(Bloomberg) -- The stock market managed to rebound after the latest inflation figures did little to alter bets the Federal Reserve will cut rates this year — even if it keeps a more cautious stance for now.

Following a series of twists and turns, the S&P 500 pushed decidedly higher. Notwithstanding the fact that the consumer price index continued to show some signs of “stickiness,” the overall report came only slightly above estimates. While that's not ideal for a central bank trying to get close to to its 2% target, the February CPI was not a shocker to traders dreading another post-inflation selloff.

“Fears have been circulating prior to the release for an extra-hot print, which appears to have boosted markets as they failed to materialize,” said Josh Jamner at ClearBridge Investments. “Overall, there should be relatively little market impact from today's release given it is largely consistent with the prior understanding of the disinflationary process.”

The S&P 500 rose 1% — and was on track for another all-time high. Tech led gains on Tuesday, with Nvidia Corp. up 5%. Bonds fell ahead of this week's remaining auctions — a 10-year note at 1 p.m. New York time and a 30-year bond on Wednesday — and a growing slate of new corporate bonds.

While the CPI reading may breathe new life into the sticky inflation narrative, whether it actually delays rate cuts is a different story, according to Chris Larkin at E*Trade from Morgan Stanley.

“Sticky doesn't necessarily mean overheating, Larkin noted.

To Bret Kenwell at eToro, regardless of whether the inflation print is ideal, investors mostly want to know whether they can count on what's expected — and right now, that's for a June rate cut.

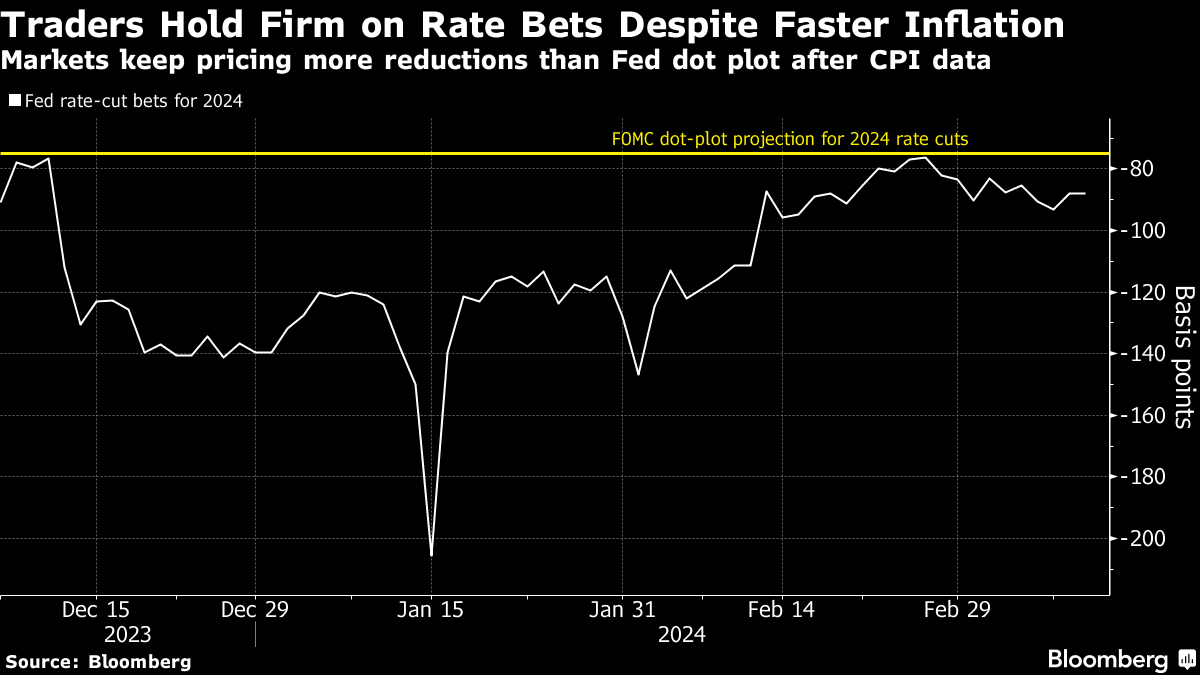

The inflation reading did little to alter traders' conviction that the Fed will shift to cutting interest rates this year. Futures are pricing in nearly 70% odds that the central bank will start easing in June and enact at least three quarter-point cuts over the course of 2024.

“The Fed usually cuts interest rates to get ahead of an impending economic slowdown, and with the economy running so strong currently, it's difficult to justify any rate cuts,” said Skyler Weinand at Regan Capital. “Still, the Fed is likely to cut interest rates one or two times this year, as an acknowledgement that inflation has meaningfully decelerated, even if it's not quite fully back to its 2% target.”

More Comments on CPI:

- Quincy Krosby at LPL Financial:

Much of core inflation remains “sticky” and isn't unwinding at a pace that would offer the Fed the confidence it needs to begin the easing cycle perhaps even in June.

What could help underpin a move in June or July, however, is that Owners Equivalent Rent (OER) has begun to tick lower, and given its heavy weighting in the CPI a continued downward trajectory by June or July could certainly assuage Fed concerns regarding inflation remaining stubbornly higher.

Still, the FOMC has been clear in its orchestrated message to the markets, that it requires more than one month of cooler data.

Today's report suggests that while the last mile towards 2% has become a bit longer, the underlying report offers a modicum of hope that by June or certainly July the Fed should feel more comfortable that they're increasingly closer to their destination.

