Good morning!

The GIFT Nifty was down 34 points or 0.13% at 25,270 as of 7:05 a.m., indicating a lower open for the benchmark Nifty 50.

US equity futures were steady while European contracts rose in Asian trade.

S&P 500 futures flat

Euro Stoxx 50 up 0.1%

Markets On Home Turf

India's benchmark equity indices closed in the red for a second straight session on Monday.

The NSE Nifty 50 ended 0.49% lower at 25,202.35 and the BSE Sensex closed 0.56% down at 82,159.97. The Nifty fell over 0.69% during the day to 25,151.05, while the Sensex slipped 0.76% to 81,997.29.

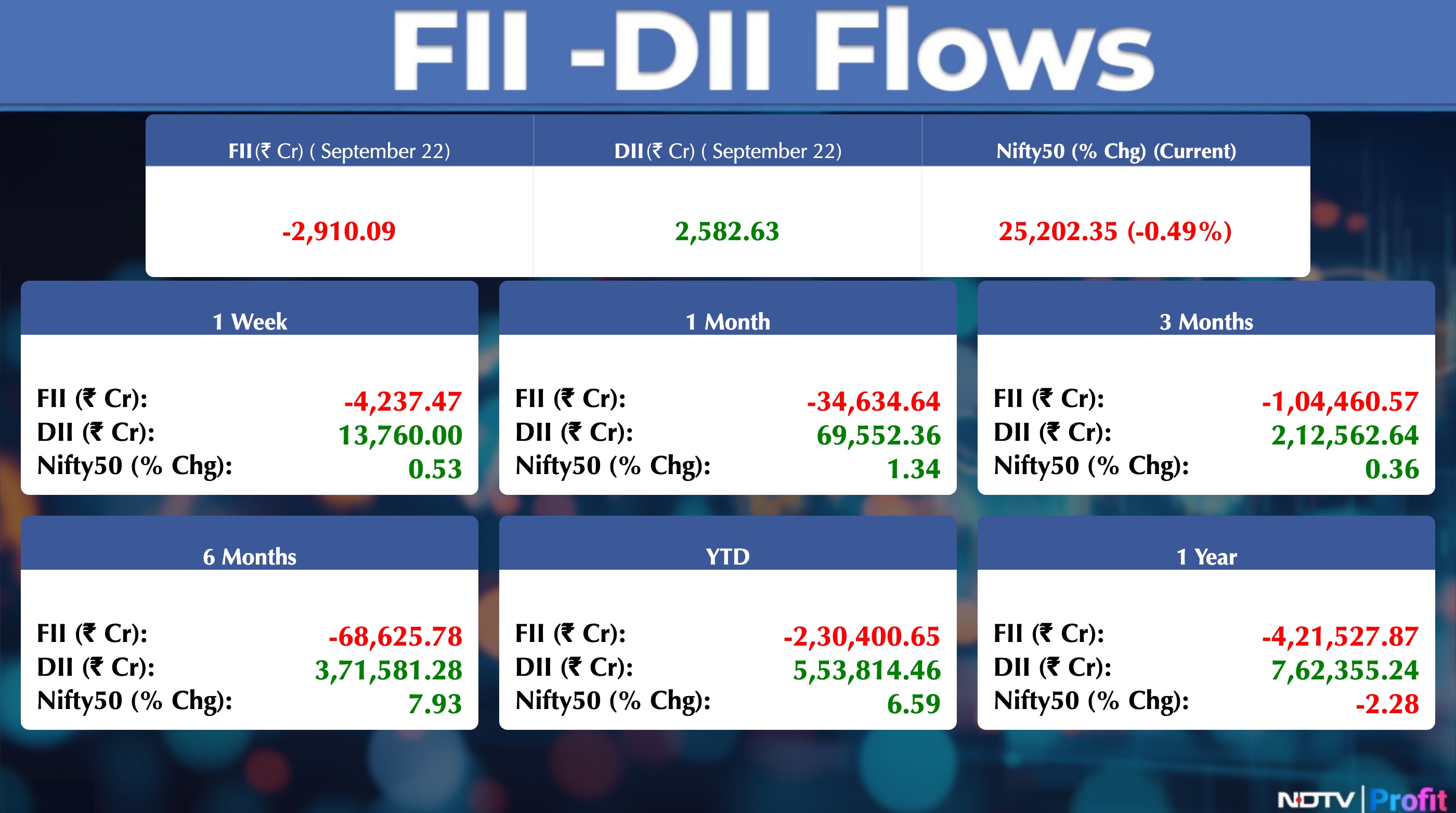

The foreign portfolio investors on Thursday turned net sellers of Indian shares, after two days of buying. FPIs sold stocks worth approximately Rs 2,910.09 crore, according to provisional data from the National Stock Exchange. The DIIs stayed net buyers for the twentieth session and bought stake worth Rs 2,582.63 crore.

