Pharmaceutical Industries Ltd. weighed on the benchmark index.

Tata Consultancy Services Ltd., Tata Motors Ltd., Bajaj Auto Ltd., Divi's Laboratories Ltd., and Nestle India Ltd. limited losses in the benchmark index.

All 12 sectors ended in negative on NSE. The NSE Nifty Pharma index fell the most among peer indices tracking sharp losses in Sun Pharmaceutical Industries Ltd. The NSE Nifty Metal was the best performing sector.

Broader markets ended lower on BSE. The S&P BSE Midcap index ended 0.49%, and the S&P BSE Smallcap index settled 0.60%.

On BSE, all 20 sectors ended lower. The S&P BSE Consumer Durables fell over 1% to become the top loser, and the S&P BSE was the best performing sector.

Market breadth was skewed in the favour of sellers. Around 2,365 stocks declined, 1,475 stocks advanced, and 103 remained unchanged on BSE.

Q4 pre-sales at Rs 743 crore, up 6%.

FY24 annual sales at Rs 2,822 crore, up 26% YoY

Kolte Patil Developers launched projects with total GDV of Rs 3,800 crore in FY24 in Pune and Bengaluru.

Source: Exchange Filing

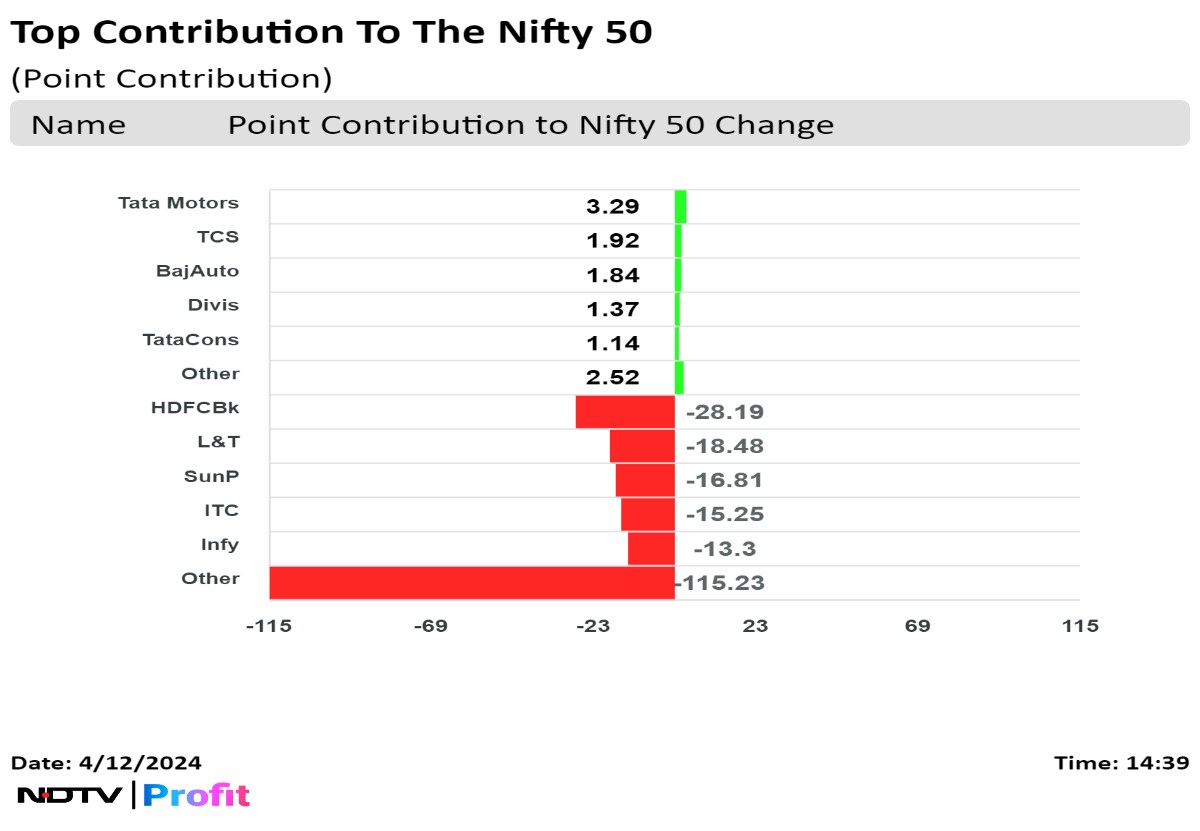

As of 2:40 p.m., HDFC Bank Ltd., Larsen & Toubro Ltd., Sun Pharmaceutical Industries Ltd., ITC Ltd., Infosys Ltd. weighed on the index.

Tata Motors Ltd., Tata Consultancy Services Ltd., Bajaj Auto Ltd., Divi's Laboratories Ltd., and Tata Consumer Products Ltd. added to the Index.

As of 2:40 p.m., HDFC Bank Ltd., Larsen & Toubro Ltd., Sun Pharmaceutical Industries Ltd., ITC Ltd., Infosys Ltd. weighed on the index.

Tata Motors Ltd., Tata Consultancy Services Ltd., Bajaj Auto Ltd., Divi's Laboratories Ltd., and Tata Consumer Products Ltd. added to the Index.

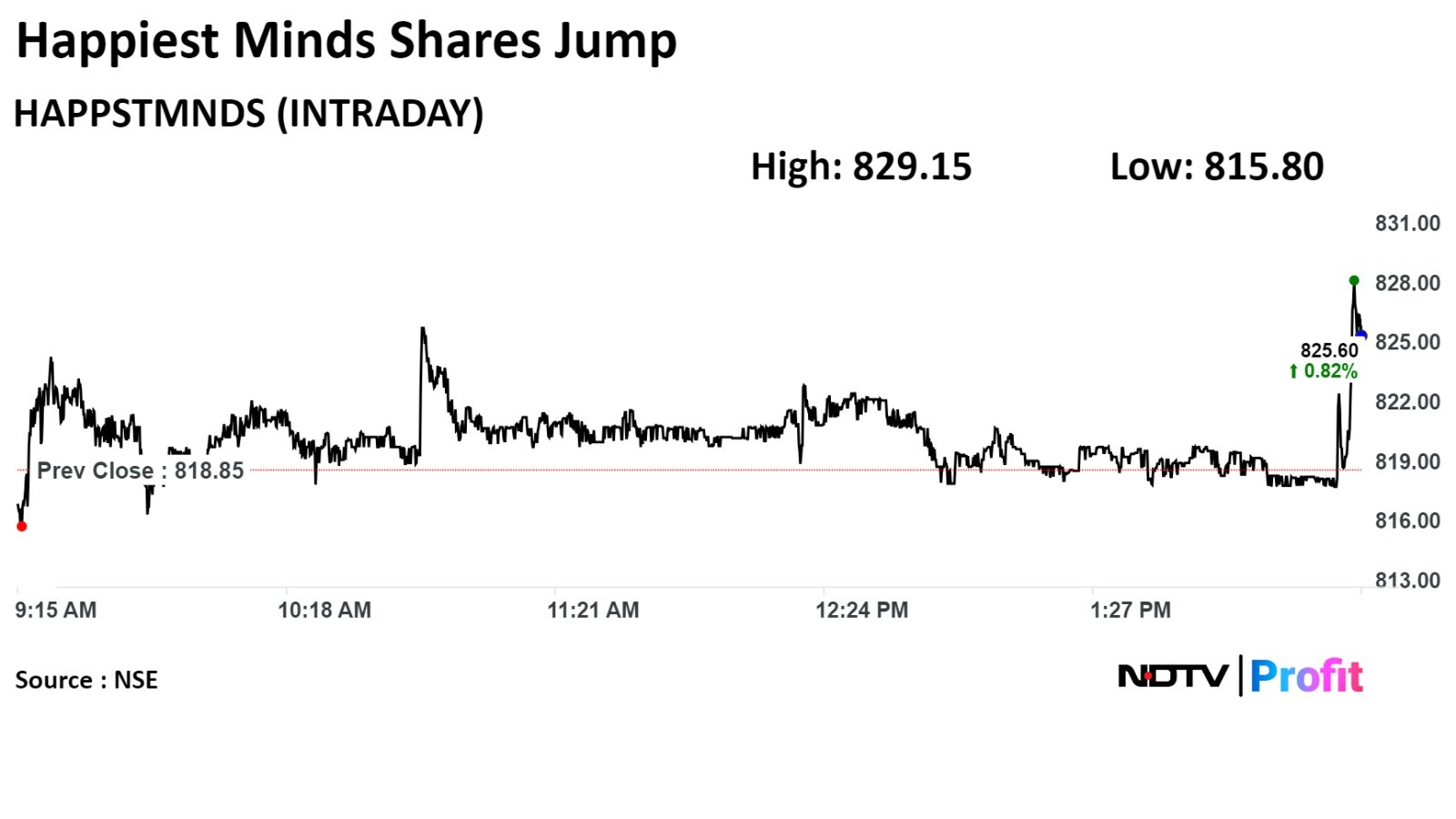

Happiest Minds Technologies Ltd. has inked a pact with ENERCON for wind energy solutions.

Source: Exchange Filing

Happiest Minds Technologies Ltd. has inked a pact with ENERCON for wind energy solutions.

