(Bloomberg) -- Wall Street got a reality check on Tuesday, with hotter-than-estimated inflation data triggering a slide in both stocks and bonds.

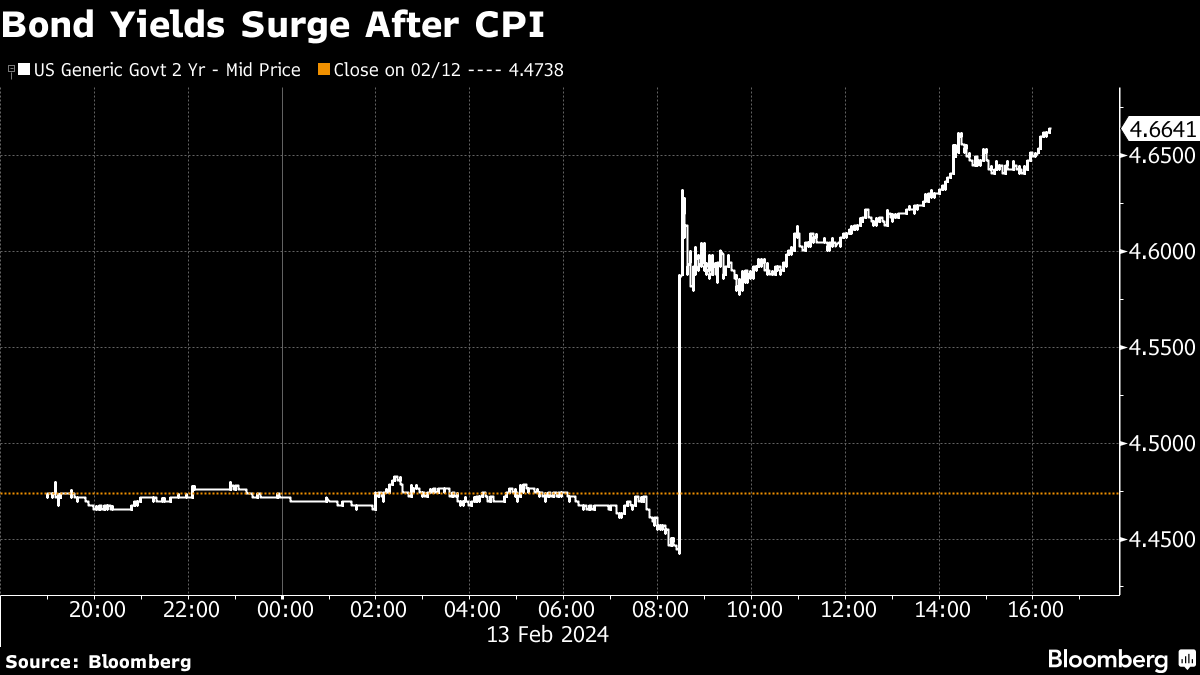

Equities pushed away from their all-time highs as the consumer price index topped estimates across the board. Treasuries sold off, with two-year yields hitting the highest since before the Fed's December “pivot.” Swap traders ratcheted down their expectations for a central bank cut before July. The stock market's “fear gauge” — the VIX — surged the most since October. And a measure of perceived risk in the US investment-grade corporate bond market soared — with three issuers getting sidelined.

“Today's CPI report caught a lot of people off guard,” said Chris Zaccarelli at Independent Advisor Alliance. “Many investors were expecting the Fed to begin cutting rates and were spending a lot of time arguing that the Fed was taking too long to get started – not appreciating that inflation could be sticky and not continue down in a straight line.”

