(Bloomberg) -- Stocks struggled to find solid ground after approaching a record on speculation the Federal Reserve will cut rates in 2024.

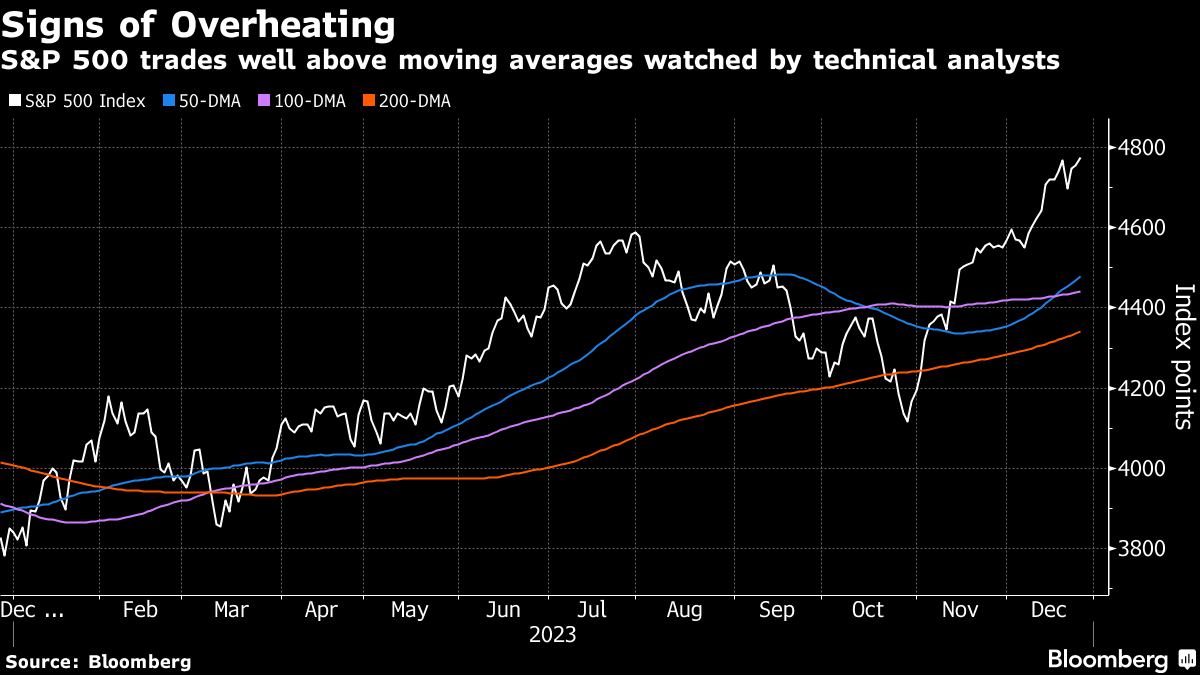

With just a few days left before the year is over, equities barely budged. While some traders cited an old Wall Street adage that says “never short a dull market,” concerns have surfaced amid overbought levels and warnings about overly dovish Fed bets. The S&P 500 wavered near its all-time high — a feat recently achieved by the Nasdaq 100 and the Dow Jones Industrial Average that's fueled a debate on whether investors should be worried or celebrating.

“Perhaps the most important question is: what has the S&P 500 done after it has climbed out of its hole?” said Ed Clissold at Ned Davis Research. “Did the rally to new highs leave the market overbought and in need of a correction? Or was it a breakout to a new up leg? History sides with the latter.”

The S&P 500 has outperformed its long-term average one-, three-, six-, and 12-months later, Clissold noted. The one-month returns are not quite as strong, suggesting a short-term overbought condition in some cases. One year later, the gauge has risen 13 out of 14 times by a median of 13.4%.

The S&P 500 traded less than 0.5% away from its all-time high of 4,796.56. Strong demand for a $58 billion sale of five-year notes sent bond yields slumping. That followed Tuesday's surprisingly solid two-year auction that drew buyers seeking to lock in higher yields before the Fed starts easing policy.

Benchmark 10-year Treasury rates sank to around 3.8% — the lowest since July.

Traders have stepped up bets on rate cuts as early as March, according to Fed swaps pricing. That view has gained momentum since policymakers updated their forecasts this month to show they expect to reduce rates at a stronger pace than indicated in their previous projections.

To Jose Torres at Interactive Brokers, optimism about the Fed having potentially won the war against inflation is excessive as data in coming months will likely persuade officials to delay rate cuts until May at the earliest.

“Markets have priced in the dovish pivot and stocks never discount the same news twice,” said Tom Essaye, a former Merrill Lynch trader who founded The Sevens Report newsletter. “As we start 2024, markets will need to see new, positive catalysts to send the S&P 500 to new all-time highs.”

In another sign of possible overexuberance, 90% of the stocks in the S&P 500 are currently trading above their 50-day averages, according to Sam Stovall at CFRA.

“Despite the possibility of a pause after recovering all that was lost in the 2022 bear market, history reminds us that the S&P 500 typically enjoyed a post-recovery gain of 10% in four months before stumbling into another decline of 5% or more — none of which became a new bear market,” Stovall noted.

Bespoke Investment Group said theGoldman Sachs US Financial Conditions Index has gone from rapid tightening to rapid easing. The gauge is currently at the lowest since August 2022. Rapid easing in the past has been followed by strong periods for both large and small-cap equities, Bespoke noted.

“Asset prices continue to march slowly higher towards year-end,” said Louis Navellier, chief investment officer at Navellier & Associates. “January may see some delayed profit-taking, but there's still plenty of money on the sidelines to pick up any bargains that may be created.”