Source: Exchange Filing

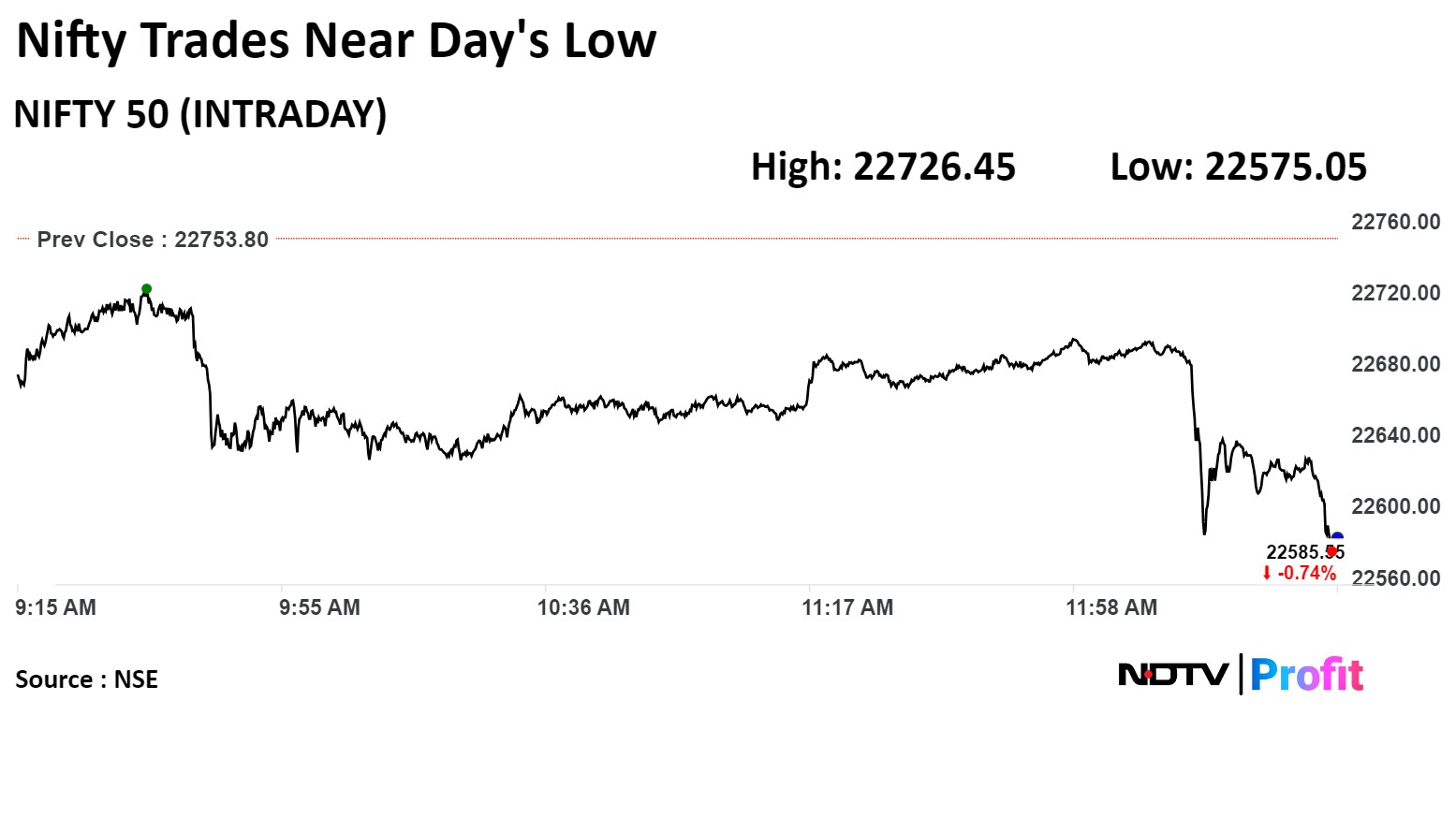

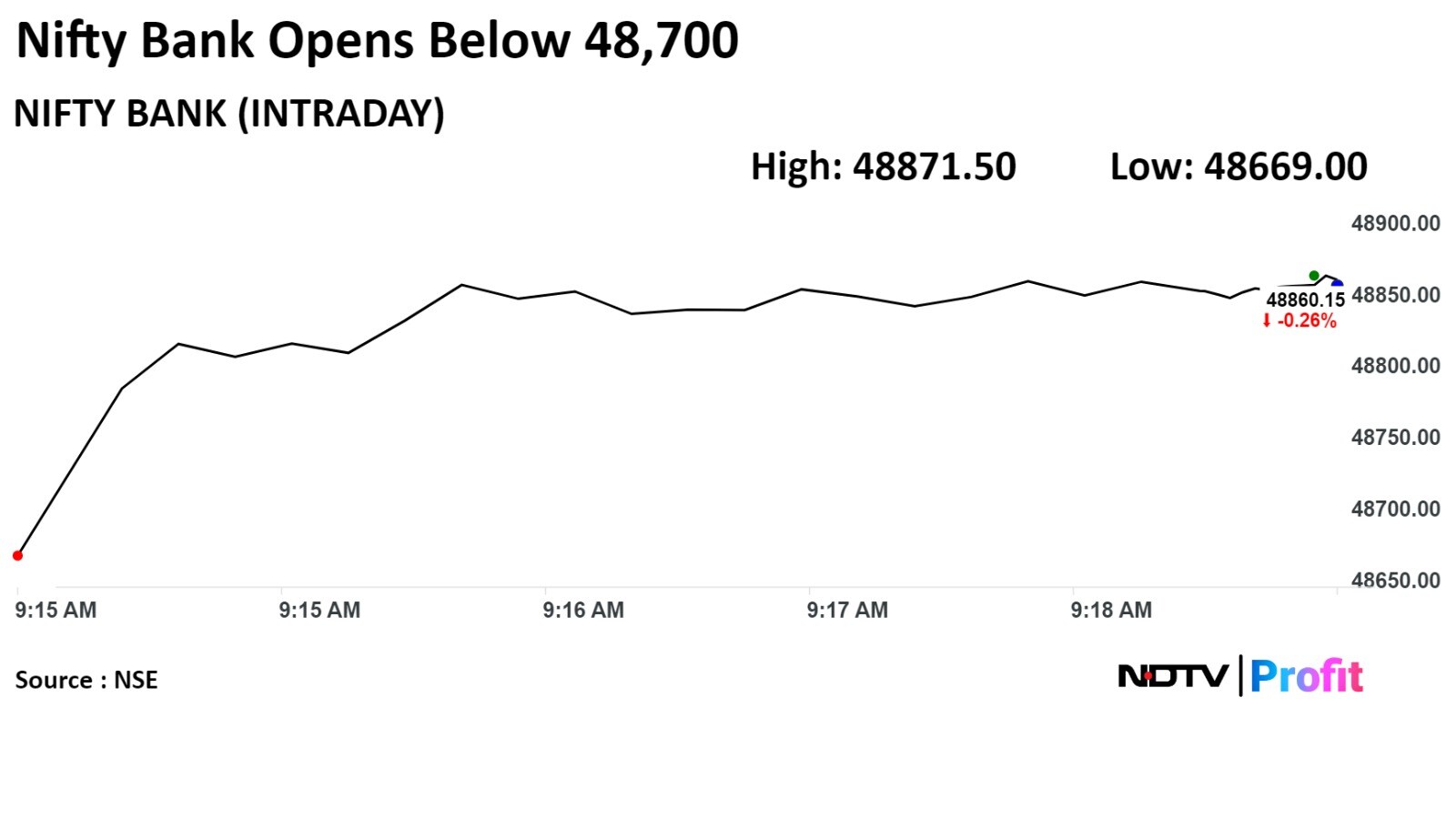

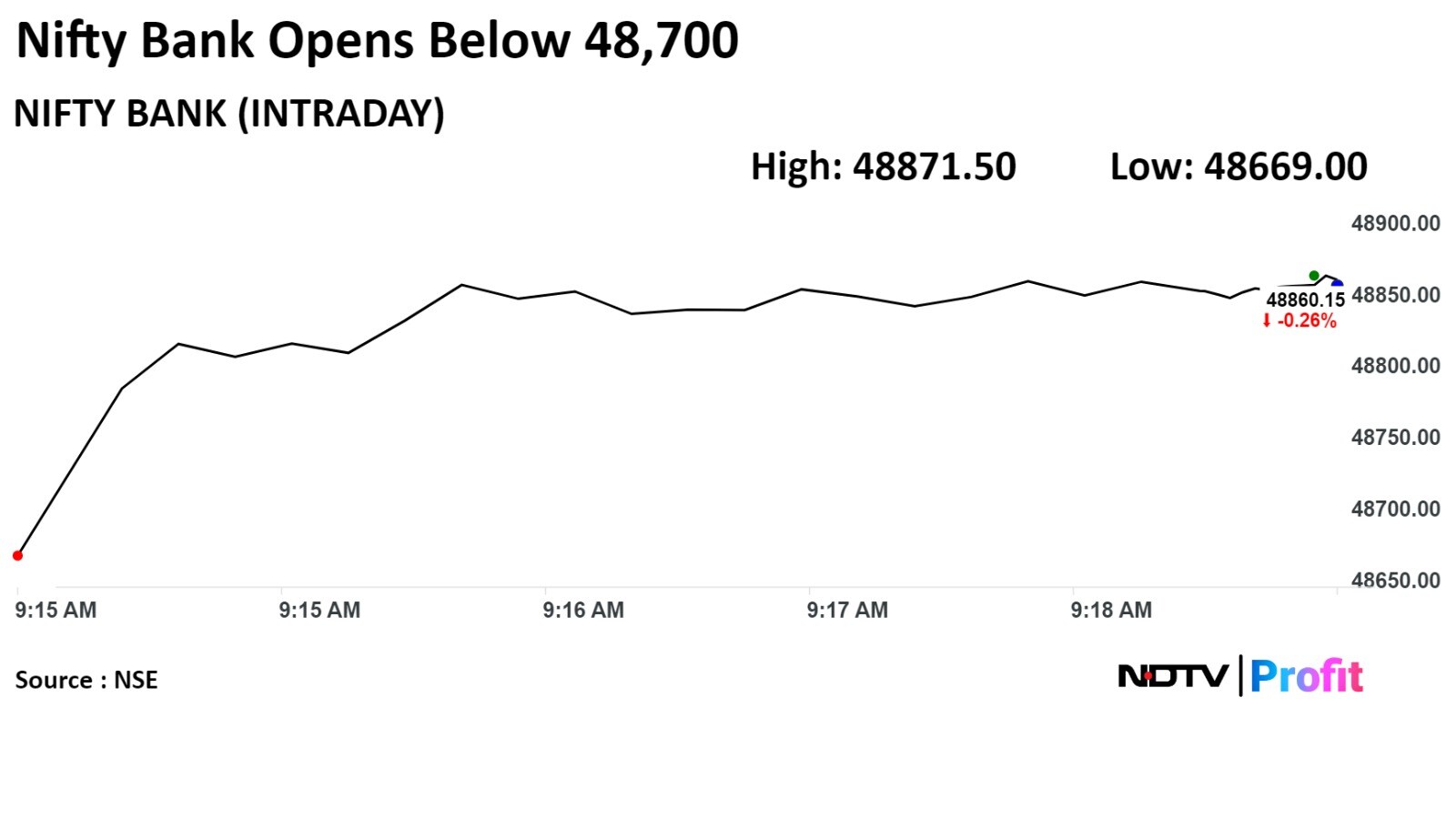

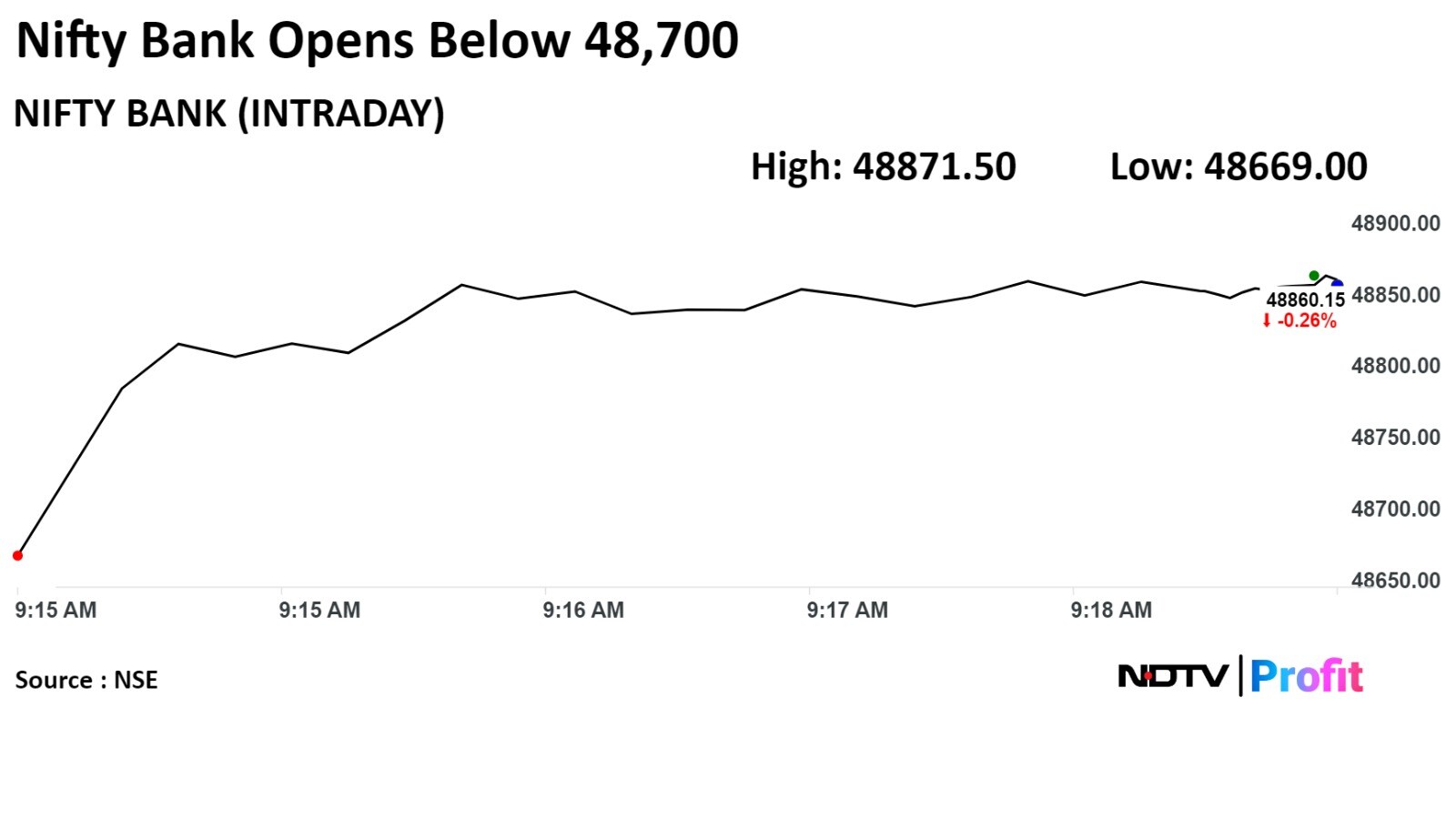

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

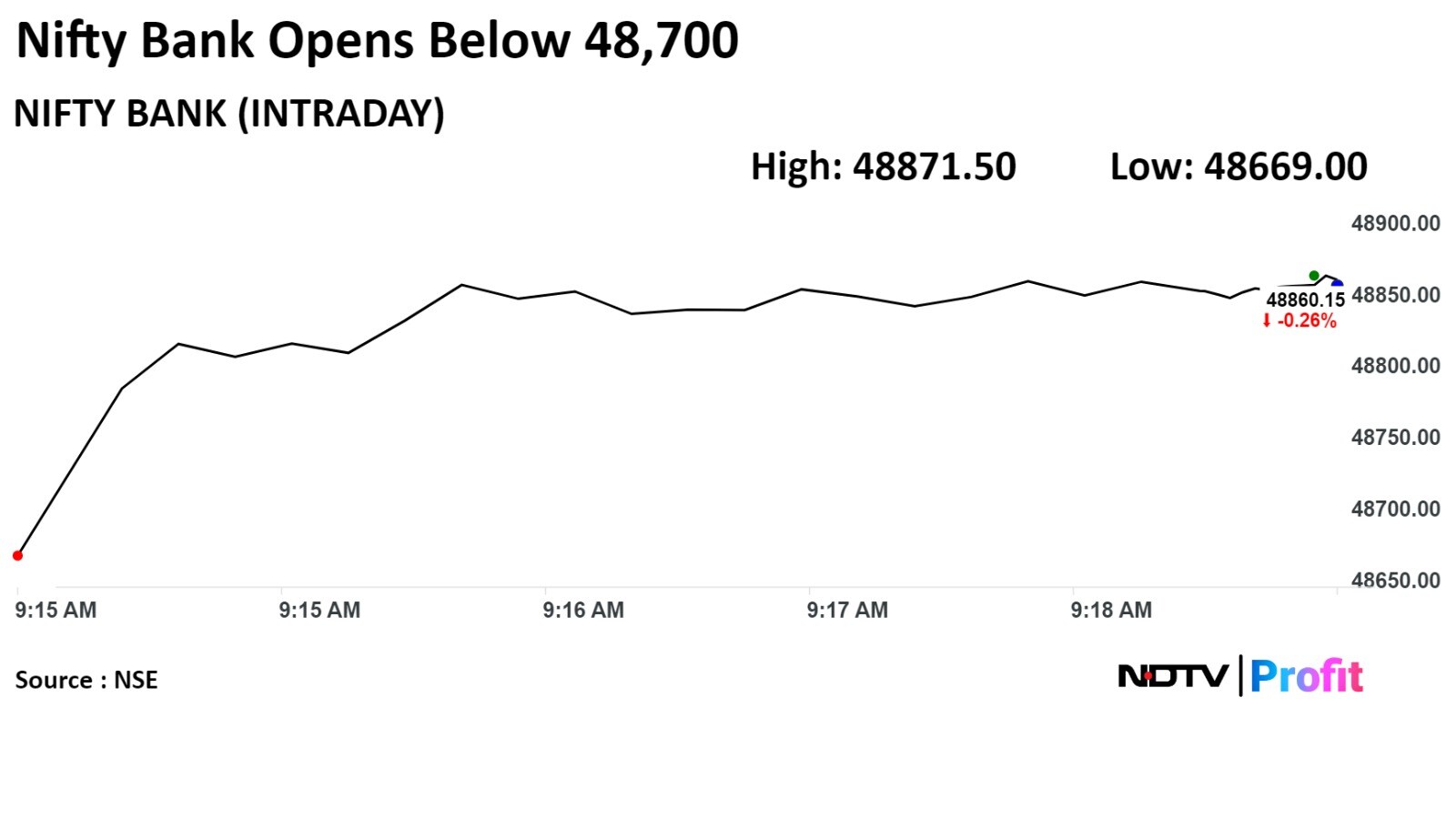

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

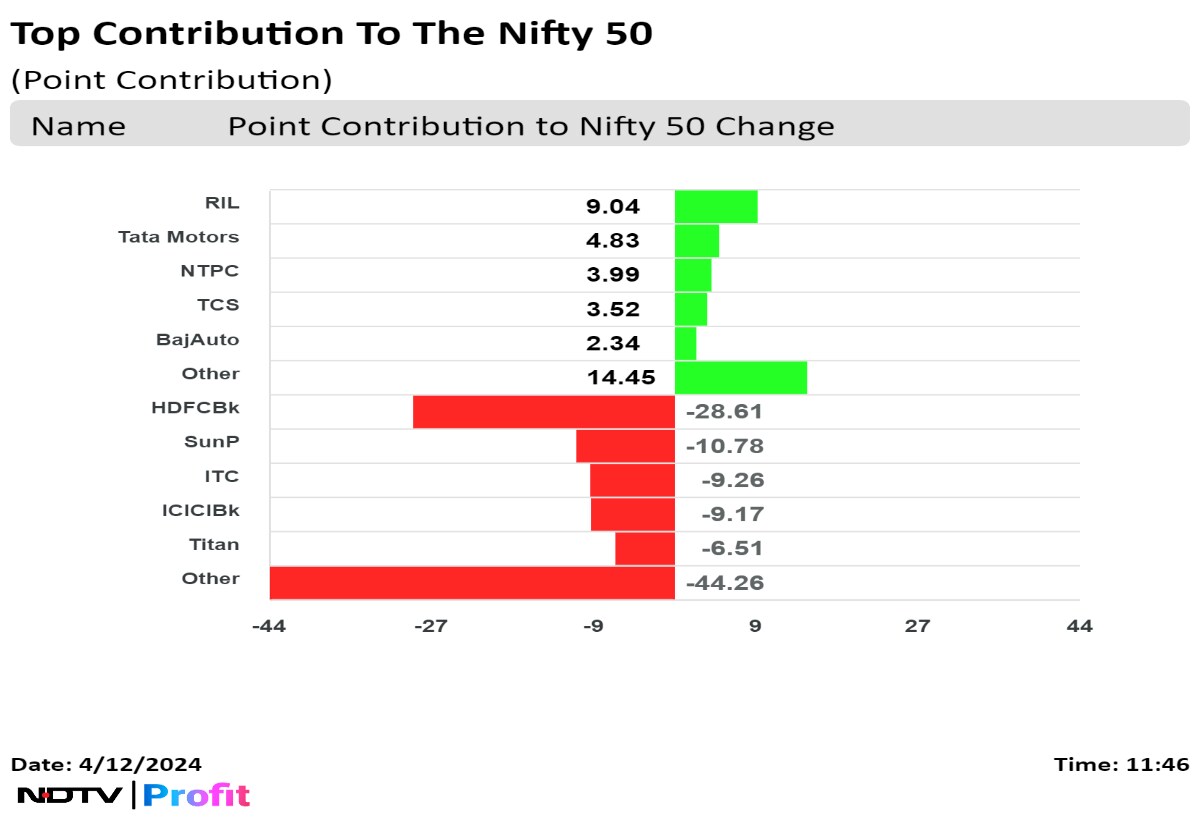