Wall Street Recap

US stocks hit another all-time closing high on Monday as tech stocks drove the market higher, reversing an early decline, while central bank speakers offered clues on the path of interest rates, Bloomberg reported.

The S&P 500 closed 0.4% higher, its 28th all-time close this year. The tech-heavy Nasdaq 100 gained 0.6% and the Dow Jones Industrial Average jumped 0.14%.

Asia Market Update

Asian equities posted a modest gain at the open after Wall Street shares rallied to a new record. Benchmarks in Australia, Japan and South Korea rose.

Nikkei up 1%

Kospi up 0.2%

S&P/ASX 200 flat

Hang Seng down 0.2%

Commodities Check

Oil prices were was little changed after a four-day decline. Brent traded above $66 a barrel after slipping 2.8% over the previous four sessions, while West Texas Intermediate was near $62.

Gold prices hit an all-time high, with traders shrugging off cautious commentary from Federal Reserve officials about the outlook for monetary policy after the US central bank cut interest rates last week. Bullion edged up to hit $3,749.27 on ounce in Asia on Tuesday.

Stocks In News

Godrej Industries: The company approves allotment of NCDs ‘Series 1 debentures' worth Rs 400 crore. The company also approves allotment of NCDs ‘Series 2 debentures' worth Rs 400 crore.

Amic Forging: The company updates that Anshul Chamaria resigns as CFO effective October 31.

Ethos Limited: The company has relocated its Second Movement store from Square One Mall, Saket, New Delhi, to a new boutique in Global Gateway.

Alkem Laboratories: The company launches Pertuza, a Pertuzumab biosimilar in India. (Alert: Pertuza is used for treatment of HER2-positive breast cancer.)

Glenmark Pharmaceuticals: The board to meet on September 26 to mull interim dividend for FY26.

Emkay Global Financial Services: The Board of Directors approved the preferential issue totaling up to Rs 227.53 crore. The company further informs that equity investment by Kirti Doshi (through Antique Securities) acquired over a 21% stake in the company.

Muthoot Capital Services: The company confirmed timely redemption of its commercial paper and having made a payment of Rs 50 crore to the beneficiaries.

Adani Green Energy: The company incorporates arm Adani Ecogen Three.

Shukra Pharmaceuticals: The board to meet on October 3 to consider preferential issue of warrants to promoters.

AU Small Finance Bank: The company and Zaggle enter into a strategic partnership to launch co-branded retail credit and prepaid cards.

JK Lakshmi Cement: The company commissions an additional grinding unit of 13.5 lakh tonnes per annum at Surat. The company also completes de-bottlenecking of its cement mills at Jaykaypuram. The company has also entered into a power purchase and a share purchase agreement with Ampin C&I Power to purchase solar power under captive power laws, simultaneously acquiring a 26% equity stake in the latter.

Tata Consultancy Services (TCS): The company to report Q2 earnings on October 9.

Tata Investment Corporation: The company sets October 14, 2025 as the record date for stock split in the ratio of 1:10.

Arisinfra Solutions: The company gets Rs 40 crore order from AVS Housing and Construction for project execution and material supply.

Timken India: The company to acquire 26.1% stake of Sunstreamgreen Energy for Rs 70 lakh.

Paytm: The company completes investment of Rs 300 crore in arm Paytm Money via rights issue. The company also completed an investment of Rs 155 crore in arm Paytm Services via rights issue.

PN Gadgil: The company opens a new store in Pune.

Suraj Estate Developers: The company launches ‘Suraj Park View 1' in Dadar, Mumbai with a gross development value of Rs 250 crore.

NTPC: The company gets total tax demand of Rs 12.7 crore including penalty from Andhra Pradesh body.

