(Bloomberg) -- Wall Street geared up for another busy session of bond sales as issuers looked to borrow before key economic data later this week.

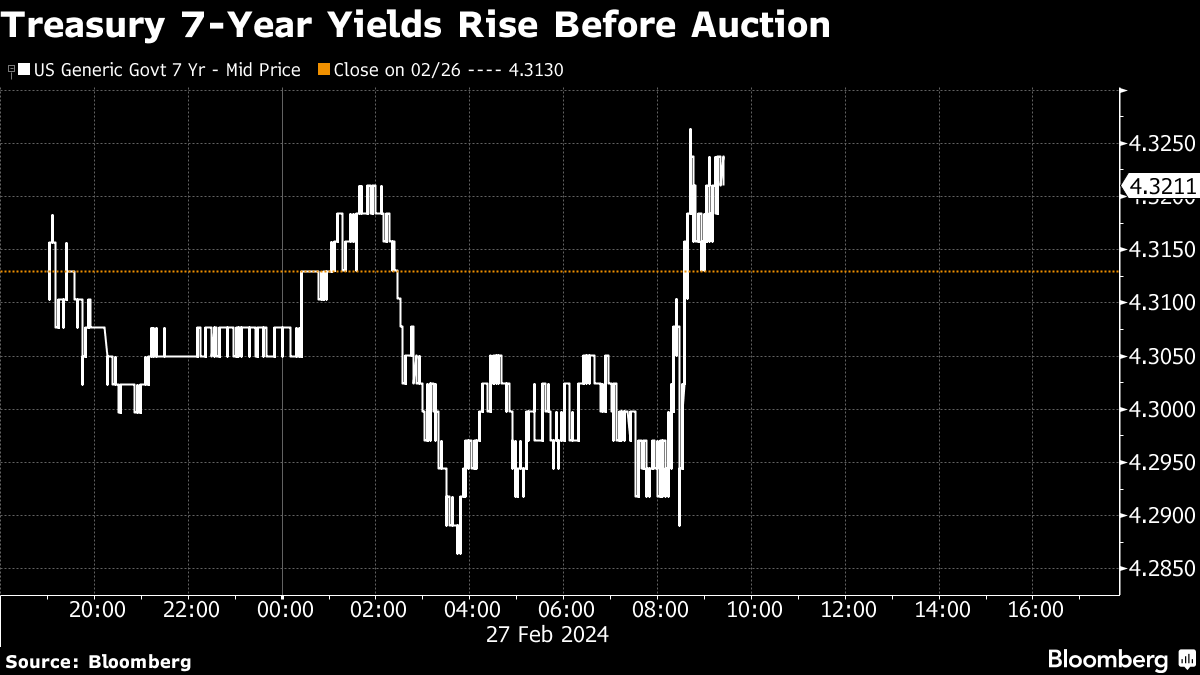

Treasuries were mixed ahead of a $42 billion auction of seven-year notes and another heavy slate of new corporate bonds. Eight companies are considering selling US investment-grade bonds on Tuesday, according to an informal survey of debt underwriters. The offerings come a day after 18 companies sold debt, bringing February issuance to a record.

“We continue to recommend investors act soon to lock in currently attractive bond yields,” said Solita Marcelli at UBS Global Wealth Management. “We particularly like the five-year duration segment of quality bonds, as this part of the yield curve offers the best combination of high yields, stability, and sensitivity to falling interest rate expectations. We also like actively managed fixed-income strategies for better diversification and the breadth of opportunity in the asset class.”