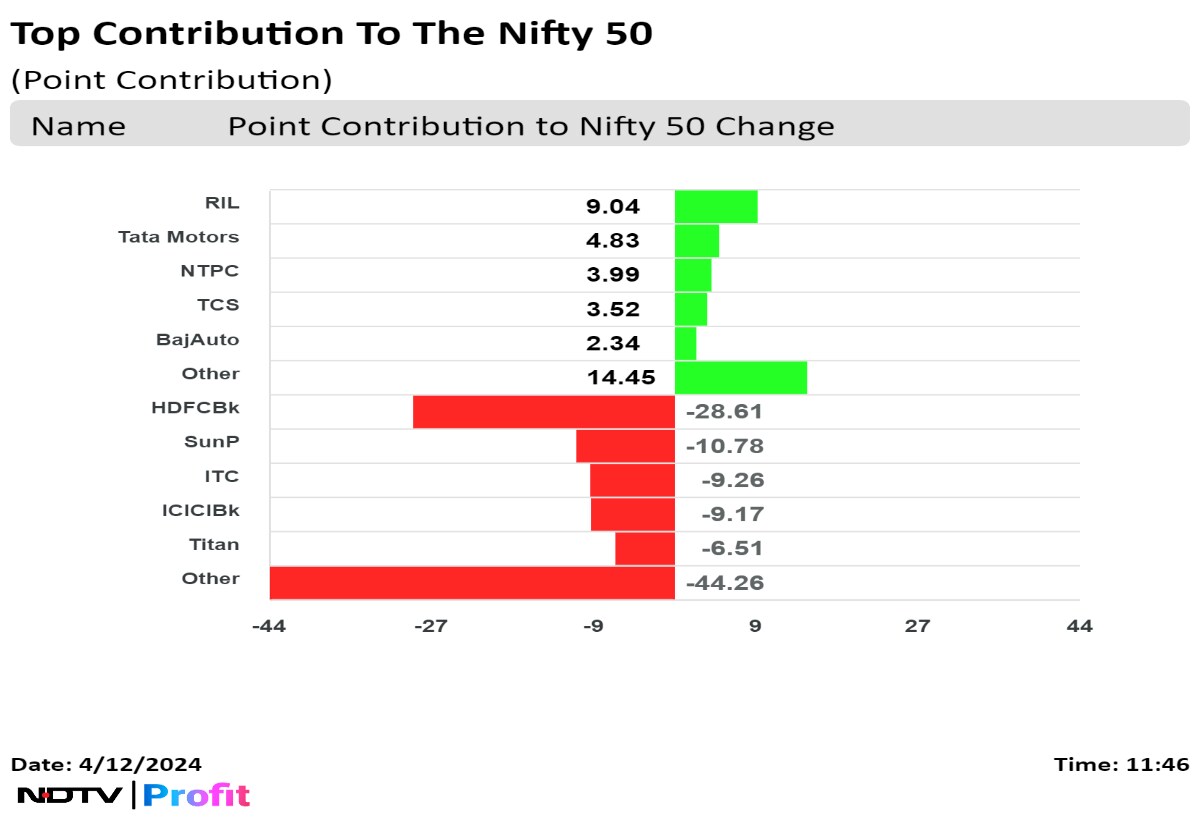

Shares of HDFC Bank Ltd., Sun Pharmaceutical Industries Ltd., ITC Ltd., ICICI Bank Ltd., and Titan Ltd. were weighing on the Nifty 50.

On the other hand, those of Reliance Industries Ltd., Tata Motors Ltd., NTPC Ltd., Tata Consultancy Services Ltd., and Bajaj Auto Ltd. were contributing the most to the index.