TVS Holdings: The company issues NCRPS as a bonus, redeemable in 12–15 months with 6% annual dividend.

Dhani Services: The company allots 2.25 crore shares to promoter group at issue price of Rs 90.3 per share.

Dr Reddy's Laboratories: The company gets European drug agency's positive view for Xgeva biosimilar. The company also gets the European drug agency's positive view for Prolia biosimilar.

Electronics Mart India: The company opens three multi-brand stores in Andhra Pradesh and Telangana.

KFin Technologies: The company denies reports citing General Atlantic plans to sell 10–15% of its stake in the company at 5–8% discount.

RDB Realty and Infrastructure: The company gets in a pact with Stargen Power for execution of solar power projects for Rs 225 crore.

Rail Vikas Nigam Limited (RVNL): The company emerges as lowest bidder for Rs 145 crore project of Southern Railway.

Kolte-Patil Developers: The company seeks shareholder approval to offer securities for a total amount not exceeding Rs 2,500 crore.

Sterling and Wilson Renewable Energy: The company's arm Sterling and Wilson Solar had a standby letter of credit amounting to Rs 63.47 crore called upon by a customer.

Brigade Enterprises: The company in joint development pact to develop residential project in Bengaluru. The project has a gross development value of nearly Rs 1,200 crore.

Refex Industries: The board approved the merger of Refex Green Mobility into RIL, followed by the demerger of the combined Green Mobility Business undertaking from RIL into a new entity, Refex Mobility.

KEC International: The company gets orders worth Rs 3,243 crore in international transmission and distribution business. The company's year-to-date order intake stands at nearly Rs 11,700 crore.

Birla Corporation: The company updates that Telangana government declares company arm RCCPL as preferred bidder in auction of Guda-Rampur limestone and manganese block.

Medicap Healthcare: The company files DRHP for fresh issue of shares worth Rs 240 crore.

MedPlus Health Services: The company's arm gets suspension order for drug license for store in Andhra Pradesh.

Infobeans Technologies: The company updates on impact on operations as insignificant since less than 1% of company's revenue is linked to H1B visa holders.

India Nippon Electricals: The company updates about opportunities for new products in overseas markets, increasing demand for premium vehicles and robust development process. Updates on high volatility in demand from customers and frequent disruptions in the supply chain.

Reliance Industries (RIL): The company's arm Reliance Global Project Services Pte dissolved with effect from September 20.

Purple Style Labs: The company files DRHP for IPO worth Rs 660 crore.

Alkem Laboratories: The company gets a total tax demand of Rs 35 crore along with penalty from Mumbai tax body.

Systematix Corporate Services: The company to invest Rs 10 crore in one or more tranches as a sponsor in India SME Growth Fund.

Universal Cables: The company updates Amit Kumar Chopra resigns as CFO.

Amber Enterprises India: The company closes QIP, approves allocation of 12.6 lakh shares at issue price of Rs 7,950 per share.

Zensar Technologies: The company informs that they do not foresee significant impact on financials or operations, given lower dependency on H1B visa.

NTPC Green Energy: The company declares commercial operation of part capacity of a 9.9 megawatt wind project in Bhuj plant of Ayana Renewable Power Four.

Afcons Infrastructure: The board to meet on September 25 to consider issuance of NCDs on private placement basis.

IPO Offering

Ivalue Infosolutions: The company is a technology services and solutions provider specializing in enterprise digital transformation.

The public issue was subscribed to 1.82 times on day 3. The bids were led by Qualified institutional investors (3.18 times), non-institutional investors (1.26 times), retail investors (1.28 times).GK Energy: The company provides EPC services for solar-powered agricultural water pump systems. The public issue was subscribed to 6.41 times on day 2. The bids were led by Qualified institutional investors (2.90 times), non-institutional investors (10.05 times), retail investors (6.84 times)

Saatvik Green Energy: The company is the manufacturer of modules and offers engineering, procurement and construction services.The public issue was subscribed to 1.09 times on day 2. The bids were led by Qualified institutional investors (0.01 times), non-institutional investors (1.38 times), retail investors (1.56 times), Employee Reserved (3.34 times)

