(Bloomberg) -- The world's biggest bond market remained under pressure, with traders sifting through a slew of remarks from Federal Reserve speakers on speculation that policymakers will be in no rush to cut rates.

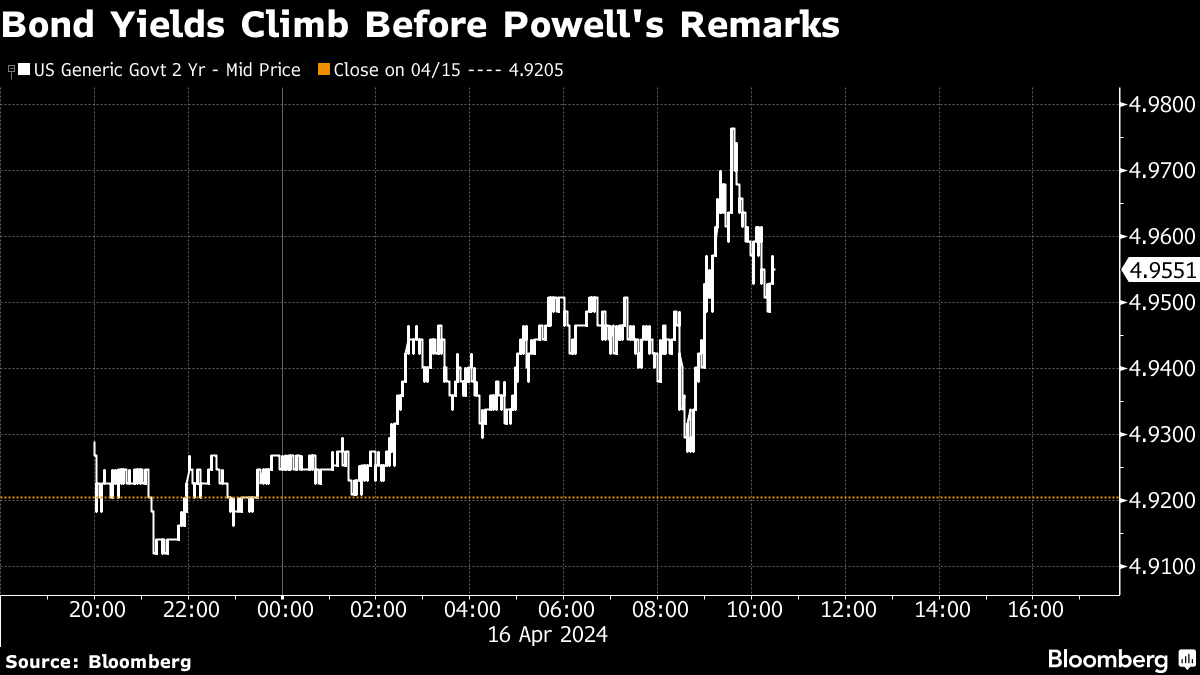

Just hours away from Jerome Powell's speech, US two-year yields came closer to the 5% mark. The dollar extended its rally into a fifth straight session. Equities struggled after their worst back-to-back selloff in more than a year.

“Powell is likely to set the near-term market narrative,” said Chris Senyek at Wolfe Research. “The Fed Chair is always a wildcard.”

To Krishna Guha at Evercore, Powell's remarks are “higher stakes than normal” coming after hot economic data.

“We think he will try to combine a reassuring message on the overall economics of disinflation with an emphasis that the Fed will not brush recent data under the carpet,” Guha noted.

The S&P 500 hovered near 5,050. Solid earnings from two Wall Street giants — Morgan Stanley and Bank of America Corp. did little to spark risk appetite. Megacaps were mixed. UnitedHealth Group Inc. rallied after beating profit expectations. Treasury 10-year yields hit a fresh high for 2024. The greenback headed for its biggest five-day gain in over a year.

In light of recent economic developments in the US, Powell's tone will be key, according to Win Thin and Elias Haddad at Brown Brothers Harriman.

“There is always a significant risk that Powell makes a dovish slip in his comments,” they said. “However, we expect him to maintain a more hawkish tone. The Fed needs and wants the market to do the tightening for them. That means higher yields, which require a more hawkish Fed tone.”