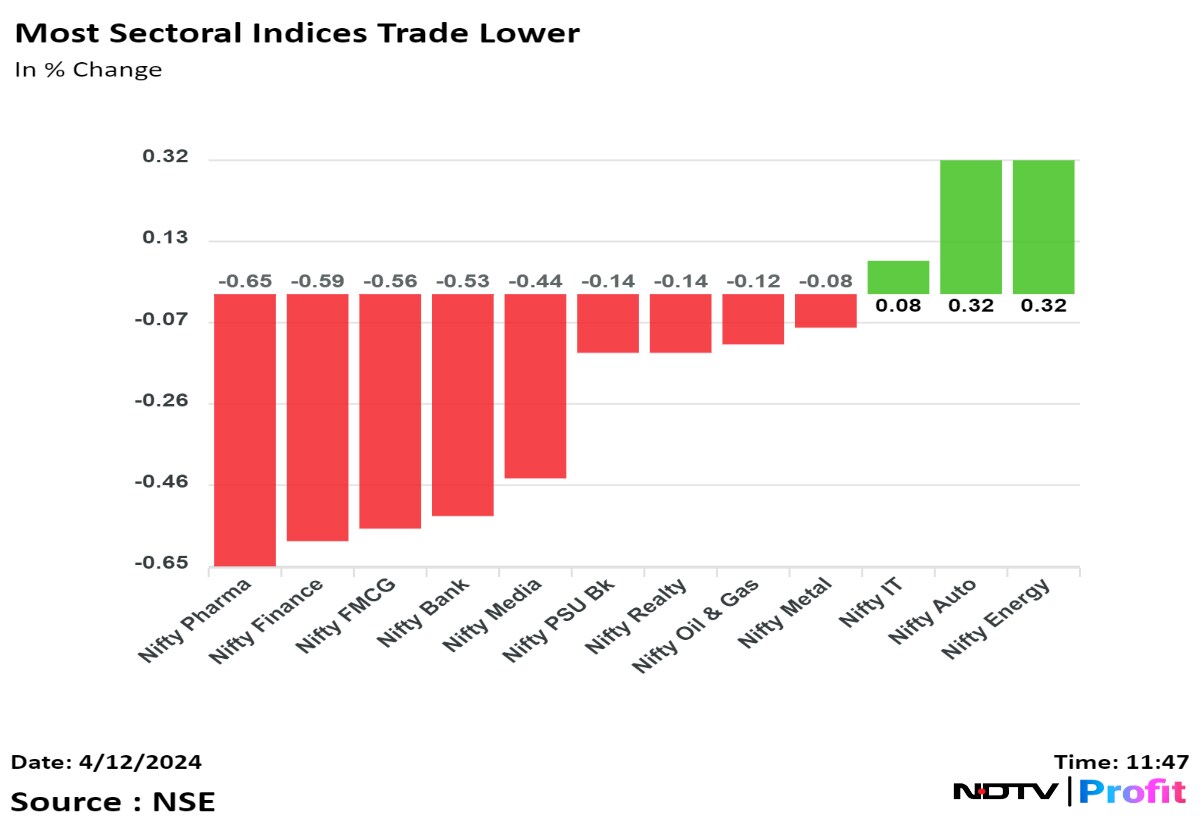

Most sectoral indices were lower with Nifty Pharma and Nifty Financial Services falling the most. Nifty Energy and Nifty Auto were the top gainers.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

Shares of HDFC Bank Ltd., Sun Pharmaceutical Industries Ltd., ITC Ltd., ICICI Bank Ltd., and Titan Ltd. were weighing on the Nifty 50.

On the other hand, those of Reliance Industries Ltd., Tata Motors Ltd., NTPC Ltd., Tata Consultancy Services Ltd., and Bajaj Auto Ltd. were contributing the most to the index.

Most sectoral indices were lower with Nifty Pharma and Nifty Financial Services falling the most. Nifty Energy and Nifty Auto were the top gainers.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

Shares of HDFC Bank Ltd., Sun Pharmaceutical Industries Ltd., ITC Ltd., ICICI Bank Ltd., and Titan Ltd. were weighing on the Nifty 50.

On the other hand, those of Reliance Industries Ltd., Tata Motors Ltd., NTPC Ltd., Tata Consultancy Services Ltd., and Bajaj Auto Ltd. were contributing the most to the index.

Most sectoral indices were lower with Nifty Pharma and Nifty Financial Services falling the most. Nifty Energy and Nifty Auto were the top gainers.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

India's benchmark stock indices were trading lower through midday on Friday, led by losses in index heavyweights HDFC Bank Ltd. and Sun Pharmaceutical Industries Ltd. The indices fell as back-to-back strong US economic data, including a better-than-expected CPI in March, pushed back expectations of an earlier rate cut by the Fed.

At 12:44 p.m., the NSE Nifty 50 traded 181.95 points, or 0.59%, lower at 22,571.85, and the BSE S&P Sensex fell 605 points, or 0.8%, to trade at 74,402.42.

Milan Vaishnav, founder and technical analyst of Gemstone Equity Research, expects the Nifty to neither slide nor give any "runaway kind of price". He expects the Nifty to trade between 22,400 and 23,000.

Meanwhile, the Nifty Bank will be relatively stronger than the 50-stock index, he said. "As long as it trades above 48,700, all technical rebounds will play out far better in the Nifty Bank," Vaishnav said.

Shares of HDFC Bank Ltd., Sun Pharmaceutical Industries Ltd., ITC Ltd., ICICI Bank Ltd., and Titan Ltd. were weighing on the Nifty 50.

On the other hand, those of Reliance Industries Ltd., Tata Motors Ltd., NTPC Ltd., Tata Consultancy Services Ltd., and Bajaj Auto Ltd. were contributing the most to the index.

Most sectoral indices were lower with Nifty Pharma and Nifty Financial Services falling the most. Nifty Energy and Nifty Auto were the top gainers.

Broader markets outperformed. The S&P BSE Midcap was 0.40% higher, and the S&P BSE Smallcap index traded 0.29% up.

On BSE, all 12 sectors advanced, and eight declined out of 20. The S&P BSE Capital Goods rose the most.

Market breadth was skewed in the favour of sellers. Around 1,924 stocks declined, 1,723 stocks declined, and 132 remained unchanged on BSE.

HDFC Bank owns 95% stake in HDB Financial.

Investment may be conducted at a valuation of $7-10 billion.

Investment to likely come ahead of HDB Financial's potential IPO.

HDFC Bank yet to approve any transaction.

HDFC Bank is reviewing potential buyers for HDB Financial stake.

Source: People in the know to NDTV Profit

HFCL Ltd.'s unit HTL Ltd gets purchase orders of Rs 64.93 crore for supply of optical fiber cables.

Source: Exchange Filing

Pratham EPC Projects Ltd. received Rs 497 crore orders from Sun Petro Chemicals for crude oil pipeline.

Source: Exchange Filing

The order value is double the total market cap of Pratham EPC Projects Ltd. The company's current market cap is Rs 241.98 crore, according to data on NSE.

Godfrey Phillips India Ltd. is to exit retail business division '24Seven'.

Source: Exchange Filing

March passenger vehicle sales at 3.68 lakh units

March domestic two-wheeler sales at 14.8 lakh units

March local car sales at 1.12 lakh units

March local utility vehicle sales at 1.94 lakh units

Source: Bloomberg

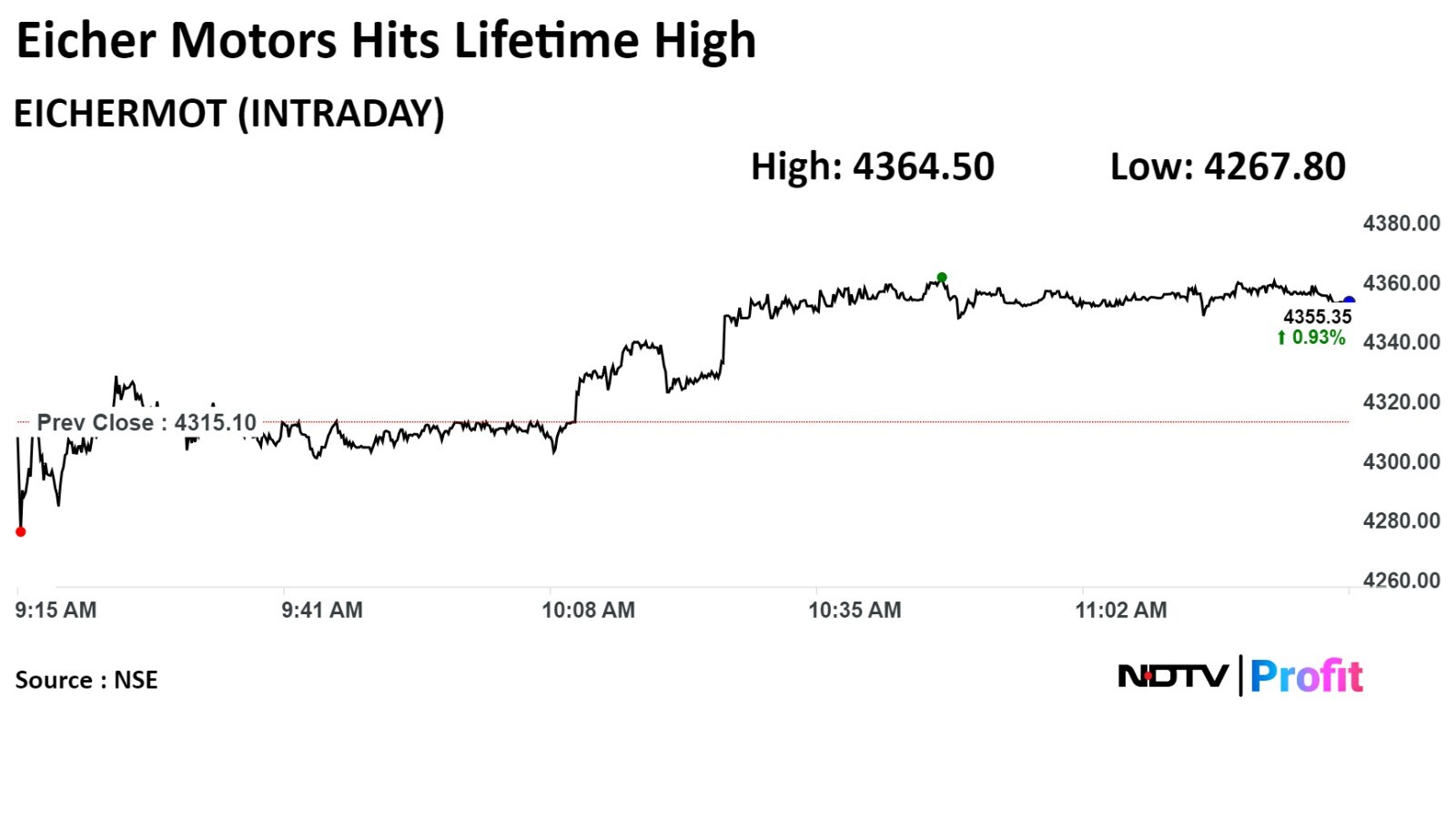

Shares of Eicher Motors Ltd. rose 1.14% to Rs 4,364.50, the highest level since its listing Sep 7, 2004. It was trading 0.97% higher at Rs 4,357.15 as of 11:35 a.m., as compared to 0.35% decline in NSE Nifty 50 index.

Shares of Eicher Motors Ltd. rose 1.14% to Rs 4,364.50, the highest level since its listing Sep 7, 2004. It was trading 0.97% higher at Rs 4,357.15 as of 11:35 a.m., as compared to 0.35% decline in NSE Nifty 50 index.