- Jason Pride at Glenmede:

Like a piece of gum stubbornly stuck to the bottom of their shoes, sticky services inflation is a problem that the Fed just can't shake. Today's report likely doesn't change the Fed's calculus all too much, as it still seeks evidence of sustainably waning inflation before cutting rates. The base case remains roughly three rate cuts this year beginning sometime around summer.

- Michael Shaoul at Marketfield Asset Management:

In summary, although a lot of progress was made over the last 18 months, the majority of it took place in the first 12 months of this period, which much less progress since then. We do not yet see any signs of a resurgence in CPI in the report, but the risks look much more balanced than the general consensus indicates, including that which has taken hold within the FOMC.

- George Mateyo at Key Private Bank:

The Fed will likely be unmoved by today's CPI reading, and may instead revisit recent trends within the labor market which show signs of cooling potentially opening the door for rate cuts this summer. But with core inflation slightly above expectations and wages still rising faster than their comfort zone, they're unlikely to aggressively alter their stance.”

Core was not a bore, but it may be one report the Fed may choose to ignore.

That said, the underlying components were a mixed bag and might be considered as more noise after a noisy set of data released in January.

- Mark Hamrick at Bankrate:

If there's some good news here that people were looking for, it is that food prices were flat on the month overall. Half of the six major grocery categories were down last month.

What does the Federal Reserve take away from this? Mainly, it will be looking for more data given that it is already taken a March rate move off the table. Officials have said they can afford to be patient as they consider when and if to cut rates. They'd feel more comfortable about rate reductions if inflation were to be less sticky. The slightly stronger than expected CPI doesn't do much to add to their confidence, but they can still ponder the possibilities for May, June, and July.

- Sonu Varghese at Carson Group:

Today's data validates the Fed's decision to be patient, with headline and core inflation on the hotter side. There was encouraging news below the headlines, with shelter inflation pulling back from January, as well as easing in food services inflation.

The big picture is that inflation is trending lower, just not as fast as everyone wants thanks to two months in a row of firmer inflation data.

It means that we're still on track for interest rate cuts in 2024, but less than what the market expected at the beginning of the year.

- Giuseppe Sette at Toggle AI:

This is a “stable inflation” report. With strong employment and CPI not budging from the 3% handle, the Fed will not be in a rush to cut.

- Paul Ashworth at Capital Economics:

On balance, we expect the Fed to begin cutting interest rates in June, by which time there will be more evidence of core PCE inflation moving close to the 2% target. But that will now require a shift in tone in the March CPI data.

- Torsten Slok at Apollo Global Management:

Inflation has started to move sideways and remains well above the Fed's 2% inflation target. This means the Fed will keep rates higher for longer.

The Fed is widely expected to hold interest rates steady for a fifth straight meeting when policymakers gather March 19-20. Much of the focus by investors will be on the Federal Open Market Committee's quarterly forecasts for rates, including whether fresh employment and inflation figures have prompted any changes.

Corporate Highlights:

- Oracle Corp. reported a spike in bookings in its cloud computing business, showing progress in its bid to capture more of the competitive market.

- Kohl's Corp. reported same-store sales in the fourth quarter that missed the average analyst estimate, suggesting the department store chain struggled to attract shoppers during the crucial holiday shopping season.

- 3M Co. named aerospace veteran William Brown its new chief executive officer, ending a turbulent run of nearly six years for Mike Roman marked by a declining stock and growing concerns over legal liabilities related to so-called forever chemicals.

- Deutsche Bank AG Chief Executive Officer Christian Sewing vowed to meet previous cost targets, saying he's working on additional measures.

- Southwest Airlines Co. plans to cut flying capacity for the full year, halt most hiring and rework schedules after Boeing Co. slashed expected 737 Max deliveries as the planemaker faces regulatory and criminal investigations over safety issues.

- Archer-Daniels-Midland Co. revised its intersegment sales for the last three years following an internal probe into its financial reporting and disclosed a $137 million impairment charge related to its animal nutrition unit. The shares rose in early trading.

- Scholastic Corp., the biggest publisher and distributor of children's books, has agreed to acquire 9 Story Media Group, as it looks for ways to broaden the audience for its library of children's stories.

Key events this week:

- Eurozone industrial production, Wednesday

- ECB Governing Council member Yannis Stournaras speaks, Wednesday

- Volkswagen, Adidas earnings, Wednesday

- US PPI, retail sales, initial jobless claims, business inventories, Thursday

- China property prices, Friday

- Japan's largest union federation announces results of annual wage negotiations, just ahead of Bank of Japan policy meeting, Friday

- Bank of England issues inflation survey, Friday

- US industrial production, University of Michigan consumer sentiment, Empire Manufacturing, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 1% as of 10:57 a.m. New York time

- The Nasdaq 100 rose 1.2%

- The Dow Jones Industrial Average rose 0.7%

- The Stoxx Europe 600 rose 0.8%

- The MSCI World index rose 0.8%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro was little changed at $1.0918

- The British pound fell 0.3% to $1.2774

- The Japanese yen fell 0.6% to 147.87 per dollar

Cryptocurrencies

- Bitcoin fell 0.4% to $71,850.74

- Ether fell 1.1% to $3,990.44

Bonds

- The yield on 10-year Treasuries advanced five basis points to 4.15%

- Germany's 10-year yield advanced two basis points to 2.33%

- Britain's 10-year yield declined four basis points to 3.94%

Commodities

- West Texas Intermediate crude rose 0.7% to $78.44 a barrel

- Spot gold fell 0.9% to $2,163.49 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Michael Mackenzie, Ye Xie and Felice Maranz.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.