Ganesh Consumer Products: Ganesh Consumer Products is a FMCG company. The company is the brand of wheat-based derivatives (maida, sooji, dalia) in East India.The public issue was subscribed to 0.12 times on day 1. The bids were led by Qualified institutional investors (0.00 times), non-institutional investors (0.06 times), retail investors (0.20 times), Employee Reserved (0.39 times)

Atlanta Electricals: AEL is one of the leading manufacturers of power, auto and inverter duty transformers in India. The public issue was subscribed to 0.97 times on day 1. The bids were led by Qualified institutional investors (1.00 times), non-institutional investors (1.00 times), retail investors (0.95 times), Employee Reserved (0.56 times)

Listing Day

Euro Pratik Sales: The company is engaged in the business of decorative wall panel and decorative laminates industry as a seller and marketer of Decorative Wall Panels and Decorative Laminates.

The company's shares will debut on the stock exchange on Tuesday at an issue price of Rs 247 apiece. The Rs 451.31 crore IPO was subscribed to 1.34 times on day 3. The bids were led by Qualified institutional investors (1.05 times), non-institutional investors (1.92 times), retail investors (1.23 times), Employee reserved (3.88 times).

IPO Incoming

Anand Rathi Share and Stock Brokers: The company provides full-service broking facilities. It is a part of the Anand Rathi group which carries out a diverse range of financial services. The company will offer shares for bidding on Monday. The price band is set at Rs 393 to Rs 414 per share. The Rs 745 crore IPO is entirely a fresh issue.

Seshaasai Technologies: The company specialising in payment solutions, as well as communications and fulfilment services. The company will offer shares for bidding on Tuesday. The price band is at Rs 402 to Rs 423 per share. The Rs 813.07 crore IPO has a combination of fresh issue of Rs 480 crore and offer for sale of Rs 333.07 crore.

Jaro Institute of Technology Management and Research: The company provides an online higher education service. Company has a pan-India presence of over 22 offices-cum-learning centers. The company will offer shares for bidding on Tuesday. The price band is at Rs 846 to Rs 890 per share. The Rs 450 crore IPO has a combination of fresh issue of Rs 170 crore and offer for sale of Rs 280 crore.

Solarworld Energy Solutions: The company is a solar energy solutions provider specialising in engineering, procurement, and construction services for solar power projects. The company will offer shares for bidding on Tuesday. The price band is set at Rs 333 to Rs 351per share. The Rs 490 crore IPO has a fresh issue of Rs 440 crore and offer for sale of Rs 50 crore.

Bulk & Block Deals

Fortis Healthcare: Aware Super sold and Goldman Sachs bought 2.2 lakh shares at Rs 953.95 apiece.

Max Financial Services: Aware Super sold and Goldman Sachs bought 1.52 lakh shares at Rs 1,561.70 apiece.

Dynamatic Technologies: Samena Special Situations sold 62,600 shares at Rs 7,302.72 apiece.

Energy Infrastructure: 360 One Portfolio Managers sold 93 lakh shares at Rs 82.30 apiece.

Corporate Actions

Interim Dividend: Gujarat Apollo Industries, Hariom Pipe Industries, India Glycols, Crest Venture, Confidence Petroleum, AVG Logistics

Merger: Piramal Enterprises

Bonus Issue: Pidilite Industries (1:1)

Board Meeting: Sudarshan Chemical Industries

Pledge Shares Details

Aarti Pharmalabs: Safechem Enterprises, part of the promoter group, disposed of 6 lakh shares.

Hind Rectifiers: Suramya Saurabh Nevatia, promoter, pledged 5 lakh shares.

Energy Infrastructure Trust: Rapid Holdings 2, promoter, disposed of 16.9 crore shares.

Paisalo Digital: Equilibrated Venture, part of the promoter group, acquired 45 lakh shares.

Trading Tweaks

List of securities shortlisted in Short - Term ASM Framework Stage – I: Axiscades Technologies, Banco Products

F&O Cues

Nifty Sep futures is down by 0.53% to 25,276 at a premium of 74 points.

Nifty Sep futures open interest down by 1.66%.

Nifty Options 23rd Sep Expiry: Maximum Call open interest at 25,500 and Maximum Put open interest at 25,200.

Securities in ban period: RBL Bank, Sammaan Capital, HFCL

Currency/Bond

The rupee closed 22 paise weaker at 88.32 against the US Dollar. The yield on the 10-year bond ended flat at 6.49%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.