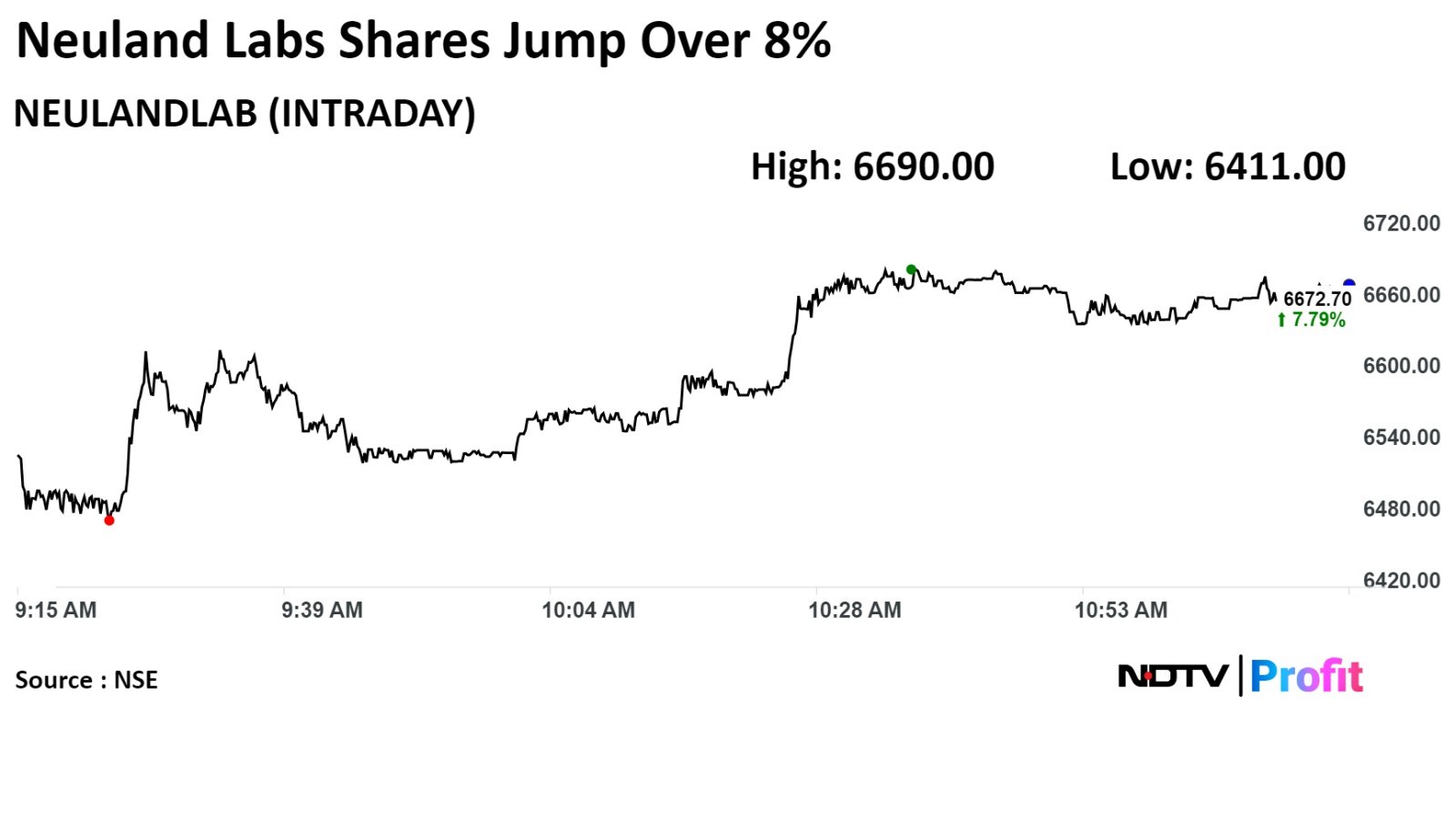

Shares jumped after Goldman Sachs initiated coverage on Neuland Laboratories Ltd. with a 'buy' rating on its exposure to a fast-growing CDMO with higher share coming from commercialised molecules.

Shares jumped after Goldman Sachs initiated coverage on Neuland Laboratories Ltd. with a 'buy' rating on its exposure to a fast-growing CDMO with higher share coming from commercialised molecules.

Great Eastern Shipping Co. Ltd. received a delivery of product tanker 'Jag Priya' of about 49,999 dwt.

Alert: Dwt stands for Deadweight Ton.

Source: Exchange Filing

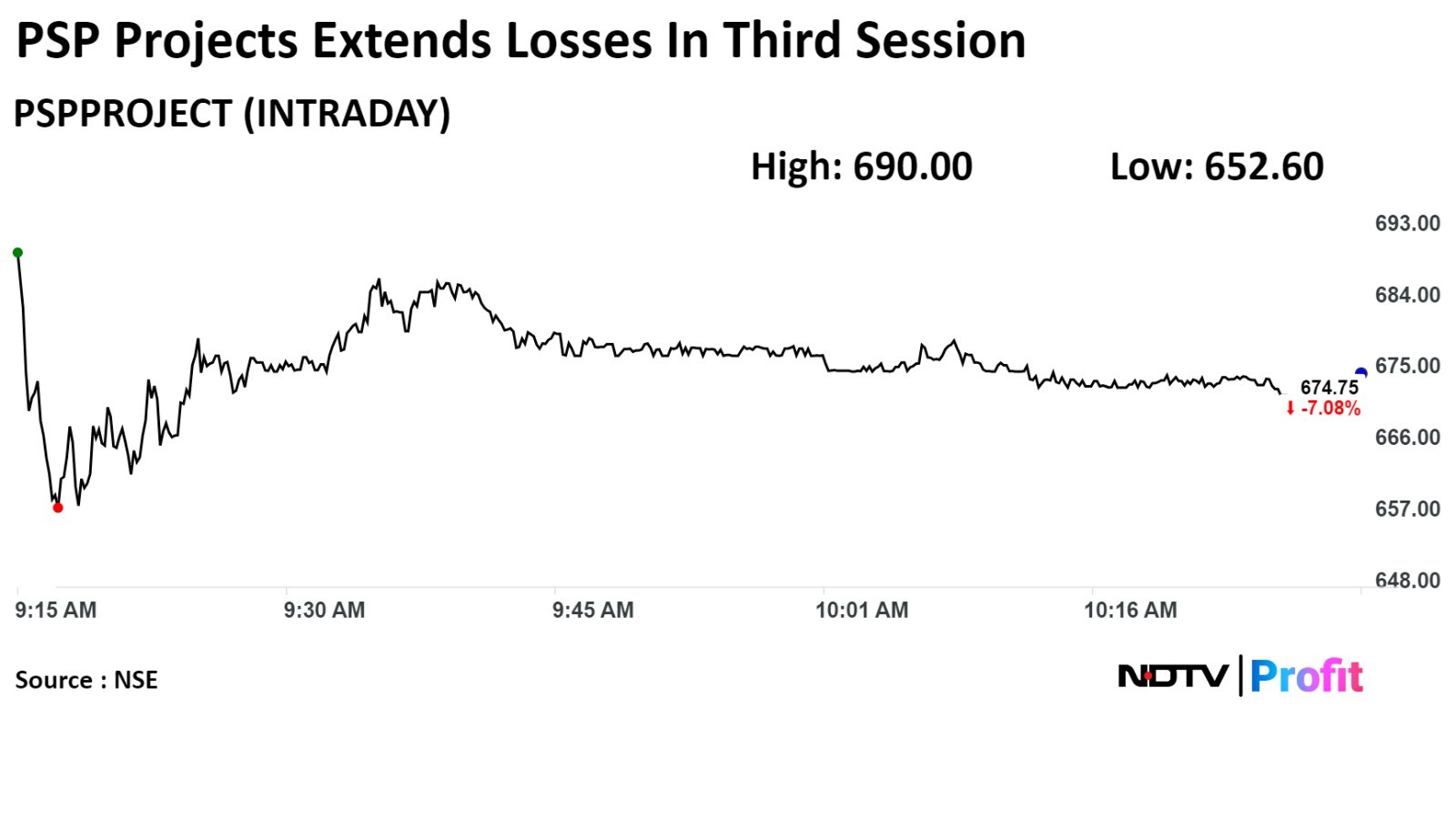

PSP Projects Ltd. plunged 10.13% to Rs 652.60, the lowest level since March 26. It was trading 6.75% down at Rs 677.10 as of 11:08 a.m., as compared to 0.42% decline in the NSE Nifty 50 index.

The scrip declined 2.74% in 12 months. On year-to-date basis, PSP Projects Ltd. declined 88.50%. Total traded volume so far in the day stood at 9.5 times its 30-day average. The relative strength index was at 45.28.

Out of 13 analysts tracking the company, 12 maintain a 'buy' rating, one recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 30.8%.

PSP Projects Ltd. plunged 10.13% to Rs 652.60, the lowest level since March 26. It was trading 6.75% down at Rs 677.10 as of 11:08 a.m., as compared to 0.42% decline in the NSE Nifty 50 index.

The scrip declined 2.74% in 12 months. On year-to-date basis, PSP Projects Ltd. declined 88.50%. Total traded volume so far in the day stood at 9.5 times its 30-day average. The relative strength index was at 45.28.

Out of 13 analysts tracking the company, 12 maintain a 'buy' rating, one recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 30.8%.

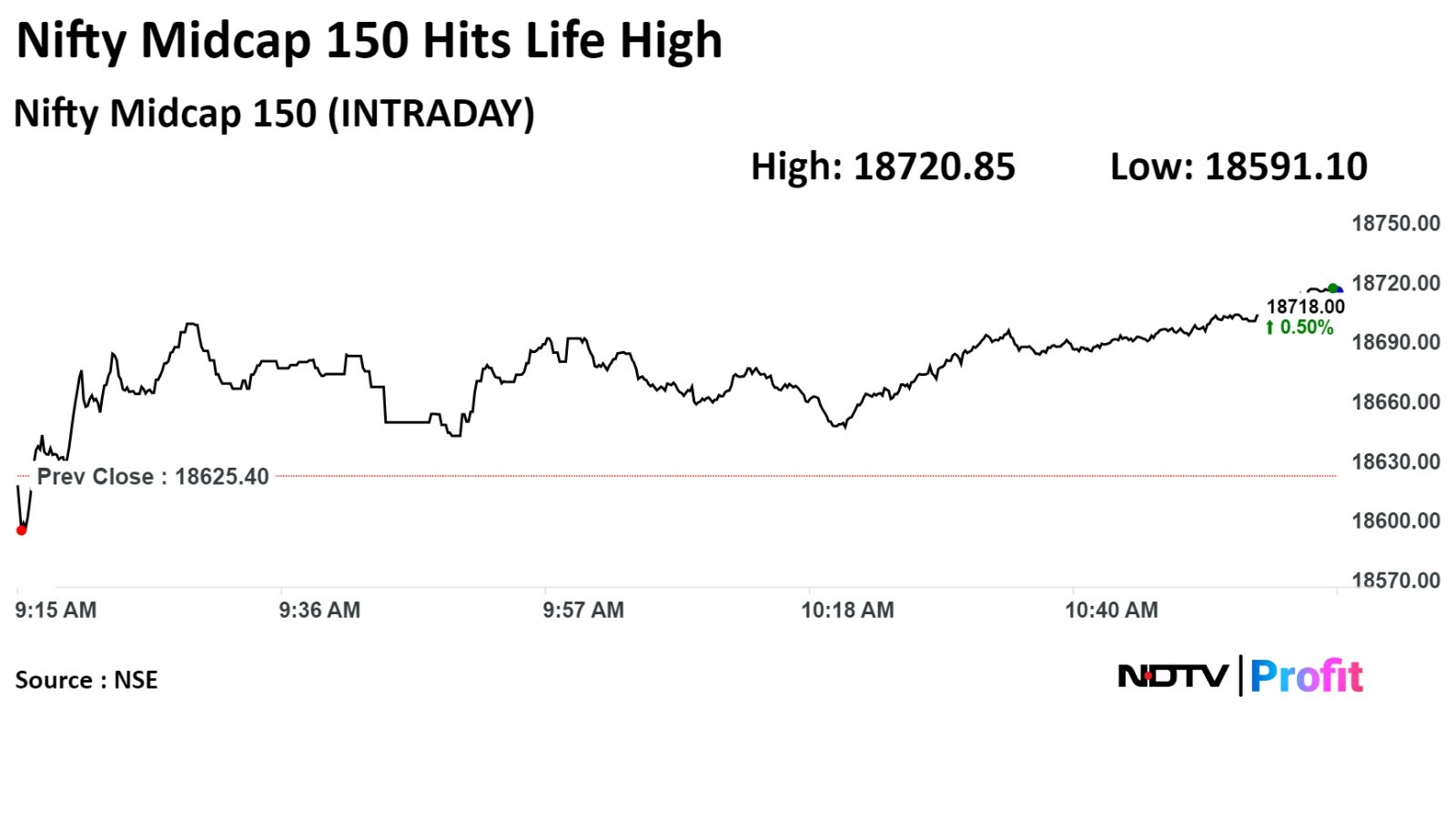

The NSE Nifty Midcap 150 index scaled a fresh high of 18,720.85 on Friday. The index has been rising fresh highs for four sessions in a row.