Policymakers around the world are struggling to confront a surging greenback and lofty US interest rates, according to Mohamed El-Erian.

“Authorities are a little bit frozen around the world as to how do you react to a generalized dollar strengthening?” El-Erian, the president of Queens' College, Cambridge and a Bloomberg Opinion columnist, told Bloomberg Television Tuesday. “How do you react to a generalized increase in interest rates in the US?”

Fed Vice Chair Philip Jefferson said Tuesday that while there has been considerable progress in lowering inflation, the Fed's task of sustainably restoring 2% inflation is “not yet done.” His San Francisco counterpart Mary Daly reiterated late Monday there's no urgency to adjust interest rates, pointing to solid economic growth, a strong labor market and still-elevated inflation.

After starting the year by pricing in as many as six rate cuts in 2024, or 1.5 percentage points of easing, traders are now doubtful there will even be a half point of reductions. Most Wall Street economists have dialed back forecasts as well, setting up a dour scenario for US yields including a possible repeat of maturities breaching 5% as they did last October.

Amid all the anxiety, the widely watched MOVE index, an options-based measure of expected volatility in Treasuries, spiked to the highest since January.

State Street Global Advisors is standing by a contrarian call for the Fed to cut interest rate as soon as June despite a string of hot economic data that has spurred most traders to push back bets to later in the year.

The $3.6 trillion asset manager remains convinced the central bank will start monetary easing well before the US presidential election in November to avoid being seen influencing the result, according to Boston-based chief investment officer Lori Heinel. The inflation backdrop still supports this move given policy works with a long lag and the quality of recent data prints has been low, she said.

Corporate Highlights:

- Morgan Stanley's traders delivered first-quarter revenue that exceeded expectations as its wealth management juggernaut also got back on track — both handing a key win for its new leader Ted Pick.

- Bank of America Corp. traders notched one of their best first quarters on record as the company also reaped the benefits of elevated borrowing costs that pushed net interest income above analysts' estimates.

- PNC Financial Services Group Inc. missed estimates for net interest income in the first quarter, a sign that the Pittsburgh-based lender has continued to struggle with muted loan growth.

- The Bank of New York Mellon Corp. reported first-quarter revenue that topped estimates as the oldest US lender benefited from higher market values and increased client activity.

- Johnson & Johnson's first-quarter profit beat estimates as the health giant's drug sales came in higher than Wall Street analysts expected.

Key events this week:

- Eurozone CPI, Wednesday

- Fed issues its Beige Book, Wednesday

- Cleveland Fed President Loretta Mester speaks, Wednesday

- Fed Governor Michelle Bowman speaks, Wednesday

- BOE Governor Andrew Bailey speaks, Wednesday

- Taiwan Semiconductor earnings, Thursday

- US Conf. Board leading index, existing home sales, initial jobless claims, Thursday

- Fed Governor Michelle Bowman speaks, Thursday

- New York Fed President John Williams speaks, Thursday

- Atlanta Fed President Raphael Bostic speaks, Thursday

- BOE Deputy Governor Dave Ramsden and ECB Governing Council member Joachim Nagel speak, Friday

- Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.2% as of 10:31 a.m. New York time

- The Nasdaq 100 was little changed

- The Dow Jones Industrial Average rose 0.2%

- The Stoxx Europe 600 fell 1.7%

- The MSCI World index fell 0.8%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro was little changed at $1.0631

- The British pound was unchanged at $1.2446

- The Japanese yen fell 0.3% to 154.67 per dollar

Cryptocurrencies

- Bitcoin fell 1% to $62,493.01

- Ether fell 0.6% to $3,065.77

Bonds

- The yield on 10-year Treasuries advanced seven basis points to 4.67%

- Germany's 10-year yield advanced six basis points to 2.50%

- Britain's 10-year yield advanced eight basis points to 4.32%

Commodities

- West Texas Intermediate crude fell 0.4% to $85.07 a barrel

- Spot gold fell 0.6% to $2,368.01 an ounce

This story was produced with the assistance of Bloomberg Automation.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.