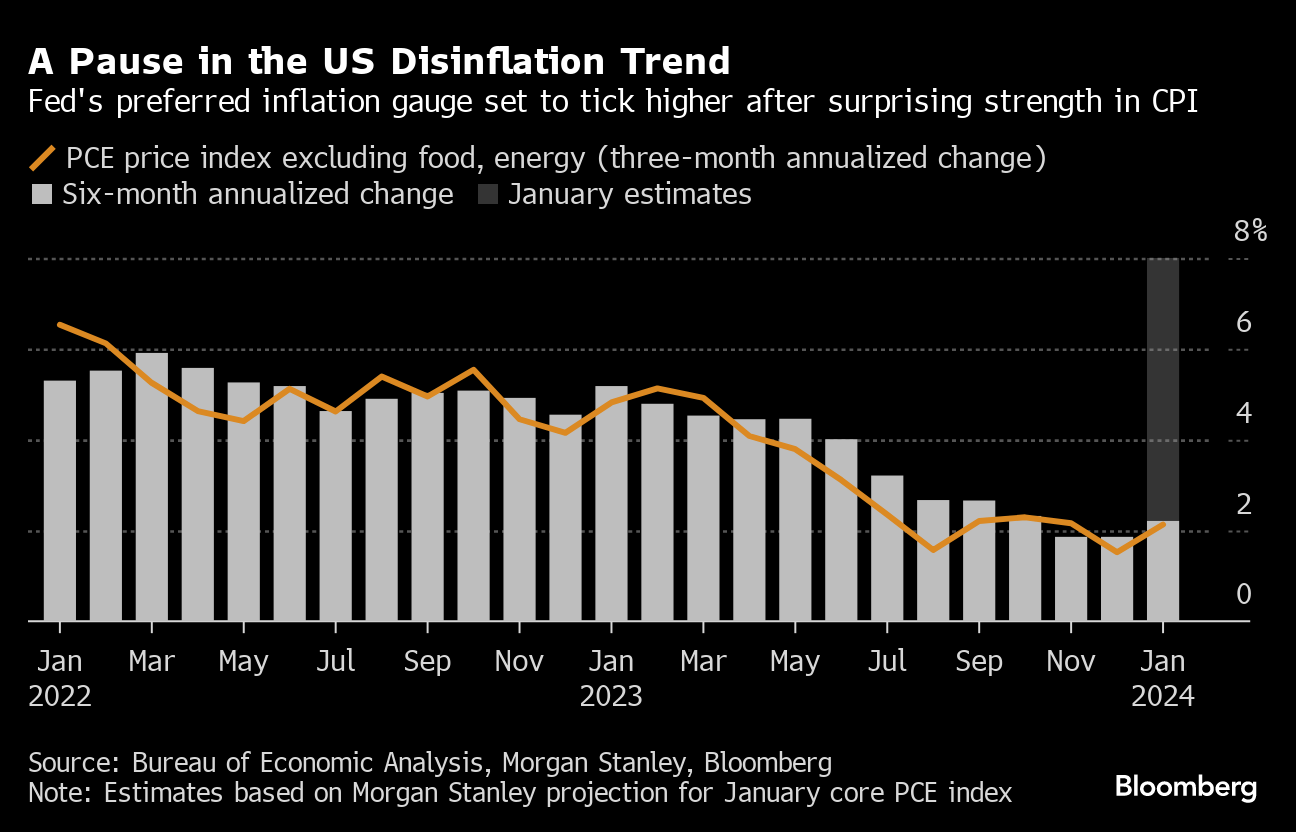

The CPI data came as a disappointment for investors after a recent downdraft in price pressures that helped build expectations for rate cuts this year. The numbers also gave credence to the wait-and-see approach highlighted by Jerome Powell and a chorus of Fed speakers.

The S&P 500 fell 1.4%, dropping below 5,000 in its worst CPI day since September 2022. Rate-sensitive shares like homebuilders and banks sank, while Tesla Inc. led losses in megacaps. The Russell 2000 of small caps slumped about 4%. US 10-year yields climbed 14 basis points to 4.31%. The so-called real yield hit 2%. The dollar rose, driving gold under $2,000.

“It is too early to declare victory over inflation,” said Torsten Slok at Apollo Global Management. “Maybe the ‘last mile' was indeed more difficult.”

Zaccarelli at Independent Advisor Alliance noted that if there's a decline in inflation in February, then the January CPI will have been just a “bump in the road.” However, if we see a new pattern of inflation stalling out at current levels — or increasing from here — then the stock market has further to fall.

Andrew Brenner at NatAlliance Securities expects more volatility for the rest of the week “as the bears have the upper hand and the bulls are grasping.”

To Jason Pride at Glenmede, evidence of “still-sticky” services inflation will likely give the Fed pause before cutting rates too quickly.

Swap contracts referencing Fed policy meetings — which as recently as mid-January fully priced in a rate cut in May and 175 basis points of easing by the end of the year — were roiled. The odds of a May cut dropped to about 32% from about 64% before the inflation data, with fewer than 90 basis points anticipated this year.

“While the door for a March cut had already been effectively shut given the recent Fed commentary and the jobs reports, the Fed has now locked the door and lost the key,” said Greg Wilensky at Janus Henderson Investors.

Much of the unanticipated increase in CPI was concentrated in what looks like a “noisy jump” in Owners' Equivalent Rent (OER) — a shelter price indicator, according to Tiffany Wilding at Pacific Investment Management Co. While that will likely revert, the details were consistent with the Fed having a “last mile problem” — and not cutting rates until midyear or later, she added.

To Jeffrey Roach at LPL Financial, while the data wasn't exactly what the Fed wanted to see, investors will have to wait until later this month for a more comprehensive look at consumer prices.

“Just as the Fed said it wouldn't rush to cut rates even after several months of encouraging economic data, they're not going to immediately reverse course just because of one hotter-than-expected CPI reading,” said Chris Larkin at E*Trade from Morgan Stanley. “Until proven otherwise, the longer-term cooling inflation trend is still in place.”

The disinflation process is not a straight line — and one hot print on its own after an extended string of more favorable releases does not represent a new trend, said Josh Jamner at ClearBridge Investments.

The surprise jump in the January consumer price index probably will be less pronounced in the Fed's preferred inflation gauge and potentially less alarming to central bank officials as they weigh when to cut interest rates. Based on the latest CPI figures, the personal consumption expenditures price index excluding food and energy — due from the Bureau of Economic Analysis on Feb. 29 — probably rose 0.29% last month, Morgan Stanley economists said.