The NSE Nifty Midcap 150 index scaled a fresh high of 18,720.85 on Friday. The index has been rising fresh highs for four sessions in a row.

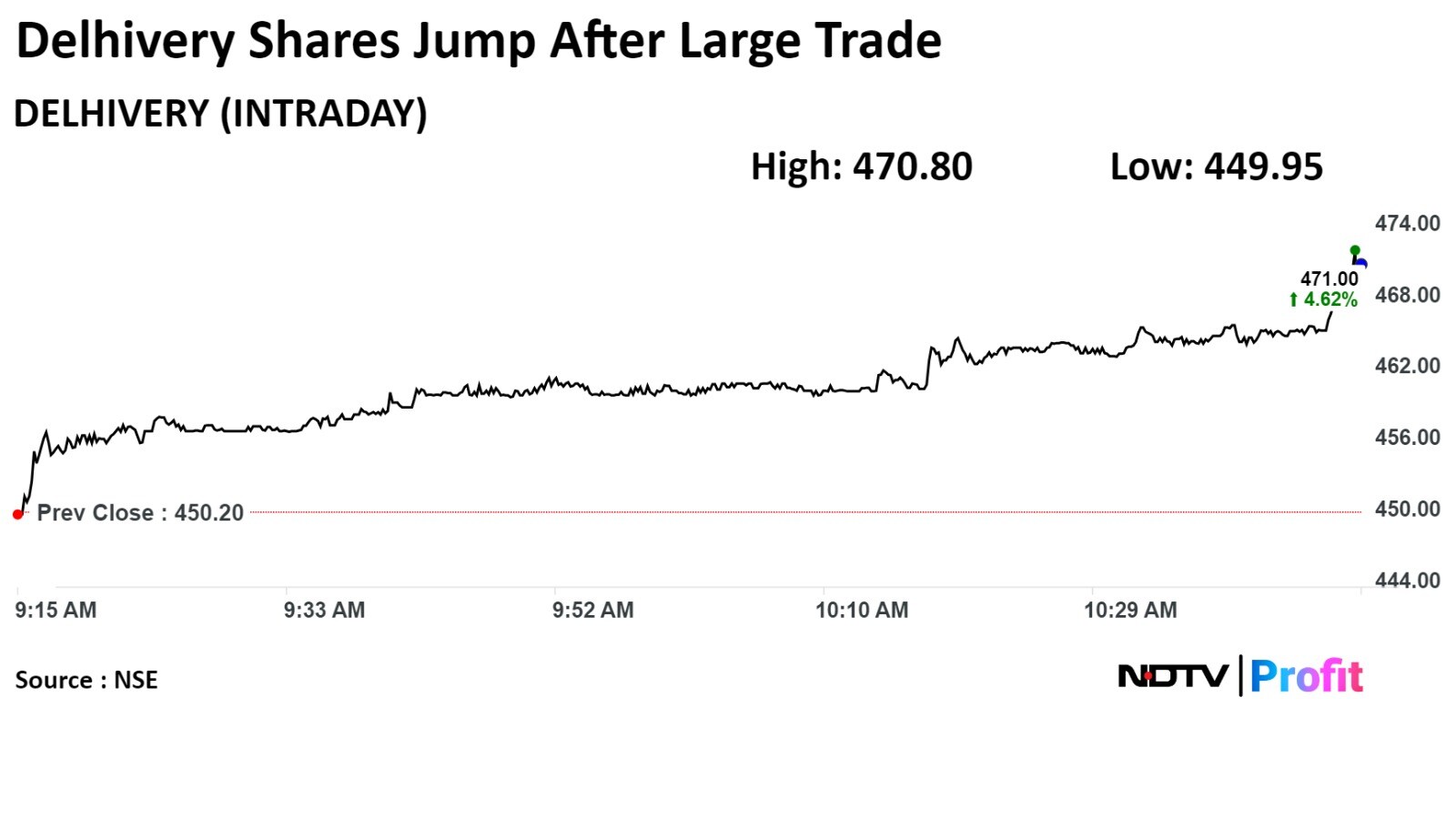

Shares of Delhivery Ltd. gained after its 1.03 million shares were traded on a bunch, according to Bloomberg.

Shares of Delhivery Ltd. gained after its 1.03 million shares were traded on a bunch, according to Bloomberg.

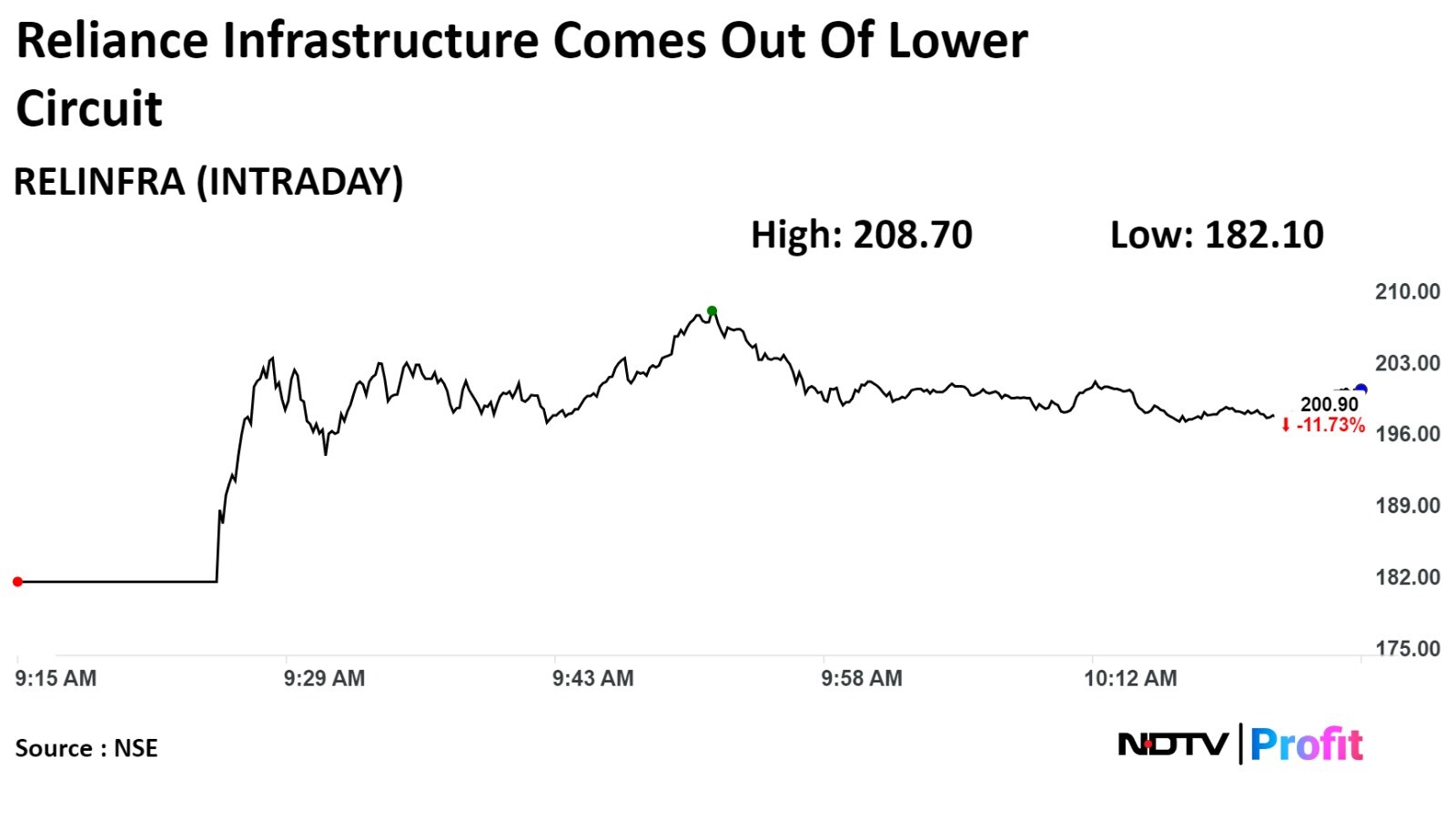

Reliance Infrastructure Ltd. erased some of its losses to move out of the 20% lower circuit on Friday.

Shares of Reliance Infrastructure were locked in 20% lower circuit after the Supreme Court on Wednesday asked Reliance Infrastructure led Delhi Airport Metro Express to refund Rs 3,300 crore to Delhi Metro Rail Corp in an arbitral award.

Reliance Infrastructure Ltd. erased some of its losses to move out of the 20% lower circuit on Friday.

Shares of Reliance Infrastructure were locked in 20% lower circuit after the Supreme Court on Wednesday asked Reliance Infrastructure led Delhi Airport Metro Express to refund Rs 3,300 crore to Delhi Metro Rail Corp in an arbitral award.