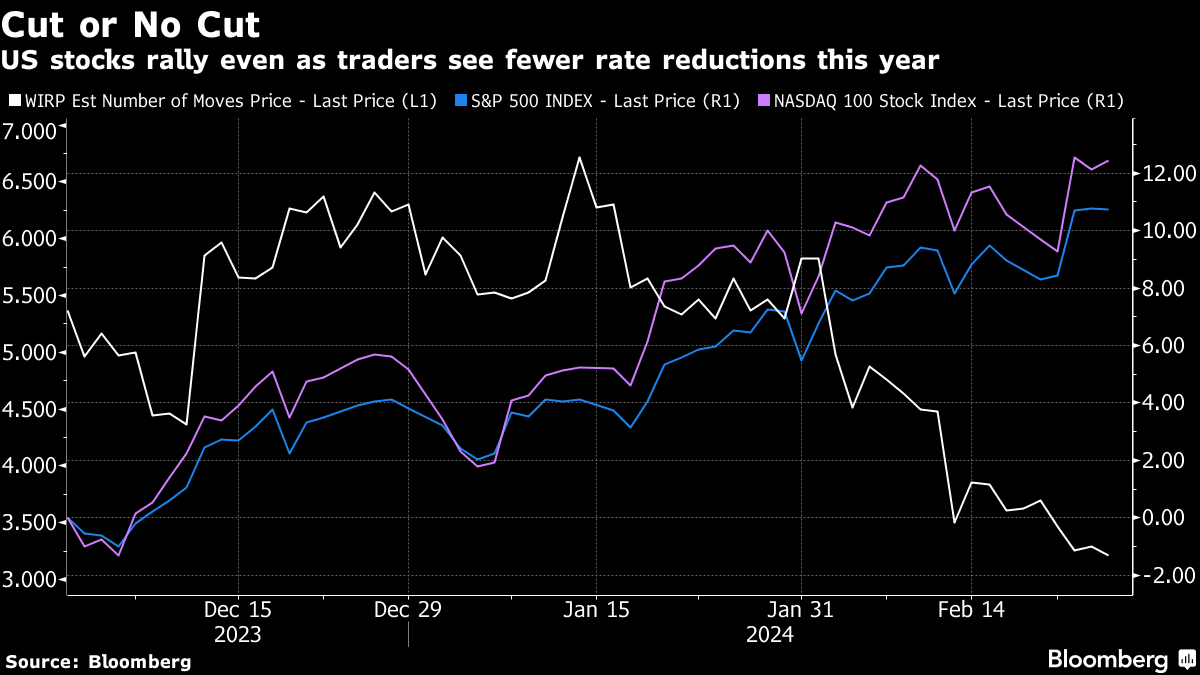

Rates have soared as Treasury investors contend with an erosion in expectations for how much the Federal Reserve will lower interest rates this year — a policy shift that would likely fuel a bond rally — and an onslaught of new corporate issuance that has given yield-seeking investors ample alternatives. Data due out Thursday is expected to show inflation as measured by the Fed's preferred gauge accelerated on a monthly basis in January, according to economists' forecasts.

Treasury 10-year yields were little changed at 4.29%. The S&P 500 fluctuated near 5,070. Nvidia Corp. halted a three-day rally. Macy's Inc. climbed on plans to close almost a third of its namesake US locations as the department-store chain seeks to fight off a pair of activist firms seeking to buy the company. Bitcoin retook the $57,000 level for the first time since late 2021.

Barclays Plc is the latest Wall Street heavyweight to ramp up its year-end target on the S&P 500 — following increases from Goldman Sachs Group Inc., UBS Group AG, and Piper Sandler & Co. Strategists led by Venu Krishna boost forecast on US equity benchmark to 5,300 from 4,800 previously.

“The US economy continues to defy rates headwinds in 2024, much as mega-cap tech continues to defy even the most bullish earnings targets,” firm's head of US equity strategy and his team write Tuesday in a note to clients

S&P 500 companies are headed for their highest quarterly earnings beat rate since the fourth quarter of 2021, according to data compiled by Bloomberg Intelligence strategists Gina Martin Adams and Wendy Soong. With more than 90% of S&P 500 companies having reported results, the gauge is on track for 7.7% year-on-year earnings per share growth, blowing past the pre-season forecast for 1.2%, according to BI's analysis.

The stock market is responding, with the S&P 500 last week logging its 13th closing record of 2024, while the Dow Jones Industrial Average surpassed 39,000 for the first time. It's telling that the milestones all occurred while investors speculated that the Fed will be in no rush to cut interest rates after a batch of hot inflation news and pushback from officials.

“While the equity market seems due for a pause and a consolidation of its recent gains, key PCE inflation data on Thursday could be the next short-term catalyst for the market, as investors are looking for additional data to help confirm if inflation is truly re-accelerating,” said Yung-Yu Ma at BMO Wealth Management. “This is a teflon stock market, which has shown a remarkable ability to shake off bad news and focus on what is positive, which is classic bull market behavior.”

Corporate Highlights:

- Norwegian Cruise Line Holdings Ltd. issued its initial financial guidance for 2024 ahead of Wall Street expectations due to strong demand.

- Lowe's Cos. said its sales will fall further this year as consumers continue to hold off from sprucing up their homes amid higher mortgage rates and a drop in new construction projects.

- Viking Therapeutics Inc. said its experimental obesity drug delivered positive results in a mid-stage trial.

- Zoom Video Communications Inc. reported quarterly sales and profit that topped analysts' estimates, a sign that corporate customers are sticking with the software company. The company also announced a $1.5 billion share buyback.

- Workday Inc., a payroll software company, issued full-year subscription revenue forecast that was weaker than expected at the midpoint.

- Intuitive Machines Inc. extended its plunge as its lander tipped on its side when touching down on the moon, putting further pressure on the high-flying stock.

- Exxon Mobil Corp. and Cnooc Ltd. are considering exercising rights to acquire Hess Corp.'s stake in a giant offshore oil development in Guyana, a move that could break up Chevron Corp.'s $53 billion deal to buy into the field.

Key Events This Week:

- Reserve Bank of New Zealand policy decision, Wednesday

- Eurozone economic confidence, consumer confidence, Wednesday

- US wholesale inventories, GDP, Wednesday

- Fed's Raphael Bostic, Susan Collins and John Williams speak, Wednesday

- G-20 finance ministers and central bank chiefs meet in Sao Paulo, Wednesday through Thursday

- Germany CPI, unemployment, Thursday

- US consumer income, PCE deflator, initial jobless claims, Thursday

- Fed's Austan Goolsbee, Raphael Bostic and Loretta Mester speak, Thursday

- China official PMI, Caixin manufacturing PMI, Friday

- Eurozone S&P Global Manufacturing PMI, CPI, unemployment, Friday

- BOE chief economist Huw Pill speaks, Friday

- US construction spending, ISM Manufacturing, University of Michigan consumer sentiment, Friday

- Fed's Raphael Bostic and Mary Daly speak, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.1% as of 9:33 a.m. New York time

- The Nasdaq 100 rose 0.3%

- The Dow Jones Industrial Average was little changed

- The Stoxx Europe 600 was little changed

- The MSCI World index rose 0.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0843

- The British pound was little changed at $1.2678

- The Japanese yen rose 0.2% to 150.37 per dollar

Cryptocurrencies

- Bitcoin rose 4.4% to $57,063.33

- Ether rose 2.5% to $3,266.1

Bonds

- The yield on 10-year Treasuries advanced one basis point to 4.29%

- Germany's 10-year yield was little changed at 2.44%

- Britain's 10-year yield advanced two basis points to 4.18%

Commodities

- West Texas Intermediate crude rose 0.6% to $78.08 a barrel

- Spot gold rose 0.2% to $2,035.87 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Alexandra Semenova and Isabelle Lee.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.