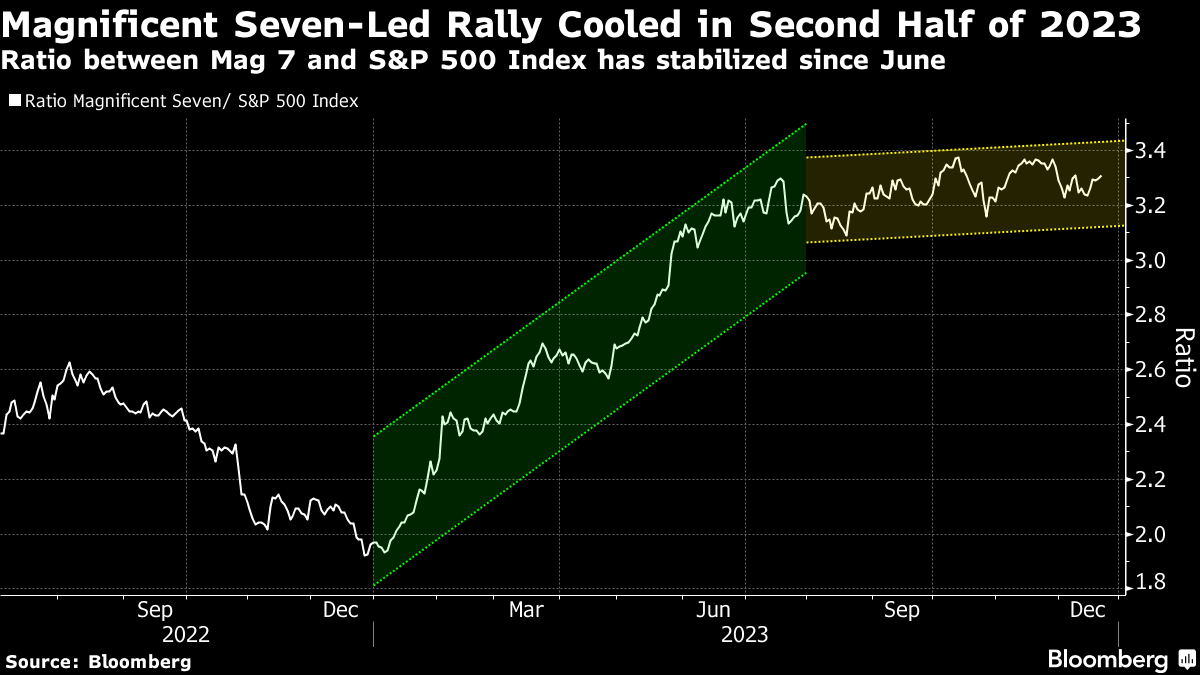

For many traders, the soft-landing scenario that investors see for next year points to further gains in US stocks. But it also dims the prospect of another stretch of wild outperformance for the technology giants that dominated in 2023.

With added fuel from the artificial-intelligence boom, the group rose almost 100% through mid-July, compared with roughly 20% for the S&P 500. But as confidence in the economy grew after the Fed's July interest-rate hike, which investors now see as the last of this cycle, the tech titans' gains became more muted.

“If you were fortunate enough to own the ‘Magnificent 7' in 2023, look to trim and rebalance back to where you were at the start of 2023,” said Michael Landsberg at Landsberg Bennett Private Wealth Management. “We still like the majority of those names, but trimming after big runs makes sense.”

Landsberg also noted he expects to see a meaningful broadening of stock-market participation in 2024 “as it's not healthy to have such a small number of heavily owned stocks drive overall market performance.”

In corporate news, Apple Inc. won a court ruling temporarily pausing a US sales ban on its newest smartwatches. The New York Times Co. sued Microsoft Corp. and OpenAI Inc. for the use of content to help develop artificial intelligence services.

Traders also kept an eye on the latest geopolitical developments.

Shipping giant Hapag-Lloyd AG said it will keep its vessels away from the Red Sea even after the launch of a US-led taskforce to protect the key trade route from militant attacks. Oil retreated from its highest close in almost a month as key technical gauges flashed weakness amid thin holiday trading.

Elsewhere, Bitcoin recovered amid renewed speculation that the US securities regulator is getting close to approving an exchange-traded fund investing directly in the biggest token.

Key events this week:

- Japan industrial production, retail sales, Thursday

- US wholesale inventories, initial jobless claims, Thursday

- UK Nationwide house prices, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.1% as of 4 p.m. New York time

- The Nasdaq 100 rose 0.2%

- The Dow Jones Industrial Average rose 0.3%

- The MSCI World index rose 0.5%

Currencies

- The Bloomberg Dollar Spot Index fell 0.4%

- The euro rose 0.6% to $1.1106

- The British pound rose 0.6% to $1.2798

- The Japanese yen rose 0.4% to 141.79 per dollar

Cryptocurrencies

- Bitcoin rose 2.7% to $43,470.76

- Ether rose 5.8% to $2,353.2

Bonds

- The yield on 10-year Treasuries declined 11 basis points to 3.79%

- Germany's 10-year yield declined eight basis points to 1.90%

- Britain's 10-year yield declined seven basis points to 3.44%

Commodities

- West Texas Intermediate crude fell 2.3% to $73.84 a barrel

- Spot gold rose 0.5% to $2,077.97 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Richard Henderson, Winnie Hsu, Robert Brand, Krystof Chamonikolas, Felice Maranz, Elena Popina and Carmen Reinicke.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.