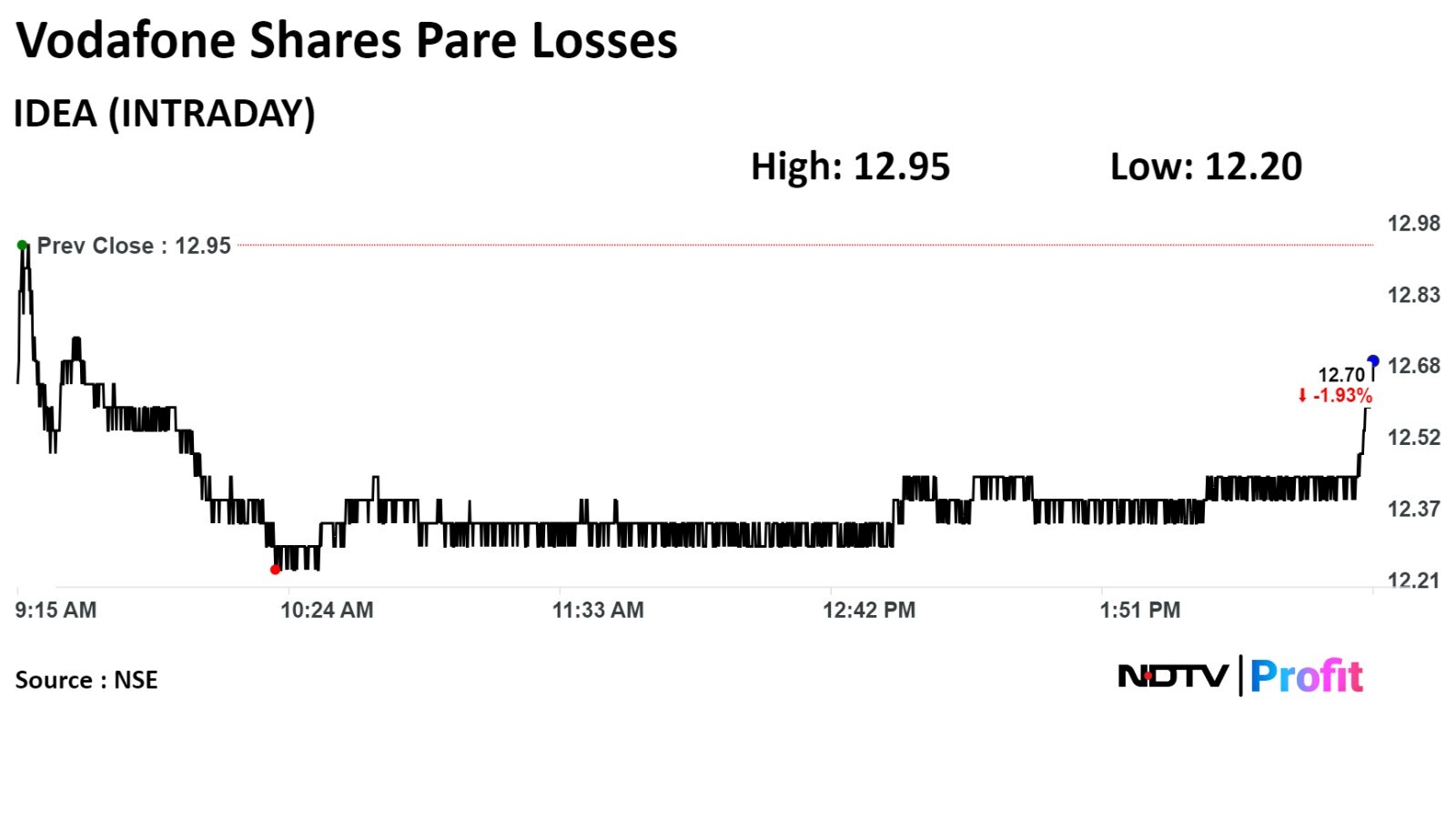

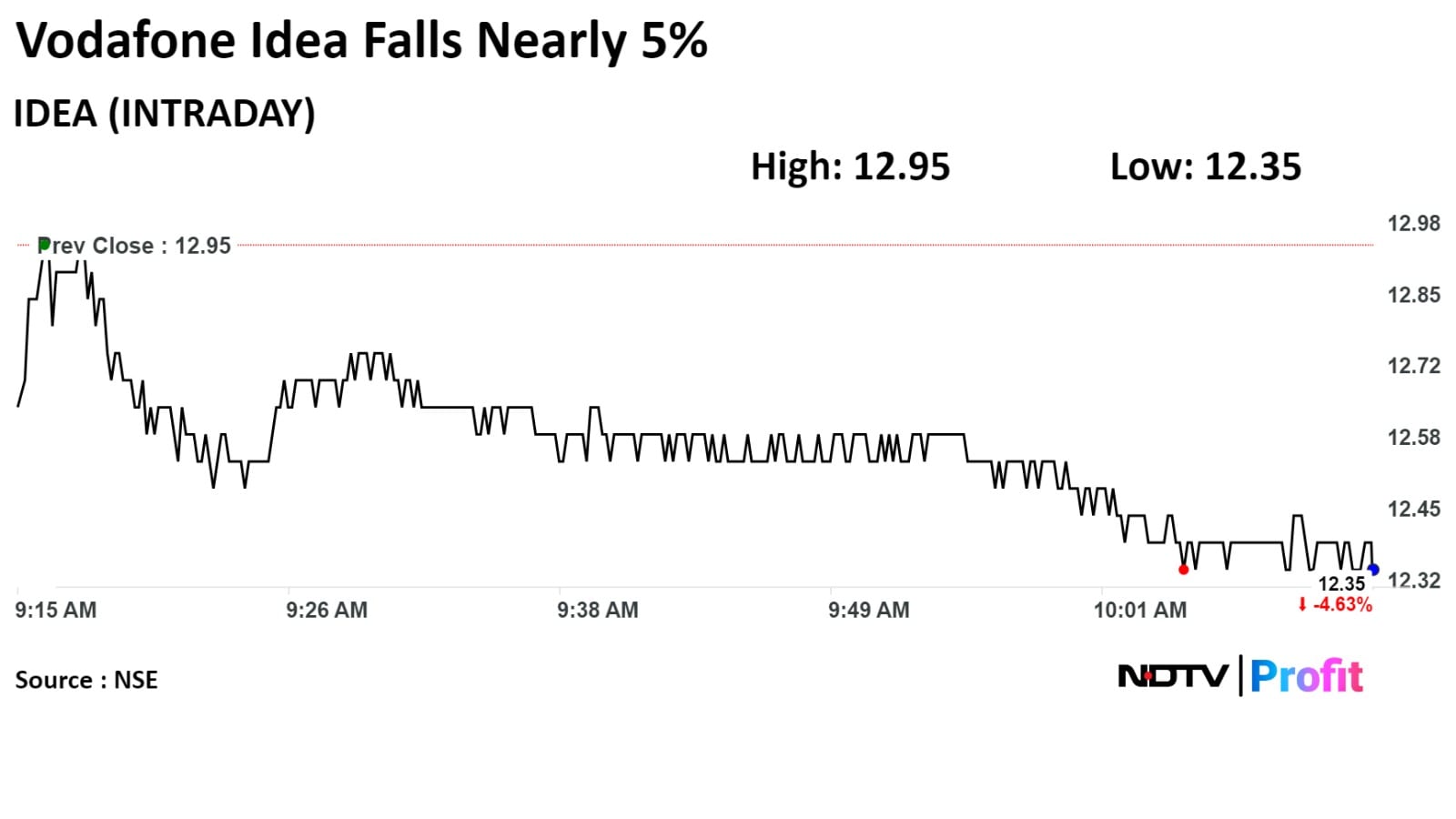

Shares of Vodafone Idea Ltd. fell nearly 5% on NSE after its board has approved to file red herring prospectus with the Registrar of Companies for follow on offering, aggregating up to Rs 18,000 crore.

Vodafone Idea Ltd. has approved the follow-on public offer's floor price at Rs 10 per equity share with the cap placed at Rs 11 per equity share, according to an exchange filing.

Shares of Vodafone Idea Ltd. fell nearly 5% on NSE after its board has approved to file red herring prospectus with the Registrar of Companies for follow on offering, aggregating up to Rs 18,000 crore.

Vodafone Idea Ltd. has approved the follow-on public offer's floor price at Rs 10 per equity share with the cap placed at Rs 11 per equity share, according to an exchange filing.

Manorama Industries Ltd. has begun commissioning of new fractionation plant having annual capacity of 25,000 ton.

Source: Exchange Filing

Manorama Industries Ltd. has begun commissioning of new fractionation plant having annual capacity of 25,000 ton.

Source: Exchange Filing

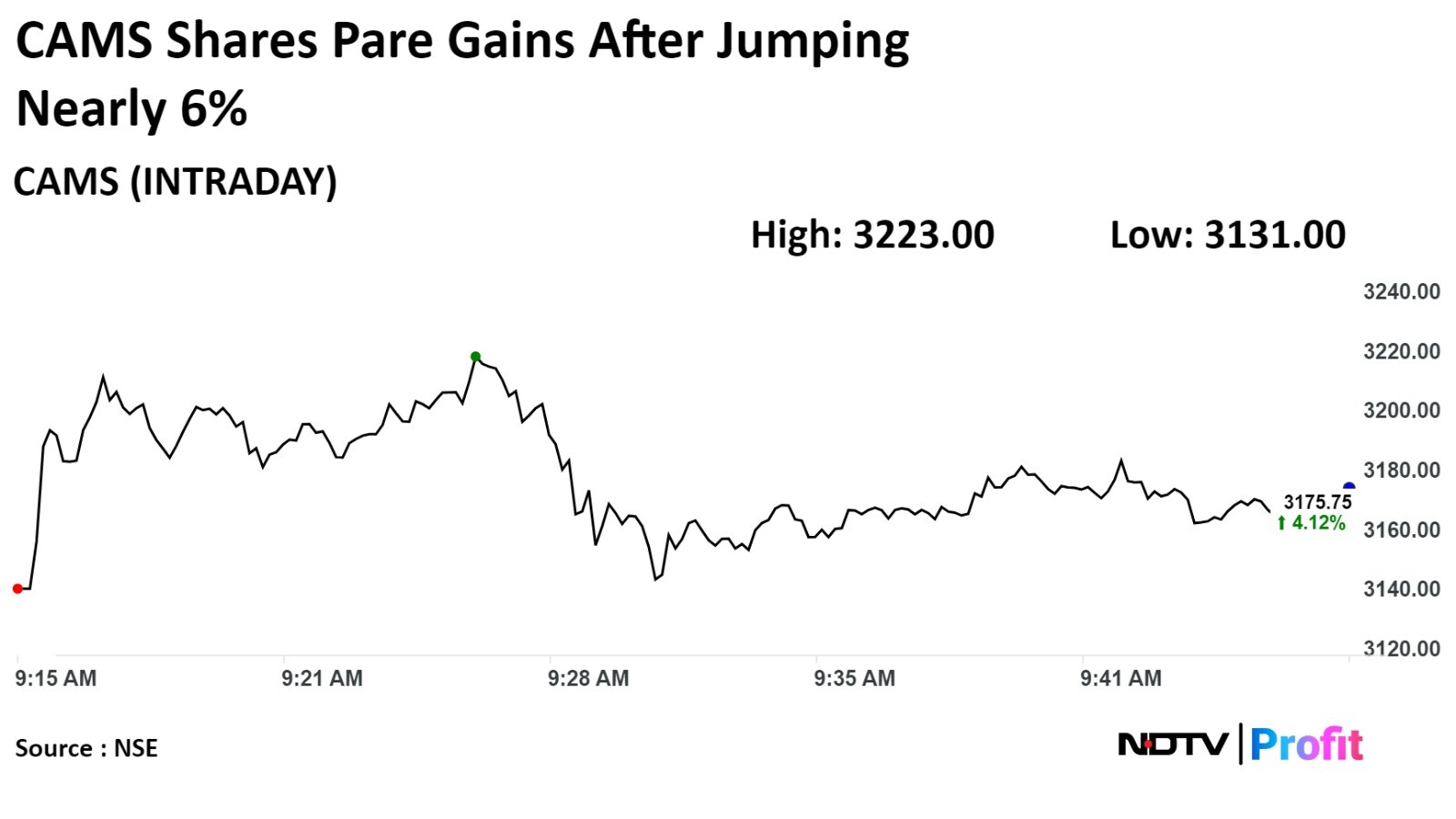

Shares of Computer Age Management Services Ltd. jumped nearly 6% today after the mutual fund transfer agency got Reserve Bank Of India's authorisation to operate as an online payment aggregator.

Shares of Computer Age Management Services Ltd. jumped nearly 6% today after the mutual fund transfer agency got Reserve Bank Of India's authorisation to operate as an online payment aggregator.

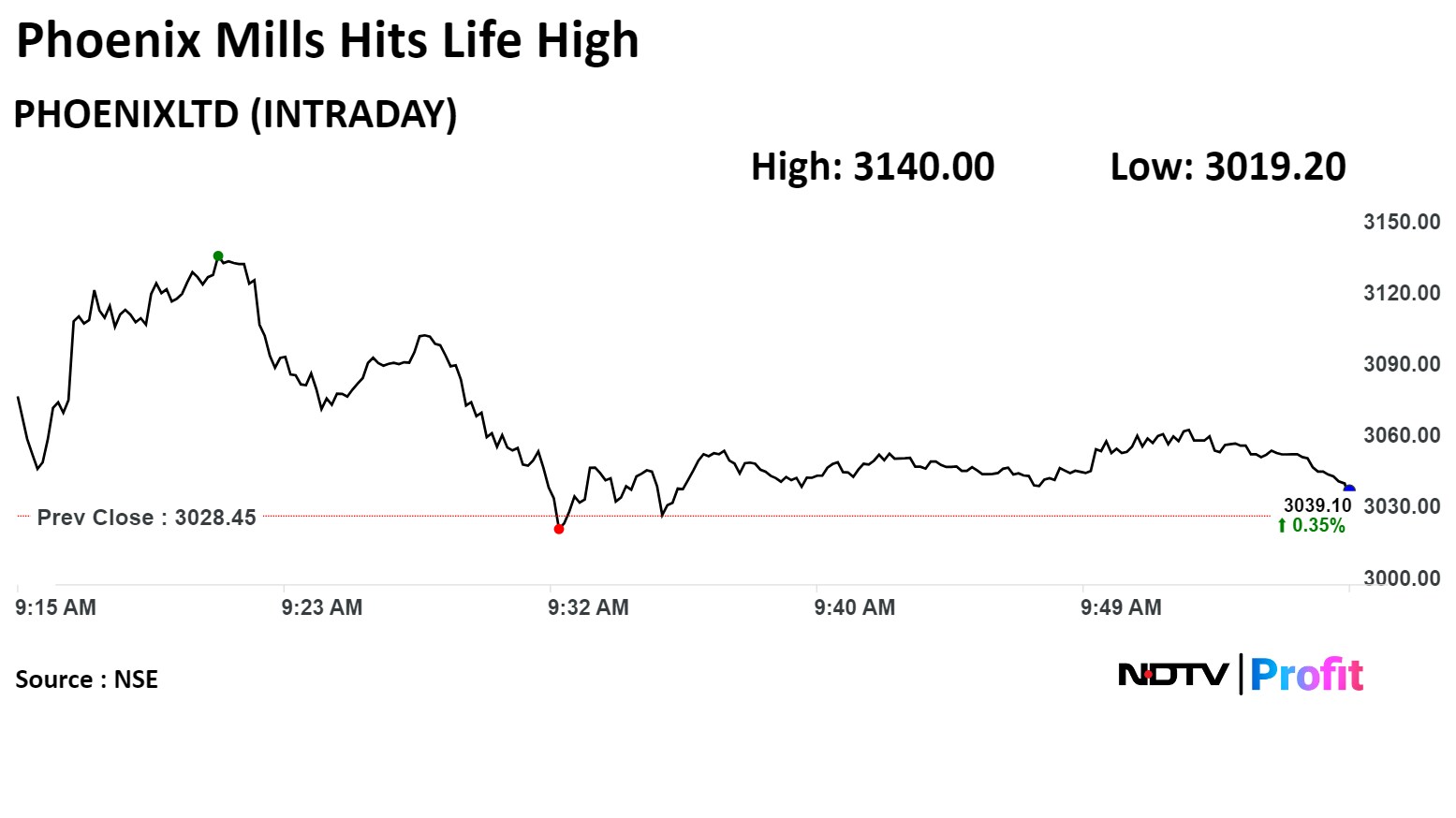

Shares of Phoenix Mills Ltd. jumped to record high on Friday after it recorded 27% annual rise in its gross retail collection in FY24

The commercial real-estate business's gross retail collection grew 27% on year to Rs 2,743 crore in FY24. During quarter four of the previous financial year, its retail collection grew 27% on the year to Rs 791 crore, the company said in an exchange filing on Wednesday.