“The CPI data has disrupted the string of Goldilocks growth and inflation data that had helped to lift the S&P 500 over 5,000,” said Brian Rose at UBS Global Wealth Management. “But it doesn't change our positive fundamental outlook for 2024 of solid growth, further disinflation, and the start of Fed rate cuts in Q2 that is supportive of risk assets.”

More Comments on CPI:

- Skyler Weinand at Regan Capital:

“Getting to the Fed's magical 2% inflation target may prove more difficult than expected and result in elevated interest rates for a longer period of time.”

- Rob Swanke at Commonwealth Financial Network:

“This is certainly not the news that the Fed will be looking for in order to begin cutting rates. So we may be on hold for several more months.”

- Paul Toft at Key Private Bank:

“We remain aligned with the Fed's comments of being more cautious in when to start cutting rates, and we believe the first rate cut will not come until the June or July meeting.”

- Neil Birrell at Premier Miton Investors:

“We are not at the stage of worrying about inflation reaccelerating, but we are not out of the woods yet either.”

- Quincy Krosby at LPL Financial:

“The ‘last mile' - as expected - is proving to be stickier and more stubborn inhibiting even the most dovish wing of the FOMC.”

- Bryce Doty at Sit Investment Associates:

“From the Fed's perspective, economic growth is strong enough that there isn't a sense of urgency on cutting rates. In the meantime, bond investors will get to enjoy higher yields a little while longer than many thought.”

- Jim Baird at Plante Moran Financial Advisors:

“There's still a viable path to a soft landing, but the January inflation report is a reminder that getting there won't be a walk in the park.”

- Lauren Goodwin at New York Life Investments:

“Though the timing of a Fed rate cut is uncertain, most investors are betting that a cut is the next move. Investors can consider locking in higher policy rates before Treasuries reflect lower rates in the coming months.”

- Alexandra Wilson-Elizondo at Goldman Sachs Asset Management:

“A delayed Fed means a focus on cash rich companies that benefit from higher real wages and a strong consumer, rather than on cyclicals that have indebtedness in floating rate form. For rates, we have kept dry powder for better entry points into the market as it reprices the central bank delay and valuations are more appealing with better risk/reward.”

Corporate Highlights:

- Jeff Bezos unloaded another 12 million Amazon.com Inc. shares, bringing his total stock sold since last Wednesday to more than $4 billion.

- Lyft Inc. issued an outlook that beat investors' expectations, signaling that the company's years-long effort to boost ridership and challenge much-larger rival Uber Technologies Inc. is paying off.

- Airbnb Inc. ended 2023 stronger than analysts' had expected and gave an optimistic outlook for the start of this year, fueled by growth in international markets and suggesting that the post-pandemic travel boom has yet to run out of steam.

- Robinhood Markets Inc. reported revenue topped estimates and executives said deposits are growing faster than last year.

- American International Group Inc. reported profit that beat analysts' estimates for the 15th straight quarter as the company saw strong growth in investment income.

- Prudential Financial Inc. said hackers it believes to be part of a cyber-crime group gained access to some of its information-technology systems and a small percentage of user accounts associated with employees and contractors.

Key Events this Week:

- Eurozone industrial production, GDP, Wednesday

- BOE Governor Andrew Bailey testifies to House of Lords economic affairs panel, Wednesday

- Chicago Fed President Austan Goolsbee speaks, Wednesday

- Fed Vice Chair for Supervision Michael Barr speaks, Wednesday

- Japan GDP, industrial production, Thursday

- US Empire manufacturing, initial jobless claims, industrial production, retail sales, business inventories, Thursday

- ECB President Christine Lagarde speaks, Thursday

- Atlanta Fed President Raphael Bostic speaks, Thursday

- Fed Governor Christopher Waller speaks, Thursday

- ECB chief economist Philip Lane speaks, Thursday

- US housing starts, PPI, University of Michigan consumer sentiment, Friday

- San Francisco Fed President Mary Daly speaks, Friday

- Fed Vice Chair for Supervision Michael Barr speaks, Friday

- ECB executive board member Isabel Schnabel speaks, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 1.4% as of 4 p.m. New York time

- The Nasdaq 100 fell 1.6%

- The Dow Jones Industrial Average fell 1.4%

- The MSCI World index fell 1.2%

Currencies

- The Bloomberg Dollar Spot Index rose 0.6%

- The euro fell 0.6% to $1.0707

- The British pound fell 0.3% to $1.2589

- The Japanese yen fell 1% to 150.78 per dollar

Cryptocurrencies

- Bitcoin fell 0.9% to $49,400.8

- Ether fell 0.1% to $2,629.74

Bonds

- The yield on 10-year Treasuries advanced 14 basis points to 4.31%

- Germany's 10-year yield advanced three basis points to 2.39%

- Britain's 10-year yield advanced nine basis points to 4.15%

Commodities

- West Texas Intermediate crude rose 1.1% to $77.78 a barrel

- Spot gold fell 1.4% to $1,992.54 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Felice Maranz, Jessica Menton, Elena Popina, Alexandra Semenova, Bre Bradham, Carly Wanna, Christopher DeReza and Matthew Boesler.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.