The scrip rose as much as 3.68% to Rs 3,140 apiece, the highest level since its listing on April 23, 2007. It was trading 0.68% higher at Rs 3,049.05 apiece, as of 09:48 a.m. This compares to a 0.45% decline in the NSE Nifty 50 Index.

It has risen 137.28% in 12 months. Total traded volume so far in the day stood at 3.7 times its 30-day average. The relative strength index was at 68.96.

Out of 17 analysts tracking the company, 11 maintain a 'buy' rating, four recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 8.4%.

Shares of Phoenix Mills Ltd. jumped to record high on Friday after it recorded 27% annual rise in its gross retail collection in FY24

The commercial real-estate business's gross retail collection grew 27% on year to Rs 2,743 crore in FY24. During quarter four of the previous financial year, its retail collection grew 27% on the year to Rs 791 crore, the company said in an exchange filing on Wednesday.

The scrip rose as much as 3.68% to Rs 3,140 apiece, the highest level since its listing on April 23, 2007. It was trading 0.68% higher at Rs 3,049.05 apiece, as of 09:48 a.m. This compares to a 0.45% decline in the NSE Nifty 50 Index.

It has risen 137.28% in 12 months. Total traded volume so far in the day stood at 3.7 times its 30-day average. The relative strength index was at 68.96.

Out of 17 analysts tracking the company, 11 maintain a 'buy' rating, four recommend a 'hold,' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 8.4%.

Shares of Bharti Hexacom Ltd. listed on the National Stock Exchange on Friday at Rs 755 apiece, a premium of 32.46% over their IPO price of Rs 570 apiece.

Bharti Hexacom Debuts At 32% Premium Over IPO Price.

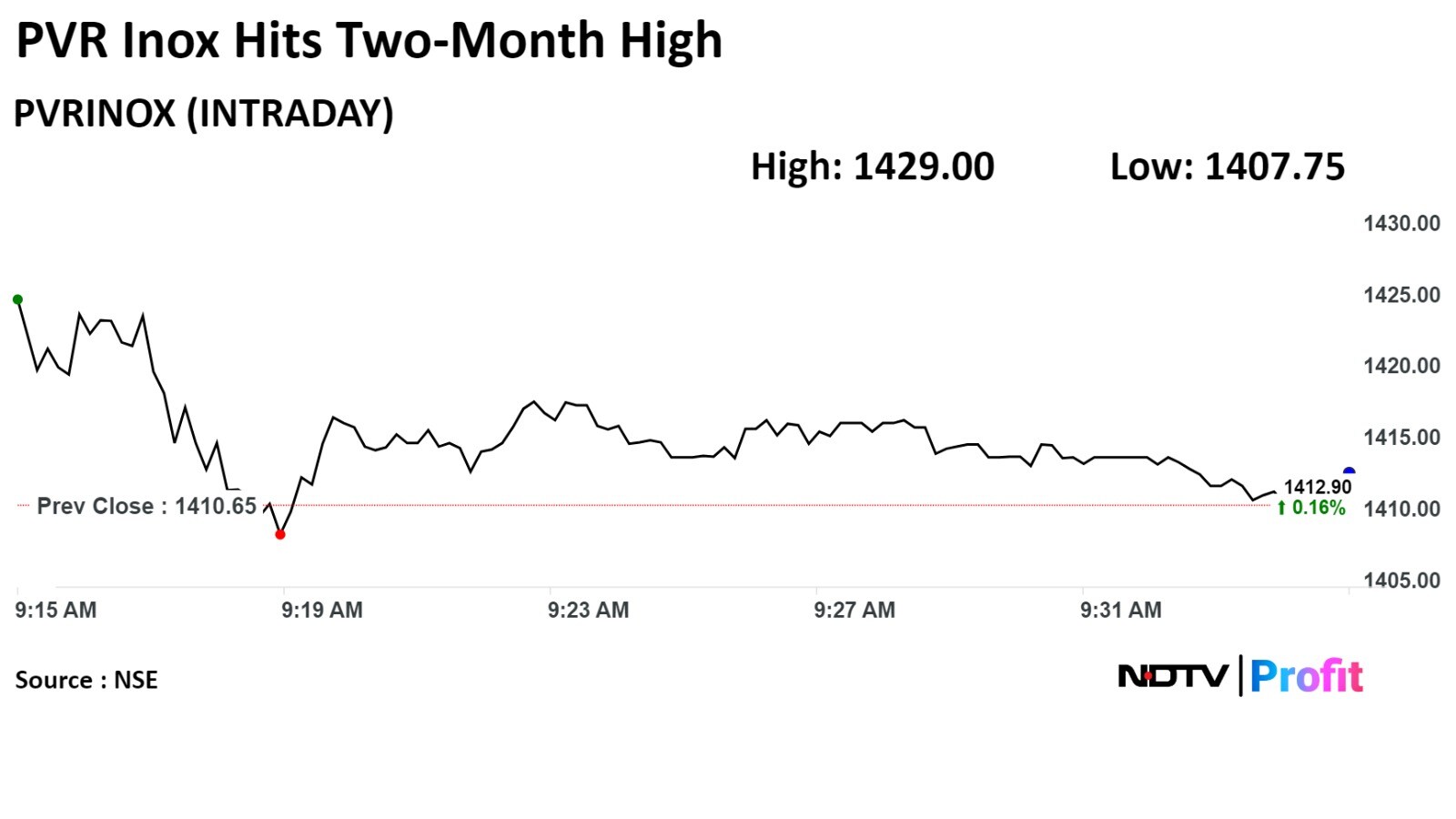

On NSE, shares of PVR Inox Ltd. rose to two-month high after CLSA retained 'Buy' rating on the company and maintained growth outlook.

CLSA has retained a 'Buy' with a target price of 2,280 , which is an upside potential of 65%.

On NSE, shares of PVR Inox Ltd. rose to two-month high after CLSA retained 'Buy' rating on the company and maintained growth outlook.

CLSA has retained a 'Buy' with a target price of 2,280 , which is an upside potential of 65%.

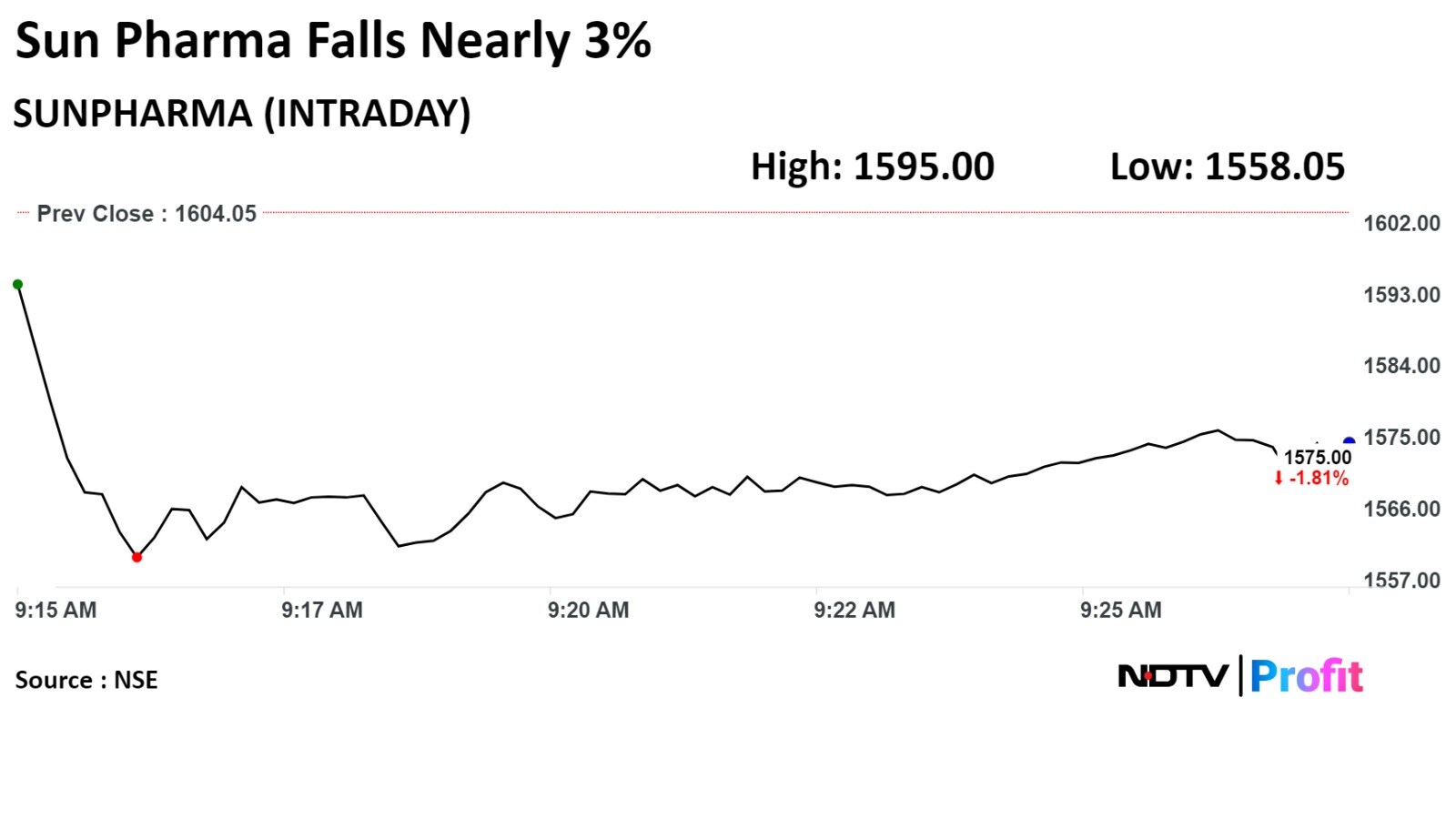

Sun Pharmaceutical Industries Ltd. slumped nearly 3% on NSE after it said to the exchanged the U.S. Food and Drug Administration has classified it Dadra facility under official action indicated category.

The U.S. FDA conducted inspection at Dadra facility from Dec 4, to Dec 15, according to an exchange filing.

Sun Pharmaceutical Industries Ltd. slumped nearly 3% on NSE after it said to the exchanged the U.S. Food and Drug Administration has classified it Dadra facility under official action indicated category.